UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED

IN STATEMENTS FILED PURSUANT

TO § 240.13d-1(a)

AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 2)1

Pitney Bowes Inc.

(Name

of Issuer)

Common Stock, $1.00 par value per share

(Title of Class of Securities)

724479100

(CUSIP Number)

KURTIS J. WOLF

HESTIA CAPITAL MANAGEMENT, LLC

175 Brickyard Road, Suite 200

Adams Township, Pennsylvania 16046

(724) 687-7842

SEBASTIAN ALSHEIMER, ESQ.

OLSHAN

FROME WOLOSKY LLP

1325

Avenue of the Americas

New

York, New York 10019

(212)

451-2300

(Name, Address and Telephone Number of Person

Authorized to Receive Notices

and Communications)

January 23, 2023

(Date of Event Which Requires

Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule

13D, and is filing this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box ¨.

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See

§ 240.13d-7 for other parties to whom copies are to be sent.

1

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to

the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided

in a prior cover page.

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

HESTIA CAPITAL PARTNERS, LP |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

3,450,000 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

3,450,000 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

3,450,000 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

2.0% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

PN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

HELIOS I, LP |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

WC |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

8,602,000 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

8,602,000 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

8,602,000 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

4.9% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

PN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

HESTIA CAPITAL PARTNERS GP, LLC |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

AF, OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

12,052,000 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

12,052,000 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

12,052,000 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

6.9% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

HESTIA CAPITAL MANAGEMENT, LLC |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

AF, OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

DELAWARE |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

12,575,000 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

12,575,000 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

12,575,000 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

7.2% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

OO |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

KURTIS J. WOLF |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

AF, OO |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

USA |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

12,575,000 |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

12,575,000 |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

12,575,000 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

7.2% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

TODD A. EVERETT |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

PF |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

USA |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

9,771 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

9,771 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

9,771 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

Less than 1% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

CARL J. GRASSI |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

PF |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

USA |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

25,000 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

25,000 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

25,000 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

Less than 1% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

LANCE E. ROSENZWEIG |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

PF |

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

USA |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

10,000 |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

10,000 |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

10,000 |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

Less than 1% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

MILENA ALBERTI-PEREZ |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

|

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

USA |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

- 0 - |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

0% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

KATIE A. MAY |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

|

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

USA |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

- 0 - |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

0% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

1 |

|

NAME OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

KENNETH T. MCBRIDE |

|

| |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP |

(a) ☒ |

| |

|

|

|

(b) ☐ |

| |

|

|

|

|

|

| |

3 |

|

SEC USE ONLY |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

| |

4 |

|

SOURCE OF FUNDS |

|

| |

|

|

|

|

| |

|

|

|

|

|

| |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e) |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION |

|

| |

|

|

|

|

| |

|

|

|

USA |

|

| NUMBER OF |

|

7 |

|

SOLE VOTING POWER |

|

| SHARES |

|

|

|

|

|

| BENEFICIALLY |

|

|

|

|

- 0 - |

|

| OWNED BY |

|

8 |

|

SHARED VOTING POWER |

|

| EACH |

|

|

|

|

|

| REPORTING |

|

|

|

|

- 0 - |

|

| PERSON WITH |

|

9 |

|

SOLE DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

|

10 |

|

SHARED DISPOSITIVE POWER |

|

| |

|

|

|

|

|

| |

|

|

|

|

- 0 - |

|

| |

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

- 0 - |

|

| |

12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES |

☐ |

| |

|

|

|

|

| |

|

|

|

|

|

| |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) |

|

| |

|

|

|

|

| |

|

|

|

0% |

|

| |

14 |

|

TYPE OF REPORTING PERSON |

|

| |

|

|

|

|

| |

|

|

|

IN |

|

The following constitutes

Amendment No. 2 to the Schedule 13D filed by the undersigned (“Amendment No. 2”). This Amendment No. 2 amends the Schedule

13D as specifically set forth herein.

| Item 2. | Identity and Background. |

Item 2 is hereby amended

and restated to read as follows:

(a) This

statement is filed by:

| (i) | Hestia Capital Partners, LP, a Delaware limited partnership (“Hestia Capital”); |

| (ii) | Helios I, LP, a Delaware limited partnership (“Helios”); |

| (iii) | Hestia Capital Partners GP, LLC, a Delaware limited liability company (“Hestia Partners GP”),

which serves as the general partner of each of Hestia Capital and Helios; |

| (iv) | Hestia Capital Management, LLC, a Delaware limited liability company (“Hestia LLC”), which

serves as the investment manager of each of Hestia Capital, Helios and certain separately managed accounts (the “SMAs”); |

| (v) | Kurtis J. Wolf (together with Hestia Capital, Helios, Hestia Partners GP and Hestia LLC, the “Hestia

Group”), as the managing member of each of Hestia Partners GP and Hestia LLC, and as a nominee for the Board; |

| (vi) | Todd A. Everett, as a nominee for the Board; |

| (vii) | Carl J. Grassi, as a nominee for the Board; |

| (viii) | Lance E. Rosenzweig, as a nominee for the Board; |

| (ix) | Milena Alberti-Perez, as a nominee for the Board; |

| (x) | Katie A. May, as a nominee for the Board; and |

| (xi) | Kenneth T. McBride, as a nominee for the Board. |

Each of the foregoing is

referred to as a “Reporting Person” and collectively as the “Reporting Persons.” Each of the Reporting Persons

is party to that certain Joint Filing and Solicitation Agreement, as further described in Item 6. Accordingly, the Reporting Persons are

hereby filing a joint Schedule 13D.

