0000730263

False

0000730263

2024-12-04

2024-12-04

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of

the Securities Exchange Act of 1934

Date of Report (Date of earliest

event reported): December 4,

2024

_______________________________

THOR

Industries, Inc.

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware |

1-9235 |

93-0768752 |

| (State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

52700

Independence Court

Elkhart,

Indiana 46514-8155

(Address of Principal Executive Offices) (Zip Code)

(574)

970-7460

(Registrant's telephone number, including area code)

601 East Beardsley Avenue, Elkhart,

Indiana, 46514-3305

(Former name or former address, if changed since

last report)

_______________________________

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section

12(b) of the Act:

| Title of

each class |

Trading Symbol(s) |

Name of each

exchange on which registered |

| Common Stock (Par value

$.10 Per Share) |

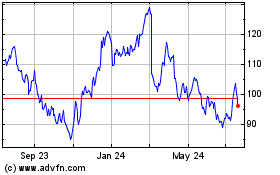

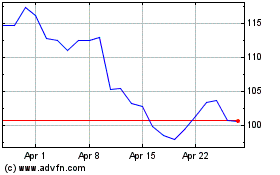

THO |

New

York Stock Exchange |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On December 4, 2024, THOR Industries, Inc. (the “Company”) issued a press release announcing certain financial results

for the first quarter ended October 31, 2024. A copy of the Company’s press release is attached hereto as Exhibit 99.1 and is incorporated

by reference herein. The Company also posted an updated investor slide presentation and a list of investor questions and answers to the

“Investors” section of its website. A copy of the Company’s slide presentation and investor questions and answers are

attached hereto as Exhibit 99.2 and 99.3, respectively, and are incorporated by reference herein. Exhibits 99.1 and 99.2 include non-GAAP

financial measures related to our operations along with a reconciliation of these GAAP to non-GAAP measures and an explanation of why

these non-GAAP measures provide useful information to investors and how management uses these non-GAAP measures. These non-GAAP measures

should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results

calculated in accordance with GAAP and reconciliations from our results should be carefully evaluated.

Item 7.01. Regulation FD Disclosure.

The press release attached hereto as Exhibit 99.1 provides earnings

guidance for the Company’s fiscal year 2025 along with updated industry information. The slide presentation attached hereto as Exhibit

99.2, and incorporated by reference herein, also provides earnings guidance as well as updated information on industry wholesale shipments

and retail market share. The Company also posted an updated list of investor questions and answers to the “Investors” section

of its website. A copy of the Company's investor questions and answers is attached hereto as Exhibit 99.3 and is incorporated by reference

herein.

In accordance with general instruction B.2 to Form 8-K, the information

set forth in Items 2.02 and 7.01 of this Form 8-K (including Exhibits 99.1, 99.2 and 99.3) shall be deemed “furnished” and

not “filed” with the Securities and Exchange Commission for purposes of Section 18 of the Securities Exchange Act of 1934,

as amended, and shall not be incorporated by reference into any filing thereunder or under the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report

to be signed on its behalf by the undersigned hereunto duly authorized.

| |

THOR Industries, Inc. |

| |

|

|

| |

|

|

| Date: December 4, 2024 |

By: |

/s/ Colleen Zuhl |

| |

|

Colleen Zuhl |

| |

|

Senior Vice President and Chief Financial Officer |

| |

|

|

EXHIBIT 99.1

THOR Industries Announces First Quarter Fiscal 2025 Results

Continues to Position Company to Excel Upon Market Return

Fiscal 2025 First Quarter Highlights

($ in thousands, except for per share data)

| | Three Months Ended October 31,

| |

| | 2024 | | 2023 | |

| Net Sales | $ | 2,142,784 | | | $ | 2,500,759 | | |

| Gross Profit | $ | 281,442 | | | $ | 357,932 | | |

| Gross Profit Margin % | | 13.1 | % | | | 14.3 | % | |

| Net Income (Loss) Attributable to THOR | $ | (1,832 | ) | | $ | 53,565 | | |

| Diluted Earnings (Loss) Per Share | $ | (0.03 | ) | | $ | 0.99 | | |

| Cash Flows from Operations | $ | 30,740 | | | $ | 59,668 | | |

| | | | | | | | | |

| EBITDA(1) | $ | 81,733 | | | $ | 160,057 | | |

| Adjusted EBITDA(1) | $ | 107,782 | | | $ | 166,918 | | |

| | |

| (1) See reconciliation of non-GAAP measures to most directly comparable GAAP financial measures included in this release | |

| | |

Key Takeaways from Fiscal 2025 First Quarter

- First quarter performance continued to be impacted by the current macro environment, in line with expectations

- Margins held up well relative to the challenging market

- Remained focused on our strategic commitment to long-term investments to create a sustainable competitive advantage and enhanced margin profile

- Restructured leadership team to allow for greater focus in North America from our CEO, Bob Martin

- Strategic, nonrecurring costs incurred during the quarter unfavorably impacted first quarter results, but actions are expected to result in future annual savings of over $10 million

- Full-year fiscal 2025 financial guidance held constant as originally provided

- Consolidated net sales in the range of $9.0 billion to $9.8 billion

- Consolidated gross profit margin in the range of 14.7% to 15.2%

- Diluted earnings per share in the range of $4.00 to $5.00

ELKHART, Ind., Dec. 04, 2024 (GLOBE NEWSWIRE) -- THOR Industries, Inc. (NYSE: THO) today announced financial results for its fiscal 2025 first quarter, ended October 31, 2024.

“As we forecasted, our performance through the first quarter of our fiscal year 2025 continued to be impacted by the soft retail and wholesale environment. Our strategic approach continues to focus on aligning our production to match the current retail environment and avoiding growth of independent dealer inventory levels of our products until market conditions indicate otherwise. By remaining disciplined and aligned with current market conditions, our companies remain incredibly well-positioned to outperform the market when retail demand inevitably picks up,” explained Bob Martin, President and CEO of THOR Industries.

“Our focus is to control what we can control in the current challenging market. Our teams have performed well as evidenced by our gross margin performance, which remains strong relative to current market conditions. This doesn’t happen by accident. Our industry has a history that includes OEMs being too aggressive during market conditions similar to those which we are currently experiencing. A short-term, top-line benefit invariably created much greater long-term hardship. We have been very intentional and disciplined in avoiding that temptation as we position our operating subsidiaries and independent dealers to outperform upon the market’s return.

“What we can control now is product. The reception by our independent dealer partners of our new product lineup at our annual Open House event in Elkhart, Indiana in late September 2024 and by our independent dealers and consumers at the Caravan Salon trade fair in Düsseldorf, Germany in late August/early September 2024 was incredibly strong and gives us reason to remain optimistic about what lies ahead. Barring further future macroeconomic headwinds, it is our expectation that retail activity will begin to trend positively in the latter half of our fiscal 2025, particularly in North America, where we anticipate the return of a stronger retail market,” added Martin.

First Quarter Financial Results

Consolidated net sales were $2.14 billion in the first quarter of fiscal 2025, compared to $2.50 billion for the first quarter of fiscal 2024, a decrease of 14.3%.

Consolidated gross profit margin for the first quarter of fiscal 2025 was 13.1%, a decrease of 120 basis points when compared to the first quarter of fiscal 2024.

Net income (loss) attributable to THOR Industries, Inc. and diluted earnings (loss) per share for the first quarter of fiscal 2025 were $(1.8) million and $(0.03), respectively, compared to $53.6 million and $0.99, respectively, for the first quarter of fiscal 2024.

EBITDA and Adjusted EBITDA for the first quarter of fiscal 2025 were $81,733 and $107,782, respectively, compared to $160,057 and $166,918, respectively, for the first quarter of fiscal 2024. See the reconciliation of non-GAAP measures to most directly comparable GAAP financial measures included in this release.

THOR’s consolidated results were primarily driven by the results of its individual reportable segments as noted below.

Segment Results

North American Towable RVs

| ($ in thousands) | Three Months Ended October 31, | | Change

|

| | 2024 | | 2023 | |

| Net Sales | $ | 898,778 | | $ | 945,454 | | (4.9 | )% |

| Unit Shipments | | 30,018 | | | 28,107 | | 6.8 | % |

| Gross Profit | $ | 112,437 | | $ | 118,011 | | (4.7 | )% |

| Gross Profit Margin % | | 12.5 | | | 12.5 | | 0 | bps |

| Income Before Income Taxes | $ | 46,821 | | $ | 49,249 | | (4.9 | )% |

| |

| | As of October 31, | | Change

|

| ($ in thousands) | 2024 | | 2023 | |

| Order Backlog | $ | 933,051 | | $ | 795,798 | | 17.2 | % |

| |

- North American Towable RV net sales were down 4.9% for the first quarter of fiscal 2025 compared to the prior-year period, driven by a 6.8% increase in unit shipments offset by an 11.7% decrease in the overall net price per unit. The decrease in the overall net price per unit was primarily due to a shift in product mix toward our lower-cost travel trailers compared to the first quarter of fiscal 2024.

