Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

Sep. 30, 2024 |

Sep. 30, 2023 |

Sep. 30, 2022 |

Sep. 30, 2021 |

| Pay vs Performance Disclosure |

|

|

|

|

| Pay vs Performance Disclosure, Table |

Pay Versus Performance In accordance with rules adopted by the SEC pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, we provide the following disclosure regarding executive “compensation actually paid” (“CAP”) and certain Company performance for the fiscal years listed below. You should refer to our Compensation Discussion and Analysis for a complete description of how executive compensation relates to Company performance and how the Compensation Committee makes its decisions. | | | | | | | | | | | | | | | | | | | | | | | | 2024 | | | $3,491,248 | | | $8,221,251 | | | $1,164,732 | | | $2,837,200 | | | 320 | | | 171 | | | $42.0 | | | $102.9 | | 2023 | | | $2,971,390 | | | $3,924,838 | | | $1,166,169 | | | $1,577,113 | | | 165 | | | 115 | | | $12.3 | | | $64.2 | | 2022 | | | $1,886,283 | | | $1,961,507 | | | $923,812 | | | $947,008 | | | 107 | | | 90 | | | $25.8 | | | $60.2 | | 2021 | | | $2,215,714 | | | $2,173,748 | | | $871,976 | | | $858,443 | | | 133 | | | 102 | | | $14.6 | | | $34.2 | | | | | | | | | | | | | | | | | | | | | | | | | | |

(1)

| 2024 Deductions from, and additions to, total compensation in the Summary Compensation Table by year to calculate CAP, calculated in accordance with Item 402(v) of Regulation S-K, include: |

| | | | | | Summary Compensation Table Total | | | $3,491,248 | | | $1,164,732 | | (Minus): Grant date values reported in the Summary Compensation Table | | | $(2,085,201) | | | $(507,214) | | Plus: Year-end fair value of unvested awards granted during the year | | | $2,853,988 | | | $694,217 | | Plus (Minus): Year-over-year change in fair value of awards granted in any prior fiscal year that are outstanding and unvested at year end | | | $3,648,001 | | | $1,401,934 | | Plus (Minus): Difference in fair values between prior year-end fair values and vest date fair values for awards granted in prior years that vested during the year | | | $313,216 | | | $83,531 | | Total Adjustments for Equity Awards | | | $4,730,003 | | | $1,672,468 | | Compensation Actually Paid (as calculated) | | | $8,221,251 | | | $2,837,200 | | | | | | | | |

Amounts reported in this column represent the “compensation actually paid” to Mr. Grant based on the total compensation reported in the Summary Compensation Table for each fiscal year, as adjusted in accordance with SEC rules. For 2024, Mr. Grant’s total compensation reported in the Summary Compensation Table was adjusted as shown in the table above. For information on the calculation of “compensation actually paid” for fiscal years 2021, 2022 and 2023, please see the “pay versus performance” disclosure in our 2023 definitive proxy statement. (2)

| Non-CEO NEOs reflect the average Summary Compensation Table total compensation and average CAP for the following executives by year: |

2024 and 2023: Troy R. Anderson, Sherrell E. Smith, Christopher E. Kevane, and Todd A. Hitchcock 2022: Troy R. Anderson, Sherrell E. Smith, Christopher E. Kevane, and Bartley H. Fesperman 2021: Troy R. Anderson, Sherrell E. Smith, Lori B. Smith, and Todd A. Hitchcock (3)

