UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-13184

TECK RESOURCES LIMITED

(Exact name of registrant as specified in its

charter)

Suite 3300 – 550 Burrard Street

Vancouver, British Columbia V6C 0B3

(Address of principal executive offices)

Indicate by check mark whether

the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☐ Form

40-F ☒

EXHIBIT INDEX

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

| |

Teck Resources Limited |

|

| |

(Registrant) |

|

| |

|

|

|

| |

|

|

|

| Date: November 24,

2023 |

By: |

/s/ Amanda R. Robinson |

|

| |

|

Amanda R. Robinson |

|

| |

|

Corporate Secretary |

|

EXHIBIT 99.1

Form 51-102F3

Material Change Report

| Item 1 | Name and Address of Company |

Teck Resources Limited (the “Company”

or “Teck”)

Suite 3300, 550 Burrard Street

Vancouver, British Columbia

V6C 0B3

| Item 2 | Date of Material Change |

November 13, 2023.

A news release was disseminated

by the Company on November 14, 2023 through the facilities of GlobeNewswire and was filed on SEDAR+

under the Company’s profile at www.sedarplus.ca

| Item 4 | Summary of Material Change |

On November 14, 2023, the Company

announced it had agreed to sell its entire interest in its steelmaking coal business (the "Steelmaking Coal Business")

through a sale of a majority stake to Glencore plc (“Glencore”) for an implied enterprise value of US$9.0 billion,

and a sale of a minority stake to Nippon Steel Corporation (“NSC”).

Glencore has agreed to acquire,

through a wholly-owned subsidiary, a 77% interest in the Steelmaking Coal Business for US$6.9 billion in cash, payable to Teck at closing

of the Glencore transaction, subject to certain adjustments described below.

NSC has agreed to acquire a 20%

interest in the Steelmaking Coal Business in exchange for its current 2.5% interest in Teck's Elkview Operations plus US$1,254,300,000

in cash payable to Teck at closing of the NSC transaction. NSC will also enter into a long-term steelmaking coal offtake rights arrangement

at market terms.

Subsequently, on November 15, 2023,

the Company entered into a definitive agreement with POSCO pursuant to which, among other things, POSCO agreed to exchange its current

2.5% interest in Teck's Elkview Operations and its 20% interest in the Greenhills joint venture with Teck, for a 3% interest in the Steelmaking

Coal Business.

| Item 5 | Full Description of Material Change |

5.1 Full

Description of Material Change

Proposed Transactions

The Company, its wholly-owned

subsidiary, Teck Metals Ltd. (the “Vendor”), Glencore and its wholly-owned subsidiary, 1448935 B.C. Ltd. (the “Purchaser”),

have entered into a share purchase agreement dated November 13, 2023 (the “Share Purchase Agreement”) pursuant to

which the Purchaser has agreed to, among other things, purchase all of the issued and outstanding shares of Teck's wholly-owned subsidiary,

Elk Valley Resources Ltd. (the "Purchased Corporation"), formed to hold Teck's interest in the Steelmaking Coal Business,

for US$6.9 billion in cash, payable to Teck

at closing, subject to customary

closing adjustments, adjustments on account of the Shareholder Loan (as defined below) and adjustments in the event that either the NSC

and/or POSCO transactions described below do not close (the "Glencore Transaction").

Pursuant to a transaction agreement

dated November 13, 2023 entered into with, among others, NSC (the “NSC Transaction Agreement”), NSC has agreed to exchange

its existing 2.5% interest in Teck's Elkview Operations and invest additional cash proceeds of US$1,254,300,000 to acquire a 20% interest

in the Steelmaking Coal Business (the “NSC Transaction”). As a condition to closing the NSC Transaction, NSC will also

enter into a long-term steelmaking coal offtake rights arrangement on customary market terms, continuing NSC’s long-standing commercial

arrangement for the purchase of steelmaking coal from the Elk Valley.

Pursuant to a transaction agreement

dated November 15, 2023 entered into with, among others, POSCO (the “POSCO Transaction Agreement”), POSCO has agreed

to exchange its existing 2.5% interest in Teck's Elkview Operations and its existing 20% interest in the Greenhills joint venture with

Teck for a 3% interest in the Steelmaking Coal Business (the “POSCO Transaction” and together with the Glencore Transaction

and the NSC Transaction, the "Proposed Transactions").

