As filed with the Securities and Exchange Commission on December 20, 2023

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

| |

TE CONNECTIVITY LTD.

(Exact name of registrant as specified in its charter)

|

|

|

TYCO ELECTRONICS GROUP S.A.

(Exact name of registrant as specified in its charter)

|

|

| |

Switzerland

(State or other jurisdiction of incorporation or organization)

|

|

|

Grand Duchy of Luxembourg

(State or other jurisdiction of incorporation or organization)

|

|

| |

98-0518048

(I.R.S. Employer Identification Number)

|

|

|

98-0518566

(I.R.S. Employer Identification Number)

|

|

| |

Mühlenstrasse 26

CH-8200 Schaffhausen, Switzerland

+41(0)52 633 66 61

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

|

|

|

46 Place Guillaume II

L-1648 Luxembourg

+352 46 43 40 401

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

|

|

John S. Jenkins, Jr.

Executive Vice President and General Counsel

TE Connectivity Ltd.

1050 Westlakes Drive

Berwyn, PA 19312

(610) 893-9800

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copy to:

Corey R. Chivers

Weil, Gotshal & Manges LLP

767 Fifth Avenue

New York, New York 10153

(212) 310-8000

Approximate date of commencement of proposed sale to the public:

From time to time after the effective date of this Registration Statement as determined by the Registrants.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☒

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer

☒

Non-accelerated filer

☐

|

|

|

Accelerated filer

☐

Smaller reporting company

☐

Emerging growth company

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

PROSPECTUS

TE CONNECTIVITY LTD.

REGISTERED SHARES

WARRANTS

UNITS

GUARANTEES

TYCO ELECTRONICS GROUP S.A.

DEBT SECURITIES

UNITS

TE Connectivity Ltd. (“TE Connectivity”) may from time to time offer to sell its registered shares, warrants or units. Warrants may be exercisable for registered shares of TE Connectivity or the debt securities described below. Units may include, be convertible into or exercisable or exchangeable for registered shares or warrants of TE Connectivity or the debt securities described below. TE Connectivity may from time to time issue guarantees of the debt securities as described below.

Tyco Electronics Group S.A. (“TEGSA”) may from time to time offer to sell its debt securities as well as units. The debt securities may consist of debentures, notes or other types of debt. The debt securities issued by TEGSA may be convertible or exchangeable for registered shares or other securities of TE Connectivity. The debt securities issued by TEGSA may also be investment grade. If the debt securities issued by TEGSA are either convertible or exchangeable or are not investment grade, such securities shall be fully and unconditionally guaranteed by TE Connectivity. Units may include, be convertible into or exercisable or exchangeable for debt securities of TEGSA and registered shares or warrants of TE Connectivity.

TE Connectivity and TEGSA may offer and sell these securities to or through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed basis. TE Connectivity and TEGSA will provide a specific plan of distribution for any securities to be offered in a supplement to this prospectus. TE Connectivity and TEGSA will provide specific terms of any securities to be offered in a supplement to this prospectus. You should read this prospectus and the applicable prospectus supplement carefully before you invest.

The principal executive offices of TE Connectivity are located at Mühlenstrasse 26, CH-8200 Schaffhausen, Switzerland, and its telephone number at that address is +41 (0)52 633 66 61. The principal executive offices of TEGSA are located at 46 Place Guillaume II, L-1648 Luxembourg, Grand Duchy of Luxembourg (Luxembourg) and its telephone number at that address is +352 46 43 40 401.

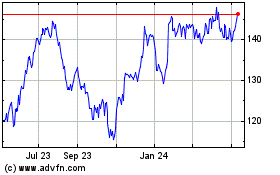

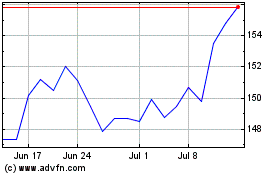

TE Connectivity’s common shares are listed on the NYSE and trade under the symbol “TEL”.

Investing in the securities involves risks. See “Risk Factors” on page 3 of this prospectus to read about factors you should consider before investing in the securities.

None of the Securities and Exchange Commission, any state securities commission, nor any similar authority in Switzerland or Luxembourg, has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

This prospectus may not be used to sell securities unless accompanied by a prospectus supplement that contains a description of those securities.

The date of this prospectus is December 20, 2023

TABLE OF CONTENTS

| |

|

|

Page

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

1 |

|

|

|

|

|

|

|

|

2 |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

3 |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

5 |

|

|

|

|

|

|

|

|

5

|

|

|

ABOUT THIS PROSPECTUS

This prospectus is part of an automatic shelf registration statement on Form S-3 that TE Connectivity and TEGSA have filed with the Securities and Exchange Commission (the “SEC”) under the Securities Act of 1933, as amended (the “Securities Act”). By using a shelf registration statement, we may sell, at any time and from time to time, in one or more offerings, any combination of the securities described in this prospectus. As allowed by the SEC’s rules, this prospectus does not contain all of the information included in the registration statement. For further information, we refer you to the registration statement, including its exhibits, filed with the SEC. Statements contained in this prospectus about the provisions or contents of any agreement or other document are not necessarily complete. If the SEC’s rules and regulations require that an agreement or document be filed as an exhibit to the registration statement, please see that agreement or document for a complete description of these matters.

You should read this prospectus, any prospectus supplement and any free writing prospectus we file with the SEC together with any additional information you may need to make your investment decision. You should also read and carefully consider the information in the documents we have referred you to in “Where You Can Find More Information” below. Information incorporated by reference after the date of this prospectus is considered a part of this prospectus and may add, update or change information contained in or incorporated by reference into this prospectus. Any information in such subsequent filings that is inconsistent with the information in or incorporated by reference into this prospectus will supersede the information in this prospectus or any earlier prospectus supplement.

You should rely only on the information incorporated by reference or provided in this prospectus, any supplement or any free writing prospectus we file with the SEC. We have not authorized anyone else to provide you with other information. We are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information in this prospectus, any prospectus supplement, any free writing prospectus or any document incorporated herein or therein by reference is accurate as of any date other than the date of the applicable document. Our business, financial condition, results of operations and prospects may have changed since that date.

Unless otherwise stated, or the context otherwise requires, references in this prospectus to “we,” “us” and “our” are to TE Connectivity and its consolidated subsidiaries, including TEGSA.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the informational requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, in accordance with these requirements, we file reports and other information relating to our business, financial condition and other matters with the SEC. We are required to disclose in such reports certain information, as of particular dates, concerning our operating results and financial condition, officers and directors, principal holders of shares, any material interests of such persons in transactions with us and other matters. The SEC maintains an Internet site that contains reports, proxy and information statements and other information regarding issuers like us that file electronically with the SEC. The address of such site is: http://www.sec.gov.

Our Internet website is www.te.com. We make available free of charge on our website our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, reports filed pursuant to Section 16 and amendments to those reports as soon as reasonably practicable after we electronically file or furnish such materials to the SEC. In addition, we have posted the charters for our Audit Committee, Management Development and Compensation Committee and Nominating, Governance and Compliance Committee, as well as our Board Governance Principles, under the heading “Executive Team — Board Documents” in the About TE section of our website. Other than any documents expressly incorporated by reference, the information on our website and any other website that is referred to in this prospectus is not part of this prospectus.

INCORPORATION BY REFERENCE

The SEC allows us to “incorporate by reference” information into this prospectus, which means that we can disclose important information to you by referring to those documents. This prospectus incorporates by reference the documents set forth below, which TE Connectivity has filed with the SEC, and any future filings made by TE Connectivity and TEGSA with the SEC under Section 13(a), 13(c), 14 or 15(d) of the Exchange Act. Notwithstanding the foregoing, unless expressly stated to the contrary, none of the information that TE Connectivity discloses under Item 2.02 or 7.01 of any Current Report on Form 8-K or exhibits relating to such disclosure that it has furnished or may from time to time furnish to the SEC will be incorporated by reference into, or otherwise included in, this prospectus. The information we file later with the SEC will automatically update and in some cases supersede the information in this prospectus and the documents listed below.

