Regis Corporation (Nasdaq GM: RGS), a leader in the haircare

industry, today announced financial results for the fourth fiscal

quarter and full year ended June 30, 2024.

Matthew Doctor, Regis Corporation's President and Chief

Executive Officer, commented: "I am very pleased with the

milestones achieved in fiscal 2024 that pave the way for a new day

at Regis. The strategic refinancing completed in June 2024 was an

outstanding result that puts Regis on solid financial footing and

creates flexibility we have not had in years. Our results and

continued growth in profitability is a testament to the hard work

and dedication of our franchisees and employees. I am excited that

for the first time since I have been CEO we are able to grow our

franchisees sales and profitability with our undivided focus, and

can start taking a longer-term view as opposed to the short-term

blocking and tackling that was required to get to this point. With

the Zenoti migration complete, and the right organization in place,

we are ready to execute on a focused set of priorities to

ultimately increase traffic to our salons through operational

excellence and drive growth and value creation for all

stakeholders."

Business Highlights and

Updates:

- Entered into a new senior secured credit facility with TCW

Asset Management Company LLC ("TCW"), a leading global asset

manager, and Midcap Financial Trust ("Midcap") in June 2024;

- A $105 million term loan replaced the Company's existing debt,

reducing outstanding indebtedness by more than $80 million and

saving approximately $7 million in cash interest annually. In

addition to the term loan, the Company has access to a $25 million

revolving credit facility;

- The new revolving credit facility and term loan will mature in

June 2029 vs. previous debt maturity of August 2025;

- Completed Zenoti point-of-sale migration in August 2024;

majority of earned migration proceeds to be received in the second

quarter fiscal 2025

Financial Highlights:

Fourth quarter fiscal 2024 compared to fourth quarter fiscal

2023:

- System-wide revenue of $293.7 million versus $311.8 million in

the fourth quarter fiscal 2023, a decline of $18.1 million; and

system-wide same-store sales decreased 1.3%;

- Operating income of $4.6 million versus $3.6 million in the

fourth quarter fiscal 2023; a $1.0 million improvement;

- Adjusted EBITDA of $7.4 million versus $5.2 million in the

fourth quarter fiscal 2023, a $2.2 million improvement;

- Franchise adjusted EBITDA of $6.1 million versus $5.5 million

in the fourth quarter fiscal 2023, a $0.6 million improvement;

- Net income of $91.2 million versus a net loss of $4.8 million

in the fourth quarter fiscal 2023, a $96.0 million improvement;

and

- Diluted earnings per share of $38.10 versus $2.07 loss per

diluted share in the fourth quarter fiscal 2023, a $40.17

improvement.

Full fiscal year 2024 compared to full fiscal year

2023:

- System-wide revenue of $1,179.5 million versus $1,230.5 million

in fiscal year 2023, a decline of $51.0 million; system-wide

same-store sales improved 0.7%;

- Operating income of $20.9 million versus $8.8 million in fiscal

year 2023, a $12.1 million improvement;

- Adjusted EBITDA of $25.9 million versus $21.0 million in fiscal

year 2023, a $4.9 million improvement;

- Franchise adjusted EBITDA of $26.3 million versus $22.8 million

in fiscal year 2023, a $3.5 million improvement;

- Net income of $91.1 million versus a net loss of $7.4 million

in fiscal year 2023, a $98.5 million improvement; and

- Diluted earnings per share of $38.34 income per diluted share

versus a $3.18 loss per diluted share in fiscal year 2023, a $41.52

improvement.

