Valaris Limited (NYSE: VAL) ("Valaris" or the "Company") today

reported fourth quarter 2023 results.

President and Chief Executive Officer Anton Dibowitz said, “We

continue to execute on our operating leverage by repricing rigs

from legacy day rates to meaningfully higher market rates and

successfully delivering reactivated rigs with attractive contracts.

At the same time, we remain laser focused on delivering high levels

of operational performance to our customers, as evidenced by

another strong year of revenue efficiency.”

Dibowitz added, “During the fourth quarter, we were awarded new

contracts and extensions with associated contract backlog of more

than $1.4 billion. These awards include two multi-year drillship

contracts at leading-edge day rates and several jackup contracts

across the North Sea, Australia and Trinidad, demonstrating the

depth of our customer relationships, track record of operational

delivery and broad-based strength of the market.”

Dibowitz concluded, “We remain confident in the strength and

duration of this upcycle and the outlook for Valaris is positive.

We expect to deliver significant earnings and cash flow growth over

the next few years and we intend to return all future free cash

flow to shareholders unless there is a better or more value

accretive use for it.”

Financial and Operational Highlights

- Net income of $829 million (including tax benefit of $790

million), Adjusted EBITDA of $58 million and Adjusted EBITDAR of

$96 million;

- Delivered revenue efficiency of 93% during the quarter and 96%

for the year;

- VALARIS DS-8 commenced a contract offshore Brazil late in the

quarter, following its reactivation;

- VALARIS 110 received TotalEnergies' and North Oil Company's

global jackup Rig of the Year award;

- Awarded new contracts and extensions with associated contract

backlog of more than $1.4 billion during the fourth quarter;

- Increased total contract backlog to more than $3.9 billion as

of February 15, 2024, representing a nearly 60% increase from

twelve months ago;

- Took delivery of newbuild drillships VALARIS DS-13 and

DS-14;

- Repurchased $50 million of shares during the fourth quarter and

$200 million during the year;

- Valaris Board of Directors authorized an increase in the

Company's share repurchase program to $600 million from $300

million in February 2024;

- ARO Drilling took delivery of newbuild jackup Kingdom 1, and

the rig started its maiden contract, during the fourth

quarter.

Fourth Quarter Review

Net income increased to $829 million from $17 million in the

third quarter 2023. Net income for the fourth quarter 2023 included

a tax benefit of $790 million discussed below. Adjusted EBITDA

increased to $58 million from $40 million in the third quarter

primarily due to more operating days across the fleet and lower

reactivation expense. Adjusted EBITDAR increased to $96 million

from $91 million in the third quarter.

Revenues increased to $484 million from $455 million in the

third quarter 2023. Excluding reimbursable items, revenues

increased to $453 million from $427 million in the third quarter.

The increase was primarily due to more operating days across the

fleet, including for drillship VALARIS DS-17 that commenced a

contract in early September, following its reactivation, and jackup

VALARIS 107, which started a contract early in the fourth quarter

after being idle for most of the third quarter.

Contract drilling expense increased to $402 million from $391

million in the third quarter 2023. Excluding reimbursable items,

contract drilling expense increased to $374 million from $369

million in the third quarter primarily due to the increase in

operating days mentioned above. This was partially offset by lower

reactivation expense and lower repair and maintenance expense for

the jackup fleet.

Depreciation expense increased to $28 million from $26 million

in the third quarter 2023. General and administrative expense of

$24 million was in line with the third quarter 2023.

Other income decreased to $0 million from $11 million in the

third quarter 2023. This was primarily due to foreign currency

exchange losses during the quarter compared to gains in the third

quarter and an increase in interest expense associated with a $400

million debt issuance that was completed in the third quarter.

Tax benefit was $790 million compared to tax expense of $11

million in the third quarter 2023. The fourth quarter tax provision

included $800 million of tax benefit due to changes in deferred tax

asset valuation allowances.

Cash and cash equivalents and restricted cash decreased to $636

million as of December 31, 2023, from $1.1 billion as of September

30, 2023. The decrease was primarily due to capital expenditures

and share repurchases, partially offset by positive operating cash

flow.

Capital expenditures increased to $463 million from $106 million

in the third quarter 2023 primarily due to the Company exercising

options to take delivery of newbuild drillships VALARIS DS-13 and

DS-14 for an aggregate purchase price of $337 million during the

quarter.

Fourth Quarter Segment Review

Floaters

Floater revenues increased to $263 million from $243 million in

the third quarter 2023. Excluding reimbursable items, revenues

increased to $247 million from $232 million in the third quarter.

The increase was primarily due to more operating days for VALARIS

DS-17, which commenced its contract with Equinor offshore Brazil in

early September, following its reactivation. This was partially

offset by fewer operating days for VALARIS DS-12 due to

mobilization and a brief shipyard visit between contracts.

Contract drilling expense increased to $226 million from $215

million in the third quarter 2023. Excluding reimbursable items,

contract drilling expense increased to $211 million from $206

million in the third quarter. The increase was primarily due to

more operating days for VALARIS DS-17, partially offset by lower

reactivation expense.

Jackups

Jackup revenues increased to $179 million from $166 million in

the third quarter 2023. Excluding reimbursable items, revenues

increased to $170 million from $155 million in the third quarter

primarily due to more operating days for VALARIS 107, 249 and

Norway, all of which incurred some idle time during the third

quarter. This was partially offset by fewer operating days for

VALARIS 76 and 123, both of which completed contracts during the

fourth quarter and are undergoing contract preparation and planned

maintenance work prior to the start of their next contracts in

2024.

Contract drilling expense increased to $123 million from $122

million in the third quarter 2023. Excluding reimbursable items,

contract drilling expense increased to $115 million from $114

million in the third quarter. Contract drilling expense was largely

flat on higher revenues primarily due to lower repair and

maintenance expense.

ARO Drilling

Revenues increased to $134 million from $122 million in the

third quarter 2023 primarily due to newbuild jackup Kingdom 1

commencing its maiden contract in November and more operating days

for ARO 4001 following some out of service days for planned

maintenance during the third quarter. Contract drilling expense

decreased to $88 million from $92 million in the third quarter

primarily due to lower bareboat charter expense, partially offset

by more operating days for the owned fleet.

Other

Revenues decreased to $41 million from $46 million in the third

quarter 2023 primarily due to lower revenues earned from bareboat

charter agreements with ARO. Contract drilling expense decreased to

$18 million from $19 million in the third quarter.

Fourth Quarter

Floaters

Jackups

ARO (1)

Other

Reconciling Items (1) (2)

Consolidated Total

(in millions, except %)

Q4 2023

Q3 2023

Chg

Q4 2023

Q3 2023

Chg

Q4 2023

Q3 2023

Chg

Q4 2023

Q3 2023

Chg

Q4 2023

Q3 2023

Q4 2023

Q3 2023

Chg

Revenues

$

263.2

$

243.3

8

%

$

179.3

$

165.9

8

%

$

133.7

$

121.5

10

%

$

41.3

$

45.9

(10

)%

$

(133.7

)

$

(121.5

)

$

483.8

$

455.1

6

%

Operating expenses

Contract drilling

226.0

215.2

(5

)%

123.3

121.7

(1

)%

88.0

92.0

4

%

18.0

18.8

4

%

(53.3

)

(56.8

)

402.0

390.9

(3

)%

Depreciation

15.0

14.2

(6

)%

11.2

10.2

(10

)%

19.5

15.8

(23

)%

1.2

1.3

8

%

(19.4

)

(15.7

)

27.5

25.8

(7

)%

General and admin.

