Tyson Foods

Vote Yes: Proxy Ballot Item #3 — Shareowner Proposal

Requesting the Board Prepare a

Report on the Alignment of Corporate Climate Lobbying Activities

Annual Meeting: February 8, 2024

CONTACT:

Laura Krausa, Common Spirit Health | laura.krausa@commonspirit.org

Mary Minette, Mercy Investment Services | mminette@Mercyinvestments.org

SUMMARY

Climate change poses financial, reputational, and physical risks to Tyson Foods (“Tyson”

or “the Company”). Recognizing these risks, the Company has set ambitious emissions reduction targets, but achieving its goals

will require strong public policies. Because of this link between the company’s long-term ambitions and public policy, investors

are increasingly asking for reports on how corporate lobbying activities, both direct and indirect, are aligned with a company’s

own climate goals and the net-zero goals of the Paris Climate Agreement. Companies in a variety of sectors have begun to release this

information; however, Tyson provides only limited information about its climate lobbying activities, although the Company reports that

it supports some trade associations and non-profit organizations that lobby negatively on climate change. Accordingly, investors are encouraged

to vote “FOR” this proposal.

RESOLVED CLAUSE

Shareholders request that Tyson Foods (“Tyson”) conduct an evaluation

and issue a report annually, beginning within the next year (at reasonable cost, omitting proprietary information) describing if, and

how, its lobbying, directly and through the activities of its trade associations and social welfare organizations, aligns with the Company’s

science-based target and long-term net zero ambitions. The report should also address the risks presented by any misaligned lobbying and

Tyson’s efforts, if any, to mitigate these risks

RATIONALE FOR A YES VOTE

| 1. | Tyson Foods has acknowledged the long-term risk posed by climate change to its business through its commitment to reach Net Zero emissions

by 2050; strong and supportive public policies are needed to reach its goals and to mitigate the risk of climate change to the food system. |

| 2. | Investors are increasingly expecting companies to report how their lobbying activities align with climate goals, and many companies

are providing robust disclosure about their public policy advocacy activities. |

| 3. | Tyson Foods makes only limited disclosure about its direct or indirect climate-related lobbying, preventing shareholders from discerning

whether its activities align with its climate goals or how the Company is managing risks related to misalignment. |

DISCUSSION

| 1. | Climate Change poses material risks to Tyson Food’s business, and strong public policy is critical to addressing those risks. |

Tyson Foods (“Tyson” or “the Company”) has acknowledged the

long-term risk posed by climate change to its business through its commitment to reach Net Zero emissions by 2050. In its 2023 Form 10-K

the Company states “The effects of climate change and legal or regulatory initiatives to address climate change could have a long-term

adverse impact on our business and results of operations.”1 Potential impacts include decreased agricultural productivity

due to changes in weather patterns, disruptions in the company’s extensive supply chain, and dropping demand for the company’s

products due to changes in consumer preferences as a result of climate concerns.

Due to the extensive risk posed by climate change to the Company’s business,

Tyson Foods has committed to reach net-zero scope 1, 2 and 3 greenhouse gas emissions in its own operations and its supply chain by 2050

and to work with the Science-based Targets Initiative to update its existing targets.2 We commend the Company for this strong

commitment to a science-based approach to setting and meeting targets to reduce its climate impact and the leadership it is demonstrating

within its industry. However, achieving this industry-leading goal will require strong public policy support for the farmers and ranchers

in the Company’s supply chain as they work to reduce emissions as well as for the development of renewable energy, vehicle electrification

and other emerging technologies to reduce the Company’s full scope of emissions. Without robust, supportive public policies, Tyson’s

climate goals may not be achievable.

In its 2023 CDP questionnaire response, the Company recognized the risk posed to

its “business as usual” by identifying climate-related factors and included some details of its direct lobbying activities

on climate change policy. However, the Company also noted that it has not evaluated whether its own public policy activities or those

of its trade associations are aligned with the net-zero goals of the Paris Climate Agreement.

A 2021 report from Ceres notes that “Companies that establish robust governance

systems to address climate change as a systemic risk and align their direct and indirect lobbying efforts to support science-based climate

policies will drive the creation of a regulatory environment that best positions them for resilient growth.” As long-term investors

in Tyson Foods, we believe that our Company must align its public policy engagement with its long-term climate goals. Transparency regarding

governance of lobbying activities, trade association memberships, and any efforts made to address misalignments between company policy

and lobbying positions are a key to showing that Tyson is adequately managing climate risk.

