United Rentals, Inc. (NYSE: URI) (“United Rentals” or “the

company”) and H&E Equipment Services, Inc. d/b/a H&E

Rentals (NASDAQ: HEES) (“H&E”) today announced their entry into

a definitive agreement under which United Rentals will acquire

H&E for $92 per share in cash, reflecting a total enterprise

value of approximately $4.8 billion, including approximately $1.4

billion of net debt.

Founded in 1961, H&E provides its customers with a

comprehensive mix of high-quality general rental fleet including

aerial work platforms, earthmoving equipment, material handling

equipment, and other general and specialty lines of equipment. With

approximately 2,900 employees and $2.9 billion of rental fleet at

original cost, the company serves a diverse mix of customers across

both construction and industrial markets through its network of

approximately 160 branches in over 30 U.S. states.

On a trailing 12-month basis through September 30, 2024, H&E

generated $696 million of adjusted EBITDA on total revenues of

$1,518 million, translating to an adjusted EBITDA margin of

approximately 45.8%.

Strong Strategic Rationale

- The transaction is consistent with United Rentals’ “grow the

core” strategy, and legacy H&E customers will benefit from

one-stop access to United Rentals’ specialty rental offerings

across Fluid Solutions, Matting Solutions, Onsite Services,

Portable Storage & Modular Space, Power & HVAC, Tool

Solutions, and Trench Safety.

- H&E’s fleet, experienced employees and customer service

footprint of branches across over 30 strategic U.S. states are

complementary with United Rentals’ existing network. Importantly,

the combination will increase capacity for United Rentals in key

U.S. geographies.

- The combination will expand United Rentals’ rental fleet by

almost 64,000 units with an original cost of over $2.9 billion and

an average age of under 41 months, as well as roughly $230 million

of non-rental fleet.

- United Rentals and H&E share many cultural attributes,

including a strong focus on safety, a customer-first business

philosophy, and best practices for talent development and

retention. Critically, H&E employees will bring a wealth of

experience to United Rentals, and will have greater opportunities

for career development within the larger combined

organization.

Strong Financial Rationale

- The purchase price of approximately $4.8 billion represents a

multiple of 6.9x adjusted EBITDA for the trailing 12 months ended

September 30, 2024, or 5.8x adjusted EBITDA including $130 million

of targeted cost synergies and the net present value of tax

attributes estimated at approximately $54 million.

- The combination is expected to generate approximately $130

million of annualized cost synergies within 24 months of closing,

primarily in the areas of corporate overhead and operations.

Additionally, United Rentals expects to realize procurement savings

of approximately 5% as compared to historical H&E pricing.

- United Rentals expects to realize approximately $120 million of

annual revenue cross-sell synergies by year three, as legacy

H&E customers take advantage of United Rentals’ specialty

rental offerings.

- The acquisition is expected to be accretive to United Rentals’

adjusted earnings per share and free cash flow generation in its

first year post-close.

- Return on invested capital (ROIC) is expected to reach the

company’s cost of capital by the end of year three on a run-rate

basis, with compelling IRR and NPV across multiple macro

scenarios.

- The transaction is projected to result in a pro forma net

leverage ratio at closing of approximately 2.3x, well within the

company’s target range of 1.5-2.5x. Upon closing, the company

intends to reduce its leverage with a goal of reaching net-debt to

EBITDA of approximately 2.0x within 12 months after acquisition

close. Accordingly, the company has paused its share repurchase

plan in anticipation of driving towards this goal.

- The integration of H&E into United Rentals’ operations

presents opportunities to improve efficiency, productivity and new

business development with the adoption of United Rentals’

operational excellence, including its technology offerings.

- The transaction is not conditioned on the availability of

financing. United Rentals has obtained bridge commitments to ensure

its ability to close the transaction as soon as possible, with the

expectation that it will use a combination of newly issued debt

and/or borrowings and existing capacity under its ABL facility to

fund the transaction and related expenses at close.

- Notably, the transaction will not impact the company’s current

dividend program.

CEO and Chairman Comments

Matthew Flannery, chief executive officer of United Rentals,

said, “In H&E we’re acquiring a well-run operation that’s

primed to benefit from our technology, operations and broad value

proposition. Most importantly, we’re gaining a great team that

shares our intense focus on safety and customer service. We’ll be

working side-by-side throughout the integration to capitalize on

best-in-class expertise from both sides. We will use our well-honed

integration playbook as we prepare the acquired branches to take

full advantage of our systems and operational capabilities, and

gain from our employee and customer-centric culture. I look forward

to welcoming our new team members upon the closing of the

acquisition.”

Flannery continued, “This purchase of H&E supports our

strategy to deploy capital to grow the core business and drive

shareholder value. This acquisition allows us to better serve our

customers with expanded capacity in key markets while also

providing the opportunity to further drive revenue through our

proven cross-selling strategy. Not only does the agreement satisfy

the rigorous strategic, financial and cultural standards we set for

acquisitions, but it also drives attractive returns for our

shareholders.”

