Sally Beauty Holdings, Inc. (NYSE: SBH) announced today that its

indirect wholly-owned subsidiaries Sally Holdings LLC and Sally

Capital Inc. (collectively, “Sally Beauty”) have commenced cash

tender offers (the “Tender Offers”) to purchase up to $100,000,000

in aggregate purchase price (as it may be increased by Sally

Beauty, the “Tender Cap”) of their outstanding 5.625 percent Senior

Notes due 2025 and 5.500 percent Senior Notes due 2023

(collectively, the “Notes”).

The terms and conditions of the Tender Offers are described in

an Offer to Purchase, dated February 19, 2019 (the “Offer to

Purchase”). Sally Beauty intends to fund the Tender Offers with

cash on hand and borrowings under its asset-based revolving credit

facility.

The following table sets forth certain terms of the Tender

Offers:

Dollars per $1,000

Principal Amount of Notes Title of Notes

CUSIP Numbers / ISIN

Aggregate Principal Amount Outstanding(1)

Series Cap Acceptance

Priority

Level

Tender Offer Consideration(2)

Early Tender Payment

Total

Consideration(2)(3)

5.625% Senior Notes due 2025 79546VAL0/ US79546VAL09

$750,000,000 N/A

1 $950.00 $30.00

$980.00

5.500% Senior Notes due 2023

79546VAK2/ US79546VAK26

$200,000,000

$25,000,000

2

$970.00

$30.00

$1,000.00

________________________________

(1) Aggregate principal amount outstanding as

of February 18, 2019. (2) Per $1,000 principal amount of Notes

accepted for purchase and excluding Accrued Interest, which will be

paid in addition to the Total Consideration or the Tender Offer

Consideration, as applicable. (3) Includes the Early Tender

Payment.

The Tender Offers will expire at midnight, New York City time,

at the end of March 18, 2019, unless extended or earlier terminated

by Sally Beauty (the “Expiration Date”). No tenders submitted after

the Expiration Date will be valid.

Holders of Notes that are validly tendered (and not validly

withdrawn) at or prior to 5:00 p.m., New York City time, on March

4, 2019 (such date and time, as it may be extended, the “Early

Tender Date”) and accepted for purchase pursuant to the Tender

Offers will receive the applicable Total Consideration for such

series, which includes the early tender payment for such series of

Notes set forth in the table above (with respect to each series of

Notes, the “Early Tender Payment”). Holders of Notes tendering

their Notes after the Early Tender Date will only be eligible to

receive the applicable tender offer consideration for such series

of Notes set forth in the table above (with respect to each series

of Notes, the “Tender Offer Consideration”), which is the

applicable Total Consideration less the Early Tender Payment.

All Notes validly tendered and accepted for purchase pursuant to

the Tender Offers will receive the applicable consideration set

forth in the table above, plus accrued and unpaid interest on such

Notes from the applicable last interest payment date with respect

to those Notes to, but not including, the applicable Settlement

Date (as defined below) (“Accrued Interest”).

Tendered Notes may be withdrawn at or prior to 5:00 p.m., New

York City time, on March 4, 2019, unless extended by Sally Beauty

(such date and time, as it may be extended, the “Withdrawal Date”),

but not thereafter. Holders of Notes who tender their Notes after

the Withdrawal Date, but prior to the Expiration Date, may not

withdraw their tendered Notes unless withdrawal rights are

otherwise required by applicable law.

Provided that the conditions to the applicable Tender Offer have

been satisfied or waived, and assuming acceptance for purchase by

Sally Beauty of Notes validly tendered pursuant to the Tender

Offers, (i) payment for applicable Notes validly tendered at or

prior to the applicable Early Tender Date and purchased in the

applicable Tender Offer shall be made on the settlement date that

is expected to be the second business day following the applicable

Early Tender Date, or as promptly as practicable thereafter (with

respect to each series of Notes, the “Early Settlement Date”) and

(ii) payment for any applicable Notes validly tendered after the

applicable Early Tender Date, but at or prior to the applicable

Expiration Date, and purchased in the applicable Tender Offer shall

be made on the settlement date that is expected to be the second

business day following the applicable Expiration Date, or as

promptly as practicable thereafter (with respect to each series of

Notes, the “Final Settlement Date” and, together with the related

Early Settlement Date, the “Settlement Dates”).

Subject to the Tender Cap, the 2023 Series Cap and proration,

the Notes accepted on any Settlement Date will be accepted in

accordance with their Acceptance Priority Levels set forth in the

table above, with 1 being the highest Acceptance Priority Level and

2 being the lowest Acceptance Priority Level, and provided further

that Notes tendered at or prior to the Early Tender Date will be

accepted for purchase with priority over Notes tendered after the

Early Tender Date, but at or prior to the Expiration Date,

regardless of the priority of the series of such later tendered

Notes. In addition, no more than $25,000,000 aggregate principal

amount of the 2023 Notes will be purchased in the Tender Offers (as

it may be increased by Sally Beauty, the “2023 Series Cap”).