•

•

•

The description of TE Connectivity’s registered shares included in Exhibit 4.1 to TE Connectivity’s Annual Report on Form 10-K for the fiscal year ended September 29, 2023.

Upon your oral or written request, we will provide you with a copy of any of these filings at no cost. Requests should be directed to Corporate Secretary, TE Connectivity Ltd., 1050 Westlakes Drive, Berwyn, PA 19312, Telephone No. (610) 893-9800.

BUSINESS

TE Connectivity Ltd.

TE Connectivity is a global industrial technology leader creating a safer, sustainable, productive, and connected future. Our broad range of connectivity and sensor solutions enable the distribution of power, signal and data to advance next-generation transportation, renewable energy, automated factories, data centers, medical technology and more.

We operate through the following reportable segments: Transportation Solutions, Industrial Solutions and Communications Solutions.

TE Connectivity is a Swiss corporation. Its registered and principal office is located at Mühlenstrasse 26, CH-8200 Schaffhausen, Switzerland, and its telephone number at that address is +41 (0)52 633 66 61. Its executive office in the United States is located at 1050 Westlakes Drive, Berwyn, Pennsylvania 19312, and its telephone number at that address is (610) 893-9800.

Tyco Electronics Group S.A.

TEGSA is a Luxembourg public limited liability company (société anonyme) and a wholly-owned subsidiary of TE Connectivity. TEGSA’s registered and principal office is located at 46 Place Guillaume II, L-1648 Luxembourg, and its telephone number at that address is +352 46 43 40 401. TEGSA is a holding company established to directly and indirectly own all of the operating subsidiaries of TE Connectivity, to issue debt securities and to perform treasury operations for TE Connectivity. Otherwise, it conducts no independent business.

RISK FACTORS

Investing in our securities involves risks. Before deciding to purchase any of our securities, you should carefully consider the discussion of risks and uncertainties under “Part I, Item 1A — Risk Factors” in TE Connectivity’s Annual Report on Form 10-K for the fiscal year ended September 29, 2023, which is incorporated by reference in this prospectus, and under similar headings in TE Connectivity’s subsequently filed quarterly reports on Form 10-Q and annual reports on Form 10-K, as well as the other risks and uncertainties described in any applicable prospectus supplement and in the other documents incorporated by reference in this prospectus. See the section entitled “Where You Can Find More Information” in this prospectus. The risks and uncertainties discussed in the documents incorporated by reference in this prospectus are those we currently believe may materially affect us. Additional risks and uncertainties not presently known to us or that we currently believe are immaterial also may materially and adversely affect our business, financial condition and results of operations.

FORWARD-LOOKING STATEMENTS

We have made forward-looking statements in this prospectus and the documents incorporated in this prospectus that are based on our management’s beliefs and assumptions and on information available to our management at the time such statements were made. Forward-looking statements include, among others, the information concerning our possible or assumed future results of operations, business strategies, financing plans, competitive position, potential growth opportunities, potential operating performance improvements, acquisitions, divestitures, the effects of competition, and the effects of future legislation or regulations. Forward-looking statements also include statements addressing our environmental, social, governance, and sustainability plans and goals. Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “aspire,” “estimate,” “predict,” “potential,” “goal,” “target,” “continue,” “may,” and “should,” or the negative of these terms or similar expressions.

Forward-looking statements involve risks, uncertainties and assumptions. Actual results may differ materially from those expressed in our forward-looking statements. You should not put undue reliance on any forward-looking statements.

The risk factors discussed under “Part I, Item 1A — Risk Factors” in TE Connectivity’s Annual Report on Form 10-K for the fiscal year ended September 29, 2023, and under similar headings in TE Connectivity’s subsequently filed quarterly reports on Form 10-Q and annual reports on Form 10-K, as well as the other risks and uncertainties described in any applicable prospectus supplement and in the other documents incorporated by reference into this prospectus, could cause our results to differ materially from those expressed in forward-looking statements. There may be other risks and uncertainties that we are unable to predict at this time or that we currently do not expect to have a material adverse effect on our business. We expressly disclaim any obligation to update these forward-looking statements other than as required by law.

USE OF PROCEEDS

Unless otherwise stated in the prospectus supplement accompanying this prospectus, we will use the net proceeds from the sale of any registered shares, warrants, debt securities or units that may be offered hereby for general corporate purposes. Such general corporate purposes may include, but are not limited to, reducing or refinancing our indebtedness or the indebtedness of our subsidiaries, financing possible acquisitions and redeeming outstanding securities. The prospectus supplement relating to an offering will contain a more detailed description of the use of proceeds of any specific offering of securities.

DESCRIPTION OF SECURITIES

We will set forth in the applicable prospectus supplement a description of the registered shares, warrants, debt securities, guarantees or units that may be offered under this prospectus.

PLAN OF DISTRIBUTION

TE Connectivity and TEGSA may offer and sell the securities offered by this prospectus to or through one or more underwriters, dealers and agents, or directly to purchasers, on a continuous or delayed basis. TE Connectivity and TEGSA will provide a specific plan of distribution for any securities to be offered in a supplement to this prospectus.

ENFORCEMENT OF CIVIL LIABILITIES

TE Connectivity is a Swiss company, and TEGSA is a Luxembourg company. TE Connectivity and TEGSA have consented in the indenture to be used in connection with the issuance of debt securities to submit to the jurisdiction of the U.S. federal and state courts in The City of New York and to receive service of process in The City of New York in any legal suit, action or proceeding brought to enforce any rights under or with respect to such indenture and any debt securities or guarantees issued under it. A substantial majority of TE Connectivity’s directly held assets consists of shares in TEGSA. Accordingly, any judgment against TEGSA or TE Connectivity in respect of the indenture, the notes or the guarantee, including for civil liabilities under the U.S. federal securities laws, obtained in any U.S. federal or state court may have to be enforced in the courts of Luxembourg or Switzerland. Investors should not assume that the courts of Luxembourg or Switzerland would enforce judgments of U.S. courts obtained against TEGSA or TE Connectivity predicated upon the civil liability provisions of the U.S. federal securities laws or that such courts would enforce, in original actions, liabilities against TEGSA or TE Connectivity predicated solely upon such laws.

Luxembourg

TEGSA is incorporated under the laws of Luxembourg. Certain members of the board of directors are non-residents of the United States and a substantial portion of TEGSA’s assets and those of such directors are located outside the United States. As a result, you may not be able to effect a service of process within the United States on TEGSA or on such persons or to enforce in Luxembourg courts judgments obtained against TEGSA or such persons in U.S. courts, including actions predicated upon the civil liability provisions of the U.S. federal and state securities laws or other laws. Likewise, it may also be difficult for an investor to enforce in U.S. courts judgments obtained against TEGSA or such persons in courts in jurisdictions outside the United States, including actions predicated upon the civil liability provisions of the U.S. securities laws.

TEGSA has been advised by Allen & Overy, société en commandite simple, its Luxembourg counsel, that the United States and the Grand-Duchy of Luxembourg are not currently bound by a treaty providing for reciprocal recognition and enforcement of judgments (other than arbitral awards) rendered in civil and commercial matters. According to such counsel, an enforceable judgment for the payment of monies rendered by any U.S. federal or state court based on civil liability, whether or not predicated solely upon the U.S. securities laws, would not directly be enforceable in Luxembourg. However, a party who received such favorable judgment in a U.S. court may initiate enforcement proceedings in Luxembourg (exequatur) by requesting enforcement of the U.S. judgment before the District Court (Tribunal d’Arrondissement) of Luxembourg sitting in civil matters pursuant to Article 678 of the New Luxembourg Code of Civil Procedure. The president of the District Court will authorize the enforcement in Luxembourg of the U.S. judgment if it is satisfied that all of the following conditions are met:

•

the U.S. judgment is enforceable (exécutoire) in the United States;

•

the jurisdictional ground of the U.S. court is founded according to Luxembourg private international law rules and to the applicable domestic U.S. federal or state jurisdiction rules;

•

the U.S. court has applied to the dispute the substantive law which would have been applied by Luxembourg courts or, at least, the judgment must not contravene the principles underlying these rules;

•

the U.S. judgment must not have violated the right of the defendant to present a defense;

•

the considerations of the U.S. judgment as well as the U.S. judgment as such do not contravene Luxembourg international public policy;

•

the U.S. court has acted in accordance with its own procedural laws; and

•

the U.S. judgment was not rendered as a result of or in connection with an evasion of Luxembourg law (“fraude à la loi”).

