UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number 001-40889

TRICON RESIDENTIAL INC.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name)

7 St. Thomas Street, Suite 801

Toronto, Ontario, Canada M5S 2B7

(416) 925-7228

(Address and telephone number of registrant’s principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☐ Form 40-F ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

INCORPORATION BY REFERENCE

Exhibits 99.1 and 99.2 of this Form 6-K are incorporated by reference as additional exhibits to the registrant’s Registration Statement on Form F-10 (File No. 333-260043).

DOCUMENTS INCLUDED AS PART OF THIS REPORT

| | | | | | | | |

| Exhibit Number | | Description |

99.1

99.2

| |

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | |

| | | | | | Tricon Residential Inc. |

| | | | |

| Date: November 7, 2023 | | | | | | By: | | /s/ David Veneziano |

| | | | | | | | Name: | | David Veneziano |

| | | | | | | | Title: | | EVP, Chief Legal Officer and Corporate Secretary |

| | | | | | | | | | | | | | |

CONDENSED INTERIM CONSOLIDATED BALANCE SHEETS | | | | |

| Unaudited (in thousands of U.S. dollars) | | | | |

| Notes | | September 30, 2023 | December 31, 2022 |

| | | | |

| Assets | | | | |

| Non-current assets | | | | |

| Rental properties | 4 | | $ | 12,122,107 | | $ | 11,445,659 | |

| Equity-accounted investments in multi-family rental properties | 5 | | 21,078 | | 20,769 | |

| Equity-accounted investments in Canadian residential developments | 6 | | 118,327 | | 106,538 | |

| Canadian development properties | 7 | | 159,902 | | 136,413 | |

| Investments in U.S. residential developments | 8 | | 154,814 | | 138,369 | |

| Restricted cash | | | 142,673 | | 117,300 | |

| Goodwill | | | 29,726 | | 29,726 | |

| Deferred income tax assets | 10 | | 80,017 | | 75,062 | |

| Intangible assets | | | 5,630 | | 7,093 | |

| Other assets | | | 108,350 | | 96,852 | |

| Derivative financial instruments | 16 | | 4,897 | | 10,358 | |

| Total non-current assets | | | 12,947,521 | | 12,184,139 | |

| | | | |

| Current assets | | | | |

| Cash | | | 172,787 | | 204,303 | |

| Amounts receivable | | | 38,671 | | 24,984 | |

| Prepaid expenses and deposits | | | 23,348 | | 37,520 | |

| | | | |

| Total current assets | | | 234,806 | | 266,807 | |

| Total assets | | | $ | 13,182,327 | | $ | 12,450,946 | |

| | | | |

| Liabilities | | | | |

| Non-current liabilities | | | | |

| Long-term debt | 14 | | $ | 5,062,495 | | $ | 4,971,049 | |

| Due to Affiliate | 15 | | 260,977 | | 256,824 | |

| Derivative financial instruments | 16 | | 32,097 | | 51,158 | |

| Deferred income tax liabilities | 10 | | 622,104 | | 591,713 | |

| Limited partners' interests in single-family rental business | | | 2,275,349 | | 1,696,872 | |

| Long-term incentive plan | 21 | | 25,795 | | 25,244 | |

| Performance fees liability | 22 | | 40,343 | | 39,893 | |

| Other liabilities | | | 33,471 | | 30,035 | |

| Total non-current liabilities | | | 8,352,631 | | 7,662,788 | |

| | | | |

| Current liabilities | | | | |

| Amounts payable and accrued liabilities | | | 205,359 | | 138,273 | |

| Resident security deposits | | | 83,874 | | 79,864 | |

| Dividends payable | 18 | | 15,834 | | 15,861 | |

| Current portion of long-term debt | 14 | | 624,962 | | 757,135 | |

| | | | |

| | | | |

| | | | |

| | | | |

| Total current liabilities | | | 930,029 | | 991,133 | |

| Total liabilities | | | 9,282,660 | | 8,653,921 | |

| | | | |

| Equity | | | | |

| Share capital | 19 | | 2,121,953 | | 2,124,618 | |

| Contributed surplus | | | 25,682 | | 21,354 | |

| Cumulative translation adjustment | | | 6,684 | | 6,209 | |

| Retained earnings | | | 1,741,413 | | 1,638,068 | |

| Total shareholders' equity | | | 3,895,732 | | 3,790,249 | |

| Non-controlling interest | | | 3,935 | | 6,776 | |

| Total equity | | | 3,899,667 | | 3,797,025 | |

| Total liabilities and equity | | | $ | 13,182,327 | | $ | 12,450,946 | |

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

Approved by the Board of Directors

David Berman Michael Knowlton

| | | | | | | | | | | | | | | | | | | | |

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME |

| Unaudited (in thousands of U.S. dollars, except per share amounts which are in U.S. dollars, unless otherwise indicated) |

| | | For the three months ended | For the nine months ended |

| Notes | | September 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 |

| | | | | | |

| Revenue from single-family rental properties | 11 | | $ | 202,571 | | $ | 170,769 | | $ | 588,537 | | $ | 464,692 | |

| Direct operating expenses | | | (67,298) | | (54,464) | | (194,407) | | (150,718) | |

| Net operating income from single-family rental properties | | | 135,273 | | 116,305 | | 394,130 | | 313,974 | |

| | | | | | |

| Revenue from strategic capital services | 12 | | $ | 8,960 | | $ | 112,470 | | $ | 34,831 | | $ | 145,268 | |

| | | | | | |

| Income from equity-accounted investments in multi-family rental properties | 5 | | 179 | | 169 | | 529 | | 499 | |

| Income from equity-accounted investments in Canadian residential developments | 6 | | 2,442 | | 3,621 | | 2,734 | | 3,508 | |

| Other income | 13 | | 730 | | 5,448 | | 322 | | 8,869 | |

| Income from investments in U.S. residential developments | 8 | | 10,492 | | 5,680 | | 23,847 | | 12,987 | |

| Compensation expense | 21 | | (20,960) | | (25,859) | | (63,182) | | (76,848) | |

| Performance fees expense | 22 | | (163) | | (4,375) | | (700) | | (32,056) | |

| General and administration expense | | | (22,174) | | (14,048) | | (59,625) | | (40,828) | |

| Gain (loss) on debt modification and extinguishment | 14 | | 1,326 | | (6,816) | | 1,326 | | (6,816) | |

| Transaction costs | | | (5,176) | | (3,658) | | (13,173) | | (11,359) | |

| Interest expense | 17 | | (80,475) | | (60,094) | | (236,221) | | (142,812) | |

| Fair value gain on rental properties | 4 | | 73,261 | | 107,166 | | 208,907 | | 802,573 | |

| Fair value loss on Canadian development properties | 7 | | — | | (1,314) | | — | | (440) | |

Realized and unrealized gain on derivative financial instruments(1) | 16 | | 30,456 | | 31,866 | | 20,777 | | 158,991 | |

| Amortization and depreciation expense | | | (4,522) | | (3,853) | | (13,067) | | (10,844) | |

Realized and unrealized foreign exchange (loss) gain | | | (62) | | 623 | | 69 | | 662 | |

| Net change in fair value of limited partners’ interests in single-family rental business | | | (38,819) | | (42,318) | | (118,543) | | (246,553) | |

| | | (53,465) | | (7,762) | | (246,000) | | 419,533 | |

| Income before income taxes from continuing operations | | | $ | 90,768 | | $ | 221,013 | | $ | 182,961 | | $ | 878,775 | |

| Income tax recovery (expense) - current | 10 | | 163 | | 29,860 | | (1,737) | | 28,294 | |

| Income tax expense - deferred | 10 | | (9,806) | | (72,087) | | (23,930) | | (183,578) | |

| Net income from continuing operations | | | $ | 81,125 | | $ | 178,786 | | $ | 157,294 | | $ | 723,491 | |

| | | | | | |

| Income before income taxes from discontinued operations | 3, 5 | | — | | 2,277 | | — | | 37,889 | |

| Income tax expense - current | 3 | | — | | (45,094) | | — | | (45,094) | |

| Income tax expense - deferred | 3 | | — | | 40,482 | | — | | 40,482 | |

| Net income from discontinued operations | | | — | | (2,335) | | — | | 33,277 | |

| Net income | | | $ | 81,125 | | $ | 176,451 | | $ | 157,294 | | $ | 756,768 | |

| | | | | | |

| Attributable to: | | | | | | |

| Shareholders of Tricon | | | 80,156 | | 175,591 | | 152,450 | | 753,773 | |

| Non-controlling interest | | | 969 | | 860 | | 4,844 | | 2,995 | |

| Net income | | | $ | 81,125 | | $ | 176,451 | | $ | 157,294 | | $ | 756,768 | |

| | | | | | |

| Other comprehensive income | | | | | | |

| Items that will be reclassified subsequently to net income | | | | | | |

| Cumulative translation reserve | | | (5,161) | | (15,812) | | 475 | | (19,714) | |

| Comprehensive income for the period | | | $ | 75,964 | | $ | 160,639 | | $ | 157,769 | | $ | 737,054 | |

| | | | | | |

| Attributable to: | | | | | | |

| Shareholders of Tricon | | | 74,995 | | 159,779 | | 152,925 | | 734,059 | |

| Non-controlling interest | | | 969 | | 860 | | 4,844 | | 2,995 | |

| Comprehensive income for the period | | | $ | 75,964 | | $ | 160,639 | | $ | 157,769 | | $ | 737,054 | |

| | | | | | |

| Basic earnings per share attributable to shareholders of Tricon | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| Continuing operations | 20 | | $ | 0.29 | | 0.65 | | $ | 0.56 | | 2.63 | |

| Discontinued operations | 20 | | — | | (0.01) | | — | | 0.12 | |

| Basic earnings per share attributable to shareholders of Tricon | | | $ | 0.29 | | $ | 0.64 | | $ | 0.56 | | $ | 2.75 | |

| | | | | | |

| Diluted earnings per share attributable to shareholders of Tricon | | | | | | |

| Continuing operations | 20 | | $ | 0.18 | | 0.49 | | $ | 0.48 | | 1.87 | |

| Discontinued operations | 20 | | — | | (0.01) | | — | | 0.11 | |

| Diluted earnings per share attributable to shareholders of Tricon | | | $ | 0.18 | | $ | 0.48 | | $ | 0.48 | | $ | 1.98 | |

| | | | | | |

| Weighted average shares outstanding - basic | 20 | | 273,810,276 | | 274,710,065 | | 273,738,512 | | 274,474,675 | |

| Weighted average shares outstanding - diluted | 20 | | 310,497,125 | | 311,910,445 | | 310,341,448 | | 312,023,897 | |

(1) The Company reclassified realized gains on interest rate caps for the three and nine months period ended from Other income to Realized and unrealized gains on derivative financial instruments.

