- Earnings Increased 19% to $3.83 Per Share

- Home Sale Revenues Increased 10% to $4.4 Billion

- Closings Increased 8% to 8,097 Homes; Average Sales Price

Increased 2% to $549,000

- Home Sale Gross Margin Increased 30 Basis Points to

29.9%

- Net New Orders Totaled 7,649 Homes with a Value of $4.4

Billion

- Unit Backlog of 12,982 Homes with a Value of $8.1

Billion

- Repurchased $314 Million of Common Shares and $300 Million

of Senior Notes in the Quarter

PulteGroup, Inc. (NYSE: PHM) announced today financial results

for its second quarter ended June 30, 2024. For the quarter, the

Company reported net income of $809 million, or $3.83 per share.

Reported net income for the quarter includes a $52 million pre-tax,

or $0.19 per share, insurance benefit recorded in the period, and a

$13 million, or $0.06 per share, benefit related to the favorable

resolution of certain state tax matters. Prior year reported net

income of $720 million, or $3.21 per share, included a $65 million

pre-tax, or $0.21 per share, insurance benefit recorded in the

period.

“PulteGroup’s balanced operating model continues to deliver

outstanding financial results as increases in closings, average

sales price and gross margin were key drivers of the 19% increase

in our earnings to $3.83 per share,” said Ryan Marshall, President

and Chief Executive Officer of PulteGroup. “The resulting strong

cash flows are providing us with tremendous flexibility as we

continued to intelligently allocate capital in the quarter to

invest in our business growth, while returning funds to

shareholders and further strengthening our overall capital

structure.

“While interest rate movements can impact short-term homebuying

demand, long-term market dynamics continue to benefit from a

structural shortage of homes caused by years of underbuilding,”

added Mr. Marshall. “As demonstrated by our 27.1% return on equity*

for the past 12 months, we continue to successfully navigate these

conditions by actively managing sales price, pace and starts on a

community-by-community basis with the goal of realizing high

returns on invested capital and equity over time.”

Home sale revenues for the second quarter increased 10% over the

prior year to $4.4 billion. Higher revenues in the quarter were

driven by an 8% increase in closings to 8,097 homes, combined with

a 2% increase in average sales price to $549,000.

The Company reported second quarter homebuilding gross margins

of 29.9%, which is an increase of 30 basis points over both last

year and the first quarter of 2024. The Company’s reported second

quarter SG&A expense of $361 million, or 8.1% of home sale

revenues, includes the $52 million pre-tax insurance benefit

recorded in the quarter. Prior year reported SG&A expense of

$315 million, or 7.8% of home sale revenues, includes a $65 million

pre-tax insurance benefit recorded in the second quarter of

2023.

In the second quarter, the Company reported net new orders of

7,649, compared with 7,947 homes in the comparable prior year

period. The dollar value of net new orders in the second quarter

increased 2% over the prior year to $4.4 billion. The Company

operated out of an average of 934 communities in the period, which

is an increase of 3% over the second quarter of 2023.

At the end of the second quarter, the Company’s backlog was

12,982 homes with a value of $8.1 billion.

The Company's financial services operations reported second

quarter pre-tax income of $63 million, compared with prior year

pre-tax income of $46 million. The 36% increase in pre-tax income

was driven by gains across all business lines within financial

services: mortgage, title and insurance. Mortgage capture rate for

the second quarter was 86%, up from 80% last year.

The Company’s reported income tax expense for the second quarter

was $239 million, representing an effective tax rate of 22.8%. The

Company’s effective tax rate is inclusive of the $13 million

benefit related to the favorable resolution of certain state tax

matters realized in the quarter.

In the second quarter, the Company repurchased 2.8 million of

its outstanding common shares for $314 million, or an average price

of $113.79 per share. The Company also completed a tender offer in

the period for $300 million of its outstanding senior notes,

lowering its quarter-end outstanding notes payable to $1.7 billion.

Inclusive of these transactions, the Company ended the second

quarter with $1.4 billion of cash and a debt-to-capital ratio of

12.8%.

A conference call discussing PulteGroup's second quarter 2024

results is scheduled for Tuesday, July 23, 2024, at 8:30 a.m.

Eastern Time. Interested investors can access the live webcast via

PulteGroup's corporate website at www.pultegroup.com.

* The Company's return on equity is calculated as net income for

the trailing twelve months divided by average shareholders' equity,

where average shareholders' equity is the sum of ending

shareholders' equity balances of the trailing five quarters divided

by five.