—

—

—

%

—

—

—

%

6.3

5.6

(13

)%

—

—

—

%

18.0

18.6

24.3

24.2

—

%

Equity in earnings of ARO

—

—

—

%

—

—

—

%

—

—

—

%

—

—

—

%

8.3

2.4

8.3

2.4

246

%

Operating income

$

22.2

$

13.9

60

%

$

44.8

$

34.0

32

%

$

19.9

$

8.1

146

%

$

22.1

$

25.8

(14

)%

$

(70.7

)

$

(65.2

)

$

38.3

$

16.6

131

%

Net income (loss)

$

24.3

$

14.5

68

%

$

46.1

$

34.4

34

%

$

10.3

$

(1.3

)

nm

$

22.1

$

25.8

(14

)%

$

725.7

$

(56.4

)

$

828.5

$

17.0

nm

Adjusted EBITDA

$

37.2

$

28.2

32

%

$

56.0

$

44.2

27

%

$

39.4

$

23.9

65

%

$

23.2

$

27.2

(15

)%

$

(98.3

)

$

(83.5

)

$

57.5

$

40.0

44

%

Adjusted EBITDAR

$

75.7

$

79.1

(4

)%

$

56.0

$

44.2

27

%

$

39.4

$

23.9

65

%

$

23.2

$

27.2

(15

)%

$

(98.3

)

$

(83.5

)

$

96.0

$

90.9

6

%

(1)

The full operating results included above

for ARO are not included within our consolidated results and thus

deducted under "Reconciling Items" and replaced with our equity in

earnings of ARO.

(2)

Our onshore support costs included within

contract drilling expenses are not allocated to our operating

segments for purposes of measuring segment operating income (loss)

and as such, those costs are included in “reconciling items.”

Further, general and administrative expense and depreciation

expense incurred by our corporate office are not allocated to our

operating segments for purposes of measuring segment operating

income (loss) and are included in "reconciling items"

As previously announced, Valaris will hold its fourth quarter

2023 earnings conference call at 9:00 a.m. CST (10:00 a.m. ET) on

Thursday, February 22, 2024. An updated investor presentation will

be available on the Valaris website after the call.

About Valaris Limited

Valaris Limited (NYSE: VAL) is the industry leader in offshore

drilling services across all water depths and geographies.

Operating a high-quality rig fleet of ultra-deepwater drillships,

versatile semisubmersibles, and modern shallow-water jackups,

Valaris has experience operating in nearly every major offshore

basin. Valaris maintains an unwavering commitment to safety,

operational excellence, and customer satisfaction, with a focus on

technology and innovation. Valaris Limited is a Bermuda exempted

company. To learn more, visit the Valaris website at www.valaris.com.

Forward-Looking Statements

Statements contained in this press release that are not

historical facts are forward-looking statements within the meaning

of Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements include words or phrases such as

"anticipate," "believe," "estimate," "expect," "intend," "likely,"

"plan," "project," "could," "may," "might," "should," "will" and

similar words and specifically include statements regarding

expected financial performance; expected utilization, day rates,

revenues, operating expenses, cash flows, contract status, terms

and duration, contract backlog, capital expenditures, insurance,

financing and funding; the offshore drilling market, including

supply and demand, customer drilling programs and the attainment of

requisite permits for such programs, stacking of rigs, effects of

new rigs on the market and effect of the volatility of commodity

prices; expected work commitments, awards, contracts and letters of

intent; scheduled delivery dates for rigs; performance of our joint

ventures, including our joint venture with Saudi Aramco; timing of

the delivery of the Saudi Aramco Rowan Offshore Drilling Company

("ARO") newbuild rigs and the timing of additional ARO newbuild

orders; the availability, delivery, mobilization, contract

commencement, availability, relocation or other movement of rigs

and the timing thereof; rig reactivations; suitability of rigs for

future contracts; divestitures of assets; general economic, market,

business and industry conditions, including inflation and

recessions, trends and outlook; general political conditions,

including political tensions, conflicts and war; cybersecurity

attacks and threats; impacts and effects of public health crises,

pandemics and epidemics; future operations; ability to renew

expiring contracts or obtain new contracts, including for VALARIS

DS-13 and VALARIS DS-14; increasing regulatory complexity; targets,

progress, plans and goals related to sustainability matters; the

outcome of tax disputes; assessments and settlements; and expense

management. The forward-looking statements contained in this press

release are subject to numerous risks, uncertainties and

assumptions that may cause actual results to vary materially from

those indicated, including cancellation, suspension, renegotiation

or termination of drilling contracts and programs; our ability to

obtain financing, service our debt, fund capital expenditures and

pursue other business opportunities; adequacy of sources of

liquidity for us and our customers; future share repurchases;

actions by regulatory authorities, or other third parties; actions

by our security holders; internal control risk; commodity price

fluctuations and volatility, customer demand, loss of a significant

customer or customer contract, downtime and other risks associated

with offshore rig operations; adverse weather, including

hurricanes; changes in worldwide rig supply, including as a result

of reactivations and newbuilds; and demand, competition and

technology; supply chain and logistics challenges; consumer

preferences for alternative fuels and forecasts or expectations

regarding the global energy transition; increased scrutiny of our

sustainability targets, initiatives and reporting and our ability

to achieve such targets or initiatives; changes in customer

strategy; future levels of offshore drilling activity; governmental

action, civil unrest and political and economic uncertainties,

including recessions, volatility affecting the banking system and

financial markets, inflation and adverse changes in the level of

international trade activity; terrorism, piracy and military

action; risks inherent to shipyard rig reactivation, upgrade,

repair, maintenance or enhancement; our ability to enter into, and

the terms of, future drilling contracts; suitability of rigs for

future contracts; the cancellation of letters of intent or letters

of award or any failure to execute definitive contracts following

announcements of letters of intent, letters of award or other

expected work commitments; the outcome of litigation, legal

proceedings, investigations or other claims or contract disputes;

governmental regulatory, legislative and permitting requirements

affecting drilling operations; our ability to attract and retain

skilled personnel on commercially reasonable terms; environmental

or other liabilities, risks or losses; compliance with our debt

agreements and debt restrictions that may limit our liquidity and

flexibility; cybersecurity risks and threats; and changes in

foreign currency exchange rates. In addition to the numerous

factors described above, you should also carefully read and

consider "Item 1A. Risk Factors" in Part I and "Item 7.

Management's Discussion and Analysis of Financial Condition and

Results of Operations" in Part II of our most recent annual report

on Form 10-K, which is available on the Securities and Exchange

Commission's website at www.sec.gov or

on the Investor Relations section of our website at www.valaris.com. Each forward-looking statement

speaks only as of the date of the particular statement, and we

undertake no obligation to update or revise any forward-looking

statements, except as required by law.