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CHANGES IN EQUITY |

| Unaudited (in thousands of U.S. dollars) |

| | | | | | | | | |

| Notes | Share capital | | Contributed surplus | Cumulative translation adjustment | Retained earnings | Total shareholders' equity | Non - controlling interest | Total |

| | | | | | | | | |

| Balance at January 1, 2023 | | $ | 2,124,618 | | | $ | 21,354 | | $ | 6,209 | | $ | 1,638,068 | | $ | 3,790,249 | | $ | 6,776 | | $ | 3,797,025 | |

| | | | | | | | | |

| Net income | | — | | | — | | — | | 152,450 | | 152,450 | | 4,844 | | 157,294 | |

| | | | | | | | | |

| | | | | | | | | |

| Cumulative translation reserve | | — | | | — | | 475 | | — | | 475 | | — | | 475 | |

Distributions to

non-controlling interest | | — | | | — | | — | | — | | — | | (7,685) | | (7,685) | |

Dividends/Dividend

reinvestment plan | 18, 19 | 3,315 | | | — | | — | | (47,468) | | (44,153) | | — | | (44,153) | |

| Repurchase of common shares | 19 | (7,112) | | | — | | — | | (1,637) | | (8,749) | | — | | (8,749) | |

| Stock-based compensation | 19, 21 | 1,241 | | | 5,786 | | — | | — | | 7,027 | | — | | 7,027 | |

| | | | | | | | | |

Shares reserved for

restricted share awards | 19 | (109) | | | — | | — | | — | | (109) | | — | | (109) | |

| Tax adjustment for equity issuance costs | 10 | — | | | (1,458) | | — | | — | | (1,458) | | — | | (1,458) | |

| Balance at September 30, 2023 | | $ | 2,121,953 | | | $ | 25,682 | | $ | 6,684 | | $ | 1,741,413 | | $ | 3,895,732 | | $ | 3,935 | | $ | 3,899,667 | |

| | | | | | | | | |

| Balance at January 1, 2022 | | $ | 2,114,783 | | | $ | 22,790 | | $ | 22,842 | | $ | 893,379 | | $ | 3,053,794 | | $ | 7,275 | | $ | 3,061,069 | |

| | | | | | | | | |

| Net income | | — | | | — | | — | | 753,773 | | 753,773 | | 2,995 | | 756,768 | |

| Cumulative translation reserve | | — | | | — | | (19,714) | | — | | (19,714) | | — | | (19,714) | |

Distributions to

non-controlling interest | | — | | | — | | — | | — | | — | | (5,040) | | (5,040) | |

Dividends/Dividend

reinvestment plan | 18, 19 | 3,523 | | | — | | — | | (47,618) | | (44,095) | | — | | (44,095) | |

| | | | | | | | | |

| Stock-based compensation | 19, 21 | 739 | | | 2,866 | | — | | — | | 3,605 | | — | | 3,605 | |

| Preferred units exchanged | 15, 19 | 8,015 | | | — | | — | | — | | 8,015 | | — | | 8,015 | |

Shares reserved for

restricted share awards | | (102) | | | — | | — | | — | | (102) | | — | | (102) | |

| Tax adjustment for equity issuance costs | | — | | | (1,457) | | — | | — | | (1,457) | | — | | (1,457) | |

| Balance at September 30, 2022 | | $ | 2,126,958 | | | $ | 24,199 | | $ | 3,128 | | $ | 1,599,534 | | $ | 3,753,819 | | $ | 5,230 | | $ | 3,759,049 | |

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | |

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF CASH FLOWS |

| Unaudited (in thousands of U.S. dollars) |

| | | For the three months ended | For the nine months ended |

| Notes | | September 30, 2023 | September 30, 2022 | September 30, 2023 | September 30, 2022 |

| | | | | | |

| CASH PROVIDED BY (USED IN) | | | | | | |

| Operating activities | | | | | | |

| Net income | | | $ | 81,125 | | $ | 176,451 | | $ | 157,294 | | $ | 756,768 | |

| Net (income) loss from discontinued operations | 3 | | — | | 2,335 | | — | | (33,277) | |

| Adjustments for non-cash items | 26 | | (52,130) | | (10,569) | | (63,810) | | (463,820) | |

| Cash paid for AIP, LTIP and performance fees, net of equity contribution | 21, 22 | | (697) | | (1,043) | | (8,349) | | (14,142) | |

| Advances made to investments | 6, 8 | | (6,357) | | (4,975) | | (16,067) | | (19,144) | |

Distributions received from investments(2) | 5, 6, 8 | | 5,541 | | 6,002 | | 14,797 | | 42,397 | |

Addition of interest rate caps derivative(1) | 16 | | (528) | | — | | (5,502) | | — | |

| Changes in non-cash working capital items | 26 | | 53,194 | | (62,505) | | 71,581 | | (24,155) | |

| Net cash provided by operating activities from continuing operations | | | 80,148 | | 105,696 | | 149,944 | | 244,627 | |

Net cash provided by operating activities from discontinued operations(2) | | | — | | 1,420 | | — | | 3,499 | |

| Net cash provided by operating activities | | | $ | 80,148 | | $ | 107,116 | | $ | 149,944 | | $ | 248,126 | |

| | | | | | |

| Investing activities | | | | | | |

| | | | | | |

| | | | | | |

| Acquisition of rental properties | 4 | | (118,395) | | (646,896) | | (482,047) | | (2,109,793) | |

| Capital additions to rental properties | 4 | | (50,599) | | (100,608) | | (140,661) | | (258,387) | |

| Disposition of rental properties | 4 | | 53,483 | | 14,124 | | 155,167 | | 45,179 | |

| Disposition of Bryson MPC Holdings LLC | | | — | | 11,041 | | — | | 11,041 | |

| Additions to fixed assets and other non-current assets | | | (9,961) | | (7,476) | | (36,373) | | (26,787) | |

| Net cash used in investing activities from continuing operations | | | (125,472) | | (729,815) | | (503,914) | | (2,338,747) | |

| | | | | | |

| Net cash used in investing activities | | | $ | (125,472) | | $ | (729,815) | | $ | (503,914) | | $ | (2,338,747) | |

| | | | | | |

| Financing activities | | | | | | |

| Lease payments | | | (1,553) | | (676) | | (4,265) | | (1,935) | |

| Repurchase of common shares | 19 | | — | | — | | (8,749) | | — | |

| Proceeds from corporate borrowing | | | 128,000 | | 97,000 | | 304,000 | | 294,000 | |

| Repayments of corporate borrowing | | | (136,098) | | (45,134) | | (154,294) | | (113,334) | |

| Proceeds from rental and development properties borrowing | | | 637,177 | | 1,205,868 | | 1,227,049 | | 3,142,803 | |

| Repayments of rental and development properties borrowing | | | (767,827) | | (708,384) | | (1,423,988) | | (1,600,020) | |

| | | | | | |

| Dividends paid | 18 | | (14,681) | | (14,905) | | (44,180) | | (44,038) | |

| Change in restricted cash | | | 18,812 | | (35,710) | | (25,373) | | (70,728) | |

| Contributions from limited partners | | | 241,846 | | 128,365 | | 494,996 | | 489,388 | |

| Distributions to limited partners | | | (6,119) | | (6,810) | | (35,062) | | (35,118) | |

| Distributions to non-controlling interests | | | (1,747) | | (1,198) | | (7,685) | | (5,040) | |

| Net cash provided by financing activities from continuing operations | | | 97,810 | | 618,416 | | 322,449 | | 2,055,978 | |

| | | | | | |

| Net cash provided by financing activities | | | $ | 97,810 | | $ | 618,416 | | $ | 322,449 | | $ | 2,055,978 | |

| | | | | | |

| Effect of foreign exchange rate difference on cash | | | (86) | | (261) | | 5 | | (332) | |

| | | | | | |

| Change in cash during the period | | | 52,400 | | (4,544) | | (31,516) | | (34,975) | |

| Cash - beginning of period | | | 120,387 | | 146,463 | | 204,303 | | 176,894 | |

| Cash - end of period | | | $ | 172,787 | | $ | 141,919 | | $ | 172,787 | | $ | 141,919 | |

| | | | | | |

| Supplementary information | | | | | | |

| Cash paid on | | | | | | |

| Income taxes | | | $ | 1,108 | | $ | — | | $ | 13,563 | | $ | 872 | |

| Interest | | | $ | 73,246 | | $ | 51,689 | | $ | 216,541 | | $ | 122,113 | |

(1) The addition of interest rate caps for the three and nine month period was reclassified from financing activities to operating activities.

