false 0001549922 --12-31 0001549922 2020-05-28 2020-05-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 2, 2020 (May 28, 2020)

Summit Midstream Partners, LP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-35666

|

|

45-5200503

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

910 Louisiana Street, Suite 4200

Houston, TX 77002

(Address of principal executive office) (Zip Code)

(Registrants’ telephone number, including area code): (832) 413-4770

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Securities Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Units

|

|

SMLP

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Introductory Note

As previously disclosed, on May 3, 2020, Summit Midstream Partners, LP, a Delaware limited partnership (the “Partnership”), entered into a Purchase Agreement (the “Purchase Agreement”) with affiliates of Energy Capital Partners II, LLC, a Delaware limited liability company (“ECP”). On May 28, 2020 (the “Closing Date”), the transactions contemplated by the Purchase Agreement closed.

Pursuant to the Purchase Agreement, the Partnership acquired (i) all the outstanding limited liability company interests of Summit Midstream Partners, LLC, a Delaware limited liability company (“Summit Investments”), which is the sole member of Summit Midstream Partners Holdings, LLC, a Delaware limited liability company (“SMP Holdings”), which in turn owns (a) 34,604,581 common units representing limited partner interests in the Partnership (the “Common Units”) pledged as collateral under the Term Loan Agreement, dated as of March 21, 2017, among SMP Holdings, as borrower, the lenders party thereto and Credit Suisse AG, Cayman Islands Branch, as Administrative Agent and Collateral Agent (the “SMPH Term Loan”), (b) 10,714,285 Common Units not pledged as collateral under the SMPH Term Loan and (c) the right of SMP Holdings to receive the deferred purchase price obligation under the Contribution Agreement by and between the Partnership and SMP Holdings, dated February 25, 2016, as amended, and (ii) 5,915,827 Common Units held by SMLP Holdings, LLC, a Delaware limited liability company and an affiliate of ECP (“ECP Holdings”). The total purchase price under the Purchase Agreement was $35 million in cash and warrants to purchase up to 10 million Common Units. Pursuant to the Purchase Agreement, SMP Holdings will continue to retain the liabilities stemming from the release of produced water, including oil, from a produced water pipeline operated by Meadowlark Midstream Company, LLC that occurred near Marmon, North Dakota and was reported on January 6, 2015. We refer to the transactions contemplated by the Purchase Agreement as the “GP Buy-In Transaction.”

As a result of the GP Buy-In Transaction, the Partnership indirectly owns its own general partner, Summit Midstream Partners GP, LLC (the “General Partner”). The Partnership expects to retire the 16,630,112 of Common Units it acquired under the Purchase Agreement that are not pledged as collateral under the SMPH Term Loan. The 34,604,581 Common Units that are pledged as collateral under the SMPH Term Loan will not be considered outstanding with respect to voting and distributions under the Amended Partnership Agreement (as defined below) as long as they are held by a subsidiary of the Partnership.

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

Fourth Amended and Restated Agreement of Limited Partnership of the Partnership

Pursuant to the Purchase Agreement, on the Closing Date, the Third Amended and Restated Agreement of Limited Partnership of the Partnership was amended and restated as the Fourth Amended and Restated Agreement of Limited Partnership of the Partnership (the “Amended Partnership Agreement”) to, among other things, (i) provide the holders of Common Units with voting rights in the election of the members of the board of directors of the General Partner (the “Board”) on a staggered basis beginning in 2022 and (ii) to provide for the terms of the ECP Warrants (as defined below). Pursuant to the Amended Partnership Agreement, effective on the Closing Date, the Board has been divided into three classes of directors. Two Class I directors will serve for an initial term that expires at the 2022 annual meeting, two Class II directors will serve for an initial term that expires at the 2023 annual meeting, and one Class III director will serve for an initial term that expires at the 2024 annual meeting. J. Heath Deneke, President and Chief Executive Officer of the General Partner, will serve as the Chairman of the Board and will not be subject to public election.

The summary of the Amended Partnership Agreement in this Current Report on Form 8-K does not purport to be complete and is qualified in its entirety by reference to the full text of the Amended Partnership Agreement, which is filed herewith as Exhibit 3.1 and is incorporated into this Item 1.01 by reference.