Reorganization

In order to facilitate the

investments contemplated by the Proposed Transactions, the Company intends to effect a reorganization of the Steelmaking Coal Business,

whereby it will, through a series of transactions, cause its interests in the Steelmaking Coal Business to be held, directly or indirectly,

by a limited partnership to be formed under the laws of British Columbia (“EVR LP”) and 15516960 Canada Ltd. (“EVR

GP”), the general partner of EVR LP (the "Reorganization"). Following completion of the Reorganization, and

prior to the completion of the Proposed Transactions, the Company's interests in all of its coal related assets, including the Elkview,

Fording River, Greenhills and Line Creek operating mines located in British Columbia, Canada, (collectively, the “Steelmaking

Coal Assets”), will be held, directly or indirectly, by EVR LP, EVR LP will assume all of the liabilities related to the Steelmaking

Coal Assets, and the Company will own, directly or indirectly, all of the interests in EVR LP and EVR GP. In addition, as partial consideration

for the Steelmaking Coal Assets, EVR LP will enter into a loan agreement in favour of a subsidiary of the Company for an aggregate principal

amount of US$1.847 billion (the "Shareholder Loan"). In connection with the Reorganization, prior to the completion of

the Glencore Transaction, the Company will cause the Shareholder Loan to be transferred and become payable to the Purchased Corporation.

If the NSC Transaction Agreement is terminated, the Shareholder Loan will be capitalized prior to the closing of the Glencore Transaction.

Glencore Transaction

The following description of the

Glencore Transaction and the Share Purchase Agreement does not purport to be complete and is qualified in its entirety by reference to

the full text of the Share Purchase Agreement, which has been filed with the Canadian securities regulatory authorities and will be available

on SEDAR+ under the Company’s profile at www.sedarplus.ca.

Subject to the terms and

conditions set forth in the Share Purchase Agreement, the Purchaser has agreed to acquire the Purchased Corporation (and, indirectly,

at least a 77% interest in EVR LP and EVR GP and, if applicable, the full then-outstanding amount of the Shareholder Loan) for a base

cash purchase price of US$6,930,000,000, subject to certain adjustments. The cash purchase price payable by the Purchaser will be subject

to customary working capital, cash and debt adjustments, as well as adjustments to discount the value of a portion of the then-outstanding

balance of the Shareholder Loan attributable to NSC's and POSCO's minority interests in the Steelmaking Coal Business at closing of the

Glencore Transaction, if applicable. As well, in the event that either the NSC Transaction and/or the POSCO Transaction have not been

completed prior to the closing of the

Glencore Transaction, the attributable

interest in the Steelmaking Coal Business held by the Purchased Corporation immediately prior to, and the purchase price payable by Glencore

on, the closing of the Glencore Transaction will increase proportionately.

The Share Purchase Agreement provides

for customary closing conditions in favour of each party, as applicable, related to the truth of representations and warranties, the performance

of covenants, no illegality, no material adverse effect in respect of the Steelmaking Coal Business and the completion of the Reorganization.

The closing of the Glencore Transaction is also conditional on the receipt of required regulatory approvals in various jurisdictions (the

“Key Regulatory Approvals”), including, but not limited to, under the Investment Canada Act (Canada) (the “ICA”),

the Competition Act (Canada) and the Hart-Scott Rodino Antitrust Improvements Act of 1976. In connection with the ICA approval,

Glencore and the Purchaser have agreed to make certain undertakings and commitments to the status and operation of the Steelmaking Coal

Business. The Glencore Transaction is not conditional on the completion of either the NSC Transaction or the POSCO Transaction.

The Share Purchase Agreement provides

for customary termination rights, including (a) in the event that (i) any law is enacted or made (or any law is amended) which permanently

prohibits, enjoins or renders illegal the Glencore Transaction, and such law has become final and non-appealable, (ii) an order, decision

or notice is issued under the ICA preventing the consummation of the Glencore Transaction or imposing a burdensome condition on the Purchaser

that is not accepted by the Purchaser, or (iii) the Purchaser withdraws its application under the ICA after seeking and obtaining the

prior written consent of the Vendor (provided the party seeking to terminate for any such event must not be in breach of any representation,

warranty, covenant or obligations set forth in the Share Purchase Agreement where such breach has been a primary cause of, or resulted

in, the event giving rise to a right to terminate), or (b) in the event of a breach by either party (subject to customary cure provisions)

that would result in any of the conditions relating to the bring down of representations and warranties and performance of covenants not

being able to be satisfied by the Glencore Outside Date (as defined below). The Share Purchase Agreement may also be terminated by either

party if the Glencore Transaction has not been completed by November 13, 2024 (which date may be extended for up to 120 days in certain

circumstances, the "Glencore Outside Date"), provided the party seeking to terminate as a result of the occurrence of

the Glencore Outside Date must not be in breach of any representation, warranty, covenant or obligation set forth in the Share Purchase

Agreement where such breach has been a primary cause of, or resulted in, the closing of the Glencore Transaction not occurring.

