Ryman Hospitality Properties, Inc. (NYSE: RHP), a lodging real

estate investment trust ("REIT") specializing in group-oriented,

destination hotel assets in urban and resort markets, today

reported financial results for the first quarter ended March 31,

2013.

The end of the first quarter marked the completion of the

Gaylord Hotels conversion to Marriott’s systems, allowing the

hotels to start to benefit from the many anticipated synergies.

Colin V. Reed, chairman, chief executive officer and president of

Ryman Hospitality Properties, stated, “Despite an unusual

confluence of events during the quarter that adversely impacted the

group sector, including government related attrition and

cancellations, the timing of the Easter holiday, and negative group

mix shift year-over-year, we are seeing encouraging signs that the

benefits of the Marriott affiliation are beginning to emerge. Our

hotels produced record first quarter forward group bookings, record

first quarter in-the-year, for-the-year group bookings, and record

first quarter transient room night production. All three were

material increases year-over-year. As the Marriott systems are

fully implemented and anticipated costs savings begin to be

realized, we continue to believe that our previously discussed cost

synergies projection of $13 million to $16 million at the property

level for 2013 will be accomplished. Furthermore, our projected

corporate cost savings are being realized as expected, which can be

seen in our first quarter numbers.”

First Quarter 2013 Results (as compared to First Quarter

2012):

- Gross advanced group bookings for all

future periods increased 57.9% to 587,682 room nights (a record

first quarter bookings production); Net advance group bookings for

all future periods increased 48.4% to 454,857 room nights

- Gross advanced group bookings of

in-the-year, for-the-year room nights increased 42.0% over the same

period last year (a record first quarter bookings production)

- Transient room night bookings, aided by

the Marriott Rewards program and transient delivery channels,

increased by 18,567 room nights (a record first quarter bookings

production) and transient Average Daily Rate, or ADR, grew by

$17.05

- Cancellations in-the-year, for-the-year

included 30,100 group rooms compared to 8,817 group rooms in the

first quarter 2012; Cancellations in-the-quarter, for-the-quarter

included 16,592 group rooms compared to 1,212 group rooms in the

same period in 2012

- Attrition for groups that traveled in

the first quarter of 2013 was 8.3% of the agreed-upon room block

compared to 4.5% in the same period in 2012; Attrition and

cancellation fees collected during the quarter were $1.8 million

compared to $1.2 million in the same period in 2012

- Hospitality Revenue Per Available Room,

or RevPAR, decreased 1.2% to $117.33

- Hospitality Total RevPAR decreased 5.3%

to $287.56 compared to Hospitality Retail Adjusted Total RevPAR in

the first quarter 2012, or a decrease of 6.3% compared to

unadjusted Total RevPAR in the first quarter 2012

- Total Revenue decreased 6.2% to $222.1

million compared to Retail Adjusted Revenue in the first quarter

2012, or a decrease of 7.0% compared to unadjusted Total Revenue in

the first quarter 2012

- Hospitality Revenue decreased 6.4% to

$209.6 million compared to Hospitality Retail Adjusted Revenue in

the first quarter 2012, or a decrease of 7.3% compared to

unadjusted Hospitality Revenue in the first quarter 2012

- Net income was $53.8 million (including

an income tax benefit of $66.3 million primarily relating to the

REIT conversion) compared to net income of $6.0 million in first

quarter 2012

- Adjusted EBITDA on a consolidated basis

decreased 21.6% to $50.6 million

- Hospitality Adjusted EBITDA decreased

26.1% to $54.7 million

- Adjusted Funds from Operations, or

Adjusted FFO, was $23.5 million while Adjusted FFO excluding REIT

conversion costs was $34.9 million

- Declared first quarter dividend of

$0.50 per share paid to stockholders on April 12, 2013

- Repurchased $55.7 million of the

Company’s common stock during the quarter against its $100 million

repurchase plan

For our definitions of RevPAR, Total RevPAR, Adjusted EBITDA,

Retail Adjusted Revenue, Retail Adjusted Total RevPAR, and Adjusted

FFO as well as a reconciliation of the non-GAAP financial measure

Adjusted EBITDA to Net Income, a reconciliation of the non-GAAP

financial measure Retail Adjusted Revenue to revenue, and a

reconciliation of the non-GAAP financial measure Adjusted FFO to

Net Income, see “Retail Adjusted Revenue”, “Calculation of RevPAR

and Total RevPAR”, “Non-GAAP Financial Measures”, and “Supplemental

Financial Results” below.

Refinancing After Quarter End

- Completed private placement of $350

million of 5% senior unsecured notes due 2021

- Successfully refinanced and upsized

credit facility to $1 billion from $925 million, improving pricing

and extending the maturity to April 2017

Reed continued, “In addition, to give ourselves maximum balance

sheet flexibility and take advantage of historically low interest

rates, after quarter end, we completed the refinancing of the

majority of our debt, which provides us with a strong balance sheet

and a tremendous amount of flexibility. Finally, we announced a

healthy planned 2013 dividend payout anticipated to be

approximately $2.00 per share, or $0.50 per quarter, which we

believe gives us one of the best dividend yields in the lodging

REIT sector.”

Hospitality

Property-level results and operating metrics for the first

quarter of 2013 and 2012 are presented in greater detail below

under “Supplemental Financial Results.”

- Gaylord Opryland occupancy increased

4.2 percentage points compared to the first quarter of 2012 to 70.4

percent, and RevPAR increased 5.9 percent to $110.76. In spite of a

challenging comparison to first quarter last year, revenue at the

property declined only 2.9 percent. The decline in revenue and

Adjusted EBITDA from prior year was primarily related to a decrease

in food and beverage spending as a result of a change in group mix,

as the property experienced a shift from premium corporate and

association groups toward less profitable SMERF (Social, Military,

Educational, Religious, and Fraternal) groups and transient guests.