Second Amended and Restated Limited Liability Company Agreement of the General Partner

Pursuant to the Purchase Agreement, on the Closing Date, the Amended and Restated Limited Liability Company Agreement of the General Partner was amended and restated as the Second Amended and Restated Limited Liability Company Agreement of the General Partner (the “Amended LLC Agreement”) to, among other things, reflect the provisions in the Amended Partnership Agreement providing the holders of Common Units with voting rights in the election of the members of the Board on a staggered basis beginning in 2022.

The summary of the Amended LLC Agreement in this Current Report on Form 8-K does not purport to be complete and is qualified in its entirety by reference to the full text of the Amended LLC Agreement, which is filed herewith as Exhibit 3.2 and is incorporated into this Item 1.01 by reference.

Term Loan Credit Agreements

On the Closing Date, Summit Midstream Holdings, LLC, a Delaware limited liability company and wholly owned subsidiary of the Partnership (the “Borrower”), entered into (i) a Term Loan Credit Agreement (the “ECP NewCo Term Loan Credit Agreement”), with SMP TopCo, LLC, a Delaware limited liability company and affiliate of ECP (“ECP NewCo”), as lender and administrative agent, and Mizuho Bank (USA), as collateral agent (“Mizuho”), in a principal amount of $28,208,630.60 (the “ECP NewCo Loan”), and (ii) a Term Loan Credit Agreement (the “ECP Holdings Term Loan Credit Agreement” and together with the ECP NewCo Term Loan Credit Agreement, the “ECP Term Loan Credit Agreements”), with ECP Holdings, as lender, and ECP NewCo, as administrative agent and Mizuho, as collateral agent, in a principal amount of $6,791,369.40 (the “ECP Holdings Loan” and together with the ECP NewCo Loan, the “ECP Loans”). The amounts loaned under each ECP Term Loan Credit Agreement are equal to the cash amounts paid by the Partnership at the Closing Date under the Purchase Agreement. The ECP Loans were extended to the Borrower on the Closing Date, upon the terms and subject to the other conditions set forth therein, and will mature on March 31, 2021. The ECP Loans under each ECP Term Loan Credit Agreement bear interest at a rate of 8.00% per annum.

On the Closing Date, the Borrower entered into (i) in connection with the ECP NewCo Term Loan Credit Agreement, a Guarantee and Collateral Agreement (the “ECP NewCo Guarantee”), with the Partnership, the subsidiary guarantors listed therein and Mizuho and (ii) in connection with the ECP Holdings Term Loan Credit Agreement, a Guarantee and Collateral Agreement (the “ECP Holdings Guarantee” and together with the ECP NewCo Guarantee, the “ECP Term Loan Guarantees”), with the Partnership, the subsidiary guarantors listed therein and Mizuho. Pursuant to the ECP Term Loan Guarantees, the obligations under each of the ECP Term Loan Credit Agreements are generally (i) guaranteed by the Partnership and each subsidiary of the Borrower that guarantees the obligations under the Partnership’s existing revolving credit facility (the “Revolver”), as and to the same extent as such guarantors guarantee the obligations under the Revolver and (ii) secured by a first priority lien on and security interest in all property on which a first priority lien and security interest secures the obligations under the Revolver, in each case, on the terms and subject to the conditions set forth in the ECP Term Loan Credit Agreements.

The ECP Term Loan Credit Agreements each contain affirmative and negative covenants similar to those contained in the Revolver, that, among other things, limit or restrict the ability (i) to incur additional debt; (ii) to incur certain liens on property; (iii) to make investments; (iv) to engage in certain mergers, consolidations, acquisitions or sales of assets; (v) to declare or pay certain distributions with respect to equity interests; (vi) to enter into certain transactions with any of its affiliates; (vii) to enter into swap agreements and power purchase agreements; (viii) to enter into certain leases that would cumulatively obligate payments in excess of $50 million over any 12-month period; and (ix) to permit any Restricted Subsidiaries (as defined in the ECP Term Loan Credit Agreements) to sell certain industrial revenue bonds to certain parties without the consent of the administrative agent. In addition, the ECP Term Loan Credit Agreements contain maintenance financial covenants substantially similar to those contained in the Revolver, which will require the Borrower to maintain, beginning June 30, 2020, (a), a ratio of consolidated trailing 12-month earnings before interest, income taxes, depreciation and amortization (“EBITDA”) to net interest expense of not less than 2.50 to 1.00; (b) a ratio of total net indebtedness to consolidated trailing 12-month EBITDA of not more than 5.50 to 1.00; and (c) a ratio of first lien net indebtedness to consolidated trailing 12-month EBITDA of not more than 3.75 to 1.00. If any of the financial maintenance covenants contained in the Revolver are amended, modified or supplemented, the same financial maintenance covenant in each ECP Term Loan Credit Agreement will automatically be amended in the same manner.

