Full Year Diluted EPS of $4.91

REX American Resources Corporation (NYSE: REX) (“REX” or “the

Company”) today reported financial results for its fiscal 2018

fourth quarter (“Q4 ‘18”) ended January 31, 2019. REX management

will host a conference call and webcast today at 11:00 a.m. ET.

Conference Call:

212/271-4615

Webcast / Replay URL:

www.rexamerican.com/Corp/Page4.aspx

The webcast will be available for replay for

30 days.

REX American Resources’ Q4 ‘18 results principally reflect its

interests in six ethanol production facilities and its refined coal

operation. The One Earth Energy, LLC (“One Earth”) and NuGen

Energy, LLC (“NuGen”) ethanol production facilities are

consolidated, as is the refined coal entity, while those of its

four other ethanol plants are reported as equity in income of

unconsolidated ethanol affiliates. The Company reports results for

its two business segments as ethanol and by-products, and refined

coal.

REX’s Q4 ‘18 net sales and revenue increased 3.5% to $113.3

million, compared with $109.5 million in Q4 ‘17. The year-over-year

net sales and revenue increase was primarily due to higher average

selling prices for dried and modified distillers grains as well as

increased production in the Company’s ethanol and by-products

segment, which was partially offset by a 7.9% reduction in the

average selling price per gallon of ethanol. The Company’s Q4 ‘18

gross profit for its ethanol and by-products segment was $5.4

million, compared with $10.0 million in Q4 ‘17, primarily resulting

from lower ethanol crush spreads. As a result, the ethanol and

by-products segment income before income taxes was $1.4 million in

Q4 ‘18, compared to income of $6.5 million in Q4 ‘17. The Company’s

refined coal operation incurred a $3.2 million gross loss and a

$3.3 million loss before income taxes in Q4 ‘18, compared to a $4.0

million gross loss and a loss before income taxes of $4.3 million

in Q4 ‘17. As a result, REX reported a loss from continuing

operations before income taxes and non-controlling interests in Q4

‘18 of $1.7 million, compared with income of $1.7 million in Q4

‘17. While the refined coal operation negatively impacted gross

profit and income before income taxes, it contributed to a lower

effective tax rate.

Net income attributable to REX shareholders in Q4 ‘18 was $1.1

million, compared to $19.1 million in Q4 ‘17. Q4 ‘18 basic and

diluted net income per share attributable to REX common

shareholders was $0.17 per share, compared to $2.89 per share in Q4

‘17. The prior year results reflected a $14.4 million tax benefit

as a result of the remeasurement of the Company’s deferred tax

liabilities in connection with the passage of the 2017 Tax Cuts and

Job Act. Per share results in Q4 ‘18 and Q4 ‘17 are based on

6,341,000 and 6,604,000 diluted weighted average shares

outstanding, respectively.

Segment Income Statement Data:

Three Months Twelve Months Ended

Ended ($ in thousands)

January 31, January 31,

2019 2018

2019 2018 Net

sales and revenue: Ethanol & By-Products (1)

$ 113,168 $ 109,295 $ 485,885 $ 452,153 Refined coal (2) (3)

176 240

786 433 Total net

sales and revenue $ 113,344

$ 109,535 $

486,671 $ 452,586

Gross profit (loss): Ethanol & By-Products

(1) $ 5,381 $ 9,981 $ 43,856 $ 51,509 Refined coal (2)

(3,163 ) (3,957

) (13,641 )

(7,348 ) Total gross profit

$ 2,218 $

6,024 $ 30,215

$ 44,161 Income (loss)

before income taxes: Ethanol & By-Products (1) $ 1,354 $

6,545 $ 31,545 $ 38,352 Refined coal (2) (3,317 ) (4,336 ) (15,204

) (10,021 ) Corporate and other

288

(550 ) (1,753

) (2,938 ) Total

income (loss) before income taxes

$

(1,675 ) $

1,659 $ 14,588

$ 25,393 Benefit

(provision) for income taxes: Ethanol & By-Products $ (539

) $ 13,004 $ (2,343 ) $ 3,245 Refined coal 4,759 5,250 24,674

15,168 Corporate and other

354

222 591

1,106 Total benefit (provision) for income

taxes

$ 4,574 $

18,476 $ 22,922

$ 19,519 Segment

profit (loss): Ethanol & By-Products $ (450 ) $ 18,261 $

23,346 $ 35,880 Refined coal 1,597 1,108 10,148 5,628 Corporate and

other

(90 )

(316 ) (1,849

) (1,802 ) Net income

attributable to REX common shareholders

$

1,057 $ 19,053

$ 31,645 $

39,706

(1)

Includes results attributable to

non-controlling interests of approximately 25% for One Earth and

approximately 1% for NuGen.