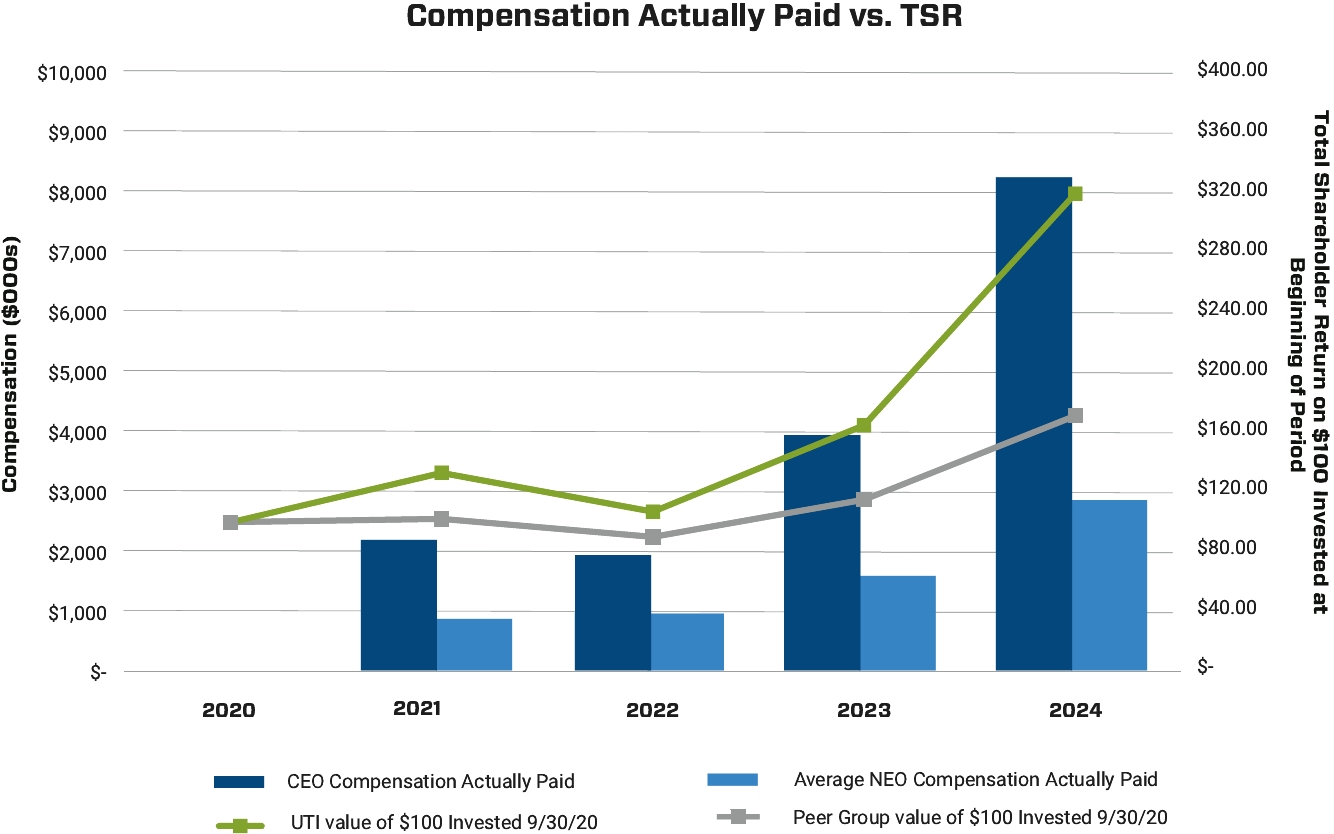

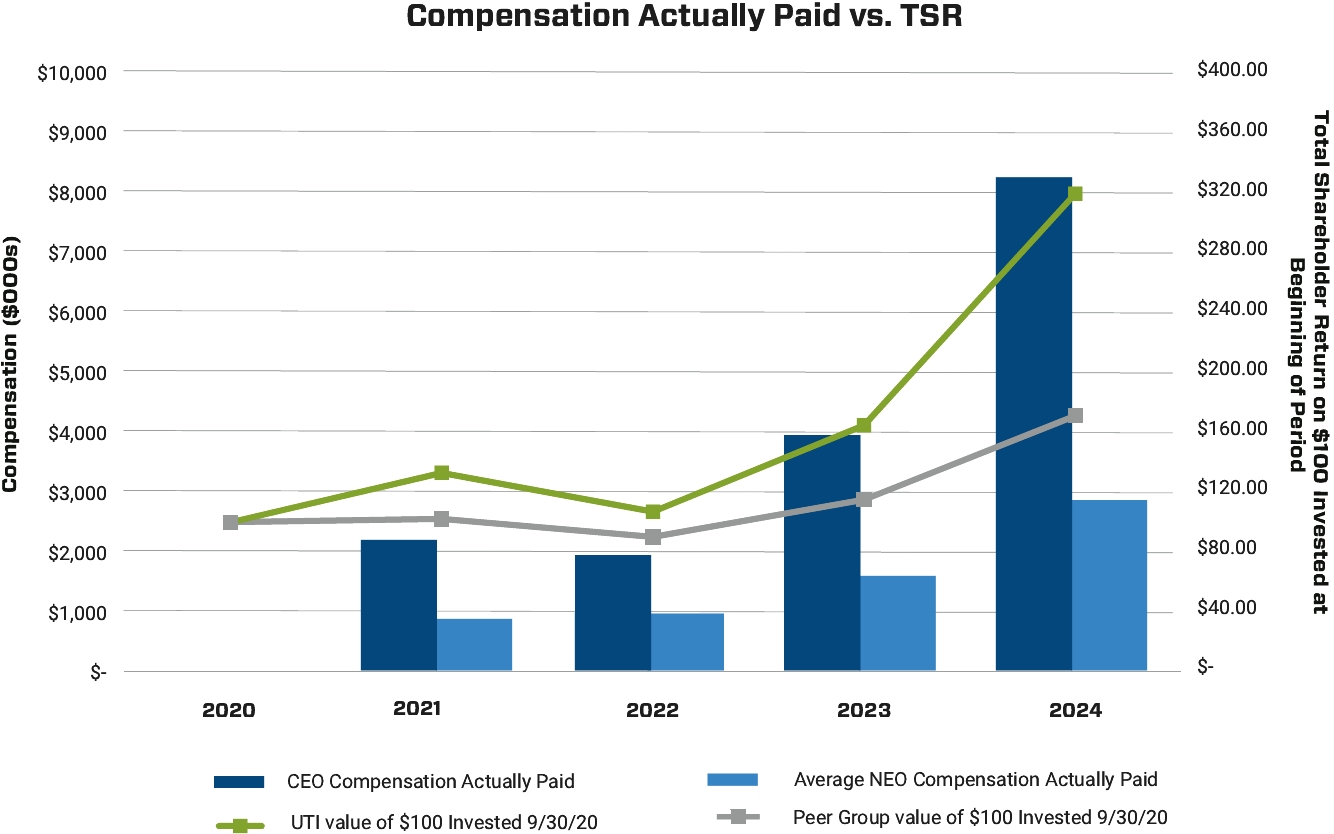

| The peer group selected by the Company for purposes of the TSR benchmarking for the pay versus performance disclosures is the same peer group the Company uses for its performance graph in the Annual Report on Form 10-K pursuant to Item 201(e) of Regulation S-K. The peer group consists of Adtalem Global Education, Inc.; American Public Education, Inc.; Lincoln Education Services Corporation; Perdoceo Education Corporation; and Strategic Education, Inc. |

(4)

| The dollar amounts reported are the Company’s net income reflected in the Company’s audited financial statements. |

(5)

| In the Company’s assessment, adjusted EBITDA is the financial performance measure that is the most important financial performance measure used by the Company in 2024 to link compensation actually paid to performance. Adjusted EBITDA is calculated in a manner consistent with the definition we use when reporting our financial results. See Exhibit 99.1 to our Current Report on Form 8-K, filed with the SEC on November 20, 2024. |

|

|

|

|

| Company Selected Measure Name |

adjusted EBITDA

|

|

|

|

| Named Executive Officers, Footnote |

Amounts reported in this column represent the “compensation actually paid” to Mr. Grant based on the total compensation reported in the Summary Compensation Table for each fiscal year, as adjusted in accordance with SEC rules. For 2024, Mr. Grant’s total