This shift in business mix resulted in a reduction in

outside-the-room spending by $3.4 million for the quarter.

- Gaylord Palms occupancy declined 1.9

percentage points to 79.9 percent compared to the first quarter of

2012, and RevPAR decreased 4.7 percent to $142.47. The property

experienced a significant shift in business mix during the quarter,

as the property had over 24,000 fewer corporate and association

room nights than the first quarter of 2012. This reduction in

premium business was replaced by over 21,000 transient and SMERF

group room nights that resulted in lower outside-the-room spending

by $4.0 million for the quarter.

- Gaylord Texan occupancy decreased 1.2

percentage points compared to the first quarter of 2012 and RevPAR

declined 3.2 percent. The property experienced a similar shift in

business mix during the quarter, as the property had over 14,000

fewer corporate and association room nights than in the 2012

quarter. This reduction in premium business was replaced by over

11,000 transient and SMERF group room nights resulting in a

reduction in outside-the-room spending by $2.9 million for the

quarter.

- Gaylord National occupancy decreased

9.1 percentage points compared to the first quarter of 2012, and

RevPAR decreased 6.2 percent. Of the occupancy decline, 4.7

percentage points were attributable to cancellations of government

groups during the quarter, as Federal budget sequestration issues

continued to negatively weigh on the behavior of these groups and

subsequently the performance of the property in the quarter. In

particular, two government related groups cancelled on short notice

during the quarter resulting in 6,758 fewer room nights. The impact

of these cancellations and general effect of government

sequestration impacted the property’s outside-the-room spending,

which decreased by $4.3 million for the quarter.

Reed continued, “While we anticipated the shift in mix at our

properties would impact our first quarter performance, the

challenges brought about by government budget issues had a negative

impact on Gaylord National. Given that our properties traditionally

rely on a mix of roughly 80 percent group and 20 percent transient

business, the significant government group cancellations were felt

more acutely by our business than some competitors in the D.C. area

who focus more heavily on the transient segment and can thus

reclaim more of those lost room nights in the quarter.

“Looking at our properties as a whole, we were pleased that in

spite of the issues in D.C., occupancy and RevPAR were only

slightly down compared to the first quarter of last year, and ADR

actually improved modestly. Our Total RevPAR performance

represented a decrease compared to last year, due to a decline in

corporate and association business partially offset by an increase

in SMERF and transient business. The negative impact of this shift

away from premium corporate and association business was felt in

terms of outside-the-room spending. However, these types of shifts

tend to occur from quarter-to-quarter, and based on the group and

association business we have secured for the remainder of the year,

we are optimistic that this shift does not reflect an ongoing

trend.”

Gross advance group bookings set a record first quarter

production level with 587,682 group room nights booked for all

future periods. Gross group room night production in-the year,

for-the-year set a record first quarter production level and

reflect a 42.0% increase over the same period last year.

Additionally, transient room night production, a first quarter

production record, increased 18,567 room nights and transient ADR

grew $17.05 compared to the prior year quarter as the Marriott

Rewards program began to gain traction and the Marriott transient

delivery channels continued to ramp for Gaylord Hotels.

Reed continued, “Despite a potentially disruptive transition

from the legacy Gaylord Hotels’ sales system to the new Marriott

sales system (CI/TY) during February and March, the sales team did

an outstanding job of not only migrating over five million group

room nights to the new system, but also generating a record sales

production quarter. Furthermore, 17% of first quarter production

resulted from new customers obtained through Marriott sales

channels, which we see as an encouraging sign.”

Opry and Attractions

Opry and Attractions segment revenue declined 2.6 percent to

$12.5 million in the first quarter of 2013 from $12.9 million in

the prior-year quarter. The segment’s Adjusted EBITDA declined 36.7

percent to $1.4 million in the first quarter of 2013, from $2.2

million in the prior-year quarter. Due to the REIT conversion, this

segment shares a greater proportion of allocated expenses for

centralized services than in the past.

Corporate

Corporate and Other Adjusted EBITDA totaled a loss of $5.4

million in the first quarter of 2013 compared to a loss of $11.5

million in the same period last year. The reduction in costs at the

Corporate level are directly related to the transition of the

Company from a C-Corp to a REIT and are in-line with previously

discussed estimated cost synergies.

REIT Conversion Costs

The Company has allocated all REIT conversion costs by operating

segments and reported these amounts separately as REIT conversion

costs in the accompanying financial information. During the first

quarter of 2013, the Company incurred $15.0 million of costs

associated with this conversion. These costs include employment and

severance costs ($11.2 million), professional fees ($1.1 million),

and various other transition costs ($2.7 million).

During the quarter, the Company recorded an income tax benefit

of $66.3 million. This benefit was primarily due to the reversal of

$137.4 million in net deferred tax liabilities that are no longer

necessary as a result of the Company’s REIT conversion, partially

offset by a valuation allowance of $76.1 million on the net

deferred tax assets of the Company’s taxable REIT subsidiaries, or

TRSs.

Dividend Update

The Company paid its first quarterly cash dividend

of $0.50 per share of common stock on April 12,

2013 to stockholders of record on March 28, 2013. It is

the Company’s current plan to distribute total annual dividends of

approximately $2.00 per share for 2013 in cash in equal

quarterly payments in April, July, October, and January, subject to

the board’s future determinations as to the amount of quarterly

distributions and the timing thereof.