VALARIS LIMITED AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In millions, except per share

amounts)

Three Months Ended

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Dec 31, 2022

OPERATING REVENUES

$

483.8

$

455.1

$

415.2

$

430.1

$

433.6

OPERATING EXPENSES

Contract drilling (exclusive of

depreciation)

402.0

390.9

373.5

377.2

353.4

Depreciation

27.5

25.8

24.5

23.3

23.8

General and administrative

24.3

24.2

26.4

24.4

23.9

Total operating expenses

453.8

440.9

424.4

424.9

401.1

EQUITY IN EARNINGS (LOSSES) OF ARO

8.3

2.4

(0.7

)

3.3

8.6

OPERATING INCOME (LOSS)

38.3

16.6

(9.9

)

8.5

41.1

OTHER INCOME (EXPENSE)

Interest income

27.2

26.6

24.6

23.0

15.5

Interest expense, net

(21.7

)

(19.4

)

(16.7

)

(11.1

)

(10.5

)

Other, net

(5.5

)

3.9

(0.8

)

0.6

(5.2

)

—

11.1

7.1

12.5

(0.2

)

INCOME (LOSS) BEFORE INCOME TAXES

38.3

27.7

(2.8

)

21.0

40.9

PROVISION (BENEFIT) FOR INCOME TAXES

(790.2

)

10.7

24.5

(27.6

)

9.8

NET INCOME (LOSS)

828.5

17.0

(27.3

)

48.6

31.1

NET (INCOME) LOSS ATTRIBUTABLE TO

NONCONTROLLING INTERESTS

6.7

(4.1

)

(2.1

)

(1.9

)

(1.9

)

NET INCOME (LOSS) ATTRIBUTABLE TO

VALARIS

$

835.2

$

12.9

$

(29.4

)

$

46.7

$

29.2

EARNINGS (LOSS) PER SHARE

Basic

$

11.47

$

0.18

$

(0.39

)

$

0.62

$

0.39

Diluted

$

11.30

$

0.17

$

(0.39

)

$

0.61

$

0.38

WEIGHTED-AVERAGE SHARES OUTSTANDING

Basic

72.8

73.7

74.8

75.2

75.2

Diluted

73.9

74.8

74.8

76.4

76.0

VALARIS LIMITED AND

SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(In millions)

As of

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Dec 31, 2022

ASSETS

CURRENT ASSETS

Cash and cash equivalents

$

620.5

$

1,041.1

$

787.3

$

822.5

$

724.1

Restricted cash

15.2

16.2

18.0

21.5

24.4

Accounts receivable, net

459.3

492.4

473.4

393.4

449.1

Other current assets

177.2

178.7

168.7

158.1

148.6

Total current assets

$

1,272.2

$

1,728.4

$

1,447.4

$

1,395.5

$

1,346.2

PROPERTY AND EQUIPMENT, NET

1,633.8

1,159.9

1,073.7

1,015.5

977.2

LONG-TERM NOTES RECEIVABLE FROM ARO

282.3

275.2

268.0

261.0

254.0

INVESTMENT IN ARO

124.4

116.1

113.7

114.4

111.1

DEFERRED TAX ASSETS

855.1

53.8

48.5

50.5

55.1

OTHER ASSETS

154.4

151.5

137.1

114.3

116.7

$

4,322.2

$

3,484.9

$

3,088.4

$

2,951.2

$

2,860.3

LIABILITIES AND SHAREHOLDERS'

EQUITY

CURRENT LIABILITIES

Accounts payable - trade

$

400.1

$

376.4

$

364.2

$

324.1

$

256.5

Accrued liabilities and other

344.2

346.6

294.7

267.7

247.9

Total current liabilities

$

744.3

$

723.0

$

658.9

$

591.8

$

504.4

LONG-TERM DEBT

1,079.3

1,079.4

681.9

542.8

542.4

DEFERRED TAX LIABILITIES

29.9

17.1

16.7

16.1

16.1

OTHER LIABILITIES

471.7

465.4

464.8

448.5

499.5

TOTAL LIABILITIES

2,325.2

2,284.9

1,822.3

1,599.2

1,562.4

TOTAL EQUITY

1,997.0

1,200.0

1,266.1

1,352.0

1,297.9

$

4,322.2

$

3,484.9

$

3,088.4

$

2,951.2

$

2,860.3

VALARIS LIMITED AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In millions)

Year Ended December 31,

2023

2022

OPERATING ACTIVITIES

Net income

$

866.8

$

181.8

Adjustments to reconcile net income to net

cash provided by operating activities:

Deferred income tax expense (benefit)

(786.4

)

7.9

Depreciation expense

101.1

91.2

Loss on extinguishment of debt

29.2

—

Net gain on sale of property

(28.6

)

(141.2

)

Accretion of discount on notes receivable

from ARO

(28.3

)

(44.9

)

Share-based compensation expense

27.3

17.4

Equity in earnings of ARO

(13.3

)

(24.5

)

Net periodic pension and retiree medical

income

(0.9

)

(16.4

)

Loss on impairment

—

34.5

Changes in deferred costs

(26.1

)

(38.8

)

Changes in contract liabilities

4.9

62.4

Other

6.7

8.3

Changes in operating assets and

liabilities

121.8

(6.6

)

Contributions to pension plans and other

post-retirement benefits

(6.7

)

(4.1

)

Net cash provided by operating

activities

$

267.5

$

127.0

INVESTING ACTIVITIES

Additions to property and equipment

$

(696.1

)

$

(207.0

)

Net proceeds from disposition of

assets

30.3

150.3

Purchases of short-term investments

—

(220.0

)

Maturities of short-term investments

—

220.0

Repayment of note receivable from ARO

—

40.0

Net cash used in investing activities

$

(665.8

)

$

(16.7

)

FINANCING ACTIVITIES

Issuance of Second Lien Notes

$

1,103.0

$

—

Redemption of First Lien Notes

(571.8

)

—

Payments for share repurchases

(198.6

)

—

Debt issuance costs

(38.6

)

—

Payments for tax withholdings for

share-based awards

(5.4

)

(2.5

)

Consent solicitation fees

—

(3.9

)

Other

(3.1

)

—

Net cash provided by (used in) financing

activities

$

285.5

$

(6.4

)

INCREASE (DECREASE) IN CASH AND CASH

EQUIVALENTS AND RESTRICTED CASH

$

(112.8

)

$

103.9

CASH AND CASH EQUIVALENTS AND RESTRICTED

CASH, BEGINNING OF PERIOD

748.5

644.6

CASH AND CASH EQUIVALENTS AND RESTRICTED

CASH, END OF PERIOD

$

635.7

$

748.5

VALARIS LIMITED AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In millions)

Three Months Ended

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Dec 31, 2022

OPERATING ACTIVITIES

Net income (loss)

$

828.5

$

17.0

$

(27.3

)

$

48.6

$

31.1

Adjustments to reconcile net income (loss)

to net cash provided by (used in) operating activities:

Deferred income tax expense (benefit)

(788.7

)

(4.8

)

2.5

4.6

0.8

Depreciation expense

27.5

25.8

24.5

23.3

23.8

Equity in losses (earnings) of ARO

(8.3

)

(2.4

)

0.7

(3.3

)

(8.6

)

Share-based compensation expense

7.8

6.8

7.0

5.7

5.9

Accretion of discount on notes

receivable

(7.1

)

(7.2

)

(7.0

)

(7.0

)

(7.1

)

Net gain on sale of property

(0.7

)

—

(27.8

)

(0.1

)

(3.5

)

Net periodic pension and retiree medical

income

(0.6

)

(0.1

)

(0.1

)

(0.1

)

(4.3

)

Loss on extinguishment of debt

—

—

29.2

—

—

Changes in contract liabilities

8.8

3.6

13.3

(20.8

)

3.6

Changes in deferred costs

3.2

(22.4

)

(7.4

)

0.5

8.8

Other

1.2

2.8

2.2

0.5

0.4

Changes in operating assets and

liabilities

27.3

31.0

(37.3

)

100.8

103.0

Contributions to pension plans and other

post-retirement benefits

(2.2

)

(1.9

)

(1.6

)

(1.0

)

0.8

Net cash provided by (used in) operating

activities

$

96.7

$

48.2

$

(29.1

)