compensation reported in the Summary Compensation Table was adjusted as shown in the table above. For information on the calculation of “compensation actually paid” for fiscal years 2021, 2022 and 2023, please see the “pay versus performance” disclosure in our 2023 definitive proxy statement. (2)

| Non-CEO NEOs reflect the average Summary Compensation Table total compensation and average CAP for the following executives by year: |

2024 and 2023: Troy R. Anderson, Sherrell E. Smith, Christopher E. Kevane, and Todd A. Hitchcock 2022: Troy R. Anderson, Sherrell E. Smith, Christopher E. Kevane, and Bartley H. Fesperman 2021: Troy R. Anderson, Sherrell E. Smith, Lori B. Smith, and Todd A. Hitchcock

|

|

|

|

| Peer Group Issuers, Footnote |

(3)

| The peer group selected by the Company for purposes of the TSR benchmarking for the pay versus performance disclosures is the same peer group the Company uses for its performance graph in the Annual Report on Form 10-K pursuant to Item 201(e) of Regulation S-K. The peer group consists of Adtalem Global Education, Inc.; American Public Education, Inc.; Lincoln Education Services Corporation; Perdoceo Education Corporation; and Strategic Education, Inc. |

|

|

|

|

| PEO Total Compensation Amount |

$ 3,491,248

|

$ 2,971,390

|

$ 1,886,283

|

$ 2,215,714

|

| PEO Actually Paid Compensation Amount |

$ 8,221,251

|

3,924,838

|

1,961,507

|

2,173,748

|

| Adjustment To PEO Compensation, Footnote |

(1)

