UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Month of August 2023

| | | | | |

| Commission file number: 001-10533 | Commission file number: 001-34121 |

|

|

| Rio Tinto plc | Rio Tinto Limited |

| ABN 96 004 458 404 |

| (Translation of registrant’s name into English) | (Translation of registrant’s name into English) |

|

|

| 6 St. James’s Square | Level 43, 120 Collins Street |

| London, SW1Y 4AD, United Kingdom | Melbourne, Victoria 3000, Australia |

| (Address of principal executive offices) | (Address of principal executive offices) |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

EXHIBITS

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the undersigned, thereunto duly authorised.

| | | | | | | | | | | |

| Rio Tinto plc | Rio Tinto Limited |

| (Registrant) | (Registrant) |

| | | |

| By | /s/ Andy Hodges | By | /s/ Andy Hodges |

| Name | Andy Hodges | Name | Andy Hodges |

| Title | Company Secretary | Title | Joint Company Secretary |

| | | |

| Date | 1 September 2023 | Date | 1 September 2023 |

| | | |

| | | | | |

| EXHIBIT 99.1

Notice to LSE |

Total voting rights and issued capital

1 August 2023

In accordance with the Financial Conduct Authority’s (FCA) Disclosure Guidance and Transparency Rule 5.6.1R, Rio Tinto plc notifies the market that as of 31 July 2023:

1.Rio Tinto plc’s issued share capital comprised 1,255,879,322 Ordinary shares of 10p each, each with one vote.

2.4,800,902 ordinary shares of 10p each are held in treasury. These shares are not taken into consideration in relation to the payment of dividends and voting at shareholder meetings.

Accordingly the total number of voting rights in Rio Tinto plc is 1,251,078,420. This figure may be used by shareholders (and others with notification obligations) as the denominator for the calculation by which they will determine if they are required to notify their interest in, or a change to their interest in, Rio Tinto plc under the FCA’s Disclosure Guidance and Transparency Rules.

Note:

As at the date of this announcement:

(a)Rio Tinto plc has also issued one Special Voting Share of 10p and one DLC Dividend Share of 10p in connection with its dual listed companies (‘DLC’) merger with Rio Tinto Limited which was designed to place the shareholders of both companies in substantially the same position as if they held shares in a single enterprise owning all of the assets of both companies;

(b)the Special Voting Share facilitates joint voting by shareholders of Rio Tinto plc and Rio Tinto Limited on joint electorate resolutions; and

(c)there are 371,216,214 publicly held Rio Tinto Limited shares in issue which do not form part of the share capital of Rio Tinto plc.

LEI: 213800YOEO5OQ72G2R82

Classification: 2.5 Total number of voting rights and capital disclosed under article 15 of the Transparency Directive

Contacts

Please direct all enquiries to media.enquiries@riotinto.com

| | | | | | | | |

Media Relations, United Kingdom

Matthew Klar M +44 7796 630 637

David Outhwaite M +44 7787 597 493

| Media Relations, Australia

Matt Chambers M +61 433 525 739

Jesse Riseborough M +61 436 653 412

Alyesha Anderson M +61 434 868 118 | Media Relations, Americas

Simon Letendre M +1 514 796 4973

Malika Cherry M +1 418 592 7293 |

Investor Relations, United Kingdom

Menno Sanderse M +44 7825 195 178

David Ovington M +44 7920 010 978

Laura Brooks M +44 7826 942 797 | Investor Relations, Australia

Tom Gallop M +61 439 353 948

Amar Jambaa M +61 472 865 948 | |

Rio Tinto plc

6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000

Registered in England No. 719885

| Rio Tinto Limited

Level 43, 120 Collins Street Melbourne 3000 Australia T +61 3 9283 3333

Registered in Australia ABN 96 004 458 404 | |

This announcement is authorised for release to the market by Steve Allen, Rio Tinto’s Group Company Secretary.

riotinto.com

| | | | | |

| EXHIBIT 99.2

Media Release |

Rio Tinto to acquire Chilean exploration assets and enter joint venture with Codelco

01 August 2023

Rio Tinto has agreed to purchase PanAmerican Silver’s stake in Agua de la Falda S.A. (“Agua de la Falda”), a company with exploration tenements in Chile’s prospective Atacama region, and to enter a joint venture with Corporación Nacional del Cobre de Chile (“Codelco”) to explore and potentially develop Agua de la Falda's assets.

Under the agreement, Rio Tinto will acquire PanAmerican Silver’s 57.74% operating stake in Agua de la Falda for $45 million and the grant of net smelter returns royalties. Rio Tinto will also acquire 100% of nearby concessions known as the Meridian Property for $550,000 and the grant of net smelter returns royalties.

Codelco, which is the world’s largest copper producer and is owned by the Chilean State, holds the remaining 42.26% of Agua de la Falda.

Rio Tinto Chief Executive Jakob Stausholm said “Copper is critical for the global energy transition, which is at the heart of Rio Tinto’s strategy, and Chile is one of the most important sources of world supply as demand for copper in renewables and electrification grows.

“Partnerships are essential to find better ways to provide materials the world needs, and we are pleased we can bring our global exploration capability to a joint venture that will be able to access Codelco’s strong local presence and industry expertise.

“Although this is an early-stage exploration project, we are very excited to be actively exploring in Chile in partnership with Codelco.”

Codelco Chairman Maximo Pacheco said “Codelco welcomes Rio Tinto in Agua de la Falda. This is a remarkable opportunity to put two leading mining companies to work together, leveraging the combined experiences, strengths, and capabilities of each organisation. By joining forces, we can enhance our exploration and development efforts for a highly promising asset.

“Public-private partnerships have proven to be successful for Codelco and Chile for many years, and we are convinced that this is a compelling alternative to move a project forward and to complement the significant exploration and project portfolio being developed exclusively by Codelco.”

The joint venture builds on an underground mining collaboration agreement between Rio Tinto and Codelco signed on 12 October 2022, aimed at encouraging innovations and technology to improve safety, productivity and environmental, social and governance (ESG) outcomes.