$

151.7

$

154.7

INVESTING ACTIVITIES

Additions to property and equipment

$

(463.0

)

$

(105.8

)

$

(71.0

)

$

(56.3

)

$

(53.9

)

Net proceeds from disposition of

assets

1.1

0.1

29.0

0.1

3.5

Maturities of short-term investments

—

—

—

—

220.0

Net cash provided by (used in) investing

activities

$

(461.9

)

$

(105.7

)

$

(42.0

)

$

(56.2

)

$

169.6

FINANCING ACTIVITIES

Payments for share repurchases

$

(51.2

)

$

(83.0

)

$

(64.4

)

$

—

$

—

Debt issuance costs

(1.9

)

(5.7

)

(31.0

)

—

—

Payments for tax withholdings for

share-based awards

(0.2

)

(4.8

)

(0.4

)

—

—

Issuance of Second Lien Notes

—

403.0

700.0

—

—

Redemption of First Lien Notes

—

—

(571.8

)

—

—

Other

(3.1

)

—

—

—

—

Net cash provided by (used in) financing

activities

$

(56.4

)

$

309.5

$

32.4

$

—

$

—

INCREASE (DECREASE) IN CASH AND CASH

EQUIVALENTS AND RESTRICTED CASH

$

(421.6

)

$

252.0

$

(38.7

)

$

95.5

$

324.3

CASH AND CASH EQUIVALENTS AND RESTRICTED

CASH, BEGINNING OF PERIOD

1,057.3

805.3

844.0

748.5

424.2

CASH AND CASH EQUIVALENTS AND RESTRICTED

CASH, END OF PERIOD

$

635.7

$

1,057.3

$

805.3

$

844.0

$

748.5

VALARIS LIMITED AND

SUBSIDIARIES

OPERATING STATISTICS

(In millions)

Three Months Ended

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Dec 31, 2022

REVENUES

Floaters

Drillships

$

190.7

$

168.2

$

147.2

$

138.9

$

144.5

Semisubmersibles

56.3

64.1

68.5

67.1

58.2

$

247.0

$

232.3

$

215.7

$

206.0

$

202.7

Reimbursable and Other Revenues (1)

16.2

11.0

11.7

8.8

8.3

Total Floaters

$

263.2

$

243.3

$

227.4

$

214.8

$

211.0

Jackups (2)

HD Ultra-Harsh & Harsh Environment

$

76.6

$

75.5

$

54.1

$

70.9

$

92.9

HD & SD Modern

79.0

68.8

67.9

70.4

62.4

SD Legacy

14.2

10.5

12.5

20.4

20.2

$

169.8

$

154.8

$

134.5

$

161.7

$

175.5

Reimbursable and Other Revenues (1)

9.5

11.1

10.1

8.1

6.3

Total Jackups

$

179.3

$

165.9

$

144.6

$

169.8

$

181.8

Other

Leased and Managed Rigs

$

36.0

$

40.1

$

37.4

$

39.1

$

33.5

Reimbursable and Other Revenues (1)

5.3

5.8

5.8

6.4

7.3

Total Other

$

41.3

$

45.9

$

43.2

$

45.5

$

40.8

Total Operating Revenues

$

483.8

$

455.1

$

415.2

$

430.1

$

433.6

Total Reimbursable and Other Revenues

(1)

$

31.0

$

27.9

$

27.6

$

23.3

$

21.9

Revenues Excluding Reimbursable and Other

Revenues

$

452.8

$

427.2

$

387.6

$

406.8

$

411.7

(1)

Reimbursable and other revenues include

certain types of non-recurring reimbursable revenues, revenues

earned during suspension periods and revenues attributable to

amortization of contract intangibles.

(2)

HD = Heavy Duty; SD = Standard Duty. Heavy

duty jackups are well-suited for operations in tropical revolving

storm areas.

VALARIS LIMITED AND

SUBSIDIARIES

OPERATING STATISTICS

(In millions)

Three Months Ended

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Dec 31, 2022

ADJUSTED EBITDA (1)

Floaters

Drillships (1)

$

16.7

$

2.8

$

0.3

$

12.2

$

18.5

Semisubmersibles (1)

20.5

25.4

30.8

28.0

20.0

$

37.2

$

28.2

$

31.1

$

40.2

$

38.5

Jackups

HD Ultra-Harsh & Harsh (1)

$

21.1

$

20.9

$

6.1

$

3.0

$

31.4

HD & SD - Modern (1)

30.1

20.4

11.6

9.4

13.0

SD - Legacy (1)

4.8

2.9

3.4

8.4

9.8

$

56.0

$

44.2

$

21.1

$

20.8

$

54.2

Total

$

93.2

$

72.4

$

52.2

$

61.0

$

92.7

Other

Leased and Managed Rigs (1)

$

23.2

$

27.2

$

24.9

$

25.4

$

22.3

Total

$

116.4

$

99.6

$

77.1

$

86.4

$

115.0

Support

costs

General and administrative expense

$

24.3

$

24.2

$

26.4

$

24.4

$

23.9

Onshore support costs

34.6

35.4

35.4

33.5

32.8

$

58.9

$

59.6

$

61.8

$

57.9

$

56.7

Valaris Total

$

57.5

$

40.0

$

15.3

$

28.5

$

58.3

(1)

Adjusted EBITDA is earnings before

interest, tax, depreciation and amortization. Adjusted EBITDA for

asset category also excludes onshore support costs and general and

administrative expense.

VALARIS LIMITED AND

SUBSIDIARIES

OPERATING STATISTICS

(In millions)

Three Months Ended

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Dec 31, 2022

ADJUSTED EBITDAR (1)

Active Fleet (1) (2)

$

137.5

$

129.3

$

104.5

$

100.4

$

121.5

Leased and Managed Rigs (1)

23.2

27.2

24.9

25.4

22.3

$

160.7

$

156.5

$

129.4

$

125.8

$

143.8

Stacked Fleet (1) (3)

(5.8

)

(6.0

)

(8.2

)

(13.1

)

(8.1

)

$

154.9

$

150.5

$

121.2

$

112.7

$

135.7

Support

costs

General and administrative expense

$

24.3

$

24.2

$

26.4

$

24.4

$

23.9

Onshore support costs

34.6

35.4

35.4

33.5

32.8

$

58.9

$

59.6

$

61.8

$

57.9

$

56.7

Valaris Total

$

96.0

$

90.9

$

59.4

$

54.8

$

79.0

Reactivation costs (4)

$

38.5

$

50.9

$

44.1

$

26.3

$

20.7

(1)

Adjusted EBITDAR is earnings before

interest, tax, depreciation, amortization and reactivation costs.

Adjusted EBITDAR for active fleet, leased and managed rigs and

stacked fleet also excludes onshore support costs and general and

administrative expense.

(2)

Active fleet represents rigs that are not

preservation stacked, including rigs that are in the process of

being reactivated.

(3)

Stacked fleet represents the combined

total of all preservation and stacking costs.

(4)

Reactivation costs, all of which are

attributed to Valaris' active fleet, are excluded from adjusted

EBITDAR.