Fourth Quarter Fiscal Year 2024

Consolidated Results

Three Months Ended June

30,

Twelve Months Ended June

30,

(Dollars in millions, except per share

data)

2024

2023

2024

2023

Consolidated revenue

$

49.4

$

55.7

$

203.0

$

233.3

System-wide revenue (1)

293.7

311.8

1,179.5

1,230.5

System-wide same-store sales comps

(1.3

)%

2.5

%

0.7

%

4.4

%

Operating income

$

4.6

$

3.6

$

20.9

$

8.8

Income (loss) from continuing

operations

91.3

(4.8

)

89.1

(11.3

)

Diluted income (loss) per share from

continuing operations

38.14

(2.07

)

37.50

(4.88

)

(Loss) income from discontinued

operations

(0.1

)

—

2.0

4.0

Net income (loss)

91.2

(4.8

)

91.1

(7.4

)

Diluted net income (loss) per share

38.10

(2.07

)

38.34

(3.18

)

Adjusted EBITDA (2)

7.4

5.2

25.9

21.0

_______________________________________________________________________________

(1)

Represents total sales within the

system.

(2)

See GAAP to non-GAAP reconciliations

within the attached section titled "Non-GAAP Reconciliations."

Revenue

Total consolidated revenue of $49.4 million in the fourth

quarter and total revenue for fiscal year 2024 of $203.0 million,

declined $6.3 million, and $30.3 million, respectively. The

declines in both periods were driven primarily by a reduction in

non-margin franchise rental income and advertising contributions

and the wind down of loss generating salons, partially offset by

non-cash revenue resulting from a change in estimate to gift card

breakage.

Operating Income

Regis reported fourth quarter 2024 income from operations of

$4.6 million compared to $3.6 million in the fourth quarter 2023.

Regis reported fiscal year 2024 income from operations of $20.9

million compared to $8.8 million in fiscal year 2023. The

improvements in operating income in both periods were driven

primarily by lower rent expense, and non-cash revenue resulting

from a change in estimate to gift card breakage, partially offset

by lower royalties and fees. The year-over-year improvement is also

driven by the wind down of franchise product sales and lower

general and administrative expenses.

Income (Loss) from Continuing Operations

Regis reported fourth quarter 2024 net income from continuing

operations of $91.3 million, or $38.14 income per diluted share,

compared to a net loss from continuing operations of $4.8 million,

or $2.07 loss per diluted share, in the fourth quarter 2023. Regis

reported fiscal year 2024 net income from continuing operations of

$89.1 million, or $37.50 income per diluted share, compared to a

net loss from continuing operations of $11.3 million, or $4.88 loss

per diluted share, in 2023. The year-over-year improvement in net

income (loss) from continuing operations in both periods was driven

by the gain on extinguishment of long-term debt of $94.6 million

and improved operating income.

Net Income (Loss)

The Company reported fourth quarter 2024 net income of $91.2

million, or $38.10 income per diluted share, compared to a net loss

of $4.8 million, or $2.07 loss per diluted share for the same

period last year. The Company reported fiscal year 2024 net income

of $91.1 million, or $38.34 income per diluted share, compared to a

net loss of $7.4 million, or $3.18 loss per diluted share, in 2023.

The year-over-year improvement in net income (loss) in both periods

was driven by the gain on extinguishment of long-term debt and

improved operating income.

Adjusted EBITDA

Fourth quarter adjusted EBITDA of $7.4 million improved $2.2

million versus adjusted EBITDA of $5.2 million in the same period

last year. The improvements were driven by lower rent expense and

non-cash revenue resulting from a change in estimate to gift card

breakage, partially offset by lower franchise revenue.

Fiscal year adjusted EBITDA of $25.9 million improved $4.9

million, versus an adjusted EBITDA of $21.0 million in the same

period last year. The improvement was primarily due to lower rent

expense, lower general and administrative expenses, and non-cash

revenue resulting from a change in estimate to gift card breakage.

Fiscal year 2023 adjusted EBITDA also benefited from a $1.1 million

grant from the state of North Carolina related to COVID-19

relief.