_____________________________

1 https://d18rn0p25nwr6d.cloudfront.net/CIK-0000100493/240fbb6c-6e24-4003-ad0d-471a53af35eb.pdf

2 https://www.tysonfoods.com/sites/default/files/2023-10/Tyson%20Foods%20Sustainability%20Report%20FY2022%20%281%29.pdf

| 2. | Investors are increasingly requesting disclosure of climate lobbying information, and many companies are complying. |

Investors increasingly expect companies to disclose information on their direct and

indirect lobbying efforts on climate issues as well as how those activities align with the company’s own climate-related goals and

the goals of the Paris Agreement. For example:

| ▪ | In 2021, a majority of investors in five companies supported proposals asking companies to report on their climate lobbying activities

and how they align with the goals of the Paris Agreement.3 |

| ▪ | 65 percent of investors responding to the 2021 ISS global policy survey on climate issues support companies reporting on how corporate

and trade association lobbying activities are in alignment (or are not in contradiction) with limiting global warming in line with Paris

Agreement goals.4 |

| ▪ | The Climate Action 100+ initiative, including large and small investors with a total of more than $60 trillion in assets under management,

has established a Net-Zero Benchmark, asking target companies to disclose how their lobbying activities, both direct and through trade

associations, align with the net-zero goals of the Paris Agreement.5 |

The Global Standard on Responsible Climate Lobbying, issued in March 2022

following a multi-stakeholder global consultation that included both companies and investors, includes 14 indicators representing best

practice for lobbying and public policy activities related to climate change. The indicators recommend company practices in four broad

areas:

| ● | Commitment to Paris-aligned public policy advocacy; |

| ● | Robust governance of climate lobbying, including management and board oversight and a clear framework for evaluating alignment; |

| ● | Analysis and reporting on alignment between public policy advocacy (both direct and indirect through organizations) and Paris Agreement

goals; and |

| ● | Public disclosure of all organizations involved in climate lobbying to which a company belongs or provides funds, as well as assessment

of the impact of those organizations’ advocacy activities.6 |

| 3. | Tyson does not adequately disclose information on its climate lobbying activities, and limited information available to investors

indicates some misalignment with the company’s net-zero goals. |

Although Tyson Foods discloses a list of its trade associations that receive more

than $50,000 in dues from the Company7 and makes general disclosures about its governance of lobbying and political expenditures,8

the Company does not disclose any information about the alignment of its direct and indirect lobbying on climate policy with its own net-zero

goals.

_____________________________

3 https://corpgov.law.harvard.edu/2021/08/11/2021-proxy-season-review-shareholder-proposals-on-environmental-matters/

4 https://www.issgovernance.com/file/publications/2021-climate-survey-summary-of-results.pdf

5 https://www.climateaction100.org/wp-content/uploads/2021/03/Climate-Action-100-Benchmark-Indicators-FINAL-3.12.pdf

6 https://climate-lobbying.com

7 https://s22.q4cdn.com/104708849/files/doc_downloads/political_activity/2022-Contributions-Lobbying-Expenses.pdf

8 https://ir.tyson.com/esg/political-activity/default.aspx

Tyson discloses a short list of trade association memberships on its 2023 CDP questionnaire,

but there is no indication of whether that list is inclusive of all of its trade associations that lobby on climate issues.9

The Company notes membership in the Business Roundtable and the U.S. Chamber of Commerce, but does not evaluate whether those organizations

are aligned with its climate policies and states that Tyson has not attempted to influence the policy positions of either organization

on climate legislation.10 The U.S. Chamber of Commerce has taken a leading role in opposing public policies designed to support

decarbonization and was assigned an E- rating, the second-worst available, by InfluenceMap.11 Among many other actions, the

Chamber opposed the Inflation Reduction Act of 2022,12 widely seen as one of the most impactful climate bills ever passed,13

and the Security and Exchange Commission’s climate disclosure rule, claiming the proposed rule is unprecedented in scope and overly

prescriptive.14 The Business Roundtable also worked against the Inflation Reduction Act and opposed much of the SEC’s

proposed climate disclosure rule15 in direct contradiction to its professed commitment, articulated in its 2019 “Statement

on the Purpose of a Corporation,” to “protect the environment by embracing sustainable practices across our businesses.”16

Tyson’s CDP list of memberships in trade associations that lobby on climate

issues does not include its membership in the National Association of Manufacturers (NAM).17 However, NAM opposed the Inflation

Reduction Act,18 supported weakened regulations on methane emissions,19 and is generally viewed as lobbying negatively

on climate policy, receiving an E rating from InfluenceMap.20

The board’s response in the proxy ignores the central issue raised in the resolution,

which asks the board to initiate a review of the lobbying it does related to climate change by the Company and by trade associations and

non-profit organizations to which it contributes. The board merely argues that its existing disclosures are sufficient and that the report

requested by our proposal is “duplicative” of existing disclosures. However, the Company’s current disclosures do not

meet our request to understand how the Company’s direct and indirect lobbying activities align with its net-zero climate goals and

what, if anything, the Company does when its lobbying activities do not support those goals.