(2) Certain comparative figures in the cash flows have been restated to present discontinued operations separately from continuing operations.

The accompanying notes are an integral part of these condensed interim consolidated financial statements.

1. NATURE OF BUSINESS

Tricon Residential Inc. (“Tricon” or the “Company”) is an owner and operator of a growing portfolio of approximately 38,000 single-family rental homes located primarily in the U.S. Sun Belt and multi-family apartments in Canada. The Company also invests in adjacent residential businesses which include residential development assets in the United States and Canada. Through its fully integrated operating platform, the Company earns rental income and ancillary revenue from single-family rental properties, income from its investments in multi-family rental properties and residential developments, as well as fees from managing strategic capital associated with its businesses.

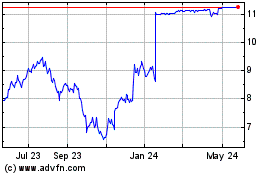

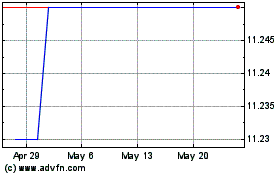

Tricon was incorporated on June 16, 1997 under the Business Corporations Act (Ontario) and its head office is located at 7 St. Thomas Street, Suite 801, Toronto, Ontario, M5S 2B7. The Company is domiciled in Canada. Tricon became a public company in Canada on May 20, 2010 and completed an initial public offering of its common shares in the U.S. on October 12, 2021. The Company’s common shares are traded under the symbol TCN on both the New York Stock Exchange and the Toronto Stock Exchange.

These condensed interim consolidated financial statements were approved for issue on November 7, 2023 by the Board of Directors of Tricon.

2. BASIS OF PRESENTATION

The following is a summary of the significant accounting policies applied in the preparation of these condensed interim consolidated financial statements.

Basis of preparation and measurement

Preparation of consolidated financial statements

The condensed interim consolidated financial statements are prepared on a going-concern basis and have been presented in U.S. dollars, which is also the Company’s functional currency. All financial information is presented in thousands of U.S. dollars except where otherwise indicated.

These condensed interim consolidated financial statements have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board ("IFRS"), including International Accounting Standard 34, Interim Financial Reporting ("IAS 34"), on a basis consistent with the accounting policies disclosed in the Company's annual financial statements. They should be read in conjunction with the annual audited consolidated financial statements for the year ended December 31, 2022.

The accounting impact of the Company's businesses and their presentation in the Company's consolidated financial statements are summarized in the table below.

| | | | | |

| Notes to the CONDENSED INTERIM CONSOLIDATED Financial Statements For the three and nine months ended September 30, 2023 (in thousands of U.S. dollars, except per share amounts and percentage amounts) |

| | | | | | | | | | | | | | | | | |

| ACCOUNTING | PRESENTATION |

| Business segment | Accounting assessment | Accounting methodology | Presentation in Balance Sheet | Presentation in Statement of Income | Presentation of Non-controlling interest |

| Single-Family Rental | | | | | |

| Tricon wholly-owned | Controlled subsidiary | Consolidation | Rental properties | Revenue from single-family rental properties | N/A |

| SFR JV-1 | Controlled subsidiary | Consolidation | Limited partners' interests

(Component of liabilities) |

| SFR JV-HD | Controlled subsidiary | Consolidation |

| SFR JV-2 | Controlled subsidiary | Consolidation |

| | | | | |

| Multi-Family Rental | | | | | |

U.S. multi-family(1) | Divested in October 2022 | Equity method | Divested in October 2022 | Income from discontinued operations from January 1, 2022 to June 30, 2022 | N/A |

Canadian multi-family:

592 Sherbourne

(The Selby) | Investments in associate | Equity method | Equity-accounted investments in multi-family rental properties | Income from equity-accounted investments in multi-family rental properties | N/A |

| | | | | |

| Canadian residential developments | | | | | |

The Shops of

Summerhill | Controlled subsidiary | Consolidation | Canadian development properties

| Other income | N/A |

| The James (Scrivener Square) | N/A |

| | | | | |

57 Spadina (The Taylor)(2) | Investments in associate | Equity method | Equity-accounted investments in Canadian residential developments | Income from equity-accounted investments in Canadian residential developments | N/A |

| WDL - Block 8 (Maple House) | Joint venture | Equity method | N/A |

| WDL - Block 20 (Oak House) | Joint venture | Equity method | N/A |

| WDL - Blocks 3/4/7 (Cherry House) | Joint venture | Equity method | N/A |

| WDL - Block 10 (Birch House) | Joint venture | Equity method | N/A |

| 6-8 Gloucester (The Ivy) | Joint venture | Equity method | N/A |

| Queen & Ontario (ROQ City) | Joint venture | Equity method | N/A |

| Symington (The Spoke) | Joint venture | Equity method | N/A |

KT Housing Now(3) | Joint venture | Equity method | N/A |

| | | | | |

| U.S. residential developments | | | | | |

| THPAS Holdings JV-1 LLC | Investments in associates | Equity method | Investments in U.S. residential developments | Income from investments in U.S. residential developments | N/A |

| THPAS Development JV-2 LLC | Investments in associates | Equity method | N/A |

| For-sale housing | Investments in associates | Equity method | N/A |

| | | | | |

Strategic Capital(4) | | | | | |

| Private funds GP entities | Controlled subsidiary | Consolidation | Consolidated | Revenue from strategic capital services | N/A |

| Johnson development management | Controlled subsidiary | Consolidation | Consolidated | Component of equity |

(1) On October 18, 2022, the Company completed the sale of its remaining 20% equity interest in the U.S. multi-family rental portfolio (Note 3).

(2) As at September 30, 2023, 57 Spadina LP (The Taylor) achieved stabilization. In the fourth quarter of 2023, being the first full quarter after stabilization, it will be reclassified from the Canadian residential developments segment to the multi-family rental segment.

(3) On June 23, 2023, the Company entered into a new joint venture investment, KT Housing Now Six Points LP, with its partner, Kilmer Group (Note 6).

(4) Strategic Capital was previously reported as Private Funds and Advisory.

| | | | | |

| Notes to the CONDENSED INTERIM CONSOLIDATED Financial Statements For the three and nine months ended September 30, 2023 (in thousands of U.S. dollars, except per share amounts and percentage amounts) |

Accounting standards and interpretations adopted

Effective January 1, 2023, the Company has adopted amendments to IAS 1, Presentation of Financial Statements, and IAS 8, Accounting Policies, Changes in Accounting Estimates and Errors to improve accounting policy disclosures and to help users of the financial statements distinguish between changes in accounting estimates and changes in accounting policies. The Company also adopted amendments to IAS 12, Income Taxes ("IAS 12"), which requires companies to recognize deferred tax on transactions, such as leases and decommissioning obligations, that on initial recognition, give rise to equal amounts of taxable and deductible temporary differences. The adoption of these standards did not have a significant impact on the Company's consolidated financial statements.

Accounting standards and interpretations issued but not yet adopted

In January 2020, the IASB issued amendments to IAS 1, Presentation of Financial Statements ("IAS 1"), to provide a more general approach to the classification of liabilities based on the contractual arrangements in place at the reporting date. In November 2022, the IASB further amended IAS 1 to clarify how conditions with which an entity must comply within twelve months after the reporting period affect the classification of a liability as current or non-current. This amendment is effective for annual reporting periods beginning on or after January 1, 2024.

In August 2023, the IASB amended IAS 21, The Effects of Changes in Foreign Exchange Rates ("IAS 21") to help entities assess the exchangeability between two currencies, determine the spot rate when exchangeability is lacking and require additional disclosure when a currency is not exchangeable. The amendments are effective for annual reporting periods beginning on or after January 1, 2025.

There are no other relevant standards, interpretations or amendments to existing standards that are not yet effective that are expected to have a material impact on the consolidated financial statements of the Company.