(2)

Includes results attributable to

non-controlling interests of approximately 5%.

(3)

Refined coal sales are reported net of the

cost of coal.

REX American Resources’ Chief Executive Officer, Zafar Rizvi,

commented, “The fourth quarter proved to be the most challenging

period of the year, as weak ethanol pricing significantly impacted

margins. Despite these headwinds, stronger distillers grains

pricing, coupled with our ability to efficiently increase output

across our ethanol and by-products segment and the benefit of our

refined coal operation, resulted in our ability to continue to

operate profitably and generate $31.6 million of net income for the

fiscal full year 2018.

“As we enter fiscal 2019, we remain focused on near- and

long-term opportunities to enhance shareholder value as we look to

leverage our robust balance sheet, including cash, cash equivalents

and short-term investments in excess of $200 million and working

capital of $234 million. While conditions have remained challenging

so far in fiscal 2019, we remain confident in our disciplined

operating approach and the value of ethanol as a worldwide fuel

supply.”

Balance Sheet and Share Repurchase Program

At January 31, 2019, REX had cash and cash equivalents and

short-term investments of $203.5 million, $54.8 million of which

was at the parent company, and $148.7 million of which was at its

consolidated production facilities. This compares with cash and

cash equivalents at January 31, 2018, of $191.0 million, $74.1

million of which was at the parent company, and $116.9 million of

which was at its consolidated ethanol production facilities.

During the fourth quarter of fiscal 2018, the Company purchased

52,759 shares at an average cost of $65.14. REX is now authorized

to repurchase up to 349,861 shares of its common stock. The Company

had 6,274,419 shares outstanding at January 31, 2019.

Repurchases by the Company are subject to available liquidity,

general market and economic conditions, alternate uses for the

capital and other factors. Share repurchases may be made from time

to time in open market transactions, block trades or private

transactions in accordance with applicable securities laws and

regulations and other legal requirements. There is no minimum

number of shares the Company is required to repurchase and the

repurchase program may be suspended or discontinued at any time

without prior notice. All shares purchased will be held in the

Company’s treasury for possible future use.

The following table summarizes select data related to

REX’s consolidated alternative energy interests:

Three Months Twelve Months Ended

Ended January 31, January 31,

2019

2018

2019

2018

Average selling price per gallon of ethanol $ 1.17 $ 1.27 $ 1.29 $

1.40 Average selling price per ton of dried distillers grains $

143.20 $ 119.20 $ 142.20 $ 105.89

Average selling price per pound of

non-food grade corn oil

$

0.25

$

0.28

$

0.25

$

0.29

Average selling price per ton of modified distillers grains $ 58.30

$ 57.03 $ 59.42 $ 45.87 Average cost per bushel of grain $ 3.41 $

3.18 $ 3.46 $ 3.35 Average cost of natural gas (per mmbtu) $

4.07 $ 4.65 $ 3.33 $ 3.75

Supplemental data related to REX’s

alternative energy interests:

REX American Resources Corporation Ethanol

Ownership Interests/Effective Annual Gallons Shipped as of January

31, 2019 (gallons in millions)

Entity

TrailingTwelveMonthsGallonsShipped

CurrentREXOwnershipInterest

REX’s Current EffectiveOwnership

of Trailing TwelveMonth Gallons Shipped

One Earth Energy, LLC (Gibson City, IL) 141.9

75.1% 106.6

NuGen Energy, LLC (Marion, SD)

143.9 99.5% 143.2

Big River Resources West Burlington,

LLC (West Burlington, IA)

109.8 10.3% 11.3

Big River Resources Galva,

LLC (Galva, IL) 128.8 10.3% 13.3

Big

River United Energy, LLC (Dyersville, IA) 131.7

5.7% 7.5

Big River Resources Boyceville, LLC

(Boyceville, WI)

58.3 10.3% 6.0

Total

714.4 n/a 287.9

Fourth Quarter Conference Call

REX will host a conference call at 11:00 a.m. ET today. Senior

management will discuss the financial results and host a question

and answer session. The dial in number for the audio conference

call is 212/271-4615 (domestic and international callers).