Agua de la Falda has previously been explored for precious metals with minimal modern exploration for copper. Analysis by Rio Tinto Exploration indicates it is prospective for new copper discoveries, which will now be the focus of the joint venture.

Contacts

Please direct all enquiries to media.enquiries@riotinto.com

| | | | | | | | |

Media Relations, United Kingdom

Matthew Klar M +44 7796 630 637

David Outhwaite M +44 7787 597 493 | Media Relations, Australia

Matt Chambers M +61 433 525 739

Jesse Riseborough M +61 436 653 412

Alyesha Anderson M +61 434 868 118 | Media Relations, Americas

Simon Letendre M +1 514 796 4973

Malika Cherry M +1 418 592 7293 |

Investor Relations, United Kingdom

Menno Sanderse M +44 7825 195 178

David Ovington M +44 7920 010 978

Laura Brooks M +44 7826 942 797

| Investor Relations, Australia

Tom Gallop M +61 439 353 948

Amar Jambaa M +61 472 865 948 | |

Rio Tinto plc

6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000

Registered in England No. 719885 | Rio Tinto Limited

Level 43, 120 Collins Street Melbourne 3000 Australia T +61 3 9283 3333

Registered in Australia ABN 96 004 458 404 | |

riotinto.com

| | | | | |

| EXHIBIT 99.3

Notice to LSE |

Shareholdings of Persons Discharging Managerial Responsibility (PDMR) / Key Management Personnel (KMP)

4 August 2023

Rio Tinto plc notifies the London Stock Exchange (LSE) of PDMR interests in securities of Rio Tinto plc, in compliance with the EU Market Abuse Regulation. As part of its dual listed company structure, Rio Tinto voluntarily notifies the Australian Securities Exchange (ASX) of material dealings in Rio Tinto plc shares by PDMR / KMP and both the ASX and the LSE of material dealings by PDMR / KMP in Rio Tinto Limited securities.

On 3 August 2023, the following director purchased shares as follows:

| | | | | | | | | | | |

| Security | Name of PDMR / KMP | Number of Shares Acquired | Price Per Share

AUD |

Rio Tinto Limited |

Susan Lloyd-Hurwitz |

436 |

114.52 |

LEI: 213800YOEO5OQ72G2R82

Contacts

Please direct all enquiries to media.enquiries@riotinto.com

| | | | | | | | |

Media Relations, United Kingdom

Matthew Klar M +44 7796 630 637

David Outhwaite M +44 7787 597 493

| Media Relations, Australia

Matt Chambers M +61 433 525 739

Jesse Riseborough M +61 436 653 412

Alyesha Anderson M +61 434 868 118 | Media Relations, Americas

Simon Letendre M +1 514 796 4973

Malika Cherry M +1 418 592 7293 |

Investor Relations, United Kingdom

Menno Sanderse M +44 7825 195 178

David Ovington M +44 7920 010 978

Laura Brooks M +44 7826 942 797 | Investor Relations, Australia

Tom Gallop M +61 439 353 948

Amar Jambaa M +61 472 865 948 | |

Rio Tinto plc

6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000

Registered in England No. 719885

| Rio Tinto Limited

Level 43, 120 Collins Street Melbourne 3000 Australia T +61 3 9283 3333

Registered in Australia ABN 96 004 458 404 | |

This announcement is authorised for release to the market by Steve Allen, Rio Tinto’s Group Company Secretary.

riotinto.com

+ See chapter 19 for defined terms. 01/01/2011 Appendix 3Y Page 1 Rule 3.19A.2 Appendix 3Y Change of Director’s Interest Notice Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public. Introduced 30/09/01 Amended 01/01/11 Name of entity Rio Tinto Limited ABN 96 004 458 404 We (the entity) give ASX the following information under listing rule 3.19A.2 and as agent for the director for the purposes of section 205G of the Corporations Act. Name of Director Susan Lloyd-Hurwitz Date of last notice 1 June 2023 Part 1 - Change of director’s relevant interests in securities In the case of a trust, this includes interests in the trust made available by the responsible entity of the trust Note: In the case of a company, interests which come within paragraph (i) of the definition of “notifiable interest of a director” should be disclosed in this part. Direct or indirect interest Indirect Nature of indirect interest (including registered holder) Note: Provide details of the circumstances giving rise to the relevant interest. Interest in securities held by SOBEDA Pty Ltd as the trustee of IWEUS Balance Trust on behalf of a body corporate controlled by Ms Lloyd-Hurwitz. Date of change 3 August 2023 No. of securities held prior to change Nil Class Ordinary shares Number acquired 436 Rio Tinto Limited ordinary shares (Shares) Number disposed Nil Value/Consideration Note: If consideration is non-cash, provide details and estimated valuation $114.52 per share No. of securities held after change 436 shares Nature of change Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy- back Acquisition of shares by way of on-market trade. EXHIBIT 99.4 Appendix 3Y Change of Director’s Interest Notice

Appendix 3Y Change of Director’s Interest Notice + See chapter 19 for defined terms. Appendix 3Y Page 2 01/01/2011 Part 2 – Change of director’s interests in contracts Note: In the case of a company, interests which come within paragraph (ii) of the definition of “notifiable interest of a director” should be disclosed in this part. Detail of contract N/A Nature of interest N/A Name of registered holder (if issued securities) N/A Date of change N/A No. and class of securities to which interest related prior to change Note: Details are only required for a contract in relation to which the interest has changed N/A Interest acquired N/A Interest disposed N/A Value/Consideration Note: If consideration is non-cash, provide details and an estimated valuation N/A Interest after change N/A Part 3 – +Closed period Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? No If so, was prior written clearance provided to allow the trade to proceed during this period? N/A If prior written clearance was provided, on what date was this provided? N/A

| | | | | |

| EXHIBIT 99.5

Media Release |

Rio Tinto releases interactive map of tailings facilities in alignment with GISTM requirements

04 August 2023

Rio Tinto has today disclosed detailed information on 14 of its global tailings facilities and their progress towards conformance with the Global Industry Standard on Tailings Management (GISTM).