3. DISCONTINUED OPERATIONS

On October 18, 2022, the Company sold its remaining 20% equity interest in its U.S. multi-family rental portfolio (held through Tricon US Multi-Family REIT LLC), for total proceeds of $219,354, which resulted in a loss on sale of $856, net of transaction costs.

| | | | | |

| (in thousands of U.S. dollars) | December 31, 2022 |

| |

| Total consideration | $ | 219,354 | |

| Net asset value on disposition | (213,493) | |

| Transaction cost | (6,717) | |

| Loss on sale | (856) | |

The Company presented prior-period income from equity-accounted investments in U.S. multi-family rental properties as discontinued operations, separate from the Company's continuing operations. The profit or loss of the discontinued operations was as follows:

| | | | | |

| Notes to the CONDENSED INTERIM CONSOLIDATED Financial Statements For the three and nine months ended September 30, 2023 (in thousands of U.S. dollars, except per share amounts and percentage amounts) |

| | | | | | | | | | | | | |

| | For the three months ended September 30 | | For the nine months ended September 30 |

| (in thousands of U.S. dollars) | | | 2022 | | 2022 |

| | | | | |

| Revenue | | | $ | 34,173 | | | $ | 99,365 | |

| Expenses | | | (22,787) | | | (65,928) | |

| Fair value gain on U.S. multi-family rental properties | | | — | | | 156,009 | |

| Net and other comprehensive income | | | $ | 11,386 | | | $ | 189,446 | |

| | | | | |

Tricon's share of net income at 20% | | | $ | 2,277 | | | $ | 37,889 | |

| | | | | |

| Income tax expense - current | | | (45,094) | | | (45,094) | |

| Income tax expense - deferred | | | 40,482 | | | 40,482 | |

| Net income from discontinued operations | | | $ | (2,335) | | | $ | 33,277 | |

4. RENTAL PROPERTIES

Management is responsible for fair value measurements included in the financial statements, including Level 3 measurements. The valuation processes and results are reviewed and approved by the Valuation Committee once every quarter, in line with the Company’s quarterly reporting dates. The Valuation Committee consists of individuals who are knowledgeable and have experience in the fair value techniques for the real estate properties held by the Company. The Valuation Committee decides on the appropriate valuation methodologies for new real estate properties and contemplates changes in the valuation methodology for existing real estate holdings. Additionally, the Valuation Committee analyzes the movements in each property’s (or group of properties') value, which involves assessing the validity of the inputs applied in the valuation.

The following table presents the changes in the rental property balances for the nine months ended September 30, 2023 and the year ended December 31, 2022.

| | | | | | | | | | | |

| (in thousands of U.S. dollars) | September 30, 2023 | | December 31, 2022 |

| | | |

Opening balance | $ | 11,445,659 | | | $ | 7,978,396 | |

Acquisitions(1) | 482,047 | | | 2,362,185 | |

Capital expenditures | 140,661 | | | 326,460 | |

Fair value adjustments(2) | 208,907 | | | 858,987 | |

Dispositions | (155,167) | | | (80,369) | |

| Balance, end of period | $ | 12,122,107 | | | $ | 11,445,659 | |

(1) The total purchase price includes $1,994 (2022 - $3,021) of capitalized transaction costs in relation to the acquisitions.

(2) Fair value adjustments include realized fair value gains of $40,441 for the nine months ended September 30, 2023 and realized fair value gains of $12,997 for the year ended December 31, 2022 on the single-family rental properties.

The Company used the following techniques to determine the fair value measurements included in the condensed interim consolidated financial statements categorized under Level 3.

Single-family rental homes

Valuation methodology

The fair value of single-family rental homes is typically determined based on comparable sales primarily by using adjusted Home Price Index (“HPI”) and periodically Broker Price Opinions (“BPOs”), as applicable. In addition, homes that were purchased in the last three to six months (or homes purchased in the year that are not yet stabilized) from the reporting date are recorded at their purchase price plus the cost of capital expenditures.

BPOs are quoted by qualified brokers who hold active real estate licenses and have market experience in the locations and segments of the properties being valued. The brokers value each property based on recent comparable sales and active comparable listings in the area, assuming the properties were all renovated to an

| | | | | |

| Notes to the CONDENSED INTERIM CONSOLIDATED Financial Statements For the three and nine months ended September 30, 2023 (in thousands of U.S. dollars, except per share amounts and percentage amounts) |

average standard in their respective areas. The Company typically obtains a BPO when a home is first included in a securitization or other long-term financing vehicle.

Adjusted HPI is used to update the value, on a quarterly basis, of single-family rental homes that were most recently valued using a BPO for purposes of use in a long-term financing, and if no BPO has been obtained, adjusted HPI is used for homes acquired more than six months prior to such quarter. The HPI is calculated based on a repeat-sales model using large real estate information databases compiled from public records. The HPI was calculated as at August 31, 2023 for rental homes acquired prior to July 1, 2023 and has been adjusted based on management's judgment informed by recent transactions and other relevant factors. The quarterly HPI change is then applied to the previously recorded fair value of the rental homes. The data used to determine the fair value of the Company’s single-family rental homes is specific to the zip code in which the property is located.

Adjusted HPI growth during the quarter was 1.1%, net of capital expenditures (2022 - 1.5%). There were 2,415 homes valued using the BPO method during the quarter (2022 - 1,682 homes). The combination of the HPI and BPO methodologies resulted in a fair value gain of $73,261 for the three months ended September 30, 2023 (2022 - $107,166).

Adjusted HPI growth for the nine months ended September 30, 2023 was 2.5%, net of capital expenditures, compared to 11.6% in the prior period. There were 3,818 homes valued using the BPO method during the period (2022 - 4,166 homes), and the combined methodologies of HPI and BPO resulted in a fair value gain of $208,907 for the nine months ended September 30, 2023 (2022 - $802,573).

Sensitivity

The adjusted HPI change during the quarter was 1.1% (2022 - 1.5%). If the change in the adjusted HPI increased or decreased by 1.0%, the impact on the single-family rental property balance at September 30, 2023 would be $95,879 and ($95,879), respectively (2022 - $83,694 and ($83,694)).

5. EQUITY-ACCOUNTED INVESTMENTS IN MULTI-FAMILY RENTAL PROPERTIES

Following the Company's divestiture of its interest in the U.S. multi-family rental portfolio in October 2022, the Company's equity-accounted investments in multi-family rental properties consist of an investment in associate ("592 Sherbourne LP", operating as "The Selby"), a 500-unit class A multi-family rental property in Toronto, over which the Company has significant influence.

The following table presents the change in the balance of equity-accounted investments in multi-family rental properties for the nine months ended September 30, 2023 and the year ended December 31, 2022.

| | | | | | | | | | | |

| (in thousands of U.S. dollars) | September 30, 2023 | | December 31, 2022 |

| | | |

| Opening balance | $ | 20,769 | | | $ | 199,285 | |

| | | |

| | | |

| Distributions | (257) | | | (3,824) | |

Income from equity-accounted investments in multi-family rental properties(1) | 529 | | | 40,144 | |

Disposition of equity-accounted investment in U.S. multi-family rental properties (Note 3) | — | | | (213,493) | |

Translation adjustment(2) | 37 | | | (1,343) | |

| Balance, end of period | $ | 21,078 | | | $ | 20,769 | |

(1) Of the $40,144 income from equity-accounted investments earned during 2022, $38,594 was attributable to U.S. multi-family rental properties and reclassified to income from discontinued operations (Note 3).

(2) For the nine months ended September 30, 2023, the USD/CAD exchange rate moved from 1.3544 as at December 31, 2022 to 1.3520 as at September 30, 2023, resulting in a favorable foreign currency translation adjustment of $37. In the prior year, the USD/CAD exchange rate moved from 1.2678 as at December 31, 2021 to 1.3544 as at December 31, 2022, resulting in an unfavorable foreign currency translation adjustment of $1,343.

6. EQUITY-ACCOUNTED INVESTMENTS IN CANADIAN RESIDENTIAL DEVELOPMENTS

The Company has entered into certain arrangements in the form of jointly controlled entities and investments in associates for various Canadian multi-family rental developments. Joint ventures represent development properties

| | | | | |

| Notes to the CONDENSED INTERIM CONSOLIDATED Financial Statements For the three and nine months ended September 30, 2023 (in thousands of U.S. dollars, except per share amounts and percentage amounts) |

held in partnership with third parties where decisions relating to the relevant activities of the joint venture require the unanimous consent of the partners. These arrangements are accounted for under the equity method.

The following table presents the change in the balance of equity-accounted investments in Canadian residential developments for the nine months ended September 30, 2023 and the year ended December 31, 2022.

| | | | | | | | | | | |

| (in thousands of U.S. dollars) | September 30, 2023 | | December 31, 2022 |

| | | |

| Opening balance | $ | 106,538 | | | $ | 98,675 | |

| | | |

Advances(1) | 9,301 | | | 13,360 | |

Distributions(2) | (372) | | | (10,212) | |

| Income from equity-accounted investments in Canadian residential developments | 2,734 | | | 11,198 | |

Translation adjustment(3) | 126 | | | (6,483) | |

| Balance, end of period | $ | 118,327 | | | $ | 106,538 | |

(1) Advances to equity-accounted investments in Canadian residential developments for the nine months ended September 30, 2023 include advances for The Ivy, Oak House (Block 20), Cherry House (Blocks 3/4/7), ROQ City (Queen & Ontario), The Spoke (Symington) and KT Housing Now.

(2) Distributions from equity-accounted investments in Canadian residential developments for the year ended December 31, 2022 represent sales proceeds from the Company's divestiture of two-thirds of its original 30% equity ownership in ROQ City (Queen & Ontario) to its institutional partner.

(3) For the nine months ended September 30, 2023, the USD/CAD exchange rate moved from 1.3544 as at December 31, 2022 to 1.3520 as at September 30, 2023, resulting in a favorable foreign currency translation adjustment of $126. In the prior year, the USD/CAD exchange rate moved from 1.2678 as at December 31, 2021 to 1.3544 as at December 31, 2022, resulting in an unfavorable foreign currency translation adjustment of $6,483.

