Rmk Strategic Income Fund Inc - Quarterly Schedule of Portfolio Holdings of Registered Management Investment Company (N-Q)

February 28 2008 - 4:30PM

Edgar (US Regulatory)

As filed with the Securities and Exchange Commission on February 28, 2008

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-Q

QUARTERLY SCHEDULE OF

PORTFOLIO HOLDINGS OF

REGISTERED MANAGEMENT INVESTMENT COMPANY

Investment Company Act File number: 811-21487

RMK Strategic Income Fund,

Inc.

(Exact Name of the Registrant as Specified in Charter)

Morgan Keegan Tower

Fifty North Front Street

Memphis, Tennessee 38103

(Address of

Principal Executive Offices – Zip Code)

Charles D. Maxwell

Morgan Keegan Tower

Fifty North Front Street

Memphis, Tennessee 38103

(Name and

address of agent for service)

Registrant’s telephone number, including area code: (901) 524-4100

Copies to:

Jennifer R. Gonzalez, Esq.

Kirkpatrick & Lockhart Preston Gates Ellis LLP

1601 K Street, N.W.

Washington, D.C. 20006

Date of fiscal year end: March 31, 2008

Date of reporting period: December 31, 2007

Form N-Q is to be used by management investment

companies to file reports with the Commission not later than 60 days after the close of their first and third fiscal quarters, pursuant to rule 30b1-5 under the Investment Company Act of 1940 (“1940 Act”)(17 CFR 270.30b1-5). The Commission

may use the information provided on Form N-Q in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to

disclose the information specified by Form N-Q, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-Q unless the Form displays a currently valid Office of

Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to the Secretary, Securities and Exchange Commission,

450 Fifth Street, NW, Washington, DC 20549-0609. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

|

Item 1.

|

Schedule of Investments.

|

The following is a copy of the schedule

of investments of RMK Strategic Income Fund, Inc. (the “Fund”):

RMK STRATEGIC INCOME FUND, INC.

Portfolio of Investments

December 31, 2007 (Unaudited)

|

|

|

|

|

|

|

|

|

Principal

Amount/

Shares

|

|

Description

|

|

Value ‡

|

|

|

ASSET-BACKED SECURITIES - INVESTMENT GRADE - 13.1% OF NET ASSETS

|

|

|

|

|

|

|

|

Certificate-Backed Obligations (“CBO”) - 4.6%

|

|

|

|

|

$

|

6,500,000

|

|

CBC Insurance Revenue Securitization LLC 2002-A C, 8.880% 2/15/23 †#

|

|

$

|

5,819,775

|

|

|

1,912,045

|

|

MKP CBO I Ltd. 4A CS 2.000% 7/12/40 †#

|

|

|

353,728

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6,173,503

|

|

|

|

|

|

|

|

|

|

|

|

|

Collateralized Debt Obligations (“CDO”) - 4.4%

|

|

|

|

|

|

2,000,000

|

|

CDO Repack SPC Ltd. 2006-BRGA, 7.800% 12/5/51 #

|

|

|

140,000

|

|

|

3,808,079

|

|

E-Trade CDO I 2004-1A, 2.000% 1/10/40 #

|

|

|

637,853

|

|

|

4,000,000

|

|

Fiorente Funding Ltd. 2006-1A M1, Zero Coupon Bond 11/4/56 †#

|

|

|

400,000

|

|

|

1,482,983

|

|

Fort Dequesne CDO Ltd. 2006-1A D, 8.131% 10/26/46 †#

|

|

|

163,128

|

|

|

4,000,000

|

|

Grand Avenue CDO Ltd. 2005-1A, 1.913% 4/5/46 #

|

|

|

340,000

|

|

|

3,610,159

|

|

High Income Trust Securities Inc. 2003-1A B, 5.398% 11/6/37 †#

|

|

|

722,032

|

|

|

2,897,637

|

|

IMAC CDO Ltd. 2007-2A E, 9.680% 10/20/50 †#

|

|

|

101,417

|

|

|

1,000,000

|

|

Kodiak CDO 2007-2A E, 8.125 11/7/42 †#

|

|

|

150,000

|

|

|

4,925,031

|

|

Lancer Funding Ltd. 2007-2A A3, 12.243% 7/15/47 †#

|

|

|

49,250

|

|

|

3,951,033

|

|

Libertas Preferred Funding Ltd. 2007-3A 7, 12.993% 4/9/47 †#

|

|

|

395,103

|

|

|

2,000,000

|

|

Linker Finance PLC 16A E, 8.465% 5/19/45 † #

|

|

|

340,000

|

|

|

2,950,503

|

|

Millstone III-A CDO Ltd., 4.300% 7/5/46 #

|

|

|

118,020

|

|

|

993,595

|

|

Newbury Street CDO Ltd. 2007-1A D, Zero Coupon Bond 3/4/53 †#

|

|

|

19,872

|

|

|

3,000,000

|

|

Palmer Square 2A CN, 12.662% 11/2/45 †#

|

|

|

420,000

|

|

|

1,000,000

|

|

Pasa Funding Ltd. 2007-1A D, 9.243% 4/7/52 #

|

|

|

187,500

|

|

|

2,885,255

|

|

Sharps CDO 2006-1A D, 7.500% 5/8/46 †#

|

|

|

230,820

|

|

|

1,000,000

|

|

Squared CDO Ltd. 2007-1A C, 10.040% 5/11/57 †#

|

|

|

50,000

|

|

|

4,000,000

|

|

Taberna Preferred Funding Ltd. 2006-6A, Zero Coupon Bond 12/5/36 †#

|

|

|

760,000

|

|

|

2,806,645

|

|

Taberna Preferred Funding Ltd. 2006-7A C1, 1.000% 2/5/37 †#

|

|

|

575,362

|

|

|

1,983,528

|

|

Tahoma CDO Ltd. 2006-1A D, 8.616% 6/18/47 †#

|

|

|

29,753

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5,830,110

|

|

|

|

|

|

|

|

|

|

|

|

|

Home Equity Loans - 2.7%

|

|

|

|

|

|

340,712

|

|

Fremont Home Loan Trust 2004-4 M7, 6.585% 3/25/35

|

|

|

62,313

|

|

|

3,915,000

|

|

Lake Country Mortgage Loan Trust 2006-HE1 M8, 7.615% 7/25/34 †#

|

|

|

2,897,100

|

|

|

16,185,942

|

|

United Capital Markets, Inc. 2003-A, 2.300% 11/8/27 interest-only strips †#

|

|

|

647,438

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3,606,851

|

|

|

|

|

|

|

|

|

|

|

|

|

Manufactured Housing - 1.4%

|

|

|

|

|

|

2,137,288

|

|

Mid-State Trust 2005-1 B, 7.758% 1/15/40

|

|

|

1,933,756

|

|

|

|

|

|

|

|

|

|

|

Total Asset-Backed Securities - Investment Grade (cost $64,960,024)