(b) The

address of the principal office of each of the members of the Hestia Group is 175 Brickyard Road, Suite 200, Adams Township, Pennsylvania

16046. The principal business address of Mr. Everett is 11517 Hollister Drive, Austin, Texas 78739. The principal business address of

Mr. Grassi is c/o McDonald Hopkins LLC, 600 Superior Avenue, E., Suite 2100, Cleveland, OH 44114. The principal business address of Mr.

Rosenzweig is 11925 Currituck Drive, Los Angeles, California 90049. The principal business address of Ms. Alberti-Perez is 58 West 88th

Street, New York, New York 10024. The principal business address of Ms. May is 1511 Rockcliff Road, Austin, Texas 78746. The principal

business address of Mr. McBride is 1721 Paseo Del Mar, Palos Verdes Estates, California 90274.

(c) The

principal business of each of Hestia Capital and Helios is investing in securities and engaging in all related activities and transactions.

The principal business of Hestia Partners GP is serving as the general partner of each of Hestia Capital and Helios. The principal business

of Hestia LLC is serving as the investment manager of each of Hestia Capital, Helios and the SMAs. Mr. Wolf serves as the managing member

of each of Hestia Partners GP and Hestia LLC. The principal occupation of Mr. Everett is serving an independent advisor to several companies.

The principal occupation of Mr. Grassi is serving as Senior Counsel at McDonald Hopkins LLC. The principal occupation of Mr. Rosenzweig

is serving on the board of directors of GC Parent, LLC. The principal occupation of Ms. Alberti-Perez is serving on the board of directors

of Digimarc Corp. The principal occupation of Ms. May is serving on the boards of directors of several companies. The principal occupation

of Mr. McBride is serving on the boards of directors of NerdWallet Inc. and Auctane Parent, LP.

(d) No

Reporting Person, has, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) No

Reporting Person, has, during the last five years, been party to a civil proceeding of a judicial or administrative body of competent

jurisdiction and as a result of such proceeding was or is subject to a judgment, decree or final order enjoining future violations of,

or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

(f) Each

of Mses. May and Alberti-Perez and Messrs. Everett, McBride, Wolf, Grassi, and Rosenzweig are citizens of the United States of America.

| Item 3. | Source and Amount of Funds or Other Consideration. |

Item 3 is hereby amended

and restated to read as follows:

The Shares beneficially

owned by each of Hestia Capital, Helios and held in the SMAs were purchased with working capital (which may, at any given time, include

margin loans made by brokerage firms in the ordinary course of business) in open market purchases. The aggregate purchase price of the

3,450,000 Shares directly owned by Hestia Capital is approximately $15,589,347, including brokerage commissions. The aggregate purchase

price of the 8,602,000 Shares directly owned by Helios is approximately $27,509,449, including brokerage commissions. The aggregate

purchase price of the 483,000 Shares held in the SMAs is approximately $2,017,220, including brokerage commissions.

The Shares directly owned

by each of Messrs. Everett, Grassi and Rosenzweig were purchased with personal funds (which may, at any given time, include margin loans

made by brokerage firms in the ordinary course of business). The aggregate purchase price of the 9,771 Shares directly owned by Mr. Everett

is approximately $76,298, excluding brokerage commissions. The aggregate purchase price of the 25,000 Shares beneficially owned by Mr.

Grassi is approximately $104,459, excluding brokerage commissions. The aggregate purchase price of the 10,000 Shares directly owned by

Mr. Rosenzweig is approximately $45,590, excluding brokerage commissions.

| Item 4. | Purpose of Transaction. |

Item 4 is hereby amended

to add the following:

On January 23, 2023, Hestia

Capital delivered a letter to the Issuer (the “Nomination Letter”) nominating a slate of seven (7) highly-qualified candidates,

including Kurtis J. Wolf, Todd A. Everett, Carl J. Grassi, Lance E. Rosenzweig, Milena Alberti-Perez, Katie A. May, and Kenneth T. McBride

(collectively, the “Nominees”), for election to the Board at the 2023 annual meeting of stockholders (the “Annual Meeting”).

The Reporting Persons believe that the Nominees have the qualifications, experience and skill sets necessary to serve as directors of

the Issuer, as evidenced by their biographies below.

Also on January 23, 2023,

Hestia LLC issued a press release (the “Press Release”), along with a presentation titled “Pitney Bowes’ Failings

During the Roth-Lautenbach Era” (the “Stockholder Presentation”), which, among other things, announced that Hestia Capital

had nominated the Nominees for election to the Board at the Annual Meeting. Furthermore, Hestia LLC reiterated the need for new leadership

following years of value destruction under the Board’s current Chairman and Chief Executive Officer, as their long tenures have

been defined by poor capital allocation and mismanaged acquisitions. The full text of the Press Release is attached hereto as Exhibit

99.1 and is incorporated herein by reference. The full text of the Stockholder Presentation is attached hereto as Exhibit 99.2 and is

incorporated herein by reference.