The summary of the ECP Term Loan Credit Agreements and the ECP Term Loan Guarantees in this Current Report on Form 8-K does not purport to be complete and is qualified in its entirety by reference to the full text of the ECP Term Loan Credit Agreements, which are filed herewith as Exhibits 10.1 and 10.2, and the ECP Term Loan Guarantees, which are filed herewith as Exhibits 10.3 and 10.4, and are incorporated into this Item 1.01 by reference.

Intercreditor Agreement

On the Closing Date, in connection with the closing of the GP Buy-In Transaction and as contemplated pursuant to Section 6.01(j) of the Revolver, the Borrower entered into a Pari Passu Intercreditor Agreement (the “Intercreditor Agreement”) with Wells Fargo Bank, N.A., in its capacity as administrative agent and collateral agent under the Revolver, Mizuho, as collateral agent under the ECP Term Loan Credit Agreements, the Partnership and the subsidiary guarantors listed therein, setting forth the equal priority of the liens securing the ECP Term Loan Credit Agreements and the Revolver.

The summary of the Intercreditor Agreement in this Current Report on Form 8-K does not purport to be complete and is qualified in its entirety by reference to the full text of the Intercreditor Agreement, which is filed herewith as Exhibit 10.5 and is incorporated into this Item 1.01 by reference.

Warrants

On the Closing Date, the Partnership entered into (i) a Warrant to purchase up to 8,059,609 Common Units with ECP NewCo (the “ECP NewCo Warrant”) and (ii) a Warrant to purchase up to 1,940,391 Common Units with ECP Holdings (the “ECP Holdings Warrant” and together with the ECP NewCo Warrant, the “ECP Warrants”). The exercise price under the ECP Warrants is $1.023 per Common Unit. The Partnership may issue a maximum of 10,000,000 Common Units under the ECP Warrants.

The ECP Warrants also provide that the Partnership will file a registration statement to register the Common Units issuable upon exercise of the ECP Warrants no later than 90 days following the Closing Date and use commercially reasonable efforts to cause such registration statement to become effective.

Upon exercise of the ECP Warrants, each Seller may receive, at its election, (i) a number of Common Units equal to the Common Units for which the ECP Warrant is being exercised, if exercising the ECP Warrant by cash payment of the exercise price; (ii) a number of Common Units equal to the product of the number of Common Units being exercised multiplied by (a) the difference between the average of the daily volume-weighted average price (“VWAP”) of the Common Units on the New York Stock Exchange (the “NYSE”) on each of the three trading days prior to the delivery of the notice of exercise (the “VWAP Average”) and the exercise price (the “VWAP Difference”), divided by (b) the VWAP Average; and/or (iii) an amount in cash, to the extent that the Partnership’s leverage ratio would be at least 0.5x less than the maximum applicable ratio set forth in the Revolver, equal to the product of (a) the number of Common Units exercised and (b) the VWAP Difference, subject to certain adjustments under the Warrants.

The ECP Warrants are subject to standard anti-dilution adjustments for stock dividends, stock splits and recapitalizations and are exercisable at any time after the Closing Date and on or before the third anniversary of the Closing Date. Upon exercise of the ECP Warrants, the proceeds to the holders of the ECP Warrants, whether in the form of cash or Common Units, will be capped at $2.00 per Common Unit above the exercise price.

The summary of the ECP Warrants in this Current Report on Form 8-K does not purport to be complete and is qualified in its entirety by reference to the full text of the ECP Warrants, which are filed herewith as Exhibits 10.6 and 10.7 and are incorporated into this Item 1.01 by reference.