|

|

|

17,544,220

|

|

|

|

|

|

|

|

|

|

|

ASSET-BACKED SECURITIES - BELOW INVESTMENT GRADE OR UNRATED - 14.0% OF NET ASSETS

|

|

|

|

|

|

|

|

Certificate-Backed Obligations (“CBO”) - 0.1%

|

|

|

|

|

|

2,329,301

|

|

Helios Series I Multi-Asset CBO, Ltd. IA C, 7.706% 12/13/36 †#

|

|

|

122,288

|

|

|

|

|

Collateralized Debt Obligations (“CDO”) - 7.8%

|

|

|

|

|

|

1,000,000

|

|

801 Grand CDO 2006-1 LLC, 10.926% 9/20/16 †#

|

|

|

827,500

|

|

|

1,000,000

|

|

Aardvark Asset-Backed Securities CDO 2007-1A, Zero Coupon Bond 7/6/47 #

|

|

|

35,000

|

|

|

3,000,000

|

|

Acacia CDO, Ltd. 10A, 4.570% 9/7/46 †#

|

|

|

142,500

|

|

|

4,000,000

|

|

Aladdin CDO I Ltd. 2006-3A, 9.926% 10/31/13 †#

|

|

|

1,250,000

|

|

|

270,000

|

|

Attentus CDO Ltd. 2006-2A E2, 8.395% 10/9/41 #

|

|

|

46,575

|

|

|

2,000,000

|

|

Attentus CDO Ltd. 2006-2A F1, 10.243% 10/9/41 †#

|

|

|

190,000

|

|

|

680,000

|

|

Attentus CDO Ltd. 2006-2A F2, 10.295% 10/9/41 #

|

|

|

30,600

|

|

|

3,000,000

|

|

Attentus CDO Ltd. 2007-3A F2, 9.532% 10/11/42 †#

|

|

|

225,000

|

RMK STRATEGIC INCOME FUND, INC.

Portfolio of Investments

December 31, 2007 (Unaudited)

