falseU S PHYSICAL THERAPY INC /NV000088597800008859782024-05-272024-05-27

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 27, 2024

U.S. PHYSICAL THERAPY, INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

001-11151

|

|

76-0364866

|

|

(State or other jurisdiction

of incorporation or organization)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

1300 WEST SAM HOUSTON PARKWAY,

SUITE 300,

HOUSTON, Texas

|

|

77043

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant's telephone number, including area code: (713) 297-7000

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions ( see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

|

|

☐

|

Soliciting material pursuant to Rule 14a-12(b) under the Exchange Act (17 CFR 240.14a-12)

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $.01 par value

|

USPH

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| |

Emerging growth company

|

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

|

◻

|

ITEM 1.01 Entry into a Material Definitive Agreement.

The information in Item 5.02 below is incorporated by reference into this Item 1.01.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory

Arrangements of Certain Officers.

Compensatory Arrangements of Executive Officers

On May 27, 2024, U.S. Physical Therapy, Inc. (the “Company”) and each of its executive officers entered into an amendment to their respective

employment agreements to amend and restate the terms of the severance and other benefits due to the executive in the event of a Termination Event, as defined in the employment agreements. Specifically, the employment agreements were amended to

provide that, upon the occurrence of any such Termination Event, each executive is entitled to additional benefits of a pro rata portion of the awards under the then applicable subjective and objective incentive plans. The amendments were made to

the employment agreements for Christopher Reading (Chairman and Chief Executive Officer), Eric Williams (President and Co-Chief Operating Officer), Graham Reeve (Co-Chief Operating Officer), Carey Hendrickson (Chief Financial Officer), and Rick

Binstein (Executive Vice President, General Counsel and Secretary).

The foregoing descriptions are qualified in entirety by reference to the full text of each of the amended employment agreements,

which are filed as Exhibits 99.1, 99.2, 99.3, 99.4 and 99.5 respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

| |

|

|

|

Exhibits

|

|

Description of Exhibits

|

| |

|

|

|

|

First Amendment to Third Amended and Restated Employment Agreement, entered into as of May 27, 2024, by and between the Company and

Christopher Reading.

|

|

|

|

First Amendment to Employment Agreement, entered into as of May 27, 2024, by and between the Company and Eric Williams.

|

|

|

|

First Amendment to Amended and Restated Employment Agreement, entered into as of May 27, 2024, by and between the Company and Graham Reeve.

|

|

|

|

First Amendment to Employment Agreement, entered into as of May 27, 2024, by and between the Company and Carey Hendrickson. |

|

|

|

First Amendment to Amended and Restated Employment Agreement, entered into as of May 27, 2024, by and between the Company and Richard Binstein. |

* Filed herewith

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

| |

|

|

|

|

|

|

|

| |

|

|

|

U.S. PHYSICAL THERAPY, INC.

|

|

| |

|

|

|

|

|

Dated: May 31, 2024

|

|

|

|

By:

|

|

/s/ CAREY HENDRICKSON

|

|

| |

|

|

|

|

|

Carey Hendrickson

|

|

| |

|

|

|

|

|

Chief Financial Officer

|

|

| |

|

|

|

|

|

(duly authorized officer and principal financial and accounting officer)

|

|

Exhibit 99.1

FIRST AMENDMENT TO THIRD AMENDED AND RESTATED EMPLOYMENT AGREEMENT

THIS FIRST AMENDMENT TO THIRD AMENDED AND RESTATED EMPLOYMENT AGREEMENT (“Amendment”) is made and entered into as of the 27th day of May, 2024 (“Effective Date”), by and between U.S. Physical

Therapy, Inc. (the “Company”) and Chris Reading (“Employee”).

