Prologis Extends Leasing in Brazil - Analyst Blog

March 19 2013 - 10:50AM

Zacks

San Francisco-based industrial real estate investment trust

(REIT), Prologis Inc. (PLD) announced the leasing

of 239,000 square feet in a Brazil development project. The

agreement was penned with Brazil's largest bookstore chain and

leading online retailer – Saraiva.

With this deal, the two million square foot Prologis CCP Cajamar I

Industrial Park is now 100% pre-leased and Saraiva will occupy the

final building at the Industrial Park. Notably, Prologis CCP is a

joint venture between Prologis and Cyrela Commercial Properties

(CCP). This particular industrial park is strategically located in

the Cajamar submarket of Sao Paulo and close to Rodoanel Ring Road

and central Sao Paulo.

In Brazil, there is an increased demand for Class-A facilities

resulting from growth in e-commerce. To better serve customers and

reduce delivery time, firms are seeking a consolidation of

distribution networks and are settling in the vicinity of

population centers.

Prologis stands to benefit from this move as it has the capacity to

offer modern distribution facilities in strategic infill locations.

Its joint venture, Prologis CCP is a leading provider of industrial

real estate in Brazil, and as of Dec 31, 2012, it had over 8.7

million square feet developed or to be developed in the

country.

Moreover, recently Prologis announced the initiation of a new

development project – Prologis Park Kawajima 2 – in Japan. The move

is aimed at strengthening Prologis’ position as one of the leading

providers of industrial real estate in Asia.

Prologis is significantly capitalizing on the growing opportunities

across the globe. In addition, continued lease-up of development

portfolio is considerably helping Prologis in reducing its

operating risks. Also, the company has been actively spreading

itself worldwide through joint ventures. We believe such strategic

moves will help augment the company’s top line, going forward.

Prologis currently holds a Zacks Rank #3 (Hold). Other REITs that

are performing better and are worth a look include Ryman

Hospitality Properties Inc. (RHP), Omega

Healthcare Investors (OHI) and Cousins Properties

Inc. (CUZ). The first two carry a Zacks Rank #1 (Strong

Buy), while the latter holds a Rank #2 (Buy).

COUSIN PROP INC (CUZ): Free Stock Analysis Report

OMEGA HLTHCARE (OHI): Free Stock Analysis Report

PROLOGIS INC (PLD): Free Stock Analysis Report

RYMAN HOSPITLTY (RHP): Free Stock Analysis Report

To read this article on Zacks.com click here.

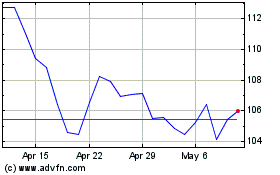

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jun 2024 to Jul 2024

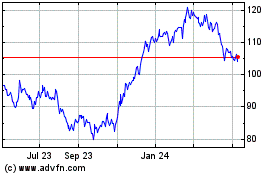

Ryman Hospitality Proper... (NYSE:RHP)

Historical Stock Chart

From Jul 2023 to Jul 2024