|

|

|

|

|

|

|

Principal

Amount/

Shares

|

|

Description

|

|

Value ‡

|

|

1,983,734

|

|

Broderick CDO Ltd. 2007-3A D, Zero Coupon Bond 12/6/50 †#

|

|

198

|

|

1,000,000

|

|

Cairn Mezzanine Asset-Backed CDO PLC 2007-3A, 10.000% 8/13/47 #

|

|

15,000

|

|

4,000,000

|

|

Dillon Read CDO Ltd. 2006-1A, 13.000% 12/5/46 †#

|

|

1,600,000

|

|

1,000,000

|

|

Gulf Stream Atlantic CDO Ltd. 2007-1A, 19.957% 7/13/47 †#

|

|

30,000

|

|

1,000,000

|

|

IXIS ABS 1 Ltd., 8.120% 12/12/46 †#

|

|

40,000

|

|

13,000,000

|

|

Kenmore Street Synthetic CDO 2006-1A, 9.926% 4/30/14 †#

|

|

2,567,500

|

|

972,743

|

|

Knollwood CDO Ltd. 2006-2A E, 11.243% 7/13/46 †#

|

|

19,455

|

|

3,000,000

|

|

Knollwood CDO Ltd. 2006-2A SN, 22.683% 7/13/46 #

|

|

15,000

|

|

4,000,000

|

|

Kodiak CDO 2006-1A, Zero Coupon Bond 8/7/37 †#

|

|

330,000

|

|

3,000,000

|

|

Kodiak CDO 2006-1A G, Zero Coupon Bond 8/7/37 †#

|

|

285,000

|

|

2,903,720

|

|

Lexington Capital Funding Ltd. 2007-3A F, 8.753% 4/10/47 †#

|

|

174,223

|

|

2,500,000

|

|

Lincoln Avenue Asset-Backed Securities CDO Ltd., Zero Coupon Bond 7/5/46 †#

|

|

75,000

|

|

1,961,789

|

|

Norma CDO Ltd. 2007-1A E, 9.541% 3/11/49 †#

|

|

88,280

|

|

1,981,373

|

|

Orchid Structured Finance CDO Ltd. 2006-3A E, 8.994% 1/6/46 †#

|

|

158,510

|

|

1,500,000

|

|

Trapeza CDO I LLC 2006-10A, 5.824% 6/6/41 #

|

|

277,500

|

|

2,000,000

|

|

Trapeza CDO I LLC 2006-10A D2, 8.700% 6/6/41 †#

|

|

910,000

|

|

2,000,000

|

|

Trapeza CDO I LLC 2006-11A, 13.600% 10/10/41 #

|

|

230,000

|

|

2,000,000

|

|

Trapeza CDO I LLC 2006-11A F, 10.204% 10/10/41 #

|

|

460,000

|

|

1,400,000

|

|

Tropic CDO V, 8.540% 7/15/36 †#

|

|

553,000

|

|

|

|

|

|

|

|

|

|

|

|

10,575,841

|

|

|

|

|

|

|

|

|

|

Equipment Leases - 4.3%

|

|

|

|

8,438,000

|

|

Aerco Limited 1X C1, Zero Coupon Bond 7/15/23 #

|

|

210,950

|

|

7,123,631

|

|

Aerco Limited 2A B2, Zero Coupon Bond 7/15/25 †#

|

|

1,674,053

|

|

9,511,931

|

|

Aerco Limited 2A C2, Zero Coupon Bond 7/15/25 †#

|

|

570,716

|

|

638,095

|

|

DVI Receivables Corp. 2001-2 A3, 3.519% 11/8/31 #

|

|

242,476

|

|

895,475

|

|

DVI Receivables Corp. 2001-2 A4, 4.613% 11/11/09 #

|

|

358,190

|

|

3,426,543

|

|

DVI Receivables Corp. 2002-1 A3A, 5.588% 6/11/10 #

|

|

1,027,963

|

|

2,741,094

|

|

Guggenheim Equipment Trust 2007-1A, 11.193% 7/15/31 †#

|

|

1,765,539

|

|

|

|

|

|

|

|

|

|

|

|

5,849,887

|

|

|

|

|

|

|

|

|

|

Home Equity Loans - 1.7%

|

|

|

|

355,643

|

|

Aames Mortgage Trust 2001-3 B, 7.130% 11/25/31 #

|

|

51,568

|

|

121,028

|

|

ACE Securities Corp. 2004-HS1 M6, 8.365% 2/25/34

|

|

6,680

|

|

921,999

|

|

Amresco Residential Securities Mortgage Loan Trust 1999-1 B, 8.865% 11/25/29

|

|

220,354

|

|

2,325,700

|

|

Asset-Backed Securities Corp. Home Equity 2002-HE3 M4, 9.152% 10/15/32

|

|

499,053

|

|

1,793,798

|

|

Equifirst Mortgage Loan Trust 2003-1 M3, 8.615% 12/25/32

|

|

518,555

|

|

3,000,000

|

|

Meritage Asset Holdings 2005-2 N4, 7.500% 11/25/35 †#

|

|

18,000

|

|

2,000,000

|

|

Meritage Mortgage Loan Trust 2005-3 B2, 7.865% 1/25/36 †#

|

|

207,000

|

|

873,740

|

|

Terwin Mortgage Trust 2005-11SL B7, Zero Coupon Bond 11/25/36 †#

|

|

26,212

|

|

1,740,219

|

|

Terwin Mortgage Trust 2005-3SL B6, 2.500% 3/25/35 interest-only strips #

|

|

26,103

|

|

932,654

|

|

Terwin Mortgage Trust 2005-7SL, Zero Coupon Bond 7/25/35 †#

|

|

93

|

|

3,000,000

|

|

Terwin Mortgage Trust 2005-R1, Zero Coupon Bond 12/28/36 †#

|

|

58,650

|

|

2,000,000

|

|

Terwin Mortgage Trust 2006-R3, 0.419% 6/26/37 †#

|

|

2,500

|

|

1,500,000

|

|

Terwin Mortgage Trust 2007-3SL B3, 6.000% 5/25/38 †#

|

|

225,000

|

|

1,128,964

|

|

Structured Asset Securities Corp. 2006-ARS1 A1, 4.975% 2/25/36 †

|

|

402,869

|

|

|

|

|

|

|

|

|

|

|

|

2,262,637

|

|

|

|

|

|

|

|

|

|

Manufactured Housing Loans - 0.1%

|

|

|

|

218,630

|

|

Greenpoint Manufactured Housing 2000-1 M2, 8.780% 3/20/30

|

|

1,495

|

|

|

|

|

|

|

|

Total Asset-Backed Securities - Below Investment Grade or Unrated (cost $92,283,013)

|

|

18,812,148

|

|

|

|

|

|

|

|

CORPORATE BONDS - INVESTMENT GRADE - 8.5% OF NET ASSETS

|

|

|

RMK STRATEGIC INCOME FUND, INC.

Portfolio of Investments

December 31, 2007 (Unaudited)

|

|

|

|

|

|

|

Principal

Amount/

Shares

|

|

Description

|

|

Value ‡

|

|

|

|

Finance - 0.8%

|

|

|

|

1,150,000

|

|

Catlin Insurance Company Ltd., 7.249% 12/31/49 †

|

|

1,051,446

|

|

|

|

Insurance - 0.2%

|

|

|

|

500,000

|

|

Security Capital Assurance Ltd., 6.880% 6/17/49 †#

|

|

250,000

|

|

|

|

Special Purpose Entities - 7.5%

|

|

|

|

2,000,000

|

|

Fixed Income Pass-Through Trust 2007-C JPM Class B, 8.291% 5/15/77 †#

|

|

660,000

|

|

2,000,000

|

|

Lincoln Park Referenced Link Notes 2001-1, 8.404% 7/30/31 †#

|

|

1,412,880

|

|

1,500,000

|

|

Parcs-R 2007-8, 7.365% 1/25/46 †

|

|

1,134,600

|

|

1,000,000

|

|

Preferred Term Securities XXVIII, Ltd., 6.293% 3/22/38 †#

|

|

870,000

|

|

2,991,609

|

|

Pyxis Master Trust 2006-7, 9.631% 10/1/37 †#

|

|

239,329

|

|

6,000,000

|

|

Steers Delaware Business Trust 2007-A, 7.243% 6/20/18 †#

|

|

5,775,000

|

|

|

|

|

|

|

|

|

|

|

|

10,091,809

|

|

|

|

|

|

|

|

Total Corporate Bonds - Investment Grade (cost $16,562,092)

