united

states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-23794

THOR Financial Technologies Trust

(Exact name of registrant as specified in charter)

327 W. Pittsburgh Street, Greensburg, PA 15601

(Address of principal executive offices) (Zip code)

The Corporation Trust Company

1209 Orange Street, Wilmington, DE 19801

(Name and address of agent for service)

Registrant's telephone number, including area code: 412-860-6078

Date of fiscal year end: 8/31

Date of reporting period: 8/31/23

Item 1. Reports to Stockholders.

THOR

Low Volatility ETF

August

31, 2023

Annual

Report

Advised

by:

THOR

Financial Technologies, LLC

327

W. Pittsburgh Street

Greensburg,

PA 15601

www.thorfunds.com

1-800-974-6964

Distributed

by Northern Lights Distributors, LLC

Member

FINRA

August

31, 2023

Dear

Shareholders,

We

are delighted to present the annual shareholder update for the THOR Low Volatility ETF (THLV or the Fund) covering the fiscal year that

concluded on August 31, 2023. This year has been marked by a blend of challenges and opportunities, and we are profoundly appreciative

of the trust and support you have vested in us as your investment manager.

Performance

Highlights

Since

its inception on September 12, 2022, through the fiscal year’s end on August 31, 2023, THLV has delivered a positive return of 2.02%.

Commencing at a net asset value (“NAV”) of $25, THLV’s closing NAV for the year stood at $25.35. Given the turbulent

nature of the financial markets throughout 2022, we are pleased with our performance thus far.

The

Fund’s benchmark, MSCI USA Minimum Volatility (USD) Index, returned 3.23% during the same time period. S&P 500 Index returned

11.47%. The THOR Low Volatility Index returned 2.14%.

Factors

attributing to performance versus the S&P 500 benchmark was highly skewed given the market cap weighted nature of the S&P 500

index construction. THLV primarily delivers an equal weight sector exposure and was unable to keep up with market cap weighted performance

during the time period. The Fund was fairly in line with the performance of the MSCI USA Minimum Volatility Index and the THOR Low Volatility

Index, the underlying index of the Fund.

On

December 16, 2022, the Fund distributed a dividend of $0.153 per share, equivalent to a yield of 0.607%.

Investment

Approach

Throughout

the fiscal year, our investment strategy and underlying rationale remained unchanged. It’s important to note that THLV does not employ

derivatives as part of its investment strategy.

The

Fund seeks to achieve its investment objective by investing at least 80% of its total assets in securities included in the Index. The

rules-based index is comprised of U.S. equity exchange traded funds (“ETFs”). The primary goal of the Index is to gain exposure

to U.S. large cap equities while attempting to lower volatility by avoiding sectors that are currently in a down trending cycle. The

Index measures the price trends and historic volatility of ten U.S. sector ETFs (the “Select List”) over the medium term.

The Select List includes sector ETFs in the Materials, Energy, Financial, Industrial, Technology, Healthcare, Utilities, Consumer Discretionary,

Real Estate, and Consumer Staples sectors. The Index uses data science weekly to evaluate the Select List to determine whether the security

is currently “risk on” (buy) or “risk

off”

(sell). Only sectors with a risk on signal are included in the Index. The Index follows a weekly reconstitution and rebalance.

There

have been no adjustments to the Fund’s management fee during the fiscal year. The annual management fee remains at a competitive 0.55%,

and we foresee no changes in the immediate future.

Expressing

Our Gratitude

In

conclusion, we want to convey our heartfelt appreciation for your unwavering trust and investment in (THLV). Our commitment to prudently

manage your assets and deliver enduring value to our shareholders remains steadfast.

Should

you have any inquiries or require additional information, please do not hesitate to contact our dedicated investor relations team at

1-800-974-6964.

Your

partnership has been integral to THLV’s journey, and we look forward to the year ahead.

Sincerely,

Bradley

R. Roth

Chief

Investment Officer

THOR

Financial Technologies

PAST

PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. TRADING COMMODITY FUTURES, EQUITIES, BONDS, AND OPTIONS IS SPECULATIVE,

INVOLVES RISK OF LOSS, AND IS NOT SUITABLE FOR ALL INVESTORS.

17420641-NLD

10/13/2023

| THOR

Low Volatility ETF |

| PORTFOLIO

REVIEW (Unaudited) |

| August

31, 2023 |

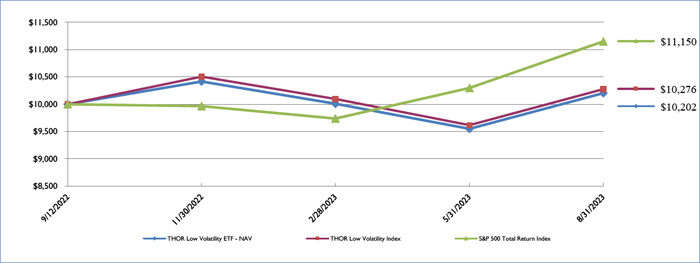

Average

Annual Total Return through August 31, 2023*, as compared to its benchmark:

| |

Inception

through**** |

| |

August

31, 2023 |

| THOR

Low Volatility ETF - NAV |

2.02% |

| THOR

Low Volatility ETF - Market Price |

2.10% |

| THOR

Low Volatility Index** |

2.76% |

| S&P

500 Total Return Index*** |

11.50% |

| * | The

performance data quoted here represents past performance. Current performance may be lower or higher than the performance data quoted

above. Investment return and principal value will fluctuate, so that shares, when redeemed, may be worth more or less than their original

cost. The returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or on the redemptions

of Fund shares. Past performance is no guarantee of future results. Performance figures for periods less than 1 year are not annualized. |

The

Fund’s per share net asset value (“NAV”) is the value of one share of the Fund as calculated in accordance with the

standard formula for valuing exchange-traded fund shares. The NAV return is based on the NAV of the Fund and the market return is based

on the market price per share of the Fund. The price used to calculate market return (“Market Price”) is determined by using

the market price or bid/ask as of close of market on the primary stock exchange on which shares of the Fund are listed for trading, as

of the time that the Fund’s NAV is calculated. Market price returns are calculated using the closing price and account for distributions

from the Fund. Market Price and NAV returns assume that dividends and capital gain distributions have been reinvested in the Fund at

Market Price and NAV, respectively. The Adviser provides investment advisory services, and is responsible for all of the expenses and

liabilities of the Fund, inclusive of fees and expenses of other investment companies in which the Fund may invest, except for any brokerage

fees and commissions, taxes, borrowing costs (such as dividend expense on securities sold short and interest), and such extraordinary

or non-recurring expenses as may arise, including litigation to which the Fund may be a party and indemnification of the Board of Trustees

and officers with respect thereto in return for a “unitary fee.” Expenses not expressly assumed by the Adviser under the Advisory

Agreement are paid by the Fund. The Advisory Agreement may be terminated with respect to the Fund without penalty on 60 days’ written

notice by a vote of a majority of the Trustees, the Adviser, or by holders of a majority of the Fund’s outstanding shares (with

respect to the Fund). The Advisory Agreement shall terminate automatically in the event of its assignment. Without waiver or reimbursement

the gross expenses and fees of the Fund is 0.65% per the current prospectus.

| ** | The

THOR Low Volatility Index (“the Index”) measures the price trends and historic volatility of ten U.S. sector ETFs (the “Select

List”) over the medium term (three to six months). The Select List includes sector-specific ETFs in the Materials, Energy, Financial,

