Production at high end of guidance - Oil

production above high end of guidance Peer-leading cost

structure supported by $0.73/Mcfe of production expenses (LOE,

T&P and Production Taxes) Significantly expands oil

inventory - Announces new 16,000 net acre position in Dimmit

County Provides preliminary 2020 budget - Remain focused on

capital discipline and free cash flow generation

SilverBow Resources, Inc. (NYSE: SBOW) (“SilverBow” or the

“Company”) today announced operating and financial results for the

third quarter of 2019. Highlights include:

- Net production averaged approximately 239 million cubic feet of

natural gas equivalent per day (“MMcfe/d”), at the high end of

guidance

- Net liquids production averaged approximately 11,000 barrels

per day ("Bbls/d"), 50% of which was oil, exceeding guidance. Net

liquids production increased 21% quarter-over-quarter and 107%

year-over-year

- Drilled and completed five net wells, primarily in the La Salle

Condensate and McMullen Oil areas

- Wells from La Salle Condensate and McMullen Oil areas showing

significant production increases compared to historical averages

with an estimated 25%-30% increase in EUR

- Average realized prices for crude oil and natural gas were 101%

and 104% of West Texas Intermediate ("WTI") and Henry Hub,

respectively, excluding hedging, as a result of favorable basis

pricing in the Eagle Ford Shale

- Oil and gas revenue of $72.0 million (excluding hedge impact),

net income of $27.7 million, and Adjusted EBITDA(1) (as defined

herein) (a non-GAAP measure) of $62.9 million, an 8% increase over

the second quarter of 2019

- Adjusted EBITDA margin(1) (as defined herein) (a non-GAAP

measure) of 75% for the quarter driven by the Company's growth in

oil production and low-cost structure

- Lease operating expenses ("LOE") of $0.25 per thousand cubic

feet of natural gas equivalent ("Mcfe") for the quarter, at the

midpoint of guidance

- Cash general and administrative expenses of $4.5 million (a

non-GAAP measure calculated as $6.2 million in net general and

administrative costs less $1.8 million of share-based

compensation), or $0.20/Mcfe, below the low end of guidance

- Anticipate full-year 2019 capital expenditures of $255-$260

million and production between 228-232 MMcfe/d, both in line with

previous guidance

- Preliminary 2020 capital budget of $175-$195 million, a 30%

decrease year-over-year at the midpoint while delivering 25% oil

production growth

1 Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP

measures that are defined and reconciled at the end of this press

release. "GAAP" refers to the accounting principles generally

accepted in the United States

MANAGEMENT COMMENTS

Sean Woolverton, SilverBow’s Chief Executive Officer, commented,

"Our third quarter results demonstrate the resilience of our

low-cost Eagle Ford asset base and our ability to generate returns

in a challenging commodity price cycle. We continue to execute on

our organic leasing campaign, and this quarter announced our newest

acreage position in Dimmit County which significantly increases our

oil location inventory. Our acreage additions this year in Webb and

Dimmit counties highlight our returns-focused approach towards

growth and our ability to sustain free cash flow, ultimately

creating long-term shareholder value."

"Our preliminary 2020 capital budget represents a 30% reduction

in projected spend year-over-year, and targets over 25% oil

production growth and positive free cash flow. At the forefront of

our strategy is the proactive management and protection of our

balance sheet, borrowing base, and liquidity. At a one-rig pace, we

will focus on returns while assessing opportunities to grow where

valuations are attractive. As we work to finalize our formal 2020

budget, we have unique optionality as we focus on diversifying our

commodity mix as well as maintaining our ability to respond quickly

to the commodity price environment and pursue strategic

expansions."

Mr. Woolverton commented further, "SilverBow is a premiere

small-cap company in the E&P space, with an exclusive focus in

the Eagle Ford. We are a returns-focused operator uniquely

positioned to adjust capital allocation based on prevailing product

prices. We have a low-cost structure and proximity to premium Gulf

Coast markets. As such, we have consistently delivered industry

leading margins and top-decile returns on capital employed.”

