Teladoc Health, Inc. (NYSE: TDOC), the global leader in

whole-person virtual care, today reported financial results for the

three months ended June 30, 2024 (“Second Quarter 2024”).

Unless otherwise noted, percentage and other changes are relative

to the three months ended June 30, 2023 (“Second Quarter

2023”).

Financial and Operational Highlights for

Second Quarter 2024

- Second

Quarter 2024 revenue of $642.4 million, down 2% year-over-year

- Second

Quarter 2024 net loss of $837.7 million, or $4.92 per share,

including a goodwill impairment charge of $790.0 million, or $4.64

per share

- Second

Quarter 2024 adjusted EBITDA of $89.5 million, up 24%

year-over-year

-

Integrated Care segment revenue of $377.4 million, up 5%

year-over-year and adjusted EBITDA margin of 17.0%

-

BetterHelp segment revenue of $265.0 million, down 9%

year-over-year and adjusted EBITDA margin of 9.6%

“I am excited to have joined Teladoc Health and for

the opportunity to lead the company going forward, building on our

strengths while driving higher levels of performance. Our scaled

position, core capabilities, and talented employees position us

well in this regard,” said Chuck Divita, Chief Executive Officer of

Teladoc Health.

“I also see opportunities to strengthen execution

and to streamline the organization to ensure we are delivering for

our customers and stakeholders. While we achieved solid performance

in the Integrated Care segment, continued headwinds in the

BetterHelp segment impacted overall results. We are focused on

addressing the work ahead of us with urgency to unlock greater

value across the company over time,” Divita added.

|

Key Financial Data |

|

|

|

|

|

|

|

|

|

|

|

|

($ in thousands, except per share data, unaudited) |

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

|

|

Six Months Ended |

|

|

| |

June 30, |

|

|

|

June 30, |

|

|

| |

|

2024 |

|

|

|

2023 |

|

|

Change |

|

|

2024 |

|

|

|

2023 |

|

|

Change |

|

Revenue |

$ |

642,444 |

|

|

$ |

652,406 |

|

|

|

(2 |

)% |

|

$ |

1,288,575 |

|

|

$ |

1,281,650 |

|

|

|

1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

$ |

(837,671 |

) |

|

$ |

(65,177 |

) |

|

N/M |

|

$ |

(919,560 |

) |

|

$ |

(134,405 |

) |

|

N/M |

|

Net loss per share, basic and diluted |

$ |

(4.92 |

) |

|

$ |

(0.40 |

) |

|

N/M |

|

$ |

(5.44 |

) |

|

$ |

(0.82 |

) |

|

N/M |

| |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA (1) |

$ |

89,481 |

|

|

$ |

72,155 |

|

|

|

24 |

% |

|

$ |

152,621 |

|

|

$ |

124,920 |

|

|

|

22 |

% |

See note (1) in the Notes section that follows.N/M

– not meaningful

Second Quarter 2024

Revenue decreased 2% to $642.4

million from $652.4 million in Second Quarter 2023. Access fees

revenue decreased 3% to $559.6 million and other revenue grew 8% to

$82.8 million. U.S. revenue decreased 4% to $540.8 million and

International revenue grew 12% to $101.6 million.

Teladoc Health Integrated Care ("Integrated Care")

segment revenue increased 5% to $377.4 million in Second Quarter

2024 and BetterHelp segment revenue decreased 9% to $265.0

million.

Non-cash goodwill impairment

charge of $790.0 million was recorded in Second Quarter

2024 and was attributable to changes in estimates of future cash

flows related to the company’s BetterHelp segment. The non-cash

charge had no impact on the provision for income taxes.

Net loss totaled

$837.7 million, or $4.92 per share, for Second Quarter 2024,

compared to $65.2 million, or $0.40 per share, for Second

Quarter 2023. Results for Second Quarter 2024 included a non-cash

goodwill impairment charge of $790.0 million, or $4.64 per share,

stock-based compensation expense of $42.1 million, or $0.25

per share, and amortization of acquired intangibles of

$64.1 million, or $0.38 per share. The amortization of

acquired intangibles increased over the prior year period

reflecting a change in the useful lives of certain intangibles in

the third quarter of 2023. Net loss for Second Quarter 2024 also

included $1.5 million, or $0.01 per share, of restructuring costs,

primarily related to severance payments.

Results for Second Quarter 2023 primarily included

stock-based compensation expense of $55.7 million, or $0.34

per share, and amortization of acquired intangibles of

$52.8 million, or $0.32 per share. Net loss for Second Quarter

2023 also included $7.5 million, or $0.05 per share, of

restructuring costs related to the abandonment of certain excess

leased office space.

Adjusted EBITDA(1) increased 24%

to $89.5 million, compared to $72.2 million for Second Quarter

2023. Integrated Care segment adjusted EBITDA increased 69% to

$64.0 million in Second Quarter 2024 and BetterHelp segment

adjusted EBITDA decreased 26% to $25.5 million in Second Quarter

2024.

GAAP gross margin, which includes

amortization of intangible assets and depreciation of property and

equipment, was 66.7% for Second Quarter 2024, compared to 67.5% for

Second Quarter 2023.

Adjusted gross margin(1) was 70.7%

for Second Quarter 2024, compared to 70.8% for Second Quarter

2023.

Six Months Ended June 30,

2024

Revenue increased 1% to $1,288.6

million from $1,281.7 million in the first six months of 2023.