Operation and Management Services Agreement

On the Closing Date, the Partnership, the General Partner and the Borrower (the “Operating Agreement Parties”) entered into an operation and management services agreement (the “Services Agreement”) with Summit Operating Services Company, LLC, a Delaware limited liability company and subsidiary of the Partnership (the “Operator”), pursuant to which the Operator will provide (i) certain operational and management services for the Partnership’s gathering and processing facilities, owned by the Borrower and its wholly owned subsidiaries, and (ii) certain corporate, general and administrative services for the Partnership and the General Partner. Under the Services Agreement, the Partnership will pay an annual operation and management fee to the Operator determined on an annual basis based on current market indicators and arms-length comparables.

Under the Services Agreement, the Operator will indemnify the Operating Agreement Parties with respect to claims, losses or liabilities incurred by the Operating Agreement Parties, including third party claims, arising out of the Operator’s gross negligence or willful misconduct. The Operating Agreement Parties will indemnify the Operator from any claims, losses or liabilities incurred by the Operator, including any third-party claims, arising from the performance of the agreement, but not to the extent of losses or liabilities caused by the Operator’s gross negligence or willful misconduct.

The summary of the Service Agreement in this Current Report on Form 8-K does not purport to be complete and is qualified in its entirety by reference to the full text of the Services Agreement, which is filed herewith as Exhibit 10.8 and is incorporated into this Item 1.01 by reference.

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

Term Loan Credit Agreements

The description of the ECP Term Loan Credit Agreements and the ECP Term Loan Guarantees set forth under Item 1.01 above is incorporated into this Item 2.03 by reference.

SMPH Term Loan

As noted above, pursuant to the Purchase Agreement, SMP Holdings became a subsidiary of the Partnership on the Closing Date. SMP Holdings will remain liable for the $158.2 million of obligations under the SMPH Term Loan, which matures on May 15, 2022 (the “Maturity Date”). Prior to the Maturity Date, SMP Holdings will pay to the lenders quarterly amortization payments equal to 1.0% per annum of the original principal amount of the loans. The SMPH Term Loan will continue to be non-recourse indebtedness to the Partnership and the Borrower and its operating subsidiaries.

Pursuant to the guarantee and collateral agreement, dated as of March 21, 2017 by and among SMP Holdings, as grantor, Summit Investments, as pledgor and grantor and Credit Suisse AG, Cayman Islands Branch (the “SMPH Guarantee”), the obligations under the SMPH Term Loan are generally (i) guaranteed by Summit Investments and (ii) secured by the 34,604,581 Common Units owned by SMP Holdings and all of its membership interests in the General Partner. As a result of the equity interests in the General Partner being pledged as collateral under the SMPH Term Loan, in the event that SMP Holdings is unable to meet its obligations under the SMPH Term Loan, including as a result of the elimination of the distributions to holders of Common Units (including SMP Holdings) or if SMP Holdings is subject to certain bankruptcy or insolvency related events, SMP Holdings’ lenders may gain control of the General Partner. In the event these lenders gain control of the General Partner, they would also gain control of 34,604,581 Common Units, representing approximately 44.4% of the Common Units to be outstanding after the closing of the GP Buy-In Transaction, thereby giving these lenders significant influence on matters put to a vote of the unitholders, including the election of directors to the Board. Borrowings under the SMPH Term Loan bear interest, at the election of SMP Holdings, at a rate based on the Alternate Base Rate (as defined in the SMPH Term Loan) plus an applicable margin of 5.0% per annum or the Adjusted Eurodollar Rate (as defined in the SMPH Term Loan) plus an applicable margin of 6.0% per annum.

The SMPH Term Loan contains customary affirmative and negative covenants that, among other things, restrict the ability of SMPH (i) to incur additional debt; (ii) to make investments; (iii) to engage in certain mergers, consolidations, acquisitions or sales of assets; (iv) to enter into swap agreements; and (v) to enter into leases that would cumulatively obligate payments in excess of (a) $25 million and (b) 3.0% of the Total Assets (as defined in

the SMPH Term Loan) over any 12-month period. In addition, the SMPH Term Loan requires SMP Holdings to maintain a ratio of consolidated trailing 12-month Operating Cash Flow (as defined in the SMPH Term Loan) minus G&A Expenses (as defined in the SMPH Term Loan) paid by SMP Holdings to net interest expense of not less than 2.0 to 1.0.