The Nominees are:

Kurtis J. Wolf, age

49, has served as the Managing Member and Chief Investment Officer of Hestia LLC, a deep value hedge fund that he founded, since 2009.

Mr. Wolf was an economic consultant to American Assets Investment Management, LLC, an investment management company, from 2016 to March

2020. From 2007 to 2008, Mr. Wolf worked as a Senior Analyst at First Q Capital, LLC, a hedge fund that invested in public companies which

had previously been backed by venture capital or private equity firms. From 2006 to 2007, Mr. Wolf served as co-Founding Partner at Lemhi

Ventures LLC, a health care services-focused venture capital incubator. Mr. Wolf previously was co-Founding Partner at Definity Health

Corporation, a leading player in the consumer-driven health care space, which was acquired by UnitedHealth Group Inc. (NYSE: UNH) in 2004.

After the acquisition, from 2005 through 2006, Mr. Wolf served as Director, Corporate Development for UnitedHealth Group Inc.'s Definity

Health Corporation subsidiary. Prior to Definity Health Corporation being acquired, from 1998 to 2000, he served as its co-Founding Partner,

primarily focusing on finance and strategy. Between his two periods at Definity Health Corporation, Mr. Wolf served as an Analyst at Relational

Investors LLC, an activist hedge fund, from 2002 to 2004. Previously, he was a co-Founding Partner and Consultant at Lemhi Consulting,

an entity related to Definity Health Corporation, from 1998 to 2000. Mr. Wolf also has experience working as a consultant both with Deloitte

Consulting from 1995 until 1998 and The Boston Consulting Group during the summer of 2001. Previously, Mr. Wolf served on the boards of

directors of GameStop Corp. (NYSE: GME), a video game, consumer electronics and gaming merchandise retailer, from June 2020 to April 2021,

and Edgewater Technology, Inc., a business and IT consulting firm, from 2017 until it became part of Alithya Group Inc. (NASDAQ: ALYA)

in November 2018. Mr. Wolf earned an M.B.A. from the Stanford Graduate School of Business and a B.A. from Carleton College.

Todd A. Everett, age

49, currently works as an independent advisor to several companies, including Doddle Parcel Services Limited, a technology company, since

January 2021, Verishop, Inc., an e-commerce marketplace, since February 2019 and Fetch Package, Inc., an off-site package delivery service

company, since December 2018. Previously, Mr. Everett was an advisor to 101 Commerce, Inc., a global e-commerce platform, from September

2018 to December 2019. Mr. Everett was Senior Vice President and Strategic Advisor, Commerce Services of the Company from March 2018 to

May 2018. Prior to that, Mr. Everett held various roles at Newgistics, Inc. (“Newgistics”), which is a subsidiary of PBI that

provides e-commerce development services, including President and Chief Executive Officer from 2015 to February 2018, Chief Operating

Officer and General Manager of Parcel and Fulfillment Services from 2014 to 2015, Senior Vice President of Operations from 2010 to 2013,

and Director of Operations from 2005 to 2010. Earlier in his career, Mr. Everett worked as a Transportation and Outsourcing Manager at

Intel Corporation (NASDAQ: INTC), a multinational corporation and technology company, from 1996 to 2005. Mr. Everett is currently on the

board of directors of ACI Group, a portfolio of direct-to-consumer companies, since May 2021. Mr. Everett served on the board of directors

of Newgistics from 2015 to October 2017. Additionally, Mr. Everett was on the board of directors of Delivering Good, Inc., a non-profit

organization that provides various products to families and individuals in need, from January 2020 to December 2021. Mr. Everett previously

sat on Iowa State University’s Transportation Council. Mr. Everett received a B.S. in Transportation and Logistics from Iowa State

University.

Carl J. Grassi, age

63, is currently Senior Counsel at McDonald Hopkins LLC (“McDonald Hopkins”), a business advisory and advocacy law firm, where

he joined in 1992. Mr. Grassi was previously President at McDonald Hopkins from 2007 to 2016. Mr. Grassi is on the boards of directors

of Hynes Industries, Inc., a custom steel manufacturer, since June 2019, Regional Brands, Inc. (formerly OTCPK: RGBD), an investment holding

company, since 2016, and DiVal, Inc. (d/b/a W. F. Hann & Sons), an HVAC plumbing contractor, since 2003. Mr. Grassi served on the

boards of directors of J. Alexander’s Holding, Inc. (formerly NYSE: JAX), a holding and operating company of various American restaurants,

from April 2020 to September 2021, McDonald Hopkins from 1997 to September 2020, Mace Security International, Inc. (OTCQX: MACE), a manufacturer

of personal safety and security products, from 2016 to March 2018, and Parts Associates, Inc., a distributor

of maintenance supplies and solutions, from 2003 to 2017. Mr.

Grassi was a member on the Advisory Boards of Ancora Holdings Inc., a wealth advisory, retirement plan management and investment management

firm, from 2016 to September 2021, and Thinsolutions, Inc., an IT services company, from 2006 to 2012. Mr. Grassi was on the boards of

directors of International Lawyers Network, a leading association of independent law firms, from May 2019 to March 2022, and Greater Cleveland

Sports Commission, a non-profit organization, from 2007 to December 2022. Mr. Grassi received a J.D. from Cleveland State University College

of Law and B.S.B.A. with a major in Accounting from John Carroll University.