Participants can also listen to a live webcast of the call on

the Company’s website, www.rexamerican.com/Corp/Page4.aspx.

A webcast replay will be available for 30 days following the live

event at www.rexamerican.com/Corp/Page4.aspx.

About REX American Resources Corporation

REX American Resources has interests in six ethanol production

facilities, which in aggregate shipped approximately 714 million

gallons of ethanol over the twelve month period ended January 31,

2019. REX’s effective ownership of the trailing twelve month

gallons shipped (for the twelve months ended January 31, 2019) by

the ethanol production facilities in which it has ownership

interests was approximately 288 million gallons. In addition, the

Company acquired a refined coal operation on August 10, 2017.

Further information about REX is available at

www.rexamerican.com.

This news announcement contains or may contain forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements can be identified by use of

forward-looking terminology such as “may,” “expect,” “believe,”

“estimate,” “anticipate” or “continue” or the negative thereof or

other variations thereon or comparable terminology. Readers are

cautioned that there are risks and uncertainties that could cause

actual events or results to differ materially from those referred

to in such forward-looking statements. These risks and

uncertainties include the risk factors set forth from time to time

in the Company’s filings with the Securities and Exchange

Commission and include among other things: the impact of

legislative and regulatory changes, the price volatility and

availability of corn, distillers grains, ethanol, non-food grade

corn oil, gasoline and natural gas, ethanol and refined coal plants

operating efficiently and according to forecasts and projections,

changes in the international, national or regional economies,

weather, results of income tax audits, changes in income tax laws

or regulations, the impact of U.S. foreign trade policy, changes in

foreign currency exchange rates and the effects of terrorism or

acts of war. The Company does not intend to update publicly any

forward-looking statements except as required by law.

- statements of operations follow -

REX AMERICAN RESOURCES CORPORATION AND SUBSIDIARIES

Consolidated Statements of Operations

(in thousands, except per share

amounts)

Unaudited

Three Months Twelve Months

Ended Ended January 31, January 31,

2019

2018

2019

2018

Net sales and revenue $ 113,344 $ 109,535 $ 486,671 $ 452,586 Cost

of sales

111,126

103,511 456,456

408,425 Gross profit 2,218 6,024 30,215

44,161 Selling, general and administrative expenses (4,476 ) (6,532

) (20,551 ) (24,060 ) Equity in (loss) income of unconsolidated

ethanol affiliates (646 ) 1,301 1,536 3,232 Interest and other

income, net

1,229

866 3,388

2,060 (Loss) Income from continuing operations

before income taxes and non-controlling interests

(1,675

)

1,659

14,588

25,393

Benefit for income taxes

4,574

18,476 22,922

19,519 Net income including non-controlling

interests 2,899 20,135 37,510 44,912 Net income attributable to

non-controlling interests

(1,842 )

(1,082 )

(5,865 ) (5,206

) Net income attributable to REX common shareholders

$ 1,057 $

19,053 $ 31,645

$ 39,706 Weighted

average shares outstanding – basic and diluted

6,341 6,604

6,440 6,596

Basic and diluted net income per share attributable to REX common

shareholders

$

0.17

$

2.89

$

4.91

$

6.02

- balance sheets follow -

REX AMERICAN RESOURCES CORPORATION AND SUBSIDIARIES

Consolidated Balance Sheets

(in thousands)

Unaudited

January 31,

January 31,

ASSETS

2019

2018

CURRENT ASSETS: Cash and cash equivalents $ 188,531 $ 190,988

Restricted cash 281 354 Short-term investments 14,975 - Accounts

receivable 11,378 12,913 Inventory 18,477 20,755 Refundable income

taxes 7,695 6,612 Prepaid expenses and other

9,284 7,412 Total

current assets 250,621 239,034 Property and equipment-net 182,521

197,827 Other assets 6,176 7,454 Equity method investments

32,075 34,549 TOTAL

ASSETS

$ 471,393 $

478,864 LIABILITIES AND EQUITY CURRENT

LIABILITIES: Accounts payable – trade $ 7,463 $ 8,149 Accrued

expenses and other current liabilities

9,546

13,716 Total current liabilities

17,009 21,865

LONG TERM LIABILITIES: Deferred taxes 4,185 21,706 Other long term

liabilities

4,928

3,367 Total long term liabilities

9,113 25,073

COMMITMENTS AND CONTINGENCIES EQUITY: REX shareholders’ equity:

Common stock, 45,000 shares authorized, 29,853 shares issued at par

299 299 Paid in capital 148,273 146,923 Retained earnings 579,558

547,913 Treasury stock, 23,580 and 23,287 shares, respectively

(335,193 )

(313,643 ) Total REX shareholders’ equity

392,937 381,492 Non-controlling interests

52,334 50,434 Total

equity

445,271

431,926 TOTAL LIABILITIES AND EQUITY

$ 471,393 $

478,864

- statements of cash flows follow -

REX AMERICAN RESOURCES CORPORATION AND SUBSIDIARIES

Consolidated Statements of Cash Flows

(in thousands)

Unaudited

Fiscal Years Ended January 31,

2019

2018

CASH FLOWS FROM OPERATING ACTIVITIES: Net income $ 37,510 $ 44,912

Adjustments to reconcile net income to net cash provided by

operating activities: Depreciation and amortization 24,828 21,462

Stock based compensation expense 669 1,641 Income from equity

method investments (1,536 ) (3,232 ) Dividends received from equity

method investments 4,010 6,516 Interest income from investments

(1,077 ) - Loss on sale of investment - 13 Loss on disposal of real

estate and property and equipment 104 192 Deferred income tax

(23,364 ) (18,605 ) Changes in assets and liabilities: Accounts

receivable 1,535 (1,089 ) Inventory 2,278 (3,649 ) Prepaid expenses

and other assets 5,217 (1,170 ) Income taxes refundable (1,083 )

(5,542 ) Accounts payable-trade 339 (1,705 ) Accrued expenses and

other liabilities

(1,499 )

1,225 Net cash provided by operating activities

47,931 40,969

CASH FLOWS FROM INVESTING ACTIVITIES: Capital expenditures (10,775

) (24,017 ) Acquisition of business, net of cash acquired - (12,049

) Purchases of short-term investments (125,989 ) - Sales of

short-term investments 112,091 - Repayment of note receivable 27 26

Proceeds from sale of investment - 64 Proceeds from sale of real

estate and property and equipment - 104 Restricted investments and

deposits

5 150

Net cash used in investing activities

(24,641 ) (35,722

) CASH FLOWS FROM FINANCING ACTIVITIES: Payments to

non-controlling interests holders (4,489 ) (3,529 ) Capital

contributions from minority investor 524 918 Treasury stock

acquired

(21,855 )

- Net cash used in financing activities

(25,820 ) (2,611

) NET (DECREASE) INCREASE IN CASH, CASH EQUIVALENTS

AND RESTRICTED CASH (2,530 ) 2,636 CASH, CASH EQUIVALENTS AND

RESTRICTED CASH-Beginning of year

191,342

188,706 CASH, CASH EQUIVALENTS

AND RESTRICTED CASH-End of year

$ 188,812

$ 191,342 Non cash

financing activities – Equity awards issued

$

1,473 $ 1,195

Non cash financing activities – Equity awards accrued

$ 487 $

1,485 Non cash investing activities – Accrued

capital expenditures

$ -

$ 1,149

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190321005148/en/

Douglas BruggemanChief Financial Officer(937) 276-3931

Joseph Jaffoni, Norberto AjaJCIR(212) 835-8500rex@jcir.com

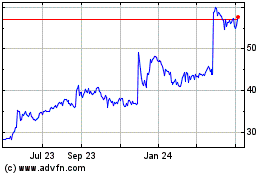

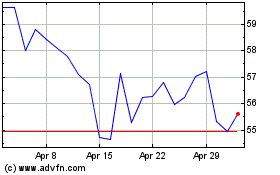

REX American Resources (NYSE:REX)

Historical Stock Chart

From Aug 2024 to Sep 2024

REX American Resources (NYSE:REX)

Historical Stock Chart

From Sep 2023 to Sep 2024