Access fees revenue decreased 1% to $1,116.8 million, and other

revenue grew 11% to $171.8 million. U.S. revenue decreased 1% to

$1,088.4 million, and International revenue grew 12% to $200.2

million for the first six months of 2024.

Revenue increased 6% to $754.5 million for the

Integrated Care segment in the first six months of 2024 and

decreased 7% to $534.0 million for the BetterHelp segment.

Non-cash goodwill impairment

charge of $790.0 million was recorded in the first six

months of 2024 and was attributable to changes in estimates of

future cash flows related to the company’s BetterHelp segment. The

non-cash charge had no impact on the provision for income

taxes.

Net loss totaled $919.6 million,

or $5.44 per share, for the first six months of 2024, compared to

$134.4 million, or $0.82 per share, for the first six months of

2023. Results for the first six months of 2024 included a non-cash

goodwill impairment charge of $790.0 million, or $4.68 per share,

stock-based compensation expense of $84.4 million, or $0.50 per

share, restructuring costs of $11.2 million, or $0.07 per share,

and amortization of acquired intangibles of $128.3 million, or

$0.76 per share.

Results for the first six months of 2023 primarily

included stock-based compensation expense of $101.8 million, or

$0.62 per share, and amortization of acquired intangibles of $103.0

million, or $0.63 per share. Net loss for the first six months of

2023 also included $15.6 million, or $0.10 per share, of

restructuring costs related to the abandonment of certain excess

leased office space.

Adjusted EBITDA(1) increased 22%

to $152.6 million, compared to $124.9 million for the first six

months of 2023. Integrated Care segment adjusted EBITDA increased

53% to $111.7 million in the first six months of 2024 and

BetterHelp segment adjusted EBITDA decreased 21% to $40.9 million

in the first six months of 2024.

GAAP gross margin, which includes

depreciation and amortization, was 66.2% for the first six months

of 2024, compared to 67.6% for the first six months of 2023.

Adjusted gross margin(1) was 70.3%

for the first six months of 2024, compared to 70.3% for the first

six months of 2023.

Capex and Cash Flow

Cash flow from operations was $88.7 million in

Second Quarter 2024, compared to $101.2 million in Second

Quarter 2023, and was $97.6 million in the first six months of

2024, compared to $114.3 million in the first six months of 2023.

Capitalized expenditures and capitalized software development costs

(together, “Capex”) were $27.7 million in Second Quarter 2024,

compared to $36.6 million in Second Quarter 2023, and were $63.3

million for the first six months of 2024, compared to $82.2 million

for the first six months of 2023. Free cash flow was

$60.9 million in Second Quarter 2024, compared to

$64.6 million in Second Quarter 2023, and was $34.3 million

for the first six months of 2024, compared to $32.1 million for the

first six months of 2023.

Financial Outlook

Teladoc Health is withdrawing the financial outlook

for the Full Year of 2024 for its Consolidated operations and its

BetterHelp segment that was last provided on April 25, 2024. It is

also withdrawing its three year outlook on its Consolidated

operations and its operating segments that had last been reaffirmed

on April 25, 2024.

The outlook provided for the Integrated Care

segment is based on current market conditions and expectations and

what we know today. Accordingly, we believe our outlook ranges

provide a reasonable baseline for future financial performance.

Integrated Care

|

For the third quarter of 2024, we expect |

|

|

Revenue growth percentage (year-over-year) |

(1)% - 2% |

|

Adjusted EBITDA margin |

14.5% - 16.0% |

|

U.S. Integrated Care Members (2) |

92.5 - 93.5 million |

| |

|

|

For the full year of 2024, we expect |

|

|

Revenue growth percentage (year-over-year) |

Low single digits to mid-single digits |

|

Adjusted EBITDA margin expansion (year-over-year) |

+150bps to +200bps |

|

U.S. Integrated Care Members (2) |

92.5 - 94.0 million |

Earnings Conference Call

The Second Quarter 2024 earnings conference call

and webcast will be held Wednesday, July 31, 2024 at 4:30 p.m.

E.T. The conference call can be accessed by dialing 1-833-470-1428

for U.S. participants and using the access code #453227. For

international participants, please visit the following link for

global dial-in numbers:

https://www.netroadshow.com/conferencing/global-numbers?confId=68682.

A live audio webcast will also be available online at

http://ir.teladoc.com/news-and-events/events-and-presentations/. A

replay of the call will be available via webcast for on-demand

listening shortly after the completion of the call, at the same web

link, and will remain available for approximately 90 days.

About Teladoc Health

Teladoc Health empowers all people everywhere to

live their healthiest lives by transforming the healthcare

experience. As the world leader in whole-person virtual care,

Teladoc Health uses proprietary health signals and personalized

interactions to drive better health outcomes across the full

continuum of care, at every stage in a person’s health journey.

Teladoc Health leverages more than two decades of expertise and

data-driven insights to meet the growing virtual care needs of

consumers and healthcare professionals. For more information,

please visit www.teladochealth.com.

Cautionary Note Regarding Forward-Looking

Statements

This press release contains “forward-looking

statements” within the meaning of the safe harbor provisions of the

U.S. Private Securities Litigation Reform Act of 1995.