Lance E. Rosenzweig,

age 60, was most recently President and Chief Executive Officer of Support.com, Inc. (formerly NASDAQ: SPRT) (“Support.com”),

a leading provider of customer and technical support solutions and security software, from August 2020 to October 2022. Previously, Mr.

Rosenzweig was the Chief Executive Officer of Startek Inc. (NYSE: SRT), a global business process outsourcing company, from July 2018

to January 2020. Prior to that, Mr. Rosenzweig was an Operating Executive of Marlin Operations Group, Inc. (“Marlin”), which

works with Marlin Equity Partners, a global investment firm, from 2015 to 2017. Mr. Rosenzweig served as President of Global Markets and

Chief Executive Officer for Aegis USA, Inc. (“Aegis USA”), a leading business process outsourcing company, from 2013 through

the company’s sale to Teleperformance in 2014. Mr. Rosenzweig was Chief Executive Officer of LibertadCard, a provider of pre-paid

debit and remit cards, from when he founded the company in 2010 to 2013. Mr. Rosenzweig co-founded PeopleSupport, Inc. (formerly NASDAQ:

PSPT) (“PeopleSupport”) , a business process outsourcing company, in 1998, where he was Chief Executive Officer from 2002

through the company’s sale to Aegis USA in 2008. Mr. Rosenzweig served as President at Newcastle Packaging, a plastic packaging

company, from 1993 to 1998. Earlier in his career, Mr. Rosenzweig was Vice President at GE Capital, a financial services subsidiary of

General Electric Company (NYSE: GE), from 1991 to 1993, Vice President of Dean Witter, Discover & Co., which was an investment bank,

from 1989 to 1991, Senior Vice President of Capel Court Financial Services, a financial services firm, from 1987 to 1989, and Corporate

Planning Manager at Jefferson Smurfit Corp., a manufacturer of paper and packaging products, from 1985 to 1987. Mr. Rosenzweig serves

on the board of directors of GC Parent, LLC, a provider of accounts receivable management, customer care and back office solutions, since

January 2023. Mr. Rosenzweig served on the board of directors of several public and private companies, including Support.com from August

2020 to September 2021, Boingo Wireless, Inc. (formerly NASDAQ: WIFI), a leading provider of wireless networks, from 2014 until its acquisition

by Digital Colony in June 2021, NextGen Healthcare, Inc. (NASDAQ: NXGN), an American software and services company, from 2012 to October

2021, Domo Tactical Communications, a provider of wireless communications technology, from 2015 to 2017, GiftCertificates.com, Inc., an

e-commerce provider of innovative reward solutions and gift products, from 2015 to 2017, Duncan Solutions, Inc., a provider of parking

and tolling solutions, from 2015 to 2017, PeopleSupport from 1998 to 2008, and Newcastle Packaging from 1993 to 1998. Mr. Rosenzweig received

an M.B.A. from Northwestern University and a B.S. in Industrial Engineering from Northwestern University.

Milena Alberti-Perez,

age 49, is on the board of directors of Digimarc Corp. (NASDAQ: DMRC), a provider of enterprise software and services, since April 2022.

Ms. Alberti-Perez was mostly recently the Chief Financial Officer at Getty Images Holding, Inc. (NYSE: GETY), a visual media company,

from January 2021 to January 2022. Previously, Ms. Alberti-Perez was Chief Financial Officer at MediaMath, Inc., a demand-side platform

for programmatic marketing and advertising, from January 2020 to December 2020. Prior to this, Ms. Alberti-Perez held various financial

and publishing roles at Penguin Random House LLC (“Penguin Random House”), a multinational publishing company, including Global

and U.S. Chief Financial Officer from 2015 to 2017, Senior Vice President of Global Corporate Finance from 2014 to 2015, Senior Vice President

of Corporate Development from 2011 to 2014, Vice President of Mergers & Acquisitions from 2010 to 2011, Director of Spanish Language

Publishing from 2004 to 2010, and Director of Corporate Development from 2001 to 2004. Earlier in her career, Ms. Alberti-Perez was an

associate in Latin American Equity Research at Morgan Stanley (NYSE: MS), a multinational investment management and financial services

company, from 1997 to 1999, and a financial analyst at Lehman Brothers Holdings Inc., which was an American global financial services

firm, from 1995 to 1997. Ms. Alberti-Perez serves on the board of directors of Overdrive, Inc., a digital content distributor, since September

2020, and RBmedia, an audiobook publishing company, since November 2018. Ms. Alberti-Perez previously served on the board of directors

of Penguin Random House as a non-voting board member and a member of its audit committee from 2015 to 2017, Companhia das Letras, the

largest publishing house in São Paulo, from 2016 to 2017, and FlatWorld (f/k/a Flat World Knowledge), a publisher of college-level

textbooks and educational supplements, as an observer from 2011 to 2016. Ms. Alberti-Perez also serves on the board of the Wild Bird Fund,

New York City’s only wildlife rehabilitation center, since 2019, and Jumpstart, a national early education organization, since 2015.