_____________________________

9 https://www.cdp.net/en/formatted_responses/responses?campaign_id=83630982&discloser_id=1036655&locale=en&organization_name=Tyson+Foods

%2C+Inc.&organization_number=19581&program=Investor&project_year=2023&redirect=https%3A%2F%2Fcdp.credit360.com%2Fsurveys%2F2023%2

Fjwbhd7d6%2F312544&survey_id=82591262

10 Ibid.

11 https://ca100.influencemap.org/Industry-Associations

12 https://www.uschamber.com/economy/coalition-letter-on-the-inflation-reduction-act

13 https://time.com/6304143/inflation-reduction-act-us-global-impact/

14 https://www.uschamber.com/assets/documents/US-Chamber-comment-on-SEC-Climate-Related-Disclosure_FINAL.pdf

15 https://www.theguardian.com/environment/2022/aug/19/top-us-business-lobby-group-climate-action-business-roundtable

16 https://www.businessroundtable.org/business-roundtable-redefines-the-purpose-of-a-corporation-to-promote-an-economy-that-serves-all-americans

17 https://ir.tyson.com/files/doc_downloads/governance/2023/2022-Trade-Association-Lobbying-Expenses.pdf

18 https://nam.org/manufacturers-remain-staunchly-opposed-to-the-inflation-reduction-act-18530/

19 https://www.regulations.gov/comment/EPA-HQ-OAR-2021-0317-2251

20 https://lobbymap.org/influencer/National-Association-of-Manufacturing-NAM

The Company’s current disclosure of a list of trade association memberships

and minimal disclosure in its CDP questionnaire do not meet our request. The Company’s assertion in its CDP response that two of

its trade associations are aligned with its climate goals, when, as stated above, they clearly are not, together with their failure to

include the National Association of Manufacturers in the list of associations that lobby on climate issues shows that the Company’s

current disclosures do not fulfill the request of our shareholder proposal.

Tyson Foods must have forward-looking public policy on climate in place to allow

the Company to reach its net-zero goals. Yet the board’s response sidesteps the importance of Tyson showing leadership by advocating

for positive climate public policy that supports the Company’s long-term goals and by examining where its trade association and

other non-profit memberships and payments may conflict with the Company’s goals and those of the Paris Agreement.

We believe additional disclosure would not only help the Company ensure that its

lobbying funds are being spent in ways that support its long-term plans to address climate risk, but also will protect the Company and

its shareowners from the reputational risk of being perceived as sending mixed messages and undercutting climate policy at the state and

federal level.

CONCLUSION

As long-term investors in Tyson Foods, we believe that the

report we request would be in the best interest of the Company and its shareowners, ensuring that the Company is working across the enterprise

toward its long-term climate goals. The assessment we request would ensure that all public policy efforts supported by Tyson are working

in tandem to meet the company’s ambitious climate targets and would help to prevent reputational risk from misalignments between

the company’s own policies and negative positions taken by its trade associations. Issuing the requested report would allow our

Company to meet not only the expectations of investors, but also join the leaders among its peers in the business community. We urge you

to vote “YES” on this shareholder proposal.

--

THE FOREGOING INFORMATION MAY BE DISSEMINATED TO SHAREHOLDERS VIA TELEPHONE, U.S.

MAIL, E-MAIL, CERTAIN WEBSITES AND CERTAIN SOCIAL MEDIA VENUES, AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE OR AS A SOLICITATION

OF AUTHORITY TO VOTE YOUR PROXY. THE COST OF DISSEMINATING THE FOREGOING INFORMATION TO SHAREHOLDERS IS BEING BORNE ENTIRELY BY ONE OR

MORE OF THE CO-FILERS. PROXY CARDS WILL NOT BE ACCEPTED BY ANY CO-FILER. PLEASE DO NOT SEND YOUR PROXY TO ANY CO-FILER. TO VOTE YOUR PROXY,

PLEASE FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

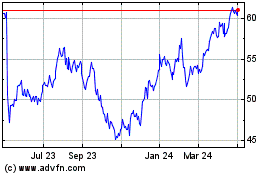

Tyson Foods (NYSE:TSN)

Historical Stock Chart

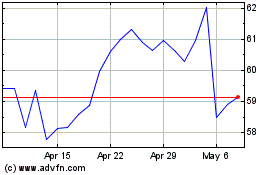

From Mar 2024 to Apr 2024

Tyson Foods (NYSE:TSN)

Historical Stock Chart

From Apr 2023 to Apr 2024