|

|

11,393,255

|

|

|

|

|

|

|

|

CORPORATE BONDS - BELOW INVESTMENT GRADE OR UNRATED - 57.7% OF NET ASSETS

|

|

|

|

|

|

Agriculture - 0.3%

|

|

|

|

675,000

|

|

Eurofresh Inc., 11.500% 1/15/13 †

|

|

405,000

|

|

|

|

Apparel - 2.6%

|

|

|

|

3,817,000

|

|

Rafaella Apparel Group Inc., 11.250% 6/15/11

|

|

3,511,640

|

|

|

|

Automotives - 4.5%

|

|

|

|

3,420,000

|

|

Cooper Standard Automotive, Inc., 8.375% 12/15/14

|

|

2,710,350

|

|

1,375,000

|

|

Dana Corp., 3/15/10 in default ~

|

|

1,017,500

|

|

3,575,000

|

|

Metaldyne Corp., 11.000% 6/15/12

|

|

2,305,875

|

|

|

|

|

|

|

|

|

|

|

|

6,033,725

|

|

|

|

|

|

|

|

|

|

Basic Materials - 7.0%

|

|

|

|

2,575,000

|

|

AmeriCast Technologies Inc., 11.000% 12/1/14 †

|

|

2,375,438

|

|

2,850,000

|

|

Key Plastics LLC, 11.750% 3/15/13 †

|

|

2,280,000

|

|

1,792,000

|

|

Millar Western Forest Products Ltd., 7.750% 11/15/13

|

|

1,335,040

|

|

2,875,000

|

|

Momentive Performance Materials Inc., 11.500% 12/1/16 †

|

|

2,486,875

|

|

1,150,000

|

|

Noranda Aluminium Holding Corp., Zero Coupon Bond 11/15/14 †

|

|

977,500

|

|

|

|

|

|

|

|

|

|

|

|

9,454,853

|

|

|

|

|

|

|

|

|

|

Building & Construction - 1.1%

|

|

|

|

1,475,000

|

|

Dayton Superior Corporation, 13.000% 6/15/09

|

|

1,375,438

|

|

175,000

|

|

Ply Gem Industries Inc., 9.000% 2/15/12

|

|

135,625

|

|

|

|

|

|

|

|

|

|

|

|

1,511,063

|

|

|

|

|

|

|

|

|

|

Communications - 1.6%

|

|

|

|

3,450,000

|

|

CCH I Holdings LLC, 11.750% 5/15/14

|

|

2,182,125

|

|

|

|

Consulting Services - 2.2%

|

|

|

|

3,200,000

|

|

MSX International Inc., 12.500% 4/1/12 †

|

|

2,976,000

|

|

|

|

Entertainment - 2.0%

|

|

|

|

2,000,000

|

|

French Lick Resorts & Casino LLC, 10.750% 4/15/14 †

|

|

1,460,000

|

|

1,675,000

|

|

Six Flags Inc., 9.625% 6/1/14

|

|

1,235,313

|

|

|

|

|

|

|

|

|

|

|

|

2,695,313

|

|

|

|

|

|

|

|

|

|

Finance - 2.0%

|

|

|

|

2,450,000

|

|

Advanta Capital Trust I, 8.990% 12/17/26

|

|

1,739,500

|

|

1,000,000

|

|

Asure Float, 10.500% 12/31/35 †#

|

|

980,000

|

|

|

|

|

|

|

|

|

|

|

|

2,719,500

|

|

|

|

|

|

|

|

|

|

Garden Products - 0.6%

|

|

|

|

1,675,000

|

|

Ames True Temper, 10.000% 7/15/12

|

|

921,250

|

RMK STRATEGIC INCOME FUND, INC.

Portfolio of Investments

December 31, 2007 (Unaudited)