Forward-looking statements can be identified by words such as:

“anticipate,” “intend,” “plan,” “believe,” “project,” “estimate,”

“expect,” “may,” “should,” “will” and similar references to future

periods. Examples of forward-looking statements include, among

others, statements we make regarding future financial or operating

results, future numbers of members, BetterHelp paying users or

clients, litigation outcomes, regulatory developments, market

developments, new products and growth strategies, and the effects

of any of the foregoing on our future results of operations or

financial condition.

Forward-looking statements are neither historical

facts nor assurances of future performance. Instead, they are based

only on our current beliefs, expectations and assumptions regarding

the future of our business, future plans and strategies,

projections, anticipated events and trends, the economy and other

future conditions. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and

changes in circumstances that are difficult to predict and many of

which are outside of our control. Our actual results and financial

condition may differ materially from those indicated in the

forward-looking statements. Important factors that could cause our

actual results and financial condition to differ materially from

those indicated in the forward-looking statements include, among

others, the following: (i) changes in laws and regulations

applicable to our business model; (ii) changes in market conditions

and receptivity to our services and offerings, including our

ability to effectively compete; (iii) results of litigation or

regulatory actions; (iv) the loss of one or more key clients or the

loss of a significant number of members or BetterHelp paying users;

(v) changes in valuations or useful lives of our assets; (vi)

changes to our abilities to recruit and retain qualified providers

into our network; (vii) the impact of and risk related to

impairment losses with respect to goodwill or other assets; and

(viii) the success of our operational review of the company to

achieve a more balanced approach to growth and margin. For a

detailed discussion of the risk factors that could affect our

actual results, please refer to the risk factors identified in our

SEC reports, including, but not limited to, our Annual Report on

Form 10-K and Quarterly Reports on Form 10-Q, as filed with the

SEC.

Any forward-looking statement made by us in this

press release is based only on information currently available to

us and speaks only as of the date on which it is made. We undertake

no obligation to publicly update any forward-looking statement,

whether written or oral, that may be made from time to time,

whether as a result of new information, future developments or

otherwise.

|

TELADOC HEALTH, INC.CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS(In thousands, except

share and per share data, unaudited) |

|

|

| |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenue |

$ |

642,444 |

|

|

$ |

652,406 |

|

|

$ |

1,288,575 |

|

|

$ |

1,281,650 |

|

|

Costs and expenses: |

|

|

|

|

|

|

|

|

Cost of revenue (exclusive of depreciation and amortization, which

are shown separately below) |

|

188,059 |

|

|

|

190,540 |

|

|

|

382,597 |

|

|

|

380,647 |

|

|

Advertising and marketing |

|

170,270 |

|

|

|

178,756 |

|

|

|

353,599 |

|

|

|

355,546 |

|

|

Sales |

|

50,438 |

|

|

|

53,530 |

|

|

|

104,802 |

|

|

|

108,020 |

|

|

Technology and development |

|

76,751 |

|

|

|

87,309 |

|

|

|

158,139 |

|

|

|

174,294 |

|

|

General and administrative |

|

109,552 |

|

|

|

125,841 |

|

|

|

221,249 |

|

|

|

239,986 |

|

|

Goodwill impairment |

|

790,000 |

|

|

|

— |

|

|

|

790,000 |

|

|

|

— |

|

|

Acquisition, integration, and transformation costs |

|

457 |

|

|

|

5,080 |

|

|

|

830 |

|

|

|

11,024 |

|

|

Restructuring costs |

|

1,500 |

|

|

|

7,530 |

|

|

|

11,173 |

|

|

|

15,632 |

|

|

Amortization of intangible assets |

|

94,862 |

|

|

|

72,511 |

|

|

|

189,919 |

|

|

|

139,371 |

|

|

Depreciation of property and equipment |

|

1,703 |

|

|

|

2,954 |

|

|

|

4,537 |

|

|

|

5,877 |

|

|

Total costs and expenses |

|

1,483,592 |

|

|

|

724,051 |

|

|

|

2,216,845 |

|

|

|

1,430,397 |

|

|

Loss from operations |

|

(841,148 |

) |

|

|

(71,645 |

) |

|

|

(928,270 |

) |

|

|

(148,747 |

) |

|

Interest income |

|

(13,572 |

) |

|

|

(11,558 |

) |

|

|

(27,514 |

) |

|

|

(20,469 |

) |

|

Interest expense |

|

5,648 |

|

|

|

5,835 |

|

|

|

11,297 |

|

|

|

11,098 |

|

|

Other expense (income), net |

|

563 |

|

|

|

207 |

|

|

|

933 |

|

|

|

(4,700 |

) |

|

Loss before provision for income taxes |

|

(833,787 |

) |

|

|

(66,129 |

) |

|

|

(912,986 |

) |

|

|

(134,676 |

) |

|

Provision for income taxes |

|

3,884 |

|

|

|

(952 |

) |

|

|

6,574 |

|

|

|

(271 |

) |

|

Net loss |

$ |

(837,671 |

) |

|

$ |

(65,177 |

) |

|

$ |

(919,560 |

) |

|

$ |

(134,405 |

) |

| |

|

|

|

|

|

|

|

|

Net loss per share, basic and diluted |

$ |

(4.92 |

) |

|

$ |

(0.40 |

) |

|

$ |

(5.44 |

) |

|

$ |

(0.82 |

) |

| |

|

|

|

|

|

|

|

|

Weighted-average shares used to compute basic and diluted net loss

per share |

|

170,229,583 |

|

|

|

164,171,372 |

|

|

|

168,980,165 |

|

|

|

163,550,481 |

|

Stock-based Compensation

Summary

Compensation costs for stock-based awards were

classified as follows (in thousands):