7. CANADIAN DEVELOPMENT PROPERTIES

The Company's Canadian development properties include one development project (The James) and an adjacent commercial property (The Shops of Summerhill) in Toronto. The following table presents the changes in the Canadian development properties balance for the nine months ended September 30, 2023 and the year ended December 31, 2022.

| | | | | | | | | | | |

| (in thousands of U.S. dollars) | September 30, 2023 | | December 31, 2022 |

| | | |

| Opening balance | $ | 136,413 | | | $ | 133,250 | |

| | | |

| Development expenditures | 23,365 | | | 12,686 | |

| | | |

| Fair value adjustments | — | | | (440) | |

Translation adjustment(1) | 124 | | | (9,083) | |

| Balance, end of period | $ | 159,902 | | | $ | 136,413 | |

(1) For the nine months ended September 30, 2023, the USD/CAD exchange rate moved from 1.3544 as at December 31, 2022 to 1.3520 as at September 30, 2023, resulting in a favorable foreign currency translation adjustment of $124. In the prior year, the USD/CAD exchange rate moved from 1.2678 as at December 31, 2021 to 1.3544 as at December 31, 2022, resulting in an unfavorable foreign currency translation adjustment of $9,083.

The Company earned $354 and $1,077 of commercial rental income from The Shops of Summerhill for the three and nine months ended September 30, 2023, respectively (2022 - $388 and $1,056), which is classified as other income (Note 13).

8. INVESTMENTS IN U.S. RESIDENTIAL DEVELOPMENTS

The Company makes investments in U.S. residential developments via equity investments and loan advances. Advances made to investments are added to the carrying value when paid; distributions from investments are deducted from the carrying value when received.

| | | | | |

| Notes to the CONDENSED INTERIM CONSOLIDATED Financial Statements For the three and nine months ended September 30, 2023 (in thousands of U.S. dollars, except per share amounts and percentage amounts) |

The following table presents the changes in the investments in U.S. residential developments for the nine months ended September 30, 2023 and the year ended December 31, 2022.

| | | | | | | | | | | |

| (in thousands of U.S. dollars) | September 30, 2023 | | December 31, 2022 |

| | | |

| Opening balance | $ | 138,369 | | | $ | 143,153 | |

Advances(1) | 6,766 | | | 15,655 | |

| Distributions | (14,168) | | | (37,336) | |

| | | |

Income from investments in U.S. residential developments(2) | 23,847 | | | 16,897 | |

Balance, end of period | $ | 154,814 | | | $ | 138,369 | |

| | | |

| | | |

| | | |

| | | |

(1) Advances to U.S. residential developments for the year ended December 31, 2022 include $2,760 in non-cash contributions related to the syndication of the Company's investment in Bryson MPC Holdings LLC to THPAS Development JV-2 LLC.

(2) There were no realized gains or losses included in the income from investments in U.S. residential developments for the nine months ended September 30, 2023 (2022 - nil).

Valuation methodology

The investments are measured at fair value (excluding THPAS Development JV-2 LLC) as determined by the Company’s proportionate share of the fair value of each Investment Vehicle’s net assets at each measurement date. The fair value of each Investment Vehicle’s net assets is determined by the waterfall distribution calculations specified in the relevant governing agreements. The inputs into the waterfall distribution calculations include the fair values of the land development and homebuilding projects and working capital held by the Investment Vehicles. The fair values of the land development and homebuilding projects are based on appraisals prepared by external third-party valuators or on internal valuations using comparable methodologies and assumptions. THPAS Development JV-2 LLC is measured at cost under the equity method and not recorded at fair value as the entity itself is not considered to be an investment entity.

The residential real estate development business involves significant risks that could adversely affect the fair value of Tricon's investments in for-sale housing, especially in times of economic uncertainty. Quantitative information about fair value measurements of the investments uses the following significant unobservable inputs (Level 3):

| | | | | | | | | | | | | | | | | | | | |

| | September 30, 2023 | December 31, 2022 | |

| Valuation technique(s) | Significant unobservable input | Range

of inputs | Weighted average of inputs | Range

of inputs | Weighted average of inputs | Other inputs and key information |

| | | | | | |

Net asset value, determined using discounted cash flow

Waterfall distribution model | a) Discount rate (1) b) Future cash flow c) Appraised value | 8.0% - 20.0% | 17.8% | 8.0% - 20.0% | 17.7% | Entitlement risk, sales risk and construction risk are taken into account in determining the discount rate.

Price per acre of land, timing of project funding requirements and distributions.

Estimated probability of default. |

Less than 1 - 9 years | 6.9 years | 1 - 10 years | 7.2 years |

(1) Generally, an increase in future cash flow will result in an increase in the fair value of fund equity investments. An increase in the discount rate will result in a decrease in the fair value of fund equity investments. The same percentage change in the discount rate will result in a greater change in fair value than the same absolute percentage change in future cash flow.

Sensitivity

For those investments valued using discounted cash flows, an increase of 2.5% in the discount rate results in a decrease in fair value of $9,263 and a decrease of 2.5% in the discount rate results in an increase in fair value of $10,921 (December 31, 2022 - ($9,445) and $10,629, respectively).

9. FAIR VALUE ESTIMATION

Fair value measurement

Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, regardless of whether that price is directly observable or estimated using another valuation technique. In estimating the fair value of an asset or a liability, the Company

| | | | | |

| Notes to the CONDENSED INTERIM CONSOLIDATED Financial Statements For the three and nine months ended September 30, 2023 (in thousands of U.S. dollars, except per share amounts and percentage amounts) |

takes into account the characteristics of the asset or liability if market participants would take those characteristics into account when pricing the asset or liability at the measurement date. Fair value for measurement and/or disclosure purposes in these condensed interim consolidated financial statements is determined on this basis, unless otherwise noted.

Inputs to fair value measurement techniques are disaggregated into three hierarchical levels, which are based on the degree to which inputs to fair value measurement techniques are observable by market participants:

•Level 1 - Inputs are unadjusted, quoted prices in active markets for identical assets or liabilities at the measurement date.

•Level 2 - Inputs (other than quoted prices included in Level 1) are either directly or indirectly observable for the asset or liability through correlation with market data at the measurement date and for the duration of the asset’s or liability’s anticipated life.

•Level 3 - Inputs are unobservable and reflect management’s best estimate of what market participants would use in pricing the asset or liability at the measurement date. Consideration is given to the risk inherent in the valuation technique and the risk inherent in the inputs in determining the estimate.

Fair value measurements are adopted by the Company to calculate the carrying amounts of various assets and liabilities.

Acquisition costs, other than those related to financial instruments classified as FVTPL which are expensed as incurred, are capitalized to the carrying amount of the instrument and amortized using the effective interest method.

The following table provides information about assets and liabilities measured at fair value on the balance sheet and categorized by level according to the significance of the inputs used in making the measurements:

| | | | | | | | | | | | | | | | | | | | | | | |

| September 30, 2023 | | December 31, 2022 |

| (in thousands of U.S. dollars) | Level 1 | Level 2 | Level 3 | | Level 1 | Level 2 | Level 3 |

| Assets | | | | | | | |

Rental properties (Note 4) | $ | — | | $ | — | | $ | 12,122,107 | | | $ | — | | $ | — | | $ | 11,445,659 | |

Canadian development properties (Note 7) | — | | — | | 159,902 | | | — | | — | | 136,413 | |

Investments in U.S. residential developments (Note 8) (1) | — | | — | | 145,373 | | | — | | — | | 130,270 | |

Derivative financial instruments (Note 16) | — | | 4,897 | | — | | | — | | 10,358 | | — | |

| | | | | | | |

| $ | — | | $ | 4,897 | | $ | 12,427,382 | | | $ | — | | $ | 10,358 | | $ | 11,712,342 | |

| Liabilities | | | | | | | |

Derivative financial instruments (Note 16) | $ | — | | $ | 32,097 | | $ | — | | | $ | — | | $ | 51,158 | | $ | — | |

Limited partners' interests in single-family rental business | — | | — | | 2,275,349 | | | — | | — | | 1,696,872 | |

| $ | — | | $ | 32,097 | | $ | 2,275,349 | | | $ | — | | $ | 51,158 | | $ | 1,696,872 | |

(1) Excludes the Company's interest in THPAS Development JV-2 LLC, which is measured at cost under the equity method (Note 8).

There have been no transfers between levels for the nine months ended September 30, 2023.

Cash, restricted cash, amounts receivable, amounts payable and accrued liabilities, lease liabilities (included in other liabilities), resident security deposits and dividends payable are measured at amortized cost, which approximates fair value because they are short-term in nature.

| | | | | |

| Notes to the CONDENSED INTERIM CONSOLIDATED Financial Statements For the three and nine months ended September 30, 2023 (in thousands of U.S. dollars, except per share amounts and percentage amounts) |

