UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 3, 2015

THE TIMKEN COMPANY

(Exact Name of Registrant as Specified in its Charter)

Ohio

(State or Other Jurisdiction

of Incorporation)

|

|

|

| 1-1169 |

|

34-0577130 |

| (Commission

File Number) |

|

(IRS Employer

Identification No.) |

4500 Mt. Pleasant St. N.W., North Canton, Ohio 44720-5450

(Address of Principal Executive Offices) (Zip Code)

(234) 262-3000

(Registrant’s telephone number, including area code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any

of the following provisions.

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 7.01 |

Regulation FD Disclosure. |

The Timken Company (the “Company”) issued a press

release on August 3, 2015 announcing that it has entered into a definitive agreement to acquire the Carlstar belts business. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated herein by

this reference.

Also on August 3, 2015, the Company posted investor slides on its website, www.timken.com, in connection with

the transaction. A copy of the investor slides is attached as Exhibit 99.2 to this Current Report on Form 8-K and incorporated herein by this reference.

This information shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the

“Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into a filing under the Securities Act of 1933, or the Exchange Act, except as shall be expressly set forth by specific

reference in such a filing.

As described in Item 7.01 above, the Company has entered into an

equity purchase agreement with The Carlstar Group LLC to acquire the Carlstar belts business from American Industrial Partners for $220 million. The transaction, expected to close in the third quarter of 2015, is subject to customary government and

regulatory approvals as well as other customary closing conditions and will be funded with a combination of cash and debt.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release of The Timken Company dated August 3, 2015. |

|

|

| 99.2 |

|

Investor Slides dated August 3, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

| THE TIMKEN COMPANY |

|

|

| By: |

|

/s/ William R. Burkhart |

|

|

William R. Burkhart |

|

|

Executive Vice President, General Counsel

and Secretary |

Date: August 3, 2015

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Press Release of The Timken Company dated August 3, 2015. |

|

|

| 99.2 |

|

Investor Slides dated August 3, 2015. |

Exhibit 99.1

|

|

|

|

|

NEWS RELEASE |

Timken To Acquire Carlstar Belts Business,

Further Expanding Its Product Portfolio

NORTH CANTON, Ohio: August 3, 2015 — The Timken Company (NYSE: TKR; www.timken.com), the world leader in tapered roller

bearings, today announced that it has reached an agreement with American Industrial Partners to acquire the Carlstar Belts Business (“Carlstar Belts”), a leading North American manufacturer of belts used in industrial, commercial and

consumer applications under well-recognized brands including Carlisle®, Ultimax® and Panther®, among others. The transaction is expected to be accretive over the balance of 2015. For the 12 months ending June 30, 2015, Carlstar Belts sales were approximately $140 million.

“Acquiring the Carlstar Belts business expands our offering in existing and complementary end markets and broadens our ability to bring

customers a diverse package of premium mechanical power transmission products and services,” said Richard G. Kyle, Timken president and chief executive officer. “We’re gaining a well-respected business with great talent and

leadership, strong manufacturing capabilities, an expanding industrial product offering and excellent customer base.”

Kyle noted

Carlstar Belts brings an important new product category into the Timken portfolio, which continues to have bearings at its core. The company has diversified its portfolio beyond bearings in recent years, adding gearboxes, chain, couplings,

lubrication systems and a variety of industrial services, which are marketed under well-known industrial brands including Philadelphia Gear®,

Drives® and InterlubeTM.

“This acquisition advances our strategic plan, which includes leveraging Timken technology and know-how to grow organically as well as

building value through bolt-on acquisitions in bearings and adjacent products and services,” Kyle added. “Like Timken, this business has long-standing customer relationships, deep technical expertise and unique operating capabilities,

making it an ideal fit. While Carlstar Belts and Timken share many existing customers and applications, the acquisition will bring new market opportunities to each, extending our collective application and channel strength to benefit our OEM

customers and distributors.”

The transaction, expected to close in the third quarter of 2015, is subject to customary government and

regulatory approvals and will be funded with a combination of cash and debt.