Balance Sheet/Liquidity Update

As of March 31, 2013, the Company had total debt outstanding of

$1,092.1 million and unrestricted cash of $44.8 million. At March

31, 2013, $171.0 million of borrowings were undrawn under the

Company’s $925 million credit facility, and the lending banks had

issued $7.7 million in letters of credit, which left $163.3 million

of availability under the credit facility. On January 17, 2013, the

Company redeemed its remaining 6.75% senior notes at par at a cost

of $152.2 million, which was funded using borrowings under the

revolving credit line of the Company’s $925 million credit

facility.

During the quarter, the Company announced a private placement of

$350 million aggregate principal amount of 5.00% senior notes due

2021 (the “Notes”), which closed on April 3, 2013. The Notes are

senior unsecured obligations of the Company’s issuing subsidiaries

and are guaranteed by the Company and all of the Company’s

subsidiaries that guarantee its senior credit facility. Aggregate

net proceeds from the sale of the notes were approximately $342

million, after deducting the initial purchasers’ discounts and

commissions and estimated offering expenses. The Company used

substantially all of the net proceeds of the offering to repay

amounts outstanding under its revolving credit facility.

In addition, the Company announced on April 18, 2013 that it

successfully refinanced its $925 million credit facility that was

scheduled to mature in August 2015. The increased and extended $1

billion credit facility will mature in April 2017 and is

comprised of a $700 million revolving credit line

($154 million of which was drawn at close) and a fully funded

$300 million term loan. The Company was able to secure

favorable pricing on the facility as the interest rate is LIBOR

plus an applicable margin based on the Company’s consolidated

funded indebtedness to total asset value ratio, or the base rate

plus the applicable margin. The initial rate is set at LIBOR +

1.75%. The extended facility reflects both a reduction in the term

loan and an increase in the revolving credit line, as well as

improved pricing. The previous credit facility was comprised of a

$400 million term loan and a $525 million revolving

credit line. At April 30, 2013, $439.0 million of borrowings were

drawn under the Company’s $1 billion credit facility, and the

issuing banks had issued $7.7 million in letters of credit, which

left $553.3 million of availability under the credit facility.

During the quarter, the Company repurchased and cancelled

approximately 1.3 million shares of its common stock for an

aggregate purchase price of $55.7 million, which the Company funded

using cash on hand and borrowings under the revolving credit line

of its credit facility.

Guidance Update:

The Company is reiterating its 2013 Guidance for Hospitality

RevPAR, Hospitality Total RevPAR, Adjusted EBITDA and Adjusted FFO,

as originally announced on February 15, 2013. However, due to

higher than expected employee transition and pension cost

associated with the REIT conversion, the Company is modifying its

2013 guidance for Adjusted FFO after

REIT conversion costs as outlined in the following table. In

addition, the Company has updated the estimated basic shares

outstanding to reflect the recent share repurchase activity.

Original Guidance

Revised Guidance Low High Low

High Hospitality RevPAR 1 3.0 %

6.0 % 3.0 % 6.0 % Hospitality

Total RevPAR 1 2.0 % 5.0 % 2.0 % 5.0 % Hospitality $ 278.0 $

288.0 $ 278.0 $ 288.0 Opry and Attractions 15.0 17.0 15.0 17.0

Corporate and Other (24.0 ) (20.0 ) (24.0 ) (20.0 ) Gaylord

National Bonds 2 12.0

12.0 12.0

12.0 Adjusted EBITDA $ 281.0 $

297.0 $ 281.0 $

297.0 Adjusted FFO 3 $ 212.0 $ 225.0 $ 212.0 $

225.0 REIT conversion costs (tax effected) $ 13.0 $ 12.0 $ 19.0 $

18.0

Adjusted FFO after REIT conversion costs 3

$ 199.0 $ 213.0 $ 193.0 $ 207.0 Adjusted FFO per Share 3 $

4.03 $ 4.27 $ 4.09 $ 4.34

Adjusted FFO per Share after REIT conversion costs 3

$ 3.78 $ 4.04 $ 3.72 $ 3.99 Estimated Basic Shares Outstanding 52.7

52.7 51.9 51.9

- Hospitality RevPAR estimated annual

increases are based on 2012 RevPAR of $123.36 (as adjusted to

reflect a change in room counting methods that does not exclude

renovation rooms from the calculation of rooms available, per

Marriott room counting methods), and Hospitality Total RevPAR

estimated annual increases are based on 2012 Retail Adjusted Total

RevPAR of $305.30 (as adjusted to reflect the elimination from the

first three quarters of 2012 of revenues from retail operation that

were outsourced to a third-party retailer beginning in the fourth

quarter of 2012, as well as Marriott room counting methods).

- Interest income from Gaylord National

bonds reported in hospitality segment results in 2013.

- Adjusted FFO guidance includes a

deduction for maintenance capital expenditures of $36.0 to $38.0

million.

For our definitions of RevPAR, Total RevPAR, Adjusted EBITDA,

Retail Adjusted Revenue, Retail Adjusted Total RevPAR, and Adjusted

FFO as well as a reconciliation of the non-GAAP financial measure

Adjusted EBITDA to Net Income, a reconciliation of the non-GAAP

financial measure Retail Adjusted Revenue to revenue, and a

reconciliation of the non-GAAP financial measure Adjusted FFO to

Net Income, see “Retail Adjusted Revenue”, “Calculation of RevPAR

and Total RevPAR”, “Non-GAAP Financial Measures”, “Supplemental

Financial Results” and “Reconciliation of Forward-Looking

Statements” below.