- North American Towable RV gross profit margin remained constant at 12.5% for the first quarter of fiscal 2025 compared to the prior-year period, despite the nearly 5% reduction in net sales.

- North American Towable RV income before income taxes for the first quarter of fiscal 2025 decreased slightly to $46.8 million from $49.2 million in the first quarter of fiscal 2024, driven primarily by the decrease in net sales.

North American Motorized RVs

| ($ in thousands) | Three Months Ended October 31, | | Change

|

| | 2024 | | 2023 | |

| Net Sales | $ | 505,208 | | $ | 711,159 | | (29.0 | )% |

| Unit Shipments | | 3,741 | | | 5,582 | | (33.0 | )% |

| Gross Profit | $ | 42,727 | | $ | 79,392 | | (46.2 | )% |

| Gross Profit Margin % | | 8.5 | | | 11.2 | | (270 | ) bps |

| Income Before Income Taxes | $ | 9,081 | | $ | 37,052 | | (75.5 | )% |

| |

| | As of October 31, | | Change

|

| ($ in thousands) | 2024 | | 2023 | |

| Order Backlog | $ | 963,141 | | $ | 1,237,547 | | (22.2 | )% |

| |

- North American Motorized RV net sales decreased 29.0% for the first quarter of fiscal 2025 compared to the prior-year period. The decrease was primarily due to the combination of a 33.0% reduction in unit shipments stemming from a softening in current dealer and consumer demand, offset in part by a 4.0% increase in net price per unit as product mix included a higher concentration of generally higher-priced Class A units in comparison to the prior-year period.

- North American Motorized RV gross profit margin was 8.5% for the first quarter of fiscal 2025 compared to 11.2% in the prior-year period. The decrease in the gross profit margin percentage for the first quarter of fiscal 2025 was primarily driven by the combination of the decrease in net sales volume along with increased sales discounting and chassis costs.

- North American Motorized RV income before income taxes for the first quarter of fiscal 2025 decreased to $9.1 million compared to $37.1 million in the prior-year period, primarily due to the decrease in net sales.

European RVs

| ($ in thousands) | Three Months Ended October 31, | | Change

|

| | 2024 | | 2023 | |

| Net Sales | $ | 604,903 | | $ | 708,201 | | (14.6 | )% |

| Unit Shipments | | 8,635 | | | 11,892 | | (27.4 | )% |

| Gross Profit | $ | 92,648 | | $ | 122,828 | | (24.6 | )% |

| Gross Profit Margin % | | 15.3 | | | 17.3 | | (200 | ) bps |

| Income Before Income Taxes | $ | 1,177 | | $ | 28,767 | | (95.9 | )% |

| |

| | As of October 31, | | Change

|

| ($ in thousands) | 2024 | | 2023 | |

| Order Backlog | $ | 2,043,636 | | $ | 3,331,171 | | (38.7 | )% |

| |

- European RV net sales decreased 14.6% for the first quarter of fiscal 2025 compared to the prior-year period, driven by a 27.4% decrease in unit shipments offset in part by a 12.8% increase in the overall net price per unit due to the total combined impact of changes in product mix and price. The overall increase in net price per unit of 12.8% includes a 2.5% increase due to the impact from foreign currency exchange rate changes.

- European RV gross profit margin decreased to 15.3% of net sales for the first quarter of fiscal 2025 from 17.3% in the prior-year period, primarily due to an increased overhead cost percentage resulting from the decreased net sales.

- European RV income before income taxes for the first quarter of fiscal 2025 was $1.2 million compared to $28.8 million during the first quarter of fiscal 2024, with the decrease driven primarily by the decreased net sales compared to the prior-year period.

Management Commentary

“The first quarter of our fiscal 2025 was, as we anticipated, a tough quarter. We held margins well given the challenging sales environment, particularly within our North American Towable segment where we held flat despite a nearly 5% decrease in net sales for the segment. As we talked about fiscal year 2025 at the conclusion of fiscal year 2024, we foretold the expectations of a challenging first half of the fiscal year followed by a stronger second half. We also forecasted, by segment, that we expected margins to solidify in our North American Towable segment but decline in both our North American Motorized and European segments. Still, given the decline in net sales across our segments we are pleased with our relative margin performance. The bottom line for this quarter is that we performed as we expected through the financial period. We remained focused on what we could control in this market as we continued to position the Company to excel when a stronger retail market inevitably returns,” said Todd Woelfer, Senior Vice President and Chief Operating Officer.

“Our European segment faced an incredibly difficult comparison given that last year was a record first quarter for the segment. In the year-over-year comparison, net sales dropped by just under 15% on a decrease in unit shipments of slightly over 27%. At the gross profit line, our European segment delivered a gross profit margin of 15.3% despite the drop on the top line. Our European team continues to perform well and their efforts to drive efficiencies throughout their processes continue to manifest in a much stronger margin profile than the segment has historically experienced.

“From an EPS perspective, this quarter was disappointing but not fully unexpected due to the challenging macro environment. Additionally, first quarter results include various nonrecurring costs related to strategic actions taken during the quarter to streamline and flatten the organization which will enable us to perform more efficiently going forward. During the quarter, we eliminated the management layer between our North American RV subsidiaries and our CEO. This will allow for Bob to return to his hands-on approach of leading and guiding these companies. In addition to other headcount reductions, we also closed an operating facility in Idaho. These strategic actions led to employee separation and facility closure-related costs totaling approximately $15.5 million during the quarter but will enable us to perform more efficiently and are expected to generate future annual savings of over $10 million. Long term, these strategic realignment actions place THOR in a better position to maximize future earnings,” explained Woelfer.

“Our initial view of fiscal year 2025 forecasted for challenging first and second quarters driven by the difficult markets and a return to a more normal cadence of operating results in Europe following a record fiscal 2024, with particular challenges facing our North American Motorized segment. As we look to the remainder of the fiscal year, we continue to believe that our initial forecast for our fiscal year 2025 is an accurate assessment of the RV industry for the next nine months. For our performance, this means that we anticipate a challenging second quarter but stronger quarters in our fiscal second half. Continued discipline in a challenging market is not always the easy path, but, without a doubt, it is the right one. Our focus is on long-term value, not short-term illusions. Our commitment to investing in innovation and developing revolutionary products affirms this focus on the long term. This is a tough market, and everyone who follows our industry understands the current market dynamics. The real story for THOR, though, is that THOR has positioned itself incredibly well for a strong performance upon the market’s return,” added Woelfer.

“In the first quarter of fiscal 2025, we generated approximately $30.7 million of cash from operations and, in keeping with our long-term strategic plan and historical commitment to taking a balanced approach to capital allocation, we continued to reinvest in our business, reduce our indebtedness and return capital to our shareholders,” added Colleen Zuhl, Senior Vice President and CFO.

“First quarter capital expenditures totaled approximately $25.3 million, as we maintained our focus on prudently upgrading facilities and machinery where needed and investing in certain innovation-related projects, while also continuing to manage our non-critical spend in response to current market conditions. Always conservative in our cash management, we continue to prioritize the investments back into our business by assessing the temporal value of each investment and foregoing or delaying projects that do not return adequate value in the shorter term. Additionally, during the first fiscal quarter we strategically paid down approximately $61.8 million of debt, and, with October’s announcement of a 4.2% increase in our regular quarterly dividend, we marked the 15th consecutive year of increasing our dividend.

“Our liquidity remains a bedrock of our business and an unrivaled strength within the industry. On October 31, 2024, we had liquidity of approximately $1.31 billion, including approximately $445.2 million in cash on hand and approximately $865.0 million available under our asset-based revolving credit facility. Our strong balance sheet, solid cash generation profile and balanced and disciplined approach to capital deployment continue to lay the groundwork necessary for us to execute on our long-term strategic plan while simultaneously working through the current challenges facing our industry,” said Zuhl.

