Pitney to Delist Preference Stock - Analyst Blog

April 11 2013 - 2:28PM

Zacks

Pitney Bowes Inc. (PBI) recently announced its

plans to delist its $2.12 Convertible Preference Stock from the New

York Stock Exchange (the “NYSE”). The decision, which has already

been notified to the NYSE, is expected to become effective by Apr

22, 2013.

The primary reasons attributed for the delisting were low number

of shares outstanding and low daily trading volume. In such a

scenario the listing fees and compliance administration costs

appear to be burdensome for Pitney. Currently, the company has

23,928 shares of outstanding Preference Stock, significantly below

the minimum number of shares specified by NYSE.

Although the stocks might continue to be traded at some of the

over-the-counter markets, the company does not intend to relist it

with any other exchange as of now. This delisting will not pertain

to the terms of the stock in any way and will not affect the

dividend payments.

As a result of this delisting, Pitney might lose investors'

confidence, as it failed to meet the requirements of NYSE. This

will likely make institutional investors skeptical of the stock, as

individual investor will have access to less information about the

company.

In this regard it is also to be noted that recently, Pitney

announced a cash tender offer to purchase some of its Notes, with

an intension to sell new debt securities through an underwritten

public offering.

Currently, Pitney has $4 billion in its long-term debt. This in

turn demands a high interest payout. Additionally, the market for

mail processing equipment and mail services is shrinking

globally.

Although management is attempting to transform Pitney to a

cloud-based, service-oriented company, the results have not yet

been able to surpass the declining revenue. During the last few

quarters free cash flow was also impacted by higher working capital

requirements due to the timing of disbursements and huge capital

expenditure made during last few quarters.

Given its deteriorating cash flows, declining revenues from

continuing operations and aggressive capex plans, it makes sense

for PBI to cut down its debt as a part of its capital management

plan. The resultant extension of maturities and lower operating

cost would also support its cash balances.

Pitney currently has a Zacks Rank #3 (Hold),. Some other

companies in the industry that are worth looking into include

Lexmark International Inc. (LXK), Xerox

Corporation (XRX) and Symantec Corp. (

SYMC), each having a Zacks Rank #2 (Buy).

LEXMARK INTL (LXK): Free Stock Analysis Report

PITNEY BOWES IN (PBI): Free Stock Analysis Report

SYMANTEC CORP (SYMC): Free Stock Analysis Report

XEROX CORP (XRX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

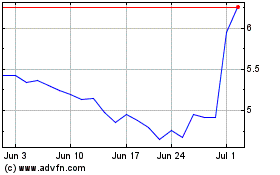

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

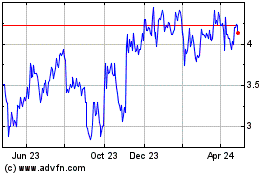

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jul 2023 to Jul 2024