R E C I T A L S

WHEREAS, the Company and Employee have entered into that certain Third Amended and Restated Employment Agreement, dated as of May 21, 2019 (the

“Agreement”); and

WHEREAS, the Company and Employee wish to amend certain terms of the Agreement;

NOW, THEREFORE, in consideration of the mutual covenants, agreements, terms and conditions contained herein and other good

and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby agree as follows:

1. Section 9.B. of the Agreement is hereby deleted and substituted in its entirety with the following:

B. Special Benefit in the Event of Termination Without Cause or Resignation for Good Cause.

In the event of the termination of employment of Employee by Employer without “cause” as cause is defined in Section 8(c)

hereof, or the resignation of employment by Employee “for good reason” as defined in Section 9 F. hereof (in either case, a “Termination Event”), Employee shall be entitled to the following special benefits:

|

(i)

|

Two (2) year’s Base Compensation; and

|

|

(ii)

|

(ii) The greater of (i) the bonus paid or payable to Employee with respect to last fiscal year of Employer completed prior to the

occurrence of the Termination Event or (ii) the average of the bonuses paid to Employee over the three (3) fiscal years of Employer ending with last fiscal year of Employer completed prior to the occurrence of the Termination Event; and

|

|

(iii)

|

(a) For any fiscal year completed prior to the Termination Event for which a cash bonus and restricted share grants awardable under

the applicable incentive plan for such fiscal year has not been both determined and paid/granted, as applicable, Employee shall receive (1) 100% of the subjective cash and 100% of the subjective restricted share awards for which Employee

was eligible under such plan, and (2) cash and restricted shares awards under the objective portion of such plans based on the actual objective performance of Employer for such plan year; and

|

(b) For any Termination Event which occurs during the final six (6) months of the applicable fiscal year, Employee shall

receive (1) a pro rata portion of the subjective cash and the subjective restricted share awards for which Employee was eligible under the applicable incentive plan for such fiscal year, based on the portion of the fiscal year that has transpired as

of the Termination Event, and (2) a pro rata portion of the objective cash and of the objective restricted share awards for which Employee was eligible under such plan, based on the portion of the fiscal year that has transpired as of the Termination

Event and the actual objective performance of Employer for the full plan year, once determined.

(iv) Employee’s accrued but unused vacation days; and

|

(v) |

All Restricted Stock owned by Employee shall immediately become Vested Shares, as such term is defined in the applicable grant agreement and plan documents.

|

The aggregate dollar amount of the special benefits described in subsections (i), (ii) and (iii) above shall be aggregated

and paid ratably on a bi-weekly basis over the 24 month period following the Termination Event; the restricted stock to be granted pursuant to subsection (iii) above shall be granted once determined and shall be Vested Shares (as defined in the

incentive plan for the applicable fiscal year). If a Change in Control has occurred within six months after, or within twelve months prior to a Termination Event, Employee shall also be entitled to the special benefits under this Section 9.B (in

addition to the benefits otherwise provided in Section 9.A.).

|

2. |

Ratification and Affirmation. Except as otherwise provided herein, all other terms and

conditions of the Agreement remain in full force and effect.

|

IN WITNESS WHEREOF, the parties have entered into this Amendment as of the date first above written.

COMPANY:

U.S. PHYSICAL THERAPY, INC.

By: /s/ Richard Binstein

Richard Binstein, Executive Vice President

EMPLOYEE:

/s/ Christopher J. Reading

Christopher J. Reading

Exhibit 99.2

FIRST AMENDMENT TO EMPLOYMENT AGREEMENT

THIS FIRST AMENDMENT TO EMPLOYMENT AGREEMENT (“Amendment”)

is made and entered into as of the 27th day of May, 2024 (“Effective Date”), by and between U.S. Physical Therapy, Inc. (the “Company”) and Eric Williams (“Employee”).

