Pitney Bowes Inc. (NYSE:PBI) today reported second quarter 2009

financial results.

Revenue for the quarter was $1.38 billion compared with $1.59

billion in the prior year, a decline of 13 percent. A stronger

dollar reduced revenue by 5 percent year-over-year. Adjusted

earnings per diluted share from continuing operations was $0.55,

compared with $0.69 in the prior year, which included $0.03 per

diluted share from a 2008 legal settlement. Adjusted earnings per

diluted share this quarter was equal to the first quarter of

2009.

Adjusted earnings per diluted share include the negative impacts

of $0.04 per diluted share associated with currency and $0.01 per

share from incremental pension costs when compared with the prior

year. Earnings were further reduced by the impacts of lower revenue

as a result of the weak global economic conditions.

On a Generally Accepted Accounting Principles (GAAP) basis,

earnings per diluted share was $0.57 compared with $0.61 for the

prior year. GAAP earnings per diluted share includes less than

$0.01 in a non-cash tax charge associated with out-of-the money

stock options that expired during the quarter and a $0.02 gain

associated with discontinued operations.

Free cash flow was $204 million for the quarter while on a GAAP

basis the company generated $207 million in cash from operations.

Free cash flow benefited from strong accounts receivable management

and lower levels of finance assets and capital investments. During

the quarter the company paid $74 million of dividends.

Year-to-date, the company has generated $444 million in free cash

flow and on a GAAP basis $483 million in cash from operations,

which was partially used to reduce debt by $179 million.

The company’s results for the quarter are further summarized

below:

Second Quarter*

Adjusted EPS $0.55

Tax Adjustments

($0.00)

GAAP EPS from Continuing Operations $0.54

Discontinued Operations $0.02

GAAP EPS

$0.57

*The sum of the earnings per share does not equal the totals

above due to rounding.

“Despite a challenging economic environment, we remain a healthy

and profitable company that continues to generate significant cash

flow and continues to invest for the future,” noted Pitney Bowes

Chairman, President and CEO Murray D. Martin, “Economic headwinds

and unfavorable currency translation drove declines in revenue and

EBIT year-over-year. However, as a result of significant cost

containment measures, compared with the first quarter we improved

EBIT margins in 6 of our 7 business reporting segments despite flat

revenue. We have reduced costs across the entire business and have

made a shift towards a more variable cost structure. We are

committed to identifying and implementing meaningful structural and

process improvements across the organization, that will reduce

costs and enable continued investment to enhance customer and

shareholder value.

“Looking ahead to the second half of 2009, we have seen a

further slowing of business activity in key international markets,

sales cycles for capital equipment purchases remain long, and we

have not yet seen improvements in key mail-intensive industries

like financial services. As a result, we are reducing our earnings

outlook for the year. However, based on strong cash flow

year-to-date, we are reaffirming our annual free cash flow

guidance.”

Business Segment Results

To provide further insight on the trends of the business, the

company is also furnishing revenue and EBIT results on a sequential

basis, which is a comparison to first quarter results.

Mailstream Solutions revenue declined 10 percent on a

constant currency basis to $936 million. On a reported basis,

revenue declined 15 percent and earnings before interest and taxes

(EBIT) declined 19 percent to $238 million when compared with the

prior year. When compared with the first quarter 2009, reported

revenue increased by one percent and EBIT increased by 3

percent.

Within Mailstream Solutions:

U.S. Mailing revenue declined 8 percent to $505 million and EBIT

declined 12 percent to $195 million when compared with the prior

year. Revenue declined by one percent and EBIT increased by one

percent when compared with the first quarter.

Similar to the first quarter, the segment benefited from the

anticipated higher number of customers with leases becoming

available for renewal and upgrade. Although equipment sales

declined 7 percent compared with the prior year, there was an

improvement in equipment sales on a sequential basis. The company

continued its focus on customer retention by providing customers

with a variety of options to upgrade or retain their existing

equipment. Many customers elected to extend the lease on their

existing equipment. These transactions benefit future period’s

profitability but have a less positive impact on revenue and

profits during the quarter than lease upgrades for new equipment.