10. INCOME TAXES

| | | | | | | | | | | | | | | | | |

| | | |

| For the three months ended September 30 | | For the nine months ended September 30 |

| (in thousands of U.S. dollars) | 2023 | 2022 | | 2023 | 2022 |

| Income tax recovery (expense) - current | $ | 163 | | $ | 29,860 | | | $ | (1,737) | | $ | 28,294 | |

| Income tax expense - deferred | (9,806) | | (72,087) | | | (23,930) | | (183,578) | |

| Income tax expense from continuing operations | $ | (9,643) | | $ | (42,227) | | | $ | (25,667) | | $ | (155,284) | |

| | | | | |

| Income tax expense from discontinued operations - current | — | | (45,094) | | | $ | — | | $ | (45,094) | |

| Income tax recovery from discontinued operations - deferred | — | | 40,482 | | | — | | 40,482 | |

| Income tax expense from discontinued operations | $ | — | | $ | (4,612) | | | $ | — | | $ | (4,612) | |

| | | | | |

| | | | | |

The expected realization of deferred income tax assets and deferred income tax liabilities is as follows:

| | | | | | | | | | | |

| (in thousands of U.S. dollars) | September 30, 2023 | | December 31, 2022 |

| Deferred income tax assets | | | |

| Deferred income tax assets to be recovered after more than 12 months | $ | 80,017 | | | $ | 75,062 | |

| Deferred income tax assets to be recovered within 12 months | — | | | — | |

| Total deferred income tax assets | $ | 80,017 | | | $ | 75,062 | |

| | | |

| Deferred income tax liabilities | | | |

| Deferred income tax liabilities reversing after more than 12 months | $ | 622,104 | | | $ | 591,713 | |

| Deferred income tax liabilities reversing within 12 months | — | | | — | |

| Total deferred income tax liabilities | $ | 622,104 | | | $ | 591,713 | |

| | | |

| Net deferred income tax liabilities | $ | 542,087 | | | $ | 516,651 | |

The movement of the deferred income tax accounts was as follows:

| | | | | | | | | | | |

| (in thousands of U.S. dollars) | September 30, 2023 | | December 31, 2022 |

| Change in net deferred income tax liabilities | | | |

| Net deferred income tax liabilities, beginning of period | $ | 516,651 | | | $ | 364,744 | |

| Charge to the statement of comprehensive income | 23,930 | | | 148,697 | |

| Charge to equity | 1,458 | | | 1,945 | |

| Other | 48 | | | 1,265 | |

| Net deferred income tax liabilities, end of period | $ | 542,087 | | | $ | 516,651 | |

The tax effects of the significant components of temporary differences giving rise to the Company’s deferred income tax assets and liabilities were as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands of U.S. dollars) | Investments | Long-term incentive plan accrual | Performance fees liability | Issuance

costs | Net operating losses | Other | Total |

| Deferred income tax assets | | | | | | | |

| At December 31, 2022 | $ | — | | $ | 8,009 | | $ | 9,091 | | $ | 8,723 | | $ | 43,926 | | $ | 5,313 | | $ | 75,062 | |

| Addition / (Reversal) | — | | (73) | | 111 | | (2,361) | | 7,835 | | (557) | | 4,955 | |

| At September 30, 2023 | $ | — | | $ | 7,936 | | $ | 9,202 | | $ | 6,362 | | $ | 51,761 | | $ | 4,756 | | $ | 80,017 | |

| | | | | | | |

(in thousands of U.S. dollars)

| | | Investments | Rental properties | Deferred placement fees | Other | Total |

| Deferred income tax liabilities | | | | | | | |

| At December 31, 2022 | | | $ | 1,505 | | $ | 589,720 | | $ | 488 | | $ | — | | $ | 591,713 | |

| (Reversal) / Addition | | | (121) | | 30,127 | | 385 | | — | | 30,391 | |

| At September 30, 2023 | | | $ | 1,384 | | $ | 619,847 | | $ | 873 | | $ | — | | $ | 622,104 | |

| | | | | |

| Notes to the CONDENSED INTERIM CONSOLIDATED Financial Statements For the three and nine months ended September 30, 2023 (in thousands of U.S. dollars, except per share amounts and percentage amounts) |

The Company believes it will have sufficient future income to realize the deferred income tax assets.

11. REVENUE FROM SINGLE-FAMILY RENTAL PROPERTIES

The components of the Company's revenue from single-family rental properties are as follows:

| | | | | | | | | | | | | | | | | |

| | | |

| For the three months ended September 30 | | For the nine months ended September 30 |

| (in thousands of U.S. dollars) | 2023 | 2022 | | 2023 | 2022 |

| | | | | |

| Base rent | $ | 167,926 | | $ | 140,549 | | | $ | 488,448 | | $ | 382,008 | |

Other revenue(1) | 11,865 | | 11,264 | | | 33,753 | | 30,114 | |

| Non-lease component | 22,780 | | 18,956 | | | 66,336 | | 52,570 | |

| Total revenue from single-family rental properties | $ | 202,571 | | $ | 170,769 | | | $ | 588,537 | | $ | 464,692 | |

(1) Other revenue includes revenue earned on ancillary services and amenities as well as lease administrative fees.

12. REVENUE FROM STRATEGIC CAPITAL SERVICES

The components of the Company’s revenue from strategic capital services (previously reported as revenue from private funds and advisory services) are described in the table below. Intercompany revenues and expenses between the Company and its subsidiaries, such as property management fees, are eliminated upon consolidation. Under certain arrangements, asset-based fees that are earned from third-party investors in Tricon's subsidiary entities are billed directly to those investors and are therefore not recognized in the accounts of the applicable subsidiary. These amounts are included in the asset management fees revenue recognized in the statements of comprehensive income.

| | | | | | | | | | | | | | | | | |

| | | |

| For the three months ended September 30 | | For the nine months ended September 30 |

| (in thousands of U.S. dollars) | 2023 | 2022 | | 2023 | 2022 |

| | | | | |

Asset management fees | $ | 2,884 | | $ | 3,252 | | | $ | 8,428 | | $ | 9,454 | |

Performance fees | 426 | | 101,242 | | | 4,134 | | 110,329 | |

Development fees | 5,082 | | 5,055 | | | 21,072 | | 17,073 | |

Property management fees | 568 | | 2,921 | | | 1,197 | | 8,412 | |

Total revenue from strategic capital services | $ | 8,960 | | $ | 112,470 | | | $ | 34,831 | | $ | 145,268 | |

13. OTHER INCOME

Other income is comprised of the following:

| | | | | | | | | | | | | | | | | |

| For the three months ended September 30 | | For the nine months ended September 30 |

| (in thousands of U.S. dollars) | 2023 | 2022 | | 2023 | 2022 |

| | | | | |

| The Shops of Summerhill commercial rental | $ | 354 | | $ | 388 | | | $ | 1,077 | | $ | 1,056 | |

| Insurance recoveries | 244 | | — | | | 244 | | — | |

| Interest income | 2,105 | | — | | | 3,654 | | — | |

| | | | | |

| Net operating loss from non-core homes | (1,973) | | — | | | (4,653) | | — | |

Gain on sale - Bryson MPC Holdings LLC | — | | 5,060 | | | — | | 5,060 | |

| Income from Bryson - pre-sale | — | | — | | | — | | 2,753 | |

| Total other income | $ | 730 | | $ | 5,448 | | | $ | 322 | | $ | 8,869 | |

| | | | | |

| Notes to the CONDENSED INTERIM CONSOLIDATED Financial Statements For the three and nine months ended September 30, 2023 (in thousands of U.S. dollars, except per share amounts and percentage amounts) |

14. DEBT

The following table presents a summary of the Company's outstanding debt as at September 30, 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2023 | |

| (in thousands of U.S. dollars) | Maturity dates | Coupon/stated interest rates | Interest rate floor | Interest rate cap | Effective interest rates(1) | Extension options(2) | Total facility | Outstanding balance | | |

Term Loan (3), (4) | April 2024 | SOFR+2.30% | 0.50% SOFR | 5.09% SOFR | 7.04 | % | 6 months | $ | 302,065 | $ | 302,065 | | | |

Securitization debt 2017-2(3) | January 2024 | 3.68% | N/A | N/A | 3.68 | % | N/A | 322,268 | 322,268 | | | |

Warehouse credit facility 2022 (5) | January 2024 | SOFR+1.95% | 0.15% SOFR | 3.25% SOFR | 5.20 | % | One year | 100,000 | 76,690 | | | |

Securitization debt 2018-1(3) | May 2025 | 3.96% | N/A | N/A | 3.96 | % | N/A | 289,185 | 289,185 | | | |

Securitization debt 2020-2(3) | November 2027 | 1.94% | N/A | N/A | 1.94 | % | N/A | 409,636 | 409,636 | | | |

| Single-family rental wholly-owned properties borrowings | | | | 1,423,154 | 1,399,844 | | | |

SFR JV-1 securitization debt 2019-1(3) | March 2026 | 3.12% | N/A | N/A | 3.12 | % | N/A | 331,431 | 331,431 | | | |

SFR JV-1 securitization debt 2020-1(3) | July 2026 | 2.43% | N/A | N/A | 2.43 | % | N/A | 552,441 | 552,441 | | | |

SFR JV-1 securitization debt 2021-1(3) | July 2026 | 2.57% | N/A | N/A | 2.57 | % | N/A | 682,956 | 682,956 | | | |

| Single-family rental JV-1 properties borrowings | | | | 1,566,828 | 1,566,828 | | | |

SFR JV-2 warehouse credit facility(12) | July 2024 | SOFR+1.99% | 0.10% SOFR | N/A | 6.98 | % | One year | 134,456 | 134,456 | | | |

SFR JV-2 term loan(3) | October 2025 | SOFR+2.10% | 0.50% SOFR | 4.55% SOFR | 6.65 | % | Two one years | 500,000 | 390,208 | | | |

SFR JV-2 securitization debt 2022-1(3) | April 2027 | 4.32% | N/A | N/A | 4.32 | % | N/A | 530,387 | 530,387 | | | |

SFR JV-2 securitization debt 2022-2(3) | July 2028 | 5.47% | N/A | N/A | 5.47 | % | N/A | 347,459 | 347,459 | | | |

SFR JV-2 securitization debt 2023-1(3), (10) | July 2028 | 5.27% | N/A | N/A | 5.86 | % | N/A | 416,430 | 416,430 | | | |