| |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Cost of revenue (exclusive of depreciation and amortization, which

are shown separately) |

$ |

1,313 |

|

|

$ |

1,243 |

|

|

$ |

2,707 |

|

|

$ |

2,596 |

|

|

Advertising and marketing |

|

3,378 |

|

|

|

4,002 |

|

|

|

7,167 |

|

|

|

7,128 |

|

|

Sales |

|

6,953 |

|

|

|

9,870 |

|

|

|

14,920 |

|

|

|

17,947 |

|

|

Technology and development |

|

9,683 |

|

|

|

15,689 |

|

|

|

18,982 |

|

|

|

28,416 |

|

|

General and administrative |

|

20,780 |

|

|

|

24,921 |

|

|

|

40,656 |

|

|

|

45,676 |

|

|

Total stock-based compensation expense (3) |

$ |

42,107 |

|

|

$ |

55,725 |

|

|

$ |

84,432 |

|

|

$ |

101,763 |

|

See note (3) in the Notes section that follows.

Revenues

| |

Three Months Ended |

|

|

|

Six Months Ended |

|

|

| |

June 30, |

|

|

|

June 30, |

|

|

|

($ in thousands, unaudited) |

|

2024 |

|

|

|

2023 |

|

|

Change |

|

|

2024 |

|

|

|

2023 |

|

|

Change |

|

Revenue by Type |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Access fees |

$ |

559,648 |

|

|

$ |

575,661 |

|

|

|

(3 |

)% |

|

$ |

1,116,822 |

|

|

$ |

1,126,531 |

|

|

|

(1 |

)% |

|

Other |

|

82,796 |

|

|

|

76,745 |

|

|

|

8 |

% |

|

|

171,753 |

|

|

|

155,119 |

|

|

|

11 |

% |

|

Total Revenue |

$ |

642,444 |

|

|

$ |

652,406 |

|

|

|

(2 |

)% |

|

$ |

1,288,575 |

|

|

$ |

1,281,650 |

|

|

|

1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue by Geography |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Revenue |

$ |

540,802 |

|

|

$ |

561,787 |

|

|

|

(4 |

)% |

|

$ |

1,088,402 |

|

|

$ |

1,103,448 |

|

|

|

(1 |

)% |

|

International Revenue |

|

101,642 |

|

|

|

90,619 |

|

|

|

12 |

% |

|

|

200,173 |

|

|

|

178,202 |

|

|

|

12 |

% |

|

Total Revenue |

$ |

642,444 |

|

|

$ |

652,406 |

|

|

|

(2 |

)% |

|

$ |

1,288,575 |

|

|

$ |

1,281,650 |

|

|

|

1 |

% |

Summary Operating Metrics

Consolidated

| |

Three Months Ended |

|

|

|

|

|

Six Months Ended |

|

|

|

|

| |

June 30, |

|

|

|

|

|

June 30, |

|

|

|

|

|

(In millions) |

|

2024 |

|

|

|

2023 |

|

|

|

Change |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

Change |

|

|

Total Visits |

|

4.2 |

|

|

|

4.7 |

|

|

|

(11 |

)% |

|

|

8.8 |

|

|

|

9.5 |

|

|

|

(7 |

)% |

Integrated Care

| |

As of June 30, |

|

|

|

(In millions) |

|

2024 |

|

|

|

2023 |

|

|

Change |

|

U.S. Integrated Care Members (2) |

|

92.4 |

|

|

|

85.9 |

|

|

|

8 |

% |

|

Chronic Care Program Enrollment (4) |

|

1.173 |

|

|

|

1.073 |

|

|

|

9 |

% |

| |

Three Months Ended |

|

|

|

|

|

Six Months Ended |

|

|

|

|

| |

June 30, |

|

|

|

|

|

June 30, |

|

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

Change |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

Change |

|

|

Average Monthly RevenuePer U.S. Integrated Care Member (5) |

$ |

1.36 |

|

|

$ |

1.41 |

|

|

|

(4 |

)% |

|

$ |

1.37 |

|

|

$ |

1.40 |

|

|

|

(2 |

)% |

BetterHelp

| |

Average for |

|

|

|

|

|

Average for |

|

|

|

|

| |

Three Months Ended |

|

|

|

|

|

Six Months Ended |

|

|

|

|

| |

June 30, |

|

|

|

|

|

June 30, |

|

|

|

|

|

(In millions) |

|

2024 |

|

|

|

2023 |

|

|

|

Change |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

Change |

|

|

BetterHelp Paying Users (6) |

|

0.407 |

|

|

|

0.476 |

|

|

|

(14 |

)% |

|

|

0.411 |

|

|

|

0.471 |

|

|

|

(13 |

)% |

See notes (2), (4), (5), and (6) in the Notes

section that follows.