Reed continued, “When we originally announced our outlook for

the year it was with the understanding that our performance would

strengthen as the year progressed and we would begin to realize the

revenue and cost synergies we expected once the Marriott systems

were fully implemented. With the successful integration of our

hotels on the Marriott platform, coupled with the strong

in-the-year, for-the-year group bookings and transient demand, we

believe we will end the year within our original guidance range

other than for Adjusted FFO after REIT conversion costs. Despite

the challenges we experienced in the first quarter, our hotel

assets are heading in the right direction, our corporate cost

savings are being realized as expected, and we are seeing many

positive signs for the future. As a result, we are reiterating our

guidance for Hospitality RevPAR, Hospitality Total RevPAR, Adjusted

EBITDA and Adjusted FFO.”

Earnings Call information

Ryman Hospitality Properties will hold a conference call to

discuss this release today at 10:00 a.m. ET. Investors can listen

to the conference call over the Internet at www.rymanhp.com. To

listen to the live call, please go to the Investor Relations

section of the website (Investor Relations/Presentations, Earnings,

and Webcasts) at least 15 minutes prior to the call to register,

download and install any necessary audio software. For those who

cannot listen to the live broadcast, a replay will be available

shortly after the call and will run for at least 30 days.

About Ryman Hospitality Properties, Inc.:

Ryman Hospitality Properties, Inc. (NYSE: RHP) is a REIT for

federal income tax purposes, specializing in group-oriented,

destination hotel assets in urban and resort markets. The Company’s

owned assets include a network of four upscale, meetings-focused

resorts totaling 7,795 rooms that are managed by world-class

lodging operator Marriott International, Inc. under the Gaylord

Hotels brand. Other owned assets managed by Marriott International,

Inc. include Gaylord Springs Golf Links, the Wildhorse Saloon, the

General Jackson Showboat and The Inn at Opryland, a 303-room

overflow hotel adjacent to Gaylord Opryland. The Company also owns

and operates a number of media and entertainment assets, including

the Grand Ole Opry (opry.com), the legendary weekly showcase of

country music’s finest performers for nearly 90 years; the Ryman

Auditorium, the storied former home of the Grand Ole Opry located

in downtown Nashville; and WSM-AM, the Opry’s radio home. For

additional information about Ryman Hospitality Properties, visit

www.rymanhp.com.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains statements as to the Company’s

beliefs and expectations of the outcome of future events that are

forward-looking statements as defined in the Private Securities

Litigation Reform Act of 1995. You can identify these statements by

the fact that they do not relate strictly to historical or current

facts. Examples of these statements include, but are not limited

to, statements regarding the future performance of our business,

the effect of the Company’s election of REIT status, the amount of

REIT conversion or other costs relating to the restructuring

transactions, anticipated cost synergies and revenue enhancements

from the Marriott relationship, the expected approach to making

dividend payments, the board’s ability to alter the dividend policy

at any time, plans to engage in common stock repurchase

transactions and the timing and form of such transactions, and

other business or operational issues. These forward-looking

statements are subject to risks and uncertainties that could cause

actual results to differ materially from the statements made. These

include the risks and uncertainties associated with economic

conditions affecting the hospitality business generally, the

geographic concentration of the Company’s hotel properties,

business levels at the Company’s hotels, the effect of the

Company’s election to be taxed as a REIT for federal income tax

purposes effective for the year ending December 31, 2013, the

Company’s ability to remain qualified as a REIT, the Company’s

ability to execute its strategic goals as a REIT, the effects of

business disruption related to the Marriott management transition

and the REIT conversion, the Company’s ability to realize cost

savings and revenue enhancements from the REIT conversion and the

Marriott transaction, the Company’s ability to generate cash flows

to support dividends, future board determinations regarding the

timing and amount of dividends and changes to the dividend policy,

which could be made at any time, the determination of Adjusted FFO

and REIT taxable income, and the Company’s ability to borrow funds

pursuant to its credit agreements. Other factors that could cause

operating and financial results to differ are described in the

filings made from time to time by the Company with the U.S.

Securities and Exchange Commission (SEC) and include the risk

factors described in the Company’s Annual Report on Form 10-K for

the fiscal year ended December 31, 2012. The Company does not

undertake any obligation to release publicly any revisions to

forward-looking statements made by it to reflect events or

circumstances occurring after the date hereof or the occurrence of

unanticipated events.

Additional Information

This release should be read in conjunction with the consolidated

financial statements and notes thereto included in our most recent

report on Form 10-K. Copies of our reports are available on our

website at no expense at www.rymanhp.com and through the SEC’s

Electronic Data Gathering Analysis and Retrieval System (“EDGAR”)

at www.sec.gov.

Retail Adjusted Revenue

Under Marriott International, Inc.’s management of Gaylord

Opryland, Gaylord Texan, and Gaylord National, the retail

operations of such hotels were outsourced to a third party retailer

beginning in the fourth quarter of 2012. The properties now receive

rental lease payments rather than full retail revenue and

associated expense. The net impact of this change lowered overall

retail revenue for each affected property. During the first quarter

of 2013 the change resulted in revenue decreases of approximately

$2.2 million (Gaylord Opryland–$1.3 million, Gaylord Texan–$0.5

million, and Gaylord National–$0.4 million). The change impacted

consolidated revenue, Hospitality segment revenue, property

revenue, and Total RevPAR as explained below. To enable

period-over-period comparison, we have included adjusted 2012

revenue and 2012 Total RevPAR figures to reflect the elimination of

retail revenues from operations that have been outsourced in the

2013 period. No adjustments were made to the Gaylord Palms’ results

due to the fact that during all periods presented, retail

operations were outsourced at that property. A reconciliation of

actual revenue to Retail Adjusted Revenue for the 2012 period is

set forth below under “Supplemental Financial Results.”

