– Gross Advanced Group Bookings for all Future

Periods Increased 20.5 Percent Over Fourth Quarter 2012 –

– Full Year 2013 Net Income at $118.4 million

–

– Full Year 2013 Adjusted Funds From Operations

excluding REIT conversion costs at $190.2 million –

– Gaylord Texan initiates and accelerates room

renovation project in December 2013 –

– Declares First Quarter 2014 dividend of $0.55

per share an increase of 10% over prior quarter dividend –

– Issues 2014 Guidance –

Ryman Hospitality Properties, Inc. (NYSE:RHP), a lodging real

estate investment trust ("REIT") specializing in group-oriented,

destination hotel assets in urban and resort markets, today

reported financial results for the fourth quarter and full year

ended December 31, 2013.

Colin V. Reed, chairman, chief executive officer and president

of Ryman Hospitality Properties, stated,

“Although 2013 was certainly a year in which we navigated our

fair share of transitional challenges, we are generally pleased

with how our business performed in the fourth quarter and our

position entering 2014. While the fourth quarter came in below our

expectations due to a few unanticipated events, we are encouraged

by group dynamics that evolved throughout the quarter. Our bookings

performance during the fourth quarter was certainly a highlight, as

we booked over 772,000 gross room nights, a more than 20 percent

increase year-over-year and the highest booking quarter since 2010.

On a net room night basis, we booked over 637,000 room nights, a

year-over-year increase of 37 percent. Our group room night

bookings entering 2014 were 4.7 percent higher than they were

entering 2013. In addition, our group mix for these bookings is

more favorable with a 10 percent increase in corporate group room

nights, which bodes well for outside-the room spending. These

bookings results reflect the work we have done to improve the sales

process with Marriott, and we are confident that we will continue

to see these enhancements drive results in 2014.”

“Additional positive highlights during the fourth quarter

include a significant decrease in in-the-year, for-the-year

cancellations and attrition rates across our hotels. We saw

in-the-year, for-the-year cancellations decline nearly 70 percent

in the fourth quarter compared to the same period last year, and

attrition rates came in at 10.7 percent for the fourth quarter 2013

compared to 12.2 percent for third quarter 2013 and 12.5 percent in

fourth quarter 2012. While impacted by severe winter weather in

December and accelerated rooms renovation at the Gaylord Texan, our

transient segment continued to show growth with a 13.5 percent

increase in room nights in the fourth quarter over the prior year

quarter, while full year 2013 transient room nights increased 20.7

percent compared to full year 2012. In terms of our bottom line, we

remain focused on continuing to work with Marriott to improve

margin performance and realize cost synergies, and we expect to see

continued improvement in the coming quarters. In aggregate, all of

these factors contribute to our view that our business is well

positioned for 2014 and beyond.”

Fourth Quarter and Full Year 2013 Results (as compared to

Fourth Quarter and Full Year 2012)

- Gross advanced group bookings in the

fourth quarter 2013 for all future periods increased 20.5 percent

to approximately 772,000 room nights; net advanced group bookings

in the fourth quarter 2013 for all future periods increased 37.4

percent to approximately 637,000 room nights. Gross advanced group

bookings for the full year 2013 for all future periods increased

11.3 percent to approximately 2.2 million room nights; net advanced

group bookings for the full year 2013 for all future periods

increased 7.7 percent to approximately 1.6 million room

nights.

- As of December 31, 2013, group

occupancy on the books for 2014 was 48.2 occupancy points, which is

2.2 occupancy points higher than as of the same time last year for

2013.

- Transient room nights in the fourth

quarter increased 13.5 percent to approximately 190,000 room nights

while transient Average Daily Rate, or ADR, increased 1.7 percent.

Transient room nights for full year 2013 increased 20.7 percent to

approximately 576,000 room nights while transient ADR increased 2.3

percent.

- Cancellations in-the-year, for-the-year

in the fourth quarter 2013 decreased 69.8 percent to approximately

5,300 group rooms compared to approximately 17,400 group rooms in

the fourth quarter 2012. Cancellations in-the-year, for-the-year

for full year 2013 increased 5.4 percent to approximately 67,000

group rooms compared to approximately 63,000 group rooms for full

year 2012.

- Attrition for groups that traveled in

the fourth quarter of 2013 was 10.7 percent of contracted room

block compared to 12.5 percent in the same period in 2012, and

attrition and cancellation fees collected during the fourth quarter

of 2013 were $3.4 million compared to $1.9 million in the same

period in 2012. Attrition for groups that traveled during full year

2013 was 11.1 percent of contracted room block compared to 8.3

percent for full year 2012, and attrition and cancellation fees

collected during full year 2013 were $8.5 million compared to $6.4

million for full year 2012.

- Total Revenue in the fourth quarter

2013 was flat at $266.1 million compared to Total Revenue in the

fourth quarter 2012 of $266.3 million. Total Revenue for full year

2013 decreased 3.2 percent to $954.6 million compared to Total

Revenue for full year 2012 of $986.6 million, or a decrease of 2.5

percent compared to Total Retail Adjusted Revenue for full year

2012.

- Hospitality Revenue Per Available Room,

or RevPAR, for the fourth quarter 2013 was flat at $123.39.

Hospitality RevPAR for full year 2013 decreased 2.0 percent to

$120.89.

- Hospitality Total RevPAR in the fourth

quarter 2013 decreased 0.9 percent to $331.26 compared to

Hospitality Total RevPAR in the fourth quarter 2012. Hospitality

Total RevPAR for full year 2013 decreased 3.8 percent to $297.22

compared to unadjusted Hospitality Total RevPAR for full year 2012,

or a decrease of 3.0 percent compared to Hospitality Retail

Adjusted Total RevPAR for full year 2012.

- Hospitality Revenue for the fourth

quarter 2013 decreased 0.9 percent to $246.8 million compared to

Hospitality Revenue in the fourth quarter 2012. Hospitality Revenue

for full year 2013 decreased 4.1 percent to $878.5 million compared

to unadjusted Hospitality Revenue for full year 2012, or a decrease

of 3.3 percent compared to Hospitality Retail Adjusted Revenue for

full year 2012.

- Net income in the fourth quarter 2013

was $30.2 million compared to a net loss of $15.0 million in fourth

quarter 2012. Net income for the fourth quarter 2013 includes $0.8

million of REIT conversion costs; whereas net income for the fourth

quarter 2012 includes $44.2 million of REIT conversion costs. In

addition, net income for the fourth quarter of 2012 included a

$20.0 million one-time gain on the sale of the Gaylord Hotels brand

rights to Marriott. Net income for full year 2013 was $118.4

million compared to a net loss of $26.6 million for full year 2012.

Net income for the full year 2013 reflects a decrease in total

operating expenses of $113.0 million compared to full year 2012,

due primarily to a $79.8 million decrease in REIT conversion costs.

Net income for the full year 2013 also includes a tax benefit of

$92.7 million, consisting primarily of a non-cash benefit of $64.8

million resulting from the reversal of certain net deferred tax

liabilities in connection with the REIT conversion.