|

|

|

|

|

|

|

Principal

Amount/

Shares

|

|

Description

|

|

Value ‡

|

|

|

|

Hotels - 0.6%

|

|

|

|

1,200,000

|

|

Trump Entertainment Resorts Inc., 8.500% 6/1/15

|

|

913,500

|

|

|

|

Industrials - 1.9%

|

|

|

|

341,566

|

|

Home Products Inc., pays-in-kind 3/20/17 #

|

|

232,289

|

|

300,000

|

|

Masonite Corporation, 11.000% 4/6/15

|

|

234,000

|

|

2,240,000

|

|

Terphane Holding Corp., 12.500% 6/15/09 †

|

|

2,060,800

|

|

|

|

|

|

|

|

|

|

|

|

2,527,089

|

|

|

|

|

|

|

|

|

|

Investment Companies - 0.2%

|

|

|

|

1,000,000

|

|

Regional Diversified Funding, Zero Coupon Bond 1/25/36 †#

|

|

320,000

|

|

|

|

Manufacturing - 5.1%

|

|

|

|

725,000

|

|

BGF Industries Inc., 10.250% 1/15/09

|

|

706,875

|

|

3,000,000

|

|

JB Poindexter & Co. Inc., 8.750% 3/15/14

|

|

2,512,500

|

|

3,400,000

|

|

MAAX Corp., 6/15/12 in default ~

|

|

816,000

|

|

1,800,000

|

|

Propex Fabrics Inc., 10.000% 12/1/12

|

|

810,000

|

|

2,125,000

|

|

Wolverine Tube, Inc., 10.500% 4/1/09

|

|

2,018,750

|

|

|

|

|

|

|

|

|

|

|

|

6,864,125

|

|

|

|

|

|

|

|

|

|

Oil & Natural Gas - 1.3%

|

|

|

|

1,500,000

|

|

Seametric International, 11.625% 5/25/12 †#

|

|

1,380,000

|

|

|

|

Paper Products - 2.2%

|

|

|

|

1,825,000

|

|

Corp Durango SAB de CV, 10.500% 10/5/17 †

|

|

1,651,625

|

|

1,475,000

|

|

Mercer International Inc., 9.250% 2/15/13

|

|

1,349,625

|

|

|

|

|

|

|

|

|

|

|

|

3,001,250

|

|

|

|

|

|

|

|

|

|

Real Estate Services - 1.7%

|

|

|

|

3,550,000

|

|

Realogy Corp., 12.375% 4/15/15 †

|

|

2,236,500

|

|

|

|

Retail - 3.3%

|

|

|

|

1,361,000

|

|

Lazydays RV Center Inc., 11.750% 5/15/12

|

|

1,170,460

|

|

500,000

|

|

Rare Restaurant Group LLC/RRG Finance Corp., 9.250% 5/15/14 †

|

|

462,500

|

|

2,390,000

|

|

Uno Restaurant Corp., 10.000% 2/15/11 †

|

|

1,768,600

|

|

2,000,000

|

|

VICORP Restaurants, Inc., 10.500% 4/15/11

|

|

1,020,000

|

|

|

|

|

|

|

|

|

|

|

|

4,421,560

|

|

|

|

|

|

|

|

|

|

Special Purpose Entities - 12.1%

|

|

|

|

1,750,000

|

|

Duane Park I, Ltd., Zero Coupon Bond 6/27/16 †#

|

|

665,000

|

|

2,000,000

|

|

Eirles Two Ltd. 262, 10.378% 8/3/21 #

|

|

1,500,000

|

|

3,500,000

|

|

Eirles Two Ltd. 263, 12.878% 8/3/21 #

|

|

2,380,000

|

|

695,000

|

|

Interactive Health LLC, 7.250% 4/1/11 †

|

|

486,500

|

|

1,500,000

|

|

MCBC Holdings Inc., 11.521% 10/15/14 †

|

|

1,440,000

|

|

3,900,000

|

|

PNA Intermediate Holding Corp., 11.869% 2/15/13 †

|

|

3,529,500

|

|

1,000,000

|

|

Preferred Term Securities II, Ltd., 10.000% 5/22/33 †#

|

|

490,000

|

|

3,000,000

|

|

Preferred Term Securities XXI, Ltd., 24.250% 3/22/38 †#

|

|

840,000

|

|

999,070

|

|

Preferred Term Securities XXI-2TR, 9.999% 3/22/38 †#

|

|

569,470

|

|

2,400,000

|

|

Preferred Term Securities XXII, Ltd., 10.000% 9/22/36 †

|

|

908,400

|

|

3,200,000

|

|

Preferred Term Securities XXIII, Ltd., 10.000% 12/22/36 †

|

|

1,460,800

|

|

2,000,000

|

|

Preferred Term Securities XXVIII, Ltd., 10.000% 3/22/38 †#

|

|

1,860,000

|

|

997,523

|

|

Pyxis Master Trust, 9.631% 10/1/37 †#

|

|

79,802

|

|

|

|

|

|

|

|

|

|

|

|

16,209,472

|

|

|

|

|

|

|

|

|

|

Telecommunications - 3.9%

|

|

|

|

3,975,000

|

|

Primus Telecommunications GP, 8.000% 1/15/14

|

|

2,176,313

|

|

2,075,000

|

|

Securus Technologies Inc., 11.000% 9/1/11

|

|

1,805,250

|

|

1,500,000

|

|

Securus Technologies Inc., 11.000% 9/1/11

|

|

1,305,000

|

|

|

|

|

|

|

|

|

|

|

|

5,286,563

|

|

|

|

|

|

|

RMK STRATEGIC INCOME FUND, INC.

Portfolio of Investments

December 31, 2007 (Unaudited)

|

|

|

|

|

|

|

Principal

Amount/

Shares

|

|

Description

|

|

Value ‡

|

|

|

|

Tobacco - 1.5%

|

|

|

|

2,625,000

|

|

North Atlantic Trading Co., 9.250% 3/1/12

|

|

1,942,500

|

|

|

|

|

|

|

|

Total Corporate Bonds - Below Investment Grade or Unrated (cost $101,489,739)

|

|

77,513,028

|

|

|

|

|

|

|

|

MORTGAGE-BACKED SECURITIES - INVESTMENT GRADE - 22.1% OF NET ASSETS

|

|

|

|

|

|

Collateralized Mortgage Obligations - 22.1%

|

|

|

|

33,186,074

|

|

Banc of America Funding Corp. 2007- E 8A5, 0.500% 9/20/47 interest-only strips #

|

|

408,521

|

|

565,706

|

|

Countrywide Alternative Loan Trust 2005-49CB A5, 5.500% 11/25/35

|

|

529,143

|

|

1,991,450

|

|

Countrywide Alternative Loan Trust 2005-56 M4, 5.785% 11/25/35 #

|

|

955,896

|

|

84,338,923

|

|

Countrywide Alternative Loan Trust 2006-OA17 2X, 0.585% 12/20/46 interest-only strips #

|

|

4,216,946

|

|

20,796,287

|

|

Countrywide Alternative Loan Trust 2006-OA21 X, 2.765% 3/20/47 interest only-strips #

|

|

1,156,897

|

|

35,520,266

|

|

Countrywide Alternative Loan Trust 2007-OA8 X 2.000% 6/25/47 interest-only strips #

|

|

1,243,209

|

|

3,000,000

|

|

Deutsche Mortgage Securities, Inc. 2006-RS1 N2, 6.446% 9/27/35 †#

|

|

1,950,000

|

|

5,234,904

|

|

Harborview Mortgage Loan Trust 2004-1 X, 1.691% 4/19/34 interest-only strips

|

|

119,256

|

|

36,183,435

|

|

Harborview Mortgage Loan Trust 2005-16 X4, 0.003% 1/19/36 interest-only strips #

|

|

547,817

|

|

35,516,952

|

|

Harborview Mortgage Loan Trust 2006-5 X1, 1.939% 7/19/47 interest-only strips #

|

|

1,415,351

|

|

37,100,031

|

|

Lehman XS Trust 2007-4N 3AX, 2.931% 3/25/47 interest-only strips #

|

|

2,934,241

|

|

13,987,395

|

|

Mellon Residential Funding Corp. 2004-TBC1 X, 0.237% 2/26/34 interest-only strips †#

|

|

146,868

|

|

45,873,426

|

|

Residential Accredit Loans Inc. 2006-Q05 XC, 1.347% 5/25/46 interest-only strips #

|

|

1,400,516

|

|

38,221,957

|

|

Residential Accredit Loans Inc. 2006-Q05 XN, 1.759% 5/25/46 interest-only strips #

|

|

1,509,767

|

|

114,980,018

|

|

Residential Accredit Loans Inc. 2007-QH8 P, 0.500% 10/25/37 interest-only strips #

|

|

525,459

|

|

114,980,016

|

|

Residential Accredit Loans Inc. 2007-QH8 X, 0.981% 10/25/37 interest-only strips #

|

|

3,939,215

|

|

53,243,722

|

|

Structured Asset Mortgage Investments Inc. 2006-AR1 3X, 1.200% 2/25/36 interest-only strips #