These tailings facilities are those rated Very High or Extreme under GISTM classifications, based on the highest potential consequences in the extremely unlikely event of a failure.

Rio Tinto Chief Technology Officer Mark Davies said "Since the tragic failure of the tailings facility at Brumadinho in Brazil in 2019, the entire industry has been working to improve the way we manage tailings facilities.

"Responsible tailings management is critical to ensure the safety of our people and communities and to protect the environment. It is fundamental for our business and social license. We have made considerable progress since August 2020 towards conformance with the GISTM. We have completed most of the work and have detailed plans to complete outstanding items.

“GISTM has meant a step change in how the industry manages its tailings facilities. Good tailings management is also about transparent partnership, and we have been working with the local communities near our facilities to increase awareness of our management practices and how we can best work together to continue to keep people and the environment safe from harm.”

Details of these facilities and their progress in implementing the requirements of the GISTM can be accessed via an interactive map available at http://www.riotinto.com/tailings.

Contacts

Please direct all enquiries to media.enquiries@riotinto.com

| | | | | | | | |

Media Relations, United Kingdom

Matthew Klar M +44 7796 630 637

David Outhwaite M +44 7787 597 493 | Media Relations, Australia

Matt Chambers M +61 433 525 739

Jesse Riseborough M +61 436 653 412

Alyesha Anderson M +61 434 868 118 | Media Relations, Americas

Simon Letendre M +1 514 796 4973

Malika Cherry M +1 418 592 7293 |

Investor Relations, United Kingdom

Menno Sanderse M +44 7825 195 178

David Ovington M +44 7920 010 978

Laura Brooks M +44 7826 942 797

| Investor Relations, Australia

Tom Gallop M +61 439 353 948

Amar Jambaa M +61 472 865 948 | |

Rio Tinto plc

6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000

Registered in England No. 719885 | Rio Tinto Limited

Level 43, 120 Collins Street Melbourne 3000 Australia T +61 3 9283 3333

Registered in Australia ABN 96 004 458 404 | |

riotinto.com

EXHIBIT 99.6 Media Release Rio Tinto and H2 Green Steel partner to accelerate the green steel transition 9 August 2023 LONDON – Rio Tinto and H2 Green Steel, an industrial startup establishing large scale production of green steel, have signed a multi-year supply agreement for high grade direct reduction iron ore pellets from Rio Tinto’s Iron Ore Company of Canada (IOC) operations. Rio Tinto will also purchase and on-sell a part of the surplus low carbon hot briquetted iron (HBI) produced by H2 Green Steel during the ramp-up of its steelmaking capacity. IOC’s direct reduction pellets will account for a significant part of the iron ore supply to H2 Green Steel’s flagship plant in Boden, Sweden, which will be one of the world’s first large-scale producers of low carbon iron and steel. The fully integrated, digitalised, and circular plant is expected to start operations in 2025, processing direct reduction pellets into HBI and then making steel through electric arc furnaces using green hydrogen. The Boden site will hold one of the world’s largest electrolysis plants for green hydrogen production. The production of steel, a key material for infrastructure and net-zero energy transition, currently contributes around 8% of global carbon emissions. By using green hydrogen in electric arc furnaces instead of coal in traditional steelmaking with a blast furnace, CO2 emissions can be reduced by up to 95 percent. H2 Green Steel Chief Executive Officer Henrik Henriksson said: “This is a significant milestone for our project in Boden. Not only by securing a supply of the high-quality iron ore needed for our green steel production, but also because we have a buyer for a portion of the HBI we initially expect to produce. Rio Tinto is a global leader in the mining industry and we welcome its concrete actions to accelerate the decarbonisation of the steel industry.” Rio Tinto Head of Steel Decarbonisation Simon Farry said: “We are partnering across the steel ecosystem to find better ways to support the decarbonisation of iron and steel making, and to reduce our scope 3 emissions. Our supply of high-grade iron ore pellets will support the acceleration of H2 Green Steel’s project, and on-selling their low-carbon HBI will enable us to gain a deeper understanding of the future needs of our customers and end users in the emerging green iron and steel market.”

Media Release 2 / 2 Contacts Please direct all enquiries to media.enquiries@riotinto.com Media Relations, United Kingdom Matthew Klar M +44 7796 630 637 David Outhwaite M +44 7787 597 493 Media Relations, Australia Matt Chambers M +61 433 525 739 Jesse Riseborough M +61 436 653 412 Alyesha Anderson M +61 434 868 118 Media Relations, Americas Simon Letendre M +1 514 796 4973 Malika Cherry M +1 418 592 7293 Investor Relations, United Kingdom Menno Sanderse M +44 7825 195 178 David Ovington M +44 7920 010 978 Laura Brooks M +44 7826 942 797 Investor Relations, Australia Tom Gallop M +61 439 353 948 Amar Jambaa M +61 472 865 948 Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 Rio Tinto Limited Level 43, 120 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 riotinto.com Category: IOC