| 2024 Deductions from, and additions to, total compensation in the Summary Compensation Table by year to calculate CAP, calculated in accordance with Item 402(v) of Regulation S-K, include: |

| | | | | | Summary Compensation Table Total | | | $3,491,248 | | | $1,164,732 | | (Minus): Grant date values reported in the Summary Compensation Table | | | $(2,085,201) | | | $(507,214) | | Plus: Year-end fair value of unvested awards granted during the year | | | $2,853,988 | | | $694,217 | | Plus (Minus): Year-over-year change in fair value of awards granted in any prior fiscal year that are outstanding and unvested at year end | | | $3,648,001 | | | $1,401,934 | | Plus (Minus): Difference in fair values between prior year-end fair values and vest date fair values for awards granted in prior years that vested during the year | | | $313,216 | | | $83,531 | | Total Adjustments for Equity Awards | | | $4,730,003 | | | $1,672,468 | | Compensation Actually Paid (as calculated) | | | $8,221,251 | | | $2,837,200 | | | | | | | | |

Amounts reported in this column represent the “compensation actually paid” to Mr. Grant based on the total compensation reported in the Summary Compensation Table for each fiscal year, as adjusted in accordance with SEC rules. For 2024, Mr. Grant’s total compensation reported in the Summary Compensation Table was adjusted as shown in the table above. For information on the calculation of “compensation actually paid” for fiscal years 2021, 2022 and 2023, please see the “pay versus performance” disclosure in our 2023 definitive proxy statement.

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 1,164,732

|

1,166,169

|

923,812

|

871,976

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 2,837,200

|

1,577,113

|

947,008

|

858,443

|

| Adjustment to Non-PEO NEO Compensation Footnote |

(1)

| 2024 Deductions from, and additions to, total compensation in the Summary Compensation Table by year to calculate CAP, calculated in accordance with Item 402(v) of Regulation S-K, include: |

| | | | | | Summary Compensation Table Total | | | $3,491,248 | | | $1,164,732 | | (Minus): Grant date values reported in the Summary Compensation Table | | | $(2,085,201) | | | $(507,214) | | Plus: Year-end fair value of unvested awards granted during the year | | | $2,853,988 | | | $694,217 | | Plus (Minus): Year-over-year change in fair value of awards granted in any prior fiscal year that are outstanding and unvested at year end | | | $3,648,001 | | | $1,401,934 | | Plus (Minus): Difference in fair values between prior year-end fair values and vest date fair values for awards granted in prior years that vested during the year | | | $313,216 | | | $83,531 | | Total Adjustments for Equity Awards | | | $4,730,003 | | | $1,672,468 | | Compensation Actually Paid (as calculated) | | | $8,221,251 | | | $2,837,200 | | | | | | | | |

Amounts reported in this column represent the “compensation actually paid” to Mr. Grant based on the total compensation reported in the Summary Compensation Table for each fiscal year, as adjusted in accordance with SEC rules. For 2024, Mr. Grant’s total compensation reported in the Summary Compensation Table was adjusted as shown in the table above. For information on the calculation of “compensation actually paid” for fiscal years 2021, 2022 and 2023, please see the “pay versus performance” disclosure in our 2023 definitive proxy statement.