Fourth Quarter Fiscal Year 2024 Segment

Results

Franchise

Three Months Ended June

30,

Increase (Decrease)

Twelve Months Ended June

30,

Increase (Decrease)

(Dollars in millions) (1)

2024

2023

2024

2023

Royalties

$

16.1

$

16.6

$

(0.5

)

$

64.1

$

66.0

$

(1.9

)

Fees

2.4

3.0

(0.6

)

10.2

11.3

(1.1

)

Product sales to franchisees

—

0.6

(0.6

)

0.5

2.8

(2.3

)

Advertising fund contributions

5.9

7.7

(1.8

)

25.7

31.7

(6.0

)

Franchise rental income

22.7

25.6

(2.9

)

95.3

111.4

(16.1

)

Total franchise revenue

$

47.1

$

53.5

$

(6.4

)

$

195.7

$

223.2

$

(27.5

)

Franchise same-store sales comps

(1.4

)%

2.4

%

0.6

%

4.4

%

Franchise adjusted EBITDA

$

6.1

$

5.5

$

0.6

$

26.3

$

22.8

$

3.5

as a percent of revenue

13.0

%

10.2

%

13.4

%

10.2

%

as a percent of adjusted revenue (2)

33.0

%

27.1

%

35.1

%

28.5

%

Total franchise salons

4,391

4,795

(404

)

as a percent of total franchise and

company-owned salons

99.6

%

98.6

%

_______________________________________________________________________________

(1)

Variances calculated on amounts

shown in millions may result in rounding differences.

(2)

Adjusted revenue excludes

non-margin revenue. See GAAP to non-GAAP reconciliations within the

attached section titled "Non-GAAP Reconciliations."

Franchise Revenue

Fourth quarter franchise revenue was $47.1 million, a $6.4

million, or 12.0% decrease compared to the prior year quarter.

Non-margin franchise rental income decreased $2.9 million due to

fewer salons in the current year. Royalties were $16.1 million, a

$0.5 million, or 3.0% decrease, versus the same period last year

due to the decline in salon count. Product sales to franchisees

decreased $0.6 million, as a result of the transition out of the

wholesale product business. Franchise fees decreased $0.6 million

compared to the prior year quarter, primarily due to a decrease in

terminated development agreements.

Fiscal year 2024 franchise revenue was $195.7 million, a $27.5

million, or 12.3% decrease compared to the prior year primarily due

to a decline in non-margin franchise rental income as a result of a

lower franchise salon count.

Franchise Adjusted EBITDA

Fourth quarter franchise adjusted EBITDA of $6.1 million

improved $0.6 million from the same period last year. The

improvement was primarily due to lower rent expense.

Fiscal year 2024 franchise adjusted EBITDA of $26.3 million

improved $3.5 million year-over-year. The improvement was primarily

due to lower rent expense and lower general and administrative

expenses.

Company-Owned Salons

Three Months Ended June

30,

Increase (Decrease)

Twelve Months Ended June

30,

Increase (Decrease)

(Dollars in millions) (1)

2024

2023

2024

2023

Total company-owned salon revenue

$

2.3

$

2.2

$

0.1

$

7.3

$

10.1

$

(2.8

)

Company-owned same-store sales comps

2.4

%

8.7

%

3.5

%

4.9

%

Company-owned salon adjusted EBITDA

$

1.3

$

(0.3

)

$

1.6

$

(0.3

)

$

(1.8

)

$

1.5

as a percent of revenue

56.5

%

(13.6

)%

(4.1

)%

(17.8

)%

Total Company-owned salons

17

68

(51

)

as a percent of total franchise and

company-owned salons

0.4

%

1.4

%

_______________________________________________________________________________

(1)

Variances calculated on amounts shown in

millions may result in rounding differences.

Company-Owned Salon Revenue

Fourth quarter revenue for the company-owned salon segment

improved $0.1 million versus the prior year to $2.3 million. The

year-over-year improvement in revenue was primarily driven by

non-cash revenue resulting from a change in estimate related to

gift card breakage, partially offset by company-owned salon

closures.

Fiscal year 2024 revenue for the company-owned salon segment

declined $2.8 million versus the prior year to $7.3 million due to

company-owned salon closures, partially offset by non-cash revenue

resulting from a change in estimate related to gift card

breakage.

Company-Owned Salon Adjusted EBITDA

Fourth quarter company-owned salon adjusted EBITDA improved $1.6

million year-over-year primarily due to a change in estimate

related to gift card breakage and the closure of unprofitable

salons.