The summary of the SMPH Term Loan and the SMPH Guarantee in this Current Report on Form 8-K does not purport to be complete and is qualified in its entirety by reference to the full text of the SMPH Term Loan and the SMPH Guarantee, which are filed herewith as Exhibits 10.9 and 10.10, respectively, and are incorporated into this Item 2.03 by reference.

|

Item 3.02.

|

Unregistered Sales of Equity Securities.

|

The description of the ECP Warrants set forth under Item 1.01 above is incorporated into this Item 3.02 by reference.

The ECP Warrants issued pursuant to the Purchase Agreement and the Common Units underlying the ECP Warrants have not been registered under the Securities Act of 1933, as amended (the “1933 Act”), and were issued, and ECP Warrants issued in the future and the Common Units underlying those ECP Warrants will be issued, in reliance upon the exemption provided in Section 4(a)(2) of the 1933 Act.

|

Item 3.03.

|

Material Modifications to the Rights of Security Holders.

|

The descriptions of the Amended Partnership Agreement and the Amended LLC Agreement set forth under Item 1.01 above are incorporated into this Item 3.03 by reference.

|

Item 5.01.

|

Changes in Control of the Registrant.

|

The description of the GP Buy-In Transaction set forth above is incorporated into this Item 5.01 by reference.

|

Item 5.02.

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

|

Termination of the Deferred Compensation Plan

On May 29, 2020 (the “DCP Termination Date”), in connection with the closing of the GP Buy-In Transaction, Summit Investments, which is a wholly owned subsidiary of the Partnership as of the Closing Date, terminated its Deferred Compensation Plan (the “DCP”), which is a supplemental executive retirement plan that has provided key employees and directors with an opportunity to defer receipt of a portion of their salary, bonus and other specified compensation. The DCP has been maintained as an unfunded, nonqualified plan providing benefits based on the participant’s notional account balance at the time of retirement or termination.

As a result of the termination of the DCP, payment of all remaining amounts under the DCP will be made in a lump sum to participants or their designated beneficiaries, as applicable, including approximately $655,000, $40,000 and $200,000 to each of Steven J. Newby, former President and Chief Executive Officer, Marc D. Stratton, Executive Vice President and Chief Financial Officer and Brad N. Graves, former Executive Vice President and Chief Commercial Officer, respectively, as soon as administratively practicable, and in any event, not later than 90 days following the DCP Termination Date. From and after the DCP Termination Date, no additional deferrals of any kind will be made under the DCP.

Resignation of Directors of the Board

Pursuant to the Purchase Agreement, on the Closing Date, each of Mr. Peter Labbat, Mr. Chris Leininger, Mr. Matthew Delaney, Mr. Francesco Ciabatti and Mr. Thomas Lane, all directors of the Board affiliated with ECP, resigned from the Board. None of the resignations were the result of any disagreement with the Partnership or any of its affiliates on any matter relating to the operations, policies or practices of the Partnership.

Appointment of Directors to the Board

On the Closing Date, in connection with the closing of the transactions contemplated under the Purchase Agreement, Robert J. McNally and Marguerite Woung-Chapman (the “New Directors”) were unanimously appointed by the Board to serve as members of the Board, in each case until such person’s successor shall have been duly elected and qualified or until his or her earlier resignation, removal or death. There is no arrangement or understanding between any of the New Directors and any other persons pursuant to which these New Directors were appointed. The Board considered the independence of each of the New Directors under the NYSE listing standards and concluded that each New Director is an independent director under the applicable NYSE standards. There are no transactions in which the New Directors have an interest requiring disclosure under Item 404(a) of Regulation S-K under the 1933 Act.

The New Directors will receive the following compensation for his or her service on the Board (and its committees) in accordance with the General Partner’s independent director compensation program: (i) an $80,000 annual cash retainer; (ii) $100,000 in annual unit compensation; (iii) an annual retainer of $7,000 to Mr. McNally for his service on the Audit Committee of the Board and (iv) an annual retainer of $10,000 to Ms. Woung-Chapman for her service as Chair of the Corporate Governance and Nominating Committee of the Board.