Calculation of RevPAR and Total RevPAR

We calculate revenue per available room (“RevPAR”) for our

hotels by dividing room revenue by room nights available to guests

for the period. We calculate total revenue per available room

(“Total RevPAR”) for our hotels by dividing the sum of room

revenue, food & beverage, and other ancillary services revenue

by room nights available to guests for the period. We calculate

retail adjusted total revenue per available room (“Retail Adjusted

Total RevPAR”) for our hotels by dividing the sum of room revenue,

food & beverage, and other ancillary services revenue minus the

retail inventory adjustment for the period by room nights available

to guests for the period.

RevPAR estimated annual increases included in our guidance are

based on 2012 RevPAR of $123.36 (as adjusted to reflect a change in

room counting methods that does not exclude renovation rooms from

the calculation of rooms available, per Marriott room counting

methods), and Total RevPAR estimated annual increases are based on

2012 Retail Adjusted Total RevPAR of $305.30 (as adjusted to

reflect the elimination from the first three quarters of 2012 of

revenues from retail operations that were outsourced to a

third-party retailer beginning in the fourth quarter of 2012, as

well as Marriott room counting methods).

Non-GAAP Financial Measures

We present the following non-GAAP financial measures we believe

are useful to investors as key measures of our operating

performance: Adjusted EBITDA, Adjusted FFO and Retail Adjusted

Revenue, as described above.

To calculate Adjusted EBITDA, we determine EBITDA, which

represents net income (loss) determined in accordance with GAAP,

plus loss (income) from discontinued operations, net; provision

(benefit) for income taxes; other (gains) and losses, net; (income)

loss from unconsolidated entities; interest expense; and

depreciation and amortization, less interest income. Adjusted

EBITDA is calculated as EBITDA plus preopening costs; non-cash

ground lease expense; equity-based compensation expense; impairment

charges; any closing costs of completed acquisitions; interest

income on Gaylord National bonds; other gains (and losses); REIT

conversion costs and any other adjustments we have identified in

this release. We believe Adjusted EBITDA is useful to investors in

evaluating our operating performance because this measure helps

investors evaluate and compare the results of our operations from

period to period by removing the impact of our capital structure

(primarily interest expense) and our asset base (primarily

depreciation and amortization) from our operating results. A

reconciliation of net income (loss) to EBITDA and Adjusted EBITDA

and a reconciliation of segment operating income to segment

Adjusted EBITDA are set forth below under “Supplemental Financial

Results.” Our method of calculating Adjusted EBITDA as used herein

differs from the method we used to calculate Adjusted EBITDA as

presented in press releases covering periods prior to 2013.

We calculate Adjusted FFO to mean net income (loss) (computed in

accordance with GAAP), excluding non-controlling interests, and

gains and losses from sales of property; plus depreciation and

amortization (excluding amortization of deferred financing costs

and debt discounts) and impairment losses; we also exclude

written-off deferred financing costs, non-cash ground lease

expense, amortization of debt discounts and amortization of

deferred financing costs; and gain (loss) on extinguishment of

debt, and subtract certain capital expenditures (the required

FF&E reserves for our managed properties plus maintenance

capital expenditures for our non-managed properties). We also

exclude the effect of the non-cash income tax benefit relating to

the REIT conversion. We have presented Adjusted FFO both excluding

and including REIT conversion costs. We believe that the

presentation of Adjusted FFO provides useful information to

investors regarding our operating performance because it is a

measure of our operations without regard to specified non-cash

items such as real estate depreciation and amortization, gain or

loss on sale of assets and certain other items which we believe are

not indicative of the performance of our underlying hotel

properties. We believe that these items are more representative of

our asset base than our ongoing operations. We also use Adjusted

FFO as one measure in determining our results after taking into

account the impact of our capital structure. A reconciliation of

net income (loss) to Adjusted FFO is set forth below under

“Supplemental Financial Results.”

We caution investors that amounts presented in accordance with

our definitions of Adjusted EBITDA and Adjusted FFO may not be

comparable to similar measures disclosed by other companies,

because not all companies calculate these non-GAAP measures in the

same manner. Adjusted EBITDA and Adjusted FFO, and any related per

share measures, should not be considered as alternative measures of

our net income (loss), operating performance, cash flow or

liquidity. Adjusted EBITDA and Adjusted FFO may include funds that

may not be available for our discretionary use due to functional

requirements to conserve funds for capital expenditures and

property acquisitions and other commitments and uncertainties.

Although we believe that Adjusted EBITDA and Adjusted FFO can

enhance an investor’s understanding of our results of operations,

these non-GAAP financial measures, when viewed individually, are

not necessarily better indicators of any trend as compared to GAAP

measures such as net income (loss) or cash flow from operations. In

addition, you should be aware that adverse economic and market and

other conditions may harm our cash flow.

RYMAN HOSPITALITY PROPERTIES, INC.

AND SUBSIDIARIES CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS Unaudited (In thousands, except per share data)

Three Months Ended Mar. 31, 2013

2012

Revenues:

Rooms $ 85,509 $ 87,534 Food and beverage 98,188 108,076 Other

hotel revenue 25,884 30,438 Opry and Attractions

12,532 12,867 Total revenues

222,113 238,915

Operating expenses: Rooms 25,087 22,968 Food and beverage

61,248 61,614 Other hotel expenses 69,568 72,894 Management fees

3,469 - Total

hotel operating expenses 159,372 157,476 Opry and Attractions

11,286 10,757 Corporate 6,666 13,006 REIT conversion costs 14,992

3,053 Casualty loss 32 174 Preopening costs - 331 Depreciation and

amortization 32,009

32,434 Total operating expenses 224,357

217,231 Operating income (loss)