SFR JV-2 delayed draw term loan(3) | September 2028 | 5.39 | % | N/A | N/A | 5.39 | % | N/A | 194,480 | 194,480 | | | |

| Single-family rental JV-2 properties borrowings | | | | 2,123,212 | 2,013,420 | | | |

| | | | | | | | | | |

SFR JV-HD warehouse credit facility(6) | May 2024 | SOFR+2.00% | 0.15% SOFR | 2.85% SOFR | 4.85 | % | One year | 350,000 | 262,816 | | | |

JV-HD term loan A(3),(7) | March 2028 | 5.96% | N/A | N/A | 5.96 | % | N/A | 150,000 | 150,000 | | | |

JV-HD term loan B(3),(7) | March 2028 | 5.96% | N/A | N/A | 5.96 | % | N/A | 150,000 | 150,000 | | | |

| Single-family rental JV-HD properties borrowings | | | | 650,000 | 562,816 | | | |

Single-family rental properties borrowings | | | 4.34 | % | | 5,763,194 | 5,542,908 | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | |

The Shops of Summerhill mortgage | October 2025 | 5.58% | N/A | N/A | 5.58 | % | N/A | 15,926 | 15,926 | | | |

Construction facility(8), (13) | June 2026 | Prime+1.25% | N/A | N/A | 8.23 | % | One year | 170,118 | 25,488 | | | |

Canadian development properties borrowings | | | 7.21 | % | | 186,044 | 41,414 | | | |

| | | | | | | | | | |

Corporate office mortgages | November 2024 | 4.25% | N/A | N/A | 4.30 | % | N/A | 12,448 | 12,448 | | | |

Corporate credit facility(9), (11) | June 2025 | SOFR+3.07% | N/A | N/A | 8.42 | % | N/A | 500,000 | 150,000 | | | |

Corporate borrowings | | | | | 8.10 | % | | 512,448 | 162,448 | | | |

| | | | | | | | $ | 5,746,770 | | | |

Transaction costs (net of amortization) | | | | | | (47,375) | | | |

Debt discount (net of amortization) | | | | | | (11,938) | | | |

Total debt | | | | | 4.47 | % | | $ | 6,461,686 | $ | 5,687,457 | | | |

| | | | | | | | | | |

Current portion of long-term debt(2) | | | | | | | $ | 624,962 | | | |

Long-term debt | | | | | | | | $ | 5,062,495 | | | |

| | | | | | | | | | |

Fixed-rate debt - principal value | | | | 3.83 | % | | | $ | 4,405,047 | | | |

Floating-rate debt - principal value | | | | 6.56 | % | | | $ | 1,341,723 | | | |

| | | | | | | | | |

| | | | | | | | | |

(1) The effective interest rate is determined using the ending consolidated debt balances as at September 30, 2023 and the average of the applicable reference rates for the nine months ended September 30, 2023. The effective interest rate using the average debt balances and the average of the applicable reference rates for the nine months ended September 30, 2023 is 4.51%.

(2) The Company has the ability to extend the maturity of the loans where an extension option exists and intends to exercise such options wherever available. The current portion of long-term debt reflects the balance after the Company's extension options have been exercised.

| | | | | |

| Notes to the CONDENSED INTERIM CONSOLIDATED Financial Statements For the three and nine months ended September 30, 2023 (in thousands of U.S. dollars, except per share amounts and percentage amounts) |

(3) The term loan and securitization debt are secured, directly and indirectly, by approximately 30,200 single-family rental homes.

(4) On July 27, 2023, the Company amended the loan agreement to extend the maturity of the term loan by six months to April 2024 (with the option to extend for another six months to October 2024) and increased the commitment value by $100,000 with an interest rate cap of 4.25% SOFR. The coupon rate remains unchanged. The amendment resulted in the extinguishment of the original liability and the recognition of a gain on debt extinguishment of $1,326 in the consolidated statements of comprehensive income. A new liability was recognized, reflecting the amended terms. The weighted average interest rate cap on this facility is 5.09% of SOFR, based on $202,065 at 5.50% of SOFR and $100,000 at 4.25% of SOFR

(5) On September 22, 2023, the Company amended the loan agreement in respect of the Warehouse credit facility 2022 to increase the commitment value by $50,000 to $100,000. The coupon rate also changed from SOFR+1.85% to SOFR+1.95%.

(6) On May 11, 2023, SFR JV-HD amended its warehouse facility agreement to decrease the commitment value by $140,000 to $350,000 and increase the interest rate cap to 2.85% of SOFR. The maturity date and the extension option remained unchanged.

(7) On March 10, 2023, SFR JV-HD entered into two new term loan facilities, each with a total commitment of $150,000, a term to maturity of five years and a fixed interest rate of 5.96%. These facilities are secured by pools of 707 and 696 single-family rental properties. The loan proceeds were primarily used to pay down existing short-term SFR JV-HD debt and to fund the acquisition of rental homes.

(8) The construction facility is secured by the land under development at The James (Scrivener Square).

(9) The Company has provided a general security agreement creating a first priority security interest on the assets of the Company, excluding, among other things, single-family rental homes, multi-family rental properties and interests in for-sale housing. As part of the corporate credit facility, the Company designated $35,000 to issue letters of credit as security against contingent obligations related to its Canadian multi-family developments. As at September 30, 2023, the letters of credit outstanding totaled $5,501 (C$7,438).

(10) On July 11, 2023, SFR JV-2 entered into a new securitized loan facility with a total commitment of $416,430, a term to maturity of five years and a weighted average fixed interest rate of 5.27%. The securitization involved the issuance of five classes of fixed-rate pass-through certificates at a discount of $12,160 to the stated face value, resulting in an effective interest rate of 5.86%. This facility is secured by a pool of 2,115 single-family rental properties. The loan proceeds were primarily used to pay down the existing short-term SFR JV-2 variable-rate debt.

(11) On September 15, 2023, the margin on the corporate facility was reduced by 3 basis points from 3.10% to 3.07%.

(12) On August 1, 2023, the interest rate cap on this facility expired and was not renewed.

(13) The extension option on this facility is subject to the lender's discretion.

| | | | | |

| Notes to the CONDENSED INTERIM CONSOLIDATED Financial Statements For the three and nine months ended September 30, 2023 (in thousands of U.S. dollars, except per share amounts and percentage amounts) |

The Company was in compliance with the covenants and other undertakings outlined in all loan agreements.

The scheduled principal repayments and debt maturities are as follows, reflecting the maturity dates after all extensions have been exercised:

| | | | | | | | | | | | | | |

| (in thousands of U.S. dollars) | Single-family rental borrowings | Canadian development properties borrowings | Corporate borrowings | Total |

| | | | |

| 2023 | $ | — | | $ | 56 | | $ | 98 | | $ | 154 | |

| 2024 | 624,333 | | 228 | | 12,350 | | 636,911 | |

| 2025 | 763,147 | | 15,642 | | 150,000 | | 928,789 | |

| 2026 | 1,957,036 | | 25,488 | | — | | 1,982,524 | |

| 2027 | 940,023 | | — | | — | | 940,023 | |

| 2028 and thereafter | 1,258,369 | | — | | — | | 1,258,369 | |

| 5,542,908 | | 41,414 | | 162,448 | | 5,746,770 | |

| Transaction costs (net of amortization) | | | (47,375) | |

| Debt discount (net of amortization) | | | (11,938) | |

| Total debt | | | | $ | 5,687,457 | |

Fair value of debt

The table below presents the fair value and the carrying value (net of unamortized deferred financing fees and debt discount) of the fixed-rate loans as at September 30, 2023.

| | | | | | | | |

| September 30, 2023 |

| (in thousands of U.S. dollars) | Fair value | Carrying value |

| | |

| Securitization debt 2017-2 | $ | 320,469 | | $ | 322,186 | |

| Securitization debt 2018-1 | 281,725 | | 288,953 | |

| Securitization debt 2020-2 | 357,096 | | 405,031 | |

| SFR JV-1 securitization debt 2019-1 | 312,893 | | 328,319 | |

| SFR JV-1 securitization debt 2020-1 | 506,580 | | 547,584 | |

| SFR JV-1 securitization debt 2021-1 | 613,377 | | 676,629 | |

| SFR JV-2 securitization debt 2022-1 | 496,358 | | 524,241 | |

| SFR JV-2 securitization debt 2022-2 | 335,694 | | 342,530 | |

| SFR JV-2 securitization debt 2023-1 | 402,150 | | 397,540 | |

| SFR JV-2 delayed draw term loan | 182,811 | | 193,190 | |

| JV-HD term loan A | 148,892 | | 148,892 | |

| JV-HD term loan B | 148,891 | | 148,891 | |

| The Shops of Summerhill mortgage | 15,416 | | 15,857 | |

| Corporate office mortgages | 12,007 | | 12,448 | |

| Total | $ | 4,134,359 | | $ | 4,352,291 | |

The carrying value of variable term loans approximates their fair value, since their variable interest terms are indicative of prevailing market prices.

15. DUE TO AFFILIATE

Structured entity – Tricon PIPE LLC (the “Affiliate”)

Tricon PIPE LLC (the “Affiliate” or “LLC”) was incorporated on August 7, 2020 for the purpose of raising third-party capital through the issuance of preferred units for an aggregate amount of $300,000. The Company has a 100% voting interest in this Affiliate; however, the Company does not consolidate this structured entity.

| | | | | |

| Notes to the CONDENSED INTERIM CONSOLIDATED Financial Statements For the three and nine months ended September 30, 2023 (in thousands of U.S. dollars, except per share amounts and percentage amounts) |

During the year ended December 31, 2022, 4,675 preferred units were exchanged for 554,832 common shares of the Company at $8.50 per share. The exchange reduced the Affiliate's preferred unit liability and the Company's associated promissory note owed to the Affiliate by $4,675. As at September 30, 2023, the Affiliate has a preferred unit liability of $295,325 (December 31, 2022 - $295,325) and a promissory note receivable from Tricon of $295,325 (December 31, 2022 - $295,325).