Industrial, Technology, Healthcare, Utilities, Consumer Discretionary, Real Estate, and Consumer Staples sectors with a clear sector

mandate, low overall expenses, and sufficient trading liquidity. The THOR Low Volatility Index uses a proprietary algorithm that measures

price momentum to evaluate the Select List to determine whether the security is currently “risk on” (buy) or “risk

off” (sell), and the Fund’s portfolio is adjusted weekly based on the algorithm. Only sectors with a risk on signal are included

in the Index. The Fund’s portfolio holdings may differ significantly from the securities held in the Index, and unlike a mutual fund,

an unmanaged index assumes no transaction costs, taxes, management fees or other expenses. Investors may not invest directly in an index. |

| *** | The

S&P 500 Index is a large-cap, market-weighted, U.S. equities index that tracks the price (excluding dividends) of the 500 leading

companies that reflect the industries of the U.S. economy and is often considered a proxy for the stock market in general. The Fund’s

portfolio holdings may differ significantly from the securities held in the index, and unlike a mutual fund, an unmanaged index assumes

no transaction costs, taxes, management fees or other expenses. Investors may not invest directly in an index. |

| **** | As

of the close of business on the day of commencement of trading on September 12, 2022. |

Comparison

of the Change in Value of a $10,000 Investment

Portfolio

Composition as of August 31, 2023:

| Compositions | |

Percentage of Net Assets | |

| Exchange-Traded Funds: | |

| | |

| Equity | |

| 98.1 | % |

| Other Assets in Excess of Liabilities | |

| 1.9 | % |

| | |

| 100.0 | % |

Please

refer to the Schedule of Investments in this Annual Report for a detailed listing of the Fund’s holdings.

| THOR

Low Volatility ETF |

| SCHEDULE

OF INVESTMENTS |

| August

31, 2023 |

| Shares | | |

| |

Fair Value | |

| | | | |

EXCHANGE-TRADED FUNDS — 98.1% | |

| | |

| | | | |

EQUITY - 98.1% | |

| | |

| | 190,539 | | |

The Consumer Staples Select Sector SPDR Fund | |

$ | 13,863,617 | |

| | 156,900 | | |

The Energy Select Sector SPDR Fund | |

| 13,951,548 | |

| | 408,726 | | |

The Financial Select Sector SPDR Fund | |

| 14,052,000 | |

| | 103,161 | | |

The Health Care Select Sector SPDR Fund | |

| 13,742,077 | |

| | 129,804 | | |

The Industrial Select Sector SPDR Fund | |

| 14,048,687 | |

| | 170,119 | | |

The Materials Select Sector SPDR Fund | |

| 14,101,164 | |

| | 381,804 | | |

The Real Estate Select Sector SPDR Fund | |

| 14,134,384 | |

| | | | |

| |

| 97,893,477 | |

| | | | |

| |

| | |

| | | | |

TOTAL EXCHANGE-TRADED FUNDS (Cost $95,766,622) | |

| 97,893,477 | |

| | | | |

| |

| | |

| | | | |

TOTAL INVESTMENTS - 98.1% (Cost $95,766,622) | |

$ | 97,893,477 | |

| | | | |

OTHER ASSETS IN EXCESS OF LIABILITIES – 1.9% | |

| 1,848,923 | |

| | | | |

NET ASSETS - 100.0% | |

$ | 99,742,400 | |

| | | | |

| |

| | |

SPDR

- Standard & Poor’s Depositary Receipt

See

accompanying notes to financial statements.

| THOR

Low Volatility ETF |

| STATEMENT

OF ASSETS AND LIABILITIES |

| August

31, 2023 |

| ASSETS | |

| | |

| Investment securities: | |

| | |

| At cost | |

$ | 95,766,622 | |

| At fair value | |

$ | 97,893,477 | |

| Cash and cash equivalents | |

| 1,892,527 | |

| Interest receivable | |

| 5,577 | |

| TOTAL ASSETS | |

| 99,791,581 | |

| | |

| | |

| LIABILITIES | |

| | |

| Investment advisory fees payable | |

| 49,181 | |

| TOTAL LIABILITIES | |

| 49,181 | |

| NET ASSETS | |

$ | 99,742,400 | |

| | |

| | |

| Net Assets Consist Of: | |

| | |

| Paid in capital | |

$ | 100,597,866 | |

| Accumulated losses | |

| (855,466 | ) |

| NET ASSETS | |

$ | 99,742,400 | |

| | |

| | |

| Net Asset Value Per Share: | |

| | |

| Shares: | |

| | |

| Net assets | |

$ | 99,742,400 | |

| Shares of beneficial interest outstanding (a) | |

| 3,934,000 | |

| | |

| | |

| Net asset value (Net Assets ÷ Shares Outstanding), offering price and redemption price per share | |

$ | 25.35 | |

| (a) | Unlimited

number of shares of beneficial interest authorized, no par value. |

See

accompanying notes to financial statements.

| THOR

Low Volatility ETF |

| STATEMENT

OF OPERATIONS |

| For

the Period Ended August 31, 2023 * |

| INVESTMENT INCOME | |

| | |

| Dividends | |

$ | 1,328,148 | |

| Interest | |

| 199,490 | |

| TOTAL INVESTMENT INCOME | |

| 1,527,638 | |

| | |

| | |

| EXPENSES | |

| | |

| Investment advisory fees | |

| 475,584 | |

| TOTAL EXPENSES | |

| 475,584 | |

| | |

| | |

| NET INVESTMENT INCOME | |

| 1,052,054 | |

| | |

| | |

| REALIZED AND UNREALIZED GAIN (LOSS) ON INVESTMENTS | |

| | |

| Net realized loss from investments | |

| (3,778,557 | ) |

| Net realized gain from redemptions in-kind | |

| 2,065,582 | |

| Net change in unrealized appreciation on investments | |

| 2,126,855 | |

| NET REALIZED AND UNREALIZED GAIN ON INVESTMENTS | |

| 413,880 | |

| | |

| | |

| NET INCREASE IN NET ASSETS RESULTING FROM OPERATIONS | |

$ | 1,465,934 | |

| * | The

THOR Low Volatility ETF commenced operations on September 12, 2022. |

See

accompanying notes to financial statements.

| THOR

Low Volatility ETF |

| STATEMENT

OF CHANGES IN NET ASSETS |

| | |

For the | |

| | |

Period Ended | |

| | |

August 31, 2023 * | |

| FROM OPERATIONS | |

| | |

| Net investment income | |

$ | 1,052,054 | |

| Net realized loss from investments | |

| (3,778,557 | ) |

| Net realized gain from redemptions in-kind | |

| 2,065,582 | |

| Net change in unrealized appreciation on investments | |

| 2,126,855 | |

| Net increase in net assets resulting from operations | |

| 1,465,934 | |

| | |

| | |

| DISTRIBUTIONS TO SHAREHOLDERS | |

| | |

| Total distributions paid | |

| (545,292 | ) |

| Net decrease in net assets from distributions to shareholders | |

| (545,292 | ) |

| | |

| | |

| FROM SHARES OF BENEFICIAL INTEREST | |

| | |

| Proceeds from shares sold | |

| 145,411,534 | |

| Payments for shares redeemed | |

| (46,689,776 | ) |

| Net increase in net assets from shares of beneficial interest | |

| 98,721,758 | |

| | |

| | |

| TOTAL INCREASE IN NET ASSETS | |

| 99,642,400 | |

| | |

| | |

| NET ASSETS | |

| | |

| Beginning of Period | |

| 100,000 | (a) |

| End of Period | |

$ | 99,742,400 | |

| | |

| | |

| SHARE ACTIVITY | |

| | |

| Shares Outstanding, Beginning of Period | |

| 4,000 | (a) |

| Shares Sold | |

| 5,830,000 | |

| Shares Redeemed | |

| (1,900,000 | ) |

| Shares Outstanding, End of the Period | |

| 3,934,000 | |

| * | The

THOR Low Volatility ETF commenced operations on September 12, 2022. |

| (a) | Beginning

capital of $100,000 was contributed by fund management of THOR Financial Technologies, LLC, investment advisor to the Fund, in exchange

for 4,000 shares of the fund in connection with the seeding of the THOR Low Volatility ETF, a series of the THOR Financial Technologies