Ms. Alberti-Perez is a member of the Latino Corporate Directors Association, a non-profit organization, since October 2018. Ms. Alberti-Perez

previously served on boards of directors of THE CITY, a non-profit news organization, from June 2019 to January 2021, and the University

of Pennsylvania’s Executive Fund, the annual giving fund of the University of Pennsylvania, from 2015 to April 2021. Ms. Alberti-Perez

received an M.B.A. from the Harvard Business School and a B.A. in Economics from The University of Pennsylvania.

Katie A. May, age

56, is on the boards of directors of several companies. Most recently, Ms. May was the Chief Executive Officer of ShippingEasy, Inc.,

an Austin, Texas-based start-up, from 2012 to January 2020. Previously, Ms. May was Chief Executive Officer of Kidspot.com.au Pty Ltd,

an Australian-based digital parenting publisher, from when she founded the company in 2005 to 2012. Prior to that, Ms. May worked as

Chief Marketing Officer of SEEK Limited (OTCMKTS: SKLTY), an Australian based online employment marketplace operating across Asia Pacific

and Latin America, from 1999 to 2005. Earlier in her career, Ms. May worked as an Associate at Booz & Company, a global strategy

consulting firm that is now a business unit of PricewaterhouseCoopers LLP, from 1996 to 1999, Brand Manager at Philip Morris USA, a subsidiary

of Altria Group, Inc. (NYSE: MO) that manufactures and markets tobacco products, from 1994 to 1996, and Tax/Corporate Finance Senior

at Arthur Andersen LLP, which was an accounting firm, from 1989 to 1992. Ms. May serves on the boards of directors of Buildxact, a software

company, since February 2022, Thinkific Labs, Inc. (OTCMKTS: THNCF), a leading cloud-based software platform, since April 2021, Onramp

Funds, Inc., a financing technology platform, since March 2021, ROKT Pte Ltd, a global leader in ecommerce marketing technology, since

July 2020 and Vivi International Pty Ltd., an Australian education technology company, since February 2020. Ms. May served on the board

of directors of Stamps.com, Inc. (formerly NASDAQ: STMP), a company that provides mailing and shipping services, from March 2019 to September

2021. Ms. May received an M.B.A. from The University of Texas at Austin and B.B.A. in Accounting from The University of Texas at Austin.

Kenneth T. McBride, age

55, is currently on the boards of directors of NerdWallet Inc. (NASDAQ: NRDS), a personal finance company, since April 2022. Additionally,

Mr. McBride is on the board of directors of Auctane Parent, LP (“Auctane”) (f/k/a Stamps Parent LP), an e-commerce and mailing

and shipping software company, which acquired Stamps.com, Inc. (formerly NASDAQ: STMP) (“Stamps.com”) in October 2021, where

he has also been a member of the board of directors, since 2001, and also served on the boards of directors of Auctane’s wholly-owned

subsidiaries. Mostly recently, Mr. McBride was the Chief Executive Officer of Stamps.com from 2001 until he decided to step down from

the role in November 2021, Chairman of its board of directors from 2012 to October 2021, and Chief Financial Officer from 2000 to 2004.

Earlier in his career, Mr. McBride worked as an Equity Research Analyst at Salomon Smith Barney, which was an investment banking firm,

from 1997 to 1999. Mr. McBride was previously on the boards of directors of CafePress Inc. (formerly NASDAQ: PRSS), an online retailer

of stock and user-customized on-demand products, from 2015 to November 2018 and LegalZoom.com, Inc. (NASDAQ: LZ), an online legal technology

company, from 2012 to 2014. Mr. McBride has also been on the board of trustees of the California Science Center Foundation, a museum and

California state agency based in Los Angeles, since 2006. Mr. McBride received an M.S.E.E. and a B.S.E.E. in Electrical Engineering from

Stanford University and an M.B.A. from the Graduate School of Business at Stanford University.

| Item 5. | Interest in Securities of the Issuer. |

Items 5(a) – (c)

are hereby amended and restated to read as follows:

The aggregate percentage

of Shares reported owned by each person named herein is based upon 174,004,015 shares outstanding as of October 25, 2022 as reported in

the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission on November 4, 2022.

| (a) | As of the date hereof, Hestia Capital directly owned 3,450,000 Shares. |

Percentage: 2.0%

| (b) | 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 3,450,000

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 3,450,000 |

| (c) | Hestia Capital has not entered into any transactions in the Shares since the filing of Amendment No. 1

to the Schedule 13D. |

| (a) | As of the date hereof, Helios directly owned 8,602,000 Shares. |

Percentage: Approximately

4.9%

| (b) | 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 8,602,000

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 8,602,000 |

| (c) | The transactions in the Shares by Helios since the filing of Amendment No. 1 to the Schedule 13D are set

forth in Schedule A and are incorporated herein by reference. |

| (a) | As the general partner of each of Hestia Capital and Helios, Hestia Partners GP may be deemed the beneficial

owner of the (i) 3,450,000 Shares directly owned by Hestia Capital and the (ii) 8,602,000 Shares directly owned by Helios. |

Percentage: Approximately

6.9%

| (b) | 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 12,052,000

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 12,052,000 |

| (c) | Hestia Partners GP has not entered into any transactions in the Shares since the filing of Amendment No.

