Amended Current Report Filing (8-k/a)

June 01 2020 - 5:13PM

Edgar (US Regulatory)

NYSE true 0001108524 0001108524 2020-04-22 2020-04-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K/A

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

April 22, 2020

Date of Report (date of earliest event reported)

salesforce.com, inc.

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-32224

|

|

94-3320693

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

Salesforce Tower

415 Mission Street, 3rd Fl

San Francisco, CA 94105

(Address of principal executive offices)

Registrant’s telephone number, including area code: (415) 901-7000

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange

on which registered

|

|

Common Stock, par value $0.001 per share

|

|

CRM

|

|

New York Stock Exchange, Inc.

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

On April 24, 2020, salesforce.com, inc. (the “Company”) filed a Current Report on Form 8-K (the “Form 8-K”) regarding the approval of fiscal 2021 stock option, restricted stock unit and performance-based restricted stock unit awards for the Company’s named executive officers. The Company is filing this amended report to correct an error in the number of stock options that was reported for each named executive officer. The full text of the Form 8-K is set forth below as previously filed, except with the corrected stock option amounts as described above.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

|

On April 22, 2020, the Compensation Committee (the “Committee”) of the Board of Directors of salesforce.com, inc. (the “Company”) approved stock option, restricted stock unit and performance-based restricted stock unit awards as set forth below to Mr. Marc Benioff, our principal executive officer, Mr. Mark Hawkins, our principal financial officer, and Messrs. Parker Harris, Srinivas Tallapragada and Bret Taylor, each a named executive officer (collectively, the “Named Executive Officers”) in the Company’s 2019 Proxy Statement. The stock options grant the right to purchase shares of common stock at the fair market value on the grant date. Both the stock option and restricted stock unit grants are subject in each case to the Company’s applicable standard four-year vesting schedule. The performance-based restricted stock units are subject to vesting based on a performance-based condition and a service-based condition, as described in more detail below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Stock

Options

|

|

|

Restricted Stock

Units

|

|

|

Performance-Based

Restricted Stock Units

|

|

|

Marc Benioff

|

|

|

201,782

|

|

|

|

n/a

|

|

|

|

86,344

|

|

|

Mark Hawkins

|

|

|

126,114

|

|

|

|

16,220

|

|

|

|

17,989

|

|

|

Parker Harris

|

|

|

138,725

|

|

|

|

17,841

|

|

|

|

19,788

|

|

|

Srinivas Tallapragada

|

|

|

138,725

|

|

|

|

17,841

|

|

|

|

19,788

|

|

|

Bret Taylor

|

|

|

151,336

|

|

|

|

19,463

|

|

|

|

21,586

|

|

The performance-based restricted stock unit awards granted to the Named Executive Officers provide that, if the officer remains employed through May 15, 2023, his shares will vest in a percentage of the target number of shares shown above, between zero and 200 percent, depending on how the Company’s total shareholder return (“TSR”) ranks over the three-year period from the grant date (the “Performance Period”), relative to the companies in the NASDAQ-100 Index as of the grant date (the “Index Group”). If the Company’s TSR over the Performance Period is at the 60th percentile when ranked against the TSRs of the companies in the Index Group, 100 percent of the target number of shares will be eligible to vest. For every percentile by which the Company’s TSR ranking within the Index Group exceeds the 60th percentile, the number of shares eligible to vest will increase by 2 22/39 percent of target, up to a maximum payout of 200 percent of target if the Company’s TSR ranking is at the 99th percentile. For every percentile by which the Company’s TSR ranking within the Index Group is below the 60th percentile, the number of shares eligible to vest will decrease by 3 1/3 percent of target, with no payout if the Company’s TSR ranking is below the 30th percentile. Additionally, if the Company’s absolute TSR over the Performance Period is negative, in no event will the number of shares eligible to vest exceed 100 percent of the target amount, even if the Company’s TSR ranks above the 60th percentile within the Index Group.

Special vesting rules apply to the performance-based restricted stock units in the event of a change of control. Each award provides that if a change of control of the Company occurs during the officer’s employment, his shares will become eligible to vest based on how the Company’s TSR performance ranks relative to the Index Group from the grant date through the date of the change of control (instead of through the three-year Performance Period), using the same zero to 200 percent scale described above (any such shares that become eligible to vest based the Company’s TSR performance as compared to the Index Group through the date of the change of control are referred to as “eligible shares”). A portion of the service-based condition will be considered satisfied as of the date of a change of control, and a pro-rated portion of the eligible shares (if any) will vest to reflect service through that date, with the remaining eligible shares vesting in equal quarterly installments thereafter over the balance of the original Performance Period, subject to the officer’s continued employment through each vesting date. Any shares eligible to vest based on the TSR performance are also subject to accelerated vesting if the officer’s employment terminates within three months before, or 18 months after, a change of control in a qualifying termination of employment, determined in accordance with the terms of his existing change of control and retention agreement.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

salesforce.com, inc.

|

|

|

|

|

|

By:

|

|

/s/ Amy Weaver

|

|

|

|

Amy Weaver

|

|

|

|

President and Chief Legal Officer

|

Dated: June 1, 2020

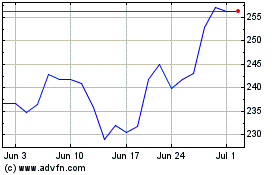

Salesforce (NYSE:CRM)

Historical Stock Chart

From Mar 2024 to Apr 2024

Salesforce (NYSE:CRM)

Historical Stock Chart

From Apr 2023 to Apr 2024