Trust. |

See

accompanying notes to financial statements.

| THOR

Low Volatility ETF |

| FINANCIAL

HIGHLIGHTS |

Per

Share Data and Ratios for a Share of Beneficial Interest Outstanding Throughout the Period Presented

| | |

For the | |

| | |

Period Ended | |

| | |

August 31, 2023 (a) | |

| | |

| |

| Net asset value, beginning of period | |

$ | 25.00 | |

| Activity from investment operations: | |

| | |

| Net investment income (b) | |

| 0.29 | |

| Net realized and unrealized gain on investments | |

| 0.21 | |

| Total from investment operations | |

| 0.50 | |

| Less distributions from: | |

| | |

| Net investment income | |

| (0.15 | ) |

| Total distributions | |

| (0.15 | ) |

| Net asset value, end of period | |

$ | 25.35 | |

| Market price, end of period | |

$ | 25.37 | |

| Total return (c)(d) | |

| 2.02 | % |

| Market price total return (d)(i) | |

| 2.10 | % |

| Net assets, end of period (000s) | |

$ | 99,742 | |

| Ratio of net expenses to average net assets (e)(h) | |

| 0.55 | % |

| Ratio of net investment income to average net assets (e)(f)(h) | |

| 1.21 | % |

| Portfolio Turnover Rate (d)(g) | |

| 440 | % |

| | |

| | |

| (a) | The

THOR Low Volatility ETF commenced operations on September 12, 2022. |

| (b) | Per

share amounts calculated using the average shares method, which more appropriately presents the per share data for the period. |

| (c) | Total

return is calculated assuming a purchase of shares at net asset value on the first day and a sale at net asset value on the last day

of the period. Distributions are assumed, for the purpose of this calculation, to be reinvested at the ex-dividend date net asset value

per share on their respective payment dates. |

| (f) | Recognition

of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying investment companies

in which the Fund invests. |

| (g) | Portfolio

turnover rate excludes securities received or delivered from in-kind transactions. |

| (h) | Does

not include the expenses of other investment companies in which the Fund invests. |

| (i) | Market

value total return is calculated assuming an initial investment made at market value at the beginning of the period, reinvestment of

all distributions at market value during the period and redemption on the last day of the period at market value. The market value is

determined by the midpoint of the bid/ask spread at 4:00 p.m. from the NYSE Exchange. Market value returns may vary from net asset value

returns. |

See

accompanying notes to financial statements.

THOR

Low Volatility ETF

NOTES TO FINANCIAL STATEMENTS

August 31, 2023

The

THOR Low Volatility ETF (the “Fund”) is a diversified series of THOR Financial Technologies Trust (the “Trust), a statutory

trust organized under the laws of the State of Delaware on April 11, 2022, and registered under the Investment Company Act of 1940, as

amended (the “1940 Act”). The Trust is governed by its Board of Trustees (the “Board” or “Trustees”). THOR

Low Volatility ETF is a “fund of funds”, in that the Fund will generally invest in other investment companies. The Fund commenced

operations on September 12, 2022. The Fund is an actively managed exchange traded fund (“ETF”). The investment objective of

the Fund is to seek to provide investment results that generally correspond, before fees and expenses, to the performance of the THOR

Low Volatility Index (the “Index”) . The Fund’s investment objective may be changed by the Board upon 60 days’ written

notice to shareholders.

| (2) | SIGNIFICANT

ACCOUNTING POLICIES |

The

following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These

policies are in conformity with accounting principles generally accepted in the United States of America (’‘GAAP”), and

require management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent

assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from

operations during the reporting period. Actual results could differ from those estimates. The Fund is an investment company and accordingly

follows the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting

Standard Codification Topic 946 “Financial Services – Investment Companies, including Accounting Standards Update 2013-08”.

Security

Valuation – Securities listed on an exchange are valued at the last reported sale price at the close of the regular trading

session of the exchange on the business day the value is being determined, or in the case of securities listed on NASDAQ at the NASDAQ

Official Closing Price. In the absence of a sale such securities shall be valued at the mean between the current bid and ask prices on

the day of valuation. Short-term debt obligations having 60 days or less remaining until maturity, at time of purchase may be valued

at amortized cost (which approximates fair value). Investments in open-end investment companies are valued at net asset value (“NAV”).

The

Fund may hold securities, such as private investments, interests in commodity pools, other non-traded securities or temporarily illiquid

securities, for which market quotations are not readily available or are determined to be unreliable. These securities are valued using

the “fair value” procedures approved by the Board. The Board designated the adviser as its valuation designee (the “Valuation

Designee”) to execute these procedures. The Board may also enlist third party consultants such a valuation specialist at a public

accounting firm, valuation consultant or financial officer of a security issuer on an as-needed basis to assist the Valuation Designee

in determining a security-specific fair value. The Board is responsible for reviewing and approving fair value methodologies utilized

by the Valuation Designee, approval of which shall be based upon whether the Valuation Designee followed the valuation procedures established

by the Board.

Fair

Valuation Process – The applicable investments are valued by the Valuation Designee pursuant to valuation procedures established

by the Board. For example, fair value determinations are required for the following securities: (i) securities for which market quotations

are insufficient or not readily available on a particular business day (including securities for which there is a short and temporary

lapse in the provision of a price by the regular pricing source); (ii) securities for which, in the judgment of the Valuation Designee,

the prices or values available do not represent the fair value of the instrument; factors which may cause the Valuation Designee to make

such a judgment include, but are not limited to, the following: only a bid price or an asked price is available; the spread between bid

and asked prices is substantial; the frequency of sales; the thinness of the market; the size of reported trades; and actions of the

securities markets, such as the suspension or limitation of trading; (iii) securities determined to be illiquid; and (iv) securities

with respect to which an event that will affects the value thereof has

THOR

Low Volatility ETF

NOTES TO FINANCIAL STATEMENTS (Continued)

August 31, 2023

occurred

(a “significant event”) since the closing prices were established on the principal exchange on which they are traded, but prior

to a Fund’s calculation of its net asset value. Restricted or illiquid securities, such as private investments or non -traded securities

are valued based upon the current bid for the security from two or more independent dealers or other parties reasonably familiar with

the facts and circumstances of the security (who should take into consideration all relevant factors as may be appropriate under the

circumstances). If a current bid from such independent dealers or other independent parties is unavailable, the Valuation Designee shall

determine, the fair value of such security using the following factors: (i) the type of security; (ii) the cost at date of purchase;

(iii) the size and nature of the Fund’s holdings; (iv) the discount from market value of unrestricted securities of the same class

at the time of purchase and subsequent thereto; (v) information as to any transactions or offers with respect to the security; (vi) the

nature and duration of restrictions on disposition of the security and the existence of any registration rights; (vii) how the yield

of the security compares to similar securities of companies of similar or equal creditworthiness; (viii) the level of recent trades of

similar or comparable securities; (ix) the liquidity characteristics of the security; (x) current market conditions; and (xi) the market

value of any securities into which the security is convertible or exchangeable.

Valuation

of Underlying Funds – The Fund may invest in portfolios of open -end or closed -end investment companies (the “Underlying Funds”).

Investment companies are valued at their respective net asset values as reported by such investment companies. Open- end investment companies

value securities in their portfolios for which market quotations are readily available at their market values (generally the last reported

sale price) and all other securities and assets at their fair value to the methods established by the board of directors of the open-end

funds. The shares of many closed-end investment companies and ETFs, after their initial public offering, frequently trade at a price

per share, which is different than the net asset value per share. The difference represents a market premium or market discount of such

shares. There can be no assurances that the market discount or market premium on shares of any closed-end investment company or ETF purchased

by the Fund will not change.

