TPG RE Finance Trust, Inc. Announces Tax Treatment of 2023 Dividends

January 26 2024 - 4:15PM

Business Wire

TPG RE Finance Trust, Inc. (NYSE: TRTX) (“TRTX” or the

“Company”) today announced the income tax treatment of its 2023

common stock and its 6.25% Series C Cumulative Redeemable Preferred

Stock (the “Series C Preferred”) dividends.

The following table summarizes, for income tax purposes, the

nature of cash dividends paid to the Company’s common stockholders

for the tax year ended December 31, 2023:

Common Stock (CUSIP # 87266M107)

Record

Date

Payment Date

Total Distribution per

Share

Ordinary Income per Share

(1)

Capital Gain per Share

Non-Dividend

Distribution

3/29/2023

4/25/2023

$0.2400

$0.1119

$0.0000

$0.1281

6/28/2023

7/25/2023

0.2400

0.0000

0.0000

0.2400

9/28/2023

10/25/2023

0.2400

0.0000

0.0000

0.2400

12/29/2023(2)

1/25/2024

0.2400

0.0000

0.0000

0.0000

Totals

$0.9600

$0.1119

$0.0000

$0.6081

The following table summarizes, for income tax purposes, the

nature of cash dividends paid to the holders of the Company’s

Series C Preferred Stock for the tax year ended December 31,

2023:

Series C Preferred Stock (CUSIP#

87266M206)

Record

Date

Payment Date

Total Distribution per

Share

Ordinary Income per Share

(1)

Capital Gain per Share

Non-Dividend

Distribution

3/20/2023

3/30/2023

$0.3906

$0.3906

$0.0000

$0.0000

6/20/2023

6/30/2023

0.3906

0.0000

0.0000

0.3906

9/19/2023

9/29/2023

0.3906

0.0000

0.0000

0.3906

12/19/2023

12/29/2023

0.3906

0.0000

0.0000

0.3906

Totals

$1.5624

$0.3906

$0.0000

$1.1718

- Ordinary Income dividends are eligible for the 20% deduction

applicable to “qualified REIT dividends” pursuant to IRC Section

199A.

- Pursuant to IRC Section 857(b)(9), cash distributions made on

January 25, 2024 with a record date of December 29, 2023 are

treated for federal income tax purposes as received by shareholders

on December 31, 2023 to the extent of the Company’s 2023 earnings

and profits. As the Company’s aggregate 2023 dividends declared

exceeded its 2023 earnings and profits, the January 2024 cash

distribution declared in the fourth quarter of 2023 will be treated

as a 2024 distribution for federal income tax purposes and will not

be included on the 2023 Form 1099-DIV.

Shareholders are encouraged to consult with their personal tax

advisors as to their specific tax treatment of the Company’s

dividends. For additional information, refer to the Investor

Relations section of the Company’s website.

ABOUT TRTX

TPG RE Finance Trust, Inc. is a commercial real estate finance

company that originates, acquires, and manages primarily first

mortgage loans secured by institutional properties located in

primary and select secondary markets in the United States. The

Company is externally managed by TPG RE Finance Trust Management,

L.P., a part of TPG Real Estate, which is the real estate

investment platform of global alternative asset management firm TPG

Inc. (NASDAQ: TPG). For more information regarding TRTX, visit

https://www.tpgrefinance.com/.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240126435392/en/

INVESTOR RELATIONS +1 (212) 405-8500

IR@tpgrefinance.com

MEDIA TPG RE Finance Trust, Inc. Courtney Power +1 (415)

743-1550 media@tpg.com

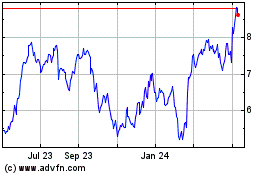

TPG Real Estate Finance (NYSE:TRTX)

Historical Stock Chart

From Nov 2024 to Dec 2024

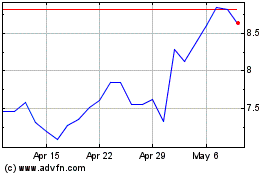

TPG Real Estate Finance (NYSE:TRTX)

Historical Stock Chart

From Dec 2023 to Dec 2024