Fiscal year 2024 company-owned salon adjusted EBITDA loss

improved $1.5 million year-over-year driven primarily by the

closure of unprofitable salons; and non-cash revenue resulting from

a change in estimate related to gift card breakage, partially

offset by a $1.1 million grant from the state of North Carolina

related to COVID-19 relief in fiscal year 2023.

Balance Sheet and Cash

Flow

The Company ended fiscal year 2024 with $10.1 million in cash

and cash equivalents. On June 24, 2024, the Company refinanced its

credit facility, reducing its indebtedness by more than $80

million, resulting in $115.3 million in outstanding borrowings

($105.0 million term loan and $10.2 million revolver draw) and

total liquidity of $19.9 million at June 30, 2024. The Company

utilized its U.S. federal and state net operating losses to offset

the entire tax liability related to this transaction. Net cash used

in operating activities for the fiscal year totaled $2.0 million,

an improvement of $5.8 million from the prior year. Cash use

improved due primarily to lower general and administrative expense,

partially offset by a decrease in franchise revenue.

Non-GAAP reconciliations

For GAAP to non-GAAP reconciliations, please refer to the

attached section titled "Non-GAAP Reconciliations." A complete

reconciliation of reported earnings to adjusted earnings is

included in this press release and is available on the Company’s

website at www.regiscorp.com.

Earnings Webcast

Regis Corporation will host a conference call via webcast

discussing fourth quarter and fiscal year 2024 results today,

August 28, 2024, at 7:30 a.m., Central time. Interested parties are

invited to participate in the live webcast by registering for the

event at www.regiscorp.com/investor-relations.html. The webcast

will include a slide presentation. A replay of the presentation

will be available on our website at the same web address.

About Regis Corporation

Regis Corporation (NasdaqGM:RGS) is a leader in the haircare

industry. As of June 30, 2024, the Company franchised or owned

4,408 locations. Regis' franchised and corporate locations operate

under concepts such as Supercuts®, SmartStyle®, Cost Cutters®,

Roosters®, and First Choice Haircutters®. For additional

information about the Company, including a reconciliation of

certain non-GAAP financial information and certain supplemental

financial information, please visit the Investor Information

section of the corporate website at www.regiscorp.com.

This press release contains or may contain "forward-looking

statements" within the meaning of the federal securities laws,

including statements concerning anticipated future events and

expectations that are not historical facts. These forward-looking

statements are made pursuant to the safe harbor provisions of the

Private Securities Litigation Reform Act of 1995. The

forward-looking statements in this document reflect management's

best judgment at the time they are made, but all such statements

are subject to numerous risks and uncertainties, which could cause

actual results to differ materially from those expressed in or

implied by the statements herein. Such forward-looking statements

are often identified herein by use of words including, but not

limited to, "may," "believe," "project," "forecast," "expect,"

"estimate," "anticipate," and "plan." In addition, the following

factors could affect the Company's actual results and cause such

results to differ materially from those expressed in

forward-looking statements. These uncertainties include a potential

material adverse impact on our business and results of operations

as a result of changes in consumer shopping trends and changes in

manufacturer distribution channels; laws and regulations could

require us to modify current business practices and incur increased

costs including increases in minimum wages; changes in general

economic environment; changes in consumer tastes, hair product

innovation, fashion trends and consumer spending patterns;

compliance with Nasdaq listing requirements; reliance on franchise

royalties and overall success of our franchisees’ salons; our

salons' dependence on a third-party supplier agreement for

merchandise; our franchisees' ability to attract, train and retain

talented stylists and salon leaders; the success of our

franchisees, which operate independently; data security and privacy

compliance and our ability to manage cyber threats and protect the

security of potentially sensitive information about our guests,

franchisees, employees, vendors or Company information; the ability

of the Company to maintain a satisfactory relationship with

Walmart; marketing efforts to drive traffic to our franchisees'