LEGAL MATTERS

Unless otherwise indicated in the applicable prospectus supplement, Weil, Gotshal & Manges LLP, New York, New York will pass upon the validity of the debt securities, guarantees, warrants and units offered by TE Connectivity or TEGSA. The validity of the registered shares offered by TE Connectivity will be passed upon by Bär & Karrer AG, Zurich, Switzerland, unless otherwise indicated in the applicable prospectus supplement.

EXPERTS

The financial statements of TE Connectivity Ltd. as of September 29, 2023 and September 30, 2022, and for each of the three years in the period ended September 29, 2023, incorporated by reference in this Prospectus by reference to TE Connectivity Ltd.’s Annual Report on Form 10-K for the fiscal year ended September 29, 2023, and the effectiveness of TE Connectivity Ltd.’s internal control over financial reporting have been audited by Deloitte & Touche LLP, an independent registered public accounting firm, as stated in their reports. Such financial statements are incorporated by reference in reliance upon the reports of such firm given upon their authority as experts in accounting and auditing.

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution

The following statement sets forth the expenses of TE Connectivity Ltd. (“TE Connectivity”) and Tyco Electronics Group S.A. (“TEGSA” and together with TE Connectivity, the “Registrants”) in connection with the offering described in this Registration Statement (all of which will be borne by the Registrants). All amounts shown are estimated.

| |

SEC registration fee

|

|

|

|

$ |

* |

|

|

| |

Printing expenses

|

|

|

|

|

+ |

|

|

| |

Legal fees and expenses

|

|

|

|

|

+ |

|

|

| |

Audit fees and expenses

|

|

|

|

|

+ |

|

|

| |

Miscellaneous expenses

|

|

|

|

|

+ |

|

|

| |

Trustee fees and expenses

|

|

|

|

|

+ |

|

|

| |

Total

|

|

|

|

$ |

|

|

|

*

In accordance with Rules 456(b) and 457(r), the Registrants are deferring payment of the registration fee for the securities offered by this prospectus.

+

Estimated expenses are not presently known.

The foregoing sets forth the general categories of expenses (other than underwriting discounts and commissions) that the Registrants anticipate they will incur in connection with the offering of securities under this registration statement. Information regarding estimated expenses of issuance and distribution of each identified class of securities being registered will be provided at the time information as to such class is included in a prospectus supplement in accordance with Rule 430B.

Item 15. Indemnification of Directors and Officers

TE Connectivity Ltd.

The articles of association and organizational regulations of TE Connectivity provide as follows:

•

TE Connectivity shall indemnify and hold harmless, to the fullest extent permitted by law, the existing and former directors and officers of TE Connectivity, and their heirs, executors and administrators out of the assets of TE Connectivity from and against all damages, losses, liabilities and expenses in connection with threatened, pending or completed actions, proceedings or investigations, whether civil, criminal, administrative or other (including, but not limited to, liabilities under contract, tort and statute or any applicable foreign law or regulation and all reasonable legal and other costs and expenses properly payable) which they or any of them, their heirs, executors or administrators, shall or may incur or sustain by or by reason of (i) any act done or alleged to be done, concurred or alleged to be concurred in or omitted or alleged to be omitted in or about the execution of their duty, or alleged duty, or (ii) serving as director or officer of TE Connectivity, or (iii) serving at the request of TE Connectivity as director, officer, or employee or agent of another corporation, partnership, trust or other enterprise. This indemnity shall not extend to any matter in which any of said persons is found, in a final judgment or decree of a court, arbitral tribunal or governmental or administrative authority of competent jurisdiction not subject to appeal, to have committed an intentional or grossly negligent breach of said person’s duties as director or officer.

•

Without limiting the foregoing, TE Connectivity shall advance to existing and former directors and officers court costs and attorney fees in connection with civil, criminal, administrative or investigative proceedings as described in the preceding paragraph. TE Connectivity may reject and/or recover such advanced costs if a court or governmental or administrative authority of competent jurisdiction

not subject to appeal holds that the director or officer in question has committed an intentional or grossly negligent breach of his statutory duties as a director or officer.

•

TE Connectivity may procure insurance on behalf of any person who is or was a director, officer, employee or agent of TE Connectivity, or is or was serving at the request of TE Connectivity as a director, officer, employee or agent of another company, partnership, joint venture, trust or other enterprise, or in a fiduciary or other capacity with respect to any employee benefit plan maintained by TE Connectivity, against any liability asserted against him or her and incurred by him or her in any such capacity, or arising out of his or her status as such, whether or not TE Connectivity would have the power to indemnify him or her against such liability under the provisions of art. 26 (of TE Connectivity’s articles of association). The insurance premiums shall be charged to and paid by TE Connectivity or its subsidiaries.

Tyco Electronics Group S.A.

Under the articles of association of TEGSA, TEGSA may indemnify any director or officer and his or her heirs, executors and administrators against expenses reasonably incurred by such director or officer in connection with any action, suit or proceeding to which the director or officer may be made a party by reason of being or having been a director or officer of TEGSA or, at such director’s or officer’s request, of any other corporation of which TEGSA is a shareholder or creditor and from which the director or officer is not entitled to be indemnified, except in relation to matters as to which the director or officer is finally adjudged in such action, suit or proceeding to be liable for gross negligence or misconduct.

In the event of a settlement, indemnification will be provided only in connection with such matters covered by the settlement as to which TEGSA is advised by counsel that the person to be indemnified did not commit a breach of duty. Luxembourg law permits TEGSA to maintain insurance to compensate for any civil liability incurred by a director or officer in his or her official capacity or to indemnify for such loss or liability, and TE Connectivity has policies covering TEGSA’s directors and officers.

Item 16. Exhibits

| |

Exhibit

Number

|

|

|

Description

|

|

| |

1.1

|

|

|

Form of Underwriting Agreement.*

|

|

| |

4.1

|

|

|

Articles of Association of TE Connectivity Ltd., as amended and restated (Incorporated by reference to Exhibit 3.1 to TE Connectivity Ltd.’s Current Report on Form 8-K, filed March 20, 2023).

|

|

| |

4.2

|

|

|

Organizational Regulations of TE Connectivity Ltd., as amended and restated (Incorporated by reference to Exhibit 3.1 to TE Connectivity Ltd.’s Current Report on Form 8-K, filed December 12, 2022).

|

|

| |

4.3

|

|

|

|

|

| |

4.4

|

|

|

Indenture, dated as of September 25, 2007, among Tyco Electronics Group S.A., as issuer, TE Connectivity Ltd., as guarantor, and Deutsche Bank Trust Company Americas, as trustee (Incorporated by reference to Exhibit 4.1(a) to TE Connectivity Ltd.’s Annual Report on Form 10-K for the fiscal year ended September 28, 2007, filed December 14, 2007).

|

|

| |

4.5

|

|

|

Form of Note.*

|

|

| |

4.6

|

|

|

Form of Warrant Agreement for TE Connectivity Ltd.*

|

|

| |

4.7

|

|

|

Form of Unit Agreement for TE Connectivity Ltd.*

|

|

| |

4.8

|

|

|

Form of Unit Agreement for Tyco Electronics Group S.A.*

|

|

| |

5.1

|

|

|

|

|

| |

5.2

|

|

|

Opinion of Bär & Karrer AG.+

|

|

| |

22.1

|

|

|

Guaranteed Securities (Incorporated by reference to Exhibit 22.1 to TE Connectivity Ltd.’s Annual Report on Form 10-K for the fiscal year ended September 29, 2023, filed November 13, 2023).

|

|

*

To be filed by amendment or as an exhibit to a document filed under the Securities Exchange Act of 1934 and incorporated herein by reference.

+

Filed herewith.