Robert J. McNally

Mr. McNally will be a Class II director and will serve on the Audit Committee of the Board. From 2018 through 2019, Mr. McNally served as President and Chief Executive Officer of EQT Corporation, an NYSE-listed independent natural gas producer with operations in Pennsylvania, West Virginia and Ohio. Prior to that, from 2016 to 2018, Mr. McNally served as Senior Vice President and Chief Financial Officer of EQT Corporation. From 2010 until 2016, Mr. McNally served as Executive Vice President and Chief Financial Officer of Precision Drilling Corporation, a TSE and NYSE-listed drilling contractor with operations primarily in the United States, Canada and the Middle East. From 2009 to 2010, and for a period in 2007, Mr. McNally served as an Investment Principal for Kenda Capital LLC. In 2008, Mr. McNally served as the Chief Executive Officer of Dalbo Holdings, Inc. In 2006, Mr. McNally served as Executive Vice President of Operations and Finance for Warrior Energy Services Corp. From 2000 to 2005, Mr. McNally worked in corporate finance with Simmons & Company International. Mr. McNally began his career as an engineer with Schlumberger Limited and served in various capacities of increasing responsibility during his tenure from 1994 until 2000. In addition to his experience as an executive, Mr. McNally has had extensive experience in the boardroom, where he has served, at various times, on the boards of Warrior Energy Services, Dalbo Holdings, EQT Midstream Partners, EQT GP Holdings, Rice Midstream Partners and EQT Corporation. He has a B.S. in Mechanical Engineering from University of Illinois, a B.A. in Mathematics from Knox College, and an M.B.A. from Tulane University Freeman School of Business. Mr. McNally brings a wealth of executive management, operational, and financial experience in the oil and gas industry to the Board.

Marguerite Woung-Chapman

Ms. Woung-Chapman will be a Class II director and will serve as Chair of the Corporate Governance and Nominating Committee of the Board. In 2018, Ms. Woung-Chapman served as Senior Vice President, General Counsel and Corporate Secretary of Energy XXI Gulf Coast, Inc., a NASDAQ-listed independent exploration and production company that was engaged in the development, exploitation and acquisition of oil and natural gas properties in the U.S. Gulf Coast region. Prior to that, from 2012 to 2017, Ms. Woung-Chapman served in various capacities at EP Energy Corporation, a private company that subsequently became a NYSE-listed independent oil and gas exploration and production company, including, among others, Senior Vice President, Land Administration, General Counsel and Corporate Secretary. Ms. Woung-Chapman began her career as a corporate attorney with El Paso Corporation (including its predecessors) and served in various capacities of increasing responsibility during her tenure from 1991 until 2012, including, among others, Vice President, Legal Shared Services, Corporate Secretary and Chief Governance Officer. She has a B.S. in Linguistics from Georgetown University and a J.D. from the Georgetown University Law Center. Commencing on June 1, 2020, Ms. Woung Chapman will also serve as the Chair of the Board of Directors and President of the Girl Scouts of San Jacinto Council, which is the second largest Girl Scout council in the country. Ms. Woung-Chapman has valuable and extensive experience in all aspects of management and strategic direction of publicly-traded energy companies and brings a unique combination of corporate governance, regulatory, compliance, legal and business administration experience to the Board.

|

Item 5.03.

|

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

|

The descriptions of the Amended Partnership Agreement and the Amended LLC Agreement set forth under Item 1.01 above are incorporated into this Item 5.03 by reference.

|

Item 7.01.

|

Regulation FD Disclosure.

|

Also, on May 28, 2020, the Partnership issued a press release announcing the closing of the GP Buy-In Transaction and related transactions, a copy of which is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information furnished in this Item 7.01 shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “1934 Act”), and shall not be deemed incorporated by reference in any filing with the Securities and Exchange Commission (the “SEC”), whether or not filed under the 1933 Act, or the 1934 Act, regardless of any general incorporation language in such document.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits.

|

|

|

|

|

|

|

Exhibit

Number

|

|

|

Description

|

|

|

|

|

|

|

|

|

3.1

|

|

|

Fourth Amended and Restated Agreement of Limited Partnership of Summit Midstream Partners, LP, dated May 28, 2020.

|

|

|

|

|

|

|

|

|

3.2

|

|

|

Second Amended and Restated Limited Liability Company Agreement of Summit Midstream GP, LLC, dated May 28, 2020.