Operating Results by Segment (see note (7)

in the Notes section that follows)

The following table presents operating results by

reportable segment for the periods indicated:

| |

Three Months Ended |

|

|

|

Six Months Ended |

|

|

| |

June 30, |

|

|

|

June 30, |

|

|

|

($ in thousands, unaudited) |

|

2024 |

|

|

|

2023 |

|

|

Change |

|

|

2024 |

|

|

|

2023 |

|

|

Change |

|

Teladoc Health Integrated Care |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

377,421 |

|

|

$ |

360,050 |

|

|

|

5 |

% |

|

$ |

754,532 |

|

|

$ |

710,022 |

|

|

|

6 |

% |

|

Adjusted EBITDA |

$ |

64,028 |

|

|

$ |

37,968 |

|

|

|

69 |

% |

|

$ |

111,702 |

|

|

$ |

73,095 |

|

|

|

53 |

% |

|

Adjusted EBITDA Margin % |

|

17.0 |

% |

|

|

10.5 |

% |

|

642 bps |

|

|

14.8 |

% |

|

|

10.3 |

% |

|

451 bps |

| |

|

|

|

|

|

|

|

|

|

|

|

|

BetterHelp |

|

|

|

|

|

|

|

|

|

|

|

|

Therapy Services |

$ |

259,073 |

|

|

$ |

288,288 |

|

|

|

(10 |

)% |

|

$ |

522,785 |

|

|

$ |

564,216 |

|

|

|

(7 |

)% |

|

Other Wellness Services |

|

5,950 |

|

|

|

4,068 |

|

|

|

46 |

% |

|

|

11,258 |

|

|

|

7,412 |

|

|

|

52 |

% |

|

Total Revenue |

$ |

265,023 |

|

|

$ |

292,356 |

|

|

|

(9 |

)% |

|

$ |

534,043 |

|

|

$ |

571,628 |

|

|

|

(7 |

)% |

|

Adjusted EBITDA |

$ |

25,453 |

|

|

$ |

34,187 |

|

|

|

(26 |

)% |

|

$ |

40,919 |

|

|

$ |

51,825 |

|

|

|

(21 |

)% |

|

Adjusted EBITDA Margin % |

|

9.6 |

% |

|

|

11.7 |

% |

|

(209) bps |

|

|

7.7 |

% |

|

|

9.1 |

% |

|

(140) bps |

|

TELADOC HEALTH, INC.CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS (In thousands,

unaudited) |

| |

| |

Six Months EndedJune 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

Cash flows from operating activities: |

|

|

|

|

Net loss |

$ |

(919,560 |

) |

|

$ |

(134,405 |

) |

|

Adjustments to reconcile net loss to net cash flows from operating

activities: |

|

|

|

|

Goodwill impairment |

|

790,000 |

|

|

|

— |

|

|

Amortization of intangible assets |

|

189,919 |

|

|

|

139,371 |

|

|

Depreciation of property and equipment |

|

4,537 |

|

|

|

5,877 |

|

|

Amortization of right-of-use assets |

|

4,902 |

|

|

|

5,778 |

|

|

Provision for allowances for doubtful accounts |

|

810 |

|

|

|

3,048 |

|

|

Stock-based compensation |

|

84,432 |

|

|

|

101,763 |

|

|

Deferred income taxes |

|

1,368 |

|

|

|

(3,557 |

) |

|

Other, net |

|

2,695 |

|

|

|

7,587 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

Accounts receivable |

|

(2,971 |

) |

|

|

(7,032 |

) |

|

Prepaid expenses and other current assets |

|

(13,017 |

) |

|

|

16,625 |

|

|

Inventory |

|

(6,032 |

) |

|

|

20,613 |

|

|

Other assets |

|

676 |

|

|

|

(17,463 |

) |

|

Accounts payable |

|

12,614 |

|

|

|

(31,788 |

) |

|

Accrued expenses and other current liabilities |

|

154 |

|

|

|

20,742 |

|

|

Accrued compensation |

|

(45,802 |

) |

|

|

(15,532 |

) |

|

Deferred revenue |

|

(1,638 |

) |

|

|

7,546 |

|

|

Operating lease liabilities |

|

(5,424 |

) |

|

|

(4,946 |

) |

|

Other liabilities |

|

(60 |

) |

|

|

111 |

|

|

Net cash provided by operating activities |

|

97,603 |

|

|

|

114,338 |

|

|

Cash flows from investing activities: |

|

|

|

|

Capital expenditures |

|

(3,061 |

) |

|

|

(4,267 |

) |

|

Capitalized software development costs |

|

(60,199 |

) |

|

|

(77,927 |

) |

|

Net cash used in investing activities |

|

(63,260 |

) |

|

|

(82,194 |

) |

|

Cash flows from financing activities: |

|

|

|

|

Net proceeds from the exercise of stock options |

|

2,677 |

|

|

|

677 |

|

|

Proceeds from employee stock purchase plan |

|

2,798 |

|

|

|

5,435 |

|

|

Cash received for withholding taxes on stock-based compensation,

net |

|

83 |

|

|

|

1,450 |

|

|

Other, net |

|

(2 |

) |

|

|

(1 |

) |

|

Net cash provided by financing activities |

|

5,556 |

|

|

|

7,561 |

|

|

Net increase in cash and cash equivalents |

|

39,899 |

|

|

|

39,705 |

|

|

Effect of foreign currency exchange rate changes |

|

(1,191 |

) |

|

|

808 |

|

|

Cash and cash equivalents at beginning of the period |

|

1,123,675 |

|

|

|

918,182 |

|

|

Cash and cash equivalents at end of the period |

$ |

1,162,383 |

|

|

$ |

958,695 |

|

The following table presents the selected cash flow

information for the following quarters (in thousands,

unaudited):