Item 17. Undertakings

The undersigned Registrants hereby undertake:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information in the registration statement. Notwithstanding the foregoing, any increase or decrease in the volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Filing Fee Tables” table in the effective registration statement; and

(iii) To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that paragraphs (i), (ii) and (iii) above do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Securities and Exchange Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein and the offering of such securities in the post-effective amendment at that time shall be deemed to be the initial bona fide offering thereof.

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(4) That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i) Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the purpose of providing the information required by Section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

(5) That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities, the undersigned Registrants undertake that in a primary offering of securities of the undersigned Registrants pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned Registrants will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i) Any preliminary prospectus or prospectus of the undersigned Registrants relating to the offering required to be filed pursuant to Rule 424;

(ii) Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned Registrants or used or referred to by the undersigned Registrants;

(iii) The portion of any other free writing prospectus relating to the offering containing material information about the undersigned Registrants or its securities provided by or on behalf of the undersigned Registrants; and

(iv) Any other communication that is an offer in the offering made by the undersigned Registrants to the purchaser.

(6) That, for purposes of determining any liability under the Securities Act of 1933, each filing of TE Connectivity’s annual report pursuant to Section 13(a) or Section 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan’s annual report pursuant to Section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of the securities at that time shall be deemed to be the initial bona fide offering thereof.

(7) To file an application for the purposes of determining the eligibility of the trustee to act under subsection (a) of Section 310 of the Trust Indenture Act in accordance with the rules and regulations prescribed by the Commission under Section 305(b)(2) of the Trust Indenture Act.

(8) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers or controlling persons of the Registrants pursuant to the foregoing provisions, or otherwise, the Registrants have been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by a registrant of expenses incurred or paid by a director, officer or controlling person of such registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the Registrants will, unless in the opinion of its counsel the matter has been settled by controlling precedent,

submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities and Exchange Act and will be governed by the final adjudication of such issue.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Berwyn, Pennsylvania, on this 20th day of December 2023.

TE CONNECTIVITY LTD.

By:

/s/ Heath A. Mitts

Name:

Heath A. Mitts

Title:

Executive Vice President and Chief Financial Officer

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons on December 20, 2023 in the capacities indicated below.

| |

Signature

|

|

|

Title

|

|

| |

/s/ Terrence R. Curtin

Terrence R. Curtin

|

|

|

Chief Executive Officer and Director

(Principal Executive Officer)

|

|

| |

/s/ Heath A. Mitts

Heath A. Mitts

|

|

|

Executive Vice President and Chief Financial Officer and Director

(Principal Financial Officer)

|

|

| |

/s/ Robert J. Ott

Robert J. Ott

|

|

|

Senior Vice President and Corporate Controller

(Principal Accounting Officer)

|

|

| |

*

Jean-Pierre Clamadieu

|

|

|

Director

|

|

| |

*

Carol A. Davidson

|

|

|

Director

|

|

| |

*

Lynn A. Dugle

|

|

|

Director

|

|

| |

*

William A. Jeffrey

|

|

|

Director

|

|

| |

*

Syaru Shirley Lin

|

|

|

Director

|

|

| |

*

Thomas J. Lynch

|

|

|

Director

|

|

| |

Signature

|

|

|

Title

|

|

| |

*

Abhijit Y. Talwalkar

|

|

|

Director

|

|

| |

*

Mark C. Trudeau

|

|

|

Director

|

|

| |

*

Dawn C. Willoughby

|

|

|

Director

|

|

| |

*

Laura H. Wright

|

|

|

Director

|

|

*

The undersigned does hereby sign this Registration Statement on behalf of the above-indicated director of TE Connectivity Ltd. pursuant to a power of attorney executed by such director.

| |

|

|

|

By:

|

|

|

/s/ John S. Jenkins, Jr.

John S. Jenkins, Jr.

Attorney-in-Fact

|

|

AUTHORIZED REPRESENTATIVE

Pursuant to the requirements of the Securities Act of 1933, as amended, the undersigned has signed this Registration Statement, solely in the capacity of the duly authorized representative of TE Connectivity Ltd. in the United States, on this 20th day of December 2023.

| |

|

|

|

By:

|

|

|

/s/ John S. Jenkins, Jr.

John S. Jenkins, Jr.

TE Connectivity Ltd.

Executive Vice President and General Counsel

|

|

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-3 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Berwyn, Pennsylvania, on this 20th day of December 2023.

TYCO ELECTRONICS GROUP S.A.

By:

/s/ Harold G. Barksdale

Name:

Harold G. Barksdale

Title:

Director

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons on December 20, 2023 in the capacities indicated below.

| |

Signature

|

|

|

Title

|

|

| |

/s/ Harold G. Barksdale

Harold G. Barksdale

|

|

|

Director and Authorized Representative in the United States

|

|

| |

/s/ Helena Brogan

Helena Brogan

|

|

|

Director

|

|

| |

/s/ Sabine M. Carbon

Sabine M. Carbon

|

|

|

Director and Controller

(Principal Financial and Accounting Officer)

|

|

| |

/s/ Jean-Jacques Fotzeu

Jean-Jacques Fotzeu

|

|

|

Director

|

|

| |

/s/ Sarah Huot de Saint Albin

Sarah Huot de Saint Albin

|

|

|

Director

|

|

| |

/s/ Patrick Segmueller

Patrick Segmueller

|

|

|

Director

|

|

Exhibit 5.1

767 Fifth Avenue

New York, NY 10153-0119

+1 212 310 8000 tel

+1 212 310 8007 fax

December 20, 2023

TE Connectivity Ltd.

Mühlenstrasse 26

CH-8200 Schaffhausen

Switzerland

Tyco Electronics Group S.A.

46 Place Guillaume II

L-1648 Luxembourg

Ladies and Gentlemen:

We have acted as counsel to TE Connectivity Ltd.,

a Swiss corporation (“TE Connectivity”), and Tyco Electronics Group S.A., a Luxembourg company (“TEGSA” and,

together with TE Connectivity, the “Registrants”), in connection with the preparation and filing with the Securities and Exchange

Commission (the “Commission”) of the Registrants’ Registration Statement on Form S-3 (the “Registration Statement”),

under the Securities Act of 1933, as amended (the “Securities Act”), relating to the registration of the offer, issuance and

sale from time to time (i) by TE Connectivity of an indeterminate amount of (a) registered shares (the “Registered Shares”);

(b) warrants (the “Warrants”); (c) units (the “TE Connectivity Units”) comprised of Registered Shares,

Warrants or Debt Securities (as defined below); and (d) guarantees (the “Guarantees”) of Debt Securities; and (ii) by

TEGSA of an indeterminate amount of (a) debt securities (the “Debt Securities”) and (b) units comprised of Debt

Securities and Registered Shares or Warrants (the “TEGSA Units” and, together with the TE Connectivity Units, the “Units”).

We refer to the Registered Shares, the Warrants, the Units, the Guarantees and the Debt Securities collectively as the “Securities.”

In so acting, we have examined originals or copies

(certified or otherwise identified to our satisfaction) of the Registration Statement, the Prospectus contained in the Registration Statement

(the “Prospectus”), the Indenture, dated as of September 25, 2007 (the “Indenture”), among TEGSA, as issuer,

TE Connectivity, as guarantor, and Deutsche Bank Trust Company Americas, as trustee (the “Trustee”), the form of Guarantee

of TE Connectivity included in the Indenture and such corporate records, agreements, documents and other instruments, and such certificates

or comparable documents of public officials and of officers and representatives of each of the Registrants, and have made such inquiries

of such officers and representatives, as we have deemed relevant and necessary as a basis for the opinions hereinafter set forth.

TE

Connectivity Ltd.

Tyco Electronics Group S.A.

December 20, 2023

Page 2

|  |

In such examination, we have assumed the genuineness

of all signatures, the legal capacity of all natural persons, the authenticity of all documents submitted to us as originals, the conformity

to original documents of all documents submitted to us as certified, conformed or photostatic copies and the authenticity of the originals

of such latter documents. As to all questions of fact material to this opinion that have not been independently established, we have relied

upon certificates or comparable documents of officers and representatives of each of the Registrants.