(2,244 ) 21,684 Interest expense, net of amounts capitalized

(13,323 ) (14,362 ) Interest income 3,051 3,154 Other gains and

(losses), net (6 ) -

Income (loss) before income taxes (12,522 ) 10,476

(Provision) benefit for income taxes 66,292

(4,469 ) Income from continuing operations

53,770 6,007 Income from discontinued operations, net of

taxes 10 21 Net

income $ 53,780 $ 6,028

Basic net income per

share:

Income from continuing operations $ 1.03 $ 0.12 Income from

discontinued operations, net of taxes -

- Net income $ 1.03 $

0.12

Fully diluted net

income per share:

Income from continuing operations $ 0.81 $ 0.12 Income from

discontinued operations, net of taxes -

- Net income $ 0.81 $

0.12

Weighted average

common shares for the period:

Basic 52,427 48,715 Diluted (1) 66,720 50,137

(1)

Represents GAAP calculation of diluted

shares and does not consider anti-dilutive effect of the Company's

purchased call options associated with its convertible notes. For

the three months ended March 31, 2013 and 2012, the purchased call

options effectively reduce dilution by approximately 7.7 million

and 0.8 million shares of common stock, respectively.

RYMAN HOSPITALITY PROPERTIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE

SHEETS Unaudited (In thousands)

Mar. 31, Dec.

31, 2013 2012 ASSETS: Property and

equipment, net of accumulated depreciation $

2,128,451 $ 2,148,999 Cash and cash equivalents -

unrestricted 44,848 97,170 Cash and cash equivalents - restricted

6,934 6,210 Notes receivable 148,925 149,400 Trade receivables, net

60,745 55,343 Deferred financing costs 9,660 11,347 Prepaid

expenses and other assets 55,879

63,982 Total assets $ 2,455,442 $

2,532,451 LIABILITIES AND STOCKHOLDERS'

EQUITY: Debt and capital lease obligations $ 1,092,081 $ 1,031,863

Accounts payable and accrued liabilities 145,042 218,461 Deferred

income taxes 35,026 88,938 Deferred management rights proceeds

185,615 186,346 Dividends payable 25,971 - Other liabilities

139,071 153,245 Stockholders' equity 832,636

853,598 Total liabilities and stockholders'

equity $ 2,455,442 $ 2,532,451

RYMAN HOSPITALITY

PROPERTIES, INC. AND SUBSIDIARIES SUPPLEMENTAL FINANCIAL

RESULTS ADJUSTED EBITDA RECONCILIATION Unaudited (in

thousands)

Three Months Ended Mar. 31,

2013 2012 $ Margin $

Margin

Consolidated

Revenue $ 222,113 $ 238,915

Net income $ 53,780 $ 6,028 Income from discontinued

operations, net of taxes (10 ) (21 ) Provision (benefit) for income

taxes (66,292 ) 4,469 Other (gains) and losses, net 6 - Interest

expense, net 10,272 11,208 Depreciation & amortization

32,009 32,434

EBITDA 29,765 13.4 % 54,118 22.7 % Preopening costs - 331

Non-cash lease expense 1,399 1,426 Equity-based compensation 1,394

2,356 Interest income on Gaylord National bonds 3,048 3,150 Other

gains and (losses), net (6 ) - (Gain) loss on disposal of assets 1

- Casualty loss 32 174 REIT conversion costs

14,992 3,053

Adjusted EBITDA $ 50,625

22.8 % $ 64,608 27.0 %

Hospitality

segment

Revenue $ 209,581 $ 226,048

Operating income 17,661

39,705 Depreciation & amortization 26,801 28,536 Preopening

costs - 331 Non-cash lease expense 1,399 1,426 Equity-based

compensation - 783 Interest income on Gaylord National bonds 3,048

3,150 Other gains and (losses), net (6 ) - (Gain) loss on disposal

of assets 1 - REIT conversion costs 5,747

-

Adjusted EBITDA $ 54,651 26.1 %

$ 73,931 32.7 %

Opry and Attractions

segment

Revenue $ 12,532 $ 12,867

Operating income (loss)

(190 ) 684 Depreciation & amortization 1,366 1,285 Equity-based

compensation 129 63 Casualty loss - 141 REIT conversion costs

70 -

Adjusted EBITDA $ 1,375

11.0 % $ 2,173 16.9 %

Corporate and Other

segment

Operating loss (19,715 ) (18,705 ) Depreciation &

amortization 3,842 2,613 Equity-based compensation 1,265 1,510

Casualty loss 32 33 REIT conversion costs

9,175 3,053

Adjusted

EBITDA $ (5,401 ) $ (11,496 )

RYMAN HOSPITALITY PROPERTIES,

INC. AND SUBSIDIARIES SUPPLEMENTAL FINANCIAL RESULTS

FUNDS FROM OPERATIONS ("FFO") AND ADJUSTED FFO

RECONCILIATION Unaudited (in thousands, except per share data)

Three Months Ended Mar. 31, 2013

2012 $

$

Consolidated

Net income $ 53,780 $ 6,028 Depreciation & amortization

32,009 32,434 (Gains) losses on sale of real estate assets 1

-

FFO 85,790 38,462 Capital

expenditures (1) (7,747 ) (13,842 ) Non-cash lease expense 1,399

1,426 Impairment charges 132 - Write-off of deferred financing

costs 544 - Amortization of deferred financing costs 1,165 1,212

Amortization of debt discounts 3,593 3,307 Noncash tax benefit

resulting from REIT conversion (61,340 ) -

Adjusted FFO $ 23,536 $ 30,565 REIT conversion

costs (tax effected) 11,338 1,944

Adjusted FFO excluding REIT conversion costs $ 34,874

$ 32,509 FFO per basic share $ 1.64 $ 0.79

Adjusted FFO per basic share $ 0.45 $ 0.63 Adjusted FFO (excl. REIT

conversion costs) per basic share $ 0.67 $ 0.67 FFO per

diluted share (2) $ 1.29 $ 0.77 Adjusted FFO per diluted share (2)

$ 0.35 $ 0.61 Adjusted FFO (excl. REIT conversion costs) per

diluted share (2) $ 0.52 $ 0.65

(1)

Represents FF&E reserve for managed

properties and maintenance capital expenditures for non-managed

properties.