About the Carlstar Belts Business

Carlstar Belts supplies power transmission belts for industrial, commercial and consumer applications primarily in North America. Originally

founded over 100 years ago as part of the Dayco Corporation, the business today has approximately 750 employees, is headquartered in Springfield, Mo., and sells its products under industry-leading, well-recognized brands including Carlisle®, Ultimax® and Panther®, among

others. The Carlstar Belts product portfolio features more than 20,000 SKUs specifically engineered for demanding applications. The product line is engineered for maximum performance and

durability and is available in wrap molded, raw edge, v-ribbed and synchronous belt designs.

About American Industrial Partners

American Industrial Partners (“AIP”) is an operationally oriented middle-market private equity firm that makes control investments in

North American-based industrial businesses serving domestic and global markets. The firm has deep roots in the industrial economy and has been active in private equity investing since 1989. To date, AIP has completed over 50 transactions and is

currently managing more than $1.1 billion in equity capital. AIP invests in all forms of corporate divestitures, management buyouts, recapitalizations and going-private transactions of established businesses with revenues of $75 million–$1

billion. For more information about American Industrial Partners, contact Ben DeRosa, partner at 212-627-2360, extension 200 or visit www.americanindustrial.com.

About The Timken Company

The

Timken Company (NYSE: TKR; www.timken.com) engineers, manufactures and markets bearings, transmissions, gearboxes, chain and related products, and offers a spectrum of powertrain rebuild and repair services. The leading authority on tapered

roller bearings, Timken today applies its deep knowledge of metallurgy, tribology and mechanical power transmission across a variety of bearings and related systems to improve reliability and efficiency of machinery and equipment all around the

world. The company’s growing product and services portfolio features many strong industrial brands including Timken®, Fafnir®,

Philadelphia Gear®, Drives® and InterlubeTM. Known for its quality products and

collaborative technical sales model, Timken posted $3.1 billion in sales in 2014. With 14,000 employees operating from 28 countries, Timken makes the world more productive and keeps industry in motion.

Certain statements in this release (including statements regarding the company’s estimates and expectations) that are not historical

in nature are “forward-looking” statements within the meaning of the Private Securities Litigation Reform Act of 1995. In particular, the statements regarding the company’s expectations regarding accretion and the expected market

opportunities are forward-looking. The company cautions that actual results may differ materially from those projected or implied in forward-looking statements due to a variety of important factors, including: the inability to complete the

acquisition due to either the failure to satisfy any condition to the closing of the transaction, including receipt of regulatory approval, or the occurrence of any event, change or other circumstance that could give rise to the termination of the

purchase agreement; the inability to successfully integrate the newly acquired business into the company’s operations or achieve the expected synergies associated with the acquisition; and adverse changes in the markets served by the newly

acquired business. Additional factors are discussed in the company’s filings with the Securities and Exchange Commission, including the company’s Annual Report on Form 10-K for the year ended Dec. 31, 2014, quarterly reports on Form

10-Q and current reports on Form 8-K. Except as required by the federal securities laws, the company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or

otherwise.

|

|

|

|

|

|

|

|

|

The Timken Company |

|

|

|

|

|

2

|

|

|

| Media Contact: |

|

Investor Relations: |

|

|

| Gloria Irwin |

|

Shelly Chadwick |

| Communications Manager |

|

Vice President – Treasury & Investor Relations |

| Telephone: 234.262.3514 |

|

Telephone: 234.262.3223 |

| Mediarelations@timken.com |

|

Shelly.chadwick@timken.com |

|

|

|

|

|

|

|

|

|

The Timken Company |

|

|

|

|

|

3

|

Expanding the Timken Power Transmission Portfolio:

Carlstar Belts August 3, 2015 Exhibit 99.2 |

|

2 Forward-Looking Statements Safe Harbor Certain statements in this presentation (including statements regarding the company's forecasts, beliefs,

estimates and expectations) that are not historical in nature are

"forward-looking" statements within the meaning of

the Private Securities Litigation Reform Act of 1995. In particular, the statements related to Timken’s plans, outlook, future financial performance, targets, projected sales, cash flows, liquidity and expectations

regarding the future financial performance of the company, including the

information under the headings, “Strategic Rationale”

and “Financial Summary” are forward-looking. The company cautions that actual results may differ materially from those projected or implied in forward-looking statements due to a variety of important

factors, including: the inability to complete the acquisition due to either the

failure to satisfy any condition to the closing of the

transaction, including receipt of regulatory approval, or the occurrence of any event, change or other circumstance that could give rise to the termination of the purchase agreement; the inability to

successfully integrate the newly acquired business into the company’s

operations or achieve the expected synergies associated with the

acquisition; and adverse changes in the markets served by the newly acquired business. Additional factors are discussed in the company's filings with the Securities and Exchange

Commission, including the company's Annual Report on Form 10-K for the year

ended Dec. 31, 2014, quarterly reports on Form 10-Q and

current reports on Form 8-K. Except as required by the federal securities laws, the company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a

result of new information, future events or otherwise.

2 |

|

3 • A leading North American supplier, offering power transmission belts for industrial, commercial and consumer applications • Portfolio features more than 20,000 parts engineered for demanding applications • Products include wrap molded, raw edge, v-ribbed, synchronous belts • Serves diverse industries • Business founded over 100 years ago; headquartered in Springfield, MO Carlstar Belts Business* Key Metrics* ($M) Revenue $140 Adj. EBITDA $22 % Margin 16% # of Employees ~750 *Trailing 12-months as of

June 30, 2015 Key Market Sectors

Agriculture Outdoor Power Consumer Outdoor Power Commercial Power Sports Industrial Distribution 3 The transaction, expected to close in the third quarter of 2015, is subject to customary government and regulatory

approvals as well as other customary closing conditions and will be funded with

a combination of cash and debt. |

|

• Aligns well with Timken strategy and business model • Broadens Timken power transmission products offering • Leverages Timken channel strength and customer access • Creates significant synergy opportunities • Expected to be accretive in year one Strategic Rationale 4 |

|

5 Housed Units Chain & Augers Belts Gears & Services Lubrication Systems Building Out Our Power Transmission Offering Timken Power Transmission Portfolio 5 |

|

• Leverage Timken and Carlstar customer relationships and distribution channels to drive revenue growth • Expand geographically • Cost synergies • EPS accretive* – Marginally over balance of 2015 – 2016 accretion of $0.08-$0.10 per share expected • Expected to earn cost of capital by year 3 Financial Summary • Purchase price of $220M • Funded with cash and debt • Transaction structure results in $23M NPV tax benefit (tax- deductible goodwill) • Purchase multiple of ~9x TTM EBITDA including tax benefit Meets Financial Criteria Transaction Highlights Synergy Drivers Pro Forma (TTM) * Excluding one-time transaction costs and inventory step-up impact

6 Timken Carlstar Belts Pro forma Sales 3,001 140 3,141 Adj. EBITDA 491 22 513 % Margin 16% 16% 16% |

|

Dec 2012 Oct 2011 March 2013 July 2011 April 2013 May 2013 Electric motor repair and services Electric motor repair, related services, up-tower wind maintenance and repair Lubrication delivery systems Chains, augers Industrial gear drive and repair services Industrial gear drive and repair services Split roller housed units Electric motor repair and services April 2014 Nov 2014 July 2010 Spherical roller bearing steel housed unit and couplings Portfolio Transformation – Building for Growth Aug 2015 Industrial and commercial belts Carlstar Belts 7 |

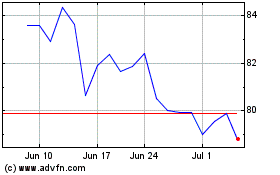

Timken (NYSE:TKR)

Historical Stock Chart

From Oct 2024 to Oct 2024

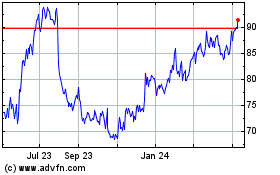

Timken (NYSE:TKR)

Historical Stock Chart

From Oct 2023 to Oct 2024