EXHIBIT 99.7 Media Release Rio Tinto to build the largest solar power plant in Canada’s North 10 August 2023 YELLOWKNIFE, Canada – Rio Tinto’s Diavik Diamond Mine will build the largest solar power plant across Canada’s territories, featuring over 6,600 solar panels that will generate approximately 4,200 megawatt- hours of carbon-free electricity annually for the mine. The solar power plant will provide up to 25% of Diavik’s electricity during closure work that will run until 2029, with commercial production from the operation expected to end in early 2026. The facility will be equipped with bi-facial panels which will not only generate energy from direct sunlight, but also from the light that reflects off the snow that covers Diavik for most of the year. It will cut diesel consumption at the site by approximately one million liters per year and reduce emissions by 2,900 tonnes of CO2 equivalent, which is comparable to eliminating the emissions of 630 cars. President and Chief Operating Officer of the Diavik Diamond Mine Angela Bigg said: “I am delighted that we will be significantly increasing our renewable power generation with the largest solar power plant in Canada’s northern territories at the Diavik Diamond Mine. Through its wind-diesel hybrid power facility, Diavik is already a leader in cold climate renewable technology and this important project reinforces our dedication to reducing our carbon footprint. I would like to thank both the Government of the Northwest Territories and the Government of Canada for their support to deploy this project.” The solar power plant will significantly expand Diavik’s renewable energy generation, which already features a wind-diesel hybrid power facility that has a capacity of 55.4 MW and provides the site’s electricity. The project is supported by CAN$3.3 million in funding from the Government of the Northwest Territories’ Large Emitters GHG Reducing Investment Grant program, and CAN$600,000 from the Government of Canada’s Clean Electricity Investment Tax Credit. Government of the Northwest Territories Finance Minister Caroline Wawzonek said: “The Diavik solar power plant is a welcome sign of Rio Tinto’s commitment to renewable energy and reducing emissions. The Government of the Northwest Territories is pleased to have provided support through the Large Emitters GHG Reducing Investment Grant program, one of the original pieces of our made-in-the-NWT approach to the federal carbon tax. This collaboration exemplifies our commitment to facilitating sustainable development while reducing greenhouse gas emissions in the Northwest Territories and should be a signal of how our economic development can continue to position us as leaders in these spaces.” Diavik is working with the Government of the Northwest Territories and community partners to determine how its renewable energy infrastructure can best benefit the region following closure. Rio Tinto is progressing decarbonisation initiatives across its global operations, with the aim of reducing its Scope 1 and 2 greenhouse gas (GHG) emissions by 50% by 2030 and to achieve net zero across its operations by 2050.

Media Release 2 / 3 Construction will start in coming weeks and the solar power plant will be fully operational in the first half of 2024. Notes to editors The Diavik mine, 100 percent owned and operated by Rio Tinto, is Canada’s largest diamond producer and produces 3.5 to 4.5 million carats of rough diamonds per annum. Since mining began in 2003 Diavik has produced over 100 million carats of diamonds. Commercial production is expected to end in the first quarter of 2026. Under the Large Emitter Greenhouse Gas Reducing Investment Grant Program, the GNWT set aside twelve per cent (12%) of the total carbon tax paid by a prescribed large emitter during a fiscal year and makes the fund available to that emitter for projects that contribute to a reduction of greenhouse gas emissions in the Northwest Territories. The Diavik Solar Power Plant is the first project to be funded by the Large Emitter Greenhouse Gas Reducing Investment Grant Program.

Media Release 3 / 3 Contacts Please direct all enquiries to media.enquiries@riotinto.com Media Relations, United Kingdom Matthew Klar M +44 7796 630 637 David Outhwaite M +44 7787 597 493 Media Relations, Australia Matt Chambers M +61 433 525 739 Jesse Riseborough M +61 436 653 412 Alyesha Anderson M +61 434 868 118 Media Relations, Americas Simon Letendre M +1 514 796 4973 Vanessa Damha M +1 514 715 2152 Malika Cherry M +1 418 592 7293 Investor Relations, United Kingdom Menno Sanderse M +44 7825 195 178 David Ovington M +44 7920 010 978 Laura Brooks M +44 7826 942 797 Investor Relations, Australia Tom Gallop M +61 439 353 948 Amar Jambaa M +61 472 865 948 Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 Rio Tinto Limited Level 43, 120 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 riotinto.com Category: Diavik

EXHIBIT 99.8 Notice to ASX/LSE Agreements reached on trans-Guinean infrastructure in milestone for Simandou iron ore project 11 August 2023 Rio Tinto and the Simfer1 joint venture (Simfer) reached an important milestone today by concluding key agreements with the Republic of Guinea and Winning Consortium Simandou2 (WCS) on the trans-Guinean infrastructure for the world class Simandou iron ore project. The Co-Development Convention with the Republic of Guinea and associated agreements adjusting Simfer and WCS’s existing mine conventions create the legal framework for the co-development of more than 600 kilometres of new multi-use rail together with port facilities, that will be used to export iron ore from the Simandou mining concessions in the southeast of the country. Rio Tinto Executive Committee lead for Guinea and Copper Chief Executive Bold Baatar said “With these agreements we have reached an important milestone towards full sanction of the Simandou project, bringing together the complementary strengths and expertise of Rio Tinto and our partners, the Government of Guinea and Winning Consortium Simandou, for the infrastructure that will unlock this world class resource. Simandou, the world’s largest known undeveloped supply of high-grade, low-impurity iron ore, will strengthen Rio Tinto’s portfolio by complementing our existing Pilbara and Iron Ore Company of Canada products.” The infrastructure capacity and associated cost will be shared equally between Simfer, which is developing blocks 3 and 4 of the Simandou project, and WCS, which is developing blocks 1 and 2. China Baowu Steel Group has also previously entered into a term sheet agreement with WCS that may see it partner in the WCS scope for blocks 1 and 2 of the Simandou mining concession and the infrastructure joint venture. The Co-Development Convention requires ratification by the Guinean State. It is also subject to a number of conditions, including the Guinean State’s approval of the final feasibility study for the project. Negotiations continue between the partners to finalise the investment agreements and related shareholders’ agreements which underpin the co-development. A further announcement will be made when appropriate concerning these agreements. Critical path works continue to be progressed by the partners to ensure progress is maximised during the 2023-24 dry season. 1 The Simfer joint venture comprises Simfer S.A., the holder of Simandou South Blocks 3 & 4, which is owned by the Government of Guinea (15%) and Simfer Jersey Limited (85%). In turn, Simfer Jersey Limited is a joint venture between the Rio Tinto Group (53%) and Chalco Iron Ore Holdings (47%) – a Chinalco-led joint venture of leading Chinese SOEs (Chinalco (75%), Baowu (20%), China Rail Construction Corporation (2.5%) and China Harbour Engineering Company (2.5%). 2 WCS is a consortium between Winning International Group (49.99%), Weiqiao Aluminium (part of the China Hongqiao Group) (49.99%) and United Mining Suppliers (0.0002%).