OPERATIONS HIGHLIGHTS

During the third quarter, the Company drilled six gross (five

net) wells while completing five gross (five net) wells and

bringing seven gross (seven net) wells online. Activity primarily

focused on the McMullen Oil area where three net wells were

completed. The Company continues to focus on capital efficiency and

optimizing well designs. Year-to-date, the Company has realized a

24% improvement in lateral feet drilled per day over the full-year

2018 average, resulting in a decrease in average cost per lateral

foot of 22% over the same time frame. On the completions side, the

Company averaged over seven stages per day year to date, a 64%

increase over the full-year 2018 average, and lowered completion

costs per well by 26% over the same time frame. Additionally, total

proppant volumes pumped per day have averaged over 3.5 million lbs

per day, a 54% increase compared to the full-year 2018 average.

The Company continues to see strong results in its McMullen Oil

and La Salle Condensate assets. A two-well pad in the McMullen Oil

area was brought online early in the third quarter, and produced a

30-day per well average of 1,200 barrels of oil equivalent per day

("Boe/d") (90% liquids). Both wells were completed utilizing over

3,000 pounds of proppant and 50 barrels of fluid per lateral foot.

In the La Salle Condensate area, the Company completed one well,

which was brought online in mid-August and produced a 30-day

average of 1,209 Boe/d (73% liquids).

Through year-end, the Company is focused on its six-well pad in

Webb County. The super-pad site will utilize dual frac crews,

de-bundled sand logistics and other innovative techniques to

maximize the efficiency of this large, complex operation. From

acquisition of this position in June to expected first production

by late fourth quarter, the Company expects to have assessed,

prepared and delivered first production in just five months. The

Company is targeting initial gross production from the pad between

75-100 MMcfe/d toward the latter part of the fourth quarter.

PRODUCTION VOLUMES, OPERATING COSTS AND REALIZED

PRICES

The Company's total net production for the third quarter

averaged approximately 239 MMcfe/d, which was at the high end of

guidance. Production mix for the third quarter consisted of

approximately 72% natural gas, 14% natural gas liquids ("NGLs"),

and 14% oil. Liquids comprised 49% of total revenue for the third

quarter, compared to 33% in the third quarter of 2018.

Lease operating expenses of $0.25/Mcfe for the third quarter

were in-line with the Company’s guidance range. After deducting

$1.8 million of non-cash compensation expense, cash general and

administrative costs of $4.5 million for the third quarter compared

favorably to guidance, with a per unit cash cost of $0.20/Mcfe.

Transportation and processing expenses ("T&P") came in at

$0.31/Mcfe and production and ad valorem taxes were 5.2% of oil and

gas revenue for the third quarter. Both metrics were at or below

the low end of the Company's guidance range. Total production

expenses, which include LOE, T&P and production taxes, were

$0.73/Mcfe for the quarter. The Company's all-in cash operating

expenses for the quarter, which includes cash general and

administrative costs, were $0.94/Mcfe.

Average realized prices for crude oil and natural gas were 101%

and 104% of WTI and Henry Hub, respectively, excluding hedging. The

Company’s average realized natural gas price, excluding the effect

of hedging, was $2.32 per thousand cubic feet of natural gas

("Mcf") compared to $2.97/Mcf in the third quarter of 2018. The

average realized crude oil selling price, excluding the effect of

hedging, was $57.14 per barrel of oil ("Bbl") compared to

$71.68/Bbl in the third quarter of 2018. The average realized NGL

selling price in the quarter was $11.99/Bbl, compared to $30.59/Bbl

in the third quarter of 2018. Despite lower commodity prices, the

Company realized strong growth in Adjusted EBITDA year-over-year,

driven by an increase in production, effective cost control and

greater percentage of revenue contribution from liquids.

FINANCIAL RESULTS

The Company reported total oil and gas revenue of $72.0 million

for the second quarter, up 11% over the third quarter of 2018. On a

GAAP basis, the Company reported net income of $27.7 million for

the third quarter of 2019, which includes an unrealized gain on the

value of the Company's hedge portfolio of $13.4 million and a $1.0

million net tax provision.

The Company reported Adjusted EBITDA of $62.9 million for the

second quarter, up 41% over the third quarter of 2018. On a per

unit basis, the Company's reported Adjusted EBITDA of $2.85/Mcfe

for the third quarter came in 13% higher than the third quarter of

2018.

