Textainer Closes Acquisition by Stonepeak and Announces Post-Acquisition Redemption of All Preference Shares and Related Depositary Shares

March 14 2024 - 8:59AM

Textainer Group Holdings Limited (NYSE: TGH; JSE: TXT)

(“

Textainer”), one of the world’s largest lessors

of intermodal containers, today announced that it completed the

previously announced acquisition of Textainer by investment

vehicles managed by Stonepeak.

All common shares of Textainer converted into the right to

receive $50.00 per share in cash. The per share consideration paid

to shareholders on the JSE will be in South African Rand at an

exchange rate of 18.98821 Rand for each USD 1.00. The common

shares, which trade on the New York Stock Exchange (the

“NYSE”) under the ticker symbol “TGH”, were

suspended from trading today prior to the open of market and will

be delisted from the NYSE within 10 days.

In addition, Textainer intends to file a certification on Form

15F with the SEC requesting the termination of registration of the

common shares under Section 12(g) of the Securities Exchange Act of

1934, as amended (the “Exchange Act”) and the

suspension of Textainer’s reporting obligations under Section 13 of

the Exchange Act with respect to the common shares.

Also on March 14, 2024, after the closing of the acquisition,

Textainer issued a notice of redemption for all its (i) 7.000%

Series A Cumulative Redeemable Perpetual Preference Shares (the

“Series A Preference Shares”) and the

corresponding redemption of each depositary share representing a

1/1000th interest in each such share, CUSIP 88314W204 (NYSE: TGH

PRA) (the “Series A Depositary Shares”), and (ii)

6.250% Series B Cumulative Redeemable Perpetual Preference Shares

(the “Series B Preference Shares” and,

collectively with the Series A Preference Shares, the

“Preference Shares”) and the corresponding

redemption of each depositary share representing a 1/1000th

interest in each such share, CUSIP 88314W303 (NYSE: TGH PRB) (the

“Series B Depositary Shares”).

The redemption date for the Preference Shares and corresponding

depositary shares will be April 15, 2024 (the “Redemption

Date”). The redemption price for (i) each Series A

Preference Shares will be $25,150.69 and (ii) each Series B

Preference Share will be $25,134.55 (representing, in each case,

$25,000 plus all accumulated and unpaid distributions to, but not

including, the Redemption Date, whether or not declared). The

corresponding depositary share redemption price will be (i) $25.15

per Series A Depositary Share and (ii) $25.13 per Series B

Depositary Share (representing, in each case, $25.00 plus all

accumulated and unpaid distributions to, but not including, the

Redemption Date, whether or not declared).

Regular quarterly dividends on the Preference Shares and

depositary shares are payable March 15, 2024, to each holder of

record on March 1, 2024. No dividends on the Preference Shares and

depositary shares will accrue on or after the Redemption Date, nor

will any interest accrue on amounts held to pay the redemption

price.

Following the redemption of the Preference Shares and depositary

shares, Textainer will request that the NYSE delist the depositary

shares.

In addition, Textainer intends to file a certification on Form

15F with the SEC requesting the termination of registration of the

Series A Preference Shares and the Series B Preference Shares under

Section 12(g) of the Exchange Act and the suspension of Textainer’s

reporting obligations under Section 13 of the Exchange Act with

respect to the Preference Shares.

About Textainer Group Holdings Limited

Textainer has operated since 1979 and is one of the world’s

largest lessors of intermodal containers with more than 4 million

TEU in our owned and managed fleet. We lease containers to

approximately 200 customers, including all of the world’s leading

international shipping lines, and other lessees. Our fleet consists

of standard dry freight, refrigerated intermodal containers, and

dry freight specials. We also lease tank containers through our

relationship with Trifleet Leasing and are a supplier of containers

to the U.S. Military. Textainer is one of the largest and most

reliable suppliers of new and used containers. In addition to

selling older containers from our fleet, we buy older containers

from our shipping line customers for trading and resale and we are

one of the largest sellers of used containers. Textainer operates

via a network of 14 offices and approximately 400 independent

depots worldwide. Visit www.textainer.com for additional

information about Textainer.

Cautionary Statement Regarding Forward-Looking

Statements

Certain statements in this press release may constitute

“forward-looking statements.” Actual results could differ

materially from those projected or forecast in the forward-looking

statements. The factors that could cause actual results to differ

materially include the following: the effects of industry, market,

business, economic, political or regulatory conditions; decreases

in the demand for leased containers; decreases in market leasing

rates for containers; difficulties in re-leasing containers after

their initial fixed-term leases; customers’ decisions to buy rather

than lease containers; increases in the cost of repairing and

storing Textainer’s off-hire containers; Textainer’s dependence on

a limited number of customers and suppliers; customer defaults;

decreases in the selling prices of used containers; the impact of

COVID-19 or future global pandemics on Textainer’s business and

financial results; risks resulting from the political and economic

policies of the United States and other countries, particularly

China, including but not limited to, the impact of trade wars,

duties, tariffs or geo-political conflict; risks stemming from the

international nature of Textainer’s business, including global and

regional economic conditions, including inflation and attempts to

control inflation, and geopolitical risks such as the ongoing war

in Ukraine and activities in Israel; extensive competition in the

container leasing industry and developments thereto; decreases in

demand for international trade; disruption to Textainer’s

operations from failures of, or attacks on, Textainer’s information

technology systems; disruption to Textainer’s operations as a

result of natural disasters; compliance with laws and regulations

related to economic and trade sanctions, security, anti-terrorism,

environmental protection and anti-corruption; the availability and

cost of capital; restrictions imposed by the terms of Textainer’s

debt agreements; and changes in tax laws in Bermuda, the United

States and other countries.

You should carefully consider the foregoing factors and the

other risks and uncertainties that affect Textainer’s business

described in the “Risk Factors” and “Information Regarding

Forward-Looking Statements; Cautionary Language” sections of its

Annual Report on Form 20-F and other documents filed from time to

time with the U.S. Securities and Exchange Commission (the

“SEC”), all of which are available at www.sec.gov.

These filings identify and address other important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking statements.

Forward-looking statements speak only as of the date they are made.

Readers are cautioned not to put undue reliance on forward-looking

statements, and Textainer assumes no obligation to, and does not

intend to, update or revise these forward-looking statements,

whether as a result of new information, future events, or

otherwise, unless required by law. Textainer does not give any

assurance that it will achieve expectations.

Contacts

TextainerInvestor Relations+1

415-658-8333ir@textainer.com

Textainer (NYSE:TGH)

Historical Stock Chart

From Nov 2024 to Dec 2024

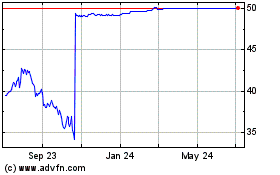

Textainer (NYSE:TGH)

Historical Stock Chart

From Dec 2023 to Dec 2024