(2)

The GAAP calculation of diluted shares

does not consider the anti-dilutive effect of the Company's

purchased call options associated with its convertible notes. For

the three months ended March 31, 2013 and 2012, the purchased call

options effectively reduce dilution by approximately 7.7 million

and 0.8 million shares of common stock, respectively.

RYMAN HOSPITALITY PROPERTIES, INC. AND

SUBSIDIARIES SUPPLEMENTAL FINANCIAL RESULTS Unaudited

(in thousands, except operating metrics)

Three Months Ended Mar. 31,

2013 2012 (1) HOSPITALITY OPERATING

METRICS:

Hospitality

Segment

Occupancy 67.5% 68.7% Average daily rate (ADR) $ 173.84 $

172.82 RevPAR $ 117.33 $ 118.78 OtherPAR $ 170.23 $ 187.97 Total

RevPAR $ 287.56 $ 306.75 Revenue $ 209,581 $ 226,048

Adjusted EBITDA $ 54,651 $ 73,931 Adjusted EBITDA Margin 26.1%

32.7%

Gaylord

Opryland

Occupancy 70.4% 66.2% Average daily rate (ADR) $ 157.33 $

158.00 RevPAR $ 110.76 $ 104.56 OtherPAR $ 153.62 $ 164.90 Total

RevPAR $ 264.38 $ 269.46 Revenue $ 68,608 $ 70,669 Adjusted

EBITDA $ 21,233 $ 22,895 Adjusted EBITDA Margin 30.9% 32.4%

Gaylord

Palms

Occupancy 79.9% 81.8% Average daily rate (ADR) $ 178.29 $

182.71 RevPAR $ 142.47 $ 149.44 OtherPAR $ 224.54 $ 253.32 Total

RevPAR $ 367.01 $ 402.76 Revenue $ 46,442 $ 51,532 Adjusted

EBITDA $ 12,786 $ 20,212 Adjusted EBITDA Margin 27.5% 39.2%

Gaylord

Texan

Occupancy 68.2% 69.4% Average daily rate (ADR) $ 175.13 $

177.75 RevPAR $ 119.46 $ 123.43 OtherPAR $ 209.32 $ 227.65 Total

RevPAR $ 328.78 $ 351.08 Revenue $ 44,681 $ 48,274 Adjusted

EBITDA $ 12,243 $ 16,609 Adjusted EBITDA Margin 27.4% 34.4%

Gaylord

National

Occupancy 55.6% 64.7% Average daily rate (ADR) $ 208.33 $

190.94 RevPAR $ 115.91 $ 123.51 OtherPAR $ 148.72 $ 170.55 Total

RevPAR $ 264.63 $ 294.06 Revenue $ 47,536 $ 53,413 Adjusted

EBITDA $ 7,992 $ 13,799 Adjusted EBITDA Margin 16.8% 25.8%

The Inn at

Opryland (2)

Occupancy 56.6% 55.6% Average daily rate (ADR) $ 109.09 $

103.57 RevPAR $ 61.74 $ 57.55 OtherPAR $ 23.13 $ 24.53 Total RevPAR

$ 84.87 $ 82.08 Revenue $ 2,314 $ 2,160 Adjusted EBITDA $

397 $ 416 Adjusted EBITDA Margin 17.2% 19.3% (1) For

purposes of comparability, both 2013 and 2012 occupancy, RevPAR,

OtherPAR and Total RevPAR are calculated using Marriott's method of

calculating available rooms and do not exclude renovation rooms

from the calculation of rooms available, which is different from

how the Company has previously accounted for renovation rooms prior

to the Marriott transition. In addition, both 2013 and 2012

occupancy and ADR do not include complimentary room nights in the

calculation of occupied rooms, which is different from how the

Company has previously accounted for complimentary rooms.

(2) Includes other hospitality revenue and expense.

RYMAN HOSPITALITY PROPERTIES, INC. AND SUBSIDIARIES

SUPPLEMENTAL FINANCIAL RESULTS RECONCILIATION OF ADJUSTED

RESULTS Unaudited (in thousands, except operating metrics)

Three Months Ended

Mar. 31, 2013 2012 Consolidated:

Revenue $ 222,113 $ 238,915 Less: Retail Inventory Adjustment

- (2,205 ) Retail Adjusted Revenue $ 222,113 $

236,710

Hospitality Segment: Revenue $ 209,581 $

226,048 Less: Retail Inventory Adjustment -

(2,205 ) Retail Adjusted Revenue $ 209,581 $ 223,843 Total

RevPAR $ 287.56 $ 306.75 Retail Adjusted Total RevPAR $ 287.56 $

303.76

Gaylord Opryland: Revenue $ 68,608 $ 70,669

Less: Retail Inventory Adjustment - (1,336 )