Based on and subject to the foregoing and assuming

that (i) each of the Registrants validly exists and has the requisite corporate power and authority to issue the Securities and to

execute, deliver and perform its obligations under the Securities, (ii) each trustee for the Debt Securities and warrant agent for

the Warrants, when appointed, will validly exist and have the requisite corporate power and authority to enter into and perform its obligations

under the Indenture, the supplemental indenture relating to the Debt Securities and any warrant agreement, as applicable, (iii) any

Securities issuable upon conversion, exercise or exchange of any Securities being offered or issued will be duly authorized, created and,

if appropriate, reserved for issuance upon such conversion, exercise or exchange, (iv) the Registration Statement and any amendments

thereto (including any post-effective amendments) will have become effective and comply with all applicable laws and no stop order suspending

the Registration Statement’s effectiveness will have been issued and remain in effect, in each case, at the time the Securities

are offered or issued as contemplated by the Registration Statement, (v) a prospectus supplement will have been prepared and filed

with the Commission describing the Securities offered thereby and will at all relevant times comply with all applicable laws, (vi) TE

Connectivity has timely filed all necessary reports pursuant to the Securities Exchange Act of 1934, as amended, which are incorporated

by reference into the Registration Statement, (vii) all Securities will be issued and sold in compliance with applicable federal

and state securities laws and in the manner stated in the Registration Statement and any applicable prospectus supplement and (viii) any

definitive purchase, underwriting or similar agreement with respect to any Securities will have been duly authorized and validly executed

and delivered by the Registrants and the other party or parties thereto, we are of the opinion that:

1.

Debt Securities. Assuming that (i) the execution, delivery and performance of any Debt Securities (including any Debt Securities

that may be issued as part of Units or otherwise pursuant to the terms of any other Securities) and the terms thereof have been duly authorized

by all necessary corporate action on the part of TEGSA, (ii) the form of the Debt Securities and any supplemental indenture relating

to such Debt Securities has been duly authorized, executed and delivered by all parties thereto substantially in the form so filed, (iii) the

terms of such Debt Securities to be issued under the Indenture and the applicable supplemental indenture have been duly established in

conformity with the Indenture and the applicable supplemental indenture so as not to violate any applicable law, affect the enforceability

of such Debt Securities or result in a default under or breach of any agreement or instrument binding upon the Registrants, and so as

to comply with any requirement or restriction imposed by any court or governmental or regulatory body having jurisdiction over the Registrants,

(iv) such Debt Securities have been duly executed and authenticated in accordance with the Indenture and delivered against any contemplated

payment therefor and issued and sold as contemplated in the Registration Statement, the Prospectus and any prospectus supplement relating

thereto, and in accordance with any underwriting agreement and (v) such Debt Securities and the supplemental indenture relating to

such Debt Securities are governed by New York law, such Debt Securities (including any Debt Securities that may be issued as part of Units

or otherwise pursuant to the terms of any other Securities) will constitute legal, valid and binding obligations of TEGSA, enforceable

against TEGSA in accordance with their terms.

TE

Connectivity Ltd.

Tyco Electronics Group S.A.

December 20, 2023

Page 3

|  |

2.

Warrants. Assuming that (i) the execution, delivery and performance of any Warrants (including any Warrants that may be

issued as part of Units or otherwise pursuant to the terms of any other Securities) and the terms thereof have been duly authorized by

all necessary corporate action on the part of TE Connectivity, (ii) the warrant agreement or warrant agreements relating to such

Warrants have been duly authorized, executed and delivered by all parties thereto substantially in the form so filed, (iii) the terms

of such Warrants have been duly established so as not to violate any applicable law, affect the enforceability of such Warrants or result

in a default under or breach of any agreement or instrument binding upon TE Connectivity, and so as to comply with any requirement or

restriction imposed by any court or governmental or regulatory body having jurisdiction over TE Connectivity, (iv) such Warrants

or certificates representing such Warrants have been duly executed, authenticated and delivered against any contemplated payment therefor

and issued and sold as contemplated in the Registration Statement, the Prospectus and any prospectus supplement relating thereto, and

in accordance with any underwriting agreement and (v) such Warrants and the warrant agreement or warrant agreements relating to such

Warrants are governed by New York law, such Warrants (including any Warrants that may be issued as part of Units or otherwise pursuant

to the terms of any other Securities) will constitute legal, valid and binding obligations of TE Connectivity, enforceable against TE

Connectivity in accordance with their terms.

3.

Units. Assuming that (i) the execution, delivery and performance of any Units and the terms thereof have been duly authorized

by all necessary corporate action on the part of the applicable Registrant and the securities of any other entities to be included in

the Units, if any, have been duly authorized and issued by such entity, (ii) the unit agreement or unit agreements relating to such

Units have been duly authorized, executed and delivered by all parties thereto substantially in the form so filed, (iii) the terms

of such Units have been duly established so as not to violate any applicable law, affect the enforceability of such Units or result in

a default under or breach of any agreement or instrument binding upon the applicable Registrant, and so as to comply with any requirement

or restriction imposed by any court or governmental or regulatory body having jurisdiction over the applicable Registrant, (iv) such

Units have been issued, paid for and delivered against any contemplated payment therefor and issued and sold as contemplated in the Registration

Statement, the Prospectus and any prospectus supplement relating thereto, and in accordance with any underwriting agreement and (v) such

Units and the unit agreement or unit agreements relating to such Units are governed by New York law, such Units will constitute legal,

valid and binding obligations of the applicable Registrant, enforceable against the applicable Registrant in accordance with their terms.

TE

Connectivity Ltd.

Tyco Electronics Group S.A.

December 20, 2023

Page 4

|  |

4.

Guarantees. Assuming that (i) the execution, delivery and performance of any Guarantees and the terms of the offering

thereof have been duly authorized by all necessary corporate action on the part of TE Connectivity, (ii) any supplemental indenture

relating to such Debt Securities and such Guarantees has been duly authorized, executed and delivered by all parties thereto substantially

in the form so filed, (iii) the Debt Securities have been duly executed and authenticated in accordance with the Indenture and any

applicable supplemental indenture, (iv) the terms of the Guarantees to be issued under the Indenture and any applicable supplemental

indenture have been duly established in conformity with the Indenture and any applicable supplemental indenture so as not to violate

any applicable law, affect the enforceability of such Guarantees or result in a default under or breach of any agreement or instrument

binding upon TE Connectivity, and so as to comply with any requirement or restriction imposed by any court or governmental or regulatory

body having jurisdiction over TE Connectivity, (v) the Guarantees have been duly executed in accordance with the Indenture and any

applicable supplemental indenture and delivered against any contemplated payment therefor and issued and sold as contemplated in the

Registration Statement, the Prospectus and any prospectus supplement relating thereto, and in accordance with any underwriting agreement

and (vi) such Guarantees and the supplemental indenture relating to such Guarantees are governed by New York law, such Guarantees

will constitute legal, valid and binding obligations of TE Connectivity, enforceable against TE Connectivity in accordance with their

terms.

The opinions expressed above with respect to the

validity, binding effect and enforceability of the Securities are subject to applicable bankruptcy, insolvency, fraudulent conveyance,

reorganization, moratorium and similar laws affecting creditors’ rights and remedies generally, and subject, as to enforceability,

to general principles of equity, including principles of commercial reasonableness, good faith and fair dealing (regardless of whether

enforcement is sought in a proceeding at law or in equity) and except that rights to indemnification and contribution thereunder may

be limited by federal or state securities laws or public policy relating thereto. The opinions are also subject to the issuance of any

legally required consents, approvals, authorizations or orders of the Commission and any other regulatory authority. The opinions expressed

herein are limited to the laws of the State of New York, and we express no opinion as to the effect on the matters covered by this letter

of the laws of any other jurisdiction.

We hereby consent to the use of this letter as

an exhibit to the Registration Statement and to the reference to our firm under the caption “Legal Matters” in the Prospectus,

which is a part of the Registration Statement. In giving such consent, we do not hereby admit that we are in the category of persons whose

consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission.