R E C I T A L S

WHEREAS, the Company and Employee have entered into that certain Employment Agreement, dated as of December 3, 2020 (the “Agreement”); and

WHEREAS, the Company and Employee wish to amend certain terms of the Agreement;

NOW, THEREFORE, in consideration of the mutual covenants, agreements, terms and conditions contained herein and other good

and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby agree as follows:

1. Section 9.B. of the Agreement is hereby deleted and substituted in its entirety with the following:

B. Special Benefit in the Event of Termination Without Cause or Resignation for Good Cause.

In the event of the termination of employment of Employee by Employer without “cause” as cause is defined in Section 8(c)

hereof, or the resignation of employment by Employee “for good reason” as defined in Section 9 F. hereof (in either case, a “Termination Event”), Employee shall be entitled to the following special benefits:

|

(i)

|

Two (2) year’s Base Compensation; and

|

|

(ii)

|

The greater of (i) the bonus paid or payable to Employee with respect to last fiscal year of Employer completed prior to the

occurrence of the Termination Event or (ii) the average of the bonuses paid to Employee over the three (3) fiscal years of Employer ending with last fiscal year of Employer completed prior to the occurrence of the Termination Event; and

|

|

(iii)

|

(a) For any fiscal year completed prior to the Termination Event for which a cash bonus and restricted share grants awardable under

the applicable incentive plan for such fiscal year has not been both determined and paid/granted, as applicable, Employee shall receive (1) 100% of the subjective cash and 100% of the subjective restricted share awards for which Employee

was eligible under such plan, and (2) cash and restricted shares awards under the objective portion of such plans based on the actual objective performance of Employer for such plan year; and

|

(b) For any Termination Event which occurs during the final six (6) months of the applicable fiscal year, Employee shall

receive (1) a pro rata portion of the subjective cash and the subjective restricted share awards for which Employee was eligible under the applicable incentive plan for such fiscal year, based on the portion of the fiscal year that has transpired as

of the Termination Event, and (2) a pro rata portion of the objective cash and of the objective restricted share awards for which Employee was eligible under such plan, based on the portion of the fiscal year that has transpired as of the Termination

Event and the actual objective performance of Employer for the full plan year, once determined.

|

(iv)

|

Employee’s accrued but unused vacation days; and

|

|

(v)

|

All Restricted Stock owned by Employee shall immediately become Vested Shares, as such term is defined in the applicable grant

agreement and plan documents.

|

The aggregate dollar amount of the special benefits described in subsections (i), (ii) and (iii) above shall be aggregated

and paid ratably on a bi-weekly basis over the 24 month period following the Termination Event; the restricted stock to be granted pursuant to subsection (iii) above shall be granted once determined and shall be Vested Shares (as defined in the

incentive plan for the applicable fiscal year). If a Change in Control has occurred within six months after, or within twelve months prior to a Termination Event, Employee shall also be entitled to the special benefits under this Section 9.B (in

addition to the benefits otherwise provided in Section 9.A.).

|

2. |

Ratification and Affirmation. Except as otherwise provided herein, all other terms and

conditions of the Agreement remain in full force and effect.

|

IN WITNESS WHEREOF, the parties have entered into this Amendment as of the date first above written.

| |

|

|

| |

COMPANY:

|

| |

|

|

| |

U.S. PHYSICAL THERAPY, INC.

|

| |

|

|

| |

By:

|

/s/ Christoher J. Reading

|

| |

|

Christopher J. Reading, CEO

|

| |

|

|

| |

EMPLOYEE:

|

| |

|

|

| |

|

/s/ Eric Williams

|

| |

|

Eric Williams

|

Exhibit 99.3

FIRST AMENDMENT TO AMENDED AND RESTATED EMPLOYMENT AGREEMENT

THIS FIRST AMENDMENT TO AMENDED AND RESTATED EMPLOYMENT AGREEMENT (“Amendment”) is made and entered into as of the 27th day of May, 2024 (“Effective Date”), by and between U.S. Physical Therapy, Inc.

(the “Company”) and Graham Reeve (“Employee”).

