Regis Corporation Announces New Credit Facility to Refinance Existing Debt

June 25 2024 - 6:00AM

Business Wire

Refinancing reduces outstanding debt by more

than $80 million, saving ~$7 million in cash interest annually and

accelerating Regis’ investment in long-term growth

Supplemental Presentation Available on the

Regis Investor Relations Website

Regis Corporation (NasdaqGM: RGS) (“Regis” or the “Company”), a

leader in the haircare industry, today announced that it has

entered into a new senior secured credit facility with TCW Asset

Management Company LLC (“TCW”), a leading global asset manager, and

Midcap Financial Trust (“Midcap”). A $105 million term loan

replaces the Company’s existing debt, reducing outstanding

indebtedness by more than $80 million and saving approximately $7

million in cash interest annually. In addition to the term loan,

the Company will have access to a $25 million revolving credit

facility. The new revolving credit facility and term loan will

mature on June 24, 2029. Upon transition of the Company’s

outstanding letters of credit to the new revolving credit facility,

the Company expects to have full access to the availability in

excess of the outstanding letters of credit.

“This strategic refinancing is a significant milestone for Regis

and the next step on our path towards sustainable long-term growth

and value creation,” said Matthew Doctor, Regis Corporation's

President and Chief Executive Officer. “We conducted a

comprehensive strategic review to address our capital structure,

and we are pleased to have reached a refinancing agreement that

will significantly reduce our debt, improve the health of our

balance sheet and increase our financial flexibility so we can

focus on transforming our business operations.”

“The investment from TCW and Midcap is a testament to their

confidence in the long-term prospects of our business and our

ability to enhance value for our shareholders. We remain committed

to improving the customer experience, implementing new technology,

supporting the stylist and franchisee community, and managing our

corporate expenses. We look forward to updating the market on our

progress on our fiscal fourth quarter 2024 earnings call.”

For additional details on the transaction and pro forma

capitalization levels, please visit the June 2024 Refinancing

Transaction Summary, linked here and located on the Investor

Relations section of the corporate website in Presentations &

Supplemental Financial Information. Additional details will also be

available on Form 8-K filed with the Securities and Exchange

Commission.

Jefferies LLC served as financial advisor and Weil, Gotshal

& Manges LLP served as legal counsel to Regis.

About Regis Corporation

Regis Corporation (NasdaqGM: RGS) is a leader in the haircare

industry. As of March 31, 2024, the Company franchised or owned

4,557 locations. Regis' franchised and corporate locations operate

under concepts such as Supercuts®, SmartStyle®, Cost Cutters®,

Roosters® and First Choice Haircutters®. For additional information

about the Company, including a reconciliation of certain non-GAAP

financial information and certain supplemental financial

information, please visit the Investor Relations section of the

corporate website at www.regiscorp.com.

Forward-Looking Statements

This press release contains or may contain “forward-looking

statements” within the meaning of the federal securities laws,

including statements with respect to the impact on the Company’s

indebtedness, savings in cash interest, ability to enhance value

for stockholders and sustainable growth, and statements concerning

anticipated future events and expectations that are not historical

facts. These forward-looking statements are made pursuant to the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. The forward-looking statements in this document

reflect management’s best judgment at the time they are made, but

all such statements are subject to numerous risks and

uncertainties, which could cause actual results to differ

materially from those expressed in or implied by the statements

herein. Such forward-looking statements are often identified herein

by use of words including, but not limited to, “may,” “will,”

“accelerating,” “enhance,” “improve,” “transforming,” “,” and

“anticipate”. In addition, the following factors could affect the

Company's actual results and cause such results to differ

materially from those expressed in forward-looking statements.

These factors include a potential material adverse impact on our

business and results of operations as a result of changes in

consumer shopping trends and changes in manufacturer distribution

channels; laws and regulations could require us to modify current

business practices and incur increased costs; our potential

responsibility for Empire Education Group, Inc.'s liabilities;

changes in general economic environment; changes in consumer

tastes, hair product innovation, fashion trends and consumer

spending patterns; compliance with listing requirements; reliance

on franchise royalties and overall success of our franchisees’

salons; our salons' dependence on a third-party supplier agreement

for merchandise; our franchisees' ability to attract, train and

retain talented stylists and salon leaders; the success of our

franchisees, which operate independently; data security and privacy

compliance and our ability to manage cyber threats and protect the

security of potentially sensitive information about our guests,

franchisees, employees, vendors or Company information; the ability

of the Company to maintain a satisfactory relationship with

Walmart; marketing efforts to drive traffic to our franchisees'

salons; the successful migration of our franchisees to the Zenoti

salon technology platform; our ability to maintain and enhance the

value of our brands; reliance on information technology systems;

reliance on external vendors; the use of social media; the

effectiveness of our enterprise risk management program; ability to

generate sufficient cash flow to satisfy our debt service

obligations; compliance with covenants in our financing

arrangement, access to the existing revolving credit facility, and

acceleration of our obligation to repay our indebtedness; the

completion and/or results of the strategic alternatives review;

limited resources to invest in our business; premature termination

of agreements with our franchisees; financial performance of Empire

Education Group, Inc.; our ability to close the sale of our

ownership stake in Empire Education Group, Inc.; the continued

ability of the Company to implement cost reduction initiatives and

achieve expected cost savings; continued ability to compete in our

business markets; reliance on our management team and other key

personnel; the continued ability to maintain an effective system of

internal control over financial reporting; changes in tax exposure;

the ability to use U.S. net operating loss carryforwards; potential

litigation and other legal or regulatory proceedings; future

goodwill impairment or other factors not listed above. Additional

information concerning potential factors that could affect future

financial results is set forth under Item 1A on Form 10-K. We

undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information,

future events or otherwise. However, your attention is directed to

any further disclosures made in our subsequent annual and periodic

reports filed or furnished with the SEC on Forms 10-K, 10-Q and 8-K

and Proxy Statements on Schedule 14A.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240625325660/en/

Investors: Kersten Zupfer investorrelations@regiscorp.com

Media: Jude Gorman / Dan Moore Collected Strategies

Regis-CS@collectedstrategies.com

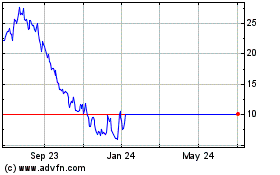

Regis (NYSE:RGS)

Historical Stock Chart

From Dec 2024 to Jan 2025

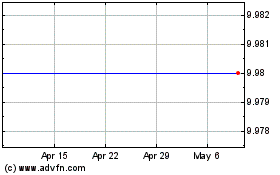

Regis (NYSE:RGS)

Historical Stock Chart

From Jan 2024 to Jan 2025