1 to the Schedule 13D. The transactions in the Shares on behalf of Helios since the filing of Amendment No. 1 to the Schedule 13D are

set forth in Schedule A and are incorporated herein by reference. |

| (a) | As of the date hereof, 523,000 Shares were held in SMAs. As the investment manager of each of Hestia Capital

and Helios, Hestia LLC may be deemed the beneficial owner of the (i) 3,450,000 Shares directly owned by Hestia Capital and (ii) 8,602,000

Shares directly owned by Helios. |

Percentage: Approximately

7.2%

| (b) | 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 12,575,000

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 12,575,000 |

| (c) | Hestia LLC has not entered into any transactions in the Shares since the filing of Amendment No. 1 to

the Schedule 13D. The transactions in the Shares on behalf of Helios and the SMAs since the filing of Amendment No. 1 to the Schedule

13D are set forth in Schedule A and are incorporated herein by reference. |

| (a) | As the managing member of each of Hestia Partners GP and Hestia LLC, Mr. Wolf may be deemed the beneficial

owner of the (i) 3,450,000 Shares directly owned by Hestia Capital, (ii) 8,602,000 Shares directly owned by Helios and (iii) 523,000 Shares

held in SMAs. |

Percentage: Approximately

7.2%

| (b) | 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 12,575,000

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 12,575,000 |

| (c) | Mr. Wolf has not entered into any transactions in the Shares since the filing of Amendment No. 1 to the

Schedule 13D. The transactions in the Shares on behalf of Helios and the SMAs since the filing of Amendment No. 1 to the Schedule 13D

are set forth in Schedule A and are incorporated herein by reference. |

| (a) | As of the date hereof, Mr. Everett directly owned 9,771 Shares. |

Percentage: Less than 1%

| (b) | 1. Sole power to vote or direct vote: 9,771

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 9,771

4. Shared power to dispose or direct the disposition: 0 |

| (c) | Mr. Everett has not entered into any transactions in the Shares during the past sixty (60) days. |

| (a) | As of the date hereof, Mr. Grassi beneficially owned 25,000 Shares, which are held in a trust. |

Percentage: Less than 1%

| (b) | 1. Sole power to vote or direct vote: 25,000

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 25,000

4. Shared power to dispose or direct the disposition: 0 |

| (c) | The transactions in the Shares by Mr. Grassi during the past sixty (60) days are set forth in Schedule

A and are incorporated herein by reference. |

| (a) | As of the date hereof, Mr. Rosenzweig directly owned 10,000 Shares. |

Percentage: Less than 1%

| (b) | 1. Sole power to vote or direct vote: 10,000

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 100,000

4. Shared power to dispose or direct the disposition: 0 |

| (c) | The transactions in the Shares by Mr. Rosenzweig during the past sixty (60) days are set forth in Schedule

A and are incorporated herein by reference. |

| (a) | As of the date hereof, Ms. Alberti-Perez does not own any Shares. |

Percentage: Approximately

0%

| (b) | 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 0 |

| (c) | Ms. Alberti-Perez has not entered into any transactions in the Shares during the past sixty (60) days. |

| (a) | As of the date hereof, Ms. May does not own any Shares. |

Percentage: 0%

| (b) | 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 0 |

| (c) | Ms. May has not entered into any transactions in the Shares during the past sixty (60) days. |

| (a) | As of the date hereof, Mr. McBride does not own any Shares. |

Percentage: 0%

| (b) | 1. Sole power to vote or direct vote: 0

2. Shared power to vote or direct vote: 0

3. Sole power to dispose or direct the disposition: 0

4. Shared power to dispose or direct the disposition: 0 |

| (c) | Mr. McBride has not entered into any transactions in the Shares during the past sixty (60) days. |

| Item 6. | Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer. |

Item 6 is hereby amended

to add the following:

On January 23, 2023, the

Reporting Persons (collectively, the “Group”) entered into a Joint Filing and Solicitation Agreement (the “Joint Filing

and Solicitation Agreement”) pursuant to which the parties agreed, among other things, (a) to the joint filing on behalf of each

of them of statements on Schedule 13D with respect to the securities of the Issuer, (b) to solicit proxies for the election of the Nominees

at the Annual Meeting, (c) to provide notice to the Group’s legal counsel within 24 hours of (i) any purchase or sale of securities

of the Issuer, or (ii) any securities of the Issuer over which they acquire or dispose of beneficial ownership, (d) that the Hestia Group

would bear all expenses incurred in connection with the Group’s activities. A copy of the Joint Filing and Solicitation Agreement

is attached hereto as Exhibit 99.3 and is incorporated herein by reference.

Hestia Capital has entered

into a letter agreement with each of the Nominees, except for Mr. Wolf, (the “Indemnification Agreements”), pursuant to which

it and its affiliates have agreed to indemnify such Nominees against certain claims arising from the solicitation of proxies from the

Issuer’s stockholders in connection with the Annual Meeting and any related transactions. A form of Indemnification Agreement is

attached hereto as Exhibit 99.4 and is incorporated herein by reference.