salons; our ability to maintain and enhance the value of our

brands; reliance on information technology systems; reliance on

external vendors; the use of social media; the effectiveness of our

enterprise risk management program; ability to generate sufficient

cash flow to satisfy our debt service obligations; compliance with

covenants in our financing arrangement; premature termination of

agreements with our franchisees; the continued ability of the

Company to implement cost reduction initiatives and achieve

expected cost savings; continued ability to compete in our business

markets; reliance on our management team and other key personnel;

the continued ability to maintain an effective system of internal

control over financial reporting; changes in tax exposure; the

ability of our Tax Preservation Plan to protect the future

availability of the Company's tax assets; potential litigation and

other legal or regulatory proceedings; or other factors not listed

above. Additional information concerning potential factors that

could affect future financial results is set forth under Item 1A of

this Form 10-K. We undertake no obligation to publicly update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise. However, your attention is

directed to any further disclosures made in our subsequent annual

and periodic reports filed or furnished with the SEC on Forms 10-K,

10-Q and 8-K and Proxy Statements on Schedule 14A.

REGIS CORPORATION

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Dollars in thousands, except

per share data)

June 30,

2024

2023

ASSETS

Current assets:

Cash and cash equivalents

$

10,066

$

9,508

Receivables, net

9,434

10,885

Other current assets

22,550

16,845

Total current assets

42,050

37,238

Property and equipment, net

3,664

6,422

Goodwill

173,146

173,791

Other intangibles, net

2,427

2,783

Right of use asset

287,912

360,836

Other assets

21,297

26,307

Total assets

$

530,496

$

607,377

LIABILITIES AND SHAREHOLDERS' EQUITY

(DEFICIT)

Current liabilities:

Accounts payable

$

12,747

$

14,309

Accrued expenses

21,644

30,109

Short-term lease liability

69,127

81,917

Total current liabilities

103,518

126,335

Long-term debt, net

99,545

176,830

Long-term lease liability

230,607

291,901

Other non-current liabilities

40,039

49,041

Total liabilities

473,709

644,107

Commitments and contingencies

Shareholders' equity (deficit):

Common stock, $0.05 par value; issued and

outstanding, 2,279,948 and 2,277,828 common shares as of June 30,

2024 and 2023, respectively

114

114

Additional paid-in capital

69,660

66,764

Accumulated other comprehensive income

8,584

9,023

Accumulated deficit

(21,571

)

(112,631

)

Total shareholders' equity (deficit)

56,787

(36,730

)

Total liabilities and shareholders' equity

(deficit)

$

530,496

$

607,377

REGIS CORPORATION

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Dollars and shares in

thousands, except per share data)

Three Months Ended June

30,

Twelve Months Ended June

30,

2024

2023

2024

2023

Revenues:

Royalties

$

16,063

$

16,607

$

64,098

$

65,981

Fees

2,449

2,965

10,189

11,266

Product sales to franchisees

—

608

451

2,802

Advertising fund contributions

5,856

7,744

25,663

31,747

Franchise rental income

22,724

25,596

95,258

111,441

Company-owned salon revenue

2,284

2,195

7,323

10,089

Total revenue

49,376

55,715

202,982

233,326

Operating expenses:

Cost of product sales to franchisees

—

715

436

3,540

Inventory reserve

—

—

—

1,228

General and administrative

11,639

11,544

45,387

50,751

Rent

1,268

3,276

5,525

9,196

Advertising fund expense

5,856

7,744

25,663

31,747

Franchise rent expense

22,724

25,596

95,258

111,441

Company-owned salon expense (1)

779

1,536

5,080

8,827

Depreciation and amortization

1,888

1,664

3,945

7,716

Long-lived asset impairment

629

65

798

101

Total operating expenses

44,783

52,140

182,092

224,547

Operating income

4,593

3,575

20,890

8,779

Other (expense) income:

Interest expense

(6,864

)

(9,018

)

(25,393

)

(22,141

)

Gain on extinguishment of long-term debt,

net

94,611

—

94,611

—

Other, net

27

198

(172

)