Capital expenditures incurred during the third quarter totaled

approximately $49.5 million, which includes $4.9 million for

leasing expenditures.

2019 GUIDANCE AND PRELIMINARY 2020 OUTLOOK

The Company tightened its full-year capital budget range to

$255-$260 million and full-year production guidance range to

228-232 MMcfe/d. For the fourth quarter, the Company is guiding for

average estimated production of 225-234 MMcfe/d, with the largest

variable being the timing of initial production from the Company's

six-well pad in Webb County.

While still finalizing the 2020 budget, the Company expects to

increase oil production by over 25% year-over-year and generate

free cash flow while reducing capital expenditures by approximately

30% to a preliminary range of $175-$195 million. Additional detail

concerning the Company's fourth quarter and full-year 2019

financial and operational guidance can be found in the table

included at the end of today’s news release and the Corporate

Presentation uploaded to the Investor Relations section of the

Company’s website.

HEDGING UPDATE

Hedging continues to be an important element of the Company's

strategy to protect cash flow. The Company maintains an active

hedging program to provide predictable cash flows while still

allowing for flexibility in capturing price increases. As of

September 30, 2019, the Company had 67% of total estimated

production volumes hedged for the remainder of 2019, using the

midpoint of production guidance. For 2020, the Company has 86

million cubic feet of natural gas per day ("MMcf/d") hedged at an

average price of $2.66/Mcf and 3,191 Bbls/d of oil hedged at an

average price of $56.30/Bbl. Please see the Company's Form 10-Q

filing for the third quarter of 2019, which the Company expects to

file on Thursday, November 7, 2019, for a detailed summary of its

derivative contracts.

CAPITAL STRUCTURE AND LIQUIDITY

The Company's liquidity as of September 30, 2019, was $130.9

million, primarily consisting of approximately $2.9 million of cash

and $128.0 million of availability under the Company’s credit

facility. Subsequent to quarter end, the borrowing base of the

Company's credit facility was redetermined to be $400 million. As

of November 1, 2019, the Company had 11.8 million total common

shares outstanding.

CONFERENCE CALL AND UPDATED INVESTOR PRESENTATION

The Company will host a conference call for investors on

Thursday, November 7, 2019, at 9:00 a.m. Central Time (10:00 a.m.

Eastern Time). Interested investors can listen to the call by

dialing 1-877-420-2751 (U.S.) or 1-442-275-1680 (International) and

requesting SilverBow’s Third Quarter 2019 Earnings Conference Call

or by visiting the Company's website.

A simultaneous webcast of the call may be accessed over the

internet by visiting the Company's website at www.sbow.com,

clicking on “Investor Relations” and “Events and Presentations” and

then clicking on the “Third Quarter 2019 Earnings Conference Call”

link. The webcast will be archived for replay on the SilverBow

website for 14 days. Additionally, an updated Corporate

Presentation will be uploaded to the Investor Relations section of

the Company's website before the conference call.

ABOUT SILVERBOW RESOURCES, INC.

SilverBow Resources, Inc. (NYSE: SBOW) is a Houston-based energy

company actively engaged in the exploration, development, and

production of oil and gas in the Eagle Ford Shale in South Texas.

With over 30 years of history operating in South Texas, the Company

possesses a significant understanding of regional reservoirs which

it leverages to assemble high quality drilling inventory while

continuously enhancing its operations to maximize returns on

capital invested. For more information, please visit

www.sbow.com.

FORWARD-LOOKING STATEMENTS

This release includes “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

These forward-looking statements represent management's

expectations or beliefs concerning future events, and it is

possible that the results described in this release will not be

achieved. These forward-looking statements are subject to a number

of risks and uncertainties, many of which are beyond our control,

which could cause actual results to differ materially from the

results discussed in the forward-looking statements, including

among other things: oil and natural gas price levels and

volatility; our ability to satisfy our short- or long-term

liquidity needs; our ability to execute our business strategy,

including the success of our drilling and development efforts;

timing, cost and amount of future production of oil and natural

gas; expectations regarding future free cash flow; and other

factors discussed in the Company’s reports filed with the

Securities and Exchange Commission ("SEC"), including its Annual

Report on Form 10-K for the year ended December 31, 2018 and Forms

10-Q filed thereafter. All statements, other than statements of

historical fact included in this press release, regarding our

strategy, future operations, financial position, future cash flows,

estimated production levels, expected oil and natural gas pricing,

estimated oil and natural gas reserves or the present value

thereof, reserve increases, capital expenditures, budget, projected

costs, prospects, plans and objectives of management are

forward-looking statements.