Outlook

“Our current view of fiscal year 2025 remains consistent with our initial financial forecast and guidance. In September, the RVIA released its expectations that for calendar year 2025 it expects wholesale unit shipment totals to exceed 345,000 units. We continue to be a bit more conservative with our view but do see potential upside in the market if consumer confidence elevates during calendar 2025. The signs of the return of the normalized market are beginning to show in the form of an uptick in dealer optimism. We share our dealers’ reasons to have confidence in the future of our industry. In the interim, we will hold steadfast to our strategy of prudence in the face of a challenging market as we focus on controlling what we can control, all while positioning THOR to outperform upon the market’s return,” concluded Martin.

Fiscal 2025 Guidance

“Our view of the remainder of our fiscal year 2025 remains unchanged from our initial assessment. In terms of sequence of performance, we will have a challenging second quarter followed by stronger third and fourth quarters. By the end of our fiscal year 2025, we anticipate that the retail market will begin to trend positively, setting up fiscal year 2026 to be a stronger year. Given our expectations surrounding overall market volumes in both North America and Europe, the Company reconfirms our initial financial guidance for fiscal 2025,” commented Woelfer.

For fiscal 2025, the Company’s full-year financial guidance includes:

- Consolidated net sales in the range of $9.0 billion to $9.8 billion

- Consolidated gross profit margin in the range of 14.7% to 15.2%

- Diluted earnings per share in the range of $4.00 to $5.00

Supplemental Earnings Release Materials

THOR Industries has provided a comprehensive question and answer document, as well as a PowerPoint presentation, relating to its quarterly results and other topics.

To view these materials, go to http://ir.thorindustries.com.

About THOR Industries, Inc.

THOR Industries is the sole owner of operating subsidiaries which, combined, represent the world’s largest manufacturer of recreational vehicles.

For more information on the Company and its products, please go to www.thorindustries.com.

Forward-Looking Statements

This release includes certain statements that are “forward-looking” statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are made based on management’s current expectations and beliefs regarding future and anticipated developments and their effects upon THOR, and inherently involve uncertainties and risks. These forward-looking statements are not a guarantee of future performance. We cannot assure you that actual results will not differ materially from our expectations. Factors which could cause materially different results include, among others: the impact of inflation on the cost of our products as well as on general consumer demand; the effect of raw material and commodity price fluctuations, including the impact of tariffs, and/or raw material, commodity or chassis supply constraints; the impact of war, military conflict, terrorism and/or cyber-attacks, including state-sponsored or ransom attacks; the impact of sudden or significant adverse changes in the cost and/or availability of energy or fuel, including those caused by geopolitical events, on our costs of operation, on raw material prices, on our suppliers, on our independent dealers or on retail customers; the dependence on a small group of suppliers for certain components used in production, including chassis; interest rates and interest rate fluctuations and their potential impact on the general economy and, specifically, on our independent dealers and consumers and our profitability; the ability to ramp production up or down quickly in response to rapid changes in demand while also managing costs and market share; the level and magnitude of warranty and recall claims incurred; the ability of our suppliers to financially support any defects in their products; the financial health of our independent dealers and their ability to successfully manage through various economic conditions; legislative, regulatory and tax law and/or policy developments including their potential impact on our independent dealers, retail customers or on our suppliers; the costs of compliance with governmental regulation; the impact of an adverse outcome or conclusion related to current or future litigation or regulatory investigations; public perception of and the costs related to environmental, social and governance matters; legal and compliance issues including those that may arise in conjunction with recently completed transactions; lower consumer confidence and the level of discretionary consumer spending; the impact of exchange rate fluctuations; restrictive lending practices which could negatively impact our independent dealers and/or retail consumers; management changes; the success of new and existing products and services; the ability to maintain strong brands and develop innovative products that meet consumer demands; the ability to efficiently utilize existing production facilities; changes in consumer preferences; the risks associated with acquisitions, including: the pace and successful closing of an acquisition, the integration and financial impact thereof, the level of achievement of anticipated operating synergies from acquisitions, the potential for unknown or understated liabilities related to acquisitions, the potential loss of existing customers of acquisitions and our ability to retain key management personnel of acquired companies; a shortage of necessary personnel for production and increasing labor costs and related employee benefits to attract and retain production personnel in times of high demand; the loss or reduction of sales to key independent dealers, and stocking level decisions of our independent dealers; disruption of the delivery of units to independent dealers or the disruption of delivery of raw materials, including chassis, to our facilities; increasing costs for freight and transportation; the ability to protect our information technology systems from data breaches, cyber-attacks and/or network disruptions; asset impairment charges; competition; the impact of losses under repurchase agreements; the impact of the strength of the U.S. dollar on international demand for products priced in U.S. dollars; general economic, market, public health and political conditions in the various countries in which our products are produced and/or sold; the impact of changing emissions and other related climate change regulations in the various jurisdictions in which our products are produced, used and/or sold; changes to our investment and capital allocation strategies or other facets of our strategic plan; and changes in market liquidity conditions, credit ratings and other factors that may impact our access to future funding and the cost of debt.

These and other risks and uncertainties are discussed more fully in Item 1A of our Annual Report on Form 10-K for the year ended July 31, 2024.

We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward-looking statements contained in this release or to reflect any change in our expectations after the date hereof or any change in events, conditions or circumstances on which any statement is based, except as required by law.

| THOR INDUSTRIES, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF INCOME |

| FOR THE THREE MONTHS ENDED OCTOBER 31, 2024 AND 2023 |

| ($000’s except share and per share data) (Unaudited) |

| |

| | Three Months Ended October 31,

| |

| | 2024

| | % Net Sales (1) | | 2023 | | % Net Sales (1)

| |

| Net sales | $ | 2,142,784 | | | | | $ | 2,500,759 | | | | |

| Gross profit | $ | 281,442 | | | 13.1% | | $ | 357,932 | | | 14.3% | |

| Selling, general and administrative expenses | | 240,197 | | | 11.2% | | | 217,896 | | | 8.7% | |

| Amortization of intangible assets | | 29,822 | | | 1.4% | | | 32,344 | | | 1.3% | |

| Interest expense, net | | 15,228 | | | 0.7% | | | 20,197 | | | 0.8% | |

| Other income (expense), net | | 2,649 | | | 0.1% | | | (14,913 | ) | | (0.6)% | |

| Income (loss) before income taxes | | (1,156 | ) | | (0.1)% | | | 72,582 | | | 2.9% | |

| Income tax provision (benefit) | | (283 | ) | | —% | | | 17,549 | | | 0.7% | |

| Net income (loss) | | (873 | ) | | —% | | | 55,033 | | | 2.2% | |

| Less: Net income attributable to non-controlling interests | | 959 | | | —% | | | 1,468 | | | 0.1% | |

| Net income (loss) attributable to THOR Industries, Inc. | $ | (1,832 | ) | | (0.1)% | | $ | 53,565 | | | 2.1% | |

| Earnings (loss) per common share | | | | | | | | | | | | |

| Basic | $ | (0.03 | ) | | | | $ | 1.01 | | | | |

| Diluted | $ | (0.03 | ) | | | | $ | 0.99 | | | | |

| Weighted-avg. common shares outstanding – basic | | 52,974,603 | | | | | | 53,295,835 | | | | |

| Weighted-avg. common shares outstanding – diluted | | 52,974,603 | (2) | | | | | 53,853,719 | | | | |

| | | | | | | | | | | | | |

| (1) Percentages may not add due to rounding differences |

| (2) Due to a loss for the three months ended October 31, 2024, zero incremental shares are included because the effect would be antidilutive |

| |

| SUMMARY CONDENSED CONSOLIDATED BALANCE SHEETS ($000’s) (Unaudited) |

| |

| | October 31,

2024 | | July 31,

2024 | | | October 31,

2024 | | July 31,

2024

| |

| Cash and equivalents | $ | 445,222 | | $ | 501,316 | | Current liabilities | $ | 1,481,505 | | $ | 1,567,022 | |

| Accounts receivable, net | | 638,445 | | | 700,895 | | Long-term debt, net | | 1,043,790 | | | 1,101,265 | |

| Inventories, net | | 1,371,771 | | | 1,366,638 | | Other long-term liabilities | | 285,930 | | | 278,483 | |

| Prepaid income taxes, expenses and other | | 77,526 | | | 81,178 | | Stockholders’ equity | | 4,061,956 | | | 4,074,053 | |

| Total current assets | | 2,532,964 | | | 2,650,027 | | | | | | | | |

| Property, plant & equipment, net | | 1,380,362 | | | 1,390,718 | | | | | | | | |

| Goodwill | | 1,791,704 | | | 1,786,973 | | | | | | | | |

| Amortizable intangible assets, net | | 833,098 | | | 861,133 | | | | | | | | |

| Equity investments and other, net | | 335,053 | | | 331,972 | | | | | | | | |

| Total | $ | 6,873,181 | | $ | 7,020,823 | | | $ | 6,873,181 | | $ | 7,020,823 | |

| |

Non-GAAP Reconciliation

The following table reconciles net income (loss) to consolidated EBITDA and Adjusted EBITDA:

EBITDA Reconciliation

($ in thousands)

| | Three Months Ended October 31,

| |

| | 2024 | | 2023 | |

| Net income (loss) | $ | (873 | ) | | $ | 55,033 | | |

| Add back: | | | | | | | | |

| Interest expense, net | | 15,228 | | | | 20,197 | | |

| Income tax provision (benefit) | | (283 | ) | | | 17,549 | | |

| Depreciation and amortization of intangible assets | | 67,661 | | | | 67,278 | | |

| EBITDA | $ | 81,733 | | | $ | 160,057 | | |

| Add back: | | | | | | | | |

| Stock-based compensation expense | | 10,537 | | | | 10,452 | | |

| Net expense (income) related to certain contingent liabilities | | — | | | | (10,000 | ) | |

| Non-cash foreign currency loss (gain) | | 3,392 | | | | (979 | ) | |

| Market value loss (gain) on equity investments | | 388 | | | | 2,871 | | |

| Equity method investment loss (gain) | | 2,254 | | | | 5,935 | | |

| Employee & facility strategic initiatives | | 15,459 | | | | — | | |

| Other loss (gain), including sales of PP&E | | (5,981 | ) | | | (1,418 | ) | |

| Adjusted EBITDA | $ | 107,782 | | | $ | 166,918 | | |

| |

Adjusted EBITDA is a non-GAAP performance measure included to illustrate and improve comparability of the Company's results from period to period, particularly in periods with unusual or one-time items. Adjusted EBITDA is defined as net income (loss) before net interest expense, income tax expense (benefit) and depreciation and amortization adjusted for certain unusual items and other one-time items. The Company considers this non-GAAP measure in evaluating and managing the Company's operations and believes that discussion of results adjusted for these items is meaningful to investors because it provides a useful analysis of ongoing underlying operating trends. The adjusted measures are not in accordance with, nor are they a substitute for, GAAP measures, and they may not be comparable to similarly titled measures used by other companies.

Contact:

Jeff Tryka, CFA

Lambert Global

616-295-2509

jtryka@lambert.com

Exhibit 99.2

FINANCIAL RESULTS FIRST QUARTER FISCAL 2025

2 FORWARD - LOOKING STATEMENTS This presentation includes certain statements that are “forward - looking” statements within the meaning of the U . S . Private Securities Litigation Reform Act of 1995 , Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . These forward - looking statements are made based on management’s current expectations and beliefs regarding future and anticipated developments and their effects upon THOR, and inherently involve uncertainties and risks . These forward - looking statements are not a guarantee of future performance . We cannot assure you that actual results will not differ materially from our expectations . Factors which could cause materially different results include, among others : the impact of inflation on the cost of our products as well as on general consumer demand ; the effect of raw material and commodity price fluctuations, including the impact of tariffs, and/or raw material, commodity or chassis supply constraints ; the impact of war, military conflict, terrorism and/or cyber - attacks, including state - sponsored or ransom attacks ; the impact of sudden or significant adverse changes in the cost and/or availability of energy or fuel, including those caused by geopolitical events, on our costs of operation, on raw material prices, on our suppliers, on our independent dealers or on retail customers ; the dependence on a small group of suppliers for certain components used in production, including chassis ; interest rates and interest rate fluctuations and their potential impact on the general economy and, specifically, on our independent dealers and consumers and our profitability ; the ability to ramp production up or down quickly in response to rapid changes in demand while also managing costs and market share ; the level and magnitude of warranty and recall claims incurred ; the ability of our suppliers to financially support any defects in their products ; the financial health of our independent dealers and their ability to successfully manage through various economic conditions ; legislative, regulatory and tax law and/or policy developments including their potential impact on our independent dealers, retail customers or on our suppliers ; the costs of compliance with governmental regulation ; the impact of an adverse outcome or conclusion related to current or future litigation or regulatory investigations ; public perception of and the costs related to environmental, social and governance matters ; legal and compliance issues including those that may arise in conjunction with recently completed transactions ; lower consumer confidence and the level of discretionary consumer spending ; the impact of exchange rate fluctuations ; restrictive lending practices which could negatively impact our independent dealers and/or retail consumers ; management changes ; the success of new and existing products and services ; the ability to maintain strong brands and develop innovative products that meet consumer demands ; the ability to efficiently utilize existing production facilities ; changes in consumer preferences ; the risks associated with acquisitions, including : the pace and successful closing of an acquisition, the integration and financial impact thereof, the level of achievement of anticipated operating synergies from acquisitions, the potential for unknown or understated liabilities related to acquisitions, the potential loss of existing customers of acquisitions and our ability to retain key management personnel of acquired companies ; a shortage of necessary personnel for production and increasing labor costs and related employee benefits to attract and retain production personnel in times of high demand ; the loss or reduction of sales to key independent dealers, and stocking level decisions of our independent dealers ; disruption of the delivery of units to independent dealers or the disruption of delivery of raw materials, including chassis, to our facilities ; increasing costs for freight and transportation ; the ability to protect our information technology systems from data breaches, cyber - attacks and/or network disruptions ; asset impairment charges ; competition ; the impact of losses under repurchase agreements ; the impact of the strength of the U . S . dollar on international demand for products priced in U . S . dollars ; general economic, market, public health and political conditions in the various countries in which our products are produced and/or sold ; the impact of changing emissions and other related climate change regulations in the various jurisdictions in which our products are produced, used and/or sold ; changes to our investment and capital allocation strategies or other facets of our strategic plan ; and changes in market liquidity conditions, credit ratings and other factors that may impact our access to future funding and the cost of debt . These and other risks and uncertainties are discussed more fully in Item 1 A of our Annual Report on Form 10 - K for the year ended July 31 , 2024 . We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward - looking statements contained in this presentation or to reflect any change in our expectations after the date hereof or any change in events, conditions or circumstances on which any statement is based, except as required by law .

3 Founded in 1980 and headquartered in Elkhart, Indiana, THOR is a global family of companies that makes it easier and more enjoyable to connect people with nature and each other to create lasting outdoor memories. Net Sales $2.14 B Gross Profit Margin 13.1% (1) (2) (3) Unit Shipments 42,394 For the fiscal quarter ended October 31, 2024 Attributable to THOR Industries, Inc. See Appendix to this presentation for reconciliation of non - GAAP measures to most directly comparable GAAP financial measures First Quarter Fiscal 2025 Results (1) EBITDA (3) $81.7 M Adjusted EBITDA (3) $107.8 M Net Income (Loss) (2) $(1.8) M Diluted EPS (2) $(0.03)

EUROPEAN SEGMENT NORTH AMERICAN MOTORIZED SEGMENT NORTH AMERICAN TOWABLE SEGMENT 4 We consist of a trusted family of brands that are loved by RV consumers

5 Together, the THOR family of companies represents the world’s largest manufacturer of recreational vehicles. We offer a comprehensive range of RVs to inspire and empower everyone to Go Everywhere; Stay Anywhere. Other, net $133,895 6.3% North American Motorized $505,208 23.6% (1) (2) $ in thousands As compared to the fiscal quarter ended October 31, 2023 THOR CONSOLIDATED NET SALES (1) North American Towable $898,778 41.9% European $604,903 28.2% Other, net $135,945 5.5% North American Motorized $711,159 28.4% North American Towable $945,454 37.8% European $708,201 28.3% FIRST QUARTER FISCAL 2025 FIRST QUARTER FISCAL 2024 $2.50 billion $2.14 billion (14.3)% (2)