Exchange

Traded Funds – The Fund may invest in ETFs, which are a type of fund bought and sold on a securities exchange. An ETF trades

like common stock and represents a fixed portfolio of securities. The risks of owning an ETF generally reflect the risks of owning the

underlying securities in which it invests, although the lack of liquidity on an ETF could result in it being more volatile. Additionally,

ETFs have fees and expenses that reduce their value.

Exchange

Traded Notes – The Funds may invest in exchange traded notes (“ETNs”). ETNs are a type of debt security that is linked

to the performance of underlying securities. The risks of owning ETNs generally reflect the risks of owning the underlying securities

they are designed to track. In addition, ETNs are subject to credit risk generally to the same extent as debt securities.

The

Fund utilizes various methods to measure the fair value of all of its investments on a recurring basis. GAAP establishes a hierarchy

that prioritizes inputs to valuation methods. The three levels of input are:

Level

1 – Unadjusted quoted prices in active markets for identical assets and liabilities that the Fund has the ability to access.

Level

2 – Observable inputs other than quoted prices included in Level 1 that are observable for the asset or liability, either directly

or indirectly. These inputs may include quoted prices for the identical instrument on an inactive market, prices for similar instruments,

interest rates, prepayment speeds, credit risk, yield curves, default rates and similar data.

Level

3 – Unobservable inputs for the asset or liability, to the extent relevant observable inputs are not available, representing the

Fund’s own assumptions about the assumptions a market participant would use in valuing the asset or liability, and would be based

on the best information available.

The

availability of observable inputs can vary from security to security and is affected by a wide variety of factors, including, for example,

the type of security, whether the security is new and not yet established in the marketplace,

THOR

Low Volatility ETF

NOTES TO FINANCIAL STATEMENTS (Continued)

August 31, 2023

the

liquidity of markets, and other characteristics particular to the security. To the extent that valuation is based on models or inputs

that are less observable or unobservable in the market, the determination of fair value requires more judgment. Accordingly, the degree

of judgment exercised in determining fair value is greatest for instruments categorized in Level 3.

The

inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, for disclosure purposes,

the level in the fair value hierarchy within which the fair value measurement falls in its entirety, is determined based on the lowest

level input that is significant to the fair value measurement in its entirety.

The

inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

The following table summarizes the inputs used as of August 31, 2023, for the Fund’s assets and liabilities measured at fair value:

| Assets* | |

Level 1 | | |

Level 2 | | |

Level 3 | | |

Total | |

| Exchange-Traded

Funds | |

$ | 97,893,477 | | |

$ | — | | |

$ | — | | |

$ | 97,893,477 | |

| Total | |

$ | 97,893,477 | | |

$ | — | | |

$ | — | | |

$ | 97,893,477 | |

The

Fund did not hold any Level 2 or Level 3 securities during the period.

| * | Refer

to the Schedule of Investments for portfolio composition. |

Security

Transactions and Related Income

Security

transactions are accounted for on trade date basis. Interest income is recognized on an accrual basis. Discounts are accreted and premiums

are amortized on securities purchased over the lives of the respective securities. Dividend income is recorded on the ex-dividend date.

Realized gains or losses from sales of securities are determined by comparing the identified cost of the security lot sold with the net

sales proceeds.

Dividends

and Distributions to Shareholders

Ordinarily,

dividends from net investment income, if any, are declared and paid annually by the Fund. The Fund distributes its net realized capital

gains, if any, to shareholders annually. Dividends from net investment income and distributions from net realized gains are recorded

on ex-dividend date and determined in accordance with federal income tax regulations, which may differ from GAAP. These “book/tax”

differences are considered either temporary (i.e., deferred losses, capital loss carry forwards) or permanent in nature. To the extent

these differences are permanent in nature, such amounts are reclassified within the composition of net assets based on their federal

tax-basis treatment; temporary differences do not require reclassification.

Cash

The

Fund considers its investments in an FDIC (“Federal Deposit Insurance Corporation”) insured interest bearing savings account

to be cash. The Fund maintains cash balances, which, at times, may exceed federally insured limits. The Fund maintains these balances

with a high-quality financial institution.

Federal

Income Taxes

The

Fund intends to continue to comply with the requirements of the Internal Revenue Code applicable to regulated investment companies and

to distribute all of its taxable income to its shareholders. Therefore, no provision for federal income tax is required. The Fund recognizes

the tax benefits of uncertain tax positions only where the position is “more likely than not” to be sustained assuming examination

by tax authorities. Management has analyzed the Fund’s tax positions and has concluded that no liability for unrecognized tax benefits

should be

THOR

Low Volatility ETF

NOTES TO FINANCIAL STATEMENTS (Continued)

August 31, 2023

recorded

related to uncertain tax positions expected to be taken in the Fund’s August 31, 2023 tax return. The Fund identified its major

tax jurisdictions as U.S. Federal, Delaware, Pennsylvania and foreign jurisdictions where the Fund makes significant investments. The

Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expenses in the Statement of Operations.

The Fund is not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will

change materially in the next twelve months.

Trustee

Fees

For

the period ended August 31, 2023, the Trustees were paid $15,000.

Indemnification

The

Trust indemnifies its officers and trustees for certain liabilities that may arise from the performance of their duties to the Fund and

Trust. Additionally, in the normal course of business, the Fund enters into contracts that contain a variety of representations and warranties

which provide general indemnities. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future

claims that may be made against the Fund that have not yet occurred. However, the Fund expects the risk of loss due to these warranties

and indemnities to be remote.

| (3) | INVESTMENT

TRANSACTIONS |

For

the period ended August 31, 2023, cost of purchases and proceeds from sales of portfolio securities (excluding in-kind transactions and

short-term investments) for the Fund amounted to $378,511,308 and $375,447,294, respectively. For the period ended August 31, 2023, cost

of purchases and proceeds from sales of portfolio securities for in-kind transactions, amounted to $138,963,326 and $44,547,742, respectively.

| (4) | INVESTMENT

MANAGEMENT AGREEMENT AND TRANSACTIONS WITH RELATED PARTIES |

THOR

Trading Advisors, LLC, d/b/a THOR Financial Technologies, LLC serves as the Fund’s investment adviser (the “Adviser”).

Pursuant to an Investment Management Agreement with the Fund, the Adviser, under the oversight of the Board, directs the daily investment

operations of the Fund and supervises the performance of administrative and professional services provided by others. The Adviser pays

all ordinary operating expenses of the Fund. As compensation for its services, the Fund pays to the Adviser a unitary management fee

(computed daily and paid monthly) at an annual rate of 0.55% of its average daily net assets. The Fund will pay all (i) brokerage expenses

and other fees, charges, taxes, levies or expenses (such as stamp taxes) incurred in connection with the execution of portfolio transactions

or in connection with creation and redemption transactions (including without limitation any fees, charges, taxes, levies or expenses

related to the purchase or sale of an amount of any currency, or the patriation or repatriation of any security or other asset, related

to the execution of portfolio transactions or any creation or redemption transactions); (ii) legal fees or expenses in connection with

any arbitration, litigation or pending or threatened arbitration or litigation, including any settlements in connection therewith; (iii)

extraordinary expenses (in each case as determined by a majority of the Independent Trustees, as defined under the 1940 Act); (iv) distribution

fees and expenses paid by the Trust under any distribution plan adopted pursuant to Rule 12b-1 under the 1940 Act; (v) interest and taxes

of any kind or nature (including, but not limited to, income, excise, transfer and withholding taxes); (vi) fees and expenses related

to the provision of securities lending services; and (vii) the advisory fee payable to the Adviser. For the period ended August 31, 2023,

the Fund paid advisory fees of $475,584.