VALARIS LIMITED AND

SUBSIDIARIES

OPERATING STATISTICS

(In millions)

Three Months Ended

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Dec 31, 2022

ADJUSTED EBITDAR (1)

Floaters

Drillships (1)

$

55.2

$

53.7

$

44.4

$

38.2

$

38.8

Semisubmersibles (1)

20.5

25.4

30.9

28.2

20.4

$

75.7

$

79.1

$

75.3

$

66.4

$

59.2

Jackups

HD Ultra-Harsh & Harsh (1)

$

21.1

$

20.9

$

6.1

$

3.1

$

31.4

HD & SD - Modern (1)

30.1

20.4

11.5

9.4

13.0

SD - Legacy (1)

4.8

2.9

3.4

8.4

9.8

$

56.0

$

44.2

$

21.0

$

20.9

$

54.2

Total

$

131.7

$

123.3

$

96.3

$

87.3

$

113.4

Other

Leased and Managed Rigs (1)

$

23.2

$

27.2

$

24.9

$

25.4

$

22.3

Total

$

154.9

$

150.5

$

121.2

$

112.7

$

135.7

Support

costs

General and administrative expense

$

24.3

$

24.2

$

26.4

$

24.4

$

23.9

Onshore support costs

34.6

35.4

35.4

33.5

32.8

$

58.9

$

59.6

$

61.8

$

57.9

$

56.7

Valaris Total

$

96.0

$

90.9

$

59.4

$

54.8

$

79.0

(1)

Adjusted EBITDAR is earnings before

interest, tax, depreciation, amortization and reactivation costs.

Adjusted EBITDAR for asset category also excludes onshore support

costs and general and administrative expense.

VALARIS LIMITED AND

SUBSIDIARIES

OPERATING STATISTICS

(In millions)

As of

Feb 15, 2024

Nov 1, 2023

Aug 1, 2023

May 1, 2023

Feb 21, 2023

CONTRACT BACKLOG (1)

Floaters

Drillships

$

2,307.6

$

1,726.5

$

1,684.9

$

1,499.0

$

1,062.3

Semisubmersibles

224.1

259.5

272.4

270.2

314.6

$

2,531.7

$

1,986.0

$

1,957.3

$

1,769.2

$

1,376.9

Jackups

HD Ultra-Harsh & Harsh

646.8

327.9

307.4

277.7

348.3

HD & SD - Modern

347.1

406.8

366.8

317.7

341.1

SD - Legacy

173.5

186.9

118.4

119.7

52.9

$

1,167.4

$

921.6

$

792.6

$

715.1

$

742.3

Total

$

3,699.1

$

2,907.6

$

2,749.9

$

2,484.3

$

2,119.2

Other

Leased and Managed Rigs

$

222.3

$

250.5

$

291.4

$

318.9

$

344.0

Valaris Total

$

3,921.4

$

3,158.1

$

3,041.3

$

2,803.2

$

2,463.2

(1)

Our contract drilling backlog reflects

commitments, represented by signed drilling contracts, and is

calculated by multiplying the contracted day rate by the contract

period. Contract drilling backlog includes drilling contracts

subject to FID and drilling contracts which grant the customer

termination rights if FID is not received with respect to projects

for which the drilling rig is contracted. The contracted day rate

excludes certain types of lump sum fees for rig mobilization,

demobilization, contract preparation, as well as customer

reimbursables and bonus opportunities.

VALARIS LIMITED AND

SUBSIDIARIES

OPERATING STATISTICS

Three Months Ended

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Dec 31, 2022

AVERAGE DAILY REVENUE (1)

Floaters

Drillships

$

307,000

$

288,000

$

253,000

$

239,000

$

232,000

Semisubmersibles

229,000

257,000

252,000

259,000

220,000

$

285,000

$

279,000

$

252,000

$

245,000

$

229,000

Jackups

HD Ultra-Harsh & Harsh

$

111,000

$

116,000

$

100,000

$

126,000

$

119,000

HD & SD Modern

119,000

105,000

102,000

98,000

87,000

SD Legacy

79,000

83,000

81,000

76,000

74,000

$

111,000

$

108,000

$

99,000

$

104,000

$

99,000

Total

$

174,000

$

171,000

$

158,000

$

154,000

$

143,000

Other

Leased and Managed Rigs

$

39,000

$

44,000

$

41,000

$

44,000

$

36,000

Valaris Total

$

136,000

$

134,000

$

124,000

$

124,000

$

115,000

(1)

Average daily revenue is derived by

dividing contract drilling revenues, adjusted to exclude certain

types of non-recurring reimbursable revenues, revenues earned

during suspension periods and revenues attributable to amortization

of drilling contract intangibles, by the aggregate number of

operating days. Beginning with the third quarter of 2023, we began

presenting average daily revenue instead of the previously reported

average day rate metric, which further excluded lump-sum revenues

and amortization thereof. Average daily revenue is a more

comprehensive measurement of our revenue-earning performance and

more closely aligns with the calculation methodology used by our

closest offshore drilling peers. The prior period has been adjusted

to conform with the current period presentation.

VALARIS LIMITED AND

SUBSIDIARIES

OPERATING STATISTICS

Three Months Ended

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Dec 31, 2022

UTILIZATION - TOTAL FLEET (1)

Floaters

Drillships

60

%

58

%

58

%

59

%

62

%

Semisubmersibles

53

%

54

%

60

%

57

%

57

%

58

%

57

%

59

%

58

%

60

%

Jackups

HD Ultra-Harsh & Harsh

68

%

64

%

55

%

57

%

77

%

HD & SD Modern

52

%

51

%

52

%

57

%

55

%

SD Legacy

97

%

69

%

78

%

99

%

99

%

62

%

58

%

55

%

62

%

68

%

Total

60

%

57

%

56

%

60

%

65

%

Other

Leased and Managed Rigs

100

%

100

%

100

%

100

%

100

%

Valaris Total

68

%

65

%

65

%

68

%

72

%

Pro Forma Jackups (2)

69

%

66

%

65

%

69

%

74

%

(1)

Rig utilization is derived by dividing the

number of operating days by the number of available days in the

period for the total fleet.

(2)

Includes all Valaris jackups including

those leased to ARO Drilling.

VALARIS LIMITED AND

SUBSIDIARIES

OPERATING STATISTICS

Three Months Ended

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Dec 31, 2022

UTILIZATION - ACTIVE FLEET (1)

(2)

Floaters

Drillships

68

%

63

%

71

%

77

%

85

%

Semisubmersibles

89

%

90

%

100

%

96

%

96

%

72

%

70

%

78

%

82

%

88

%

Jackups

HD Ultra-Harsh & Harsh

83

%

79

%

67

%

67

%

85

%

HD & SD Modern

80

%

79

%

81

%

89

%

86

%

SD Legacy

97

%

68

%

78

%

99

%

99

%

83

%

78

%

74

%

81

%

87

%

Total

79

%

75

%

76

%

81

%

87

%

Other

Leased and Managed Rigs

100

%

100

%

100

%

100

%

100

%

Valaris Total

84

%

81

%

82

%

86

%

90

%

Pro Forma Jackups (3)

86

%

83

%

81

%

85

%

88

%

(1)

Rig utilization is derived by dividing the

number of operating days by the number of available days in the

period for the active fleet.

(2)

Active fleet represents rigs that are not

preservation stacked, including rigs that are in the process of

being reactivated.

(3)

Includes all Valaris jackups including

those leased to ARO Drilling.