The quarter’s revenue and EBIT reflect lower levels of business

activity and the related lower financing revenue, meter rentals,

and supplies sales versus the prior year.

International Mailing revenue declined 14 percent on a constant

currency basis to $218 million. On a reported basis, revenue

declined 28 percent with 14 points of decline due to an adverse

currency impact when compared with the prior year. EBIT declined 47

percent to $27 million. Adjusting for the legal settlement received

during the second quarter last year, EBIT would have declined 38

percent. Reported revenue declined by 8 percent and EBIT declined

13 percent when compared with the first quarter.

Economic conditions internationally appear to be lagging the

U.S. This has resulted in ongoing deferred capital purchases for

mailing equipment and delays by customers in adding new services.

This was particularly noticeable in Canada, Asia and certain key

markets in Europe. In addition to a lower level of revenue during

the quarter, EBIT was adversely affected by changes in currency

rates that increased some product costs.

Worldwide Production Mail revenue declined 7 percent on a

constant currency basis to $130 million. On a reported basis,

revenue declined 13 percent with 6 points of the decline due to an

adverse currency impact compared with the prior year. EBIT declined

32 percent to $10 million. Reported revenue increased 19 percent

and EBIT doubled when compared with the first quarter.

Customers worldwide continued to defer making large capital

investments and as a result are keeping existing equipment longer

than usual. This trend again resulted in increased service revenue.

There was also sequential improvement in the placement of new

high-speed inserting equipment.

Software revenue declined 12 percent on a constant currency

basis to $83 million. On a reported basis, revenue declined 19

percent and EBIT declined 17 percent to $5 million, when compared

with the prior year. Reported revenue increased 10 percent and EBIT

doubled when compared with the first quarter.

Worldwide consolidation in the financial services industry and

slowness in the retail sector continued to adversely impact the

sales and renewal of software licenses. Uncertainty surrounding the

economy has resulted in many large multi-national organizations

changing their approval policies for capital expenditures, which

has lengthened the sales cycle. Ongoing business integration drove

EBIT margin improvements versus the prior year and prior quarter.

This helped offset the pressure on margin due to lower revenue and

a mix of lower margin software sales.

Mailstream Services revenue declined 6 percent on a

constant currency basis to $442 million. On a reported basis,

revenue declined 8 percent and EBIT increased 9 percent to $41

million when compared with the prior year. Reported revenue

declined one percent while EBIT increased 20 percent when compared

with the first quarter.

Within Mailstream Services:

Management Services revenue declined 8 percent on a constant

currency basis to $264 million. On a reported basis, revenue

declined 12 percent and EBIT declined 11 percent to $16 million,

when compared with the prior year. Reported revenue declined by one

percent and EBIT increased 18 percent when compared with the first

quarter.

In the U.S., EBIT as a percentage of revenue remained at 10

percent, comparable to the prior quarter, despite lower business

activity and a decline in transaction volumes. The company

continues to flex its costs with changing customer demand by taking

actions to reduce the fixed cost structure of the business. Outside

the U.S., the company’s significant exposure to the weak financial

services industry in the UK, and overall reduced print volumes

throughout most of Europe, again pressured the segment’s EBIT as a

percentage of revenue.

Mail Services revenue increased 4 percent on a constant currency

basis to $139 million. On a reported basis, revenue increased 3

percent and EBIT increased 36 percent to $22 million, when compared

with the prior year. Reported revenue declined 2 percent and EBIT

increased 17 percent when compared with the first quarter.

Expansion of the customer base and continued growth in mail

volume processed drove an increase in revenue for the quarter. The

company is achieving improved EBIT margin contributions from the

integration of mail services sites acquired last year and the

ongoing productivity initiatives taken by the business.

Marketing Services revenue declined 17 percent to $40 million

and EBIT declined 11 percent to $3 million, when compared with the

prior year. Revenue declined 3 percent while EBIT increased 56

percent when compared with the first quarter.

Revenue was negatively affected by reduced business in the areas

of marketing campaign management and loyalty programs. Ongoing cost

reduction initiatives resulted in EBIT margin improvement.