Very truly yours,

/s/ Weil, Gotshal & Manges LLP

Exhibit 5.2

Postfach 1548 | CH-8002 Zürich

TE Connectivity Ltd.

Rheinstrasse 20

CH-8200 Schaffhausen

Switzerland

Tyco Electronics Group S.A.

46 Place Guillaume II

L-1648 Luxembourg

Zurich, 20 December 2023

Registration Statement on Form S-3

Dear Sir or Madam

We are acting as special Swiss counsel to TE Connectivity

Ltd. (the "Company"). This opinion is being rendered at the request of the Company in connection with the Company’s

registration statement on Form S-3 (the "Registration Statement") that is being filed with the U.S. Securities and

Exchange Commission (the "SEC") on the date hereof relating to the registration under the U.S. Securities Act of 1933,

as amended (the "Securities Act"), of registered shares in the Company, each share having a par value of CHF 0.57 (as

such par value may be amended from time to time) (the "Common Shares"), either separately or represented by warrants

as well as units to be issued from time to time pursuant to Rule 415 under the Securities Act.

We have not investigated the laws of any jurisdiction

other than Switzerland, and do not express an opinion on the laws of any jurisdiction other than Switzerland. We have examined and relied

on originals or copies, certified or otherwise identified to our satisfaction, of such documents, corporate records, and other instruments

as we have deemed necessary or advisable for the purpose of rendering this opinion, including a certified extract, dated 20 December 2023,

of the Commercial Register of the Canton of Schaffhausen, Switzerland (the "Commercial Register"), and the Company's

articles of association certified to be up-to-date as of 20 December 2023 (the "Articles").

In so doing, we have assumed the genuineness of

all signatures, the authenticity of all documents submitted to us as originals, the conformity to original documents of all the documents

submitted to us as certified, conformed or photostatic copies and the authenticity of the originals of such latter documents. We assume

no obligation to advise you of any changes to this opinion that may come to our attention after the date hereof. Further, we assume that

if any new Common Shares will be issued as described in the Registration Statement, they will be issued (i) by way of an ordinary

share capital increase in accordance with articles 650 et. seq. of the Swiss Code of Obligations ("CO") and the Articles,

(ii) within the capital band in accordance with articles 653s et seq. CO and the Articles, in particular Article 5, or (iii) out

of conditional share capital in accordance with articles 653 et. seq. CO and the Articles, in particular Article 6. This opinion

speaks as of its date and is strictly limited to the matters stated herein and we assume no obligation to review or update this opinion

if applicable law or the existing facts or circumstances should change.

Based on the foregoing and subject to the qualifications

set forth herein, we are of the opinion that each Common Share of the Company, including such shares as are issued upon exercise of a

warrant or upon conversion of units, will be, when issued and delivered on the terms and conditions referred to herein, validly issued,

fully paid and non-assessable.

We hereby consent to the filing of this opinion

as an exhibit to the Registration Statement and to any and all references to our firm in the prospectus contained in, and which is part

of, the Registration Statement. In giving this consent, we do not hereby admit that we are within the category of persons whose consent

is required under Section 7 of the Securities Act or the rules and regulations of the SEC promulgated thereunder.

Yours faithfully,

Exhibit 23.3

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

We consent to the incorporation by reference in this Registration Statement

on Form S-3 of our reports dated November 13, 2023, relating to the financial statements of TE Connectivity Ltd. and the

effectiveness of TE Connectivity Ltd.’s internal control over financial reporting, appearing in the Annual Report on Form 10-K

of TE Connectivity Ltd. for the year ended September 29, 2023. We also consent to the reference to us under the heading “Experts”

in such Registration Statement.

/s/ Deloitte & Touche LLP

Philadelphia, Pennsylvania

December 20, 2023

Exhibit 24.1

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS:

That each person whose signature appears below

constitutes and appoints Terrence R. Curtin, Heath A. Mitts and John S. Jenkins, Jr., his or her true and lawful attorneys-in-fact

and agents, each acting alone, with full powers of substitution and resubstitution, for him or her and in his or her name, place and stead,

in any and all capacities, to sign this Registration Statement on Form S-3 and any and all amendments (including post-effective amendments)

and supplements to this Registration Statement or any subsequent registration statement and all amendments thereto TE Connectivity Ltd.

may hereafter file with the Securities and Exchange Commission pursuant to Rule 462(b) under the Securities Act of 1933, as

amended, and to file the same, with all exhibits thereto, and other documents in connection therewith, with the Securities and Exchange

Commission, granting unto such attorneys-in-fact and agents, and each of them (with full power to act alone), full power and authority

to do and perform each and every act and thing requisite and necessary to be done in and about the premises, as fully to all intents and

purposes as he might or could do, and hereby ratifies and confirms all his or her said attorneys-in-fact and agents, each acting alone,

or his substitute or substitutes, may lawfully do or cause to be done by virtue hereof. This Power of Attorney may be signed in any number

of counterparts, each of which shall constitute an original and all of which, taken together, shall constitute one Power of Attorney.

Dated and effective as of the 20th of December 2023.

| /s/ Terrence R. Curtin |

|

/s/ Heath A. Mitts |

| Terrence R. Curtin, Chief Executive Officer and Director (Principal Executive Officer) |

|

Heath A. Mitts, Executive Vice President and Chief Financial Officer and Director (Principal Financial Officer) |

| |

|

|

| /s/ Jean-Pierre Clamadieu |

|

/s/ Abhijit Y. Talwalkar |

| Jean-Pierre Clamadieu, Director |

|

Abhijit Y. Talwalkar, Director |

| |

|

|

| /s/ Carol A. Davidson |

|

/s/ Mark C. Trudeau |

| Carol A. Davidson, Director |

|

Mark C. Trudeau, Director |

| |

|

|

| /s/ Lynn A. Dugle |

|

/s/ Dawn C. Willoughby |

| Lynn A. Dugle, Director |

|

Dawn C. Willoughby, Director |

| |

|

|

| /s/ William A. Jeffrey |

|

/s/ Laura H. Wright |

| William A. Jeffrey, Director |

|

Laura H. Wright, Director |

| |

|

|

| /s/ Syaru Shirley Lin |

|

/s/ Robert J. Ott |

| Syaru Shirley Lin |

|

Robert J. Ott, Senior Vice President and Corporate Controller (Principal Accounting Officer) |

| |

|

|

| /s/ Thomas J. Lynch |

|

|

| Thomas J. Lynch, Director |

|

|

Exhibit 25.1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM T-1

STATEMENT OF ELIGIBILITY UNDER THE TRUST INDENTURE ACT OF 1939

OF A CORPORATION DESIGNATED TO ACT AS TRUSTEE

¨ CHECK IF AN APPLICATION TO DETERMINE ELIGIBILITY OF A TRUSTEE

PURSUANT TO SECTION 305(b)(2)

DEUTSCHE BANK TRUST COMPANY AMERICAS

(formerly BANKERS TRUST COMPANY)

(Exact name of trustee as specified in its charter)

| NEW YORK |

13-4941247 |

| (Jurisdiction of Incorporation or |

(I.R.S. Employer |

| organization if not a U.S. national bank) |

Identification no.) |

| |

|

| ONE COLUMBUS CIRCLE |

|

| NEW YORK NY |

10019 |

| (Address of principal |

(Zip Code) |

| executive offices) |

|

| Deutsche Bank Trust Company Americas |

| Attention: Mirko Mieth |

| Legal Department |

| One Columbus Circle, 19th Floor |

| New York, New York 10019 |

| (212) 250–1663 |

| (Name, address and telephone number of agent for service) |

| TE CONNECTIVITY LTD. |

TYCO ELECTRONICS GROUP S.A. |

| (Exact name of registrant as specified in its charter) |

(Exact name of registrant as specified in its charter) |

| Switzerland |

Grand Duchy of Luxembourg |

| (State or other jurisdiction of incorporation or organization) |

(State or other jurisdiction of incorporation or organization) |

| 98-0518048 |

98-0518566 |

| (I.R.S. Employer Identification Number) |

(I.R.S. Employer Identification Number) |

| Mühlenstrasse 26, |

46 Place Guillaume II |

| CH-8200 Schaffhausen, Switzerland |

L-1648 Luxembourg |

| +41 (0)52 633 66 61 |

+352 46 43 40 401 |

| (Address, including zip code, and telephone number, including |

(Address, including zip code, and telephone number, including |

| area code, of registrant’s principal executive offices) |

area code, of registrant’s principal executive offices) |

(Exact name of obligor as specified in its charter)

Debt

Securities

(Title of the Indenture securities)

Item 1. General Information.