Bradley W. Barber, chief executive officer of H&E, said,

“I’m extremely proud of what we’ve built at H&E over the last

60 years and am confident that our combination with United Rentals

will take the business to new heights going forward.”

John M. Engquist, Executive Chairman of H&E, added, “I

couldn’t be more pleased with this win-win outcome for both

organizations, our customers and our shareholders. Importantly, I

want to thank our employees for driving the results that made this

transaction possible. I am confident that we’ve found an excellent

landing spot for them and I am excited for the new opportunities

they will have as part of United Rentals.”

Transaction Details

The boards of directors of United Rentals and H&E

unanimously approved the transaction, which is subject to customary

closing conditions, including a minimum tender of at least a

majority of then-outstanding H&E common shares and the

expiration of the waiting period under the Hart-Scott-Rodino

Antitrust Improvements Act of 1976. United Rentals intends to

commence a tender offer by January 28, 2025 to acquire all of the

outstanding shares of H&E common stock for $92 per share in

cash. Following completion of the tender offer, United Rentals will

acquire all remaining shares not tendered in the offer through a

second-step merger at the same price as in the tender offer. The

transaction is expected to close in the first quarter of 2025. The

company plans to update its 2025 financial outlook to reflect the

combined operations following the completion of the

transaction.

The merger agreement includes a 35-day “go-shop” period which

runs through February 17, 2025, during which H&E—with the

assistance of BofA Securities, its exclusive financial advisor—will

actively solicit, evaluate and potentially enter into negotiations

with, and provide due diligence access to, parties that submit

alternative proposals. H&E will have the right to terminate the

merger agreement to accept a superior proposal subject to the

conditions and procedures specified in the merger agreement, which

H&E will file with a Current Report on Form 8-K. There can be

no assurance that this 35-day “go shop” will result in a superior

proposal, and H&E does not intend to disclose developments with

respect to the solicitation process unless and until its board of

directors makes a determination requiring further disclosure.

Advisors

Sullivan & Cromwell acted as the company’s legal advisor.

Morgan Stanley Senior Funding, Inc. and Wells Fargo have provided

committed bridge financing. BofA Securities acted as financial

advisor to H&E and Milbank LLP acted as

H&E's legal advisor.

Non-GAAP Measures

H&E’s adjusted EBITDA is a non-GAAP financial measure as

defined under the rules of the Securities and Exchange Commission.

United Rentals and H&E believe that this non-GAAP financial

measure provides useful information about the proposed transaction;

however, it should not be considered as an alternative to GAAP net

income. A reconciliation between H&E’s adjusted EBITDA and GAAP

net income is provided in the investor presentation available on

United Rentals’ website.

Conference Call

United Rentals will hold a conference call today, Tuesday,

January 14, 2025, at 8:30 a.m. Eastern Time. The conference

call number is 800-420-1271 (international: 785-424-1634). The

replay number for the call is 402-220-6985. The passcode for both

the conference call and replay is 73193. The conference call will

also be available live by audio webcast at unitedrentals.com.

About United Rentals

United Rentals, Inc. is the largest equipment rental company in

the world. The company has an integrated network of 1,571 rental

locations in North America, 39 in Europe, 37 in Australia and 19 in

New Zealand. In North America, the company operates in 49 states

and every Canadian province. The company’s approximately 27,550

employees serve construction and industrial customers, utilities,

municipalities, homeowners and others. The company offers

approximately 5,000 classes of equipment for rent with a total

original cost of $21.85 billion. United Rentals is a member of the

Standard & Poor’s 500 Index, the Barron’s 400 Index and the

Russell 3000 Index® and is headquartered in Stamford, Conn.

Additional information about United Rentals is available

at unitedrentals.com.

About H&E Equipment Services, Inc.

Founded in 1961, H&E is one of the largest rental equipment

companies in the nation. The Company’s fleet is comprised of aerial

work platforms, earthmoving, material handling, and other general

and specialty lines. H&E serves a diverse set of end markets in

many high-growth geographies and has branches throughout

the Pacific Northwest, West Coast, Intermountain,

Southwest, Gulf Coast, Southeast, Midwest and Mid-Atlantic

regions.

Cautionary Statement Regarding Forward-Looking

Statements

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended, and the Private Securities Litigation Reform Act of

1995, known as the PSLRA. Forward-looking statements involve

significant risks and uncertainties that may cause actual results

to differ materially from such forward-looking statements. These

statements are based on current plans, estimates and projections,

and, therefore, you should not place undue reliance on them. No

forward-looking statement, including any such statement concerning

the completion and anticipated benefits of the proposed

transaction, can be guaranteed, and actual results may differ

materially from those projected. Forward-looking statements are not

historical facts, but rather are based on current expectations,

estimates, assumptions and projections about the business and

future financial results of the equipment rental industries, and

other legal, regulatory and economic developments. United Rentals

and H&E use words such as “anticipates,” “believes,” “plans,”

“expects,” “projects,” “future,” “intends,” “may,” “will,”