VALARIS LIMITED AND

SUBSIDIARIES

OPERATING STATISTICS

Three Months Ended

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Dec 31, 2022

AVAILABLE DAYS - TOTAL FLEET

(1)

Floaters

Drillships

1,032

1,012

1,001

990

1,012

Semisubmersibles

460

460

455

450

460

1,492

1,472

1,456

1,440

1,472

Jackups

HD Ultra-Harsh & Harsh

1,012

1,012

990

990

1,012

HD & SD Modern

1,288

1,288

1,274

1,260

1,288

SD Legacy

184

184

199

270

276

2,484

2,484

2,463

2,520

2,576

Total

3,976

3,956

3,919

3,960

4,048

Other

Leased and Managed Rigs

920

920

910

900

920

Valaris Total

4,896

4,876

4,829

4,860

4,968

(1)

Represents the maximum number of days

available in the period for the total fleet, calculated by

multiplying the number of rigs in each asset category by the number

of days in the period, irrespective of asset status.

VALARIS LIMITED AND

SUBSIDIARIES

OPERATING STATISTICS

Three Months Ended

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Dec 31, 2022

AVAILABLE DAYS - ACTIVE FLEET

(1)

Floaters

Drillships

920

920

819

751

736

Semisubmersibles

276

276

273

270

276

1,196

1,196

1,092

1,021

1,012

Jackups

HD Ultra-Harsh & Harsh

828

828

808

841

920

HD & SD Modern

828

828

819

810

828

SD Legacy

184

184

199

270

276

1,840

1,840

1,826

1,921

2,024

Total

3,036

3,036

2,918

2,942

3,036

Other

Leased and Managed Rigs

920

920

910

900

920

Valaris Total

3,956

3,956

3,828

3,842

3,956

(1)

Represents the maximum number of days

available in the period for the active fleet, calculated by

multiplying the number of rigs in each asset category by the number

of days in the period, for active rigs only. Active rigs are

defined as rigs that are not preservation stacked.

VALARIS LIMITED AND

SUBSIDIARIES

OPERATING STATISTICS

Three Months Ended

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Dec 31, 2022

OPERATING DAYS (1)

Floaters

Drillships

622

584

583

581

623

Semisubmersibles

245

249

272

258

264

867

833

855

839

887

Jackups

HD Ultra-Harsh & Harsh

691

652

540

564

778

HD & SD Modern

665

654

663

718

713

SD Legacy

178

126

155

268

273

1,534

1,432

1,358

1,550

1,764

Total

2,401

2,265

2,213

2,389

2,651

Other

Leased and Managed Rigs

920

920

910

900

920

Valaris Total

3,321

3,185

3,123

3,289

3,571

(1)

Represents the total number of days under

contract in the period. Days under contract equals the total number

of days that rigs have earned and recognized day rate revenue,

including days associated with early contract terminations,

compensated downtime and mobilizations. When revenue is deferred

and amortized over a future period, for example when we receive

fees while mobilizing to commence a new contract or while being

upgraded in a shipyard, the related days are excluded from days

under contract.

VALARIS LIMITED AND

SUBSIDIARIES

OPERATING STATISTICS

Three Months Ended

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Dec 31, 2022

REVENUE EFFICIENCY (1)

Floaters

Drillships

88

%

89

%

95

%

97

%

96

%

Semisubmersibles

94

%

93

%

100

%

100

%

100

%

90

%

90

%

96

%

98

%

97

%

Jackups

HD Ultra-Harsh & Harsh

99

%

99

%

99

%

100

%

96

%

HD & SD Modern

97

%

97

%

98

%

100

%

99

%

SD Legacy

97

%

99

%

100

%

99

%

100

%

98

%

98

%

99

%

100

%

98

%

Valaris Total

93

%

94

%

97

%

99

%

98

%

(1)

Revenue efficiency is day rate revenue

earned as a percentage of maximum potential day rate revenue.

VALARIS LIMITED AND

SUBSIDIARIES

OPERATING STATISTICS

As of

NUMBER OF RIGS

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Dec 31, 2022

Active Fleet (1)

Floaters

Drillships

10

10

9

9

8

Semisubmersibles

3

3

3

3

3

13

13

12

12

11

Jackups

HD Ultra-Harsh & Harsh

9

9

9

9

10

HD & SD Modern

9

9

9

9

9

SD Legacy

2

2

2

3

3

20

20

20

21

22

Total Active Fleet

33

33

32

33

33

Stacked Fleet

Floaters

Drillships

3

1

2

2

3

Semisubmersibles

2

2

2

2

2

5

3

4

4

5

Jackups

HD Ultra-Harsh & Harsh

2

2

2

2

1

HD & SD Modern

5

5

5

5

5

7

7

7

7

6

Total Stacked Fleet

12

10

11

11

11

Leased Rigs (2)

Jackups

HD Ultra-Harsh & Harsh

1

1

1

1

1

HD & SD Modern

7

7

7

7

7

Total Leased Rigs

8

8

8

8

8

Valaris Total

53

51

51

52

52

Managed Rigs (2)

2

2

2

2

2

(1)

Active fleet represents rigs that are not

preservation stacked, including rigs that are in the process of

being reactivated.

(2)

Leased rigs and managed rigs included in

Other reporting segment.

ARO DRILLING

CONDENSED BALANCE SHEET

INFORMATION

(In millions)

As of

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Dec 31, 2022

Cash

$

92.9

$

110.3

$

100.6

$

101.2

$

176.2

Other current assets

184.0

191.2

188.3

189.3

140.6

Non-current assets

1,081.0

915.3

879.6

830.2

818.1

Total assets

$

1,357.9

$

1,216.8

$

1,168.5

$

1,120.7

$

1,134.9

Current liabilities

$

136.0

$

173.6

$

122.6

$

68.5

$

86.3

Non-current liabilities

1,056.8

886.2

887.5

887.4

884.6

Total liabilities

$

1,192.8

$

1,059.8

$

1,010.1

$

955.9

$

970.9

Shareholders' equity

$

165.1

$

157.0

$

158.4

$

164.8

$

164.0

Total liabilities and shareholders'

equity

$

1,357.9

$

1,216.8

$

1,168.5

$

1,120.7

$

1,134.9

ARO DRILLING

CONDENSED INCOME STATEMENT

INFORMATION

(In millions)

Three Months Ended

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Dec 31, 2022

Revenues

$

133.7

$

121.5

$

117.8

$

123.6

$

120.4

Operating expenses

Contract drilling (exclusive of

depreciation)

88.0

92.0

95.0

90.9

85.5

Depreciation

19.5

15.8

15.6

15.0

16.1

General and administrative

6.3

5.6

5.7

4.6

5.6

Operating income

$

19.9

$

8.1

$

1.5

$

13.1

$

13.2

Other expense, net

3.6

9.0

8.8

10.4

1.8

Provision for income taxes

6.0

0.4

—

1.9

0.7

Net income (loss)

$

10.3

$

(1.3

)

$

(7.3

)

$

0.8

$

10.7

EBITDA

$

39.4

$

23.9

$

17.1

$

28.1

$

29.3

ARO Drilling condensed balance sheet and income statement

information presented above represents 100% of ARO. Valaris has a

50% ownership interest in ARO.

ARO DRILLING

OPERATING STATISTICS

As of

(In millions)

Feb 15, 2024

Nov 1, 2023

Aug 1, 2023

May 1, 2023

Feb 21, 2023

CONTRACT BACKLOG (1)

Owned Rigs

$

1,475.4

$

1,547.0

$

686.3

$

747.7

$

794.3

Leased Rigs

662.7

743.7

815.0

884.7

937.5

Total

$

2,138.1

$

2,290.7

$

1,501.3

$

1,632.4

$

1,731.8

(1)

Contract drilling backlog reflects

commitments, represented by signed drilling contracts, and is

calculated by multiplying the contracted day rate by the contract

period. The contracted day rate excludes certain types of lump sum

fees for rig mobilization, demobilization, contract preparation, as

well as customer reimbursables and bonus opportunities.