Furnish the following information as to the trustee.

| (a) | Name and address of each examining or supervising authority

to which it is subject. |

| |

Name |

Address |

| |

|

|

| |

Federal Reserve Bank (2nd District) |

New York, NY |

| |

Federal Deposit Insurance Corporation |

Washington, D.C. |

| |

New York State Banking Department |

Albany, NY |

| (b) | Whether it is authorized to exercise corporate trust powers. Yes. |

Item 2. Affiliations with Obligor.

If the obligor is an affiliate of the Trustee, describe each

such affiliation.

N/A.

| Item 3. -15. | Not Applicable |

| Item 16. | List of Exhibits. |

| |

Exhibit 1 - |

Restated Organization Certificate of Bankers Trust Company dated August 31,

1998; Certificate of Amendment of the Organization Certificate of Bankers Trust Company dated September 25, 1998; Certificate of

Amendment of the Organization Certificate of Bankers Trust Company dated December 18, 1998; Certificate of Amendment of the

Organization Certificate of Bankers Trust Company dated September 3, 1999; and Certificate of Amendment of the Organization

Certificate of Bankers Trust Company dated March 14, 2002, incorporated herein by reference to Exhibit 1 filed with Form T-1

Statement, Registration No. 333-201810. |

| |

|

|

| |

Exhibit 2 - |

Certificate of Authority to commence business, incorporated herein by reference to Exhibit 2

filed with Form T-1 Statement, Registration No. 333-201810. |

| |

|

|

| |

Exhibit 3 - |

Authorization of the Trustee to exercise corporate trust powers, incorporated herein by

reference to Exhibit 3 filed with Form T-1 Statement, Registration No. 333-201810. |

| |

|

|

| |

Exhibit 4 - |

A copy of existing By-Laws of Deutsche Bank Trust Company Americas, dated March 2, 2023 (see attached). |

| |

Exhibit 5 - |

Not applicable. |

| |

|

|

| |

Exhibit 6 - |

Consent of Bankers Trust Company required by Section 321(b) of the Act, incorporated herein

by reference to Exhibit 6 filed with Form T-1 Statement, Registration No. 333-201810. |