- Adjusted EBITDA on a consolidated basis

for fourth quarter 2013 increased 10.6% to $69.5 million compared

to $62.8 million for fourth quarter 2012. Adjusted EBITDA on a

consolidated basis for full year 2013 decreased 3.7 percent to

$248.3 million compared to $257.9 million for full year 2012.

- Hospitality Adjusted EBITDA for fourth

quarter 2013 increased 1.3 percent to $67.5 million compared to

$66.6 million for fourth quarter 2012. Hospitality Adjusted EBITDA

for full year 2013 decreased 12.4 percent to $245.0 million

compared to $279.8 million for full year 2012.

- Adjusted Funds from Operations, or

Adjusted FFO, for fourth quarter 2013 was $59.0 million compared to

$8.3 million in fourth quarter 2012. Adjusted FFO excluding REIT

conversion costs was $58.1 million compared to $28.4 million in

fourth quarter 2012. Full year 2013 Adjusted FFO was $174.8 million

compared to $86.6 million for full year 2012. Adjusted FFO

excluding REIT conversion costs for full year 2013 was $190.2

million compared to $129.8 million for full year 2012.

- During the fourth quarter 2013, a few

meaningful events occurred that impacted Adjusted EBITDA on a

consolidated basis, Hospitality Adjusted EBITDA, and Adjusted FFO.

- Offsetting favorable overall hotel

performance in October and November, transient business in December

for three of our hotels (Gaylord Texan, Gaylord Opryland, and

Gaylord National) was negatively impacted by winter weather

conditions. As a whole, the winter storm had an approximately $2.9

million unfavorable impact to Hospitality Adjusted EBITDA and

Adjusted FFO, with Gaylord Texan contributing approximately $2.2

million of this impact.

- The room renovation project at Gaylord

Texan was accelerated and began in December, resulting in

approximately one-quarter of the room inventory being out of

service for the month. The negative impact was approximately $3.7

million in revenue and approximately $2.0 million in Hospitality

Adjusted EBITDA in December. In addition, the room renovation

project included a non-capitalizable expense of $0.5 million which

further impacted Hospitality Adjusted EBITDA and Adjusted FFO for

the quarter.

- As previously noted the sales teams for

the hotels produced the highest group room night production since

2010. As a result, sales incentive expense incurred in the fourth

quarter 2013 exceeded the company’s original estimates and impacted

Hospitality Adjusted EBITDA and Adjusted FFO by $2.2 million.

- In November, the Company determined

that it was not economically feasible to expand the Gaylord Palms

property in the near-term and subsequently terminated a 2008 tax

incentive arrangement with Osceola County. As a result, Gaylord

Palms received a $3.1 million reimbursement of sales and marketing

expenses from Osceola County, which increased the hotel’s Adjusted

EBITDA and Adjusted FFO.

- In December, the Company terminated a

cash-based deferred compensation plan for its board of directors

and replaced it with a new compensation plan based on restricted

stock unit awards. This plan change resulted in a $3.4 million

non-cash charge to equity-based compensation expense, which was

offset by a $3.4 million reversal of cash compensation cost and

positively impacted Adjusted EBITDA within the Corporate and Other

segment.

For the Company’s definitions of RevPAR, Total RevPAR, Adjusted

EBITDA, Retail Adjusted Revenue, Retail Adjusted Total RevPAR, and

Adjusted FFO as well as a reconciliation of the non-GAAP financial

measure Adjusted EBITDA to Net Income, a reconciliation of the

non-GAAP financial measure Retail Adjusted Revenue to revenue, and

a reconciliation of the non-GAAP financial measure Adjusted FFO to

Net Income, see “Retail Adjusted Revenue”, “Calculation of RevPAR

and Total RevPAR”, “Non-GAAP Financial Measures”, and “Supplemental

Financial Results” below.

Hospitality

Property-level results and operating metrics for the fourth

quarter of 2013 and 2012 are presented in greater detail below and

under “Supplemental Financial Results.”

- Gaylord Opryland RevPAR increased 3.6

percent to $122.63 compared to the fourth quarter of 2012. Total

RevPAR decreased by 0.3 percent to $302.19 as compared to Total

RevPAR in the fourth quarter of 2012. The growth in RevPAR was led

by a 4.2 percentage point increase in occupancy, partially offset

by a 2.3 percent decrease in ADR due to a group mix shift from

premium corporate groups to lower rated association and other

groups. Transient room nights increased 18.2 percent over fourth

quarter 2012, while transient ADR decreased by 2.8 percent. Total

revenue for the fourth quarter 2013 was slightly unfavorable

compared to prior year as a result of a decline in ADR and

outside-the-room spending on banquets, offset by the increase in

transient room nights. The property was impacted negatively by

severe winter weather in December, which offset favorable overall

hotel performance in October and November. Through expense

management, the property was able to offset the decline in revenue

and slightly increase Adjusted EBITDA margin for the quarter to

26.0 percent, or an increase of 0.6 percentage points over the same

period last year.

- Gaylord Palms RevPAR increased 7.7

percent to $125.10 compared to the fourth quarter of 2012. Total

RevPAR increased 3.2 percent to $346.75 compared to Total RevPAR in

the fourth quarter of 2012. The increase in RevPAR is primarily

related to an increase in room nights for the corporate and

transient segments, partially offset by a decline in association

room nights. Furthermore, transient ADR increased 4.4 percent to

$173.25 compared to the fourth quarter of 2012. During the fourth

quarter 2013, the property realized a $3.1 million sales and

marketing expense reimbursement from Osceola County related to the

termination of the tax incentive agreement for the previously

planned expansion of the property. This adjustment impacts the

year-over-year comparisons for Adjusted EBITDA and Adjusted EBITDA

margin. Excluding the impact of the sales and marketing expense

reimbursement, Adjusted EBITDA for the fourth quarter of 2013

increased 20.7 percent compared to the same period last year and

Adjusted EBITDA margin increased 3.5 percentage points compared to

the same period last year.

- Gaylord Texan RevPAR decreased 9.0

percent to $125.88 compared to the fourth quarter of 2012. Total

RevPAR decreased 8.7 percent to $399.58 as compared to the fourth

quarter of 2012. Transient room nights for the property decreased

5.5 percent from fourth quarter of 2012, while transient ADR

increased by 2.6 percent. The property was negatively impacted by a

drop in transient room nights for December, driven by severe winter

weather that heavily disrupted demand to the property’s holiday

events. The weather disruption negatively impacted revenue by

approximately $2.4 million and approximately $2.2 million of

Adjusted EBITDA decline. In addition, the property was impacted by

the acceleration of the room renovation program which began in

December. Approximately 448 guest rooms were out of service during

most of the month of December. Overall, approximately 11,400 total

room nights were out of service as a result of the renovation. The

negative impact of this renovation was roughly $3.7 million in

revenue and approximately $2.0 million in Hospitality Adjusted

EBITDA in December. In addition, the room renovation included a

non-capitalizable expense of approximately $0.5 million which

further impacted Hospitality Adjusted EBITDA and Adjusted FFO for

the quarter. Adjusted EBITDA margin declined 2.8 percentage points

for the fourth quarter compared to the same period last year.