Revised 2009 Guidance

The company is adjusting the guidance it provided on May 5,

2009. The company has not seen indications that economic and

business conditions in mail-intensive industries will improve this

year and has also seen further declines in some key geographies.

Sales cycles for most capital purchase decisions by customers

remain long. The changing guidance reflects these factors,

including the impact of the sustained economic downturn on

high-margin financing, rental, and supplies revenue streams. While

the company has been successful in reducing its cost structure

across its entire business and is shifting to a more variable cost

structure, these actions have not been enough to offset the impact

of lower revenue.

Given the persistent decline in business activity and the lack

of tangible signs of sustained near-term improvement in the

economy, the company now expects 2009 revenue to decline in the

range of 4 percent to 7 percent on a constant currency basis. On a

reported basis, the company expects revenue to decline in the range

of 7 percent to 10 percent, which includes an estimated negative 3

percent impact from currency when compared with 2008. The company

expects adjusted earnings per diluted share from continuing

operations for the year will be in the range of $2.15 to $2.35.

This range includes the expected negative impact of $0.23 to $0.28

per diluted share from currency and incremental pension expense.

Adjusted earnings per diluted share from continuing operations

excludes an annual estimated 6 cents per diluted share non-cash tax

charge associated with out-of-the-money stock options that was

recorded in the first half of 2009. On a GAAP basis, the company

expects earnings per diluted share from continuing operations for

the year will be in the range of $2.09 to $2.29.

The company is reaffirming its free cash flow guidance in the

range of $700 million to $800 million for the year, based on its

strong cash flow performance year-to-date.

The 2009 earnings guidance is summarized in the table below:

Full Year 2009

Adjusted EPS $2.15 to $2.35

Tax Adjustments

($0.06)

GAAP EPS from Continuing Operations

$2.09 to $2.29

Mr. Martin concluded, “While the economic environment continues

to be highly uncertain, we remain focused on the things that we can

control. Let me reiterate our commitment to identify and implement

structural and process improvements across the organization, as we

remain focused on strengthening our long-term ability to generate

value for customers and shareholders, while ensuring that the

company is in the best possible position to capitalize on an

eventual economic recovery.”

Management of Pitney Bowes will discuss the company’s results in

a broadcast over the Internet today at 5:00 p.m. EST. Instructions

for listening to the earnings results via the Web are available on

the Investor Relations page of the company’s web site at

www.pb.com/investorrelations.

Pitney Bowes is a $6.3 billion global technology leader whose

products, services and solutions deliver value within the

mailstream and beyond. For more information about the company, its

products, services and solutions, visit www.pitneybowes.com.

The company's financial results are reported in accordance with

generally accepted accounting principles (GAAP). However, earnings

per share, income from continuing operations, and free cash flow

results are adjusted to exclude the impact of special items such as

transformation initiatives, restructuring charges, tax adjustments,

accounting adjustments and write downs of assets. Although these

charges represent actual expenses to the company, these charges

might mask the periodic income and financial and operating trends

associated with our business. The use of free cash flow has

limitations. GAAP cash flow has the advantage of including all cash

available to the company after actual expenditures for all

purposes. Free cash flow permits a shareholder insight into the

amount of cash that management could have available for other

discretionary uses. It adjusts for long-term commitments such as

capital expenditures, as well as special items like cash used for

restructuring charges, unusual tax payments and contributions to

its pension funds. These items use cash that is not otherwise

available to the company and are important expenditures. Management

compensates for these limitations by using a combination of GAAP

cash flow and free cash flow in doing its planning.

EBIT excludes interest payments and taxes, both cash expenses to

the company, and as a result, has the effect of showing a greater

amount of earnings than net income. The company uses EBIT for

purposes of measuring the performance of its management team. The

interest rates and tax rates applicable to the company generally

are outside the control of management, and it can be useful to

judge performance independent of those variables. Financial results

on a constant currency basis exclude the impact of changes in

foreign currency exchange rates since the prior period under

comparison and are calculated using the average of the rates in

effect during that period. Constant currency measures are intended

to help investors better understand the underlying operational

performance of the business excluding the impacts of shifts in

currency exchange rates over the intervening period.