Three Months Ended

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Dec 31, 2022

AVERAGE DAILY REVENUE (1)

Owned Rigs

$

100,000

$

91,000

$

90,000

$

99,000

$

95,000

Leased Rigs (2)

97,000

98,000

98,000

98,000

91,000

Total

$

98,000

$

95,000

$

95,000

$

98,000

$

93,000

UTILIZATION (3)

Owned Rigs

96

%

91

%

83

%

91

%

96

%

Leased Rigs (2)

94

%

95

%

98

%

95

%

91

%

Total

95

%

93

%

91

%

93

%

93

%

REVENUE EFFICIENCY (4)

Owned Rigs

94

%

99

%

95

%

98

%

97

%

Leased Rigs (2)

98

%

97

%

99

%

95

%

93

%

Total

96

%

98

%

97

%

96

%

95

%

NUMBER OF RIGS (AT QUARTER END)

(5)

Owned Rigs

8

7

7

7

7

Leased Rigs (2)

8

8

8

8

8

Total

16

15

15

15

15

AVAILABLE DAYS (6)

Owned Rigs

695

644

637

630

644

Leased Rigs (2)

736

736

728

720

736

Total

1,431

1,380

1,365

1,350

1,380

OPERATING DAYS (7)

Owned Rigs

668

585

532

575

618

Leased Rigs (2)

691

697

713

683

672

Total

1,359

1,282

1,245

1,258

1,290

(1)

Average daily revenue is derived by

dividing contract drilling revenues, adjusted to exclude certain

types of non-recurring reimbursable revenues, revenues earned

during suspension periods and revenues attributable to amortization

of drilling contract intangibles, by the aggregate number of

operating days.

(2)

All ARO leased rigs are leased from

Valaris.

(3)

Rig utilization is derived by dividing the

number of operating days by the number of available days in the

period for the rig fleet.

(4)

Revenue efficiency is day rate revenue

earned as a percentage of maximum potential day rate revenue.

(5)

Rig count for owned rigs as of December

31, 2023 excludes a rig under construction, which is expected to be

delivered in the first half of 2024.

(6)

Represents the maximum number of days

available in the period for the rig fleet, calculated by

multiplying the number of rigs in each asset category by the number

of days in the period, irrespective of asset status.

(7)

Represents the total number of days under

contract in the period. Days under contract equals the total number

of days that rigs have earned and recognized day rate revenue,

including days associated with early contract terminations,

compensated downtime and mobilizations. When revenue is deferred

and amortized over a future period, for example when we receive

fees while mobilizing to commence a new contract or while being

upgraded in a shipyard, the related days are excluded from days

under contract.

Non-GAAP Financial Measures

To supplement Valaris’ condensed consolidated financial

statements presented on a GAAP basis, this press release provides

investors with Adjusted EBITDA and Adjusted EBITDAR, which are

non-GAAP measures.

Valaris defines "Adjusted EBITDA" as net income (loss) from

continuing operations before income tax expense, interest expense,

other (income) expense, depreciation expense, amortization, loss on

impairment and equity in (earnings) losses of ARO. Adjusted EBITDA

is a non-GAAP measure that our management uses to facilitate

period-to-period comparisons of our core operating performance and

to evaluate our long-term financial performance against that of our

peers. We believe that this measure is useful to investors and

analysts in allowing for greater transparency of our core operating

performance and makes it easier to compare our results with those

of other companies within our industry. Adjusted EBITDA should not

be considered (a) in isolation of, or as a substitute for, net

income (loss), (b) as an indication of cash flows from operating

activities, or (c) as a measure of liquidity. Adjusted EBITDA may

not be comparable to other similarly titled measures reported by

other companies.

Valaris defines "Adjusted EBITDAR" as Adjusted EBITDA before

reactivation costs. Adjusted EBITDAR is a non-GAAP measure that our

management uses to assess the performance of our fleet excluding

one-time rig reactivation costs. We believe that this measure is

useful to investors and analysts in allowing for greater

transparency of our core operating performance. Adjusted EBITDAR

should not be considered (a) in isolation of, or as a substitute

for, net income (loss), (b) as an indication of cash flows from

operating activities, or (c) as a measure of liquidity. Adjusted

EBITDAR may not be comparable to other similarly titled measures

reported by other companies.

Valaris defines ARO "EBITDA" as net income before income tax

expense, other expense, net and depreciation expense. EBITDA is a

non-GAAP measure that our management uses to facilitate

period-to-period comparisons of ARO's core operating performance

and to evaluate ARO's long-term financial performance against that

of ARO's peers. We believe that this measure is useful to investors

and analysts in allowing for greater transparency of ARO's core

operating performance and makes it easier to compare ARO's results

with those of other companies within ARO's industry. EBITDA should

not be considered (a) in isolation of, or as a substitute for, net

income (loss), (b) as an indication of cash flows from operating

activities, or (c) as a measure of liquidity. EBITDA may not be

comparable to other similarly titled measures reported by other

companies.

The Company is not able to provide a reconciliation of the

Company's forward-looking Adjusted EBITDA, as discussed on its

fourth quarter 2023 earnings conference call, to the most directly

comparable GAAP measure without unreasonable effort because of the

inherent difficulty in forecasting and quantifying certain amounts

necessary for such a reconciliation, including forward-looking tax

expense and other income (expense).

Non-GAAP financial measures should be considered as a supplement

to, and not as a substitute for, or superior to, financial measures

prepared in accordance with GAAP.

Reconciliation of Net Income to Adjusted EBITDA

A reconciliation of net income as reported to Adjusted EBITDA is

included in the tables below (in millions):

Three Months Ended

Dec 31, 2023

Sep 30, 2023

VALARIS

Net income

$

828.5

$

17.0

Add (subtract):

Income tax expense (benefit)

(790.2

)

10.7

Interest expense

21.7

19.4

Other income

(21.7

)

(30.5

)

Operating income

38.3

16.6

Add (subtract):

Depreciation expense

27.5

25.8

Equity in earnings of ARO

(8.3

)

(2.4

)

Adjusted EBITDA

$

57.5

$

40.0

Three Months Ended

Dec 31, 2023

Sep 30, 2023

ARO

Net income (loss)

$

10.3

$

(1.3

)

Add:

Income tax expense

6.0

0.4

Other expense, net

3.6

9.0

Operating income

$

19.9

$

8.1

Add:

Depreciation expense

19.5

15.8

EBITDA

$

39.4

$

23.9

Reconciliation of Net Income to Adjusted EBITDA and Adjusted

EBITDAR

(In millions)

Three Months Ended

Dec 31, 2023

Sep 30, 2023

FLOATERS

Net income

$

24.3

$

14.5

Subtract:

Other income

(2.1

)

(0.6

)

Operating income

$

22.2

$

13.9

Add:

Depreciation

15.0

14.2

Other

—

0.1

Adjusted EBITDA

$

37.2

$

28.2

Add:

Reactivation costs

38.5

50.9

Adjusted EBITDAR

$

75.7

$

79.1

JACKUPS

Net income

$

46.1

$

34.4

Subtract:

Other income

(1.3

)

(0.4

)

Operating income

$

44.8

$

34.0

Add:

Depreciation

11.2

10.2

Adjusted EBITDA

$

56.0

$

44.2

Adjusted EBITDAR

$

56.0

$

44.2

OTHER

Net income

$

22.1

$

25.8

Operating income

$

22.1

$

25.8

Add (subtract):

Depreciation

1.2

1.3

Other

(0.1

)