|

|

1,404,569

|

|

3,000,000

|

|

Structured Asset Mortgage Investments Inc. 2006-AR3 1B1, 5.265% 4/25/36

|

|

2,446,662

|

|

116,579

|

|

Structured Asset Investment Loan Trust 2004-5A B, Zero Coupon Bond 6/27/34 †#

|

|

1,574

|

|

834,062

|

|

Structured Asset Securities Corp. 1999-SP1, 9.000% 5/25/29

|

|

576,358

|

|

418,779,414

|

|

Washington Mutual, Inc. 2006-AR4 2X, 1.212% 5/25/46 interest-only strips #

|

|

255,887

|

|

12,041,725

|

|

Washington Mutual, Inc. 2006-AR4 PPP, Zero Coupon Bond 5/25/46 interest-only strips #

|

|

293,146

|

|

79,281,088

|

|

Washington Mutual, Inc. 2007-0A3 CX2P, 0.800% 2/25/47 interest-only strips #

|

|

1,702,958

|

|

|

|

|

|

|

|

Total Mortgage-Backed Securities - Investment Grade (cost $32,976,116)

|

|

29,680,256

|

|

|

|

|

|

|

|

MORTGAGE-BACKED SECURITIES - BELOW INVESTMENT GRADE OR UNRATED - 8.8% OF NET ASSETS

|

|

|

|

|

|

Collateralized Mortgage Obligations - 8.8%

|

|

|

|

2,517,087

|

|

Countrywide Alternative Loan Trust 2006-6CB B4, 5.576% 5/25/36 #

|

|

614,698

|

|

2,000,000

|

|

Countrywide Alternative Loan Trust 2006-OA11 N3, 12.500% 9/25/46 † #

|

|

1,110,000

|

|

3,000,000

|

|

Greenwich Structured Adjustable Rate Mortgage Products 2005-3A N2, 2.000% 6/27/35 †#

|

|

1,425,000

|

|

6,000,000

|

|

Greenwich Structured Adjustable Rate Mortgage Products 2005-4A N-2, Zero Coupon Bond 7/27/45 †#

|

|

2,700,000

|

|

2,959,362

|

|

Harborview Mortgage Loan Trust 2006-4 B11, 6.715% 5/19/47 †#

|

|

364,712

|

|

4,979,598

|

|

Harborview Mortgage Loan Trust 2006-5 B1, 6.715% 7/19/47 #

|

|

640,376

|

|

1,000,000

|

|

Harborview Corp. 2006-14 N4, 8.350% 3/19/38 †#

|

|

180,000

|

|

5,000,000

|

|

Harborview Corp. 2006-14 PS, Zero Coupon Bond 12/19/36 †#

|

|

872,300

|

|

2,000,000

|

|

Harborview Corp. 2006-8A N5, Zero Coupon Bond 7/21/36 †#

|

|

260,940

|

|

5,000,000

|

|

Long Beach Asset Holdings Corp. 2005-WL1 N4, 7.500% 6/25/45 †#

|

|

160,000

|

|

3,000,000

|

|

Long Beach Mortgage Loan Trust 2005-WL2 B3, 7.283% 8/25/35 †#

|

|

112,500

|

|

574,299

|

|

Meritage Mortgage Loan Trust 2004-2 B1, 8.115% 1/25/35 †#

|

|

9,763

|

|

1,021,575

|

|

Park Place Securities Inc. 2005-WCW1 B, 5.000% 9/25/35 †#

|

|

25,539

|

|

5,000,000

|

|

Park Place Securities Inc. 2005-WCW2 M10, 7.365% 7/25/35 #

|

|

656,500

|

|

3,000,000

|

|

Park Place Securities Inc. 2005-WHQ3 M11, 7.365% 6/25/35 #

|

|

1,290,000

|

|

1,000,000

|

|

Park Place Securities Inc. 2005-WHQ4, 7.365% 9/25/35 †#

|

|

192,500

|

RMK STRATEGIC INCOME FUND, INC.

Portfolio of Investments

December 31, 2007 (Unaudited)

|

|

|

|

|

|

|

Principal

Amount/

Shares

|

|

Description

|

|

Value ‡

|

|

1,000,000

|

|

Sharp SP I LLC Trust 2006-A HM3 N3, 12.500% 10/25/46 †#

|

|

902,800

|

|

1,423,000

|

|

Structured Asset Investment Loan Trust 2003-BC1 B2, 9.000% 5/25/32

|

|

189,663

|

|

1,053,973

|

|

Structured Asset Securities Corp. 2004-S3 M9, 6.000% 11/25/34 †#

|

|

98,020

|

|

|

|

|

|

|

|

Total Mortgage-Backed Securities - Below Investment Grade or Unrated (cost $35,585,640)

|

|

11,805,311

|

|

|

|

|

|

|

|

MUNICIPAL SECURITIES - 0.1% OF NET ASSETS

|

|

|

|

13,185

|

|

Pima County Arizona Health Care Facilities, Revenue Bonds, 6.000% 6/1/08

|

|

12,478

|

|

24,836

|

|

Pima County Arizona Health Care Facilities, Revenue Bonds, 6.274% 6/1/09

|

|

20,608

|

|

35,126

|

|

Pima County Arizona Health Care Facilities, Revenue Bonds, 6.455% 6/1/10

|

|

26,314

|

|

|

|

|

|

|

|

Total Municipal Securities (cost $67,845)

|

|

59,400

|

|

|

|

|

|

|

|

COMMON STOCKS - 8.3% OF NET ASSETS

|

|

|

|

|

|

Basic Materials - 0.3%

|

|

|

|

27,000

|

|

Horsehead Holdings ~

|

|

458,190

|

|

|

|

Communications - 0.3%

|

|

|

|

14,100

|

|

Citizens Communications Company

|

|

179,493

|

|

9,076

|

|

TerreStar Corporation ~

|

|

65,801

|

|

9,300

|

|

Windstream Corporation

|

|

121,086

|

|

|

|

|

|

|

|

|

|

|

|

366,380

|

|

|

|

|

|

|

|

|

|

Consumer Products - 0.4%

|

|

|

|

13,663

|

|

Home Products #~

|

|

410

|

|

189,000

|

|

Insight Health Services Holdings Corp ~

|

|

567,000

|

|

|

|

|

|

|

|

|

|

|

|

567,410

|

|

|

|

|

|

|

|

|

|

Energy - 0.9%

|

|

|

|

1,100

|

|

Diamond Offshore Drilling, Inc.