| |

|

|

| |

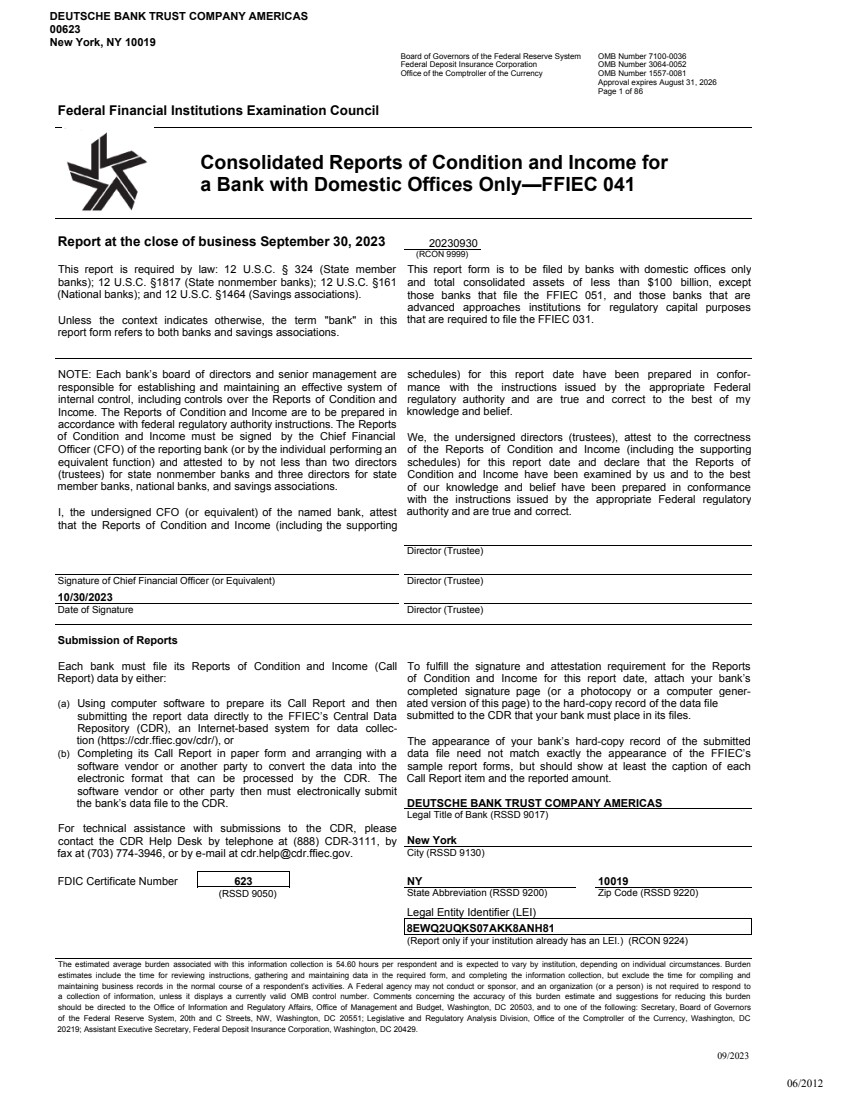

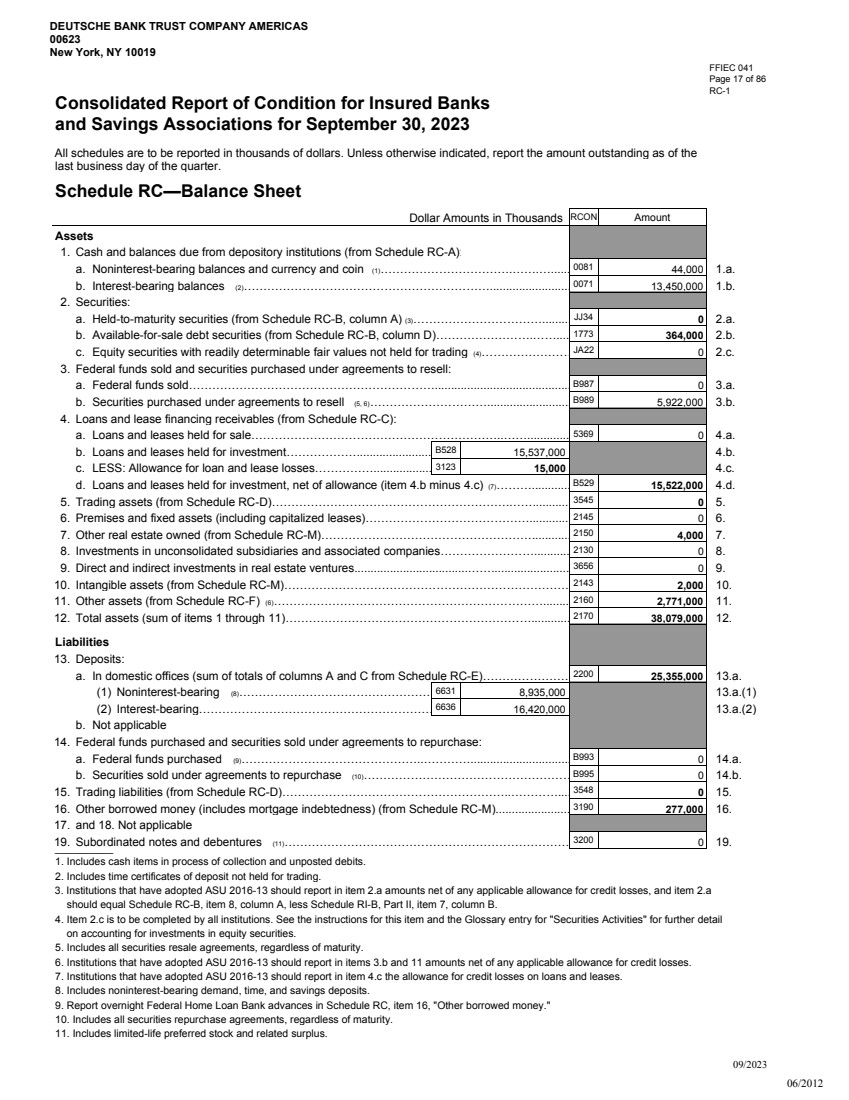

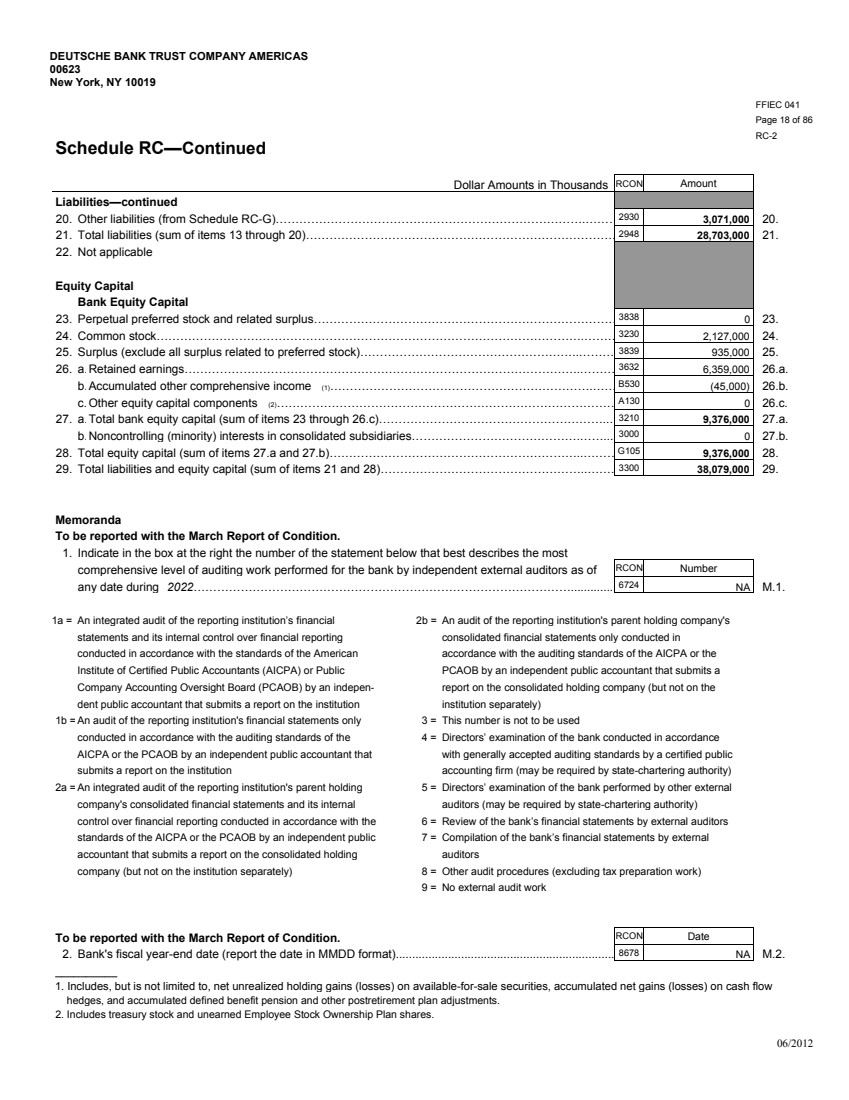

Exhibit 7 - |

A copy of the latest report of condition of the trustee published pursuant to law or the requirements of its supervising or examining authority. |

| |

|

|

| |

Exhibit 8 - |

Not Applicable. |

| |

|

|

| |

Exhibit 9 - |

Not Applicable. |

SIGNATURE

Pursuant to the requirements of the Trust Indenture Act of 1939, as amended, the trustee, Deutsche Bank Trust Company Americas, a corporation

organized and existing under the laws of the State of New York, has duly caused this statement of eligibility to be signed on its behalf

by the undersigned, thereunto duly authorized, all in The City of New York, and State of New York, on this 20th day of December, 2023.

| |

DEUTSCHE BANK TRUST COMPANY AMERICAS |

| |

|

|

| |

|

/s/ Joseph Denno |

| |

By: |

Name: Joseph Denno |

| |

|

Title: Vice President |

Exhibit 4

AMENDED AND RESTATED

BY-LAWS

OF

DEUTSCHE BANK TRUST COMPANY AMERICAS

ARTICLE I

STOCKHOLDERS

Section 1.01. Annual

Meeting. The annual meeting of the stockholders of Deutsche Bank Trust Company Americas (the “Company”) shall be held

in the City of New York within the State of New York within the first four months of the Company’s fiscal year, on such date and

at such time and place as the board of directors of the Company (“Board of Directors” or “Board”) may designate

in the call or in a waiver of notice thereof, for the purpose of electing directors and for the transaction of such other business as

may properly be brought before the meeting.

Section 1.02. Special

Meetings. Special meetings of the stockholders of the Company may be called by the Board of Directors or by the President, and shall

be called by the President or by the Secretary upon the written request of the holders of record of at least twenty-five percent (25%)

of the shares of stock of the Company issued and outstanding and entitled to vote, at such times. If for a period of thirteen months after

the last annual meeting, there is a failure to elect a sufficient number of directors to conduct the business of the Company, the Board

of Directors shall call a special meeting for the election of directors within two weeks after the expiration of such period; otherwise,

holders of record of ten percent (10%) of the shares of stock of the Company entitled to vote in an election of directors may, in writing,

demand the call of a special meeting at the office of the Company for the election of directors, specifying the date and month thereof,

but not less than two nor more than three months from the date of such call. At any such special meeting called on demand of stockholders,

the stockholders attending, in person or by proxy, and entitled to vote in an election of directors shall constitute a quorum for the

purpose of electing directors, but not for the transaction of any other business.

Section 1.03. Notice

of Meetings. Notice of the time, place and purpose of every meeting of stockholders shall be delivered personally or mailed not less

than 10 nor more than 50 days before the date of such meeting (or any other action) to each stockholder of record entitled to vote, at

his post office address appearing upon the records of the Company or at such other address as shall be furnished in writing by him to

the Secretary of the Company for such purpose. Such further notice shall be given as may be required by law or by these By-Laws. Any meeting

may be held without notice if all stockholders entitled to vote are present in person or by proxy, or if notice is waived in writing,

either before or after the meeting, by those not present.

Section 1.04. Quorum.

The holders of record of at least a majority of the shares of the stock of the Company issued and outstanding and entitled to vote, present

in person or by proxy, shall, except as otherwise provided by law, by the Company’s Organization Certificate or by these By-Laws,

constitute a quorum at all meetings of the stockholders; if there be no such quorum, the holders of a majority of such shares so present

or represented may adjourn the meeting from time to time until a quorum shall have been obtained.

Section 1.05. Organization

of Meetings. Meetings of the stockholders shall be presided over by the Chairman of the Board or, if he is not present, by the President

or, if he is not present, by a chairman to be chosen at the meeting. The Secretary of the Company, or in his absence an Assistant Secretary,

shall act as secretary of the meeting, if present.

Section 1.06. Voting.

At each meeting of stockholders, except as otherwise provided by statute, the Company’s Organization Certificate or these By-Laws,

every holder of record of stock entitled to vote shall be entitled to one vote in person or by proxy for each share of such stock standing

in his name on the records of the Company. Elections of directors shall be determined by a plurality of the votes cast thereat and, except

as otherwise provided by statute, the Company’s Organization Certificate or these By-Laws, all other action shall be determined

by a majority of the votes cast at such meeting.

At all elections of directors,

the voting shall be by ballot or in such other manner as may be determined by the stockholders present in person or by proxy entitled