Pitney Bowes has provided a quantitative reconciliation to GAAP

in supplemental schedules. This information may also be found at

the company's web site www.pb.com/investorrelations in the

Investor Relations section.

This document contains “forward-looking statements” about our

expected future business and financial performance. Pitney Bowes

assumes no obligation to update any forward-looking statements

contained in this document as a result of new information or future

events or developments. For us forward-looking statements include,

but are not limited to, statements about possible transformation

initiatives; restructuring charges and our future revenue and

earnings guidance. Forward-looking statements involve risks and

uncertainties that could cause actual results to differ materially

from those projected. These risks and uncertainties include, but

are not limited to: the uncertain economic environment, including

adverse impacts on customer demand; changes in foreign currency

exchange rates; and changes in postal regulations, as more fully

outlined in the company's 2008 Form 10-K Annual Report and other

reports filed with the Securities and Exchange Commission.

Note: Consolidated statements of income; revenue and EBIT by

business segment; and reconciliation of GAAP to non-GAAP measures

for the three and six months ended June 30, 2009 and 2008, and

consolidated balance sheets at June 30, 2009 and March 31, 2009 are

attached.

Pitney Bowes Inc.

Consolidated Statements of

Income

(Unaudited)

(Dollars in thousands, except per

share data)

Three Months Ended June 30, Six Months Ended June 30, 2009

2008 2009 2008

Revenue:

Equipment sales $ 257,196 $ 311,650 $ 489,021 $ 614,363 Supplies

81,973 101,286 170,002 208,886 Software 87,380 109,120 167,106

214,525 Rentals 156,151 185,855 324,281 370,808 Financing 174,508

197,263 357,306 396,202 Support services 179,246 194,955 353,593

386,480 Business services 442,008 487,957

896,737 970,779 Total

revenue 1,378,462 1,588,086

2,758,046 3,162,043

Costs and expenses:

Cost of equipment sales 139,770 166,282 262,855 327,395 Cost of

supplies 21,369 26,419 44,710 54,291 Cost of software 21,570 26,453

41,067 54,190 Cost of rentals 38,013 39,671 73,864 77,975 Financing

interest expense 25,438 27,552 49,890 57,928 Cost of support

services 101,223 115,931 199,549 229,926 Cost of business services

352,306 383,009 712,213 762,300 Selling, general and administrative

424,265 497,689 867,793 994,184 Research and development 46,622

53,168 93,571 103,168 Restructuring charges and asset impairments -

18,815 - 35,908 Other interest expense 29,553 30,137 57,304 61,528

Interest income (933 ) (3,562 ) (2,485 )

(6,552 ) Total costs and expenses 1,199,196

1,381,564 2,400,331

2,752,241

Income from continuing operations

before income taxes

179,266 206,522 357,715 409,802

Provision for income taxes

62,535 70,386 134,684

145,933

Income from continuing

operations

116,731 136,136 223,031 263,869

Gain (loss) from discontinued

operations, net of income tax

5,102 (2,831 ) 7,725

(6,663 )

Net income before attribution of

noncontrolling interests

121,833 133,305 230,756 257,206

Less: Preferred stock dividends of

subsidiaries

attributable to noncontrolling interests 4,571

4,796 9,092 9,594

Pitney Bowes Inc. net income

$ 117,262 $ 128,509 $ 221,664 $ 247,612

Amounts attributable to Pitney

Bowes Inc. common

stockholders: Income from continuing operations $ 112,160 $ 131,340

$ 213,939 $ 254,275 Gain (loss) from discontinued operations

5,102 (2,831 ) 7,725 (6,663 )

Pitney Bowes Inc. net income $ 117,262 $ 128,509

$ 221,664 $ 247,612

Basic earnings per share of common

stock attributable to

Pitney Bowes Inc. common stockholders (1): Continuing operations $

0.54 $ 0.63 $ 1.04 $ 1.21 Discontinued operations 0.02

(0.01 ) 0.04 (0.03 ) Net

income $ 0.57 $ 0.62 $ 1.07 $ 1.18

Diluted earnings per share of

common stock attributable to

Pitney Bowes Inc. common stockholders (1): Continuing operations $

0.54 $ 0.63 $ 1.03 $ 1.20 Discontinued operations 0.02

(0.01 ) 0.04 (0.03 ) Net

income $ 0.57 $ 0.61 $ 1.07 $ 1.17

Average common and potential

common

shares outstanding 207,138,489 209,543,013

207,001,754 211,481,391

(1) The sum of the earnings per

share amounts may not equal the totals above due to rounding.