|

|

156,200

|

|

11,800

|

|

Legacy Reserves LP

|

|

244,260

|

|

200

|

|

NuStar Energy L.P.

|

|

10,660

|

|

151,500

|

|

Pinnacle Gas Resources, Inc. ~

|

|

693,870

|

|

2,300

|

|

Williams Partners L.P.

|

|

90,160

|

|

|

|

|

|

|

|

|

|

|

|

1,195,150

|

|

|

|

|

|

|

|

|

|

Financials - 3.5%

|

|

|

|

15,100

|

|

Apollo Investment Corporation

|

|

257,455

|

|

13,700

|

|

Compass Diversified Trust

|

|

204,130

|

|

26,200

|

|

FSI Realty Trust †~

|

|

52,400

|

|

262,000

|

|

FSI Realty Trust Regulation D †~

|

|

524,000

|

|

43,648

|

|

Grubb & Ellis Company

|

|

279,784

|

|

21,600

|

|

KKR Financial Corp.

|

|

303,480

|

|

37,600

|

|

Maiden Holdings †

|

|

300,800

|

|

15,100

|

|

MFA Mortgage Investments, Inc.

|

|

139,675

|

|

42,647

|

|

Mid Country †#~

|

|

724,999

|

|

167,000

|

|

Muni Funding Co. †~

|

|

1,002,000

|

|

93,500

|

|

Star Asia Financial Ltd. †

|

|

864,875

|

|

9,000

|

|

TICC Capital Corp.

|

|

83,070

|

|

|

|

|

|

|

|

|

|

|

|

4,736,668

|

|

|

|

|

|

|

|

|

|

Industrial - 1.2%

|

|

|

|

7,900

|

|

Aircastle Limited

|

|

208,007

|

|

91,386

|

|

Intermet Corporation #~

|

|

10,966

|

|

10,800

|

|

OceanFreight Inc.

|

|

207,684

|

|

53,900

|

|

Orion Marine Group ~

|

|

808,500

|

|

1,050

|

|

Port Townsend Paper Corp. ~

|

|

420,000

|

|

|

|

|

|

1,655,157

|

|

|

|

|

|

|

RMK STRATEGIC INCOME FUND, INC.

Portfolio of Investments

December 31, 2007 (Unaudited)

|

|

|

|

|

|

|

|

|

Principal

Amount/

Shares

|

|

Description

|

|

Value ‡

|

|

|

|

|

Insurance - 0.1%

|

|

|

|

|

|

333

|

|

Providence Washington Insurance Companies #~

|

|

|

67

|

|

|

|

|

Technology - 1.6%

|

|

|

|

|

|

298,800

|

|

Banctec Inc. †~

|

|

|

1,792,800

|

|

|

37,864

|

|

Ness Technologies, Inc. ~

|

|

|

349,485

|

|

|

5,193

|

|

Taiwan Semiconductor Manufacturing Company Ltd.

|

|

|

51,722

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,194,007

|

|

|

|

|

|

|

|

|

|

|

Total Common Stocks (cost $21,897,921)

|

|

|

11,173,029

|

|

|

|

|

|

|

|

|

|

|

PREFERRED STOCKS - 2.1% OF NET ASSETS

|

|

|

|

|

|

1,000

|

|

Credit Genesis CLO 2005 †#

|

|

|

650,000

|

|

|

9

|

|

Harborview 2006-8 †#~

|

|

|

1

|

|

|

67,000

|

|

Indymac Indx CI-1 Corp. †#~

|

|

|

82,409

|

|

|

2,725

|

|

Terrestar Corporation

|

|

|

2,043,750

|

|

|

2,000

|

|

WEBS CDO 2006-1 PS †#

|

|

|

20

|

|

|

|

|

|

|

|

|

|

|

Total Preferred Stocks (cost $6,857,359)

|

|

|

2,776,180

|

|

|

|

|

|

|

|

|

|

|

EURODOLLAR TIME DEPOSITS - 4.7% OF NET ASSETS

|

|

|

|

|

|

|

|

State Street Bank & Trust Company Eurodollar time deposits dated December 31, 2007, 3.150% maturing at $6,301,103 on January 2, 2008.

|

|

|

6,300,000

|

|

|

|

|

|

|

|

|

|

|

Total Investments - 139.4% of Net Assets (cost $378,979,749)

|

|

|

187,056,827

|

|

|

|

|

|

|

|

|

|

|

Other Assets and Liabilities, net - (39.4%) of Net Assets

|

|

|

(52,902,189

|

)

|

|

|

|

|

|

|

|

|

|

Net Assets

|

|

$

|

134,154,638

|

|

|

|

|

|

|

|

|

|

|

†

|

Securities sold within the terms of a private placement memorandum, exempt from registration under Rule 144A under the Securities Act of 1933, as amended, and may be resold in

transactions exempt from registration, normally to qualified institutional buyers.

|

|

‡

|

See Notes to the Schedule of Investments regarding investment valuations.

|

|

~

|

Non-income producing security.

|

|

#

|

Security valued at fair value.

|

All of the Fund’s

investment securities, other than equity securities, are pledged as collateral under the line of credit.

Notes to the Schedule of Investments

(Unaudited)

Investment Valuations

—Investments in securities listed or traded on a securities

exchange are valued at the last quoted sales price on the exchange where the security is primarily traded as of the close of business on the New York Stock Exchange, usually 4:00 p.m. Eastern Time, on the valuation date. Equity securities traded on

the Nasdaq Stock Market are valued at the Nasdaq Official Closing Price (“NOCP”) provided by Nasdaq each business day. The NOCP is the most recently reported price as of 4:00:02 p.m. Eastern Time, unless that price is outside the range of

the “inside” bid and asked price (

i.e.

