This news release contains “forward-looking information and

statements” within the meaning of applicable securities laws. For a

full disclosure of the forward-looking information and statements

and the risks to which they are subject, see the “Cautionary

Statement Regarding Forward-Looking Information and Statements”

later in this news release.

Precision Drilling Corporation (“Precision”) (TSX:PD; NYSE:PDS)

is pleased to announce that it has entered into an agreement to

acquire all of the issued and outstanding common shares of CWC

Energy Services Corp. ("CWC") (TSXV:CWC) for total consideration of

approximately $141 million, comprised of 947,909 Precision shares,

valued at approximately $88 million as of September 1, 2023 market

close, $14 million in cash, plus the assumption of CWC’s

outstanding debt.

With this transaction, Precision adds to its fleet: 62 marketed

service rigs in Canada, seven marketed drilling rigs in Canada, and

11 marketed drilling rigs in the U.S., including seven AC triple

rigs. Currently, three of the Canadian drilling rigs and seven of

the U.S. drilling rigs are actively working for customers.

Additional transaction highlights include:

- Well

Positioned, High-Quality Assets: Well-maintained assets

across Canada and the U.S. in complementary geographic regions

supported by skilled and experienced personnel and strong customer

relationships;

- Material

Synergies: Precision expects to realize annual operating

synergies of approximately $20 million once CWC is fully

integrated, and Precision has identified approximately $20 million

of excess CWC real estate that it expects to monetize

post-transaction closing; and

- Financially

Beneficial: Precision expects the transaction to be

accretive on a 2024 cash flow per share basis and to support its

ongoing deleveraging plan.

Precision’s President and CEO, Kevin Neveu, stated, “This

acquisition supports our High Performance, High Value strategy as

it allows us to expand our service offering in both Canada and the

U.S. with high-quality rigs and field personnel. With the expected

synergies and by further leveraging our scale, we believe the

transaction will be accretive to earnings and provide significant

cash flow to drive shareholder returns and support our debt

reduction strategy. I am excited to welcome the CWC employees to

the Precision team.”

Precision remains committed to reducing its debt levels by $500

million between 2022 and 2025 and achieving a sustained Net

Debt-to-Adjusted EBITDA ratio of less than 1.0 times by the end of

2025. For 2023, Precision remains on track to reduce its debt by

$150 million.

Transaction Details Details of the terms of the

transaction are set out in the Arrangement Agreement, which will be

filed and available for viewing on SEDAR under each of Precision’s

and CWC’s profiles at www.sedar.com.

The transaction is expected to be completed in the fourth

quarter of 2023 subject to CWC shareholder approval, Toronto Stock

Exchange (“TSX”), court and regulatory approvals, Competition

Bureau approval, and the satisfaction of other customary closing

conditions. Evercore is acting as financial advisor and Osler,

Hoskin & Harcourt LLP is acting as legal advisor to

Precision.

About PrecisionPrecision is a leading provider

of safe and environmentally responsible High Performance, High

Value services to the energy industry, offering customers access to

an extensive fleet of Super Series drilling rigs. Precision has

commercialized an industry-leading digital technology portfolio

known as Alpha™ that utilizes advanced automation software and

analytics to generate efficient, predictable, and repeatable

results for energy customers. Additionally, Precision offers well

service rigs, camps and rental equipment all backed by a

comprehensive mix of technical support services and skilled,

experienced personnel.

Precision is headquartered in Calgary, Alberta, Canada and is

listed on the Toronto Stock Exchange under the trading symbol “PD”

and on the New York Stock Exchange under the trading symbol

“PDS”.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATION AND STATEMENTS

Certain statements contained in this news release, including

statements that contain words such as “could”, “should”, “can”,

“anticipate”, “estimate”, “intend”, “plan”, “expect”, “believe”,

“will”, “may”, “continue”, “project”, “potential” and similar

expressions and statements relating to matters that are not

historical facts constitute “forward-looking information” within

the meaning of applicable Canadian securities legislation and

“forward-looking statements” within the meaning of the “safe

harbor” provisions of the United States Private Securities

Litigation Reform Act of 1995 (collectively, “forward-looking

information and statements”).

