Regional Management Corp. Completes $250 Million Asset-Backed Securitization

November 27 2024 - 4:15PM

Business Wire

Regional Management Corp. (NYSE: RM), a diversified consumer

finance company, announced today that it has completed a $250

million asset-backed securitization, marking its 11th successful

securitization.

The Regional Management Issuance Trust 2024-2 (RMIT 2024-2)

notes were issued at a weighted-average coupon of 5.34% (an 85 bps

improvement over the prior RMIT 2024-1 issued notes), secured by

$284 million of receivables, with a 2-year revolving period. The

Class A notes of the securitization received a top rating of “AAA”

from Standard & Poor’s and Morningstar DBRS. The company used a

portion of the proceeds from the RMIT 2024-2 securitization to

fully pay off notes from its RMIT 2022-2B securitization having an

original weighted-average coupon of 7.51%.

“This transaction clearly demonstrates the ongoing strength of

our company and securitization platform,” said Robert W. Beck,

President and Chief Executive Officer of Regional Management Corp.

“We experienced significant demand across all classes of notes,

including from new investors. The deal was 5.4 times

oversubscribed, allowing us to achieve strong results from tight

credit spreads. The securitization further enhances our balance

sheet and continues to moderate our exposure to interest rate risk.

As of the transaction’s closing, our fixed-rate debt as a

percentage of total debt was approximately 83%, with a

weighted-average coupon of 4.1% and a weighted-average revolving

duration of 1.4 years. We remain well-positioned to successfully

execute on our long-term growth strategy and drive sustainable

returns and value for our shareholders.”

The transaction was a private offering of securities, not

registered under the Securities Act of 1933, or any state

securities law. All of such securities having been sold, this

announcement of their sale appears as a matter of record only.

About Regional Management Corp.

Regional Management Corp. (NYSE: RM) is a diversified consumer

finance company that provides attractive, easy-to-understand

installment loan products primarily to customers with limited

access to consumer credit from banks, thrifts, credit card

companies, and other lenders. Regional Management operates under

the name “Regional Finance” online and in branch locations in 19

states across the United States. Most of its loan products are

secured, and each is structured on a fixed-rate, fixed-term basis

with fully amortizing equal monthly installment payments, repayable

at any time without penalty. Regional Management sources loans

through its multiple channel platform, which includes branches,

centrally managed direct mail campaigns, digital partners, and its

consumer website. For more information, please visit

www.RegionalManagement.com.

Forward-Looking Statements

This press release may contain various “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Forward-looking statements are not statements

of historical fact but instead represent Regional Management

Corp.’s expectations or beliefs concerning future events.

Forward-looking statements include, without limitation, statements

concerning financial outlooks or future plans, objectives, goals,

projections, strategies, events, or performance, and underlying

assumptions and other statements related thereto. Words such as

“may,” “will,” “should,” “likely,” “anticipates,” “expects,”

“intends,” “plans,” “projects,” “believes,” “estimates,” “outlook,”

and similar expressions may be used to identify these

forward-looking statements. Such forward-looking statements speak

only as of the date on which they were made and are about matters

that are inherently subject to risks and uncertainties, many of

which are outside of the control of Regional Management. As a

result, actual performance and results may differ materially from

those contemplated by these forward-looking statements. Therefore,

investors should not place undue reliance on forward-looking

statements.

Factors that could cause actual results or performance to differ

from the expectations expressed or implied in forward-looking

statements include, but are not limited to, the following: managing

growth effectively, implementing Regional Management’s growth

strategy, and opening new branches as planned; Regional

Management’s convenience check strategy; Regional Management’s

policies and procedures for underwriting, processing, and servicing

loans; Regional Management’s ability to collect on its loan

portfolio; Regional Management’s insurance operations; exposure to

credit risk and repayment risk, which risks may increase in light

of adverse or recessionary economic conditions; the implementation

of evolving underwriting models and processes, including as to the

effectiveness of Regional Management's custom scorecards; changes

in the competitive environment in which Regional Management

operates or a decrease in the demand for its products; the

geographic concentration of Regional Management’s loan portfolio;

the failure of third-party service providers, including those

providing information technology products; changes in economic

conditions in the markets Regional Management serves, including

levels of unemployment and bankruptcies; the ability to achieve

successful acquisitions and strategic alliances; the ability to

make technological improvements as quickly as competitors; security

breaches, cyber-attacks, failures in information systems, or

fraudulent activity; the ability to originate loans; reliance on

information technology resources and providers, including the risk

of prolonged system outages; changes in current revenue and expense

trends, including trends affecting delinquencies and credit losses;

any future public health crises, including the impact of such

crisis on our operations and financial condition; changes in

operating and administrative expenses; the departure, transition,

or replacement of key personnel; the ability to timely and

effectively implement, transition to, and maintain the necessary

information technology systems, infrastructure, processes, and

controls to support Regional Management’s operations and

initiatives; changes in interest rates; existing sources of

liquidity may become insufficient or access to these sources may

become unexpectedly restricted; exposure to financial risk due to

asset-backed securitization transactions; risks related to

regulation and legal proceedings, including changes in laws or

regulations or in the interpretation or enforcement of laws or

regulations; changes in accounting standards, rules, and

interpretations and the failure of related assumptions and

estimates; the impact of changes in tax laws and guidance,

including the timing and amount of revenues that may be recognized;

risks related to the ownership of Regional Management’s common

stock, including volatility in the market price of shares of

Regional Management’s common stock; the timing and amount of future

cash dividend payments; and anti-takeover provisions in Regional

Management’s charter documents and applicable state law.

The foregoing factors and others are discussed in greater detail

in Regional Management’s filings with the Securities and Exchange

Commission. Regional Management will not update or revise

forward-looking statements to reflect events or circumstances after

the date of this press release or to reflect the occurrence of

unanticipated events or the non-occurrence of anticipated events,

whether as a result of new information, future developments, or

otherwise, except as required by law. Regional Management is not

responsible for changes made to this document by wire services or

Internet services.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241126982313/en/

Investor Relations Garrett Edson, (203) 682-8331

investor.relations@regionalmanagement.com

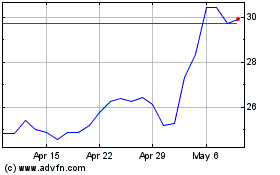

Regional Management (NYSE:RM)

Historical Stock Chart

From Nov 2024 to Dec 2024

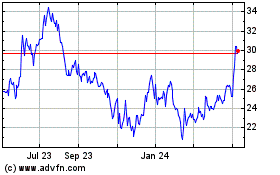

Regional Management (NYSE:RM)

Historical Stock Chart

From Dec 2023 to Dec 2024