R E C I T A L S

WHEREAS, the Company and Employee have entered into that certain Amended and Restated Employment Agreement, dated as of May 21, 2019 (the “Agreement”); and

WHEREAS, the Company and Employee wish to amend certain terms of the Agreement;

NOW, THEREFORE, in consideration of the mutual covenants, agreements, terms and conditions contained herein and other good

and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby agree as follows:

1. Section 9.A. of the Agreement is hereby deleted and substituted in its entirety with the following:

|

A.

|

Special Benefits in the Event of Termination Without Cause or Resignation for Good Cause.

|

In the event of the termination of employment of Employee by Employer without “cause as cause is defined in Section 8(c)

hereof, or the resignation of employment by Employee “for good reason” as defined in Section 9 D. hereof (in either case, a “Termination Event”), Employee shall be entitled to the following special benefits:

|

(i)

|

Two (2) years’ Base Compensation; and

|

|

(ii)

|

The greater of (i) the bonus paid or payable to Employee with respect to last fiscal year of Employer completed prior to the

occurrence of the Termination Event or (ii) the average of the bonuses paid to Employee over the three (3) fiscal years of Employer ending with last fiscal year of Employer completed prior to the occurrence of the Termination Event; and

|

|

(iii)

|

(a) For any fiscal year completed prior to the Termination Event for which a cash bonus and restricted share grants awardable under

the applicable incentive plan for such fiscal year has not been both determined and paid/granted, as applicable, Employee shall receive (1) 100% of the subjective cash and 100% of the subjective restricted share awards for which Employee

was eligible under such plan, and (2) cash and restricted shares awards under the objective portion of such plans based on the actual objective performance of Employer for such plan year; and

|

(b) For any Termination Event which occurs during the final six (6) months of the applicable fiscal year, Employee shall

receive (1) a pro rata portion of the subjective cash and the subjective restricted share awards for which Employee was eligible under the applicable incentive plan for such fiscal year, based on the portion of the fiscal year that has transpired as

of the Termination Event, and (2) a pro rata portion of the objective cash and of the objective restricted share awards for which Employee was eligible under such plan, based on the portion of the fiscal year that has transpired as of the Termination

Event and the actual objective performance of Employer for the full plan year, once determined.

|

(iv)

|

Employee’s accrued but unused vacation days; and

|

|

(v)

|

All Restricted Stock owned by Employee shall immediately become Vested Shares, as such term is defined in the applicable grant

agreement and plan documents

|

The aggregate dollar amount of the special benefits described in subsections (i), (ii) and (iii) above shall be

aggregated and paid ratably on a bi-weekly basis over the 24 month period following the Termination Event; the restricted stock to be granted pursuant to subsection (iii) above shall be granted once determined and shall be Vested Shares (as defined

in the incentive plan for the applicable fiscal year).

If a Change in Control has occurred within six (6) months after, or within twelve (12) months prior to a Termination

Event, Employee also shall be entitled to a Change of Control benefit of $283,333.00. For purposes hereof, a “Change in Control” is defined as:

|

(i)

|

The transfer or sale by Employer of all or substantially all of the assets of Employer whether or not this Agreement is assigned or

transferred as a part of such sale;

|

|

(ii)

|

The transfer or sale of more than fifty percent (50%) of the outstanding shares of Common Stock of Employer;

|

|

(iii)

|

A merger or consolidation involving Employer in a transaction in which the shareholders of Employer immediately prior to the merger

or consolidation own less than fifty percent (50%) of the company surviving the merger or consolidation; or

|

|

(iv)

|

A merger or consolidation involving Employer in a transaction in which the board members of Employer after the merger or

consolidation constitute less than fifty percent (50%) of the board of the company surviving the merger or consolidation; or

|

|

(v)

|

The voluntary or involuntary dissolution of Employer.

|

|

2. |

Ratification and Affirmation. Except as otherwise provided herein, all other terms and

conditions of the Agreement remain in full force and effect.

|

IN WITNESS WHEREOF, the parties have entered into this Amendment as of the date first above written.

COMPANY:

U.S. PHYSICAL THERAPY, INC.

By: /s/ Christopher J. Reading

Christopher J.

Reading, Chief Executive Officer

EMPLOYEE:

/s/ Graham Reeve

Graham Reeve

Exhibit 99.4

FIRST AMENDMENT TO EMPLOYMENT AGREEMENT

THIS FIRST AMENDMENT TO EMPLOYMENT AGREEMENT (“Amendment”)

is made and entered into as of the 27th day of May, 2024 (“Effective Date”), by and between U.S. Physical Therapy, Inc. (the “Company”) and Carey Hendrickson (“Employee”).

