Ryman Hospitality Properties, Inc. Refinances and Extends Credit Facility to 2017

April 18 2013 - 4:10PM

Business Wire

Ryman Hospitality Properties, Inc. (NYSE: RHP) today announced

that the Company and its subsidiaries successfully refinanced their

$925 million credit facility that was scheduled to mature in August

2015. The increased and extended $1 billion credit facility will

mature in April 2017 and is comprised of a $700 million

revolving credit line ($154 million of which was drawn at

close) and a fully funded $300 million term loan. The Company

was able to secure favorable pricing on the facility with initial

pricing set at LIBOR + 1.75%. Pricing is determined on a grid

pricing structure based on a consolidated funded indebtedness to

total asset value ratio. The extended facility reflects both a

reduction in the term loan and an increase in the revolving credit

line, as well as improved pricing. The previous credit facility was

comprised of a $400 million term loan and a $525 million

revolving credit line.

With the recently completed private placement of $350 million in

principal amount of 5% senior notes due 2021, the Company and its

subsidiaries’ existing debt has no maturity date prior to 2017,

other than the Company’s $360 million outstanding 3.75 %

convertible notes due in 2014.

“This refinancing of our bank credit facility, coupled with the

recent completion of our senior notes offering, further strengthens

our balance sheet and enhances our flexibility to take advantage of

strategic growth opportunities moving forward,” stated Colin V.

Reed, chairman, chief executive officer and president of Ryman

Hospitality Properties. “Given the extremely attractive rates at

which we were able to complete these transactions, we are confident

that the timing was right and that they are in long-term best

interest of our Company and our shareholders.”

About Ryman Hospitality Properties,

Inc.:

Ryman Hospitality Properties, Inc. (NYSE: RHP), is a REIT for

federal income tax purposes, specializing in group-oriented,

destination hotel assets in urban and resort markets. The Company’s

owned assets include a network of four upscale, meetings-focused

resorts totaling 7,795 rooms that are managed by world-class

lodging operator Marriott International, Inc. under the Gaylord

Hotels brand. Other owned assets managed by Marriott International,

Inc. include Gaylord Springs Golf Links, the Wildhorse Saloon, the

General Jackson Showboat and The Inn at Opryland, a 303-room

overflow hotel adjacent to Gaylord Opryland. The Company also owns

and operates a number of media and entertainment assets, including

the Grand Ole Opry (opry.com), the legendary weekly showcase of

country music’s finest performers for nearly 90 years; the Ryman

Auditorium, the storied former home of the Grand Ole Opry located

in downtown Nashville; and WSM-AM, the Opry’s radio home. For

additional information about Ryman Hospitality Properties, visit

www.rymanhp.com.

Cautionary Note Regarding

Forward-Looking Statements

This press release contains statements as to the Company’s

beliefs and expectations of the outcome of future events that are

forward-looking statements as defined in the Private Securities

Litigation Reform Act of 1995. You can identify these statements by

the fact that they do not relate strictly to historical or current

facts. Examples of these statements include, but are not limited

to, statements regarding future growth opportunities and the future

timing of debt maturities. These forward-looking statements are

subject to risks and uncertainties that could cause actual results

to differ materially from the statements made. These include the

risks and uncertainties associated with compliance with agreements

governing our debt, economic conditions affecting the hospitality

business generally, the geographic concentration of the Company’s

hotel properties, business levels at the Company’s hotels, the

Company’s ability to remain qualified as a REIT, the Company’s

ability to execute its strategic goals as a REIT or to make

strategic acquisitions, and the Company’s ability to borrow funds

pursuant to its credit agreements and to refinance indebtedness.

Other factors that could cause operating and financial results to

differ are described in the filings made from time to time by the

Company with the U.S. Securities and Exchange Commission (SEC) and

include the risk factors described in the Company’s Annual Report

on Form 10-K for the fiscal year ended December 31, 2012. The

Company does not undertake any obligation to release publicly any

revisions to forward-looking statements made by it to reflect

events or circumstances occurring after the date hereof or the

occurrence of unanticipated events.

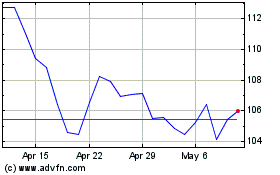

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jun 2024 to Jul 2024

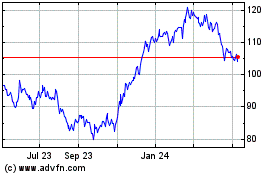

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jul 2023 to Jul 2024