All forward-looking statements speak only as of the date of this

news release. You should not place undue reliance on these

forward-looking statements. Although we believe that our plans,

intentions and expectations reflected in or suggested by the

forward-looking statements we make in this release are reasonable,

we can give no assurance that these plans, intentions or

expectations will be achieved. The risk factors and other factors

noted herein and in the Company's SEC filings could cause its

actual results to differ materially from those contained in any

forward-looking statement. These cautionary statements qualify all

forward-looking statements attributable to us or persons acting on

our behalf.

All subsequent written and oral forward-looking statements

attributable to us or to persons acting on our behalf are expressly

qualified in their entirety by the foregoing. We undertake no

obligation to publicly release the results of any revisions to any

such forward-looking statements that may be made to reflect events

or circumstances after the date of this release or to reflect the

occurrence of unanticipated events. New factors emerge from time to

time, and it is not possible for us to predict all such

factors.

(Financial Highlights to Follow)

Condensed Consolidated Balance Sheets

(Unaudited)

SilverBow Resources, Inc. and Subsidiaries

(in thousands, except share amounts)

September 30, 2019

December 31, 2018

ASSETS

Current Assets:

Cash and cash equivalents

$

2,850

$

2,465

Accounts receivable, net

34,633

46,472

Fair value of commodity derivatives

20,604

15,261

Other current assets

2,683

2,126

Total Current Assets

60,770

66,324

Property and Equipment:

Property and equipment, full cost method,

including $43,066 and $56,715, respectively, of unproved property

costs not being amortized at the end of each period

1,193,671

986,100

Less – Accumulated depreciation,

depletion, amortization & impairment

(355,574

)

(284,804

)

Property and Equipment, Net

838,097

701,296

Right of Use Assets

10,443

—

Fair Value of Long-Term Commodity

Derivatives

7,051

4,333

Deferred Tax Asset

20,427

—

Other Long-Term Assets

4,558

5,567

Total Assets

$

941,346

$

777,520

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current Liabilities:

Accounts payable and accrued

liabilities

$

38,951

$

48,921

Fair value of commodity derivatives

898

2,824

Accrued capital costs

10,655

38,073

Accrued interest

1,157

1,513

Current lease liability

6,386

—

Undistributed oil and gas revenues

8,983

14,681

Total Current Liabilities

67,030

106,012

Long-Term Debt, Net

475,663

387,988

Non-Current Lease Liability

4,154

—

Deferred Tax Liabilities

1,706

1,014

Asset Retirement Obligations

4,265

3,956

Fair Value of Long-Term Commodity

Derivatives

142

3,723

Stockholders' Equity:

Preferred stock, $0.01 par value,

10,000,000 shares authorized, none issued

—

—

Common stock, $0.01 par value, 40,000,000

shares authorized, 11,865,081 and 11,757,972 shares issued,

respectively, and 11,783,846 and 11,692,101 shares outstanding,

respectively

119

118

Additional paid-in capital

291,754

286,281

Treasury stock, held at cost, 81,235 and

65,871 shares, respectively

(2,193

)

(1,870

)

Retained earnings (accumulated

deficit)

98,706

(9,702

)

Total Stockholders’ Equity

388,386

274,827

Total Liabilities and Stockholders’

Equity

$

941,346

$

777,520

Condensed Consolidated Statements of

Operations (Unaudited)

SilverBow Resources, Inc. and Subsidiaries

(in thousands, except per-share amounts)

Three Months Ended September

30, 2019

Three Months Ended September

30, 2018

Revenues:

Oil and gas sales

$

72,014

$

65,034

Operating Expenses:

General and administrative, net

6,247

5,486

Depreciation, depletion, and

amortization

24,937

18,766

Accretion of asset retirement

obligations

88

87

Lease operating costs

5,507

4,207

Workovers

93

—

Transportation and gas processing

6,782

6,138

Severance and other taxes

3,778

2,464

Total Operating Expenses

47,432

37,148

Operating Income (Loss)

24,582

27,886

Non-Operating Income (Expense)

Gain (loss) on commodity derivatives,

net

13,409

(13,600

)

Interest expense, net

(9,435

)

(7,212

)

Other income (expense), net

134

226

Income (Loss) Before Income Taxes

28,690

7,300

Provision (Benefit) for Income Taxes

1,039

220

Net Income (Loss)

$

27,651

$

7,080

Per Share Amounts

Basic: Net Income (Loss)

$

2.35

$

0.61

Diluted: Net Income (Loss)

$

2.35

$

0.60

Weighted-Average Shares Outstanding -

Basic

11,762

11,671

Weighted-Average Shares Outstanding -

Diluted

11,780

11,792

Nine Months Ended September

30, 2019

Nine Months Ended September

30, 2018

Revenues:

Oil and gas sales

$

218,781

$

169,134

Operating Expenses:

General and administrative, net

19,146

16,856

Depreciation, depletion, and

amortization

70,771

44,994

Accretion of asset retirement

obligations

257

330

Lease operating costs

15,074

12,927

Workovers

613

—

Transportation and gas processing

19,917

16,585

Severance and other taxes

11,044

8,156

Total Operating Expenses

136,822

99,848

Operating Income (Loss)

81,959

69,286

Non-Operating Income (Expense)

Gain (loss) on commodity derivatives,

net

34,312

(30,707

)

Interest expense, net

(27,500

)

(19,686

)

Other income (expense), net

173

(477

)

Income (Loss) Before Income Taxes

88,944

18,416

Provision (Benefit) for Income Taxes

(19,464

)

549

Net Income (Loss)

$

108,408

$

17,867

Per Share Amounts

Basic: Net Income (Loss)

$

9.24

$

1.53

Diluted: Net Income (Loss)

$

9.21

$

1.52

Weighted-Average Shares Outstanding -

Basic

11,739

11,643

Weighted-Average Shares Outstanding -

Diluted

11,776

11,759

Condensed Consolidated Statements of

Cash Flows (Unaudited)

SilverBow Resources, Inc. and Subsidiaries

(in thousands)

Nine Months Ended September

30, 2019

Nine Months Ended September

30, 2018

Cash Flows from Operating Activities:

Net income (loss)

$

108,408

$

17,867

Adjustments to reconcile net income (loss)

to net cash provided by (used in) operating activities

Depreciation, depletion, and

amortization

70,771

44,994

Accretion of asset retirement

obligations

257

330

Deferred income taxes

(19,735

)

549

Share-based compensation expense

5,091

4,240

(Gain) Loss on derivatives, net

(34,312

)

30,707

Cash settlement (paid) received on

derivatives

16,087

(5,671

)

Settlements of asset retirement

obligations

(67

)

(159

)

Other

1,782

4,114

Change in operating assets and

liabilities

(Increase) decrease in accounts receivable

and other current assets

13,746

(6,533

)

Increase (decrease) in accounts payable

and accrued liabilities

(8,824

)

(2,612

)

Increase (decrease) in income taxes

payable

217

—

Increase (decrease) in accrued

interest

(356

)

198

Net Cash Provided by (Used in) Operating

Activities

153,065

88,024

Cash Flows from Investing Activities:

Additions to property and equipment

(234,859

)

(163,151

)

Proceeds from the sale of property and

equipment

(96

)

27,940

Payments on property sale obligations

(4,402

)

(7,036

)

Transfer of company funds from restricted

cash

—

(222

)

Net Cash Provided by (Used in) Investing

Activities

(239,357

)

(142,469

)

Cash Flows from Financing Activities:

Proceeds from bank borrowings

315,000

192,300

Payments of bank borrowings

(228,000

)

(141,300

)

Net proceeds from issuances of common

stock

—

709

Purchase of treasury shares

(323

)

(418

)

Payments of debt issuance costs

—

(330

)