Each of the Nominees, except

Mr. Wolf, has granted Mr. Wolf a power of attorney (collectively, the “POAs”) to execute certain SEC filings and other documents

in connection with the solicitation of proxies from the Issuer’s stockholders in connection with the Annual Meeting and any other

related transactions. A form of Power of Attorney is attached hereto as Exhibit 99.5 and is incorporated herein by reference.

| Item 7. | Material to be Filed as Exhibits. |

Item 7 is hereby amended to add the following

exhibits:

| 99.1 | Press Release, dated January 23, 2023. |

| 99.2 | Stockholder Presentation, dated January 23, 2023. |

| 99.3 | Joint Filing and Solicitation Agreement, dated January 23, 2023. |

| 99.4 | Form of Indemnification Agreement. |

| 99.5 | Form of Power of Attorney. |

SIGNATURES

After reasonable inquiry

and to the best of his knowledge and belief, each of the undersigned certifies that the information set forth in this statement is true,

complete and correct.

Dated: January 24, 2023

| |

Hestia Capital Partners, LP |

| |

|

| |

By: |

Hestia Capital Management, LLC,

its Investment Manager |

| |

|

|

| |

By: |

/s/ Kurtis J. Wolf |

| |

|

Name: |

Kurtis J. Wolf |

| |

|

Title: |

Managing Member |

| |

Helios I, LP |

| |

|

| |

By: |

Hestia Capital Management, LLC,

its Investment Manager |

| |

|

|

| |

By: |

/s/ Kurtis J. Wolf |

| |

|

Name: |

Kurtis J. Wolf |

| |

|

Title: |

Managing Member |

| |

Hestia Capital Partners GP, LLC |

| |

|

| |

By: |

/s/ Kurtis J. Wolf |

| |

|

Name: |

Kurtis J. Wolf |

| |

|

Title: |

Managing Member |

| |

Hestia Capital Management, LLC |

| |

|

| |

By: |

/s/ Kurtis J. Wolf |

| |

|

Name: |

Kurtis J. Wolf |

| |

|

Title: |

Managing Member |

| |

/s/ Kurtis J. Wolf |

| |

Kurtis J. Wolf

Individually and as attorney-in-fact for Todd A. Everett,

Carl J. Grassi, Lance E. Rosenzweig, Milena Alberti-Perez, Katie A. May and Kenneth T. McBride |

SCHEDULE A

Transactions in the Shares Since the Filing

of Amendment No. 1 to the Schedule 13D

| Nature of the Transaction |

Amount of Securities

Purchased/(Sold) |

Price ($) |

Date of

Purchase |

HELIOS I, LP

| Purchase of Common Stock |

60,000 |

3.7100 |

12/22/2022 |

| Purchase of Common Stock |

25,000 |

4.2200 |

01/19/2023 |

Hestia

Capital Management, LLC

(through the Separately Managed Accounts)

| Purchase of Common Stock |

40,000 |

3.4600 |

12/19/2022 |

CARL J. GRASSI

| Purchase of Common Stock |

12,500 |

4.1800 |

01/04/2023 |

| Purchase of Common Stock |

12,500 |

4.1767 |

01/04/2023 |

LANCE E. ROSENZWEIG

| Purchase of Common Stock |

5,000 |

4.4480 |

01/05/2023 |

| Purchase of Common Stock |

5,000 |

4.6700 |

01/06/2023 |

Exhibit

99.1

Hestia Capital Nominates Seven Highly Qualified, Independent

Candidates for Election to Pitney Bowes’ Long-Tenured, Underperforming Board of Directors

Highlights Well-Rounded Slate’s Capital

Allocation Acumen, Corporate Governance Experience, Relevant Sector Backgrounds, Transaction Expertise and Sorely Needed Ownership Perspectives

Reiterates Its View That Stockholders Deserve

New Leadership Following Years of Value Destruction Under Chair Michael Roth (26+ Years of Board Service) and CEO Marc Lautenbach (10+

Years of CEO and Board Service)

Urges the Board to Avoid Initiating a Reactionary

Director Refreshment or Employing Entrenchment Maneuvers to Insulate Messrs. Roth and Lautenbach

PITTSBURGH--(BUSINESS WIRE)--Hestia Capital Management,

LLC (collectively with its affiliates, “Hestia” or “we”), which is the third largest stockholder of Pitney Bowes,

Inc. (NYSE: PBI) (“Pitney Bowes” or the “Company”) and has a beneficial ownership position of approximately 7.2%

of the Company's outstanding shares, today announced that it has nominated seven highly qualified and independent candidates for election

to the Company’s nine-member Board of Directors (the “Board”) at the Company’s 2023 Annual Meeting of Stockholders

(the “Annual Meeting”). In addition, Hestia released a presentation (downloadable here) that details a sampling of current

leadership’s failings that have led to significant stockholder value destruction.

Kurt Wolf, Founder and Chief Investment Officer of

Hestia, commented:

“Hestia has purposefully recruited a well-rounded

slate of director candidates that possesses capital allocation acumen, corporate governance expertise, relevant sector backgrounds, operating

and transaction experience and ownership perspectives – all of which are needed at Pitney Bowes. Our slate also has deep knowledge

of the Company’s balance sheet, business segments, market opportunities and secular headwinds. As a result of their experience and

insight, our candidates have already been able to identify steps for turning around the Company and quickly repairing its severely damaged

credit rating. We look forward to announcing an interim Chief Executive Officer candidate, issuing a 100-day transition plan and sharing

a detailed value creation strategy prior to the upcoming Annual Meeting.