6 ($ in thousands) Q1 2025 Q1 2024 Change Net Sales – Segments (4.9)% $ 945,454 $ 898,778 North American Towable (29.0)% 711,159 505,208 North American Motorized (14.6)% 708,201 604,903 European (1.5)% 135,945 133,895 Other, net (14.3)% $ 2,500,759 $ 2,142,784 Total (120) bps 14.3% 13.1% Gross Profit Margin % (103.4)% $ 53,565 $ (1,832) Net Income (Loss) (1) (103.0)% $ 0.99 $ (0.03) Diluted Earnings (Loss) per Share (1) (48.9)% $ 160,057 $ 81,733 EBITDA (2) (35.4)% $ 166,918 $ 107,782 Adjusted EBITDA (2) THOR remains committed to our strategic approach resulting in strong performance relative to current market conditions (1) (2) Attributable to THOR Industries, Inc. See the Appendix to this presentation for reconciliation of non - GAAP measures to most directly comparable GAAP financial measures First Quarter Fiscal 2025 Summary First Quarter Fiscal 2025 Highlights • Maintained strong margin performance relative to the challenging market • Remained focused on our strategic commitment to long - term investments to create competitive advantage and enhanced margin profile a sustainable • Restructured leadership team to allow for greater focus in North America from our CEO, Bob Martin • Strategic, nonrecurring costs incurred during the quarter unfavorably impacted first quarter results, but actions are expected to result in future annual savings of over $10 million • Announced an increase in our dividend for the 15th consecutive year • Received incredibly strong reception of our new product lineup at both our Open House in Elkhart, IN and the Caravan Salon trade fair in Düsseldorf, Germany

7 Fiscal 2025 First Quarter Key Drivers • Net sales decreased year - over - year on 6 . 8 % higher shipment volume due to a shift in product mix toward our lower - cost travel trailers • Gross profit margin percentage remained constant despite the 4 . 9 % decrease in net sales through the combined impact of lower sales discounting, cost - saving initiatives and the change in product mix in the current - year quarter • Maintained disciplined approach to the alignment of production to match the current retail environment and independent dealer demand North American Towable Segment Q1 2025 Q1 2024 Change (4.9)% $ 945,454 $ 898,778 Net Sales (1) 0 bps 12.5% 12.5% Gross Profit Margin % 6.8 % 28,107 30,018 Wholesale Unit Shipments (11.0)% $ 33,638 $ 29,941 Average Sales Price October 31, 2024 October 31, 2023 Change 17.2 % $ 795,798 $ 933,051 Backlog (1) (9.1)% 71,624 65,109 Dealer Inventory (2) (1) (2) $ in thousands Independent Dealer Inventory of THOR products, in units

8 North American Motorized Segment Fiscal 2025 First Quarter Key Drivers • Net sales decreased 29 . 0 % compared to the first quarter of fiscal 2024 due to a softening of current independent dealer and consumer demand for motorized products • Gross profit margin percentage decreased 270 bps from the prior - year period primarily driven by the combined impact of the decrease in sales volume along with increased sales discounting and chassis costs • Independent dealer inventory of THOR Motorized products at October 31 , 2024 decreased 18 . 3 % from the prior year as independent dealers have adjusted their ordering patterns and optimal unit stocking levels in response to elevated carrying costs and current retail activity Q1 2025 Q1 2024 Change (29.0)% $ 711,159 $ 505,208 Net Sales (1) (270) bps 11.2% 8.5% Gross Profit Margin % (33.0)% 5,582 3,741 Wholesale Unit Shipments 6.0 % $ 127,402 $ 135,046 Average Sales Price October 31, 2024 October 31, 2023 Change (22.2)% $ 1,237,547 $ 963,141 Backlog (1) (18.3)% 12,127 9,909 Dealer Inventory (2) (1) (2) $ in thousands Independent Dealer Inventory of THOR products, in units

9 European Segment Fiscal 2025 First Quarter Key Drivers • Net sales decreased 14 . 6 % driven by a 27 . 4 % decrease in unit shipments offset in part by an increase in the overall net price per unit due to the total combined impact of the change in product mix and price, including a higher concentration of motorcaravans • Gross profit margin percentage decreased 200 bps compared to the first quarter of fiscal 2024 due to an increased overhead cost percentage resulting from the decrease in net sales • Independent dealer inventory levels of our European products are generally in line with historic seasonal levels following a period of restocking that impacted much of fiscal 2023 and part of fiscal 2024 Q1 2025 Q1 2024 Change (14.6)% $ 708,201 $ 604,903 Net Sales (1) (200) bps 17.3% 15.3% Gross Profit Margin % (27.4)% 11,892 8,635 Wholesale Unit Shipments 17.6 % $ 59,553 $ 70,052 Average Sales Price October 31, 2024 October 31, 2023 Change (38.7)% $ 3,331,171 $ 2,043,636 Backlog (1) 15.8 % 21,909 25,363 Dealer Inventory (2) (1) (2) $ in thousands Independent Dealer Inventory of THOR products, in units

10 $ 1,305,297 $ 1,091,397 Outstanding Debt (1) ($ in thousands) As of October 31, 2024 As of October 31, 2023 $ 425,828 $ 445,222 Cash and Cash Equivalents 998,000 865,000 Availability under Revolving Credit Facility $ 1,423,828 $ 1,310,222 Total Liquidity Leverage Ratios (2) Q1 FY 2025 Q1 FY 2024 1.2 x 1.0 x Net Debt / TTM EBITDA 1.1 x 1.0 x Net Debt / TTM Adjusted EBITDA Cash Flow Generation Q1 FY 2025 Q1 FY 2024 $ 59,668 $ 30,740 Cash from Operating Activities (1) (2) Total gross debt obligations inclusive of the current portion of long - term debt See the Appendix to this presentation for reconciliation of non - GAAP measures to most directly comparable GAAP financial measures Liquidity, low leverage ratio and strong cash flow generation are unrivaled strengths of THOR’s within the RV industry

11 Capital Management PRIORITIES AND FISCAL 2025 ACTIONS Invest in THOR’s business ▪ Capex investment of $ 25 . 3 million for Q 1 FY 25 , while we continue to manage non - critical spend in response to current market conditions Pay THOR's dividend ▪ Increased regular quarterly dividend to $0.50 in October 2024 ▪ Represents 15 th consecutive year of dividend increases Reduce the Company's debt obligations ▪ Payments on total debt of $61.8 million during Q1 FY25 ▪ Committed to long - term net debt leverage ratio target of approximately 1.0x; currently at 1.0x Repurchase shares on a strategic and opportunistic basis ▪ $422.8 million available to be repurchased under current authorizations as of October 31, 2024 Support opportunistic strategic investments

12 As forecasted, overall performance continued to be impacted by a soft retail and wholesale environment Held relatively strong margins despite a challenging market Remained focused on our strategic commitment to long - term investments to create a sustainable competitive advantage and enhanced margin profile Restructured leadership team to allow for greater focus on North America from our CEO, Bob Martin Incurred strategic, nonrecurring costs during the quarter unfavorably impacting current results, but actions are expected to result in future annual savings of over $ 10 million Paid down approximately $ 61 . 8 million of our total debt during the first quarter of FY 2025 Key takeaways from Q1 FY 2025

13 Full - Year Fiscal 2025 Guidance ▪ We reconfirm our initial financial forecast and guidance for fiscal 2025 , which ends July 31 , 2025 , following the results of our first quarter ▪ We expect to have a challenging second quarter ahead, followed by stronger third and fourth quarters ▪ We will continue to control what we can control, maximize our performance in the current environment and position THOR to outperform upon the market’s return Fiscal Year 2025 Guidance (1) $9.0B – $9.8B Consolidated Net Sales 325,000 – 340,000 North American RV Industry Wholesale Unit Shipments 14.7% – 15.2% Consolidated Gross Profit Margin $4.00 – $5.00 Diluted Earnings per Share Outlook ▪ We hold steadfast to our strategy of prudence in the face of a difficult market ▪ We continue to be very optimistic about global consumer interest in the RV lifestyle and long - term demand for our products ▪ We anticipate that the retail market will begin to trend positively by the end of our fiscal 2025 , setting up our fiscal 2026 to be a stronger year (1) Our Fiscal Year 2025 runs from August 1, 2024 through July 31, 2025

14 Appendix

15 (1) All retail information presented is for the CYTD period through September 30 , 2024 . North American retail data is reported by Statistical Surveys, Inc . and is based on official state and provincial records . This information is subject to adjustment, is continuously updated and is often impacted by delays in reporting by various states or provinces . European retail data is reported by the Caravaning Industry Association e . V . (“CIVD”) and the European Caravan Federation (“ECF ” ) . This information is subject to adjustment, continuously updated and is often impacted by delays in reporting by various countries (some countries, including the United Kingdom, do not report OEM - specific data and are thus excluded from the market share calculation) . (2) (3) EUROPEAN (3) All RV Segments NORTH AMERICAN (2) CATEGORY Class B Class C Class A Fifth Wheels Travel Trailers 23.4% 40.2% 50.7% 48.5% 40.7% 39.3% MARKET SHARE (1) #1 #1 #1 #1 #1 #2 MARKET POSITION (1) THOR – The Global RV Industry Leader