- Gaylord National RevPAR decreased 3.8

percent to $128.75 compared to the fourth quarter of 2012. Total

RevPAR increased 2.4 percent to $345.38 as compared to Total RevPAR

in the fourth quarter of 2012. Transient room nights for the

property increased by 13.6 percent. Transient ADR increased by 14.3

percent over fourth quarter of 2012, which partially offset a

decline in group ADR of 10.5 percent. The decrease in group ADR was

a result of a shift from premium rated corporate groups to lower

rated association groups coupled with short-term cancellations and

higher attrition of premium rated groups. Adjusted EBITDA margin

declined 2.9 percentage points compared to the same period last

year. The property’s Adjusted EBITDA and Adjusted EBITDA margin for

the fourth quarter of 2012 benefited from a one-time utilities

credit of $1.6 million. Excluding this one-time item from last

year’s results would have resulted in a 1.2 percent increase in

Adjusted EBITDA and a 0.3 percentage point decrease in Adjusted

EBITDA margin for the fourth quarter of 2013.

Reed continued, “We saw some encouraging signs at our properties

in the fourth quarter, highlighted by Gaylord Palms which delivered

a 7.7 percent increase in RevPAR and a 20.7 percent increase in

Adjusted EBITDA, after excluding the sales and marketing expense

reimbursement from Osceola County. Gaylord Opryland and Gaylord

National also each performed well, despite harsh winter weather in

December in Nashville and what continues to be a challenging

environment in Washington D.C. amidst ongoing government

uncertainty. Gaylord Opryland and Gaylord National also each

delivered strong booking performances in the fourth quarter,

allaying concerns over the impact of new supply entering these two

markets.

“Gaylord Texan was an outlier in the fourth quarter, as a severe

winter storm in December had a significant negative impact on the

property’s holiday events and was responsible for an estimated $2.4

million loss of revenue. The room refurbishment underway at the

property was also a headwind, with over 11,400 room nights out of

service in the quarter for the renovation.”

Opry and Attractions

Revenue for the Opry and Attractions segment rose 11.3 percent

to $19.3 million in the fourth quarter of 2013 from $17.3 million

in the prior-year quarter. Adjusted EBITDA declined 2.0 percent to

$4.2 million in the fourth quarter of 2013, from $4.3 million in

the prior-year quarter. Full year 2013 was a banner year for the

Opry and Attractions segment in terms of revenue and profitability

aided by the increased profile of the city of Nashville among

various media outlets and the popularity of the TV show Nashville.

Full year 2013 revenues increased 7.8 percent to $76.1 million

while Adjusted EBITDA increased 7.2 percent to $20.1 million over

full year 2012.

Corporate

Corporate and Other Adjusted EBITDA totaled a loss of $2.3

million in the fourth quarter of 2013 compared to a loss of $8.2

million in the same period last year, or a 71.9 percent

improvement. For full year 2013, Corporate and Other Adjusted

EBITDA totaled a loss of $16.8 million, or an improvement of 58.7

percent over the same period last year. During the quarter, the

cash-based deferred compensation plan for our board of directors

was terminated and replaced with a new compensation plan based on

restricted stock unit awards. The result of this plan change was a

one-time $3.4 million non-cash charge to equity based compensation,

offset by a $3.4 million reversal of cash compensation cost, which

positively impacted Adjusted EBITDA for the fourth quarter and full

year 2013. The improvement in Corporate and Other Adjusted EBITDA

in the fourth quarter and full year 2013 as compared to the prior

year periods is directly related to the transition of the Company

to a REIT and resulting cost savings, which have exceeded our

previously discussed cost synergy estimates.

REIT Conversion Costs

The Company has segregated all conversion costs associated with

its conversion to a REIT and reported these amounts separately as

REIT conversion costs in the accompanying financial information.

During the fourth quarter of 2013, the Company incurred $0.8

million of costs associated with this conversion compared to $44.2

million in the fourth quarter of 2012. For full year 2013, the

Company incurred $22.2 million of conversion costs compared to

$102.0 million for full year 2012.

Dividend Update

The Company paid its fourth quarter cash dividend

of $0.50 per share of common stock on January 15,

2014 to stockholders of record on December 27, 2013.

Including the fourth quarter cash dividend payment, the Company

paid out a total of $2.00 per share of common stock for full year

2013.

Today, the Company declared its first quarter cash dividend of

$0.55 per share of common stock payable on April 14, 2014 to

stockholders of record on March 28, 2014. It is the Company’s

current plan to distribute total annual dividends of approximately

$2.20 per share in cash in equal quarterly payments in April, July,

October, and January, subject to the board’s future determinations

as to the amount of quarterly distributions and the timing

thereof.

As a result of the declaration of the dividend, effective

immediately after the close of business on March 26, 2014, the

conversion rate of the Company’s outstanding 3.75 percent

convertible notes due 2014 will adjust from a conversion rate of

46.7774 per $1,000 principal amount of notes, which is

equivalent to a conversion price of $21.38, to a conversion

rate of 47.4034, which is equivalent to a conversion price

of $21.10. Pursuant to customary anti-dilution adjustments,

effective immediately after the close of business on March 26,

2014, the strike price of our call options related to the

convertible notes will be adjusted to $21.10 per share of

common stock and the exercise price of the common stock warrants we

issued will be adjusted in a similar manner.

Balance Sheet/Liquidity Update

As of December 31, 2013, the Company had total debt outstanding

of $1,154.4 million and unrestricted cash of $61.6 million. At

December 31, 2013, $509.5 million of borrowings were drawn under

the Company’s $1 billion credit facility, and the lending banks had

issued $6.0 million in letters of credit, which left $484.5 million

of availability for borrowing under the credit facility.

Guidance

The following business performance outlook is based on current

information as of February 28, 2014. The Company does not expect to

update the guidance provided below before next quarter’s earnings

release. However, the Company may update its full business outlook

or any portion thereof at any time for any reason.

Reed continued, “We believe 2014 will be a solid year for our

company particularly given our group pace entering the year as well

as the continued strength of the transient segment. We entered 2014

with 4.8 percent more group room nights on the books than we had at

the same point last year for 2013. This strong demand growth and

favorable supply dynamics in the markets in which we operate should

allow for improved pricing power and higher average daily rates,

which we are reflecting in anticipated RevPAR growth of 4.0% to

6.0% versus 2013. Coupled with the strength of our group pace

entering the year, we also have a more favorable mix of group

business with a 10 percent increase in higher rated corporate group

room nights, which should positively impact outside-of-the-room

spending. As such, we believe we will generate between 5.0% and

7.0% growth in Total RevPAR over 2013. We are providing full year

2014 Adjusted EBITDA guidance for our Hospitality segment of $265.0

to $281.0 million. This includes the impact of completing the room

renovation at Gaylord Texan, which we believe will result in

approximately 32,276 room nights out of service for 2014. Our 2014

Adjusted EBITDA guidance for Opry and Attractions is $20.0 to $22.0

million and Corporate & Other guidance for Adjusted EBITDA in

2014 is a loss of $23.0 to $21.0 million. As a result, our guidance

for 2014 Adjusted EBITDA on a consolidated basis is expected to be

$262.0 to $282.0 million.

