V.F. Corp. Reaches New Yearly High - Analyst Blog

May 15 2013 - 6:20AM

Zacks

Shares of V.F. Corporation (VFC) reached a new

52-week high of $184.85 on Tuesday May 14, beating its previous

high of $180.01 on May 7. The stock’s momentum is due to the

company’s consistent positive earnings surprise trend, strong

organic revenue growth, impressive management guidance and

strategies to expand its global reach.

This home improvement retailer eventually closed trade at $184.72

on May 14, recording a year-to-date return of 22.9%. Average volume

of shares traded over the last 3 months stands at approximately

628K. Moreover, the company currently trades at a forward P/E of

17.0x, a 6.9% premium to the industry average of 15.9x.

If we look at the company’s earnings surprise history, this Zacks

Rank #2 (Buy) stock has outperformed the Zacks Consensus Estimate

in the past 14 quarters. The average positive surprise in the

trailing 14 quarters comes to 10.5%.

V.F. Corp.'s diversified brand portfolio and its approach to brand

management, which remains focused on developing its brands further,

position the company well above its peers. We believe that given

the strength of many of its brands and opportunities with regards

to distribution, the company is set for significant long-term

growth.

Last month, V.F. Corp. reported robust first-quarter 2013 earnings

results, primarily driven by strong top-line growth and improved

margins. First-quarter earnings of $2.43 per share exhibited an

improvement of over 25.3% from the comparable year-ago quarter and

the Zacks Consensus Estimate of $2.17.

V.F. Corp’s total sales grew 2.2% to $2,611.9 million in the

quarter but fell short of the Zacks Consensus Estimate of $2,652

million.

Given the solid first-quarter results, the company expects 2013

revenues to increase 6% to $11.5 billion. Gross and operating

margins are anticipated to expand by 100 basis points.

Based on these forecasts, V.F. Corp. expects its adjusted earnings

for 2013 to rise by 5 cents to $10.75 per share, compared to the

previous forecast of $10.70 per share. Currently, the Zacks

Consensus Estimate stands at $12.25 per share, which is

substantially above the company’s guidance.

Apart from strong first-quarter results, V.F. Corp.’s growth story

looks compelling. We believe that the company’s sustained focus on

strategic acquisitions, along with expanding global operations bode

well for future growth.

Besides V.F. Corp., companies such as The Home Depot

Inc. (HD), Nordstrom Inc. (JWN) and

Whirlpool Corp. (WHR) achieved new 52-week highs

of $77.42, $61.24 and $129.92, respectively, on Tuesday, May

14.

HOME DEPOT (HD): Free Stock Analysis Report

NORDSTROM INC (JWN): Free Stock Analysis Report

V F CORP (VFC): Free Stock Analysis Report

WHIRLPOOL CORP (WHR): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

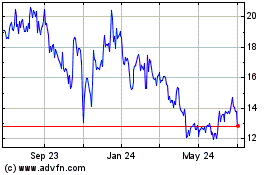

VF (NYSE:VFC)

Historical Stock Chart

From Jun 2024 to Jul 2024

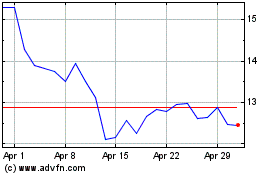

VF (NYSE:VFC)

Historical Stock Chart

From Jul 2023 to Jul 2024