Notice to ASX/LSE 2 / 2 Contacts Please direct all enquiries to media.enquiries@riotinto.com Media Relations, Australia Matt Chambers M +61 433 525 739 Jesse Riseborough M +61 436 653 412 Alyesha Anderson M +61 434 868 118 Media Relations, Americas Simon Letendre M +1 514 796 4973 Malika Cherry M +1 418 592 7293 Investor Relations, Australia Tom Gallop M +61 439 353 948 Amar Jambaa M +61 472 865 948 Media Relations, United Kingdom Matthew Klar M +44 7796 630 637 David Outhwaite M +44 7787 597 493 Investor Relations, United Kingdom Menno Sanderse M +44 7825 195 178 David Ovington M +44 7920 010 978 Laura Brooks M +44 7826 942 797 Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 Rio Tinto Limited Level 43, 120 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 This announcement is authorised for release to the market by Steve Allen, Rio Tinto’s Group Company Secretary. Category: Simandou riotinto.com

| | | | | |

| EXHIBIT 99.9

Notice to LSE |

Shareholdings of Persons Discharging Managerial Responsibility (PDMR) / Key Management Personnel (KMP)

11 August 2023

Rio Tinto plc notifies the London Stock Exchange (LSE) of PDMR interests in securities of Rio Tinto plc, in compliance with the EU Market Abuse Regulation. As part of its dual listed company structure, Rio Tinto voluntarily notifies the Australian Securities Exchange (ASX) of material dealings in Rio Tinto plc shares by PDMR / KMP and both the ASX and the LSE of material dealings by PDMR / KMP in Rio Tinto Limited securities.

On 11 August 2023, the following director purchased shares as follows:

| | | | | | | | | | | |

| Security | Name of PDMR / KMP | Number of Shares Acquired | Price Per Share

AUD |

Rio Tinto Limited |

Susan Lloyd-Hurwitz |

458 |

108.99 |

LEI: 213800YOEO5OQ72G2R82

Contacts

Please direct all enquiries to media.enquiries@riotinto.com

| | | | | | | | |

Media Relations, United Kingdom

Matthew Klar M +44 7796 630 637

David Outhwaite M +44 7787 597 493

| Media Relations, Australia

Matt Chambers M +61 433 525 739

Jesse Riseborough M +61 436 653 412

Alyesha Anderson M +61 434 868 118 | Media Relations, Americas

Simon Letendre M +1 514 796 4973

Malika Cherry M +1 418 592 7293 |

Investor Relations, United Kingdom

Menno Sanderse M +44 7825 195 178

David Ovington M +44 7920 010 978

Laura Brooks M +44 7826 942 797 | Investor Relations, Australia

Tom Gallop M +61 439 353 948

Amar Jambaa M +61 472 865 948 | |

Rio Tinto plc

6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000

Registered in England No. 719885

| Rio Tinto Limited

Level 43, 120 Collins Street Melbourne 3000 Australia T +61 3 9283 3333

Registered in Australia ABN 96 004 458 404 | |

This announcement is authorised for release to the market by Steve Allen, Rio Tinto’s Group Company Secretary.

riotinto.com

+ See chapter 19 for defined terms. 01/01/2011 Appendix 3Y Page 1 Rule 3.19A.2 Appendix 3Y Change of Director’s Interest Notice Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public. Introduced 30/09/01 Amended 01/01/11 Name of entity Rio Tinto Limited ABN 96 004 458 404 We (the entity) give ASX the following information under listing rule 3.19A.2 and as agent for the director for the purposes of section 205G of the Corporations Act. Name of Director Susan Lloyd-Hurwitz Date of last notice 4 August 2023 Part 1 - Change of director’s relevant interests in securities In the case of a trust, this includes interests in the trust made available by the responsible entity of the trust Note: In the case of a company, interests which come within paragraph (i) of the definition of “notifiable interest of a director” should be disclosed in this part. Direct or indirect interest Indirect Nature of indirect interest (including registered holder) Note: Provide details of the circumstances giving rise to the relevant interest. Interest in securities held by SOBEDA Pty Ltd as the trustee of IWEUS Balance Trust on behalf of a body corporate controlled by Ms Lloyd-Hurwitz. Date of change 11 August 2023 No. of securities held prior to change 436 Class Ordinary shares Number acquired 458 Rio Tinto Limited ordinary shares (Shares) Number disposed Nil Value/Consideration Note: If consideration is non-cash, provide details and estimated valuation $108.99 per share No. of securities held after change 894 shares Nature of change Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy- back Acquisition of shares by way of on-market trade. EXHIBIT 99.10 Appendix 3Y Change of Director’s Interest Notice

Appendix 3Y Change of Director’s Interest Notice + See chapter 19 for defined terms. Appendix 3Y Page 2 01/01/2011 Part 2 – Change of director’s interests in contracts Note: In the case of a company, interests which come within paragraph (ii) of the definition of “notifiable interest of a director” should be disclosed in this part. Detail of contract N/A Nature of interest N/A Name of registered holder (if issued securities) N/A Date of change N/A No. and class of securities to which interest related prior to change Note: Details are only required for a contract in relation to which the interest has changed N/A Interest acquired N/A Interest disposed N/A Value/Consideration Note: If consideration is non-cash, provide details and an estimated valuation N/A Interest after change N/A Part 3 – +Closed period Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? No If so, was prior written clearance provided to allow the trade to proceed during this period? N/A If prior written clearance was provided, on what date was this provided? N/A

| | | | | |

| EXHIBIT 99.11

Notice to LSE |

Shareholdings of Persons Discharging Managerial Responsibility (PDMR) / Key Management Personnel (KMP)

17 August 2023

Rio Tinto plc notifies the London Stock Exchange (LSE) of PDMR interests in securities of Rio Tinto plc, in compliance with the EU Market Abuse Regulation. As part of its dual listed company structure, Rio Tinto voluntarily notifies the Australian Securities Exchange (ASX) of material dealings in Rio Tinto plc shares by PDMR / KMP and both the ASX and the LSE of material dealings by PDMR / KMP in Rio Tinto Limited securities.