Guidance Full Year 2014

US$ in millions, except per share figures

Low

High Hospitality RevPAR 4.0 % 6.0 % Hospitality Total

RevPAR 5.0 % 7.0 %

Adjusted

EBITDA

Hospitality 1,2 $ 265.0 $ 281.0 Opry and Attractions 20.0 22.0

Corporate and Other (23.0 ) (21.0 ) Total

Adjusted EBITDA $ 262.0 $ 282.0

Adjusted FFO 3 $ 177.0 $ 199.0 Adjusted FFO per Share 3 $ 3.50 $

3.93 Estimated Basic Shares Outstanding 50.6 50.6

1. Hospitality segment guidance assumes 32,276 room

nights out of service in 2014 due to the renovation of rooms at

Gaylord Texan. The out of service rooms do not impact total

available room count for calculating hotel metrics (e.g., RevPAR

and Total RevPAR). 2. Estimated interest income of $12.0 million

from Gaylord National bonds reported in hospitality segment

guidance in 2014 and historical results in 2013. 3. Adjusted FFO

guidance includes a deduction for maintenance capital expenditures

of $41.0 to $43.0 million.

For our definitions of RevPAR, Total RevPAR, Adjusted EBITDA,

and Adjusted FFO as well as a reconciliation of the non-GAAP

financial measure Adjusted EBITDA to Net Income, and a

reconciliation of the non-GAAP financial measure Adjusted FFO to

Net Income, see “Calculation of RevPAR and Total RevPAR”, “Non-GAAP

Financial Measures”, “Supplemental Financial Results” and

“Reconciliation of Forward-Looking Statements” below.

Earnings Call information

Ryman Hospitality Properties will hold a conference call to

discuss this release today at 10:00 a.m. ET. Investors can listen

to the conference call over the Internet at www.rymanhp.com. To

listen to the live call, please go to the Investor Relations

section of the website (Investor Relations/Presentations, Earnings,

and Webcasts) at least 15 minutes prior to the call to register,

download and install any necessary audio software. For those who

cannot listen to the live broadcast, a replay will be available

shortly after the call and will run for at least 30 days.

About Ryman Hospitality Properties, Inc.

Ryman Hospitality Properties, Inc. (NYSE: RHP) is a REIT for

federal income tax purposes, specializing in group-oriented,

destination hotel assets in urban and resort markets. The Company’s

owned assets include a network of four upscale, meetings-focused

resorts totaling 7,795 rooms that are managed by world-class

lodging operator Marriott International, Inc. under the Gaylord

Hotels brand. Other owned assets managed by Marriott International,

Inc. include Gaylord Springs Golf Links, the Wildhorse Saloon, the

General Jackson Showboat and The Inn at Opryland, a 303-room

overflow hotel adjacent to Gaylord Opryland. The Company also owns

and operates a number of media and entertainment assets, including

the Grand Ole Opry (opry.com), the legendary weekly showcase of

country music’s finest performers for nearly 90 years; the Ryman

Auditorium, the storied former home of the Grand Ole Opry located

in downtown Nashville; and WSM-AM, the Opry’s radio home. For

additional information about Ryman Hospitality Properties, visit

www.rymanhp.com.

Cautionary Note Regarding Forward-Looking Statements

This press release contains statements as to the Company’s

beliefs and expectations of the outcome of future events that are

forward-looking statements as defined in the Private Securities

Litigation Reform Act of 1995. You can identify these statements by

the fact that they do not relate strictly to historical or current

facts. Examples of these statements include, but are not limited

to, statements regarding the future performance of our business,

the effect of the Company’s election of REIT status, anticipated

cost synergies and revenue enhancements from the Marriott

relationship, the effect of and degree of success of the joint

action plan to improve the performance of the Hospitality segment,

estimated capital expenditures, out-of-service rooms, the expected

approach to making dividend payments, the board’s ability to alter

the dividend policy at any time, and other business or operational

issues. These forward-looking statements are subject to risks and

uncertainties that could cause actual results to differ materially

from the statements made. These include the risks and uncertainties

associated with economic conditions affecting the hospitality

business generally, the geographic concentration of the Company’s

hotel properties, business levels at the Company’s hotels, the

effect of the Company’s election to be taxed as a REIT for federal

income tax purposes effective for the year ending December 31,

2013, the Company’s ability to remain qualified as a REIT, the

Company’s ability to execute its strategic goals as a REIT, the

effects of business disruption related to the Marriott management

transition and the REIT conversion, the Company’s ability to

realize cost savings and revenue enhancements from the REIT

conversion and the Marriott transaction and to realize improvements

in profitability, the Company’s ability to generate cash flows to

support dividends, future board determinations regarding the timing

and amount of dividends and changes to the dividend policy, which

could be made at any time, the determination of Adjusted FFO and

REIT taxable income, and the Company’s ability to borrow funds

pursuant to its credit agreements. Other factors that could cause

operating and financial results to differ are described in the

filings made from time to time by the Company with the U.S.

Securities and Exchange Commission (SEC) and include the risk

factors described in the Company’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2012 and its Quarterly Reports

on Form 10-Q for the fiscal quarters ended March 31, 2013, June 30,

2013, and September 30, 2013, as well as in the Company’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2013,

which is being filed today. The Company does not undertake any

obligation to release publicly any revisions to forward-looking

statements made by it to reflect events or circumstances occurring

after the date hereof or the occurrence of unanticipated

events.

Additional Information

This release should be read in conjunction with the consolidated

financial statements and notes thereto included in our most recent

report on Form 10-K. Copies of our reports are available on our

website at no expense at www.rymanhp.com and through the SEC’s

Electronic Data Gathering Analysis and Retrieval System (“EDGAR”)

at www.sec.gov.

Retail Adjusted Revenue

Under Marriott International, Inc.’s management of Gaylord

Opryland, Gaylord Texan, and Gaylord National, the retail

operations of such hotels were outsourced to a third party retailer

beginning in the fourth quarter of 2012. The properties now receive

rental lease payments rather than full retail revenue and

associated expense. The net impact of this change lowered overall

retail revenue for each affected property. For full year 2012 the

change resulted in revenue decreases of approximately $7.9 million

(Gaylord Opryland–$4.6 million, Gaylord Texan–$1.9 million, and

Gaylord National–$1.4 million). The change impacted consolidated

revenue, Hospitality segment revenue, property revenue, and Total

RevPAR as explained below. To enable period-over-period comparison,

we have included adjusted full year 2012 revenue and Total RevPAR

figures to reflect the elimination of retail revenues in the Q1-Q3

2012 periods from operations that have been outsourced commencing

in the fourth quarter of 2012. No adjustments were made to the

Gaylord Palms’ results due to the fact that during all periods

presented, retail operations were outsourced at that property. No

adjustments were made for the fourth quarter because the

outsourcing of retail began in the fourth quarter of 2012. A

reconciliation of actual revenue to Retail Adjusted Revenue for the

full year 2012 is set forth below under “Supplemental Financial

Results.”