The

Trust, with respect to the Fund, has adopted a distribution and service plan (“Plan”) pursuant to Rule 12b-1 under the 1940

Act. Under the Plan, the Fund is authorized to pay distribution fees to Northern Lights Distributors, LLC (the “Distributor”

or “NLD”) and other firms that provide distribution and shareholder services (“Service Providers”). If a Service

Provider provides these services, the Fund may pay fees at an annual rate not to exceed

THOR

Low Volatility ETF

NOTES TO FINANCIAL STATEMENTS (Continued)

August 31, 2023

0.25%

of average daily net assets, pursuant to Rule 12b-1 under the 1940 Act.

No

distribution or service fees are currently paid by the Fund and there are no current plans to impose these fees.

In

the event Rule 12b-1 fees were charged, over time they would increase the cost of an investment in the Fund.

In

addition, certain affiliates of the Distributor provide services to the Fund as follows:

Ultimus

Fund Solutions, LLC (“Ultimus”) – Ultimus, an affiliate of the Distributor, provides administration and fund accounting

services to the Fund. Pursuant to a separate servicing agreement with Ultimus, the Adviser pays Ultimus customary fees for providing

administration and fund accounting services to the Fund. Certain officers of the Trust are also officers of Ultimus and are not paid

any fees directly by the Adviser for serving in such capacities.

BluGiant,

LLC (“BluGiant”), BluGiant, an affiliate of UFS and the Distributor, provides EDGAR conversion and filing services as well

as print management services for the Fund on an ad-hoc basis. For the provision of these services, BluGiant receives customary fees from

the Fund.

| (5) | DISTRIBUTIONS

TO SHAREHOLDERS AND TAX COMPONENTS OF CAPITAL |

The

Statement of Assets and Liabilities represents cost for financial reporting purposes. Aggregate cost for federal tax purposes is $96,347,698

for the Fund, and differs from market value by net unrealized appreciation (depreciation) which consisted of:

| Gross unrealized appreciation: | |

$ | 2,259,061 | |

| Gross unrealized depreciation: | |

| (713,282 | ) |

| Net unrealized appreciation: | |

$ | 1,545,779 | |

The

tax character of fund distributions paid for the period ended August 31, 2023, was as follows:

| | |

Fiscal Period Ended | |

| | |

August 31, 2023 | |

| Ordinary Income | |

$ | 545,292 | |

| Long-Term Capital Gain | |

| — | |

| Return of Capital | |

| — | |

| | |

$ | 545,292 | |

As

of August 31, 2023, the components of accumulated earnings/(deficit) on a tax basis were as follows:

| Undistributed | | |

Undistributed | | |

Post October Loss | | |

Capital Loss | | |

Other | | |

Unrealized | | |

Total | |

| Ordinary | | |

Long-Term | | |

and | | |

Carry | | |

Book/Tax | | |

Appreciation/ | | |

Accumulated Earnings/ | |

| Income | | |

Gains | | |

Late Year Loss | | |

Forwards | | |

Differences | | |

(Depreciation) | | |

(Losses) | |

| $ | 506,762 | | |

$ | — | | |

$ | (2,489,138 | ) | |

$ | (418,869 | ) | |

$ | — | | |

$ | 1,545,779 | | |

$ | (855,466 | ) |

The

difference between book basis and tax basis undistributed net investment income/(loss), accumulated net realized gain/(loss), and unrealized

appreciation/(depreciation) from investments is primarily attributable to the tax deferral of losses on wash sales.

THOR

Low Volatility ETF

NOTES TO FINANCIAL STATEMENTS (Continued)

August 31, 2023

Capital

losses incurred after October 31 within the fiscal year are deemed to arise on the first business day of the following fiscal year for

tax purposes. The Fund incurred and elected to defer such capital losses of $2,489,138.

At

August 31, 2023, the Fund had capital loss carry forwards (“CLCF’) for federal income tax purposes available to offset future

capital gains, as follows:

| Short-Term | | |

Long-Term | | |

Total | | |

CLCF Utilized | |

| $ | 418,869 | | |

$ | — | | |

$ | 418,869 | | |

$ | — | |

Permanent

book and tax differences, primarily attributable to tax adjustments for realized gain (loss) on in-kind redemptions resulted in reclassification

for the period ended August 31, 2023, as follows:

| Paid | | |

| |

| In | | |

Accumulated | |

| Capital | | |

Loss | |

| $ | 1,776,108 | | |

$ | (1,776,108 | ) |

| (6) | CAPITAL

SHARE TRANSACTIONS |

Shares

are not individually redeemable and may be redeemed by the Fund at NAV only in large blocks known as “Creation Units.” Shares

are created and redeemed by the Fund only in Creation Unit size aggregations of 25,000 shares. For purposes of GAAP, in-kind redemption

transactions are treated as a sale of securities and any resulting gains and losses are recognized based on the market value of the securities

on the date of the transfer. Only Authorized Participants or transactions done through an Authorized Participant are permitted to purchase

or redeem Creation Units from the Fund. An Authorized Participant is either (i) a broker-dealer or other participant in the clearing

process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a Depository Trust Company

(“DTC”) participant and, in each case, must have executed a Participant Agreement with the Distributor. Such transactions are

generally permitted on an in-kind basis, with a balancing cash component to equate the transaction to the NAV per share of the Fund on

the transaction date. Cash may be substituted equivalent to the value of certain securities generally when they are not available in

sufficient quantity for delivery, not eligible for trading by the Authorized Participant or as a result of other market circumstances.

In addition, the Fund may impose transaction fees on purchases and redemptions of Fund shares to cover the custodial and other costs

incurred by the Fund in effecting trades. A fixed fee payable to the custodian may be imposed on each creation and redemption transaction

regardless of the number of Creation Units involved in the transaction (“Fixed Fee”). Purchases and redemptions of Creation

Units for cash or involving cash-in-lieu are required to pay an additional variable charge to compensate the Fund and its ongoing shareholders

for brokerage and market impact expenses relating to Creation Unit transactions (“Variable Charge,” and together with the Fixed

Fee, the “Transaction Fees”). Transactions in capital shares for the Fund are disclosed in the Statement of Changes in Net

Assets.

The

Transaction Fees for the Fund are listed in the table below:

| Fee

for In-Kind and Cash Purchases |

Maximum

Additional Variable Charge for |

| |

Cash

Purchases* |

| $200 |

2.00% |

| * | The

maximum Transaction Fee may be up to 2.00% of the amount invested. |

THOR

Low Volatility ETF

NOTES TO FINANCIAL STATEMENTS (Continued)

August 31, 2023

| (7) | PRINCIPAL

INVESTMENT RISKS |

The

Fund’s investments in securities, financial instruments and derivatives expose it to various risks, certain of which are discussed

below. Please refer to the Fund’s prospectus and statement of additional information for further information regarding the risks

associated with the Fund’s investments which include, but are not limited to: models and data risk, allocation risk, authorized

participant risk, ETF structure risks, index calculation agent risk, index tracking risk, new/smaller fun risk, large capitalization

stock risk, passive investment risk, portfolio turnover risk, securities market risk, and underlying funds risk.

Models

and Data Risk. The Fund’s index relies heavily on a proprietary algorithm as well as data and information supplied by third

parties that are utilized by such model. To the extent the algorithm does not perform as designed or as intended, including accurately

measuring historic price trends and volatility, the Fund’s strategy may not be successfully implemented and the Fund may lose value.

Allocation

Risk. The risk that if the Fund’s strategy for allocating assets among different sectors does not work as intended, the Fund

may not achieve its objective or may underperform other funds with the same or similar investment strategy.

Authorized

Participant Risk. Only an Authorized Participant (“AP”) may engage in creation or redemption transactions directly with

the Fund. The Fund has a limited number of institutions that may act as APs on an agency basis (i.e., on behalf of other market participants).