16 298.3 323.0 334.5 298.1 208.6 152.4 217.1 227.6 257.6 282.8 312.8 326.9 376.0 442.0 426.1 359.4 389.6 544.0 434.9 267.3 289.8 309.3 370.0 384.5 390.4 353.5 237.0 165.6 242.3 252.4 285.7 321.1 356.7 374.2 430.7 504.6 483.7 406.1 430.4 600.2 493.3 313.2 324.1 346.1 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (e) (e) TOWABLE RV WHOLESALE MARKET TRENDS (UNITS 000's) YTD Shipments (Units) % Change Unit Change Sept. 2023 Sept. 2024 +7.7% 18,291 238,121 256,412 YTD Shipments (Units) % Change Unit Change Sept. 2023 Sept. 2024 +13.4% 27,130 202,361 229,491 71.7 61.4 55.8 55.4 28.4 13.2 25.2 24.8 28.2 38.3 44.0 47.3 54.7 62.6 57.6 46.6 40.8 56.2 58.4 45.9 34.3 36.8 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (e) (e) YTD Shipments (Units) % Change Unit Change Sept. 2023 Sept. 2024 (24.7)% (8,839) 35,760 26,921 Historical Data: Recreation Vehicle Industry Association (RVIA) (e) Calendar years 2024 and 2025 represent the most recent RVIA "most likely" estimates from their September 2024 issue of Roadsigns RV Industry Overview North America RV WHOLESALE MARKET TRENDS (UNITS 000's) 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (e) (e) MOTORIZED RV WHOLESALE MARKET TRENDS (UNITS 000's)

17 RV Industry Overview THOR Forest River Winnebago Grand Design Gulfstream REV Group All Others 2024 Motorized 31,771 units 2023 Motorized 37,318 units 2023 Towable 281,045 units 47.5% 49.0% 40.9% 2015 2016 2017 RV Retail Registrations (1) 2018 2019 CCS Index (2) 2010 2011 2012 2013 2014 2020 2021 2022 2023 0 100,000 200,000 300,000 400,000 500,000 600,000 North America CONSUMER CONFIDENCE VS. RV RETAIL REGISTRATIONS (1)(2) 0 25 50 75 100 125 150 16.7% 6.9% 10.0% 10.1% 16.7% 6.4% (1) (2) Source: Statistical Surveys, Inc., U.S. and Canada; CYTD through September 30, 2024 and 2023 Source: The Conference Board, Consumer Confidence Survey ® , through September 2024 2024 Towable 256,906 units 37.5% 8.6% 12.5% 38.5% 9.0% 1.5% Note: 2024 represented above includes the trailing twelve months of registrations through September 30, 2024 CALENDAR YEAR - TO - DATE RV RETAIL MARKET SHARE (1) 1.6% 1.7% 1.3% 35.3% 11.6% 18.9% 17.8%

18 Change Total Nine Months Ended September 30, 2024 2023 Motorcaravans & Campervans Nine Months Ended September 30, 2024 2023 Change Change Caravans Nine Months Ended September 30, 2024 2023 Country 6.9 % 76,128 81,385 9.9 % 57,376 63,046 (2.2)% 18,752 18,339 Germany 6.3 % 24,758 26,329 8.6 % 19,102 20,753 (1.4)% 5,656 5,576 France 11.7 % 20,148 22,512 35.5 % 9,990 13,534 (11.6)% 10,158 8,978 U.K. 0.9 % 52,550 53,034 4.1 % 34,391 35,788 (5.0)% 18,159 17,246 All Others 5.6 % 173,584 183,260 10.1 % 120,859 133,121 (4.9)% 52,725 50,139 Total EUROPEAN INDUSTRY UNIT REGISTRATIONS BY COUNTRY (1) 198 203 210 208 189 154 150 156 147 137 140 152 168 190 202 211 236 261 219 210 324 320 310 366 289 206 228 247 264 304 333 376 416 471 493 465 449 379 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Europe North America The Company monitors retail trends in the European RV market as reported by the European Caravan Federation, whose industry data is reported to the public quarterly. Industry wholesale shipment data for the European RV market is not available. FULL - YEAR COMPARISON OF NEW VEHICLE REGISTRATIONS BY CONTINENT (UNITS 000's) (1) (2) 570 522 RV Industry Overview: Europe (1) (2) Source: European Caravan Federation; CYTD September 30, 2024 and 2023; European retail registration data available at www.CIVD.de Source: Statistical Surveys; North American retail registration data available at www.statisticalsurveys.com

19 Opportunities for New RVers entering the market Significant growth in RV ownership RV Owner future purchase intent is high RVing included in 2024 holiday travel plans 95 % of new RV owners plan to purchase another RV in the future (3) 21 million Americans plan to go RVing between Thanksgiving and New Year’s (2) 97 % increase in RV ownership for leisure travelers since 2014 (1) 26 % of those interested in buying an RV are motivated by a new hobby (4) Real data from RVers underpins long - term RV industry growth (1) (2) (3) (4) KOA 2024 Camping & Outdoor Hospitality Report RVIA 2024 Winter Travel Intention Survey THOR 2024 North American New RV Path to Purchase Study RV Trader 2024 Report

20 Additional Historical Metrics $5,364,516 $3,939,828 $795,798 $933,051 $1,237,547 $963,141 $3,331,171 $2,043,636 NA Towables NA Motorized European 10/31/23 10/31/24 82,400 122,300 83,800 75,000 Inventory Units 10/31/21 10/31/22 10/31/23 10/31/24 NORTH AMERICAN INDEPENDENT DEALER INVENTORY OF THOR PRODUCTS RV BACKLOG OF $3.94 billion (26.6)% (1) (1) (2) As compared to October 31, 2023 Comparable independent dealer inventory unit information was not available prior to July 31, 2023 21,900 25,400 Inventory Units 10/31/23 10/31/24 EUROPEAN INDEPENDENT DEALER INVENTORY OF THOR PRODUCTS (2)

Adjusted EBITDA is a non - GAAP performance measure included to illustrate and improve comparability of the Company's results from period to period, particularly in periods with unusual or one - time items . Adjusted EBITDA is defined as net income (loss) before net interest expense, income tax expense (benefit) and depreciation and amortization adjusted for certain unusual items and other one - time items . The Company considers this non - GAAP measure in evaluating and managing the Company's operations and believes that discussion of results adjusted for these items is meaningful to investors because it provides a useful analysis of ongoing underlying operating trends . The adjusted measures are not in accordance with, nor are they a substitute for, GAAP measures, and they may not be comparable to similarly titled measures used by other companies . 21 Quarterly EBITDA Reconciliation TTM 1QFY25 4QFY24 3QFY24 2QFY24 1QFY24 $ 209,494 $ (873) $ 91,464 $ 113,577 $ 5,326 $ 55,033 Net Income (Loss) 83,697 15,228 18,410 21,830 28,229 20,197 Add Back: Interest Expense, Net (1) 65,612 (283) 35,554 28,773 1,568 17,549 Income Tax Provision (Benefit) 277,528 67,661 73,597 68,151 68,119 67,278 Depreciation and Amortization of Intangible Assets $ 636,331 $ 81,733 $ 219,025 $ 232,331 $ 103,242 $ 160,057 EBITDA Add Back: 37,986 10,537 8,852 9,351 9,246 10,452 Stock - Based Compensation Expense (14,494) — (6,494) (5,000) (3,000) — Change in LIFO Reserve, net (7,979) — (1,079) (2,700) (4,200) (10,000) Net Expense (Income) Related to Certain Contingent Liabilities 5,311 3,392 (1,380) 1,575 1,724 (979) Non - Cash Foreign Currency Loss (Gain) 454 388 117 (581) 530 2,871 Market Value Loss (Gain) on Equity Investments 9,425 2,254 779 2,890 3,502 5,935 Equity Method Investment Loss (Gain) 2,500 — — 2,500 — — Weather - Related Losses 7,175 — — — 7,175 — Debt Amendment Expenses 15,459 15,459 — — — — Employee & Facility Strategic Initiatives (21,209) (5,981) (1,428) (4,267) (9,533) (1,418) Other Loss (Gain), Including Sales of PP&E $ 670,959 $ 107,782 $ 218,392 $ 236,099 $ 108,686 $ 166,918 Adjusted EBITDA $ 9,685,433 $ 2,142,784 $ 2,534,167 $ 2,801,113 $ 2,207,369 $ 2,500,759 Net Sales 6.9 % 5.0 % 8.6 % 8.4 % 4.9 % 6.7 % Adjusted EBITDA Margin (%) $ 1,091,397 Total Long - Term Debt as of October 31, 2024 (2) 445,222 Less: Cash and Cash Equivalents $ 646,175 Net Debt 1.0 x Net Debt / TTM EBITDA 1.0 x Net Debt / TTM Adjusted EBITDA ($ in thousands) TTM Fiscal Quarters (1) Includes $7,566 of costs associated with the debt amendment for 2QFY24 as discussed in Note 13 to the Consolidated Financial Statements of the Company’s Annual Report on Form 10 - K for the period ended July 31, 2024. Total debt obligations as of October 31, 2024 inclusive of the current portion of long - term debt. (2)

www.thorindustries.com INVESTOR RELATIONS CONTACT Jeff Tryka, CFA Lambert Global jtryka@lambert.com (616) 295 - 2509

Exhibit 99.3

FIRST QUARTER FISCAL 2025

INVESTOR QUESTIONS & ANSWERS

December 4, 2024

Forward-Looking Statements

Reference is made to the forward-looking statements disclosure provided

at the end of this document.