|

|

|

|

| Compensation Actually Paid vs. Total Shareholder Return |

CAP and Cumulative TSR / Cumulative TSR of the Peer Group

|

|

|

|

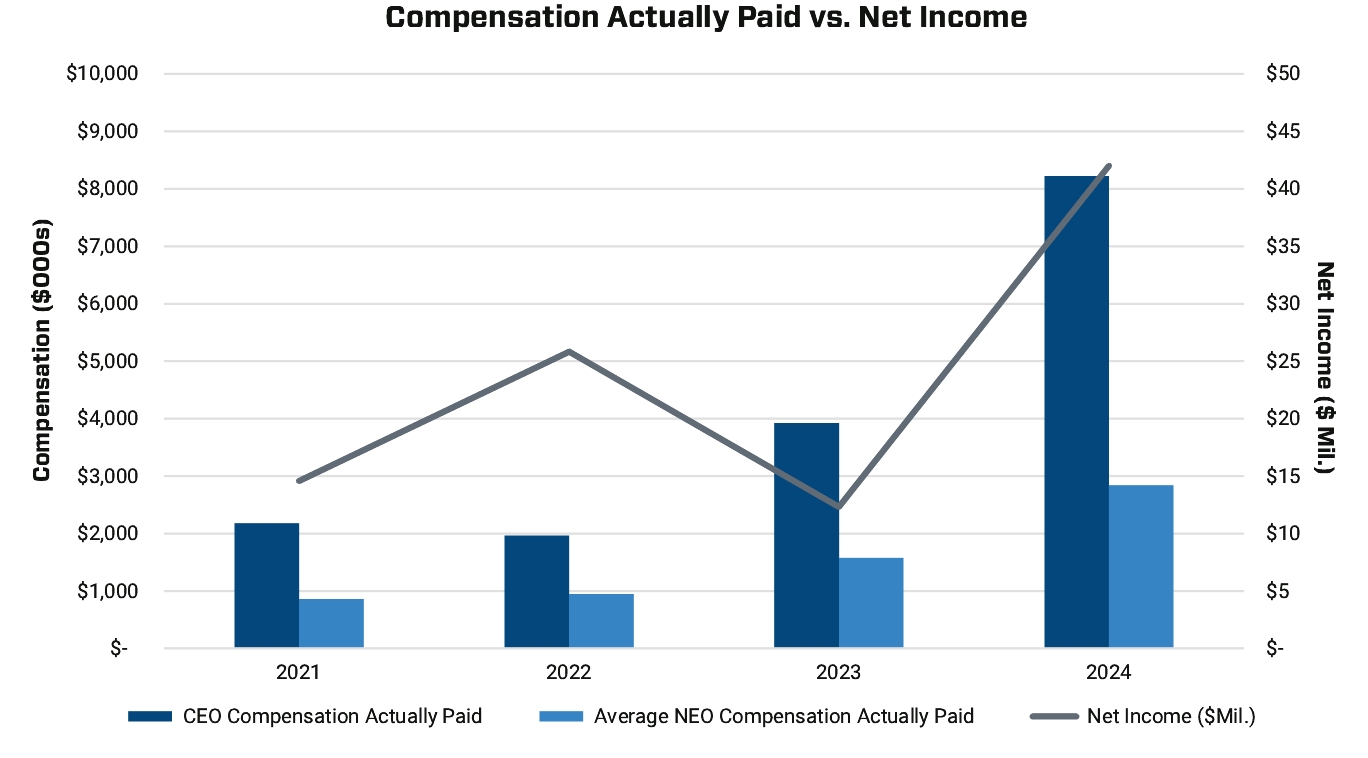

| Compensation Actually Paid vs. Net Income |

CAP and Company Net Income

|

|

|

|

| Compensation Actually Paid vs. Company Selected Measure |

CAP and Adjusted EBITDA

|

|

|

|

| Total Shareholder Return Vs Peer Group |

CAP and Cumulative TSR / Cumulative TSR of the Peer Group

|

|

|

|

| Tabular List, Table |

Tabular List of Financial Performance Measures In our assessment, the most important financial performance measures used to link CAP (as calculated in accordance with the SEC rules), to our NEOs in 2024 to our performance were:

|

|

|

|

| Total Shareholder Return Amount |

$ 320

|

165

|

107

|

133

|

| Peer Group Total Shareholder Return Amount |

171

|

115

|

90

|

102

|

| Net Income (Loss) |

$ 42,000,000

|

$ 12,300,000

|

$ 25,800,000

|

$ 14,600,000

|

| Company Selected Measure Amount |

102,900,000

|

64,200,000

|

60,200,000

|

34,200,000

|

| PEO Name |

Mr. Grant

|

Mr. Grant

|

Mr. Grant

|

Mr. Grant

|

| Measure:: 1 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

Adjusted EBITDA

|

|

|

|

| Measure:: 2 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

Stock Price

|

|

|

|

| Measure:: 3 |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Name |

Revenue

|

|

|

|

| PEO | Equity Awards Adjustments |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

$ 4,730,003

|

|

|

|

| PEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

(2,085,201)

|

|

|

|

| PEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

2,853,988

|

|

|

|

| PEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

3,648,001

|

|

|

|

| PEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

313,216

|

|

|

|

| Non-PEO NEO | Equity Awards Adjustments |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

1,672,468

|

|

|

|

| Non-PEO NEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

(507,214)

|

|

|

|

| Non-PEO NEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

694,217

|

|

|

|

| Non-PEO NEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

1,401,934

|

|

|

|

| Non-PEO NEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

| Adjustment to Compensation, Amount |

$ 83,531

|

|

|

|