“should,” “could,” “estimates,” “predicts,” “targets,” “potential,”

“continue,” “guidance” and similar expressions to identify these

forward-looking statements that are intended to be covered by the

safe harbor provisions of the PSLRA. Actual results could differ

materially from the results contemplated by these forward-looking

statements due to a number of factors, including, but not limited

to, those described in the SEC reports filed by United Rentals and

H&E, as well as the possibility that (1) United Rentals may be

unable to obtain regulatory approvals required for the proposed

transaction or may be required to accept conditions that could

reduce the anticipated benefits of the acquisition as a condition

to obtaining regulatory approvals; (2) the length of time necessary

to consummate the proposed transaction may be longer than

anticipated; (3) problems may arise in successfully integrating the

businesses of United Rentals and H&E, including, without

limitation, problems associated with the potential loss of any key

employees of H&E; (4) the proposed transaction may involve

unexpected costs, including, without limitation, the exposure to

any unrecorded liabilities or unidentified issues that we failed to

discover during the due diligence investigation of H&E or that

are not covered by insurance, as well as potential unfavorable

accounting treatment and unexpected increases in taxes; (5) our

businesses may suffer as a result of uncertainty surrounding the

proposed transaction or any adverse effects on our ability to

maintain relationships with customers, employees and suppliers; (6)

the occurrence of any event, change or other circumstances that

could give rise to the termination of the merger agreement, the

failure of the closing conditions included in the merger agreement

to be satisfied, or any other failure to consummate the proposed

transaction; (7) any negative effects of the announcement of the

proposed transaction or the financing thereof on the market price

of United Rentals or H&E common stock or other securities; and

(8) the industry may be subject to future risks that are described

in the “Risk Factors” section of the Annual Reports on Form 10-K,

Quarterly Reports on Form 10-Q and other documents filed from time

to time with the SEC by United Rentals and H&E. United Rentals

and H&E give no assurance that they will achieve their

expectations and do not assume any responsibility for the accuracy

and completeness of the forward-looking statements. The

forward-looking statements speak only as of the date hereof. United

Rentals and H&E undertake no obligation to publicly update or

revise any forward-looking statement, whether as a result of new

information, future events or otherwise, except as may be required

by applicable securities laws.

The foregoing list of factors is not exhaustive. You should

carefully consider the foregoing factors and the other risks and

uncertainties that affect the businesses of United Rentals and

H&E described in the “Risk Factors” section of the Annual

Reports on Form 10-K, Quarterly Reports on Form 10-Q and other

documents filed from time to time with the SEC by United Rentals

and H&E.

Additional Information and Where to Find It

This press release is for informational purposes only and is not

intended to be a recommendation to buy, sell or hold securities and

does not constitute an offer for the sale of, or the solicitation

of an offer to buy securities in any jurisdiction, including the

United States. Any such offer will only be made by means of a

prospectus or offering memorandum, and in compliance with

applicable securities laws. This press release is for informational

purposes only and is neither an offer to purchase nor a

solicitation of an offer to sell securities. The tender offer

described in this press release has not commenced. At the time the

tender offer is commenced, United Rentals will file, or will cause

to be filed, tender offer materials on Schedule TO with the SEC and

H&E will file a Solicitation/Recommendation Statement on

Schedule 14D-9 with the SEC, in each case with respect to the

tender offer. The tender offer materials (including an offer to

purchase, a related letter of transmittal and other offer

documents) and the solicitation/recommendation statement, as they

may be amended from time to time, will contain important

information that should be read carefully when they become

available and considered before any decision is made with respect

to the tender offer. Those materials and all other documents filed

by, or caused to be filed by, United Rentals and H&E with the

SEC will be available at no charge on the SEC’s website at

www.sec.gov. The tender offer materials and related materials also

may be obtained for free (when available) under the “Financials—SEC

Filings” section of United Rentals’ investor website at

https://investors.unitedrentals.com/, and the

Solicitation/Recommendation Statement and such other documents also

may be obtained for free (when available) from H&E under the

“Financial Information—SEC Filings” section of its investor website

at https://investor.he-equipment.com/.

Contact:

United Rentals, Inc.Elizabeth GrenfellVice

President, Investor RelationsO: (203) 618-7125investors@ur.com

H&E Equipment Services, Inc.Leslie S.

MageeChief Financial Officer225-298-5261lmagee@he-equipment.com

Jeffrey L. ChastainVice President of Investor

Relations225-952-2308jchastain@he-equipment.com

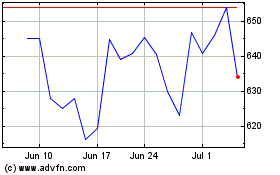

United Rentals (NYSE:URI)

Historical Stock Chart

From Dec 2024 to Jan 2025

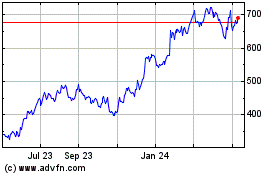

United Rentals (NYSE:URI)

Historical Stock Chart

From Jan 2024 to Jan 2025