To the extent that APs exit the business or are unable to proceed with creation or redemption orders with respect to the Fund and no

other AP is able to step forward to create or redeem Creation Units, Fund shares may be more likely to trade at a premium or discount

to net asset value and possibly face trading halts or delisting. AP concentration risk may be heightened for exchange-traded funds (“ETFs”)

that invest in non-U.S. securities or other securities or instruments that have lower trading volumes.

ETF

Structure Risks. The Fund is structured as an ETF and is subject to special risks, including:

| o | Not

Individually Redeemable. Shares of the Fund (“Shares”) are not individually redeemable and may be redeemed by the Fund

at NAV only in large blocks known as “Creation Units.” You may incur brokerage costs purchasing enough Shares to constitute

a Creation Unit. |

| o | Trading

Issues. An active trading market for the Shares may not be developed or maintained. Trading in Shares on the exchange may be halted

due to market conditions or for reasons that, in the view of the exchange, make trading in Shares inadvisable, such as extraordinary

market volatility. There can be no assurance that Shares will continue to meet the listing requirements of the exchange. If the Shares

are traded outside a collateralized settlement system, the number of financial institutions that can act as authorized participants that

can post collateral on an agency basis is limited, which may limit the market for the Shares. |

| o | Market

Price Variance Risk. The market prices of Shares will fluctuate in response to changes in NAV and supply and demand for Shares and

will include a “bid-ask spread” charged by the exchange specialists, market makers or other participants that trade the particular

security. There may be times when the market price and the NAV vary significantly. This means that Shares may trade at a discount to

NAV. |

Index

Calculation Agent Risk. The Fund seeks to achieve returns that generally correspond, before fees and expenses, to the performance

of its index, as published by its Index Calculation Agent. There is no assurance that the Index Calculation Agent will compile the index

accurately, or that the index will be determined, composed or calculated accurately. While the Adviser gives descriptions of what the

index is designed to achieve, the Index Calculation Agent does not provide any warranty or accept any liability in relation to the quality,

accuracy or completeness of data in the index, and does not guarantee that its index will be in line with its methodology.

THOR

Low Volatility ETF

NOTES TO FINANCIAL STATEMENTS (Continued)

August 31, 2023

Index

Tracking Risk. The Fund’s return may not match or achieve a high degree of correlation with the return of the Index.

Smaller

Fund Risk. A smaller fund is subject to the risk that its performance may not represent how the fund is expected to or may perform

in the long term. In addition, smaller funds may not attract sufficient assets to achieve investment and trading efficiencies. There

can be no assurance that the Fund will achieve an economically viable size, in which case it could ultimately liquidate. In a liquidation,

shareholders of the Fund will receive an amount equal to the Fund’s NAV, after deducting the costs of liquidation. Receipt of a

liquidation distribution may have negative tax consequences for shareholders.

Large

Capitalization Stock Risk. The Fund may invest in large capitalization companies. The securities of such companies may underperform

other segments of the market because such companies may be less responsive to competitive challenges and opportunities and may be unable

to attain high growth rates during periods of economic expansion.

Passive

Investment Risk. The Fund is not actively managed and, therefore, the Fund would not sell a security due to current or projected

underperformance of the security, industry, or sector unless that security is removed from the Index or selling the security is otherwise

required upon a rebalancing of the Index.

Portfolio

Turnover Risk. The Fund may buy and sell investments frequently if the Index constituents change. Such a strategy often involves

higher transaction costs, including brokerage commissions, and may increase the amount of capital gains (in particular, short term gains)

realized by the Fund. Shareholders may pay tax on such capital gains.

Securities

Market Risk. The value of securities owned by the Fund may go up or down, sometimes rapidly or unpredictably, due to factors affecting

particular companies or the securities markets generally. A general downturn in the securities market may cause multiple asset classes

to decline in value simultaneously.

Underlying

Funds Risk. Other investment companies, such as ETFs, in which the Fund invests are subject to investment advisory and other expenses,

which will be indirectly paid by the Fund. As a result, the cost of investing in the Fund is higher than the cost of investing directly

in the Underlying Funds and may be higher than other funds that invest directly in stocks and bonds. Through its investments in Underlying

Funds, the Fund is subject to the risks associated with the Underlying Funds’ investments. The U.S. money market funds in which

the Fund invests seek to maintain a stable NAV, but money market funds are subject to credit, market and other risks, and are not guaranteed.

| (8) | RECENT REGULATORY UPDATES |

On January 24, 2023, the SEC adopted rule and form amendments to require mutual funds and ETFs to transmit concise and visually engaging streamlined annual and semiannual reports to shareholders that highlight key information. Other information, including financial statements, will not appear in a streamlined shareholder report but must be available online, delivered free of charge upon request, and filed on a semiannual basis on Form N-CSR. The rule and form amendments have a compliance date of July 24, 2024. At this time, management is evaluating the impact of these amendments on the shareholder reports for the Fund.

Subsequent

events after the Statement of Assets and Liabilities date have been evaluated through the date the financial statements were issued.

Management has determined that no events or transactions occurred requiring adjustment or disclosure in the financial statements.

REPORT

OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To

the Shareholders of THOR Low Volatility ETF and

Board

of Trustees of THOR Financial Technologies Trust

Opinion

on the Financial Statements

We

have audited the accompanying statement of assets and liabilities, including the schedule of investments, of THOR Low Volatility ETF

(the “Fund”), a series of THOR Financial Technologies Trust, as of August 31, 2023, and the related statements of operations

and changes in net assets, the related notes, and the financial highlights for the period from September 12, 2022 (commencement of operations)

through August 31, 2023 (collectively referred to as the “financial statements”). In our opinion, the financial statements

present fairly, in all material respects, the financial position of the Fund as of August 31, 2023, the results of its operations, the

changes in net assets, and the financial highlights for the period from September 12, 2022 (commencement of operations) through August

31, 2023, in conformity with accounting principles generally accepted in the United States of America.

Basis

for Opinion

These

financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s

financial statements based on our audit. We are a public accounting firm registered with the Public Company Accounting Oversight Board

(United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities

laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We

conducted our audit in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain

reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our

audit included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or

fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding

the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of August 31, 2023,

by correspondence with the custodian. Our audit also included evaluating the accounting principles used and significant estimates made

by management, as well as evaluating the overall presentation of the financial statements. We believe that our audit provides a reasonable

basis for our opinion.

We

have served as the Fund’s auditor since 2023.

COHEN

& COMPANY, LTD.

Philadelphia,

Pennsylvania

October

25, 2023

COHEN

& COMPANY, LTD.

800.229.1099

| 866.818.4538

fax

| cohencpa.com

Registered

with the Public Company Accounting Oversight Board

THOR

Low Volatility ETF

EXPENSE EXAMPLE (Unaudited)

August 31, 2023

As

a shareholder of the Fund, you incur two types of costs: (1) transaction costs for purchasing and selling shares, including brokerage

commissions on purchases and sales of Fund shares (which are not reflected in the example below); and (2) ongoing costs, including management

fees and other fund expenses. This example is intended to help you understand your ongoing costs (in dollars) of investing in the Fund

and to compare these costs with the ongoing costs of investing in other mutual funds.

The

Example is based on an investment of $1,000 invested at the beginning of the period and held for the entire period from March 1, 2023

to August 31, 2023 (the ’‘period’’).

Actual

Expenses

The

first table below provides information about actual account values and actual expenses. You may use the information in this line, together

with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for

example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading

entitled ’‘Expenses Paid During the Period’’ to estimate the expenses you paid on your account during this period.