Calculation of RevPAR and Total RevPAR

We calculate revenue per available room (“RevPAR”) for our

hotels by dividing room revenue by room nights available to guests

for the period. We calculate total revenue per available room

(“Total RevPAR”) for our hotels by dividing the sum of room

revenue, food & beverage, and other ancillary services revenue

by room nights available to guests for the period. We calculate

retail adjusted total revenue per available room (“Retail Adjusted

Total RevPAR”) for our hotels for 2012 by dividing the sum of room

revenue, food and beverage, and other ancillary services revenue

minus the retail adjustment for the period by room nights available

to guests for the period.

Non-GAAP Financial Measures

We present the following non-GAAP financial measures we believe

are useful to investors as key measures of our operating

performance: Adjusted EBITDA, Adjusted FFO and Retail Adjusted

Revenue, as described above.

To calculate Adjusted EBITDA, we determine EBITDA, which

represents net income (loss) determined in accordance with GAAP,

plus loss (income) from discontinued operations, net; provision

(benefit) for income taxes; other (gains) and losses, net; loss on

extinguishment of debt; (income) loss from unconsolidated entities;

interest expense; and depreciation and amortization, less interest

income. Adjusted EBITDA is calculated as EBITDA plus preopening

costs; non-cash ground lease expense; equity-based compensation

expense; impairment charges; any closing costs of completed

acquisitions; interest income on Gaylord National bonds; other

gains (and losses); REIT conversion costs and any other adjustments

we have identified in this release. We believe Adjusted EBITDA is

useful to investors in evaluating our operating performance because

this measure helps investors evaluate and compare the results of

our operations from period to period by removing the impact of our

capital structure (primarily interest expense) and our asset base

(primarily depreciation and amortization) from our operating

results. A reconciliation of net income (loss) to EBITDA and

Adjusted EBITDA and a reconciliation of segment operating income to

segment Adjusted EBITDA are set forth below under “Supplemental

Financial Results.” Our method of calculating Adjusted EBITDA as

used herein differs from the method we used to calculate Adjusted

EBITDA as presented in press releases covering periods prior to

2013. The $4.9 million loss on the call spread settlement recorded

in 2013 related to our convertible notes repurchase does not result

in a charge to net income. Therefore, Adjusted EBITDA for 2013 does

not reflect the impact of the loss.

We calculate Adjusted FFO to mean net income (loss) (computed in

accordance with GAAP), excluding non-controlling interests, and

gains and losses from sales of property; plus depreciation and

amortization (excluding amortization of deferred financing costs

and debt discounts) and impairment losses; we also exclude

written-off deferred financing costs, non-cash ground lease

expense, amortization of debt discounts and amortization of

deferred financing costs; and gain (loss) on extinguishment of

debt, and subtract certain capital expenditures (the required

FF&E reserves for our managed properties plus maintenance

capital expenditures for our non-managed properties). We also

exclude the effect of the non-cash income tax benefit relating to

the REIT conversion. We have presented Adjusted FFO both excluding

and including REIT conversion costs. We believe that the

presentation of Adjusted FFO provides useful information to

investors regarding our operating performance because it is a

measure of our operations without regard to specified non-cash

items such as real estate depreciation and amortization, gain or

loss on sale of assets and certain other items which we believe are

not indicative of the performance of our underlying hotel

properties. We believe that these items are more representative of

our asset base than our ongoing operations. We also use Adjusted

FFO as one measure in determining our results after taking into

account the impact of our capital structure. A reconciliation of

net income (loss) to Adjusted FFO is set forth below under

“Supplemental Financial Results.” The $4.9 million loss on the call

spread settlement recorded in 2013 related to our convertible notes

repurchase does not result in a charge to net income. Therefore,

Adjusted FFO for 2013 does not reflect the impact of the loss.

We caution investors that amounts presented in accordance with

our definitions of Adjusted EBITDA and Adjusted FFO may not be

comparable to similar measures disclosed by other companies,

because not all companies calculate these non-GAAP measures in the

same manner. Adjusted EBITDA and Adjusted FFO, and any related per

share measures, should not be considered as alternative measures of

our net income (loss), operating performance, cash flow or

liquidity. Adjusted EBITDA and Adjusted FFO may include funds that

may not be available for our discretionary use due to functional

requirements to conserve funds for capital expenditures and

property acquisitions and other commitments and uncertainties.

Although we believe that Adjusted EBITDA and Adjusted FFO can

enhance an investor’s understanding of our results of operations,

these non-GAAP financial measures, when viewed individually, are

not necessarily better indicators of any trend as compared to GAAP

measures such as net income (loss) or cash flow from operations. In

addition, you should be aware that adverse economic and market and

other conditions may harm our cash flow.

RYMAN HOSPITALITY PROPERTIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

Unaudited (In thousands, except per share data)

Three Months Ended Twelve Months

Ended Dec. 31, Dec. 31, 2013 2012

2013 2012 Revenues : Rooms $ 91,927 $ 91,922 $

357,313 $ 365,611 Food and beverage 96,650 102,087 382,340 401,252

Other hotel revenue 58,216 54,996 138,856 149,178 Opry and

Attractions 19,277 17,316 76,053 70,553

Total revenues 266,070 266,321 954,562

986,594 Operating expenses: Rooms 28,829 24,202 106,849

96,900 Food and beverage 59,579 63,690 237,153 242,739 Other hotel

expenses 91,283 94,738 295,152 314,643 Management fees 4,206

4,207 14,652 4,207 Total hotel operating

expenses 183,897 186,837 653,806 658,489 Opry and Attractions

15,202 13,082 56,528 52,130 Corporate 7,291 9,393 26,292 46,876

REIT conversion costs 807 44,165 22,190 101,964 Casualty loss (21)

139 54 858 Preopening costs - - - 340 Impairment and other charges

(non-REIT conversion costs) 1,619 - 2,976 - Depreciation and

amortization 27,549 37,302 116,528

130,691 Total operating expenses 236,344 290,918

878,374 991,348 Operating income (loss) 29,726

(24,597) 76,188 (4,754) Interest expense, net of amounts

capitalized (14,982) (14,633) (60,916) (58,582) Interest income

3,144 3,051 12,267 12,307 Income from unconsolidated companies - -

10 109 Loss on extinguishment of debt - - (4,181) - Other gains and

(losses), net 82 20,000 2,447 22,251

Income (loss) before income taxes 17,970 (16,179) 25,815 (28,669)

Benefit for income taxes 12,136 1,236

92,662 2,034 Income (loss) from continuing operations 30,106

(14,943) 118,477 (26,635) Income (loss) from discontinued

operations, net of taxes 56 (9) (125)