|

|

Three Months EndedJune 30, |

|

|

2024 |

|

|

|

2023 |

|

|

Net cash provided by operating activities |

$ |

88,683 |

|

|

$ |

101,182 |

|

|

Net cash used in investing activities |

|

(27,748 |

) |

|

|

(36,570 |

) |

|

Net cash provided by financing activities |

|

3,805 |

|

|

|

4,208 |

|

|

Effect of foreign currency exchange rate changes |

|

(292 |

) |

|

|

1,296 |

|

|

Net increase in cash and cash equivalents |

$ |

64,448 |

|

|

$ |

70,116 |

|

|

CONDENSED CONSOLIDATED BALANCE SHEETS(In

thousands, except share and per share data,

unaudited) |

| |

| |

June 30,2024 |

|

December 31,2023 |

|

ASSETS |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

1,162,383 |

|

|

$ |

1,123,675 |

|

|

Accounts receivable, net of allowance for doubtful accounts of

$3,881 and $4,240 at June 30, 2024 and December 31, 2023,

respectively |

|

218,420 |

|

|

|

217,423 |

|

|

Inventories |

|

34,896 |

|

|

|

29,513 |

|

|

Prepaid expenses and other current assets |

|

130,956 |

|

|

|

118,437 |

|

|

Total current assets |

|

1,546,655 |

|

|

|

1,489,048 |

|

|

Property and equipment, net |

|

29,330 |

|

|

|

32,032 |

|

|

Goodwill |

|

283,190 |

|

|

|

1,073,190 |

|

|

Intangible assets, net |

|

1,547,498 |

|

|

|

1,677,781 |

|

|

Operating lease—right-of-use assets |

|

35,538 |

|

|

|

40,060 |

|

|

Other assets |

|

81,427 |

|

|

|

80,258 |

|

|

Total assets |

$ |

3,523,638 |

|

|

$ |

4,392,369 |

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

Current liabilities: |

|

|

|

|

Accounts payable |

$ |

56,111 |

|

|

$ |

43,637 |

|

|

Accrued expenses and other current liabilities |

|

173,804 |

|

|

|

178,634 |

|

|

Accrued compensation |

|

54,656 |

|

|

|

102,686 |

|

|

Deferred revenue—current |

|

95,434 |

|

|

|

95,659 |

|

|

Convertible senior notes, net—current |

|

550,722 |

|

|

|

— |

|

|

Total current liabilities |

|

930,727 |

|

|

|

420,616 |

|

|

Other liabilities |

|

1,007 |

|

|

|

1,080 |

|

|

Operating lease liabilities, net of current portion |

|

37,716 |

|

|

|

42,837 |

|

|

Deferred revenue, net of current portion |

|

11,743 |

|

|

|

13,623 |

|

|

Deferred taxes, net |

|

50,673 |

|

|

|

49,452 |

|

|

Convertible senior notes, net—non-current |

|

989,686 |

|

|

|

1,538,688 |

|

|

Total liabilities |

|

2,021,552 |

|

|

|

2,066,296 |

|

|

Commitments and contingencies |

|

|

|

|

Stockholders’ equity: |

|

|

|

|

Common stock, $0.001 par value; 300,000,000 shares authorized;

171,124,883 shares and 166,658,253 shares issued and outstanding as

of June 30, 2024 and December 31, 2023 respectively |

|

171 |

|

|

|

167 |

|

|

Additional paid-in capital |

|

17,689,096 |

|

|

|

17,591,551 |

|

|

Accumulated deficit |

|

(16,148,215 |

) |

|

|

(15,228,655 |

) |

|

Accumulated other comprehensive loss |

|

(38,966 |

) |

|

|

(36,990 |

) |

|

Total stockholders’ equity |

|

1,502,086 |

|

|

|

2,326,073 |

|

|

Total liabilities and stockholders’ equity |

$ |

3,523,638 |

|

|

$ |

4,392,369 |

|

Non-GAAP Financial Measures:

To supplement our financial information presented

in accordance with generally accepted accounting principles in the

United States (“GAAP”), we use certain non-GAAP financial measures

to clarify and enhance an understanding of past performance, which

include adjusted gross profit, adjusted gross margin, adjusted

EBITDA, and free cash flow. We believe that the presentation of

these financial measures enhances an investor’s understanding of

our financial performance, and are commonly used by investors to

evaluate our performance and that of our competitors. We further

believe that these financial measures are useful financial metrics

to assess our operating performance and financial and business

trends from period-to-period by excluding certain items that we

believe are not representative of our core business, and that free

cash flow reflects an additional way of viewing our liquidity that,

when viewed together with GAAP results, provides management,

investors, and other users of our financial information with a more

complete understanding of factors and trends affecting our cash

flows. We use these non-GAAP financial measures for business

planning purposes and in measuring our performance relative to that

of our competitors. We utilize adjusted EBITDA as a key measure of

our performance.

Adjusted gross profit is our total revenue minus

our total cost of revenue (exclusive of depreciation and

amortization, which are shown separately) and adjusted gross margin

is adjusted gross profit as a percentage of our total revenue.

