Pitney Bowes Inc. (NYSE:PBI) (the “Company,” “us” or “Pitney

Bowes”) today announced the Reference Yield, Total Consideration

and Tender Offer Consideration (each as defined below) for its

previously announced cash tender offers (the “Offers”) for its

4.875% Medium-Term Notes due 2014 (the “2014 Notes”), 5.000% Notes

due 2015 (the “2015 Notes”) and 4.750% Medium-Term Notes due 2016

(the “2016 Notes” and, together with the 2014 Notes and the 2015

Notes, the “Notes”).

The Offers are being made pursuant to an Offer to Purchase,

dated February 26, 2013 (the “Offer to Purchase”) and related

Letter of Transmittal, dated February 26, 2013 (the “Letter of

Transmittal”) which set forth a description of the terms and

conditions of the Offers.

The consideration to be paid in each of the Offers has been

determined in the manner described in the Offer to Purchase by

reference to a fixed spread over the yield to maturity (the

“Reference Yield”) of the applicable U.S. Treasury Security

specified in the table below and on the cover page of the Offer to

Purchase in the column entitled “Reference U.S. Treasury Security.”

Holders who validly tender and do not validly withdraw Notes at or

prior to the Early Tender Time (as defined below) that are accepted

for purchase will receive the applicable “Total Consideration”

listed in the table below, which includes an early tender payment

of $30 per $1,000 principal amount of Notes accepted for purchase

(the “Early Tender Premium”). Holders who validly tender after the

Early Tender Time but at or prior to the Expiration Time (as

defined below) that are accepted for purchase will receive the

Total Consideration listed in the table below minus the Early

Tender Premium (the “Tender Offer Consideration”). In addition, in

each case holders will receive accrued and unpaid interest on their

Notes up to, but excluding, the applicable settlement date.

Reference

Fixed

Outstanding Maximum U.S.

Spread Title of Security/ Principal

Series Treasury Reference (Basis

Tender Offer Early Tender Total CUSIP

No. Amount Tender Cap

Security Yield

Points) Consideration

Premium(1)

Consideration 4.875% Medium-Term

Notes due 2014

(CUSIP No. 72447WAU3)

$450,000,000 $200,000,000 0.250% due January 31, 2015 0.252% 40

$1,029.80 $30 $1,059.80

5.000% Notes due 2015CUSIP No.

724479AG5)

$400,000,000 $140,000,000 0.250% due January 31, 2015 0.252% 125

$1,038.95 $30 $1,068.95 4.750% Medium-Term

Notes due 2016

(CUSIP No. 72447XAA5)

$500,000,000 $75,000,000 0.375% due February 15, 2016 0.402% 200

$1,034.09 $30 $1,064.09

(1) Per $1,000 principal amount of Notes.

The Offers are scheduled to expire at 11:59 p.m., New York City

time, on March 25, 2013, unless any one or more of the Offers are

extended or earlier terminated by the Company in its sole

discretion (such date and time, as the same may be extended with

respect to any one or more of the Offers, the “Expiration Time”).

Holders of the Notes must validly tender their Notes at or before

5:00 p.m., New York City time, on March 11, 2013, unless extended

by the Company (such date and time, as the same may be extended

with respect to any one or more of the Offers, the “Early Tender

Time”), to be eligible to receive the Total Consideration. Tenders

of the Notes may be validly withdrawn at any time prior to 5:00

p.m., New York City time, on March 11, 2013, unless extended by the

Company with respect to any one or more of the Offers. After such

time, the Notes may not be validly withdrawn except as otherwise

provided in the Offer to Purchase or as required by law.

The principal amount of each series of Notes purchased pursuant

to the Offers will not exceed the applicable “Maximum Series Tender

Cap” set forth in the table above. Subject to the terms and

conditions of the Offers, the Company may, at its option, accept

for purchase and pay for (i) promptly after the Early Tender Time

and at or prior to the Expiration Time (such payment date being the

“Early Settlement Date”), a portion of the Notes of any series that

are validly tendered and not validly withdrawn at or prior to the

Early Tender Time up to the applicable Maximum Series Tender Cap,

and (ii) promptly after the Expiration Time, accept for purchase

and pay for a principal amount of the Notes of each series up to

the applicable Maximum Series Tender Cap, less the principal amount

of any Notes of such series purchased on the Early Settlement Date

(if any), in each case subject to proration as described in the

Offer to Purchase. If the aggregate principal amount of Notes for a

particular series validly tendered at or prior to the Early Tender

Time is equal to or in excess of the applicable Maximum Series

Tender Cap, no additional Notes of such series will be accepted for

purchase after the Early Tender Time.

