Pitney Bowes Underperforms - Analyst Blog

April 29 2011 - 9:49AM

Zacks

Pitney Bowes Inc. (PBI) released its

first-quarter 2011 before the market opened today, reporting

earnings per share from continuing operation of 42 cents,

underperforming the Zacks Consensus Estimate of 53 cents, but above

the prior-year estimate of 38 cents.

Revenue

Total revenue was $1.3 billion in the quarter, a decrease of 2%

year over year, led by a decline in supplies, rentals and financing

revenues ,partially offset by increased software and equipment

sales. Loss caused by outbreak of a fire in Dallas at the company’s

largest mail presort center also negatively affected the company’s

revenue and earnings.

SMB Solutions revenue inched down 5% on constant currency basis

to $680 million. Within SMB Solutions, North America Mailing

revenue was $509 million (down 5%) and International Mailing

revenue was $171 million (down 3%).

Enterprise Business Solutions revenue inched down 1% on constant

currency basis to $643 million. Within Enterprise Business

Solutions, Worldwide Production Mail revenue was $132 million (up

3%), Software revenue was $96 million (up 15%), Management Services

revenue was $242 million (down 5%), Mail Services revenue was $$144

million (down 3%) and Marketing Services revenue was $30 million

(down 6%).

Income and Expenses

Operating Income was $134.2 million compared with $160.0 million

in the prior-year quarter. SG&A expense was $429.9 million

compared with $443.3 million and R&D expense was $34.8 million

compared with $40.9 million.

Balance Sheet

Cash and cash equivalents was $652.1 million at the end of the

quarter compared with $484.4 million at the end of the prior

quarter. Long-term debt was $4,236 million compared with $4,239

million.

Free cash flow was $285.8 million for the quarter compared with

$289.7 million in the prior-year period. On a GAAP basis, the

company generated $296.8 million in cash from operations for the

quarter compared with $301.6 million.

The company paid cash dividend of $75 million during the

quarter.

Outlook

Pitney Bowes expects total revenue growth to be between flat to

3% range in 2011. Adjusted earnings from continuing operations are

expected to be in the range of $2.15 to $2.35.

The company believes it is poised to deliver solid performance

in the long term and achieve solid profitability based on its

strong product portfolio. Pitney Bowes is benefiting from its

Strategic Transformation program, helping it to effectively provide

new products and services.

The company is a leading supplier of products and services in

most of its business segments. Its meter base and its ability to

place and finance meters in key markets contribute significantly to

its revenue and profitability. However, all segments face

competition from a number of companies.

We believe that its vast experience and reputation for product

quality, as well as its sales and support service organizations,

are important factors in influencing customer choices with respect

to its products and services.

However, many of Pitney Bowes contracts are with government

entities. Government contracts are subject to extensive and complex

government procurement laws and regulations, along with regular

audits of contract pricing and business practices.

Pitney Bowes Inc. was incorporated in the state of Delaware on

April 23, 1920, as Pitney Bowes Postage Meter Company. The company

is the largest provider of mail processing equipment and integrated

mail solutions in the world.

It offers a full suite of equipment, supplies, software and

services for end-to-end mailstream solutions, which enable its

customers to optimize the flow of physical and electronic mail,

documents and packages across their operations. A major competitor

of Pitney Bowes is Siemens Inc. (SI).

We currently maintain our Neutral rating on Pitney Bowes Inc.

with a Zacks #3 Rank (short-term Hold recommendation) over the next

one-to-three months.

PITNEY BOWES IN (PBI): Free Stock Analysis Report

SIEMENS AG-ADR (SI): Free Stock Analysis Report

Zacks Investment Research

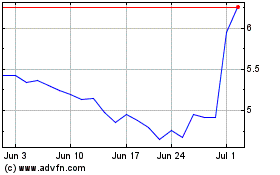

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

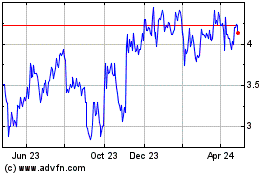

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jul 2023 to Jul 2024