Hypothetical

Example for Comparison Purposes

The

second table below provides information about hypothetical account values and hypothetical expenses based on the Fund’s actual expense

ratio and an assumed rate of return of 5% per year before expenses, which is not the Fund’s actual return. The hypothetical account

values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this

information to compare the ongoing costs of investing in the Fund and other funds. To do so, compare this 5% hypothetical example with

the 5% hypothetical examples that appear in the shareholder reports of the other funds. Please note that the expenses shown in the table

are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as brokerage commissions on purchases

or sales of Fund shares. Therefore, the second table is useful in comparing ongoing costs only and will not help you determine the relative

total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

| |

Beginning |

Ending |

Expenses

Paid |

Expense

Ratio During |

| |

Account

Value |

Account

Value |

During

Period |

the

Period |

| Actual |

3/1/23 |

8/31/23 |

3/1/23–8/31/23* |

3/1/23

– 8/31/23 |

| |

$1,000.00 |

$1,019.30 |

$2.80 |

0.55% |

| |

|

|

|

|

| |

Beginning |

Ending |

Expenses

Paid |

Expense

Ratio During |

| Hypothetical |

Account

Value |

Account

Value |

During

Period |

the

Period |

| (5%

return before expenses) |

3/1/23 |

8/31/23 |

3/1/23

– 8/31/23* |

3/1/23

– 8/31/23 |

| |

$1,000.00 |

$1,022.43 |

$2.80 |

0.55% |

| * | Expenses

are equal to the average account value over the period, multiplied by the Fund’s annualized expense ratio, multiplied by the number

of days in the period (184) divided by the number in the fiscal year (365). |

THOR

Low Volatility ETF

CHANGE IN INDEPENDENT REGISTERED PUBLIC ACCOUNTANT (Unaudited)

August 31, 2023

Change

in Independent Registered Public Accounting Firm

On

April 26, 2023, BBD, LLP (“BBD”) ceased to serve as the independent registered public accounting firm of THOR Low Volatility

ETF. The Audit Committee of the Board of Trustees approved the replacement of BBD as a result of Cohen & Company, Ltd.’s (“Cohen”)

acquisition of BBD’s investment management group.

The

report of BBD on the financial statements of the Fund for the period ended on August 31, 2023, did not contain an adverse opinion or

a disclaimer of opinion, and were not qualified or modified as to uncertainties, audit scope or accounting principles. During the period

ended August 31, 2023: (i) there were no disagreements between the registrant and BBD on any matter of accounting principles or practices,

financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of BBD, would

have caused it to make reference to the subject matter of the disagreements in its report on the financial statements of the Fund for

the period; and (ii) there were no “reportable events,” as defined in Item 304(a)(1)(v) of Regulation S-K under the Securities

Exchange Act of 1934, as amended.

The

registrant requested that BBD furnish it with a letter addressed to the U.S. Securities and Exchange Commission stating that it agrees

with the above statements. A copy of such letter is filed as an exhibit to Form N-CSR.

On

April 26, 2023, the Audit Committee of the Board of Trustees also recommended and approved the appointment of Cohen as the Fund’s

independent registered public accounting firm for the period ended August 31, 2023.

For

the period the ended August 31, 2023, neither the registrant, nor anyone acting on its behalf, consulted with Cohen on behalf of the

Fund regarding the application of accounting principles to a specified transaction (either completed or proposed), the type of audit

opinion that might be rendered on the Fund’s financial statements, or any matter that was either: (i) the subject of a “disagreement,”

as defined in Item 304(a)(1)(iv) of Regulation S-K and the instructions thereto; or (ii) “reportable events,” as defined in

Item 304(a)(1)(v) of Regulation S-K.

THOR

Low Volatility ETF

ADDITIONAL INFORMATION (Unaudited)

August 31, 2023

LIQUIDITY

RISK MANAGEMENT PROGRAM

The

Fund has adopted and implemented a written liquidity risk management program as required by Rule 22e-4 (the “Liquidity Rule”)

under the 1940 Act. The program is reasonably designed to assess and manage the Fund’s liquidity risk, taking into consideration,

among other factors, the Fund’s investment strategy and the liquidity of its portfolio investments during normal and reasonably

foreseeable stressed conditions; its short and long-term cash flow projections; and its cash holdings and access to other funding sources.

During

the period ended August 31, 2023, the Trust’s Liquidity Risk Management Program Committee (the “Committee”) reviewed the

Fund’s investments and determined that the Fund held adequate levels of cash and highly liquid investments to meet shareholder redemption

activities in accordance with applicable requirements. Accordingly, the Committee concluded that (i) the Fund’s liquidity risk management

program is reasonably designed to prevent violations of the Liquidity Rule and (ii) the Fund’s liquidity risk management program

has been effectively implemented.

THOR

Low Volatility ETF

SUPPLEMENTAL INFORMATION (Unaudited) (Continued)

August 31, 2023

The

business address of each Trustee and Officer is 327 W. Pittsburgh Street, Greensburg, PA 15601. All correspondence to the Trustees and

Officers should be directed to c/o Ultimus Fund Solutions, LLC, P.O. Box 225 Pictoria Drive, Suite 450, Cincinnati, Ohio 45246.

Interested

Trustees and Officers

Name

and Year

of Birth |

Position/Term

of Office* |

Principal

Occupation During the Past

Five Years |

Number

of

Funds in

Fund

Complex**

Overseen by

Trustee |

Other

Directorships held

by Trustee During the Past

Five Years |

Akhil

Lodha,

1985 |

Trustee,

since

June 2022 |

CEO

of StratiFi since January 2016, a financial technology company empowering investment advisors to enlighten clients about risk to

differentiate themselves, get better insights to build robust portfolios, and monitor accounts automatically to reduce business risk. |

1 |

None |

Rasheed

Hammouda,

1991 |

Trustee,

since

June 2022 |

Head

of product of Alternativ since April 2022, a marketplace and investment platform for wealth managers to allocate and manage private

investments; Co-founder and CEO of Bridge Financial Technology, a portfolio management software and data infrastructure provider

for wealth manager, enterprises and FinTechs from 2015 to 2022. |

1 |

None |

John

Cooper,

1960 |

Trustee,

since

June 2022 |

Private

equity advisor and advisory board member of Alpha TrAI, an artificial intelligence hedge fund and platform since 2020 to present;

President, MSIM Distributors at Morgan Stanley Investment Management from 2017 to 2019. |

1 |

None |

THOR

Low Volatility ETF

SUPPLEMENTAL INFORMATION (Unaudited) (Continued)

August 31, 2023

Name

and Year of

Birth |

Position/Term

of Office* |

Principal

Occupation During the Past

Five Years |

Number

of

Funds in Fund

Complex**

Overseen by

Trustee |

Other

Directorships held by

Trustee During the Past

Five Years |

Bradley

Roth,

1988 |

Trustee

since April 2022, President and Chief Executive Officer since June 2022 |

Managing

Member and CIO of THOR Financial Technologies, LLC since September 2019; Owner and Licensed Insurance Agent of McDowell Associates

since January 2014. |

1 |

None |

Alexander

Woodcock,

1989 |

Chief

Compliance Officer, since June 2022 |

Director

of Pine Advisor Solutions since 2022; Vice President of Compliance Services, SS&C ALPS from 2019 to 2022; Manager of Global Operations

Oversight, Oppenheimer Funds from 2014 to 2019. |

1 |

None |

Kyle

Wiggs,

1980 |

Secretary,

Treasurer and Chief Financial Officer, since June 2022 |

Managing

member/investment adviser representative of UX Wealth Partners, LLC since 2020; Managing Member of THOR Financial Technology, LLC

since 2019; Managing Member of Exact Strategies, LLC, 2017– 2021. |

1 |

None |

| * | The

term of office for each Trustee and officer listed above will continue indefinitely until the individual resigns or is removed. |

| ** | As

of August 31, 2023, the Trust was comprised of 1 active portfolio managed by unaffiliated investment advisers. The term “Fund Complex”

applies only to the Fund in the Trust advised by the Fund’s Adviser. The Fund does not hold themselves out as related to any other

series within the Trust that is not advised by the Fund’s Adviser. |

The

Fund’s SAI includes additional information about the Trustees and is available free of charge, upon request, by calling toll-free

at 1-800-974-6964.