Pitney Bowes Inc.

Consolidated Balance Sheets

(Unaudited)

(Dollars in thousands, except per share data)

Assets

06/30/09 03/31/09 Current assets: Cash and cash equivalents $

445,262 $ 423,217 Short-term investments 23,399 19,717 Accounts

receivable, less allowances:

06/09 $46,647

03/09 $42,336

796,119 795,272 Finance receivables, less allowances:

06/09 $42,814

03/09 $43,592

1,365,188 1,384,657 Inventories 171,267 170,228 Current income

taxes 59,199 53,018 Other current assets and prepayments

102,911 79,458 Total current assets

2,963,345 2,925,567 Property, plant and equipment, net

546,805 555,963 Rental property and equipment, net 365,852 385,680

Long-term finance receivables, less allowances:

06/09 $25,091

03/09 $24,877

1,382,681 1,371,318 Investment in leveraged leases 212,235 195,340

Goodwill 2,276,151 2,209,599 Intangible assets, net 341,612 353,603

Non-current income taxes 58,044 62,283 Other assets 389,188

425,769 Total assets $ 8,535,913

$ 8,485,122

Liabilities and stockholders'

deficit

Current liabilities: Accounts payable and accrued liabilities $

1,722,404 $ 1,684,080 Current income taxes 70,776 138,895 Notes

payable and current portion of long-term obligations 292,869

384,382 Advance billings 491,073 482,215

Total current liabilities 2,577,122 2,689,572

Deferred taxes on income 320,842 270,630 FIN 48 uncertainties and

other income tax liabilities 296,711 305,077 Long-term debt

4,209,129 4,227,697 Other non-current liabilities 788,244

820,310 Total liabilities

8,192,048 8,313,286 Noncontrolling

interests (Preferred stockholders' equity in subsidiaries) 374,165

374,165 Stockholders' deficit: Cumulative preferred stock,

$50 par value, 4% convertible 7 7 Cumulative preference stock, no

par value, $2.12 convertible 969 972 Common stock, $1 par value

323,338 323,338 Additional paid-in capital 249,312 255,535 Retained

earnings 4,351,845 4,308,909 Accumulated other comprehensive loss

(533,571 ) (644,905 ) Treasury stock, at cost (4,422,200 )

(4,446,185 ) Total Pitney Bowes Inc. stockholders'

deficit (30,300 ) (202,329 ) Total liabilities

and stockholders' deficit $ 8,535,913 $ 8,485,122

Pitney Bowes Inc. Revenue and EBIT Business

Segments June 30, 2009

(Unaudited)

(Dollars in thousands)

Three Months

Ended June 30, % 2009 2008 Change

Revenue

U.S. Mailing $ 505,159 $ 550,849 (8 %) International Mailing

217,900 302,085 (28 %) Production Mail 130,137 149,400 (13 %)

Software 82,823 102,250 (19 %)

Mailstream Solutions 936,019 1,104,584

(15 %) Management Services 263,763 300,454 (12 %) Mail

Services 138,598 134,764 3 % Marketing Services 40,082

48,284 (17 %) Mailstream Services

442,443 483,502 (8 %)

Total

revenue $ 1,378,462 $

1,588,086 (13 %)

EBIT (1)

U.S. Mailing $ 195,044 $ 220,526 (12 %) International

Mailing 27,069 51,462 (47 %) Production Mail 10,413 15,350 (32 %)

Software 5,219 6,317 (17 %) Mailstream

Solutions 237,745 293,655 (19 %)

Management Services 16,140 18,230 (11 %) Mail Services 21,723

15,980 36 % Marketing Services 3,147 3,527

(11 %) Mailstream Services 41,010

37,737 9 %

Total EBIT $ 278,755

$ 331,392 (16 %) Unallocated

amounts: Interest, net (54,058 ) (54,127 ) Corporate expense

(45,431 ) (51,928 ) Restructuring charges and asset impairments

- (18,815 )

Income from continuing

operations before income taxes $ 179,266

$ 206,522 (1) Earnings before

interest and taxes (EBIT) excludes general corporate expenses and

restructuring charges and asset impairments.