|

|

|

|

|

|

|

|

|

10.1*

|

|

|

Term Loan Credit Agreement, dated May 28, 2020, by and among Summit Midstream Holdings, LLC, as borrower, SMP TopCo, LLC, as lender and administrative agent and Mizuho Bank (USA), as collateral agent.

|

|

|

|

|

|

|

|

|

10.2*

|

|

|

Term Loan Credit Agreement, dated May 28, 2020, by and among Summit Midstream Holdings, LLC, as borrower, SMLP Holdings, LLC, as lender, SMP TopCo, LLC, as administrative agent and Mizuho Bank (USA), as collateral agent.

|

|

|

|

|

|

|

|

|

10.3*

|

|

|

Guarantee and Collateral Agreement, dated May 28, 2020, by and among Summit Midstream Holdings, LLC, Summit Midstream Partners, LP, the subsidiaries listed therein and Mizuho Bank (USA), as collateral agent, relating to the ECP NewCo Term Loan Credit Agreement.

|

|

|

|

|

|

|

|

|

10.4*

|

|

|

Guarantee and Collateral Agreement, dated May 28, 2020, by and among Summit Midstream Holdings, LLC, Summit Midstream Partners, LP, the subsidiaries listed therein and Mizuho Bank (USA), as collateral agent, relating to the ECP Holdings Term Loan Credit Agreement.

|

|

|

|

|

|

|

|

|

10.5

|

|

|

Pari Passu Intercreditor Agreement, dated as of May 28, 2020, among Wells Fargo Bank, National Association, as Revolving Credit Facility Collateral Agent, Mizuho Bank (USA), as NewCo Term Loan Collateral Agent and SMLP Holdings Term Loan Collateral Agent, Summit Midstream Holdings, LLC and other grantors from time to time party thereto.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.6

|

|

|

Warrant to Purchase Common Units, dated May 28, 2020, from Summit Midstream Partners, LP to SMP TopCo, LLC.

|

|

|

|

|

|

|

|

|

10.7

|

|

|

Warrant to Purchase Common Units, dated May 28, 2020, from Summit Midstream Partners, LP to SMLP Holdings, LLC.

|

|

|

|

|

|

|

|

|

10.8

|

|

|

Operation and Management Services Agreement, dated May 28, 2020, by and among Summit Midstream Partners, LP and Summit Operating Services Company, LLC.

|

|

|

|

|

|

|

|

|

10.9*

|

|

|

Term Loan Agreement, dated as of March 21, 2017, among Summit Midstream Partners Holdings, LLC, as borrower, the lenders party thereto and Credit Suisse AG, Cayman Islands Branch, as Administrative Agent and Collateral Agent.

|

|

|

|

|

|

|

|

|

10.10*

|

|

|

Guarantee and Collateral Agreement, dated as of March 21, 2017, by and among Summit Midstream Partners Holdings, LLC, as grantor, Summit Midstream Partners, LLC, as pledgor and grantor and Credit Suisse AG, Cayman Islands Branch, as collateral agent.

|

|

|

|

|

|

|

|

|

99.1

|

|

|

Press Release, dated May 28, 2020.

|

|

|

|

|

|

|

|

|

104

|

|

|

Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document.

|

|

*

|

Schedules and exhibits to this Exhibit have been omitted pursuant to Item 601(a)(5) of Regulation S-K. The Partnership hereby undertakes to furnish supplemental copies of any of the omitted schedules and exhibits upon request by the SEC.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

Summit Midstream Partners, LP

|

|

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

|

Summit Midstream GP, LLC (its general partner)

|

|

|

|

|

|

|

|

Dated: June 2, 2020

|

|

|

|

/s/ Marc D. Stratton

|

|

|

|

|

|

Marc D. Stratton, Executive Vice President and Chief Financial Officer

|

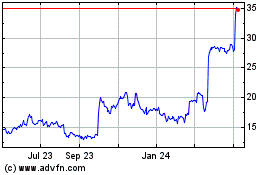

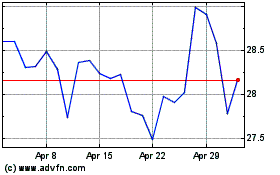

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Jul 2023 to Jul 2024