Shareholder Alert: Morgan Keegan & Company Investors Have Until April 7, 2008 Deadline To Request Lead Plaintiff Position in Cla

March 14 2008 - 6:00PM

PR Newswire (US)

RADNOR, Pa., March 14 /PRNewswire/ -- The following statement was

issued today by the law firm of Schiffrin Barroway Topaz &

Kessler, LLP: Shareholders of Morgan Keegan & Company have

until April 7, 2008, to move for appointment as lead plaintiff in a

securities class action lawsuit currently pending in the United

States District Court for the Western District of Tennessee against

Morgan Keegan & Company, Inc. ("Morgan Keegan"), Morgan Keegan

Asset Management, Inc., Regions Financial Corporation and related

companies and officers and directors (collectively the "Company").

This action was filed on behalf of all purchasers of shares of the

following Funds: RMK Advantage Income Fund (NYSE:RMA), RMK

Strategic Income Fund (NYSE:RSF) and RMK High Income Fund

(NYSE:RMH) ("the Funds") between December 6, 2004 and February 6,

2008 (the "Class Period"). If you wish to discuss this action or

have any questions concerning this notice or your rights or

interests with respect to these matters, please contact Schiffrin

Barroway Topaz & Kessler, LLP (Darren J. Check, Esq. or Richard

A. Maniskas, Esq.) toll free at 1-888-299-7706 or 1-610-667-7706,

or via e-mail at . The Complaint charges the Company, the Funds and

certain of its officers and directors with violations of the

Securities Act of 1933. Morgan Keegan served as distribution agent

and underwriter for the Funds' shares during the Class Period, and

also served as the Transfer and Dividend Disbursing Agent. RMK

Advantage Income Fund, RMK Strategic Income Fund and RMK High

Income Fund are closed-end management investment companies that

invest primarily in debt securities. More specifically, the

Complaint alleges that the Funds' Registration Statements failed to

disclose or indicate the following: (1) the true nature and extent

of the risk related to the concentrated securities within the

Funds; (2) the extent to which the Funds were invested in illiquid

securities; (3) that the Funds were invested in risky, new

investment structures in which data was difficult to obtain; (4)

that due to the Funds' illiquidity, the manager would be forced to

initially sell first the liquid, lower risk assets, thereby

penalizing holders of the Funds; (5) that the Funds were heavily

invested in illiquid and subprime structures, such as

collateralized debt obligations; (6) that the Funds were invested

in assets that were being valued subjectively under "fair

valuation" procedures; (7) that the Funds' Boards of Directors

created a conflict of interest by not discharging their

responsibilities with respect to "fair valuation" and passing said

responsibilities to the Funds' investment advisor whose

compensation was tied to the value of the Funds' assets; (8) that

the Funds did not employ sufficient "value-investing" strategies,

yet they were sold to the public as being committed to

"value-oriented" investing; (9) that although the Funds were said

to be independent and employ different investment strategies, they

were managed in a nearly identical fashion and employed nearly

identical strategies, resulting in increased risk; (10) that the

Funds were heavily invested in risky, non-conforming mortgages that

did not comply with FHLMC or FNMA standards; (11) that the Funds'

pre-2006 results were attributable to their concentration in

illiquid, subprime and untested investment structures; and (12)

that adequate internal and financial controls did not exist. Each

of the Funds, pursuant to an individual yet substantially similar

Registration Statement and Prospectus filed with the SEC were

initially offered for $15 per share. On December 6, 2004 the share

price for each of the Funds was as follows: RMA at $15.82 per

share, RSF at $16.60 per share and RMH at $18.20 per share. As a

result of various statements and news stories issued, the value of

the Funds' shares consistently declined. By February 6, 2008, each

of the Funds was trading far below the closing price on December 6,

2004. On February 6, 2008, RMA declined to $4.10 per share for a

cumulative loss of $11.72, or over 74% of the price on December 6,

2004. Similarly, RSF declined to $3.90 per share for a cumulative

loss of $12.70, or over 76% of the price on December 6, 2004.

Finally, RMH declined to $4.20 for a cumulative loss of $14, or

almost 77% of the price on December 6, 2004. As a result of

defendants' wrongful acts and omissions, and the precipitous

decline in the market value of the Funds' securities, Plaintiff and

other Class Members have suffered significant losses and damages.

Plaintiff seeks to recover damages on behalf of class members and

is represented by the law firm of Schiffrin Barroway Topaz &

Kessler which prosecutes class actions in both state and federal

courts throughout the country. Schiffrin Barroway Topaz &

Kessler is a driving force behind corporate governance reform, and

has recovered billions of dollars on behalf of institutional and

individual investors from the United States and around the world.

For more information about Schiffrin Barroway Topaz & Kessler

or to sign up to participate in this action online, please visit

http://www.sbtklaw.com/ If you are a member of the class described

above, you may, not later than April 7, 2008, move the Court to

serve as lead plaintiff of the class, if you so choose. A lead

plaintiff is a representative party that acts on behalf of other

class members in directing the litigation. In order to be appointed

lead plaintiff, the Court must determine that the class member's

claim is typical of the claims of other class members, and that the

class member will adequately represent the class. Your ability to

share in any recovery is not, however, affected by the decision

whether or not to serve as a lead plaintiff. Any member of the

purported class may move the court to serve as lead plaintiff

through counsel of their choice, or may choose to do nothing and

remain an absent class member. CONTACT: Schiffrin Barroway Topaz

& Kessler, LLP Darren J. Check, Esq. Richard A. Maniskas, Esq.

280 King of Prussia Road Radnor, PA 19087 1-888-299-7706 (toll

free) or 1-610-667-7706 Or by e-mail at DATASOURCE: Schiffrin

Barroway Topaz & Kessler, LLP CONTACT: Darren J. Check, Esq.,

or Richard A. Maniskas, Esq., both of Schiffrin Barroway Topaz

& Kessler, LLP, +1-888-299-7706 (toll free), +1-610-667-7706,

Web site: http://www.sbtklaw.com/

Copyright

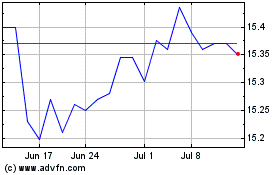

RiverNorth Capital and I... (NYSE:RSF)

Historical Stock Chart

From Jun 2024 to Jul 2024

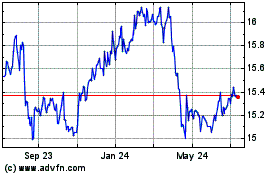

RiverNorth Capital and I... (NYSE:RSF)

Historical Stock Chart

From Jul 2023 to Jul 2024