Each Offer is being made independent of each other Offer. No

Offer is conditioned on any of the other Offers or upon any minimum

principal amount of the Notes of any series being tendered. The

Company may extend or otherwise amend the Early Tender Time or the

Expiration Time, or increase or decrease the Maximum Series Tender

Caps, with respect to any or all of the Offers, without extending

or otherwise reinstating the withdrawal rights of Holders, with

respect to one or more of the Offers, unless required by law (as

determined by the Company in its sole discretion).

The Company’s obligation to accept for purchase, and to pay for,

any Notes validly tendered pursuant to the Offers is subject to and

conditioned upon the satisfaction of, or the Company’s waiver of,

the conditions described in the Offer to Purchase.

This press release is neither an offer to purchase nor a

solicitation of an offer to sell securities. No offer,

solicitation, purchase or sale will be made in any jurisdiction in

which such offer, solicitation, or sale would be unlawful. The

Offers are being made solely pursuant to the terms and conditions

set forth in the Offer to Purchase and the Letter of

Transmittal.

Goldman, Sachs, & Co. (“Goldman Sachs”) and J.P. Morgan

Securities LLC (“J.P. Morgan”) are serving as Joint Dealer Managers

for the Offers. Questions regarding the Offers may be directed to

Goldman Sachs at 800-828-3182 (toll free) or 212-357-6436

(collect), or to J.P. Morgan at 866-834-4666 (toll free) or

212-834-2494 (collect). Requests for the Offer to Purchase or the

Letter of Transmittal or the documents incorporated by reference

therein may be directed to Global Bondholder Services Corporation,

which is acting as Tender and Information Agent for the Offers, at

the following telephone numbers: banks and brokers, 212-430-3774;

all others toll free at 866-470-4200.

About Pitney Bowes

Pitney Bowes provides technology solutions for small, mid-size

and large firms that help them connect with customers to build

loyalty and grow revenue. The company’s solutions for financial

services, insurance, healthcare, telecommunications, legal, public

sector and retail organizations are delivered on open platforms to

best organize, analyze and apply both public and proprietary data

to two-way customer communications. Pitney Bowes is the only firm

that includes direct mail, transactional mail, call centers and

in-store technologies in its solution mix along with digital

channels such as the Web, email, live chat and mobile applications.

Pitney Bowes has approximately USD$5 billion in annual revenues and

27,000 employees worldwide. Pitney Bowes: Every connection is a new

opportunity™. www.pb.com.

Forward-Looking Statements

This press release contains “forward-looking statements” about

our expected or potential future business and financial

performance. For us, forward-looking statements include, but are

not limited to, statements about our future revenue and earnings

guidance and other statements about future events or conditions.

Forward-looking statements are not guarantees of future performance

and involve risks and uncertainties that could cause actual results

to differ materially from those projected. These risks and

uncertainties include, but are not limited to: mail volumes; the

uncertain economic environment; timely development, market

acceptance and regulatory approvals, if needed, of new products;

fluctuations in customer demand; changes in postal regulations;

interrupted use of key information systems; management of

outsourcing arrangements; foreign currency exchange rates; changes

in our credit ratings; management of credit risk; changes in

interest rates; the financial health of national posts; and other

factors beyond our control as more fully outlined in the Company’s

2012 Form 10-K Annual Report and other reports filed with the

Securities and Exchange Commission. Pitney Bowes assumes no

obligation to update any forward-looking statements contained in

this document as a result of new information, events or

developments.

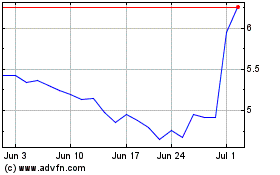

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

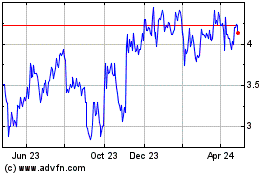

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jul 2023 to Jul 2024