On 17 August 2023, the following director purchased shares as follows:

| | | | | | | | | | | |

| Security | Name of PDMR / KMP | Number of Shares Acquired | Price Per Share

AUD |

Rio Tinto Limited |

Ben Wyatt |

100 |

103.2517 |

LEI: 213800YOEO5OQ72G2R82

Contacts

Please direct all enquiries to media.enquiries@riotinto.com

| | | | | | | | |

Media Relations, United Kingdom

Matthew Klar M +44 7796 630 637

David Outhwaite M +44 7787 597 493

| Media Relations, Australia

Matt Chambers M +61 433 525 739

Jesse Riseborough M +61 436 653 412

Alyesha Anderson M +61 434 868 118 | Media Relations, Americas

Simon Letendre M +1 514 796 4973

Malika Cherry M +1 418 592 7293 |

Investor Relations, United Kingdom

Menno Sanderse M +44 7825 195 178

David Ovington M +44 7920 010 978

Laura Brooks M +44 7826 942 797 | Investor Relations, Australia

Tom Gallop M +61 439 353 948

Amar Jambaa M +61 472 865 948 | |

Rio Tinto plc

6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000

Registered in England No. 719885

| Rio Tinto Limited

Level 43, 120 Collins Street Melbourne 3000 Australia T +61 3 9283 3333

Registered in Australia ABN 96 004 458 404 | |

This announcement is authorised for release to the market by Steve Allen, Rio Tinto’s Group Company Secretary.

riotinto.com

+ See chapter 19 for defined terms. 01/01/2011 Appendix 3Y Page 1 Rule 3.19A.2 Appendix 3Y Change of Director’s Interest Notice Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public. Introduced 30/09/01 Amended 01/01/11 Name of entity Rio Tinto Limited ABN 96 004 458 404 We (the entity) give ASX the following information under listing rule 3.19A.2 and as agent for the director for the purposes of section 205G of the Corporations Act. Name of Director Ben Wyatt Date of last notice 3 August 2022 Part 1 - Change of director’s relevant interests in securities In the case of a trust, this includes interests in the trust made available by the responsible entity of the trust Note: In the case of a company, interests which come within paragraph (i) of the definition of “notifiable interest of a director” should be disclosed in this part. Direct or indirect interest Direct Nature of indirect interest (including registered holder) Note: Provide details of the circumstances giving rise to the relevant interest. N/A Date of change 17 August 2023 No. of securities held prior to change 300 Rio Tinto Limited ordinary shares (Shares) Class Ordinary shares Number acquired 100 Shares Number disposed Nil Value/Consideration Note: If consideration is non-cash, provide details and estimated valuation $103.2517 per Share No. of securities held after change 400 Shares Nature of change Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy- back Acquisition of Shares by way of on-market trade. EXHIBIT 99.12 Appendix 3Y Change of Director’s Interest Notice

Appendix 3Y Change of Director’s Interest Notice + See chapter 19 for defined terms. Appendix 3Y Page 2 01/01/2011 Part 2 – Change of director’s interests in contracts Note: In the case of a company, interests which come within paragraph (ii) of the definition of “notifiable interest of a director” should be disclosed in this part. Detail of contract N/A Nature of interest N/A Name of registered holder (if issued securities) N/A Date of change N/A No. and class of securities to which interest related prior to change Note: Details are only required for a contract in relation to which the interest has changed N/A Interest acquired N/A Interest disposed N/A Value/Consideration Note: If consideration is non-cash, provide details and an estimated valuation N/A Interest after change N/A Part 3 – +Closed period Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? No If so, was prior written clearance provided to allow the trade to proceed during this period? N/A If prior written clearance was provided, on what date was this provided? N/A

| | | | | |

| EXHIBIT 99.13

Notice to LSE |

Shareholdings of Persons Discharging Managerial Responsibility (PDMR) / Key Management Personnel (KMP)

18 August 2023

Rio Tinto plc notifies the London Stock Exchange (LSE) of PDMR interests in securities of Rio Tinto plc, in compliance with the EU Market Abuse Regulation. As part of its dual listed company structure, Rio Tinto voluntarily notifies the Australian Securities Exchange (ASX) of material dealings in Rio Tinto plc shares by PDMR / KMP and both the ASX and the LSE of material dealings by PDMR / KMP in Rio Tinto Limited securities.

On 17 August 2023, the following director purchased shares as follows:

| | | | | | | | | | | |

| Security | Name of PDMR / KMP | Number of Shares Acquired | Price Per Share

AUD |

Rio Tinto Limited |

Susan Lloyd-Hurwitz |

486 |

102.68 |

LEI: 213800YOEO5OQ72G2R82

Contacts

Please direct all enquiries to media.enquiries@riotinto.com

| | | | | | | | |

Media Relations, United Kingdom

Matthew Klar M +44 7796 630 637

David Outhwaite M +44 7787 597 493

| Media Relations, Australia

Matt Chambers M +61 433 525 739

Jesse Riseborough M +61 436 653 412

Alyesha Anderson M +61 434 868 118 | Media Relations, Americas

Simon Letendre M +1 514 796 4973

Malika Cherry M +1 418 592 7293 |

Investor Relations, United Kingdom

Menno Sanderse M +44 7825 195 178

David Ovington M +44 7920 010 978

Laura Brooks M +44 7826 942 797 | Investor Relations, Australia

Tom Gallop M +61 439 353 948

Amar Jambaa M +61 472 865 948 | |

Rio Tinto plc

6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000

Registered in England No. 719885

| Rio Tinto Limited

Level 43, 120 Collins Street Melbourne 3000 Australia T +61 3 9283 3333

Registered in Australia ABN 96 004 458 404 | |

This announcement is authorised for release to the market by Steve Allen, Rio Tinto’s Group Company Secretary.