Forward-Looking Statements

This release includes “forward-looking statements.” These

statements are subject to a number of risks, uncertainties and

other factors that could cause our actual results, performance,

prospects or opportunities, as well as those of the markets we

serve or intend to serve, to differ materially from those expressed

in, or implied by, these statements. You can identify these

statements by the fact that they do not relate to matters of a

strictly factual or historical nature and generally discuss or

relate to forecasts, estimates or other expectations regarding

future events. Generally, the words “believe,” “expect,” “intend,”

“estimate,” “anticipate,” “plan,” “project,” “may,” “can,” “could,”

“might,” “should,” “will” and similar expressions identify

forward-looking statements, including statements related to any

potential impairment charges and the impacts or effects thereof,

expected operating and performing results, planned transactions,

planned objectives of management, future developments or conditions

in the industries in which we participate and other trends,

developments and uncertainties that may affect our business in the

future.

Such risks, uncertainties and other factors include, among other

things: interest rate changes and the availability of mortgage

financing; the impact of any changes to our strategy in responding

to the cyclical nature of the industry or deteriorations in

industry changes or downward changes in general economic or other

business conditions, including any changes regarding our land

positions and the levels of our land spend; economic changes

nationally or in our local markets, including inflation, deflation,

changes in consumer confidence and preferences and the state of the

market for homes in general; labor supply shortages and the cost of

labor; the availability and cost of land and other raw materials

used by us in our homebuilding operations; a decline in the value

of the land and home inventories we maintain and resulting possible

future writedowns of the carrying value of our real estate assets;

competition within the industries in which we operate; governmental

regulation directed at or affecting the housing market, the

homebuilding industry or construction activities, slow growth

initiatives and/or local building moratoria; the availability and

cost of insurance covering risks associated with our businesses,

including warranty and other legal or regulatory proceedings or

claims; damage from improper acts of persons over whom we do not

have control or attempts to impose liabilities or obligations of

third parties on us; weather related slowdowns; the impact of

climate change and related governmental regulation; adverse capital

and credit market conditions, which may affect our access to and

cost of capital; the insufficiency of our income tax provisions and

tax reserves, including as a result of changing laws or

interpretations; the potential that we do not realize our deferred

tax assets; our inability to sell mortgages into the secondary

market; uncertainty in the mortgage lending industry, including

revisions to underwriting standards and repurchase requirements

associated with the sale of mortgage loans, and related claims

against us; risks related to information technology failures, data

security issues, and the effect of cybersecurity incidents and

threats; the impact of negative publicity on sales; failure to

retain key personnel; the impairment of our intangible assets; the

disruptions associated with the COVID-19 pandemic (or another

epidemic or pandemic or similar public threat or fear of such an

event), and the measures taken to address it; and other factors of

national, regional and global scale, including those of a

political, economic, business and competitive nature. See Item 1A –

Risk Factors in our Annual Report on Form 10-K for the fiscal year

ended December 31, 2023 for a further discussion of these and other

risks and uncertainties applicable to our businesses. We undertake

no duty to update any forward-looking statement, whether as a

result of new information, future events or changes in our

expectations.

About PulteGroup

PulteGroup, Inc. (NYSE: PHM), based in Atlanta, Georgia, is one

of America’s largest homebuilding companies with operations in more

than 45 markets throughout the country. Through its brand portfolio

that includes Centex, Pulte Homes, Del Webb, DiVosta Homes,

American West and John Wieland Homes and Neighborhoods, the company

is one of the industry’s most versatile homebuilders able to meet

the needs of multiple buyer groups and respond to changing consumer

demand. PulteGroup’s purpose is building incredible places where

people can live their dreams.

For more information about PulteGroup, Inc. and PulteGroup

brands, go to pultegroup.com; pulte.com; centex.com; delwebb.com;

divosta.com; jwhomes.com; and americanwesthomes.com. Follow

PulteGroup, Inc. on X: @PulteGroupNews.

PulteGroup, Inc.

Consolidated Statements of

Operations

($000's omitted, except per

share data)

(Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Revenues:

Homebuilding

Home sale revenues

$

4,448,168

$

4,058,930

$

8,267,754

$

7,546,567

Land sale and other revenues

39,825

37,604

77,042

67,671

4,487,993

4,096,534

8,344,796

7,614,238

Financial Services

111,662

92,219

204,019

150,156

Total revenues

4,599,655

4,188,753

8,548,815

7,764,394

Homebuilding Cost of Revenues:

Home sale cost of revenues

(3,117,482

)

(2,856,361

)

(5,806,569

)

(5,328,690

)

Land sale and other cost of revenues

(38,873

)

(32,494

)

(75,917

)

(57,461

)

(3,156,355

)

(2,888,855

)

(5,882,486

)

(5,386,151

)

Financial Services expenses

(49,334

)

(46,778

)

(100,712

)

(90,813

)

Selling, general, and administrative

expenses

(361,145

)

(314,637

)

(718,739

)

(651,156

)

Equity income from unconsolidated

entities, net

2,167

944

40,069

3,456

Other income, net

13,324

13,586

30,008

15,405

Income before income taxes

1,048,312

953,013

1,916,955

1,655,135

Income tax expense

(239,179

)

(232,668

)

(444,846

)

(402,531

)

Net income

$

809,133

$

720,345

$

1,472,109

$

1,252,604

Per share:

Basic earnings

$

3.86

$

3.23

$

6.99

$

5.58

Diluted earnings

$

3.83

$

3.21

$

6.93

$

5.55

Cash dividends declared

$

0.20

$

0.16

$

0.40

$

0.32

Number of shares used in calculation:

Basic

209,547

222,160

210,692

223,635

Effect of dilutive securities

1,654

1,232

1,682

1,031

Diluted

211,201

223,392

212,374

224,666

PulteGroup, Inc.