Pitney Bowes

Inc. Revenue and EBIT Business Segments June

30, 2009

(Unaudited)

(Dollars in thousands)

Six Months

Ended June 30, % 2009 2008 Change

Revenue

U.S. Mailing $ 1,013,682 $ 1,103,434 (8 %) International

Mailing 455,212 610,418 (25 %) Production Mail 239,566 284,804 (16

%) Software 158,198 201,913 (22 %)

Mailstream Solutions 1,866,658 2,200,569

(15 %) Management Services 530,265 603,089 (12 %)

Mail Services 279,849 260,186 8 % Marketing Services 81,274

98,199 (17 %) Mailstream Services

891,388 961,474 (7 %)

Total

revenue $ 2,758,046 $

3,162,043 (13 %)

EBIT (1)

U.S. Mailing $ 387,878 $ 444,481 (13 %) International

Mailing 58,008 101,397 (43 %) Production Mail 15,480 23,933 (35 %)

Software 7,823 12,795 (39 %) Mailstream

Solutions 469,189 582,606 (19 %)

Management Services 29,777 36,867 (19 %) Mail Services 40,298

34,369 17 % Marketing Services 5,163 5,279

(2 %) Mailstream Services 75,238 76,515

(2 %)

Total EBIT $ 544,427

$ 659,121 (17 %) Unallocated

amounts: Interest, net (104,709 ) (112,904 ) Corporate expense

(82,003 ) (100,507 ) Restructuring charges and asset impairments

- (35,908 )

Income from continuing

operations before income taxes $ 357,715

$ 409,802 (1) Earnings before

interest and taxes (EBIT) excludes general corporate expenses and

restructuring charges and asset impairments.

Pitney Bowes

Inc. Reconciliation of Reported Consolidated Results to

Adjusted Results (Unaudited)

(Dollars in thousands, except per share data) Three Months

Ended June 30, Six Months Ended June 30, 2009 2008 2009 2008

GAAP income from continuing operations after income taxes, as

reported $ 112,160 $ 131,340 $ 213,939 $ 254,275 Restructuring

charges and asset impairments - 12,393 - 22,745 Tax adjustment 869

- 11,988 6,480 MapInfo purchase accounting - -

- 322 Income from continuing

operations after income taxes, as adjusted $ 113,029 $

143,733 $ 225,927 $ 283,822 GAAP

diluted earnings per share from continuing operations, as reported

$ 0.54 $ 0.63 $ 1.03 $ 1.20 Restructuring charges and asset

impairments - 0.06 - 0.11 Tax adjustment 0.00 - 0.06 0.03 MapInfo

purchase accounting - - -

0.00 Diluted earnings per share from continuing

operations, as adjusted $ 0.55 $ 0.69 $ 1.09 $

1.34 GAAP net cash provided by operating

activities, as reported $ 206,916 $ 217,314 $ 483,387 $ 470,449

Capital expenditures (42,414 ) (58,413 ) (90,190 ) (115,346 )

Restructuring payments and discontinued operations 16,409 24,816

49,110 37,509 Reserve account deposits 23,207

25,685 1,532 18,452 Free

cash flow, as adjusted $ 204,118 $ 209,402 $ 443,839

$ 411,064 Note: The sum of the

earnings per share amounts may not equal the totals above due to

rounding.

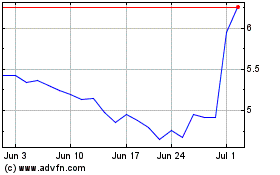

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

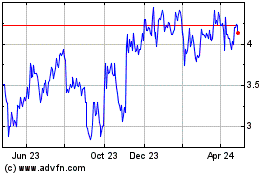

Pitney Bowes (NYSE:PBI)

Historical Stock Chart

From Jul 2023 to Jul 2024