Adjusted EBITDA consists of net loss before

provision for income taxes; other expense (income), net; interest

income; interest expense; depreciation of property and equipment;

amortization of intangible assets; restructuring costs;

acquisition, integration, and transformation cost; goodwill

impairment; and stock-based compensation.

Free cash flow is net cash provided by operating

activities less capital expenditures and capitalized software

development costs.

Our use of these non-GAAP terms may vary from that

of others in our industry, and other companies may calculate such

measures differently than we do, limiting their usefulness as

comparative measures.

Non-GAAP measures have important limitations as

analytical tools and you should not consider them in isolation, and

they should not be considered as an alternative to net loss before

provision for income taxes, net loss, net loss per share, net cash

from operating activities or any other measures derived in

accordance with GAAP. Some of these limitations are:

- adjusted gross margin has been and

will continue to be affected by a number of factors, including the

fees we charge our clients, the number of visits and cases we

complete, the costs paid to providers and medical experts, as well

as the costs of our provider network operations center;

- adjusted gross margin does not reflect

the significant depreciation and amortization to cost of

revenue;

- adjusted EBITDA eliminates the impact

of the provision for income taxes on our results of operations, and

it does not reflect other expense (income), net, interest income,

or interest expense;

- adjusted EBITDA does not reflect

restructuring costs. Restructuring costs may include certain lease

impairment costs, certain losses related to early lease

terminations, and severance;

- adjusted EBITDA does not reflect

significant acquisition, integration, and transformation costs.

Acquisition, integration and transformation costs include

investment banking, financing, legal, accounting, consultancy,

integration, fair value changes related to contingent

consideration, and certain other transaction costs related to

mergers and acquisitions. It also includes costs related to certain

business transformation initiatives focused on integrating and

optimizing various operations and systems, including upgrading our

customer relationship management (CRM) and enterprise resource

planning (ERP) systems. These transformation cost adjustments made

to our results do not represent normal, recurring, operating

expenses necessary to operate the business but, rather, incremental

costs incurred in connection with our acquisition and integration

activities;

- adjusted EBITDA does not reflect

goodwill impairment; and

- adjusted EBITDA does not reflect the

significant non-cash stock-based compensation expense which should

be viewed as a component of recurring operating costs.

In addition, although amortization of intangible

assets and depreciation of property and equipment are non-cash

charges, the assets being depreciated and amortized will often have

to be replaced in the future, and adjusted gross profit, adjusted

gross margin, and adjusted EBITDA do not reflect any expenditures

for such replacements.

We compensate for these limitations by using these

non-GAAP measures along with other comparative tools, together with

GAAP measurements, to assist in the evaluation of operating

performance. Such GAAP measurements include net loss, net loss per

share, net cash provided by operating activities, and other

performance measures.

In evaluating these financial measures, you should

be aware that in the future we may incur expenses similar to those

eliminated in this presentation. Our presentation of these non-GAAP

measures should not be construed as an inference that our future

results will be unaffected by unusual or nonrecurring items.

The following is a reconciliation of gross profit,

the most directly comparable GAAP financial measures, to adjusted

gross profit:

|

Reconciliation of GAAP Gross Profit to Adjusted Gross

Profit(In thousands, unaudited) |

| |

| |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenue |

$ |

642,444 |

|

|

$ |

652,406 |

|

|

$ |

1,288,575 |

|

|

$ |

1,281,650 |

|

|

Cost of revenue (exclusive of depreciation and amortization, which

are shown separately below) |

|

(188,059 |

) |

|

|

(190,540 |

) |

|

|

(382,597 |

) |

|

|

(380,647 |

) |

|

Amortization of intangible assets and depreciation of property and

equipment |

|

(26,146 |

) |

|

|

(21,474 |

) |

|

|

(52,458 |

) |

|

|

(34,005 |

) |

|

Gross Profit |

|

428,239 |

|

|

|

440,392 |

|

|

|

853,520 |

|

|

|

866,998 |

|

|

Amortization of intangible assets and depreciation of property and

equipment |

|

26,146 |

|

|

|

21,474 |

|

|

|

52,458 |

|

|

|

34,005 |

|

|

Adjusted gross profit |

$ |

454,385 |

|

|

$ |

461,866 |

|

|

$ |

905,978 |

|

|

$ |

901,003 |

|

| |

|

|

|

|

|

|

|

|

Gross margin |

|

66.7 |

% |

|

|

67.5 |

% |

|

|

66.2 |

% |

|

|

67.6 |

% |

|

Adjusted gross margin |

|

70.7 |

% |

|

|

70.8 |

% |

|

|

70.3 |

% |

|

|

70.3 |

% |

The following is a reconciliation of net loss, the

most directly comparable GAAP financial measure, to adjusted

EBITDA:

|

Reconciliation of GAAP Net Loss to Adjusted

EBITDA(In thousands, except for outlook data,

unaudited) |

| |

| |

Three Months EndedJune 30, |

|

Six Months EndedJune 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net loss |