During the nine months ended September 30, 2023, the Affiliate earned interest income of $12,736 (2022 - $12,777) from the Company and recognized dividends declared of $12,736 (2022 - $12,777).

The Company’s obligation with respect to its involvement with the structured entity is equal to the cash flows under the promissory note payable. The Company has not recognized any income or losses in connection with its interest in this unconsolidated structured entity in the nine months ended September 30, 2023 (2022 - nil).

Promissory note – between Tricon entities

The promissory note payable to Tricon PIPE LLC (“Promissory Note” or “Due to Affiliate”) recognized on the condensed interim consolidated balance sheets was calculated as follows:

| | | | | | | | | | | |

| (in thousands of U.S. dollars) | September 30, 2023 | | December 31, 2022 |

| | | |

| Principal amount outstanding | $ | 295,325 | | | $ | 295,325 | |

| Less: Discount and transaction costs (net of amortization) | (34,348) | | | (38,501) | |

| Due to Affiliate | $ | 260,977 | | | $ | 256,824 | |

The fair value of the Promissory Note was $228,536 as of September 30, 2023 (December 31, 2022 - $225,314). The difference between the amortized cost and the implied fair value is a result of the difference between the effective interest rate and the market interest rate for debt with similar terms.

16. DERIVATIVE FINANCIAL INSTRUMENTS

The Promissory Note contains a mandatory prepayment option that is intermingled with other options in connection with the preferred units issued by Tricon PIPE LLC (including exchange and redemption rights), as exercising the mandatory prepayment option effectively terminates the other options. Although the exchange and redemption rights exist at the Affiliate level, the Affiliate is unable to issue the common shares of the Company upon exercise of one or all of the rights by either party. As a result, such options, in essence, were deemed to be written by the Company and are treated as a single combined financial derivative instrument for valuation purposes in accordance with IFRS 9, Financial Instruments: Recognition and Measurement. The option pricing model for the derivative uses market-based inputs, including the spot price of the underlying equity, implied volatility of the equity and USD/CAD foreign exchange rates, risk-free rates from the U.S. dollar swap curves and dividend yields related to the underlying equity. The valuation of the derivative assumes a 9.75-year expected life of the investment horizon of the unitholders.

Quantitative information about fair value measurements (Level 2) using significant observable inputs other than quoted prices included in Level 1 is as follows:

| | | | | | | | | | | |

| Due to Affiliate | September 30, 2023 | | December 31, 2022 |

Risk-free rate (1) | 5.28 | % | | 4.46 | % |

Implied volatility (2) | 32.03 | % | | 36.53 | % |

Dividend yield (3) | 3.14 | % | | 3.01 | % |

(1) Risk-free rates were from the U.S. dollar swap curves matching the expected maturity of the Due to Affiliate.

(2) Implied volatility was computed from the trading volatility of the Company's stock over a comparable term to maturity and the volatility of USD/CAD exchange rates.

(3) Dividend yields were from the forecast dividend yields matching the expected maturity of the Due to Affiliate.

The Company also has other types of derivative financial instruments that consist of interest rate caps on the Company’s floating-rate debt and are classified and measured at FVTPL. Interest rate caps are valued using model

| | | | | |

| Notes to the CONDENSED INTERIM CONSOLIDATED Financial Statements For the three and nine months ended September 30, 2023 (in thousands of U.S. dollars, except per share amounts and percentage amounts) |

calibration. Inputs to the valuation model are determined from observable market data wherever possible, including market volatility and interest rates.

The values attributed to the derivative financial instruments are shown below:

| | | | | | | | | | | | | | |

| Conversion/redemption options | Exchange/prepayment options | Interest rate caps(1) | Total |

| (in thousands of U.S. dollars) |

| | | | |

| For the nine months ended September 30, 2023 | | | | |

| Derivative financial (liabilities) assets, beginning of period | $ | — | | $ | (51,158) | | $ | 10,358 | | $ | (40,800) | |

| | | | |

| Addition of interest rate caps | — | | — | | 5,502 | | 5,502 | |

| Fair value gain (loss) | — | | 19,061 | | (10,963) | | 8,098 | |

Derivative financial instruments - end of period | $ | — | | $ | (32,097) | | $ | 4,897 | | $ | (27,200) | |

| | | | |

For the year ended December 31, 2022 | | | | |

| Derivative financial (liabilities) assets, beginning of year | $ | — | | $ | (230,305) | | $ | 363 | | $ | (229,942) | |

| Derivative financial instruments exchanged into common shares of the Company | — | | 3,299 | | — | | 3,299 | |

| Addition of interest rate caps | — | | — | | 1,034 | | 1,034 | |

| Fair value gain | — | | 175,848 | | 8,961 | | 184,809 | |

Derivative financial instruments - end of year | $ | — | | $ | (51,158) | | $ | 10,358 | | $ | (40,800) | |

(1) During the three and nine months ended September 30, 2023, the Company received proceeds of $5,898 and $12,679, respectively, related to in-the-money interest rate caps. These proceeds were recognized as realized gain on derivative financial instruments in the consolidated statements of comprehensive income.

For the nine months ended September 30, 2023, there was a fair value gain on the Due to Affiliate of $19,061 (2022 - fair value gain of $151,970). The fair value gain on the derivatives was primarily driven by a decrease in Tricon's share price, on a USD-converted basis, which served to decrease the probability of exchange of the preferred units of Tricon PIPE LLC into Tricon common shares.

| | | | | |

| Notes to the CONDENSED INTERIM CONSOLIDATED Financial Statements For the three and nine months ended September 30, 2023 (in thousands of U.S. dollars, except per share amounts and percentage amounts) |

17. INTEREST EXPENSE

Interest expense is comprised of the following:

| | | | | | | | | | | | | | | | | |

| | | |

| For the three months ended September 30 | | For the nine months ended September 30 |

| (in thousands of U.S. dollars) | 2023 | 2022 | | 2023 | 2022 |

| | | | | |

Term loan | $ | 4,819 | | $ | 1,913 | | | $ | 9,836 | | $ | 4,916 | |

Securitization debt 2017-2 | 3,069 | | 3,266 | | | 9,372 | | 9,856 | |

Warehouse credit facility 2022 | 287 | | 52 | | | 392 | | 160 | |

Securitization debt 2018-1 | 2,941 | | 3,054 | | | 8,935 | | 9,223 | |

Securitization debt 2020-2 | 2,044 | | 2,110 | | | 6,202 | | 6,381 | |

SFR JV-1 securitization debt 2019-1 | 2,603 | | 2,609 | | | 7,816 | | 7,831 | |

SFR JV-1 securitization debt 2020-1 | 3,383 | | 3,385 | | | 10,151 | | 10,155 | |

SFR JV-1 securitization debt 2021-1 | 4,415 | | 4,416 | | | 13,245 | | 13,244 | |

SFR JV-2 subscription facility(2) | 828 | | 4,674 | | | 11,985 | | 9,805 | |

SFR JV-2 warehouse credit facility | 4,588 | | 6,606 | | | 22,045 | | 13,873 | |

SFR JV-2 term loan | 7,484 | | — | | | 21,531 | | — | |

SFR JV-2 securitization debt 2022-1 | 5,752 | | 5,753 | | | 17,257 | | 11,116 | |

SFR JV-2 securitization debt 2022-2 | 4,777 | | 4,510 | | | 14,332 | | 4,510 | |

SFR JV-2 securitization debt 2023-1 | 4,888 | | — | | | 4,888 | | — | |

| SFR JV-2 delayed draw term loan | 2,721 | | 457 | | | 8,214 | | 457 | |

SFR JV-HD subscription facility(1) | (35) | | 1,443 | | | 2,299 | | 2,827 | |

SFR JV-HD warehouse credit facility | 4,934 | | 3,624 | | | 17,480 | | 6,052 | |

JV-HD term loan A | 2,521 | | — | | | 5,146 | | — | |

JV-HD term loan B | 2,521 | | — | | | 5,146 | | — | |

Single-family rental interest expense | 64,540 | | 47,872 | | | 196,272 | | 110,406 | |

| | | | | |

The Shops of Summerhill mortgage | 224 | | 121 | | | 664 | | 339 | |

| | | | | |

| | | | | |

| | | | | |

Canadian development properties interest expense(3) | 224 | | 121 | | | 664 | | 339 | |

| | | | | |

Corporate office mortgages | 120 | | 115 | | | 356 | | 339 | |

Corporate credit facility | 4,991 | | 2,683 | | | 8,350 | | 5,248 | |

Corporate interest expense | 5,111 | | 2,798 | | | 8,706 | | 5,587 | |

| | | | | |

Amortization of financing costs | 4,244 | | 3,567 | | | 12,636 | | 9,316 | |

Amortization of debt discounts | 1,824 | | 1,198 | | | 4,330 | | 3,530 | |

Interest on Due to Affiliate | 4,245 | | 4,245 | | | 12,736 | | 12,777 | |

Interest on lease obligation | 287 | | 293 | | | 877 | | 857 | |

Total interest expense | 80,475 | | $ | 60,094 | | | 236,221 | | $ | 142,812 | |

(1) This facility was fully repaid during the nine months ended September 30, 2023.