Legendary mutual fund manager Peter Lynch once coined the investing

strategy:

"Buy what you know."

The philosophy seems so simple and easy. But is

it?

If you eat three times a week at McDonald's, the

strategy goes, then you should buy the stock. If you wait in line

for hours to buy the latest Apple product, buy the stock. If you

run a blog dedicated to all the new drinks at Starbucks, then you

should buy the stock.

In other words, if you love the company's product,

then buy the stock.

But if it was so easy, everyone would do it.

Fundamentals still matter. You may have loved Krispy Kreme a decade

ago, but the company ran into trouble when it expanded too quickly

and the stock tanked.

A hot product sometimes doesn't translate into a

hot stock price.

Who Owns It?

If you were Warren Buffett and your favorite drink

was Coke, then it was easy to know what company to buy. You buy

Coke's stock. But what if your favorite drink was A&W Root

Beer? There is no A&W listed on the stock exchanges. So who

owns it?

This is where "buy what you know" can get

tricky.

It turns out, the A&W Root Beer brand is owned

by Dr. Pepper Snapple Group which also owns 7UP and Hawaiian Punch,

among other brands.

"Secret" Companies That Own Your Favorite

Brands

Love the Loft store? The Loft, which used to be

called Ann Taylor Loft, is owned by, of course, Ann Taylor. That

one is easy to figure out.

But did you know that Anthropologie stores are

actually owned by Urban Outfitters? You also may not be aware that

Athleta is owned by Gap.

Here's a quiz: who owns the following well-known

brands?

1. Tommy Bahama

2. Vilebrequin

3. North Face

4. Timberland

These famous brands are owned by 3 "secret"

companies you probably haven't heard of. Even better, these

companies also own, in some cases, multiple famous brands.

It also just so happens that all 3 of these

companies are expected to have double digit earnings growth this

year. Two out of the three are also Zacks Rank Buy stocks.

It may take some extra sleuthing to uncover the

companies that own these brands, but with these solid fundamentals

and growth projections, it's well worth the extra effort.

If your favorite brand also has great fundamentals,

why not "buy what you know"?

1. Tommy Bahama = Oxford Industries

(OXM)

Oxford Industries operates 121 Tommy Bahama stores,

including 15 restaurant-retail locations, Lilly Pulitzer with 21

retail stores, and the brands Ben Sherman, Oxford Golf, Arnold

Brant and Billy London.

On June 11, Oxford beat the Zacks Consensus for the

fiscal first quarter by 5%. It saw strength in both Tommy Bahama

and Lilly Pulitzer as Tommy saw 10% same store sales growth. It

opened its first two Tommy Bahama stores in Japan in the quarter,

which is part of its broader strategy to expand in Asia.

Forward P/E = 20.6

Fiscal 2013 expected earnings growth: 19%

Zacks Rank #2 (Buy)

2. Vilebrequin = GIII Apparel Group

(GIII)

GIII-Apparel can trace its history all the way back

to 1956 in New York's Garment District. Today, the company has a

portfolio of 30 licensed brands where it markets apparel,

outerwear, beachwear, luggage, women's handbags, small leather

goods and accessories.

But it also owns several retail brands outright

including Wilson's Leather and Vilebrequin, which it just acquired.

Vilebrequin, founded in 1971 in Saint-Tropez, is a luxury men's and

boy's luxury swimsuit retailer with stores in prestige locations

such as Beverly Hills, Paris, and Cartagena. GIII will be rolling

out women's swimsuits this summer which the analysts believe will

significantly add to the bottom line.

Forward P/E = 14.6

Fiscal 2013 expected earnings growth: 13.6%

Zacks Rank #2 (Buy)

3. North Face and Timberland = V. F.

Corporation (VFC)

V. F. Corporation has to be one of the least known

companies with famous brands out there. Yet, it is one of the

largest apparel retailers in the world. In addition to North Face

and Timberland, it also owns Wrangler, Vans, Lee and premium jeans

maker 7 For All Mankind and athletic clothing maker lucy, to name

just a few.

On June 11, the company released its 5-year revenue

and EPS targets. It is projecting compounding annual growth of 10%

through 2017. Its top brands are forecast to continue with their

double digit revenue gains. North Face is expected to grow at 12%

annually. Vans is expected to see 13% to 15% growth and Timberland

is expected to do 10%.

Forward P/E = 17.4

Fiscal 2013 expected earnings growth: 12.8%

Zacks Rank #3 (Hold)

Want More of Our Best Recommendations?

Zacks' Executive VP, Steve Reitmeister, knows when key trades

are about to be triggered and which of our experts has the hottest

hand. Then each week he hand-selects the most compelling trades and

serves them up to you in a new program called Zacks

Confidential.

Learn More>>

Tracey Ryniec is the Value Stock Strategist for Zacks.com.

She is also the Editor of the Turnaround Trader and Value Investor

services. You can follow her on twitter at @TraceyRyniec.

G-III APPAREL (GIII): Free Stock Analysis Report

OXFORD INDS INC (OXM): Free Stock Analysis Report

V F CORP (VFC): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

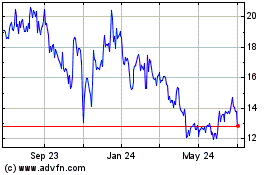

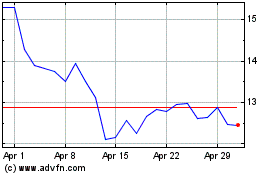

VF (NYSE:VFC)

Historical Stock Chart

From Jun 2024 to Jul 2024

VF (NYSE:VFC)

Historical Stock Chart

From Jul 2023 to Jul 2024