1,364

Income (loss) from operations before

income taxes

92,367

(5,245

)

89,936

(11,998

)

Income tax (expense) benefit

(1,070

)

442

(869

)

655

Income (loss) from continuing

operations

91,297

(4,803

)

89,067

(11,343

)

(Loss) income from discontinued

operations, net of income taxes

(96

)

—

1,993

3,958

Net income (loss)

$

91,201

$

(4,803

)

$

91,060

$

(7,385

)

Net income (loss) per share:

Basic:

Income (loss) from continuing

operations

$

38.98

$

(2.07

)

$

38.08

$

(4.88

)

Income (loss) from discontinued

operations

(0.04

)

$

—

0.85

1.70

Net income (loss) per share, basic (2)

$

38.94

$

(2.07

)

$

38.93

$

(3.18

)

Diluted:

Income (loss) from continuing

operations

$

38.14

$

(2.07

)

$

37.50

$

(4.88

)

Income (loss) from discontinued

operations

(0.04

)

$

—

0.84

1.70

Net income (loss) per share, diluted

(2)

$

38.10

$

(2.07

)

$

38.34

$

(3.18

)

Weighted average common and common

equivalent shares outstanding:

Basic

2,342

2,323

2,339

2,312

Diluted

2,394

2,323

2,375

2,312

_______________________________________________________________________________

(1)

Includes cost of service and

product sold to guests in our company-owned salons. Excludes

general and administrative expense, rent and depreciation and

amortization related to company-owned salons.

(2)

Total is a recalculation; line

items calculated individually may not sum to total due to

rounding.

REGIS CORPORATION

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Dollars in thousands)

Twelve Months Ended June

30,

2024

2023

Cash flows from operating activities:

Net income (loss)

$

91,060

$

(7,385

)

Adjustments to reconcile net income (loss)

to net cash used in operating activities

Gain from sale of OSP

(2,000

)

(4,562

)

Depreciation and amortization

3,403

7,189

Long-lived asset impairment

798

101

Deferred income taxes

519

(8

)

Inventory reserve

—

1,228

Non-cash interest

3,418

3,790

Gain on extinguishment of long-term debt,

net

(94,611

)

—

Stock-based compensation

1,558

2,316

Amortization of debt discount and

financing costs

2,987

2,891

Other non-cash items affecting

earnings

432

155

Changes in operating assets and

liabilities (1):

Receivables

848

943

Income tax receivable

1,230

(577

)

Other current assets

385

668

Other assets

5,829

6,818

Accounts payable

(1,604

)

(497

)

Accrued expenses

(4,812

)

(6,151

)

Net lease liabilities

(1,942

)

(4,991

)

Other non-current liabilities

(9,538

)

(9,817

)

Net cash used in operating activities:

(2,040

)

(7,889

)

Cash flows from investing activities:

Capital expenditures

(376

)

(481

)

Net proceeds from sale of OSP

2,000

4,500

Net cash provided by investing

activities:

1,624

4,019

Cash flows from financing activities:

Proceeds from issuance of long-term

debt

105,000

—

Borrowings on revolving credit

facility

14,238

13,357

Debt refinancing fees

(14,360

)

(4,383

)

Repayments of long-term debt

(96,499

)

(11,083

)

Taxes paid for shares withheld

(16

)

(36

)

Net cash provided by (used in) financing

activities:

8,363

(2,145

)

Effect of exchange rate changes on cash

and cash equivalents

(31

)

(53

)

Increase (decrease) in cash, cash

equivalents and restricted cash

7,916

(6,068

)

Cash, cash equivalents and restricted

cash:

Beginning of year

21,396

27,464

End of year

$

29,312

$

21,396

_______________________________________________________________________________

(1)

Changes in operating assets and

liabilities exclude assets and liabilities sold or acquired.