(9) Net income (loss) 30,162 (14,952) 118,352 (26,644) Loss

on call spread modification related to convertible notes -

- (4,869) - Net income (loss) available to

common shareholders $ 30,162 $ (14,952) $ 113,483 $ (26,644)

Basic net income

(loss) per share available to common shareholders:

Income (loss) from continuing operations $ 0.60 $ (0.32) $ 2.22 $

(0.56) Income from discontinued operations, net of taxes -

- - - Net income (loss) $ 0.60 $ (0.32) $ 2.22

$ (0.56)

Fully diluted net

income (loss) per share available to common

shareholders:

Income (loss) from continuing operations $ 0.48 $ (0.32) $ 1.81 $

(0.56) Income from discontinued operations, net of taxes -

- - - Net income (loss) $ 0.48 $ (0.32) $ 1.81

$ (0.56)

Weighted average

common shares for the period:

Basic 50,527 46,201 51,174 47,602 Diluted (1) 62,458 46,201 62,810

47,602

(1) Represents GAAP calculation of diluted

shares and does not consider anti-dilutive effect of the Company's

purchased call options associated with its convertible notes. For

the three months and twelve months ended December 31, 2013, the

purchased call options effectively reduce dilution by approximately

6.4 million and 6.3 million shares of common stock,

respectively.

RYMAN HOSPITALITY PROPERTIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS Unaudited (In

thousands)

Dec. 31, Dec.

31, 2013 2012 ASSETS: Property and

equipment, net of accumulated depreciation $ 2,067,997 $ 2,148,999

Cash and cash equivalents - unrestricted 61,579 97,170 Cash and

cash equivalents - restricted 20,169 6,210 Notes receivable 148,350

149,400 Trade receivables, net 51,782 55,343 Deferred financing

costs 19,306 11,347 Prepaid expenses and other assets 55,446

63,982 Total assets $ 2,424,629 $ 2,532,451

LIABILITIES AND STOCKHOLDERS' EQUITY: Debt and capital lease

obligations $ 1,154,420 $ 1,031,863 Accounts payable and accrued

liabilities 157,339 215,538 Deferred income taxes 23,117 88,938

Deferred management rights proceeds 186,346 189,269 Dividends

payable 25,780 - Other liabilities 119,932 153,245 Stockholders'

equity 757,695 853,598 Total liabilities and

stockholders' equity $ 2,424,629 $ 2,532,451

RYMAN

HOSPITALITY PROPERTIES, INC. AND SUBSIDIARIES SUPPLEMENTAL

FINANCIAL RESULTS ADJUSTED EBITDA RECONCILIATION

Unaudited (in thousands)

Three

Months Ended Dec. 31, Twelve Months Ended Dec.

31, 2013 2012 2013

2012 $ Margin

$ Margin $

Margin $ Margin

Consolidated

Revenue $ 266,070 $ 266,321 $ 954,562 $ 986,594

Net

income (loss) $ 30,162 $ (14,952) $ 118,352 $ (26,644) (Income)

loss from discontinued operations, net of taxes (56) 9 125 9

Benefit for income taxes (12,136) (1,236) (92,662) (2,034) Other

(gains) and losses, net (82) (20,000) (2,447) (22,251) Net loss on

the extinguishment of debt - - 4,181 - Income from unconsolidated

companies - - (10) (109) Interest expense, net 11,838 11,582 48,649

46,275 Depreciation & amortization 27,549 37,302

116,528 130,691

EBITDA 57,275 21.5% 12,705

4.8% 192,716 20.2% 125,937 12.8% Preopening costs - - - 340

Non-cash lease expense 1,399 1,427 5,595 5,706 Equity-based

compensation 5,157 1,317 10,095 8,559 Impairment charges (non-REIT

conversion costs) 1,619 - 2,976 - Interest income on Gaylord

National bonds 3,144 3,049 12,263 12,295 Other gains and (losses),

net 82 20,000 2,447 22,251 Gain on disposal of assets - (20,000)

(52) (20,000) Casualty loss (21) 139 54 858 REIT conversion costs

807 44,165 22,190

101,964

Adjusted EBITDA $ 69,462 26.1% $ 62,802 23.6%

$ 248,284 26.0% $ 257,910 26.1%

Hospitality

segment

Revenue $ 246,793 $ 249,005 $ 878,509 $ 916,041

Operating

income 36,024 24,760 111,133 128,650 Depreciation &

amortization 25,219 26,366 103,147 107,343 Preopening costs - - -

340 Non-cash lease expense 1,399 1,427 5,595 5,706 Equity-based

compensation - - - 1,979 Impairment charges (non-REIT conversion

costs) 1,469 - 2,826 - Interest income on Gaylord National bonds

3,144 3,049 12,263 12,295 Other gains and (losses), net 82 - 2,447

2,251 Gain on disposal of assets - - (52) - REIT conversion costs

184 11,043 7,597

21,220

Adjusted EBITDA $ 67,521 27.4% $ 66,645 26.8%

$ 244,956 27.9% $ 279,784 30.5%

Opry and Attractions

segment

Revenue $ 19,277 $ 17,316 $ 76,053 $ 70,553

Operating

income 2,542 2,724 13,877 12,650 Depreciation &

amortization 1,366 1,293 5,368 5,119 Equity-based compensation 163

90 575 321 Impairment charges (non-REIT conversion costs) 150 - 150

- Casualty loss (95) 32 (95) 430 REIT conversion costs 112

186 225 225

Adjusted EBITDA $ 4,238 22.0% $ 4,325 25.0% $ 20,100 26.4% $

18,745 26.6%

Corporate and Other

segment

Operating loss (8,840) (52,081) (48,822) (146,054)

Depreciation & amortization 964 9,643 8,013 18,229 Equity-based

compensation 4,994 1,227 9,520 6,259 Other gains and (losses), net

- 20,000 - 20,000 (Gain) loss on disposal of assets - (20,000) -

(20,000) Casualty loss 74 107 149 428 REIT conversion costs

511 32,936 14,368 80,519

Adjusted

EBITDA $ (2,297) $ (8,168) $ (16,772) $ (40,619)

RYMAN HOSPITALITY PROPERTIES, INC. AND SUBSIDIARIES

SUPPLEMENTAL FINANCIAL RESULTS FUNDS FROM OPERATIONS

("FFO") AND ADJUSTED FFO RECONCILIATION Unaudited (in

thousands, except per share data)

Three Months Ended Dec. 31, Twelve

Months Ended Dec. 31, 2013 2012 2013

2012 $ $ $ $

Consolidated

Net income (loss) (1) $ 30,162 $ (14,952) $ 118,352 $

(26,644) Depreciation & amortization 27,549 37,302 116,528

130,691 Gains on sale of real estate assets -

(20,000) (52) (20,000)

FFO 57,711 2,350

234,828 84,047 Capital expenditures (2) (7,755) (12,369)