In particular, forward-looking information and statements

include, but are not limited to, the following:

- the anticipated

closing of the transaction and the timing thereof;

- the amount of CWC

debt to be assumed or refinanced by Precision;

- Precision’s business

strategy and the anticipated impacts of the transaction

thereon;

- the anticipated

operational and strategic benefits of the transaction listed

herein; and

- the contemplated

activities of Precision post-transaction.

These forward-looking information and statements are based on

certain assumptions and analysis made by Precision in light of its

experience and its perception of historical trends, current

conditions, expected future developments and other factors we

believe are appropriate under the circumstances. These include,

among other things:

- that the transaction

will be completed in the timelines and on the terms currently

anticipated;

- that all necessary

TSX, court and regulatory approvals will be obtained on the

timelines and in the manner currently anticipated;

- that the approval of

CWC shareholders will be obtained; and

- general assumptions

respecting the business and operations of both Precision and CWC,

including that each business will continue to operate in a manner

consistent with past practice and pursuant to certain industry and

market conditions.

Undue reliance should not be placed on forward-looking

information and statements. Whether actual results, performance or

achievements will conform to our expectations and predictions is

subject to a number of known and unknown risks and uncertainties

which could cause actual results to differ materially from our

expectations. Such risks and uncertainties include, but are not

limited to:

- TSX, court and

regulatory approvals may not be obtained in the timelines or on the

terms currently anticipated or at all;

- CWC shareholder

approval may not be obtained;

- the transaction is

subject to a number of closing conditions and no assurance can be

given that all such conditions will be met or will be met in the

timelines required by the Arrangement Agreement; and

- the business,

operational and/or financial performance or achievements of

Precision or CWC may be materially different from that currently

anticipated. In particular, the synergies and benefits anticipated

in respect of the transaction are based on the current business,

operational and financial position of each of Precision and CWC,

which are subject to a number of risks and uncertainties.

Readers are cautioned that the forgoing list of risk factors is

not exhaustive. Additional information on these and other factors

that could affect our business, operations or financial results are

included in reports on file with applicable securities regulatory

authorities, including but not limited to Precision’s Annual

Information Form for the year ended December 31, 2022, which may be

accessed on Precision’s SEDAR profile at www.sedar.com or under

Precision’s EDGAR profile at www.sec.gov. The forward-looking

information and statements contained in this news release are made

as of the date hereof and Precision undertakes no obligation to

update publicly or revise any forward-looking statements or

information, whether as a result of new information, future events

or otherwise, except as required by law.

For further information, please contact:

Lavonne Zdunich, CPA, CADirector, Investor

Relations403.716.4500

Precision Drilling Corporation800, 525 – 8th Avenue S.W.Calgary,

Alberta, Canada T2P 1G1Website: www.precisiondrilling.com

None of the securities anticipated to be issued pursuant to the

Arrangement have been or will be registered under the United States

Securities Act of 1933, as amended (the “U.S. Securities Act”), or

any state securities laws, and any securities issued in the

Arrangement are anticipated to be issued in reliance upon available

exemptions from registration requirements pursuant to Section 3(a)

(10) of the U.S. Securities Act and applicable exemptions under

state securities laws. This news release does not constitute an

offer to sell or the solicitation of an offer to buy any

securities.

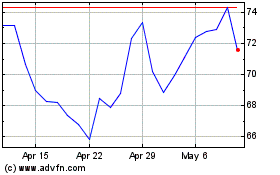

Precision Drilling (NYSE:PDS)

Historical Stock Chart

From Oct 2024 to Nov 2024

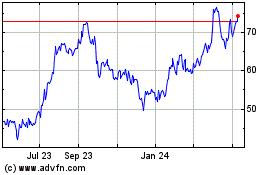

Precision Drilling (NYSE:PDS)

Historical Stock Chart

From Nov 2023 to Nov 2024