Retail Adjusted Revenue $ 68,608 $ 69,333 Total RevPAR $

264.38 $ 269.46 Retail Adjusted Total RevPAR $ 264.38 $ 264.37

Gaylord Palms: Revenue $ 46,442 $ 51,532 Less: Retail

Inventory Adjustment - - Retail

Adjusted Revenue $ 46,442 $ 51,532 Total RevPAR $ 367.01 $

402.76 Retail Adjusted Total RevPAR $ 367.01 $ 402.76

Gaylord Texan: Revenue $ 44,681 $ 48,274 Less: Retail

Inventory Adjustment - (474 ) Retail Adjusted

Revenue $ 44,681 $ 47,800 Total RevPAR $ 328.78 $ 351.08

Retail Adjusted Total RevPAR $ 328.78 $ 347.63

Gaylord

National: Revenue $ 47,536 $ 53,413 Less: Retail Inventory

Adjustment - (395 ) Retail Adjusted Revenue $

47,536 $ 53,018 Total RevPAR $ 264.63 $ 294.06 Retail

Adjusted Total RevPAR $ 264.63 $ 291.89

Inn at Opryland

(and Other Hospitality): Revenue $ 2,314 $ 2,160 Less: Retail

Inventory Adjustment - - Retail

Adjusted Revenue $ 2,314 $ 2,160 Total RevPAR $ 84.87 $

82.08 Retail Adjusted Total RevPAR $ 84.87 $ 82.08

Ryman Hospitality Properties,

Inc. and Subsidiaries RECONCILIATION OF FORWARD-LOOKING

STATEMENTS Unaudited (in thousands)

Adjusted Earnings Before Interest, Taxes, Depreciation and

Amortization ("Adjusted EBITDA") and Adjusted Funds From

Operations ("AFFO") reconciliation:

PRIOR GUIDANCE RANGE NEW GUIDANCE

RANGE FOR FULL YEAR 2013 FOR FULL YEAR 2013

Low High Low High

Ryman Hospitality

Properties, Inc.

Net Income $ 91,100 $ 98,100 $ 145,400 $ 152,400 Provision

(benefit) for income taxes (8,000 ) (7,000 ) (19,300 ) (18,400 )

Write off and Valuation Allowance - - (62,000 ) (62,000 ) Other

(gains) and losses, net (2,300 ) (2,300 ) (2,300 ) (2,300 )

Interest expense 46,000 50,900 60,000 64,000 Interest income

(12,000 ) (12,000 ) (12,000 ) (12,000 )

Operating Income 114,800 127,700 109,800 121,700 Depreciation and

amortization 120,000 125,000

120,000 125,000 EBITDA 234,800 252,700 229,800

246,700 Non-cash lease expense 5,600 5,600 5,600 5,600 Equity based

compensation 6,300 6,400 6,300 6,400 Other gains and (losses), net

2,300 2,300 2,300 2,300 Interest income 12,000 12,000 12,000 12,000

REIT conversion costs 20,000 18,000

25,000 24,000 Adjusted EBITDA $ 281,000

$ 297,000 $ 281,000 $ 297,000

Hospitality

Segment

Operating Income $ 159,100 $ 167,100 $ 156,800 $ 164,300

Depreciation and amortization 107,000 110,000

107,000 110,000 EBITDA 266,100

277,100 263,800 274,300 Non-cash lease expense 5,600 5,600 5,600

5,600 Equity based compensation - - - - Other gains and (losses),

net 2,300 2,300 2,300 2,300 Interest income 12,000 12,000 12,000

12,000 REIT conversion costs 4,000 3,000

6,300 5,800 Adjusted EBITDA $

290,000 $ 300,000 $ 290,000 $ 300,000

Opry and

Attractions Segment

Operating Income $ 8,900 $ 9,800 $ 8,700 $ 9,600 Depreciation and

amortization 5,500 6,500 5,500

6,500 EBITDA 14,400 16,300 14,200 16,100

Non-cash lease expense - - - - Equity based compensation 600 700

600 700 Interest income - - - - REIT conversion costs -

- 200 200 Adjusted

EBITDA $ 15,000 $ 17,000 $ 15,000 $ 17,000

Corporate and

Other Segment

Operating Income $ (53,200 ) $ (49,200 ) $ (55,700 ) $ (52,200 )

Depreciation and amortization 7,500 8,500

7,500 8,500 EBITDA (45,700 )

(40,700 ) (48,200 ) (43,700 ) Non-cash lease expense - - - - Equity

based compensation 5,700 5,700 5,700 5,700 Interest income - - - -

REIT conversion costs 16,000 15,000

18,500 18,000 Adjusted EBITDA $ (24,000

) $ (20,000 ) $ (24,000 ) $ (20,000 )

Ryman Hospitality

Properties, Inc.

Net Income $ 91,100 $ 98,100 $ 145,400 $ 152,400 Depreciation &

Amortization 120,000 125,000 120,000 125,000 Capital Expenditures

(38,000 ) (36,000 ) (38,000 ) (36,000 ) Non-Cash Lease Expense

5,600 5,600 5,600 5,600 Amortization of Debt Premiums/Disc. 15,000

15,000 15,000 15,000 Amortization of DFC 5,300 5,300 7,000 7,000

Other Non-recurring Items - - (62,000 ) (62,000 ) Loss (Gain) on

debt extinguishment - - -

- Adjusted FFO 199,000 213,000 193,000 207,000 REIT

Conversion Costs 13,000 12,000

19,000 18,000 Adjusted FFO Excl. REIT

Conversion Costs $ 212,000 $ 225,000 $ 212,000

$ 225,000

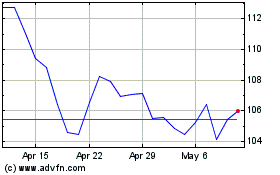

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jun 2024 to Jul 2024

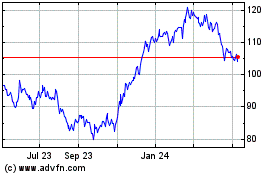

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jul 2023 to Jul 2024