$ |

(837,671 |

) |

|

$ |

(65,177 |

) |

|

$ |

(919,560 |

) |

|

$ |

(134,405 |

) |

|

Add: |

|

|

|

|

|

|

|

|

Provision for income taxes |

|

3,884 |

|

|

|

(952 |

) |

|

|

6,574 |

|

|

|

(271 |

) |

|

Other expense (income), net |

|

563 |

|

|

|

207 |

|

|

|

933 |

|

|

|

(4,700 |

) |

|

Interest expense |

|

5,648 |

|

|

|

5,835 |

|

|

|

11,297 |

|

|

|

11,098 |

|

|

Interest income |

|

(13,572 |

) |

|

|

(11,558 |

) |

|

|

(27,514 |

) |

|

|

(20,469 |

) |

|

Depreciation of property and equipment |

|

1,703 |

|

|

|

2,954 |

|

|

|

4,537 |

|

|

|

5,877 |

|

|

Amortization of intangible assets |

|

94,862 |

|

|

|

72,511 |

|

|

|

189,919 |

|

|

|

139,371 |

|

|

Restructuring costs |

|

1,500 |

|

|

|

7,530 |

|

|

|

11,173 |

|

|

|

15,632 |

|

|

Acquisition, integration, and transformation costs |

|

457 |

|

|

|

5,080 |

|

|

|

830 |

|

|

|

11,024 |

|

|

Goodwill impairment |

|

790,000 |

|

|

|

— |

|

|

|

790,000 |

|

|

|

— |

|

|

Stock-based compensation |

|

42,107 |

|

|

|

55,725 |

|

|

|

84,432 |

|

|

|

101,763 |

|

|

Total Adjustments |

|

834,064 |

|

|

|

68,335 |

|

|

|

886,435 |

|

|

|

128,419 |

|

|

Consolidated Adjusted EBITDA |

$ |

89,481 |

|

|

$ |

72,155 |

|

|

$ |

152,621 |

|

|

$ |

124,920 |

|

| |

|

|

|

|

|

|

|

|

Segment Adjusted EBITDA |

|

|

|

|

|

|

|

|

Teladoc Health Integrated Care |

$ |

64,028 |

|

|

$ |

37,968 |

|

|

$ |

111,702 |

|

|

$ |

73,095 |

|

|

BetterHelp |

|

25,453 |

|

|

|

34,187 |

|

|

|

40,919 |

|

|

|

51,825 |

|

|

Consolidated Adjusted EBITDA |

$ |

89,481 |

|

|

$ |

72,155 |

|

|

$ |

152,621 |

|

|

$ |

124,920 |

|

The following is a reconciliation of net cash

provided by operating activities, the most directly comparable GAAP

financial measure, to free cash flow:

|

Reconciliation of GAAP Net Cash Provided by Operating

Activities to Free Cash Flow(In thousands,

unaudited) |

| |

| |

Three Months Ended |

|

Six Months Ended |

| |

June 30, |

|

June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Net cash provided by operating activities |

$ |

88,683 |

|

|

$ |

101,182 |

|

|

$ |

97,603 |

|

|

$ |

114,338 |

|

|

Capital expenditures |

|

(1,912 |

) |

|

|

(1,904 |

) |

|

|

(3,061 |

) |

|

|

(4,267 |

) |

|

Capitalized software development costs |

|

(25,836 |

) |

|

|

(34,666 |

) |

|

|

(60,199 |

) |

|

|

(77,927 |

) |

|

Capex |

|

(27,748 |

) |

|

|

(36,570 |

) |

|

|

(63,260 |

) |

|

|

(82,194 |

) |

|

Free Cash Flow |

$ |

60,935 |

|

|

$ |

64,612 |

|

|

$ |

34,343 |

|

|

$ |

32,144 |

|

Notes:

- A reconciliation of each non-GAAP measure to the most

comparable measure under GAAP has been provided in this press

release in the accompanying tables. An explanation of these

non-GAAP measures is also included under the heading “Non-GAAP

Financial Measures.”

- U.S. Integrated Care Members represent

the number of unique individuals who have paid access and visit fee

only access to our suite of integrated care services in the U.S. at

the end of the applicable period.

- Excluding the amount capitalized related to software

development projects.

- Chronic Care Program Enrollment

represents the total number of enrollees across our suite of

chronic care programs at the end of a given period.

- Average monthly revenue per U.S. Integrated Care member is

calculated by dividing the total revenue generated from the

Integrated Care segment by the average number of U.S. Integrated

Care Members (see note 2) during the applicable period.

- BetterHelp Paying Users represent the

average number of global monthly paying users of our BetterHelp

therapy services during the applicable period.

- We have two segments: Teladoc Health Integrated Care

(“Integrated Care”) and BetterHelp. The Integrated Care segment

includes a suite of global virtual medical services including

general medical, expert medical services, specialty medical,

chronic condition management, mental health, and enabling

technologies and enterprise telehealth solutions for hospitals and

health systems. The BetterHelp segment includes virtual therapy and

other wellness services provided on a global basis which are

predominantly marketed and sold on a direct-to-consumer basis.

Investors:Michael

Minchak617-444-9612ir@teladochealth.com

Media:Chris

Stenrud860-491-8821pr@teladochealth.com

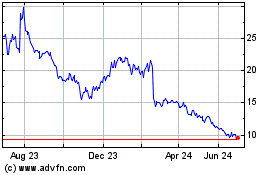

Teladoc Health (NYSE:TDOC)

Historical Stock Chart

From Dec 2024 to Jan 2025

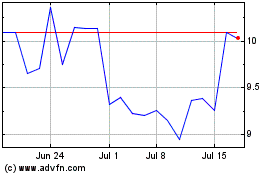

Teladoc Health (NYSE:TDOC)

Historical Stock Chart

From Jan 2024 to Jan 2025