We recognize that seeking a change in control of the

Board requires a compelling justification. Unfortunately for stockholders, that justification lies in the fact that the Board has failed

to address a decade of dismal returns, driven by misguided strategy, failed execution and missed opportunities. As we detail in our accompanying

presentation, the long tenures of Chairman Michael Roth and Chief Executive Officer Marc Lautenbach have been defined by poor capital

allocation and acquisitions that we believe Mr. Lautenbach has completely mismanaged. The combination of a poor strategy and failed execution

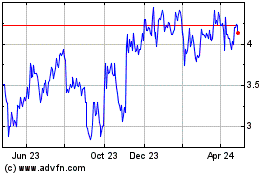

has led to a significant decline in the Company’s stock price and a continual decline in its credit ratings. Notably, an investor

would have been 6.8x better off had they invested in the S&P 500, rather than in Pitney Bowes during Mr. Lautenbach’s tenure.

This number increases to a staggering 21.6x during Mr. Roth’s tenure. This number ranges from 1.7x to 23x for the other seven directors.1

This record of failure is all the more egregious considering Pitney Bowes’ incredibly attractive competitive position and high value

products and services.

1 Total stockholder return calculation includes dividends reinvested and runs through the close of trading on November 18, 2022, which is the last day of trading prior to Hestia filing its Schedule 13D with the U.S. Securities and Exchange Commission.

Looking ahead, Pitney Bowes should not initiate an

insular and reactionary Board refresh or employ scorched earth tactics to try to deprive stockholders of their right to vote for new leaders

at the Annual Meeting. In addition to our valid concerns about management, we believe stockholders are poorly served by the Board’s

numerous interlocks to The Interpublic Group of Companies, Inc. (which Mr. Roth led for years), stale composition and insufficient sector

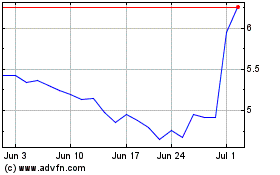

expertise. If the Board were to take note that the Company’s stock price is up more than 20% since our investment was publicly disclosed

and roughly 13% since the day we announced our intent to nominate a majority slate of director candidates, it should realize that stockholders

strongly support Hestia’s efforts. We intend to do everything in our power to continue advancing stockholders’ best interests,

regardless of the resources and time required to do so.”

THE HESTIA SLATE

Hestia has nominated seven

candidates in order to enable two incumbents to continue to serve for continuity purposes. The Hestia slate includes the below listed

individuals.

| Candidate |

Key Experience |

Bio |

| Milena Alberti-Perez |

·

CFO

experience

·

Board

and governance experience

·

Audit,

M&A and capital allocation experience |

Milena Alberti-Perez is an experienced c-level leader,

public company director and former financial executive at technology and publishing companies. Prior to serving on the board of directors

of Digimarc Corp. (NASDAQ: DMRC), where she is Audit Committee Chair, Milena was most recently the Chief Financial Officer of Getty Images

Holdings, Inc. (NYSE: GETY) from January 2021 to January 2022. Previously, Milena was the Chief Financial Officer of technology company

MediaMath, Inc. and the global Chief Financial Officer of multinational publisher Penguin Random House LLC, where she also served on the

company’s Audit Committee. Milena began her career as an investment banking analyst at Morgan Stanley and earned her M.B.A. from

the Harvard Business School and her B.A. in Economics from The University of Pennsylvania.

|

| Todd Everett |

·

CEO

experience

·

Mailing,

shipping and logistics experience

·

M&A

experience |

Todd Everett is currently a strategic advisor to technology

and ecommerce companies that include Doddle Parcel Services Limited, Verishop, Inc. and Fetch Package, Inc. Prior to holding advisory

roles, Todd held positions of increasing responsibilities at Newgistics, Inc. (“Newgistics”) from 2005 until 2018. Most recently,

he served as Chief Executive Officer and led Newgistics to significant growth and profitability prior to its sale to Pitney Bowes. Todd

was a Transportation and Outsourcing Manager at Intel Corporation (NASDAQ: INTC) from 1996 through 2005. He received a B.S. in Transportation

and Logistics from Iowa State University.

|

| Carl Grassi |

·

Board

and governance experience

·

Audit

and tax experience

·

M&A

experience |

Carl Grassi is an experienced public company director

with experience across sectors and industries. He has served as a director of companies such as J. Alexander's Holdings, Inc., which recently

sold to SPB Hospitality. Additionally, he is Senior Counsel at business advisory and advocacy law firm McDonald Hopkins, LLC (“McDonald

Hopkins”). He was McDonald Hopkins’ chairman from 2016 to 2019 after serving as firm president for nine years. Carl earned

his J.D. from Cleveland State University College of Law and his B.S.B.A. with a major in Accounting from John Carroll University.

|

| Katie May |

·

CEO experience

·

Board

and governance experience

·

Mailing,

shipping and logistics experience |

Katie May was previously the Chief Executive Officer

of ecommerce SaaS company ShippingEasy, Inc. (“ShippingEasy”) prior to selling the business to Stamps.com, Inc. (“Stamps.com”).

She was a director of Stamps.com and involved in its value-maximizing sale to Thoma Bravo. Prior to her success with ShippingEasy, Katie

founded Kidspot.com.au, where she led the thriving start-up from 2005-2012 until its sale to News Corp (NASDAQ: NWSA). She has an extensive

background in marketing, ecommerce, technology and strategic planning. Katie earned her M.B.A. from The University of Texas at Austin