Net Cash Provided by (Used in) Financing

Activities

86,677

50,961

Net Increase (Decrease) in Cash, Cash

Equivalents and Restricted Cash

385

(3,484

)

Cash, Cash Equivalents and Restricted

Cash, at Beginning of Period

2,465

8,026

Cash, Cash Equivalents and Restricted Cash

at End of Period

$

2,850

$

4,542

Supplemental Disclosures of Cash Flow

Information:

Cash paid during period for interest, net

of amounts capitalized

$

26,172

$

17,620

Changes in capital accounts payable and

capital accruals

$

(27,905

)

$

54,060

Changes in other long-term liabilities for

capital expenditures

$

—

$

(3,750

)

SilverBow Resources, Inc. Non-GAAP

Financial Measures Reconciliation of Net Income (GAAP) to

Adjusted EBITDA (Non-GAAP) (In thousands)

(Unaudited)

We present Adjusted EBITDA attributable to common stockholders

(“Adjusted EBITDA”) and Adjusted EBITDA Margin in addition to our

reported net income (loss) in accordance with U.S. GAAP. Adjusted

EBITDA and Adjusted EBITDA Margin are non-GAAP financial measures

that are used as supplemental financial measures by our management

and by external users of our financial statements, such as

investors, commercial banks and others, to assess our operating

performance as compared to that of other companies in our industry,

without regard to financing methods, capital structure or

historical costs basis. It is also used to assess our ability to

incur and service debt and fund capital expenditures. We define

Adjusted EBITDA as net income (loss):

Plus (Less):

- Depreciation, depletion and amortization;

- Accretion of asset retirement obligations;

- Interest expense;

- Impairment of oil and natural gas properties;

- Net losses (gains) on commodity derivative contracts;

- Amounts collected (paid) for commodity derivative contracts

held to settlement;

- Income tax expense (benefit); and

- Share-based compensation expense

We define Adjusted EBITDA Margin as Adjusted EBITDA divided by

the sum of oil and gas sales and derivative cash settlements

collected or paid. Our Adjusted EBITDA and Adjusted EBITDA Margin

should not be considered alternatives to net income (loss),

operating income (loss), cash flows provided by (used in) operating

activities or any other measure of financial performance or

liquidity presented in accordance with U.S. GAAP. Our Adjusted

EBITDA and Adjusted EBITDA Margin may not be comparable to

similarly titled measures of another company because all companies

may not calculate Adjusted EBITDA and Adjusted EBITDA Margin in the

same manner.

Three Months Ended September

30, 2019

Three Months Ended September

30, 2018

Net Income (Loss)

$

27,651

$

7,080

Plus:

Depreciation, depletion and

amortization

24,937

18,766

Accretion of asset retirement

obligations

88

87

Interest expense

9,435

7,212

Derivative (gain)/loss

(13,409

)

13,600

Derivative cash settlements

collected/(paid) (1)

11,407

(4,060

)

Income tax expense/(benefit)

1,039

220

Share-based compensation expense

1,752

1,566

Adjusted EBITDA

$

62,900

$

44,471

Total production volumes (MMcfe)

22,034

17,666

Adjusted EBITDA per Mcfe

$

2.85

$

2.52

Adjusted EBITDA Margin (2)

75

%

73

%

(1) This includes accruals for settled

contracts covering commodity deliveries during the period where the

actual cash settlements occur outside of the period.

(2) Adjusted EBITDA Margin equals Adjusted

EBITDA divided by the sum of Oil and Gas Sales and Derivative Cash

Settlements Collected or Paid.

Nine Months Ended September

30, 2019

Nine Months Ended September

30, 2018

Net Income (Loss)

$

108,408

$

17,867

Plus:

Depreciation, depletion and

amortization

70,771

44,994

Accretion of asset retirement

obligations

257

330

Interest expense

27,500

19,686

Derivative (gain)/loss

(34,312

)

30,707

Derivative cash settlements

collected/(paid) (1)

16,773

(6,536

)

Income tax expense/(benefit)

(19,464

)

549

Share-based compensation expense

5,091

4,241

Adjusted EBITDA

$

175,024

$

111,838

Total production volumes (MMcfe)

62,778

46,675

Adjusted EBITDA per Mcfe

$

2.79

$

2.40

Adjusted EBITDA Margin (2)

74

%

69

%

(1) This includes accruals for settled

contracts covering commodity deliveries during the period where the

actual cash settlements occur outside of the period.