0.1

Adjusted EBITDA

$

23.2

$

27.2

Adjusted EBITDAR

$

23.2

$

27.2

Reconciliation of Net Income (Loss) to Adjusted

EBITDAR

(In millions)

Three Months Ended

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Dec 31, 2022

ACTIVE FLEET (1)

Net income

$

78.7

$

57.5

$

68.2

$

55.4

$

79.9

Subtract:

Other income

$

(3.3

)

$

(1.0

)

$

(27.4

)

$

—

$

(0.9

)

Operating income

$

75.4

$

56.5

$

40.8

$

55.4

$

79.0

Add (subtract):

Reactivation costs

38.5

50.9

44.1

26.3

20.7

Depreciation and amortization

23.5

21.9

19.6

18.9

21.9

Other

0.1

—

—

(0.2

)

(0.1

)

Adjusted EBITDAR (2)

$

137.5

$

129.3

$

104.5

$

100.4

$

121.5

LEASED AND MANAGED RIGS

Net income

$

22.1

$

25.8

$

23.8

$

24.0

$

21.2

Operating income

$

22.1

$

25.8

$

23.8

$

24.0

$

21.2

Add (subtract):

Depreciation

1.2

1.3

1.2

1.3

1.3

Other

(0.1

)

0.1

(0.1

)

0.1

(0.2

)

Adjusted EBITDAR (2)

$

23.2

$

27.2

$

24.9

$

25.4

$

22.3

STACKED FLEET

Net loss

$

(8.3

)

$

(8.6

)

$

(11.7

)

$

(15.8

)

$

(6.9

)

Subtract:

Other income

$

(0.1

)

$

—

$

—

$

(0.5

)

$

(3.9

)

Operating loss

$

(8.4

)

$

(8.6

)

$

(11.7

)

$

(16.3

)

$

(10.8

)

Add (subtract):

Depreciation

2.7

2.5

3.6

3.2

2.7

Other

(0.1

)

0.1

(0.1

)

—

—

Adjusted EBITDAR (2)

$

(5.8

)

$

(6.0

)

$

(8.2

)

$

(13.1

)

$

(8.1

)

TOTAL FLEET

Net income

$

92.5

$

74.7

$

80.3

$

63.6

$

94.2

Subtract:

Other income

$

(3.4

)

$

(1.0

)

$

(27.4

)

$

(0.5

)

$

(4.8

)

Operating income

$

89.1

$

73.7

$

52.9

$

63.1

$

89.4

Add (subtract):

Reactivation costs

38.5

50.9

44.1

26.3

20.7

Depreciation and amortization

27.4

25.7

24.4

23.4

25.9

Other

(0.1

)

0.2

(0.2

)

(0.1

)

(0.3

)

Adjusted EBITDAR (2)

$

154.9

$

150.5

$

121.2

$

112.7

$

135.7

(1)

Active fleet represents rigs that are not

preservation stacked, including rigs that are in the process of

being reactivated.

(2)

Adjusted EBITDAR for active fleet, leased

and managed rigs and stacked fleet excludes onshore support costs

and general and administrative expense.

Reconciliation of Net Income (Loss) to Adjusted

EBITDA

(In millions)

Three Months Ended

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Dec 31, 2022

DRILLSHIPS

Net income (loss)

$

4.7

$

(9.9

)

$

(12.0

)

$

0.4

$

7.3

Subtract:

Other income

$

(2.0

)

$

(0.6

)

$

(0.4

)

$

(0.3

)

$

(0.9

)

Operating income (loss)

$

2.7

$

(10.5

)

$

(12.4

)

$

0.1

$

6.4

Add (subtract):

Depreciation

14.0

13.2

12.8

12.2

12.1

Other

—

0.1

(0.1

)

(0.1

)

—

Adjusted EBITDA (1)

$

16.7

$

2.8

$

0.3

$

12.2

$

18.5

SEMISUBMERSIBLES

Net income

$

19.6

$

24.4

$

29.9

$

27.1

$

19.3

Add (subtract):

Other (income) expense

$

(0.1

)

$

—

$

0.1

$

—

$

(0.2

)

Operating income

$

19.5

$

24.4

$

30.0

$

27.1

$

19.1

Add:

Depreciation

1.0

1.0

0.8

0.9

0.8

Other

—

—

—

—

0.1

Adjusted EBITDA (1)

$

20.5

$

25.4

$

30.8

$

28.0

$

20.0

(1)

Adjusted EBITDA for asset category

excludes onshore support costs and general and administrative

expense.

Reconciliation of Net Income (Loss) to Adjusted

EBITDA

(In millions)

Three Months Ended

Dec 31, 2023

Sep 30, 2023

Jun 30, 2023

Mar 31, 2023

Dec 31, 2022

HD ULTRA-HARSH & HARSH

JACKUPS

Net income (loss)

$ 15.4

$ 15.4

$ 0.4

$ (2.5

)

$ 29.3

Subtract:

Other income

$ (0.1

)

$ (0.2

)

$ —

$ (0.1

)

$ (3.5

)

Operating income (loss)

$ 15.3

$ 15.2

$ 0.4

$ (2.6

)

$ 25.8

Add (subtract):

Depreciation

5.8

5.7

5.7

5.8

5.7

Other

—

—

—

(0.2

)

(0.1

)

Adjusted EBITDA (1)

$ 21.1

$ 20.9

$ 6.1

$ 3.0

$ 31.4

HD & SD MODERN JACKUPS

Net income

$ 28.2

$ 17.7

$ 8.9

$ 7.2

$ 8.8

Subtract:

Other income

$ (1.2

)

$ (0.2

)

$ (0.1

)

$ (0.1

)

$ (0.1

)

Operating income

$ 27.0

$ 17.5

$ 8.8

$ 7.1

$ 8.7

Add (subtract):

Depreciation and amortization

3.0

2.9

2.9

2.4

4.4

Other

0.1

—

(0.1

)

(0.1

)

(0.1

)

Adjusted EBITDA (1)

$ 30.1

$ 20.4

$ 11.6

$ 9.4

$ 13.0

SD LEGACY JACKUPS

Net income

$ 2.5

$ 1.3

$ 29.8

$ 7.4

$ 8.3

Subtract:

Other income

$ —

$ —

$ (27.5

)

$ —

$ (0.1

)

Operating income

$ 2.5

$ 1.3

$ 2.3

$ 7.4

$ 8.2

Add (subtract):

Depreciation

2.4

1.6

1.0

0.9

1.6

Other

(0.1

)

—

0.1

0.1

—

Adjusted EBITDA (1)

$ 4.8

$ 2.9

$ 3.4

$ 8.4

$ 9.8

(1)

Adjusted EBITDA for asset category

excludes onshore support costs and general and administrative

expense.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240221354956/en/

Investor & Media Contacts:

Darin Gibbins Vice President - Investor Relations and Treasurer

+1-713-979-4623

Tim Richardson Director - Investor Relations +1-713-979-4619

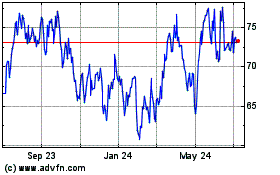

Valaris (NYSE:VAL)

Historical Stock Chart

From Oct 2024 to Nov 2024

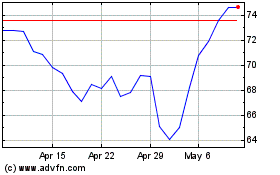

Valaris (NYSE:VAL)

Historical Stock Chart

From Nov 2023 to Nov 2024