riotinto.com

Appendix 3Y Change of Director’s Interest Notice + See chapter 19 for defined terms. 01/01/2011 Appendix 3Y Page 1 Rule 3.19A.2 Appendix 3Y Change of Director’s Interest Notice Information or documents not available now must be given to ASX as soon as available. Information and documents given to ASX become ASX’s property and may be made public. Introduced 30/09/01 Amended 01/01/11 Name of entity Rio Tinto Limited ABN 96 004 458 404 We (the entity) give ASX the following information under listing rule 3.19A.2 and as agent for the director for the purposes of section 205G of the Corporations Act. Name of Director Susan Lloyd-Hurwitz Date of last notice 11 August 2023 Part 1 - Change of director’s relevant interests in securities In the case of a trust, this includes interests in the trust made available by the responsible entity of the trust Note: In the case of a company, interests which come within paragraph (i) of the definition of “notifiable interest of a director” should be disclosed in this part. Direct or indirect interest Indirect Nature of indirect interest (including registered holder) Note: Provide details of the circumstances giving rise to the relevant interest. Interest in securities held by SOBEDA Pty Ltd as the trustee of IWEUS Balance Trust on behalf of a body corporate controlled by Ms Lloyd-Hurwitz. Date of change 17 August 2023 No. of securities held prior to change 894 Class Ordinary shares Number acquired 486 Rio Tinto Limited ordinary shares (Shares) Number disposed Nil Value/Consideration Note: If consideration is non-cash, provide details and estimated valuation $102.68 per share No. of securities held after change 1,380 shares Nature of change Example: on-market trade, off-market trade, exercise of options, issue of securities under dividend reinvestment plan, participation in buy- back Acquisition of shares by way of on-market trade. EXHIBIT 99.14

Appendix 3Y Change of Director’s Interest Notice + See chapter 19 for defined terms. Appendix 3Y Page 2 01/01/2011 Part 2 – Change of director’s interests in contracts Note: In the case of a company, interests which come within paragraph (ii) of the definition of “notifiable interest of a director” should be disclosed in this part. Detail of contract N/A Nature of interest N/A Name of registered holder (if issued securities) N/A Date of change N/A No. and class of securities to which interest related prior to change Note: Details are only required for a contract in relation to which the interest has changed N/A Interest acquired N/A Interest disposed N/A Value/Consideration Note: If consideration is non-cash, provide details and an estimated valuation N/A Interest after change N/A Part 3 – +Closed period Were the interests in the securities or contracts detailed above traded during a +closed period where prior written clearance was required? No If so, was prior written clearance provided to allow the trade to proceed during this period? N/A If prior written clearance was provided, on what date was this provided? N/A

| | | | | |

| EXHIBIT 99.15

Media Release |

Rio Tinto and Government of Madagascar reach agreement supporting the long-term operation of QMM

23 August 2023

Rio Tinto and the Government of Madagascar have reached agreement on the future fiscal arrangements for QIT Madagascar Minerals (QMM) and renewed their long-term partnership for the sustainable operation of the QMM mine in Fort Dauphin, Madagascar.

The new agreement was confirmed by the High Constitutional Court of Madagascar on 8 August 2023 and signed by the parties on 22 August 2023.

It will enhance the benefits received by the people of Madagascar and support a sustainable future for the QMM mine, providing certainty for Rio Tinto on the fiscal arrangements.

Under the terms of the agreement, there will be an increase in the royalty rate from 2% to 2.5% and QMM will issue its first dividend to the Government of Madagascar in 2023. An amount equalling the US$12 million dividend will be invested by the Government in the 109-kilometre rehabilitation project of the National Road 13 (RN13). Rio Tinto will also contribute up to US$8 million to the road project, subject to predefined milestones and deadlines. The project will bring significant improvement to the region by facilitating the movement of people and critical supplies to hard-to-access areas.

Rio Tinto has agreed to cancel US$77 million in advances made to the Government of Madagascar to finance their funding of QMM. The State will now hold a 15% free carry ownership of QMM and maintain its 20% voting right, with no obligation to contribute to capital funding or exposure to dilution.

QMM will also increase support for local communities by doubling its annual contribution to fund programs of interest.

Rio Tinto Iron and Titanium Managing Director, Sophie Bergeron said “Rio Tinto is committed to the responsible development of its mineral sands extraction business in Madagascar. This agreement is a significant milestone to support a long-term future for QMM and reaffirms our commitment to provide increased benefits for all parties, including the communities of Madagascar. We are privileged and honoured to be operating in Madagascar and we thank the country and its people for their trust.”

In 1998, Rio Tinto and the Government of Madagascar signed the Convention d’établissement (Framework Agreement), which has provided the foundation for Rio Tinto’s US$1 billion investment in QMM over the last 25 years. Whilst the Framework Agreement remains in place for the duration of QMM’s mining activities, the fiscal component was subject to renegotiation after 25 years.