(2) Adjusted EBITDA Margin equals Adjusted

EBITDA divided by the sum of Oil and Gas Sales and Derivative Cash

Settlements Collected or Paid.

Production Volumes & Pricing

(Unaudited)

SilverBow Resources, Inc. and

Subsidiaries

Three Months Ended September

30, 2019

Three Months Ended September

30, 2018

Production volumes:

Oil (MBbl) (1)

506

155

Natural gas (MMcf)

15,958

14,732

Natural gas liquids (MBbl) (1)

507

334

Total (MMcfe)

22,034

17,666

Oil, natural gas and natural gas liquids

sales:

Oil

$

28,894

$

11,124

Natural gas

37,040

43,697

Natural gas liquids

6,080

10,213

Total

$

72,014

$

65,034

Average realized price:

Oil (per Bbl)

$

57.14

$

71.68

Natural gas (per Mcf)

2.32

2.97

Natural gas liquids (per Bbl)

11.99

30.59

Average per Mcfe

$

3.27

$

3.68

(1) Oil and NGLs are converted at the rate

of one barrel to six Mcfe

Nine Months Ended September

30, 2019

Nine Months Ended September

30, 2018

Production volumes:

Oil (MBbl) (1)

1,167

473

Natural gas (MMcf)

48,274

39,081

Natural gas liquids (MBbl) (1)

1,250

793

Total (MMcfe)

62,778

46,675

Oil, natural gas and natural gas liquids

sales:

Oil

$

68,441

$

32,202

Natural gas

131,941

115,833

Natural gas liquids

18,400

21,113

Total

$

218,781

$

169,148

Average realized price:

Oil (per Bbl)

$

58.65

$

68.09

Natural gas (per Mcf)

2.73

2.96

Natural gas liquids (per Bbl)

14.72

26.63

Average per Mcfe

$

3.49

$

3.62

(1) Oil and NGLs are converted at the rate

of one barrel to six Mcfe

Fourth Quarter 2019 & Full

Year 2019 Guidance

Guidance

4Q 2019

FY 2019

Production Volumes:

Oil (Bbls/d)

4,600 - 4,700

4,300 - 4,400

Natural Gas (MMcf/d)

168 - 176

175 - 177

NGLs (Bbls/d)

4,850 - 4,950

4,600 - 4,700

Total Reported Production (MMcfe/d)

225 - 234

228 - 232

Product Pricing:

Crude Oil NYMEX Differential ($/Bbl)

($2.00) - ($1.00)

N/A

Natural Gas NYMEX Differential ($/Mcf)

($0.10) - ($0.04)

N/A

Natural Gas Liquids (% of WTI)

23% - 27%

N/A

Operating Costs & Expenses:

Lease Operating Expenses ($/Mcfe)

$0.23 - $0.27

$0.24 - $0.26

Transportation & Processing

($/Mcfe)

$0.31 - $0.35

$0.31 - $0.33

Production Taxes (% of Revenue)

5.0% - 6.0%

5.0% - 5.5%

Cash G&A, net ($MM)

$4.8 - $5.2

$18.5 - $19.5

DD&A Expense ($/Mcfe)

$1.12 - $1.17

$1.12 - $1.16

Cash Interest Expense ($MM)

$8.5 - $9.5

N/A

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191106005891/en/

Jeff Magids Senior Manager, Finance & Investor Relations

(281) 874-2700, (888) 991-SBOW

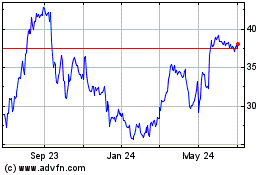

SilverBow Resources (NYSE:SBOW)

Historical Stock Chart

From Jul 2024 to Aug 2024

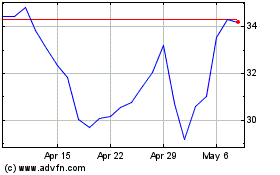

SilverBow Resources (NYSE:SBOW)

Historical Stock Chart

From Aug 2023 to Aug 2024