Fiscal First Quarter 2025 Highlights

($ in thousands, except for per share data)

| | |

Three Months Ended October 31, |

| | |

2024 | |

2023 |

| Net Sales | |

$ | 2,142,784 | | |

$ | 2,500,759 | |

| Gross Profit | |

$ | 281,442 | | |

$ | 357,932 | |

| Gross Profit Margin % | |

| 13.1 | % | |

| 14.3 | % |

| Net Income (Loss) Attributable to THOR | |

$ | (1,832 | ) | |

$ | 53,565 | |

| Diluted Earnings (Loss) Per Share | |

$ | (0.03 | ) | |

$ | 0.99 | |

| Cash Flows from Operations | |

$ | 30,740 | | |

$ | 59,668 | |

| | |

| | | |

| | |

| EBITDA(1) | |

$ | 81,733 | | |

$ | 160,057 | |

| Adjusted EBITDA(1) | |

$ | 107,782 | | |

$ | 166,918 | |

(1) See reconciliation of non-GAAP

measures to most directly comparable GAAP financial measures included in this release

Full-Year Fiscal 2025 Guidance (Unchanged from Original Fiscal

2025 Financial Guidance)

| • | Consolidated net sales in the range of $9.0 billion

to $9.8 billion |

| • | Consolidated gross profit margin in the range of 14.7% to

15.2% |

| • | Diluted earnings per share in the range of $4.00 to

$5.00 |

Quick Reference to Contents

| Q&A |

|

| |

|

|

|

| |

|

Market Update & Outlook |

2 |

| |

|

Operations Update |

5 |

| |

|

Strategic Update |

7 |

| |

|

Financial Update |

9 |

| |

|

|

|

| Segment Data |

|

| |

|

|

|

| |

|

Summary of Key Quarterly Segment Data – North American Towable RVs |

12 |

| |

|

Summary of Key Quarterly Segment Data – North American Motorized RVs |

13 |

| |

|

Summary of Key Quarterly Segment Data – European RVs |

14 |

| |

|

|

|

| Non-GAAP Reconciliation |

15 |

| |

|

|

|

| Forward-Looking Statements |

16 |

Q&A

MARKET UPDATE & OUTLOOK

| 1. | Following your 2024 Dealer Open House in late September, how would you characterize the current sentiment

of your North American independent dealers and your outlook for fiscal 2025? |

| a. | Overall, our North American independent dealers have expressed increased optimism at, and since, our Open

House event in September. Now that we have reached the other side of a contested election and have seen a second interest rate cut, we

believe we may be at the early stages of a return of higher consumer confidence. Should consumer confidence return, the outlook for the

second half of our fiscal year 2025 could be stronger than originally anticipated. For now, THOR remains cautiously optimistic about the

timing of the return of consumer sentiment that will drive the industry back to baseline. In the interim, of course, our dealers continue

to navigate the macroeconomic challenges that have triggered higher costs, higher interest rates and lower consumer confidence. We continue

to expect product mix to favor lower cost and lower margin units. Throughout this extended downturn in our market, we have remained dedicated

to our strategy of prudence. Consequently, THOR is positioned to perform exceedingly well upon the inevitable return of a robust market.

As the industry works itself through the final phase of the downturn, we will take steps to make sure that we hold this favorable position

that we have worked hard to establish during the course of the last several quarters. |

In September 2024, the Recreational Vehicle Industry Association

(“RVIA”) revised their wholesale unit shipments forecast for calendar year 2024 to reflect the continued softness in market

demand trends. The revised RVIA calendar year 2024 forecast has been moderately reduced calling for a range of North American wholesale

shipments of approximately 311,600 to 336,600 units with a median point of 324,100 units, up from the calendar year 2023 wholesale shipment

total of 313,174 units, but significantly lower than both calendar year 2021 and calendar year 2022 and lower than earlier estimates for

calendar year 2024. As part of their September forecast, the RVIA also issued a revised forecast for calendar year 2025 which calls for

a wholesale shipment range of approximately 329,900 to 362,300 units, with a median point of 346,100 units, an increase of 6.8% over the

median wholesale shipment total forecasted for calendar year 2024. The RVIA is expected to release further revisions to their forecasts

for calendar years 2024 and 2025 in early December 2024, which will take into consideration current economic conditions and recent wholesale

and retail shipment data.

| 2. | How would you assess the near-term North American retail demand environment? |

| a. | As we discussed when we reported our full year fiscal 2024 results, the first two quarters of fiscal year

2025 were forecasted to be challenging. We believe that the retail market will be moderately stronger on a year-over-year basis once we

enter the spring selling season, and that this improvement will continue throughout calendar year 2025. Moving beyond a contentious election

cycle and benefiting from lower interest rates, we are already beginning to see an uptick in consumer confidence and believe that it will

only continue to strengthen over the course of calendar year 2025 and that this increase will moderately improve the retail environment

for the industry. |

| 3. | What is the anticipated impact on North American Motorized sales as a result of the California Advanced

Clean Trucks (“ACT”) regulation that is set to go into effect beginning on January 1, 2025? How is THOR preparing for this

regulation? |

| a. | The California ACT regulation is set to implement Zero-Emission Vehicle (“ZEV”) sales requirements

on medium and heavy-duty vehicle manufacturers beginning on January 1, 2025. The intention of the regulation put forth by the California

Air Resource Board (“CARB”) is to promote the development and sale of ZEVs and Near-Zero Emission Vehicles (“NZEV”).

The sale of ZEVs and NZEVs generates credits that may be used, bought or sold to offset the sale of traditional chassis powered by internal

combustion engines. |

While the ACT regulation covers a wide range of medium and heavy-duty

chassis we utilize in our business, based on conversations with our chassis suppliers, we don’t anticipate any impact to our Class

A gas, Class B or Class C product lines in fiscal year 2025. While we continue to explore solutions with CARB and with our Class A diesel

chassis suppliers, there is some potential that our sale of Class A diesel motorhomes into California will be limited in fiscal year 2025.

In fiscal year 2024, Class A diesel products represented less

than 1% of our overall North American unit sales, of which only a portion related to California.

THOR has been preparing for and responding to the ACT regulation

and other regulatory changes in a few ways. First, alongside our dealer association, we have regularly been in contact with CARB, ensuring

our concerns with the ACT regulation and other regulations are understood and recognized. Second, our strategic planning to develop and

produce a plug-in hybrid Class A motorhome on a Harbinger chassis will be instrumental in our ability to adapt to the new regulation in

both California and in any other states that adopt the ACT regulation. The hybrid Class A (as an NZEV) gives us a product offering that

we can sell in California. Additionally, our relationship with Harbinger gives us access to purchase additional ACT credits that are generated

by Harbinger. These credits could potentially be transferred to other chassis manufacturers (including Class A diesel manufacturers) so

that they can continue to produce traditional internal combustion engine chassis for THOR’s sale into California and other states

that follow CARB. Third, we continue to work directly with our traditional chassis supply chain in developing technologies and systems

that enable us all to continue to operate, without interruption, under the framework of the ACT regulation.