In the event that the Share Purchase

Agreement is terminated: (a) by any party, as a result of the occurrence of the Glencore Outside Date in circumstances where any of the

Key Regulatory Approvals have not been obtained or any anti-trust law is then in effect that prohibits, enjoins or renders illegal the

Glencore Transaction; (b) by any party as a result of (i) the imposition or enforcement of an antitrust law or order issued pursuant to

an antitrust law that is final and not appealable which permanently prohibits enjoins or renders illegal the consummation of the Glencore

Transaction, (ii) an order, decision or notice issued under the ICA preventing the consummation of the Glencore Transaction or imposing

a burdensome condition on the Purchaser that is not accepted by the Purchaser, or (iii) the Purchaser withdrawing its application under

the ICA after seeking and obtaining the prior written consent of the Vendor; or (c) by the Vendor as a result of a willful breach by the

Purchaser or Glencore of their representations and warranties or covenants under the Share Purchase Agreement, and provided that, in the

case of a termination referred to in subparagraphs (a) or (b), all of the conditions in favor of the Purchaser and Glencore (other than

the conditions related to Key Regulatory Approvals or no illegality, unless in the case of no illegality only, such condition is not satisfied

as a result of a law that does not relate in any way to a Key Regulatory Approval or an antitrust law) are satisfied or reasonably capable

of being satisfied on or prior to the Glencore Outside Date, then the Purchaser and Glencore shall, jointly and severally, pay to the

Vendor a termination payment of US$400 million.

The Share Purchase Agreement also

provides for customary representations and warranties, interim period operating covenants and indemnities for a transaction of this nature.

Each of the Vendor's and the Purchaser's obligations under the Share Purchase Agreement are fully guaranteed by the Company and Glencore,

respectively.

Closing of the Glencore Transaction

is expected to occur in the third quarter of 2024.

Transactions with NSC and POSCO

The NSC Transaction Agreement

provides that NSC will, subject to the terms thereof, exchange its existing 2.5% interest in Teck's Elkview Operations and invest additional

cash proceeds of US$1,254,300,000 to acquire a 20% interest in each of EVR LP and EVR GP (and indirectly, a 20% interest in the Steelmaking

Coal Business).

The POSCO Transaction Agreement

provides that POSCO will, subject to the terms thereof, exchange its existing 2.5% interest in Teck's Elkview Operations and its existing

20% interest in the Greenhills joint venture, for a 3% interest in each of EVR LP and EVR GP (and, indirectly, a 3% interest in the Steelmaking

Coal Business).

The NSC Transaction Agreement and

POSCO Transaction Agreement each contain certain covenants, including that the Company will use reasonable commercial efforts to complete

the Reorganization and that each of the parties will use commercially reasonable efforts to obtain and maintain all material third party

or other consents or waivers and effect all necessary or advisable registrations or filings required by governmental entities in connection

with the Reorganization and agreements contemplated in connection therewith.

The NSC Transaction and the POSCO

Transaction are conditional on the completion of the Reorganization and other customary conditions, including in the case of the NSC Transaction

receipt of required regulatory approvals in Brazil and South Korea, but neither the NSC Transaction nor the POSCO Transaction is conditional

on the completion of the other transaction or the Glencore Transaction. For greater certainty, neither the Reorganization nor the Glencore

Transaction is conditional on completion of the NSC Transaction and the POSCO Transaction and both are expected to be implemented even

if the NSC Transaction and/or the POSCO Transaction do not occur.

The NSC Transaction Agreement and

POSCO Transaction Agreement each also provide for customary representations and warranties, interim period operating covenants, indemnities

and termination rights for transactions of this nature. The NSC Transaction Agreement and POSCO Transaction Agreement also contain customary

termination rights, including that the NSC Transaction Agreement and POSCO Transaction Agreement may be terminated if the NSC Transaction

or the POSCO Transaction, respectively, have not been completed by May 31, 2024.