(29,801) (55,183) Non-cash lease expense 1,399 1,427 5,595 5,706

Impairment charges 1,618 12,004 3,527 33,291 Loss on extinguishment

of debt - - 4,181 - Write-off of deferred financing costs - - 1,845

- Amortization of deferred financing costs 1,442 1,260 5,525 4,908

Amortization of debt discounts 3,273 3,593 13,816 13,793 Noncash

tax benefit resulting from REIT conversion 1,290 -

(64,756) -

Adjusted FFO (1) $ 58,978 $ 8,265 $

174,760 $ 86,562 REIT conversion costs (tax effected) (914)

20,133 15,414 43,251

Adjusted FFO excluding

REIT conversion costs (1) $ 58,064 $ 28,398 $ 190,174 $ 129,813

FFO per basic share $ 1.14 $ 0.05 $ 4.59 $ 1.77

Adjusted FFO per basic share $ 1.17 $ 0.18 $ 3.42 $ 1.82 Adjusted

FFO (excl. REIT conversion costs) per basic share $ 1.15 $ 0.61 $

3.72 $ 2.73 FFO per diluted share (3) $ 0.92 $ 0.05 $ 3.74 $

1.77 Adjusted FFO per diluted share (3) $ 0.94 $ 0.18 $ 2.78 $ 1.82

Adjusted FFO (excl. REIT conversion costs) per diluted share (3) $

0.93 $ 0.61 $ 3.03 $ 2.73

(1) As the impact of the loss on the call

spread modification related to the repurchase of our convertible

notes repurchase does not represent a charge to net income, net

income, adjusted FFO and adjusted FFO excluding REIT conversion

costs do not include this loss.

(2) Represents FF&E reserve for managed properties and

maintenance capital expenditures for non-managed properties.

(3) The GAAP calculation of diluted shares

does not consider the anti-dilutive effect of the Company's

purchased call options associated with its convertible notes.

Forthe three months and twelve months ended December 31, 2013, the

purchased call options effectively reduce dilution by approximately

6.4 million and 6.3 million shares, respectively.

RYMAN HOSPITALITY PROPERTIES, INC. AND SUBSIDIARIES

SUPPLEMENTAL FINANCIAL RESULTS Unaudited (in thousands,

except operating metrics)

Three Months Ended Dec. 31,

Twelve Months Ended Dec. 31, 2013 2012 (1)

2013 2012 (1) HOSPITALITY OPERATING

METRICS:

Hospitality

Segment

Occupancy 70.3% 67.7% 70.7% 70.8% Average daily rate (ADR) $

175.48 $ 182.23 $ 170.89 $ 174.20 RevPAR $ 123.39 $ 123.38 $ 120.89

$ 123.36 OtherPAR $ 207.87 $ 210.85 $ 176.33 $ 185.71 Total RevPAR

$ 331.26 $ 334.23 $ 297.22 $ 309.07 Revenue $ 246,793 $

249,005 $ 878,509 $ 916,041 Adjusted EBITDA $ 67,521 $ 66,645 $

244,956 $ 279,784 Adjusted EBITDA Margin 27.4% 26.8% 27.9% 30.5%

Gaylord

Opryland

Occupancy 74.5% 70.3% 72.8% 70.5% Average daily rate (ADR) $

164.63 $ 168.53 $ 158.24 $ 161.37 RevPAR $ 122.63 $ 118.40 $ 115.17

$ 113.83 OtherPAR $ 179.56 $ 184.80 $ 152.07 $ 159.86 Total RevPAR

$ 302.19 $ 303.20 $ 267.24 $ 273.69 Revenue $ 80,125 $

80,393 $ 281,118 $ 288,693 Adjusted EBITDA $ 20,850 $ 20,450 $

82,181 $ 84,257 Adjusted EBITDA Margin 26.0% 25.4% 29.2% 29.2%

Gaylord

Palms

Occupancy 74.4% 67.0% 75.3% 74.9% Average daily rate (ADR) $

168.05 $ 173.33 $ 164.42 $ 168.97 RevPAR $ 125.10 $ 116.16 $ 123.74

$ 126.53 OtherPAR $ 221.65 $ 219.79 $ 201.26 $ 212.89 Total RevPAR

$ 346.75 $ 335.95 $ 325.00 $ 339.42 Revenue $ 44,853 $

43,455 $ 166,785 $ 174,662 Adjusted EBITDA $ 13,888 $ 8,938 $

44,572 $ 51,250 Adjusted EBITDA Margin 31.0% 20.6% 26.7% 29.3%

Gaylord

Texan

Occupancy 69.5% 76.0% 71.3% 73.7% Average daily rate (ADR) $

181.08 $ 181.83 $ 172.74 $ 175.53 RevPAR $ 125.88 $ 138.26 $ 123.18

$ 129.38 OtherPAR $ 273.70 $ 299.33 $ 215.43 $ 232.69 Total RevPAR

$ 399.58 $ 437.59 $ 338.61 $ 362.07 Revenue $ 55,547 $

60,830 $ 186,747 $ 200,235 Adjusted EBITDA $ 15,981 $ 19,194 $

51,680 $ 62,694 Adjusted EBITDA Margin 28.8% 31.6% 27.7% 31.3%

Gaylord

National

Occupancy 62.0% 59.7% 64.5% 67.7% Average daily rate (ADR) $

207.54 $ 224.31 $ 205.56 $ 205.84 RevPAR $ 128.75 $ 133.88 $ 132.49

$ 139.33 OtherPAR $ 216.63 $ 203.32 $ 186.65 $ 192.45 Total RevPAR

$ 345.38 $ 337.20 $ 319.14 $ 331.78 Revenue $ 63,422 $

61,922 $ 232,508 $ 242,379 Adjusted EBITDA $ 15,492 $ 16,911 $

63,044 $ 78,484 Adjusted EBITDA Margin 24.4% 27.3% 27.1% 32.4%

The Inn at

Opryland (2)

Occupancy 69.9% 58.1% 68.9% 60.7% Average daily rate (ADR) $

107.06 $ 105.06 $ 107.57 $ 105.43 RevPAR $ 74.88 $ 60.99 $ 74.15 $

63.99 OtherPAR $ 30.92 $ 28.31 $ 29.42 $ 28.81 Total RevPAR $

105.80 $ 89.30 $ 103.57 $ 92.80 Revenue $ 2,846 $ 2,405 $

11,351 $ 10,072 Adjusted EBITDA $ 1,310 $ 1,152 $ 3,479 $ 3,099

Adjusted EBITDA Margin 46.0% 47.9% 30.6% 30.8%

(1) For purposes of comparability, both

2013 and 2012 occupancy, RevPAR, OtherPAR and Total RevPAR are

calculated using Marriott's method of calculating available rooms

and do not exclude renovation rooms from the calculation of rooms

available, which is different from how the Company has previously

accounted for renovation rooms prior to the Marriott transition. In

addition, both 2013 and 2012 occupancy and ADR do not include

complimentary room nights in the calculation of occupied rooms,

which is different from how the Company has previously accounted

for complimentary rooms prior to the Marriott transition.