Contacts

Please direct all enquiries to media.enquiries@riotinto.com

| | | | | | | | |

Media Relations, United Kingdom

Matthew Klar M +44 7796 630 637

David Outhwaite M +44 7787 597 493 | Media Relations, Australia

Matt Chambers M +61 433 525 739

Jesse Riseborough M +61 436 653 412

Alyesha Anderson M +61 434 868 118 | Media Relations, Americas

Simon Letendre M +1 514 796 4973

Malika Cherry M +1 418 592 7293 |

Investor Relations, United Kingdom

Menno Sanderse M +44 7825 195 178

David Ovington M +44 7920 010 978

Laura Brooks M +44 7826 942 797

| Investor Relations, Australia

Tom Gallop M +61 439 353 948

Amar Jambaa M +61 472 865 948 | |

Rio Tinto plc

6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000

Registered in England No. 719885 | Rio Tinto Limited

Level 43, 120 Collins Street Melbourne 3000 Australia T +61 3 9283 3333

Registered in Australia ABN 96 004 458 404 | |

riotinto.com

EXHIBIT 99.16 Notice to ASX/LSE Rio Tinto and First Quantum complete La Granja joint venture transaction 28 August 2023 Rio Tinto and First Quantum Minerals ("First Quantum") have completed a transaction to form a joint venture that will work to unlock the development of the La Granja project in Peru, one of the largest undeveloped copper deposits in the world. La Granja is a complex orebody located at high altitude in Cajamarca, Northern Peru, that has the potential to be a large, long-life operation, with a published Indicated and Inferred Mineral Resource totalling 4.32 billion tonnes at 0.51% copper1. Following the completion of conditions including regulatory approvals from the Government of Peru, First Quantum has acquired a 55% stake in the project for $105 million. It will invest up to a further $546 million into the joint venture to sole fund capital and operational costs to take the project through a feasibility study and toward development. Upon completion of the sole funding commitment, all subsequent expenditures will be applied on a pro-rata basis according to the share ownership of the project. As majority owner, First Quantum will now operate the La Granja project with initial work focussed on completing the feasibility study, as per the Transfer Agreement signed with the Government of Peru. Rio Tinto Copper Chief Executive Bold Baatar said: “Developing La Granja would provide a significant new supply of copper and further strengthen Rio Tinto’s portfolio of materials needed for the energy transition. Our partnership with First Quantum will bring our combined development capabilities and deep knowledge of La Granja to progress the project.” First Quantum Chief Executive Officer Tristan Pascall said: “La Granja has the potential to be a large, long- life operation and supply the copper that will be needed as the world transitions to the greener economy and where responsible mining will be the only acceptable way to produce metals. As operator, we will leverage our core strengths in mine design, project development and community engagement and look forward to developing our partnership with Rio Tinto. We appreciate the support from the Government of Peru for the completion of this transaction.” Rio Tinto acquired the La Granja Project from the Government of Peru in 2006 and carried out an extensive drilling programme that significantly expanded the declared resource and understanding of the orebody, and established partnerships with host communities, local and national governments. 1 The Mineral Resources referred to in this release comprise 130 Mt at 0.85% Cu Indicated Mineral Resources and 4,190 Mt at 0.50% Cu Inferred Mineral Resources. These Mineral Resources were reported in Rio Tinto’s 2022 Annual Report released on 22 February 2023, which is available at Annual Report (riotinto.com). The Competent Person responsible for reporting these Mineral Resources is Joanna Marshall, a Member of the Australasian Institute of Mining and Metallurgy (MAusIMM). Rio Tinto is not aware of any new information or data that materially affects these Mineral Resource estimates and confirms that all material assumptions and technical parameters underpinning the estimates continue to apply and have not materially changed. The company confirms that the form and context in which the Competent Person’s findings are presented have not been materially modified. Mineral Resources are quoted in this release on a 100 per cent basis.

Notice to ASX/LSE 2 / 2 Contacts Please direct all enquiries to media.enquiries@riotinto.com Media Relations, United Kingdom Matthew Klar M +44 7796 630 637 David Outhwaite M +44 7787 597 493 Media Relations, Australia Matt Chambers M +61 433 525 739 Jesse Riseborough M +61 436 653 412 Alyesha Anderson M +61 434 868 118 Media Relations, Americas Simon Letendre M +1 514 796 4973 Malika Cherry M +1 418 592 7293 Investor Relations, United Kingdom Menno Sanderse M +44 7825 195 178 David Ovington M +44 7920 010 978 Laura Brooks M +44 7826 942 797 Investor Relations, Australia Tom Gallop M +61 439 353 948 Amar Jambaa M +61 472 865 948 Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 Rio Tinto Limited Level 43, 120 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 This announcement is authorised for release to the market by Steve Allen, Rio Tinto’s Group Company Secretary. riotinto.com Category: General

EXHIBIT 99.17 Notice to ASX/LSE Appointment of Group Company Secretary 30 August 2023 Rio Tinto announces the appointment of Andy Hodges as Group Company Secretary, and Company Secretary of Rio Tinto plc with effect from 29 August 2023. Steve Allen will stand down as Group Company Secretary, and Company Secretary of Rio Tinto plc and Joint Company Secretary of Rio Tinto Limited, also with effect from 29 August 2023, in order to take up the role of Deputy Chief Legal Officer at Rio Tinto. Tim Paine continues as Company Secretary of Rio Tinto Limited. LEI: 213800YOEO5OQ72G2R82 Classification: 3.1. Additional regulated information required to be disclosed under the laws of a Member State.

Notice to ASX/LSE 2 / 2 Contacts Please direct all enquiries to media.enquiries@riotinto.com Media Relations, United Kingdom Matthew Klar M +44 7796 630 637 David Outhwaite M +44 7787 597 493 Media Relations, Australia Matt Chambers M +61 433 525 739 Jesse Riseborough M +61 436 653 412 Alyesha Anderson M +61 434 868 118 Media Relations, Americas Simon Letendre M +1 514 796 4973 Malika Cherry M +1 418 592 7293 Investor Relations, United Kingdom Menno Sanderse M +44 7825 195 178 David Ovington M +44 7920 010 978 Laura Brooks M +44 7826 942 797 Investor Relations, Australia Tom Gallop M +61 439 353 948 Amar Jambaa M +61 472 865 948 Rio Tinto plc 6 St James’s Square London SW1Y 4AD United Kingdom T +44 20 7781 2000 Registered in England No. 719885 Rio Tinto Limited Level 43, 120 Collins Street Melbourne 3000 Australia T +61 3 9283 3333 Registered in Australia ABN 96 004 458 404 This announcement is authorised for release to the market by Andy Hodges, Rio Tinto’s Group Company Secretary. riotinto.com

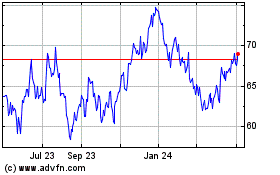

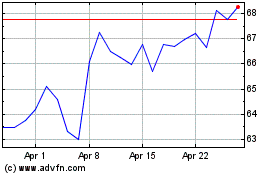

Rio Tinto (NYSE:RIO)

Historical Stock Chart

From Jun 2024 to Jul 2024

Rio Tinto (NYSE:RIO)

Historical Stock Chart

From Jul 2023 to Jul 2024