The NSC Transaction and the POSCO

Transaction are expected to close in the first quarter of 2024.

5.2 Disclosure

for Restructuring Transactions

Not applicable.

| Item 6 | Reliance on subsection 7.1(2) of National Instrument 51-102 |

Not applicable.

| Item 7 | Omitted Information |

None.

Further information regarding

the matters described in this report may be obtained from Charlene Ripley, Senior Vice President and General Counsel, who is knowledgeable

about the details of the material change and may be contacted at Charlene.Ripley@teck.com or 604-697-3509.

November 23, 2023.

Caution Regarding Forward-Looking Statements

This material change report

contains certain forward-looking information and forward-looking statements as defined in applicable securities laws (collectively referred

to as forward-looking statements). These forward-looking statements relate to future events or our future performance. All statements

other than statements of historical fact are forward-looking statements. The use of any of the words “anticipate”, “plan”,

“continue”, “estimate”, “expect”, “may”, “will”, “project”, “predict”,

“potential”, “should”, “believe” and similar expressions is intended to identify forward-looking statements.

These statements involve known and unknown risks, uncertainties and other factors that may cause actual results or events to differ materially

from those anticipated in such forward-looking statements.

These forward-looking statements

include, but are not limited to, statements relating to the Proposed Transactions; the timing for completion of the Proposed Transactions;

Teck’s ability to satisfy the conditions of closing, including the receipt of and conditions to regulatory approvals for the Proposed

Transactions; and other statements that are not historical facts.

Although Teck believes that

the forward-looking statements in this news release are based on information and assumptions that are current, reasonable and complete,

these statements are by their nature subject to a number of factors that could cause actual results to differ materially from management’s

expectations and plans as set forth in such forward-looking statements, including, without limitation, the following factors, many of

which are beyond Teck’s control and the effects of which can be difficult to predict: the possibility that the Proposed Transactions

will not be completed on the terms and conditions, or on the timing, currently contemplated, and that the transactions may not be completed

at all, due to a failure to obtain or satisfy, in a timely manner or otherwise, required regulatory approvals and other conditions of

closing necessary to complete the transactions or for other reasons; the possibility of adverse reactions or changes in business relationships

resulting from the announcement or completion of the Proposed Transactions; risk that market or other conditions are no longer favourable

to completing the Proposed Transactions; risks relating to business disruption during the pendency of or following the Proposed Transactions

and diversion of management time; risks relating to tax, legal and regulatory matters; credit, market, currency, operational, commodity,

liquidity and funding risks generally and relating specifically to the Proposed Transactions, including changes in economic conditions,

interest rates or tax rates; and other risks inherent to Teck’s business and/or factors beyond Teck’s control which could

have a material adverse effect on Teck or the ability to consummate the Proposed Transactions.

Teck cautions that the foregoing

list of important factors and assumptions is not exhaustive and other factors could also adversely affect its results. Further information

concerning risks and uncertainties associated with these forward-looking statements and Teck’s business can be found in

Teck’s Annual Information

Form for the year ended December 31, 2022, filed under Teck’s profile on SEDAR (www.sedarplus.ca)

and on EDGAR (www.sec.gov) under cover of Form 40-F, as well as subsequent filings that can also

be found under Teck’s profile.

The forward-looking statements

contained in this material change report describe Teck’s expectations at the date of this material change report and, accordingly,

are subject to change after such date. Except as may be required by applicable securities laws, Teck does not undertake any obligation

to update or revise any forward-looking statements contained in this material change report, whether as a result of new information, future

events or otherwise. Readers are cautioned not to place undue reliance on these forward-looking statements.

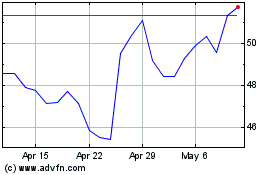

Teck Resources (NYSE:TECK)

Historical Stock Chart

From Apr 2024 to May 2024

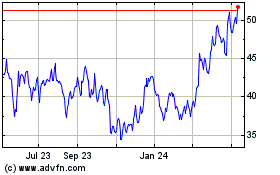

Teck Resources (NYSE:TECK)

Historical Stock Chart

From May 2023 to May 2024