Given our efforts to strategically position ourselves, we expect

minimal impact on our sales as a consequence of the ACT regulation.

| 4. | What is your outlook on the European retail environment for the remainder of fiscal 2025? |

| a. | European retail sales have been impacted by current macroeconomic conditions and elevated interest rates,

although to a lesser extent compared to North American retail sales. The European market is also following a similar trend as seen in

North America, with premium and entry-level brands performing relatively well while mainstream brands are suppressed due to shifting consumer

preferences. Despite these challenges, we continue to see relative strength in retail registrations in Europe when compared to North America.

According to the European Caravan Federation (“ECF”), total retail registrations in Europe for the nine months ended September

30, 2024 increased 5.6% in comparison with the prior-year period. This positive trend was driven by a 10.1% increase in registrations

of motorcaravans and campervans partially offset by a decrease in registrations of caravans of 4.9% during the period. Retail sales of

product produced by our European segment realized growth of 20.6% during the first nine months of calendar year 2024 compared to the same

period of calendar year 2023. |

Backlog and order entry for our European segment remain healthy,

indicating continued demand for our products. We believe that the recent European Central Bank (“ECB”) interest rate cuts

will improve sales channel throughput as carrying costs for independent dealers are reduced, and we feel well positioned to continue growing

our market share with a favorable product mix. Through the third calendar quarter of 2024, we have achieved a motorcaravan and campervan

market share of 25.1%, a sizeable improvement upon our 20.9% market share for the full calendar year 2023 driven by the strength of our

brands and improved access to chassis.

Our outlook is bolstered by our recent participation in the 2024

Caravan Salon trade fair in Düsseldorf, Germany (“CSD”). Our European brands reported a successful show with increased

sales achievement over the prior year, as well as robust consumer participation and interest. While dealers continue to contend with economic

headwinds, we remain confident in the underlying consumer demand and enthusiasm for our products.

| 5. | With the completion of the recent presidential election, do you foresee any economic impact on your

business from the potential tariff policy or other economic policies of the new administration? |

| a. | Elections and other external forces can create challenges for the RV Industry. THOR Industries is poised

to operate at a high level regardless of the political environment and is well versed at adapting to a variety of scenarios. The two primary

items that we are monitoring that could impact our financial performance and capital management are corporate tax rates and tariffs. |

A changing corporate tax rate is nothing new, and we will adapt

accordingly. We will remain prudent in our capital management and investment strategies as we navigate any potential adjustments within

the tax rate environment.

Higher tariffs generally present a challenge for our financial

performance as they tend to have a negative impact on the availability and cost of certain raw material component parts and gross margins.

While these challenges will require strategic adjustments by our management teams, we and many of our key component part suppliers are

well situated for this after experiencing the tariff environment after the 2016 election. Given the potential for an increased tariff

environment, our owned supply companies, in particular, have positioned their supply chains optimally to avoid material impact from an

aggressive tariff policy. As we wait to see what changes are actually made to the US tariff policy, our teams are aligned in how to react

to this type of environment and our sourcing strategies are well prepared.

OPERATIONS UPDATE

| 1. | What is the status of your global independent dealer inventory levels as of the end of the fiscal first

quarter? How does this impact your expectations regarding the cadence of wholesale shipments in fiscal 2025? |

| a. | As

of the October 31, 2024 end of our fiscal first quarter, North American dealer inventories held constant with their fiscal 2024 fourth

quarter levels at approximately 75,000 units, while declining from their October 31, 2023 level of 83,800, indicating that our operating

companies continued to appropriately align production with retail pull-through. We believe that the current low level of independent

North American dealer inventory positions THOR to outperform the market when the inevitable market recovery occurs. |

After spending much of fiscal 2023 and part of fiscal 2024 restocking

independent dealer inventories, we are beginning to see modest declines in our European dealer inventories. At the end of the fiscal 2025

first quarter, our European dealer inventories declined from their fiscal 2024 fourth quarter levels due to the intentional alignment

of production and wholesale sales with retail sales. As of October 31, 2024, European dealer inventory levels of THOR products approximated

25,400 units compared to 26,200 units as of July 31, 2024 and 21,900 units as of October 31, 2023. We believe that current European dealer

inventory levels are in balance with the market as of October 31, 2024.

Consistent with our approach throughout the current down cycle,

globally, THOR operating companies will continue to manage production in a disciplined manner with an elevated level of conservatism.

Our teams will also continue to work closely with our dealer partners in monitoring retail demand to ensure we respond quickly to shifts

in market demand and adjust our production plans appropriately.

| 2. | The Federal Reserve and the ECB have decreased interest rates at recent meetings. With additional meetings

scheduled in the coming weeks, how do you foresee these rate cuts and analyst expectations of further cuts impacting THOR and the RV Industry? |

| a. | The recent rate cuts by the Federal Reserve and the ECB will have minimal impact on the RV Industry in

the short term but will help stimulate wholesale and retail demand in calendar 2025 if the rate cuts are continued. These rate cuts could

be beneficial to the RV Industry and THOR in a number of ways. First, lower interest rates will boost consumer disposable income, as rates

on mortgages and other consumer debt gradually decline. We have historically seen that as consumer confidence improves, consumers are

more willing to make larger discretionary purchases like RVs. Lower rates also reduce the cost of ownership for those consumers who finance

an RV. A second positive impact will be the effect on independent dealer floorplan financing costs. While interest expense for dealers

is still well above the averages of the past decade, if the rates they pay decline, dealers are likely to be more willing to take on additional

inventory, particularly if they see a rebound in retail activity driven by more optimistic consumers. This will be especially beneficial

in the European market where independent dealers have slowed purchasing in response to their inventory carrying costs despite resilient

retail demand. Finally, THOR will also benefit from lower effective interest rates on our outstanding debt that is subject to variable

interest rates. |

| 3. | What are the key factors affecting current backlog levels? |

| | | |

| | | a. |

| ($ in thousands) | |

As of October 31, | |

|

| | |

2024 | |

2023 | |

Change |

| Recreational vehicles | |

| | | |

| | | |

| | |

| North American Towable | |

$ | 933,051 | | |

$ | 795,798 | | |

| 17.2 | % |

| North American Motorized | |

| 963,141 | | |

| 1,237,547 | | |

| (22.2 | )% |

| Total North America | |

| 1,896,192 | | |

| 2,033,345 | | |

| (6.7 | )% |

| European | |

| 2,043,636 | | |

| 3,331,171 | | |

| (38.7 | )% |

| Total | |

$ | 3,939,828 | | |

$ | 5,364,516 | | |

| (26.6 | )% |

In North America, we have seen our Towable segment backlog increase

by 17.2% while our Motorized segment backlog decreased 22.2% on a year-over-year basis. Our Towable segment backlog has increased in line

with expectations of retail demand trending promisingly in the upcoming second half of our fiscal year. We believe the decrease in our

Motorized segment backlog is primarily the result of a reduction in recent orders from our independent dealers as they have adapted their

preferred stocking levels and ordering cadence to current market and economic conditions, including recent softness in retail demand for

motorized products given their higher price point as well as elevated interest rates and other carrying costs.

In Europe, our backlog decreased by 38.7% compared to the prior

year. This decrease is mainly due to an elevated level of orders in prior periods caused by the impact of a chassis shortage on our production.

Backlog at October 31, 2023 was thus elevated due to the corresponding need to restock the independent dealer inventories of our products

that had dwindled as a consequence of the lacking chassis supply. Despite the magnitude of the decline on a year-over-year basis, we saw

sequential growth in the first quarter of fiscal 2025 and believe that the current backlog level of our European segment is healthy and

appropriate given the current economic conditions.

STRATEGIC UPDATE

| 1. | At this year’s Dealer Open House you introduced a revolutionary plug-in hybrid Class A motorhome

built on a Harbinger chassis. How was this product concept received by your independent dealers? Are you still on schedule for your stated

timeline of bringing this new motorhome to market in calendar year 2025? |

| a. | Our innovation team is working diligently to deliver numerous product and improvement initiatives that

we hope to introduce across our family of brands in the near future. One such initiative that we introduced at the 2024 Dealer Open House

is our hybrid Class A motorhome. We believe that electrification will play a central role in the future of mobility, including RVing.

Innovation and future product offerings surrounding electrification reinforces THOR’s leadership in this segment and creates major

points of product differentiation for our family of companies. The hybrid Class A motorhome made a positive impression across numerous

national publications and was a show favorite of many of our independent dealers who had the opportunity to ride in the hybrid motorhome.

We confirm that we still intend to begin commercial production of the hybrid Class A motorhome in calendar 2025. This is just one example

of the unique value proposition that THOR provides with our consistent investment in our innovation team in order to provide value for

and improve the experience of both our independent dealers and our end customers. |