PRIVACY

NOTICE

THOR FINANCIAL TECHNOLOGIES TRUST

Rev. April 2022

| FACTS |

WHAT DOES THE TRUST DO WITH YOUR PERSONAL

INFORMATION? |

| Why? |

Financial

companies choose how they share your personal information. Federal law gives consumers the right to limit some,

but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal

information. Please read this notice carefully to understand what we do. |

| What? |

The

types of personal information we collect and share depends on the product or service

that you have with us. This information can include:

●

Social Security number and wire transfer instructions

●

account transactions and transaction history

●

investment experience and purchase history

When

you are no longer our customer, we continue to share your information as described in this notice. |

| How? |

All

financial companies need to share customers’ personal information to run their everyday business. In the section below, we list

the reasons financial companies can share their customers’ personal information; the reasons the Trust chooses to share; and

whether you can limit this sharing. |

Reasons

we can share your personal

information: |

Does

the Trust

share information? |

Can

you limit

this sharing? |

| For

our everyday business purposes - such as to process your transactions, maintain your account(s), respond to court orders

and legal investigations, or report to credit bureaus. |

YES |

NO |

| For

our marketing purposes - to offer our products and services to you. |

NO |

We

don’t share |

| For

joint marketing with other financial companies. |

NO |

We

don’t share |

| For

our affiliates’ everyday business purposes - information about your transactions and records. |

NO |

We

don’t share |

| For

our affiliates’ everyday business purposes - information about your credit worthiness. |

NO |

We

don’t share |

| For

nonaffiliates to market to you |

NO |

We

don’t share |

| QUESTIONS? |

Call

1-800-974-6964 |

PRIVACY

NOTICE

THOR FINANCIAL TECHNOLOGIES TRUST

| What

we do: |

How

does the Trust protect my personal information? |

To

protect your personal information from unauthorized access and use, we use security measures

that comply with federal law. These measures include computer safeguards and secured

files and buildings.

Our

service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic

personal information. |

How does the Trust collect my personal information? |

We

collect your personal information, for example, when you

●

open an account or deposit money

●

direct us to buy securities or direct us to sell your securities

●

seek advice about your investments

We

also collect your personal information from others, such as credit bureaus, affiliates, or other companies. |

Why

can’t I limit all sharing? |

Federal

law gives you the right to limit only:

●

sharing for affiliates’ everyday business purposes – information about your

creditworthiness.

●

affiliates from using your information to market to you.

●

sharing for nonaffiliates to market to you.

State

laws and individual companies may give you additional rights to limit sharing. |

| Definitions |

| Affiliates |

Companies

related by common ownership or control. They can be financial and nonfinancial companies.

● The Trust has no affiliates.

|

| Nonaffiliates |

Companies

not related by common ownership or control. They can be financial and nonfinancial companies.

●

The Trust does not share with nonaffiliates so they can

market to you. |

| Joint

marketing |

A

formal agreement between nonaffiliated financial companies that together market financial

products or services to you.

●

The Trust does not jointly market. |

Proxy

Voting Policy

Information

regarding how the Fund votes proxies relating to portfolio securities for the twelve month period ended June 30th as well as a description

of the policies and procedures that the Fund used to determine how to vote proxies is available without charge, upon request, by calling

1-800-974-6964 or by referring to the Securities and Exchange Commission’s (“SEC”) website at http://www.sec.gov.

Portfolio

Holdings

Funds

file a complete schedule of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to its

reports on Form N-PORT, within sixty days after the end of the period. Form N-PORT reports are available at the SEC’s website at

www.sec.gov. The information on Form N-PORT is available without charge, upon request, by calling 1-800-974-6964.

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Adviser |

| THOR

Financial Technologies, LLC |

| 327

W. Pittsburgh Street |

| Greensburg,

PA 15601 |

| |

| Administrator |

| Ultimus

Fund Solutions, LLC |

| 225

Pictoria Drive, Suite 450 |

| Cincinnati,

OH 45246 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| THOR-AR23 |

Item 2. Code of Ethics.

(a) The registrant

has, as of the end of the period covered by this report, adopted a code of ethics that applies to the registrant's principal executive

officer, principal financial officer, and principal accounting officer or controller, or persons performing similar functions, regardless

of whether these individuals are employed by the registrant or a third party.

(b) During

the period covered by this report, there were no amendments to any provision of the code of ethics.

(c) During

the period covered by this report, there were no waivers or implicit waivers of a provision of the code of ethics.

Item 3. Audit Committee Financial Expert.

(a)(1)The registrant’s board of trustees has determined that Bradley

Roth is an audit committee financial expert, as defined in Item 3 of Form N-CSR. Mr. Roth is independent for purposes of this Item.

(a)(2) Not applicable.

(a)(3) Not applicable.

Item 4. Principal Accountant Fees and Services.

| (a) |

Audit Fees - The aggregate fees billed for the fiscal year for professional services rendered by the registrant's principal accountant for the audit of the registrant's annual financial statements or services that are normally provided by the accountant in connection with statutory and regulatory filings or engagements for the fiscal year are as follows: |

| Trust Series |

2023 |

|

| THOR Low Volatility ETF |

$11,000 |

|

| (b) |

Audit-Related Fees – There were no fees billed in the fiscal year for assurance and related services by the principal accountant that are reasonably related to the performance of the audit of the registrant’s financial statements and are not reported under paragraph (a) of this item. |

| (c) |

Tax Fees - The aggregate fees billed in the fiscal year for professional services rendered by the principal accountant for tax compliance, tax advice, and tax planning are as follows: |

| Trust Series |

2023 |

|

| THOR Low Volatility ETF |

$3,000 |

|

| (d) |

All Other Fees – The aggregate fees billed in the fiscal year for products and services provided by the registrant’s principal accountant, other than the services reported in paragraphs (a) through (c) of this item were $0 for the fiscal year ended August 31, 2023. |

| (e)(1) |

The audit committee does not have pre-approval policies and procedures. Instead, the audit committee or audit committee chairman approves on a case-by-case basis each audit or non-audit service before the principal accountant is engaged by the registrant. |

| (e)(2) |

There were no services described in each of paragraphs (b) through (d) of this Item that were approved by the audit committee pursuant to paragraph (c)(7)(i)(C) of Rule 2-01 of Regulation S-X. |

| (f) |

Not applicable. The percentage of hours expended on the principal accountant's engagement to audit the registrant's financial statements for the most recent fiscal year that were attributed to work performed by persons other than the principal accountant's full-time, permanent employees was zero percent (0%). |

| (g) |

All non-audit fees billed by the registrant's principal accountant for services rendered to the registrant for the fiscal year ended August 31, 2023 are disclosed in (b)-(d) above. There were no audit or non-audit services performed by the registrant's principal accountant for the registrant's adviser. |

(h) Not applicable.

(i) Not applicable.

(j) Not applicable.

Item 5. Audit Committee of Listed Companies. Not applicable to open-end

investment companies.

Item 6. Schedule of Investments. Schedule of investments in securities

of unaffiliated issuers is included under Item 1.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End

Management Investment Companies. Not applicable to open-end investment companies.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable to open-end investment companies.

Item 9. Purchases of Equity Securities by Closed-End Management Investment

Company and Affiliated Purchasers. Not applicable to open-end investment companies.

Item 10. Submission of Matters to a Vote of Security Holders. None