R E C I T A L S

WHEREAS, the Company and Employee have entered into that certain Employment Agreement, dated as of November 9, 2020 (the “Agreement”); and

WHEREAS, the Company and Employee wish to amend certain terms of the Agreement;

NOW, THEREFORE, in consideration of the mutual covenants, agreements, terms and conditions contained herein and other good

and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby agree as follows:

1. Section 9.B. of the Agreement is hereby deleted and substituted in its entirety with the following:

B. Special Benefit in the Event of Termination Without Cause or Resignation for Good Cause.

In the event of the termination of employment of Employee by Employer without “cause” as cause is defined in Section 8(c)

hereof, or the resignation of employment by Employee “for good reason” as defined in Section 9 F. hereof (in either case, a “Termination Event”), Employee shall be entitled to the following special benefits:

|

(i)

|

Two (2) year’s Base Compensation; and

|

|

(ii)

|

The greater of (i) the bonus paid or payable to Employee with respect to last fiscal year of Employer completed prior to the

occurrence of the Termination Event or (ii) the average of the bonuses paid to Employee over the three (3) fiscal years of Employer ending with last fiscal year of Employer completed prior to the occurrence of the Termination Event; and

|

|

(iii)

|

(a) For any fiscal year completed prior to the Termination Event for which a cash bonus and restricted share grants awardable under

the applicable incentive plan for such fiscal year has not been both determined and paid/granted, as applicable, Employee shall receive (1) 100% of the subjective cash and 100% of the subjective restricted share awards for which Employee

was eligible under such plan, and (2) cash and restricted shares awards under the objective portion of such plans based on the actual objective performance of Employer for such plan year; and

|

(b) For any Termination Event which occurs during the final six (6) months of the applicable fiscal year, Employee shall

receive (1) a pro rata portion of the subjective cash and the subjective restricted share awards for which Employee was eligible under the applicable incentive plan for such fiscal year, based on the portion of the fiscal year that has transpired as

of the Termination Event, and (2) a pro rata portion of the objective cash and of the objective restricted share awards for which Employee was eligible under such plan, based on the portion of the fiscal year that has transpired as of the Termination

Event and the actual objective performance of Employer for the full plan year, once determined.

|

(iv)

|

Employee’s accrued but unused vacation days; and

|

|

(v)

|

All Restricted Stock owned by Employee shall immediately become Vested Shares, as such term is defined in the applicable grant

agreement and plan documents.

|

The aggregate dollar amount of the special benefits described in subsections (i), (ii) and (iii) above shall be

aggregated and paid ratably on a bi-weekly basis over the 24 month period following the Termination Event; the restricted stock to be granted pursuant to subsection (iii) above shall be granted once determined and shall be Vested Shares (as defined

in the incentive plan for the applicable fiscal year). If a Change in Control has occurred within six months after, or within twelve months prior to a Termination Event, Employee shall also be entitled to the special benefits under this Section 9.B

(in addition to the benefits otherwise provided in Section 9.A.).

|

2. |

Ratification and Affirmation. Except as otherwise provided herein, all other terms and

conditions of the Agreement remain in full force and effect.

|

IN WITNESS WHEREOF, the parties have entered into this Amendment as of the date first above written.

COMPANY:

U.S. PHYSICAL THERAPY, INC.

By: /s/ Christopher J. Reading

Christopher J. Reading, CEO

EMPLOYEE:

/s/ Carey Hendrickson

Carey Hendrickson

Exhibit 99.5

FIRST AMENDMENT TO AMENDED AND RESTATED EMPLOYMENT AGREEMENT

THIS FIRST AMENDMENT TO AMENDED AND RESTATED EMPLOYMENT AGREEMENT (“Amendment”) is made and entered into as of the 27th day of May, 2024 (“Effective Date”), by and between U.S. Physical Therapy, Inc.

(the “Company”) and Richard Binstein (“Employee”).