, the bid and asked prices that dealers quote to each other when trading for their own accounts); in that case, Nasdaq will adjust the price to equal the inside bid or asked price, whichever is

closer. Because of delays in reporting trades, the NOCP may not be the last trade to occur before the market closes. Securities traded in the over-the-counter market and listed securities for which no sales were reported for that date are valued at

the last-quoted bid price.

Equity and debt securities issued in private placements are valued on the bid side by a primary market dealer. Long-term debt

securities (including U.S. government securities, listed corporate bonds, other debt and asset-backed securities, and unlisted securities and private placement securities) are generally valued at the latest price furnished by an independent pricing

service or primary market dealer. Short-term debt securities with remaining maturities of more than 60 days for which market quotations are readily available are valued by an independent pricing service or primary market dealer. Short-term debt

securities with remaining maturities of 60 days or less are valued at cost with interest accrued or discount accreted to the date of maturity, unless such valuation, in the judgment of Morgan Asset Management, Inc.’s (the “Adviser”)

Valuation Committee, does not represent market value.

Investments in open-end registered investment companies, if any, are valued at net asset value as

reported by those investment companies. Foreign securities denominated in foreign currencies, if any, are translated from the local currency into U.S. dollars using current exchange rates.

Investments for which market quotations are not readily available, or if available quotations are not believed to be reflective of market value, are valued at fair value

as determined by the Adviser’s Valuation Committee using procedures established by and under the supervision of the Fund’s Board of Directors. The values assigned to fair valued investments are based on available information and do not

necessarily represent amounts that might ultimately be realized, since such amounts depend on future developments inherent in long-term investments. Further, because of the inherent uncertainty of valuation, those estimated values may differ

significantly from the values that would have been used had a ready market for the investments existed, and the differences could be material.

The Fund

may use the fair value of a security to calculate its NAV when, for example, (1) a portfolio security is not traded in a public market or the principal market in which the security trades is closed, (2) trading in a portfolio security is

suspended and not resumed prior to the normal market close, (3) a portfolio security is not traded in significant volume for a substantial period, or (4) the Adviser determines that the quotation or price for a portfolio security provided

by a dealer or independent pricing services is inaccurate.

Among the more specific factors that are considered by the Valuation Committee in determining

the fair value of a security are: (1) type of security; (2) financial statements of the issuer; (3) cost at date of purchase (generally used for initial valuation); (4) size of the Fund’s holding; (5) for restricted

securities, the discount from market value of unrestricted securities of the same class at the time of purchase; (6) the existence of a shelf registration for restricted securities; (7) information as to any transactions or offers with

respect to the security; (8) special reports prepared by analysts; (9) the existence of merger proposals, tender offers or similar events affecting the security; (10) the price and

extent of public trading in similar securities of the issuer or comparable companies; (11) the fundamental analytical data relating to the investment;

(12) the nature and duration of restrictions on disposition of the securities; and (13) evaluation of the forces which influence the market in which these securities are purchased and sold.

There can be no assurance that the Fund could purchase or sell a portfolio security at the price used to calculate the Fund’s NAV. Changes in the fair valuation of

portfolio securities may be less frequent and of greater magnitude than changes in the price of portfolio securities valued at their last sale price, by an independent pricing service, or based on market quotations.

|

Item 2.

|

Controls and Procedures.

|

|

(a)

|

Based on an evaluation of the disclosure controls and procedures (as defined in Rule 30a-3(c) under the 1940 Act), as of a date within 90 days of the filing date of this report, the

Fund’s certifying officers have concluded that such disclosure controls and procedures are reasonably designed to ensure that information required to be disclosed by the Fund on Form N-CSR and Form N-Q is accumulated and communicated to the

Fund’s management to allow timely decisions regarding required disclosure.

|

|

(b)

|

The Fund’s certifying officers are not aware of any changes in the Fund’s internal controls over financial reporting (as defined in Rule 30a-3(d) under the 1940 Act) that

occurred during the Fund’s last fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Fund’s internal controls over financial reporting.

|

The certifications required by Rule 30a-2(a) of the 1940

Act are attached hereto.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of 1940, as amended, the Fund has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

|

|

|

|

|

(Fund):

|

|

RMK Strategic Income Fund, Inc.

|

|

|

|

|

|

|

|

By (Signature and Title):

|

|

/s/ Brian B. Sullivan

|

|

|

|

|

|

Brian B. Sullivan

|

|

|

|

|

|

President and Principal Executive Officer

|

|

|

|

|

|

|

|

Date:

|

|

February 28, 2008

|

|

|

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, and the Investment Company Act of

1940, as amended, this report has been signed below by the following persons on behalf of the Fund and in the capacities and on the dates indicated.

|

|

|

|

|

|

|

By (Signature and Title):

|

|

/s/ Brian B. Sullivan

|

|

|

|

|

|

Brian B. Sullivan

|

|

|

|

|

|

President and Principal Executive Officer

|

|

|

|

|

|

|

|

Date:

|

|

February 28, 2008

|

|

|

|

|

|

|

|

By (Signature and Title):

|

|

/s/ J. Thompson Weller

|

|

|

|

|

|

J. Thompson Weller

|

|

|

|

|

|

Treasurer and Principal Financial Officer

|

|

|

|

|

|

|

|

Date:

|

|

February 28, 2008

|

|

|

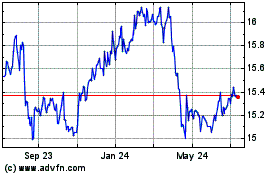

RiverNorth Capital and I... (NYSE:RSF)

Historical Stock Chart

From Jun 2024 to Jul 2024

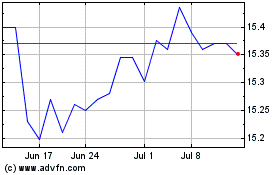

RiverNorth Capital and I... (NYSE:RSF)

Historical Stock Chart

From Jul 2023 to Jul 2024