Acceptance for tenders of any Notes may be subject to proration

if the aggregate principal amount for any series of Notes validly

tendered and not validly withdrawn would cause the Tender Cap to be

exceeded. Acceptance for tenders of the 2023 Notes may also be

subject to proration if the aggregate principal amount of the

specified series of Notes validly tendered and not validly

withdrawn is greater than the 2023 Series Cap. Furthermore, if the

Tender Offers are fully subscribed as of the Early Tender Date,

holders who validly tender Notes after the Early Tender Date will

not have any of their Notes accepted for purchase and there will be

no Final Settlement Date.

Sally Beauty reserves the right, but is under no obligation, to

increase the Tender Cap and/or the 2023 Series Cap at any time,

subject to compliance with applicable law, which could result in

Sally Beauty purchasing a greater aggregate principal amount of

Notes in the Offers. There can be no assurance that Sally Beauty

will increase the Tender Cap or the 2023 Series Cap. If Sally

Beauty increases the Tender Cap and/or the 2023 Series Cap, it does

not expect to extend the Withdrawal Date, subject to applicable

law. Accordingly, Holders should not tender Notes that they do not

wish to have purchased in the Offers.

The consummation of the Tender Offers is not conditioned upon

any minimum amount of Notes being tendered. However, the Tender

Offers are subject to, and conditioned upon, the satisfaction or

waiver of certain conditions described in the Offer to

Purchase.

This press release is neither an offer to purchase nor a

solicitation of an offer to sell securities. No offer,

solicitation, purchase or sale will be made in any jurisdiction in

which such offer, solicitation, or sale would be unlawful. The

offer is being made solely pursuant to terms and conditions set

forth in the Offer to Purchase.

The dealer manager for the Tender Offers is BofA Merrill Lynch

(the “Dealer Manager”). Any questions regarding the terms of the

Tender Offers should be directed to the Dealer Manager, BofA

Merrill Lynch at (toll-free) 888-292-0070 or (collect)

980-388-3646. Any questions regarding procedures for tendering

Notes should be directed to the Information Agent for the Tender

Offers, Global Bondholder Services Corporation, toll-free at

866-924-2200 (banks and brokers call (212) 430-3774) or 65

Broadway, Suite 404, New York, NY 10006.

Copies of the Offer to Purchase are available from the

Information Agent and Depositary and at the following web address:

http://www.gbsc-usa.com/SBH/.

About Sally Beauty Holdings, Inc.

Sally Beauty Holdings, Inc. (NYSE: SBH) is an international

specialty retailer and distributor of professional beauty supplies

with revenues of approximately $3.9 billion annually. Through the

Sally Beauty Supply and Beauty Systems Group businesses, the

Company sells and distributes through 5,129 stores, including 180

franchised units, and has operations throughout the United States,

Puerto Rico, Canada, Mexico, Chile, Peru, the United Kingdom,

Ireland, Belgium, France, the Netherlands, Spain and Germany. Sally

Beauty Supply stores offer up to 8,000 products for hair color,

hair care, skin care, and nails through proprietary brands such as

Ion®, Generic Value Products®, Beyond the Zone® and Silk Elements®

as well as professional lines such as Wella®, Clairol®, OPI®,

Conair® and Hot Shot Tools®. Beauty Systems Group stores, branded

as CosmoProf or Armstrong McCall stores, along with its outside

sales consultants, sell up to 10,500 professionally branded

products including Paul Mitchell®, Wella®, Matrix®, Schwarzkopf®,

Kenra®, Goldwell®, Joico® and CHI®, intended for use in salons and

for resale by salons to retail consumers.

Statements in this news release which are not purely historical

facts or which depend upon future events may be forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Forward-looking statements, as that term is

defined in the Private Securities Litigation Reform Act of 1995,

can be identified by the use of forward-looking terminology such as

“believes,” “projects,” “expects,” “can,” “may,” “estimates,”

“should,” “plans,” “targets,” “intends,” “could,” “will,” “would,”

“anticipates,” “potential,” “confident,” “optimistic,” or the

negative thereof, or other variations thereon, or comparable

terminology, or by discussions of strategy, objectives, estimates,

guidance, expectations and future plans. Forward-looking statements

can also be identified by the fact these statements do not relate

strictly to historical or current matters.

Readers are cautioned not to place undue reliance on

forward-looking statements as such statements speak only as of the

date they were made. Any forward-looking statements involve risks

and uncertainties that could cause actual events or results to

differ materially from the events or results described in the

forward-looking statements, including, but not limited to, the

risks and uncertainties described in our filings with the

Securities and Exchange Commission, including our most recent

Annual Report on Form 10-K for the year ended September 30, 2018,

as filed with the Securities and Exchange Commission. Consequently,

all forward-looking statements in this release are qualified by the

factors, risks and uncertainties contained therein. We assume no

obligation to publicly update or revise any forward-looking

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190219005321/en/

Investor Relations and Media InquiriesJeff

Harkins940.297.3877

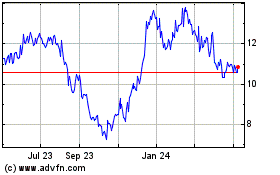

Sally Beauty (NYSE:SBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

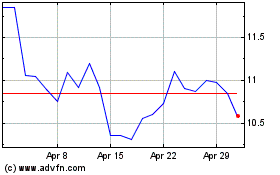

Sally Beauty (NYSE:SBH)

Historical Stock Chart

From Apr 2023 to Apr 2024