(2) Includes other hospitality revenue and expense.

RYMAN HOSPITALITY PROPERTIES, INC. AND SUBSIDIARIES

SUPPLEMENTAL FINANCIAL RESULTS RECONCILIATION OF ADJUSTED

RESULTS Unaudited (in thousands, except operating metrics)

Three

Months Ended Dec. 31, Twelve Months Ended Dec. 31,

2013 2012 2013 2012

Consolidated: Revenue $ 266,070 $ 266,321 $

954,562 $ 986,594 Less: Retail Inventory Adjustment -

- - (7,896) Retail Adjusted Revenue $

266,070 $ 266,321 $ 954,562 $ 978,698

Hospitality

Segment: Revenue $ 246,793 $ 249,005 $ 878,509 $ 916,041 Less:

Retail Inventory Adjustment - - -

(7,896) Retail Adjusted Revenue $ 246,793 $ 249,005 $

878,509 $ 908,145 Total RevPAR $ 331.26 $ 334.23 $ 297.22 $

309.07 Retail Adjusted Total RevPAR $ 331.26 $ 334.23 $ 297.22 $

306.41

Gaylord Opryland: Revenue $ 80,125 $ 80,393 $

281,118 $ 288,693 Less: Retail Inventory Adjustment -

- (4,618) Retail Adjusted Revenue $

80,125 $ 80,393 $ 281,118 $ 284,075 Total RevPAR $ 302.19 $

303.20 $ 267.24 $ 273.69 Retail Adjusted Total RevPAR $ 302.19 $

303.20 $ 267.24 $ 269.31

Gaylord Palms: Revenue $

44,853 $ 43,455 $ 166,785 $ 174,662 Less: Retail Inventory

Adjustment - - - - Retail

Adjusted Revenue $ 44,853 $ 43,455 $ 166,785 $ 174,662 Total

RevPAR $ 346.75 $ 335.95 $ 325.00 $ 339.42 Retail Adjusted Total

RevPAR $ 346.75 $ 335.95 $ 325.00 $ 339.42

Gaylord

Texan: Revenue $ 55,547 $ 60,830 $ 186,747 $ 200,235 Less:

Retail Inventory Adjustment - - -

(1,887) Retail Adjusted Revenue $ 55,547 $ 60,830 $

186,747 $ 198,348 Total RevPAR $ 399.58 $ 437.59 $ 338.61 $

362.07 Retail Adjusted Total RevPAR $ 399.58 $ 437.59 $ 338.61 $

358.66

Gaylord National: Revenue $ 63,422 $ 61,922 $

232,508 $ 242,379 Less: Retail Inventory Adjustment -

- - (1,390) Retail Adjusted Revenue $

63,422 $ 61,922 $ 232,508 $ 240,989 Total RevPAR $ 345.38 $

337.20 $ 319.14 $ 331.78 Retail Adjusted Total RevPAR $ 345.38 $

337.20 $ 319.14 $ 329.88

Inn at Opryland (and Other

Hospitality): Revenue $ 2,846 $ 2,405 $ 11,351 $ 10,072 Less:

Retail Inventory Adjustment - - -

- Retail Adjusted Revenue $ 2,846 $ 2,405 $ 11,351 $

10,072 Total RevPAR $ 105.80 $ 89.30 $ 103.57 $ 92.80 Retail

Adjusted Total RevPAR $ 105.80 $ 89.30 $ 103.57 $ 92.80

Ryman Hospitality Properties, Inc. and Subsidiaries

Reconciliation of Forward-Looking Statements

Unaudited (in thousands)

Adjusted Earnings Before Interest,

Taxes, Depreciation and Amortization ("Adjusted EBITDA")and

Adjusted Funds From Operations ("AFFO") reconciliation:

GUIDANCE FULL YEAR 2014

Low High ADJUSTED EBITDA RECONCILIATION

Ryman Hospitality

Properties, Inc.

Net Income $ 83,000 $ 103,000 Provision (benefit) for income taxes

(12,000) (12,000) Other (gains) and losses, net (2,400) (2,400)

Interest expense 64,000 64,000 Interest income (12,000)

(12,000) Operating Income 120,600 140,600 Depreciation and

amortization 115,500 115,500 EBITDA 236,100 256,100

Non-cash lease expense 5,500 5,500 Equity based compensation 6,000

6,000 Other gains and (losses), net 2,400 2,400 Interest income

12,000 12,000 Adjusted EBITDA $ 262,000 $ 282,000

Hospitality

Segment

Operating Income $ 141,100 $ 157,100 Depreciation and amortization

104,000 104,000 EBITDA 245,100 261,100 Non-cash lease

expense 5,500 5,500 Equity based compensation - - Other gains and

(losses), net 2,400 2,400 Interest income 12,000

12,000 Adjusted EBITDA $ 265,000 $ 281,000

Opry and

Attractions Segment

Operating Income $ 14,000 $ 16,000 Depreciation and amortization

5,500 5,500 EBITDA 19,500 21,500 Non-cash lease

expense - - Equity based compensation 500 500 Interest income

- - Adjusted EBITDA $ 20,000 $ 22,000

Corporate and

Other Segment

Operating Income $ (34,500) $ (32,500) Depreciation and

amortization 6,000 6,000 EBITDA (28,500) (26,500)

Non-cash lease expense - - Equity based compensation 5,500 5,500

Interest income - - Adjusted EBITDA $ (23,000) $

(21,000)

ADJUSTED FUNDS FROM OPERATIONS

RECONCILIATION

Ryman Hospitality

Properties, Inc.

Net Income $ 83,000 $ 103,000 Depreciation & Amortization

115,500 115,500 Capital Expenditures (43,000) (41,000) Non-Cash

Lease Expense 5,500 5,500 Amortization of Debt Premiums/Disc.

10,000 10,000 Amortization of DFC 6,000 6,000

Adjusted FFO $ 177,000 $ 199,000

Investor Relations Contacts:Ryman Hospitality Properties,

Inc.Mark Fioravanti, 615-316-6588Executive Vice President and Chief

Financial Officermfioravanti@rymanhp.comorRyman Hospitality

Properties, Inc.Todd Siefert, 615-316-6344Vice President of

Corporate Finance & Treasurertsiefert@rymanhp.comorMedia

Contacts:Ryman Hospitality Properties, Inc.Brian Abrahamson,

615-316-6302Vice President of Corporate

Communicationsbabrahamson@rymanhp.comorSloane & CompanyJosh

Hochberg / Dan Zacchei, 212-446-1892 /

212-446-1882jhochberg@sloanepr.com / dzacchei@sloanepr.com

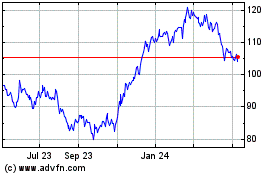

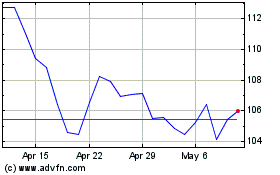

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jul 2023 to Jul 2024