Condensed Consolidated Balance

Sheets

($000's omitted)

(Unaudited)

June 30, 2024

December 31,

2023

ASSETS

Cash and equivalents

$

1,392,902

$

1,806,583

Restricted cash

53,064

42,594

Total cash, cash equivalents, and

restricted cash

1,445,966

1,849,177

House and land inventory

12,302,301

11,795,370

Land held for sale

21,559

23,831

Residential mortgage loans

available-for-sale

569,387

516,064

Investments in unconsolidated entities

210,246

166,913

Other assets

1,820,092

1,545,667

Goodwill

68,930

68,930

Other intangible assets

51,300

56,338

Deferred tax assets

54,288

64,760

$

16,544,069

$

16,087,050

LIABILITIES AND SHAREHOLDERS’

EQUITY

Liabilities:

Accounts payable

$

651,580

$

619,012

Customer deposits

654,427

675,091

Deferred tax liabilities

381,021

302,155

Accrued and other liabilities

1,459,998

1,645,690

Financial Services debt

524,042

499,627

Notes payable

1,650,178

1,962,218

5,321,246

5,703,793

Shareholders' equity

11,222,823

10,383,257

$

16,544,069

$

16,087,050

PulteGroup, Inc.

Consolidated Statements of

Cash Flows

($000's omitted)

(Unaudited)

Six Months Ended

June 30,

2024

2023

Cash flows from operating

activities:

Net income

$

1,472,109

$

1,252,604

Adjustments to reconcile net income to net

cash from operating activities:

Deferred income tax expense

89,321

93,389

Land-related charges

7,798

10,110

Depreciation and amortization

42,891

39,204

Equity income from unconsolidated

entities

(40,069

)

(3,456

)

Distributions of income from

unconsolidated entities

2,358

4,564

Share-based compensation expense

29,084

27,960

Other, net

120

(161

)

Increase (decrease) in cash due to:

Inventories

(473,665

)

52,001

Residential mortgage loans

available-for-sale

(55,346

)

244,516

Other assets

(294,335

)

(6,602

)

Accounts payable, accrued and other

liabilities

(123,002

)

(263,546

)

Net cash provided by operating

activities

657,264

1,450,583

Cash flows from investing

activities:

Capital expenditures

(55,317

)

(45,076

)

Investments in unconsolidated entities

(9,096

)

(7,858

)

Distributions of capital from

unconsolidated entities

3,474

2,216

Other investing activities, net

(5,262

)

(3,278

)

Net cash used in investing activities

(66,201

)

(53,996

)

Cash flows from financing

activities:

Repayments of notes payable

(318,288

)

(17,305

)

Financial Services borrowings

(repayments), net

24,416

(271,128

)

Proceeds from liabilities related to

consolidated inventory not owned

32,721

91,354

Payments related to consolidated inventory

not owned

(70,608

)

(33,577

)

Share repurchases

(559,999

)

(400,000

)

Cash paid for shares withheld for

taxes

(17,623

)

(10,389

)

Dividends paid

(84,893

)

(72,315

)

Net cash used in financing activities

(994,274

)

(713,360

)

Net increase (decrease) in cash, cash

equivalents, and restricted cash

(403,211

)

683,227

Cash, cash equivalents, and restricted

cash at beginning of period

1,849,177

1,094,553

Cash, cash equivalents, and restricted

cash at end of period

$

1,445,966

$

1,777,780

Supplemental Cash Flow

Information:

Interest paid (capitalized), net

$

13,215

$

2,757

Income taxes paid (refunded), net

$

365,061

$

380,527

PulteGroup, Inc.