SYSTEM-WIDE SAME-STORE SALES

(1):

Three Months Ended

June 30, 2024

June 30, 2023

Service

Retail

Total

Service

Retail

Total

Supercuts

0.4

%

(10.7

)%

—

%

4.5

%

(2.4

)%

4.2

%

SmartStyle

(3.5

)

(15.2

)

(5.5

)

(1.9

)

(9.7

)

(3.4

)

Portfolio Brands

(0.1

)

(12.6

)

(0.8

)

4.2

(0.4

)

3.8

Total

(0.4

)%

(13.3

)%

(1.3

)%

3.2

%

(5.3

)%

2.5

%

Twelve Months Ended

June 30, 2024

June 30, 2023

Service

Retail

Total

Service

Retail

Total

Supercuts

2.0

%

(8.0

)%

1.6

%

7.5

%

(5.2

)%

6.9

%

SmartStyle

(1.8

)

(11.5

)

(3.5

)

0.1

(12.8

)

(2.5

)

Portfolio Brands

2.8

(6.4

)

2.0

6.4

(3.7

)

5.5

Total

1.5

%

(9.1

)%

0.7

%

5.7

%

(8.5

)%

4.4

%

_______________________________________________________________________________

(1)

System-wide same-store sales are

calculated as the total change in sales for system-wide franchise

and company-owned locations that were open on a specific day of the

week during the current period and the corresponding prior period.

Quarterly and year-to-date system-wide same-store sales are the sum

of the system-wide same-store sales computed on a daily basis.

Franchise salons that do not report daily sales are excluded from

same-store sales. System-wide same-store sales are calculated in

local currencies to remove foreign currency fluctuations from the

calculation.

REGIS CORPORATION

System-Wide Location

Counts

June 30,

2024

2023

FRANCHISE SALONS:

Supercuts

1,946

2,082

SmartStyle/Cost Cutters in Walmart

stores

1,232

1,388

Portfolio Brands

1,117

1,223

Total North American salons

4,295

4,693

Total International salons (1)

96

102

Total Franchise salons

4,391

4,795

as a percent of total franchise and

company-owned salons

99.6

%

98.6

%

COMPANY-OWNED SALONS:

Supercuts

3

7

SmartStyle/Cost Cutters in Walmart

stores

8

48

Portfolio Brands

6

13

Total Company-owned salons

17

68

as a percent of total Franchise and

Company-owned salons

0.4

%

1.4

%

Total franchise and company-owned

salons

4,408

4,863

_______________________________________________________________________________

(1)

Canadian and Puerto Rican salons

are included in the North American salon totals.

Non-GAAP Reconciliations:

This press release includes a presentation of operating income

excluding certain non-cash charges, adjusted EBITDA, and adjusted

franchise revenue, which are non-GAAP measures. The non-GAAP

measures are financial measures that do not reflect United States

Generally Accepted Accounting Principles (GAAP). We believe our

presentation of the non-GAAP measures provides meaningful insight

into our ongoing operating performance and a supplemental

perspective of our results of operations. Presentation of the

non-GAAP measures allows investors to review our core ongoing

operating performance from the same perspective as management and

the Board of Directors. These non-GAAP financial measures provide

investors an enhanced understanding of our operations, facilitate

investors' analyses and comparisons of our current and past results

of operations and provide insight into the prospects of our future

performance. We also believe the non-GAAP measures are useful to

investors because they provide supplemental information that

research analysts frequently use to analyze financial

performance.

Items impacting comparability are not defined terms within U.S.

GAAP. Therefore, our non-GAAP financial information may not be

comparable to similarly titled measures reported by other

companies. We determine the items to consider as "items impacting

comparability" based on how management views our business, makes

financial, operating and planning decisions and evaluates the

Company's ongoing performance.

The reconciliation of U.S. GAAP operating income to non-GAAP

operating income excluding certain non-cash charges is included in

the release.

The following items have been excluded from our non-GAAP

adjusted EBITDA results: discontinued operations, inventory

reserve, one-time professional fees and settlements, severance

expense, the benefit from lease liability decreases in excess of

previously impaired right of use asset, lease termination fees,

asset retirement obligation costs, and the benefit from the

Company's debt refinancing.

