false

0001846975

0001846975

2024-10-02

2024-10-02

0001846975

sedau:UnitsEachConsistingOfOneClassOrdinaryShareAndOnehalfOfOneRedeemableWarrantMember

2024-10-02

2024-10-02

0001846975

sedau:ClassOrdinarySharesParValue0.0001PerShareMember

2024-10-02

2024-10-02

0001846975

sedau:RedeemableWarrantsEachWholeWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member

2024-10-02

2024-10-02

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): October 2, 2024

SDCL EDGE Acquisition Corporation

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

001-40980 |

|

98-1583135 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

60 East 42nd Street, Suite 1100,

New York, NY |

|

10165 |

| (Address of principal executive offices) |

|

(Zip Code) |

(212) 488-5509

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one Class A ordinary share and one-half of one redeemable warrant |

|

SEDA.U |

|

New York Stock Exchange LLC |

| Class A ordinary shares, par value $0.0001 per share |

|

SEDA |

|

New York Stock Exchange LLC |

| Redeemable warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

SEDA.WS |

|

New York Stock Exchange LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01 Regulation FD Disclosure.

The information in this Current Report on Form 8-K furnished pursuant to Item 7.01

shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise

subject to liability under that section, and it shall not be deemed incorporated by

reference in any filing under the Securities Act of 1933 (the “Securities Act”) or

the Exchange Act, except as shall be expressly set forth by specific reference in

such filing.

Item 8.01 Other Events

As previously disclosed, on February 20, 2024, SDCL EDGE Acquisition Corporation (“SEDA”) entered into a Business Combination

Agreement (the “Business Combination Agreement”) by and among: (i) SEDA, (ii) Specialty

Copper Listco Plc, a public limited company registered in England and Wales with registered

number 15395590 (“PubCo”), (iii) SEDA Magnet LLC, a Delaware limited liability company,

(iv) MAGNET Joint Venture GmbH, a limited liability company organized under the laws

of Germany, registered with the commercial register of the local court of Osnabrück

under registration number HRB 217397, (v) PP S&C Holding GmbH, a limited liability

company organized under the laws of Germany, registered with the commercial register

of the local court of Munich under registration number HRB 275474, (vi) cunova GmbH,

a limited liability company organized under the laws of Germany, registered with the

commercial register of the local court of Osnabrück under registration number HRB

216155 (“Cunova”), (vii) KME SE, a stock corporation organized under the laws of Germany,

registered with the commercial register of the local court of Osnabrück under registration

number HRB 213357, (viii) Creature Kingdom Limited, a private limited company registered

in England and Wales with registered number 06799429, and (ix) The Paragon Fund III

GmbH & Co. geschlossene Investment KG, a limited partnership organized under the laws

of Germany, registered with the commercial register of the local court of Munich under

registration number HRA 110100 and (x) Mr. Edward Wilson Davis, solely in the capacity as the representative for the shareholders

of SEDA ((i) to (x), the “Parties”).

As previously disclosed, on July 2, 2024, the Business Combination Agreement automatically terminated in accordance

with its terms (the “Termination”).

As previously disclosed, notwithstanding the Termination, the Parties continued to engage in discussions regarding pursuing the transactions contemplated by the Business Combination Agreement, including by revising financing terms to reflect market feedback.

Following additional discussions and negotiations among the Parties, on October 2, 2024, the board of directors of SEDA resolved to abandon all continued efforts

to revive and renegotiate the terms of the Business Combination Agreement and the transactions

contemplated thereunder primarily due to continued market uncertainty.

The foregoing description of the Business Combination Agreement does not purport to

be complete and is qualified in its entirety by the terms and conditions of the Business

Combination Agreement previously filed by SEDA as Exhibit 2.1 to SEDA’s Current Report on Form 8-K filed with the United States Securities and Exchange

Commission (the “SEC”) on February 20, 2024, which is incorporated by reference herein.

Important Information and Where to Find It

In connection with the Business Combination Agreement, PubCo has publicly filed with

the SEC a preliminary proxy statement/prospectus on Form F-4 (a “Proxy Statement/Prospectus”).

A definitive Proxy Statement/Prospectus will be mailed to holders of SEDA’s ordinary shares as of a record date to be established for voting on the Business

Combination and other matters as described in the Proxy Statement/Prospectus. The

Proxy Statement/Prospectus includes information regarding the persons who may, under

SEC rules, be deemed participants in the solicitation of proxies to SEDA’s shareholders in connection with the Business Combination. PubCo and SEDA may also

file other documents regarding the Business Combination with the SEC. BEFORE MAKING

ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF SEDA ARE URGED

TO READ THE PROXY STATEMENT/PROSPECTUS, THE DEFINITIVE PROXY STATEMENT/PROSPECTUS

AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC IN CONNECTION

WITH THE MERGER, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY

AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED

BUSINESS COMBINATION.

Investors and security holders are able to obtain free copies of the Proxy Statement/Prospectus

and all other relevant documents filed or that will be filed with the SEC by PubCo

or SEDA through the website maintained by the SEC at www.sec.gov. In addition, the

documents filed by SEDA may be obtained free of charge from SEDA’s website at www.sdcledge.com or by written request to SEDA at SDCL EDGE Acquisition

Corporation, 60 East 42nd Street, Suite 1100, New York, NY 10165, Attn: Francesca

Lorenzini.