Segment Data

($000's omitted)

(Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

HOMEBUILDING:

Home sale revenues

$

4,448,168

$

4,058,930

$

8,267,754

$

7,546,567

Land sale and other revenues

39,825

37,604

77,042

67,671

Total Homebuilding revenues

4,487,993

4,096,534

8,344,796

7,614,238

Home sale cost of revenues

(3,117,482

)

(2,856,361

)

(5,806,569

)

(5,328,690

)

Land sale and other cost of revenues

(38,873

)

(32,494

)

(75,917

)

(57,461

)

Selling, general, and administrative

expenses

(361,145

)

(314,637

)

(718,739

)

(651,156

)

Equity income (loss) from unconsolidated

entities, net

1,117

(110

)

39,019

2,402

Other income, net

13,324

13,586

30,008

15,405

Income before income taxes

$

984,934

$

906,518

$

1,812,598

$

1,594,738

FINANCIAL SERVICES:

Income before income taxes

$

63,378

$

46,495

$

104,357

$

60,397

CONSOLIDATED:

Income before income taxes

$

1,048,312

$

953,013

$

1,916,955

$

1,655,135

PulteGroup, Inc.

Segment Data,

continued

($000's omitted)

(Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Home sale revenues

$

4,448,168

$

4,058,930

$

8,267,754

$

7,546,567

Closings - units

Northeast

378

315

663

652

Southeast

1,499

1,405

2,944

2,573

Florida

2,150

2,067

4,067

3,819

Midwest

1,196

918

2,186

1,675

Texas

1,472

1,511

2,800

2,819

West

1,402

1,302

2,532

2,374

8,097

7,518

15,192

13,912

Average selling price

$

549

$

540

$

544

$

542

Net new orders - units

Northeast

400

400

841

785

Southeast

1,396

1,556

2,790

2,903

Florida

1,746

1,910

3,718

3,788

Midwest

1,265

1,253

2,539

2,336

Texas

1,275

1,388

2,729

2,812

West

1,567

1,440

3,411

2,677

7,649

7,947

16,028

15,301

Net new orders - dollars

$

4,358,508

$

4,271,008

$

9,057,167

$

8,061,001

Unit backlog

Northeast

745

607

Southeast

2,092

2,236

Florida

3,443

4,610

Midwest

2,045

2,011

Texas

1,566

1,782

West

3,091

2,312

12,982

13,558

Dollars in backlog

$

8,109,128

$

8,188,502

PulteGroup, Inc.

Segment Data,

continued

($000's omitted)

(Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

MORTGAGE ORIGINATIONS:

Origination volume

5,105

4,539

9,437

8,408

Origination principal

$

2,140,103

$

1,790,977

$

3,895,150

$

3,307,427

Capture rate

86.5

%

79.7

%

85.4

%

79.1

%

Supplemental Data

($000's omitted)

(Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2024

2023

2024

2023

Interest in inventory, beginning of

period

$

148,101

$

141,271

$

139,078

$

137,262

Interest capitalized

29,284

31,927

59,903

63,729

Interest expensed

(28,023

)

(31,204

)

(49,619

)

(58,997

)

Interest in inventory, end of period

$

149,362

$

141,994

$

149,362

$

141,994

PulteGroup, Inc. Reconciliation of

Non-GAAP Financial Measures

This report contains information about our debt-to-capital

ratios. These measures could be considered non-GAAP financial

measures under the SEC's rules and should be considered in addition

to, rather than as a substitute for, comparable GAAP financial

measures. We calculate total net debt by subtracting total cash,

cash equivalents, and restricted cash from notes payable to present

the amount of assets needed to satisfy the debt. We use the

debt-to-capital and net debt-to-capital ratios as indicators of our

overall leverage and believe they are useful financial measures in

understanding the leverage employed in our operations. We believe

that these measures provide investors relevant and useful

information for evaluating the comparability of financial

information presented and comparing our profitability and liquidity

to other companies in the homebuilding industry. Although other

companies in the homebuilding industry report similar information,

the methods used may differ. We urge investors to understand the

methods used by other companies in the homebuilding industry to

calculate these measures and any adjustments thereto before

comparing our measures to those of such other companies.

The following table sets forth a reconciliation of the

debt-to-capital ratios ($000's omitted):

Debt-to-Capital Ratios

June 30, 2024

December 31,

2023

Notes payable

$

1,650,178

$

1,962,218

Shareholders' equity

11,222,823

10,383,257

Total capital

$

12,873,001

$

12,345,475

Debt-to-capital ratio

12.8

%

15.9

%

Notes payable

$

1,650,178

$

1,962,218

Less: Total cash, cash equivalents,

and

restricted cash

(1,445,966

)

(1,849,177

)

Total net debt

$

204,212

$

113,041

Shareholders' equity

11,222,823

10,383,257

Total net capital

$

11,427,035

$

10,496,298

Net debt-to-capital ratio

1.8

%

1.1

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240723461528/en/

Investors: Jim Zeumer (404) 978-6434

jim.zeumer@pultegroup.com

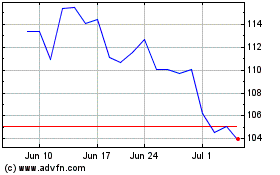

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Nov 2024 to Dec 2024

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Dec 2023 to Dec 2024