We present adjusted revenue to provide a meaningful franchise

adjusted EBITDA margin, which removes non-margin revenue from total

revenue to arrive at an adjusted margin. Margin is a common metric

used by investors, however, the majority of our revenue is offset

by equal expense, so it does not contribute to our margin. We

remove the non-margin revenue from this metric in order to show a

meaningful margin rate.

The method we use to produce non-GAAP results is not in

accordance with U.S. GAAP and may differ from methods used by other

companies. These non-GAAP results should not be regarded as a

substitute for corresponding U.S. GAAP measures, but instead should

be utilized as a supplemental measure of operating performance in

evaluating our business. Non-GAAP measures do have limitations as

they do not reflect certain items that may have a material impact

upon our reported financial results. As such, these non-GAAP

measures should be viewed in conjunction with our financial

statements prepared in accordance with U.S. GAAP.

REGIS CORPORATION

Reconciliation of U.S. GAAP

Net Income (Loss) to Adjusted EBITDA

(Dollars in thousands)

(Unaudited)

Three Months Ended June

30,

Twelve Months Ended June

30,

2024

2023

2024

2023

Consolidated reported net income (loss),

as reported (U.S. GAAP)

$

91,201

$

(4,803

)

$

91,060

$

(7,385

)

Interest expense, as reported

6,864

9,018

25,393

22,141

Income taxes, as reported

1,070

(442

)

869

(655

)

Depreciation and amortization, as

reported

1,888

1,664

3,945

7,716

Long-lived asset impairment, as

reported

629

65

798

101

EBITDA

$

101,652

$

5,502

$

122,065

$

21,918

Inventory reserve

—

—

—

1,228

Professional fees and legal

settlements

6

—

68

1,248

Severance

—

(132

)

230

720

Lease liability benefit

(45

)

(258

)

(326

)

(1,773

)

Lease termination fees

297

56

501

1,627

Gain on extinguishment of long-term debt,

net

(94,611

)

—

(94,611

)

—

Discontinued operations

96

—

(1,993

)

(3,958

)

Adjusted EBITDA, non-GAAP financial

measure

$

7,395

$

5,168

$

25,934

$

21,010

REGIS CORPORATION

Reconciliation of Reported

Franchise Adjusted EBITDA as a Percent of GAAP Franchise

Revenue

to Franchise Adjusted EBITDA

as a Percent of Adjusted Franchise Revenue

(Dollars in thousands)

(Unaudited)

Three Months Ended June

30,

Twelve Months Ended June

30,

2024

2023

2024

2023

Franchise adjusted EBITDA

$

6,111

$

5,460

$

26,257

$

22,799

GAAP franchise revenue

47,092

53,520

195,659

223,237

Franchise adjusted EBITDA as a percent of

GAAP franchise revenue

13.0

%

10.2

%

13.4

%

10.2

%

Non-margin revenue adjustments:

Franchise rental income

$

(22,724

)

$

(25,596

)

$

(95,258

)

$

(111,441

)

Advertising fund contributions

(5,856

)

(7,744

)

(25,663

)

(31,747

)

Adjusted franchise revenue

$

18,512

$

20,180

$

74,738

$

80,049

Franchise adjusted EBITDA as a percent of

adjusted franchise revenue

33.0

%

27.1

%

35.1

%

28.5

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240828028762/en/

REGIS CORPORATION: Kersten Zupfer

investorrelations@regiscorp.com

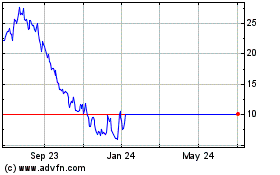

Regis (NYSE:RGS)

Historical Stock Chart

From Dec 2024 to Jan 2025

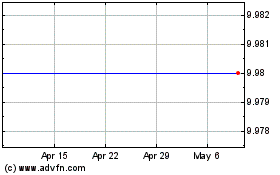

Regis (NYSE:RGS)

Historical Stock Chart

From Jan 2024 to Jan 2025