Pitney Vends Print+ Messenger - Analyst Blog

August 15 2011 - 6:04AM

Zacks

Pitney Bowes Inc. (PBI) announced the sale of

Pitney Bowes Print+ Messenger Color Inkjet System to Wilen

Direct. Known for delivering innovative services, Pitney

Bowes provides software, hardware and services that assimilate

physical and digital communications channels. Through this sell

off, Pitney is helping Wilen Direct in expanding its business

through highly developed customer communications management.

Florida based-Wilen Direct is an operating affiliate of the

Wilen Group, a full service direct marketing services provider. The

company leads in personalized direct marketing, digital and

variable data imaging, highly developed mail strategies and

technologies, logistics, and fulfillment. The Wilen Group has

generated its business over the past 35 years and has a large array

of Fortune 100 clients.

The acquisition of the system by Wilen would generate customized

four-color envelopes for Wilen’s clients, which will help in

marketing and customer communications campaigns. Using the new

Inkjet System, all basic information, including personalized

marketing messages, mailing and return addresses, company logos,

four-color graphics, and postal barcodes will be printed directly

on various array of envelopes during high-speed mailing. This, in

turn, reduces the need for envelope conversions or inserting

materials for the company.

Previously, this Inkjet system was formed after Pitney partnered

with inkjet printing technology leader Hewlett-Packard

Company (HPQ) and provided sophisticated, 100% variable

data printing on envelopes in full color. Therefore, Wilen will be

able to attract more clients with innovations and new technology

while having an edge over its competitors in the market.

Earnings Recap

Pitney reported second quarter earnings from continuing

operation of 52 cents per share, which was a penny above the Zacks

Consensus Estimate and was up 7.7% year over year. Total revenue

was $1.3 billion in the quarter, an increase of 1% year over year.

The top line included a 3% benefit from foreign currency

translation.

In addition, the company witnessed continued growth in equipment

and software sales during the quarter. This was partially offset by

declines in recurring revenue streams and supplies, rentals and

financing, which declined 3% year over year.

The company believes that it is poised to deliver solid

performance in the long term and achieve solid profitability based

on its strong product portfolio. Pitney is benefiting from its

Strategic Transformation program, helping it to effectively provide

new products and services.

Pitney is a leading supplier of products and services in most of

its business segments. Its meter base and its ability to place and

finance meters in key markets contribute significantly to its

revenue and profitability. However, all segments face competition

from a number of companies.

We believe that its vast experience and reputation for product

quality, as well as its sales and support service organizations,

are important factors in influencing customer choices with respect

to its products and services.

However, many of Pitney contracts are with government entities.

Government contracts are subject to extensive and complex

government procurement laws and regulations, along with regular

audits of contract pricing and business practices.

Pitney shares have a Zacks #3 Rank, which translates into a

short-term Hold recommendation. Moreover, considering the

fundamentals, we are maintaining a long-term Neutral recommendation

on the stock. A major competitor of Pitney -- Siemens

Inc. (SI) also retains a Zacks #3 Rank.

HEWLETT PACKARD (HPQ): Free Stock Analysis Report

PITNEY BOWES IN (PBI): Free Stock Analysis Report

SIEMENS AG-ADR (SI): Free Stock Analysis Report

Zacks Investment Research

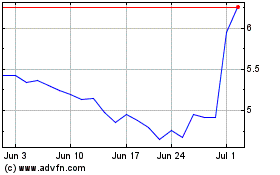

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

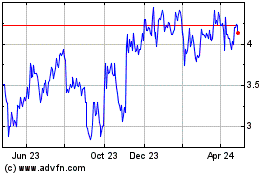

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jul 2023 to Jul 2024