R E C I T A L S

WHEREAS, the Company and Employee have entered into that certain Amended and Restated Employment Agreement, dated as of March 23, 2022 (the “Agreement”); and

WHEREAS, the Company and Employee wish to amend certain terms of the Agreement;

NOW, THEREFORE, in consideration of the mutual covenants, agreements, terms and conditions contained herein and other good

and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby agree as follows:

1. Section 9.B. of the Agreement is hereby deleted and substituted in its entirety with the following:

B. Special Benefit in the Event of Termination Without Cause or Resignation for Good Cause.

In the event of the termination of employment of Employee by Employer without “cause” as cause is defined in Section 8(c)

hereof, or the resignation of employment by Employee “for good reason” as defined in Section 9 F. hereof (in either case, a “Termination Event”), Employee shall be entitled to the following special benefits:

|

(i)

|

Two (2) year’s Base Compensation; and

|

|

(ii)

|

(ii) The greater of (i) the bonus paid or payable to Employee with respect to last fiscal year of Employer completed prior to the

occurrence of the Termination Event or (ii) the average of the bonuses paid to Employee over the three (3) fiscal years of Employer ending with last fiscal year of Employer completed prior to the occurrence of the Termination Event; and

|

|

(iii)

|

(a) For any fiscal year completed prior to the Termination Event for which a cash bonus and restricted share grants awardable under

the applicable incentive plan for such fiscal year has not been both determined and paid/granted, as applicable, Employee shall receive (1) 100% of the subjective cash and 100% of the subjective restricted share awards for which Employee

was eligible under such plan, and (2) cash and restricted shares awards under the objective portion of such plans based on the actual objective performance of Employer for such plan year; and

|

(b) For any Termination Event which occurs during the final six (6) months of the applicable fiscal year, Employee shall

receive (1) a pro rata portion of the subjective cash and the subjective restricted share awards for which Employee was eligible under the applicable incentive plan for such fiscal year, based on the portion of the fiscal year that has transpired as

of the Termination Event, and (2) a pro rata portion of the objective cash and of the objective restricted share awards for which Employee was eligible under such plan, based on the portion of the fiscal year that has transpired as of the Termination

Event and the actual objective performance of Employer for the full plan year, once determined.

|

(iv)

|

Employee’s accrued but unused vacation days; and

|

|

(v)

|

All Restricted Stock owned by Employee shall immediately become Vested Shares, as such term is defined in the applicable grant

agreement and plan documents.

|

The aggregate dollar amount of the special benefits described in subsections (i), (ii) and (iii) above shall be aggregated

and paid ratably on a bi-weekly basis over the 24 month period following the Termination Event; the restricted stock to be granted pursuant to subsection (iii) above shall be granted once determined and shall be Vested Shares (as defined in the

incentive plan for the applicable fiscal year). If a Change in Control has occurred within six months after, or within twelve months prior to a Termination Event, Employee shall also be entitled to the special benefits under this Section 9.B (in

addition to the benefits otherwise provided in Section 9.A.).

|

2. |

Ratification and Affirmation. Except as otherwise provided herein, all other terms and

conditions of the Agreement remain in full force and effect.

|

IN WITNESS WHEREOF, the parties have entered into this Amendment as of the date first above written.

COMPANY:

U.S. PHYSICAL THERAPY, INC.

By: /s/ Christopher J. Reading

Christopher J. Reading, CEO

EMPLOYEE:

/s/ Richard Binstein

Richard

Binstein

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

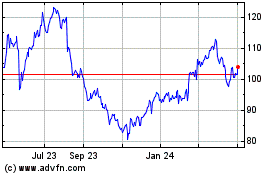

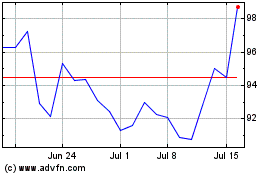

US Physical Therapy (NYSE:USPH)

Historical Stock Chart

From Oct 2024 to Nov 2024

US Physical Therapy (NYSE:USPH)

Historical Stock Chart

From Nov 2023 to Nov 2024