Participants in the Solicitation

SEDA, and certain of their respective directors and officers may be deemed to be participants

in the solicitation of proxies from SEDA’s shareholders in connection with the Business Combination. Information about SEDA’s directors and executive officers and their ownership of SEDA’s securities is set forth in SEDA’s filings with the SEC, including SEDA’s Annual Report on Form 10-K for the year ended December 31, 2023, which was filed with the SEC on April 16, 2024. Additional information regarding the interests of those persons and other

persons who may be deemed participants in the Business Combination may be obtained

by reading the Proxy Statement/Prospectus regarding the Business Combination when

it becomes available. You may obtain free copies of these documents as described in

the preceding paragraph.

No Offer or Solicitation

This Current Report on Form 8-K and the information contained herein do not constitute

an offer to sell or the solicitation of an offer to buy any security, commodity or

instrument or related derivative, nor shall there be any sale of securities in any

jurisdiction in which the offer, solicitation or sale would be unlawful prior to the

registration or qualification under the securities laws of any such jurisdiction.

No offer of securities in the United States or to or for the account or benefit of

U.S. persons (as defined in Regulation S under the Securities Act) shall be made except

by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or an exemption therefrom. Investors should consult with

their counsel as to the applicable requirements for a purchaser to avail itself of

any exemption under the Securities Act.

Forward Looking Statements

This Current Report on Form 8-K contains certain forward-looking statements within

the meaning of the federal securities laws with respect to the Business Combination

between SEDA, Cunova and the KME specialty aerospace business (the “Aerospace Business”,

together with Cunova, the “Target”), including but are not limited to, statements

regarding the benefits of the transaction, the anticipated timing of the transaction,

the products offered by the Target and the markets in which it operates, the Target’s projected future results (including EBITDA and cash flow). These forward-looking

statements generally are identified by the words “anticipate,” “expect,” “should,” “will,” “would,” and similar expressions. Forward-looking statements are

predictions, projections and other statements about future events that are based on

current expectations and assumptions and, as a result, are subject to risks and uncertainties.

Many factors could cause actual future events to differ materially from the forward-looking

statements in this document, including but not limited to: (a) the outcome of any

legal proceedings that may be instituted in connection with the Business Combination;

(b) costs related to the Business Combination; (c) changes in the applicable laws or regulations; (d) economic uncertainty caused by the impacts of geopolitical conflicts, including

Russia’s invasion of Ukraine and the ongoing conflicts in the Middle East; and (e) economic uncertainty due to rising levels of inflation and interest rates. The foregoing

list of factors is not exhaustive. You should carefully consider the foregoing factors

and the other risks and uncertainties described in the “Risk Factors” section of PubCo’s registration statement on Form F-4, the proxy statement/prospectus contained therein,

SEDA’s Annual Report on Form 10-K, SEDA’s Quarterly Reports on Form 10-Q and other documents filed by PubCo, the Target or

SEDA from time to time with the SEC. These filings identify and address other important

risks and uncertainties that could cause actual events and results to differ materially

from those contained in the forward-looking statements. Forward-looking statements

speak only as of the date they are made. Readers are cautioned not to put undue reliance

on forward-looking statements, and PubCo, the Target and SEDA assume no obligation

and do not intend to update or revise these forward-looking statements, whether as

a result of new information, future events, or otherwise. Neither PubCo, the Target

nor SEDA gives any assurance that PubCo, the Target or SEDA will achieve its expectations.

The inclusion of any statement in this communication does not constitute an admission

by PubCo, the Target or SEDA or any other person that the events or circumstances

described in such statement are material.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: October 3, 2024 |

SDCL EDGE Acquisition Corporation |

| |

|

|

| |

By: |

/s/ Ned Davis |

| |

Name: |

Ned Davis |

| |

Title: |

Chief Financial Officer |

v3.24.3

Cover

|

Oct. 02, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Oct. 02, 2024

|

| Entity File Number |

001-40980

|

| Entity Registrant Name |

SDCL EDGE Acquisition Corporation

|

| Entity Central Index Key |

0001846975

|

| Entity Tax Identification Number |

98-1583135

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

60 East 42nd Street

|

| Entity Address, Address Line Two |

Suite 1100

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10165

|

| City Area Code |

(212)

|

| Local Phone Number |

488-5509

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A ordinary share and one-half of one redeemable warrant |

|

| Title of 12(b) Security |

Units, each consisting of one Class A ordinary share and one-half of one redeemable warrant

|

| Trading Symbol |

SEDA.U

|

| Security Exchange Name |

NYSE

|

| Class A ordinary shares, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A ordinary shares, par value $0.0001 per share

|

| Trading Symbol |

SEDA

|

| Security Exchange Name |

NYSE

|

| Redeemable warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 |

|

| Title of 12(b) Security |

Redeemable warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50

|

| Trading Symbol |

SEDA.WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=sedau_UnitsEachConsistingOfOneClassOrdinaryShareAndOnehalfOfOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=sedau_ClassOrdinarySharesParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=sedau_RedeemableWarrantsEachWholeWarrantExercisableForOneClassOrdinaryShareAtExercisePriceOf11.50Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

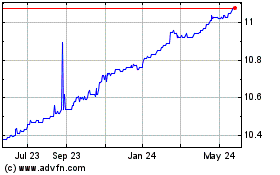

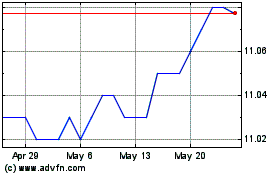

SDCL EDGE Acquisition (NYSE:SEDA)

Historical Stock Chart

From Nov 2024 to Dec 2024

SDCL EDGE Acquisition (NYSE:SEDA)

Historical Stock Chart

From Dec 2023 to Dec 2024