Orchid Island Capital, Inc. (NYSE:ORC) ("Orchid” or the

"Company"), a real estate investment trust ("REIT"), today

announced results of operations for the three month period ended

June 30, 2022.

Second Quarter 2022 Highlights

- Net loss of $60.1 million, or $0.34 per common share, which

consists of:

- Net interest income of $27.1 million, or $0.15 per common

share

- Total expenses of $4.9 million, or $0.03 per common share

- Net realized and unrealized losses of $82.3 million, or $0.46

per common share, on RMBS and derivative instruments, including net

interest expense on interest rate swaps

- Second quarter total dividends declared and paid of $0.135 per

common share

- Book value per common share of $2.87 at June 30, 2022

- Total return of (10.0)%, comprised of $0.135 dividend per

common share and $0.47 decrease in book value per common share,

divided by beginning book value per common share

- Company to discuss results on Friday, August 5, 2022, at 10:00

AM ET

- Supplemental materials to be discussed on the call can be

downloaded from the investor relations section of the Company’s

website at https://ir.orchidislandcapital.com

Management Commentary

Commenting on the second quarter results, Robert E. Cauley,

Chairman and Chief Executive Officer, said, “During the latter part

of the second quarter of 2022 inflation data drove a material

change in Federal Reserve (“Fed”) policy, interest rates and the

outlook for the economy. Specifically, the consumer price index

(“CPI”) data for May, released in June, increased far more than

market expectations. Survey measures of inflation expectations,

released on the same day, surged to multi-decade highs. The June

CPI reading was released in July and was again well above market

expectations. Equally troubling, elevated inflation readings were

very broad based, implying inflationary pressures have clearly

spread from just those sectors most exposed to COVID-19 related

supply constraints. This was the catalyst for the Fed to pivot even

more forcefully than they did during late 2021/early 2022, and the

Fed raised the Fed Funds rate by 200 basis points collectively at

the May, June and July meetings. The market expects the Fed to

continuing raising the Fed Funds rate by another 100 basis points

by year-end. Increases in the Fed Funds rate are likely to affect

economic activity, and the Fed has acknowledged their actions may

lead to a recession. Sectors of the economy most sensitive to

interest rates – such as housing – have already started to slow and

other economic indicators have shown evidence of slowing as well.

The manufacturing sector of the economy has clearly begun to slow,

and the labor market also has been impacted, as evidenced by

initial claims for unemployment in July of 2022 rising by

approximately 94,000 above the cycle low reading reported in early

March of 2022.

“The Fed pivot that occurred in mid-June led to meaningful

widening for Agency RMBS spreads in the days that followed the

release of the inflation data and were near the extremes seen in

March of 2020. This was particularly true for lower coupon fixed

rate Agency RMBS where Orchid’s portfolio is concentrated. The poor

performance of Agency RMBS and risk assets generally led to

negative returns across the markets and to book value erosion for

Orchid. However, while we have recorded significant mark-to-market

losses on our portfolio during the second quarter of 2022 and over

the last three quarters, most of these losses are unrealized and

approximately 81.1% of the pass-through portfolio as of June 30,

2022, was acquired prior to the start of the fourth quarter of

2021.

“It appears the inflation data is sufficiently strong that the

Fed sees the need for a more aggressive response, and the market

expects the Fed to continue to raise the Fed Funds rate and tighten

financial conditions until inflation appears to moderate

sufficiently. The chances such tightening of financial conditions

does not cause the economy to contract appear remote and, as stated

above, we have already seen evidence this has begun to occur. This

appears to be the market’s view as well, as evidenced by the

inversion of the U.S. Treasury yield curve. It is possible we have

already seen the highest levels in long-term U.S. Treasury yields

for this cycle.

“If, as we expect, the economy slows over the next several

quarters, the lack of any credit risk in the Agency RMBS market

should lead to relative outperformance for the sector given the

very wide spreads available currently. Further, Orchid’s existing

portfolio of discount securities retains very favorable convexity,

particularly in a decreasing rate environment as the duration, or

rate sensitivity, of the securities should not decline materially

if rates were to decrease. We believe these two factors leave

Orchid well positioned as we move into the second half of 2022 and

beyond. In fact, Agency RMBS have performed very well so far in the

third quarter and have reversed most of the widening that occurred

in June of 2022.”

Details of Second Quarter 2022 Results of Operations

The Company reported net loss of $60.1 million for the three

month period ended June 30, 2022, compared with net loss of $16.9

million for the three month period ended June 30, 2021. The Company

decreased its Agency RMBS portfolio over the course of the first

six months of 2022, from $6.5 billion at December 31, 2021 to $3.9

billion at June 30, 2022. Interest income on the portfolio in the

second quarter was down approximately $6.6 million from the first

quarter of 2022. The yield on our average MBS increased from 3.02%

in the first quarter of 2022 to 3.31% for the second of 2022,

repurchase agreement borrowing costs increased from 0.20% for the

first quarter of 2022 to 0.80% for the second quarter of 2022, and

our net interest spread decreased from 2.82% in the first quarter

of 2022 to 2.51% in the second quarter of 2022.

Book value decreased by $0.47 per share in the second quarter of

2022. The decrease in book value reflects our net loss of $0.34 per

share and the dividend distribution of $0.135 per share. The

Company recorded net realized and unrealized losses of $0.46 per

share on Agency RMBS assets and derivative instruments, including

net interest expense on interest rate swaps.

Prepayments

For the quarter ended June 30, 2022, Orchid received $122.4

million in scheduled and unscheduled principal repayments and

prepayments, which equated to a 3-month constant prepayment rate

(“CPR”) of approximately 9.4%. Prepayment rates on the two RMBS

sub-portfolios were as follows (in CPR):

Structured

PT RMBS

RMBS

Total

Three Months Ended

Portfolio (%)

Portfolio (%)

Portfolio (%)

June 30, 2022

8.3

13.7

9.4

March 31, 2022

8.1

19.5

10.7

December 31, 2021

9.0

24.6

11.4

September 30, 2021

9.8

25.1

12.4

June 30, 2021

10.9

29.9

12.9

March 31, 2021

9.9

40.3

12.0

Portfolio

The following tables summarize certain characteristics of

Orchid’s PT RMBS (as defined below) and structured RMBS as of June

30, 2022 and December 31, 2021:

($ in thousands)

Weighted

Percentage

Average

of

Weighted

Maturity

Fair

Entire

Average

in

Longest

Asset Category

Value

Portfolio

Coupon

Months

Maturity

June 30, 2022

Fixed Rate RMBS

$

3,766,151

95.6

%

3.10

%

342

1-Jun-52

Interest-Only Securities

173,754

4.4

%

3.41

%

249

25-Jan-52

Inverse Interest-Only Securities

955

0.0

%

3.02

%

293

15-Jun-42

Total Mortgage Assets

$

3,940,860

100.0

%

3.16

%

322

1-Jun-52

December 31, 2021

Fixed Rate RMBS

$

6,298,189

96.7

%

2.93

%

342

1-Dec-51

Interest-Only Securities

210,382

3.2

%

3.40

%

263

25-Jan-52

Inverse Interest-Only Securities

2,524

0.1

%

3.75

%

300

15-Jun-42

Total Mortgage Assets

$

6,511,095

100.0

%

3.03

%

325

25-Jan-52

($ in thousands)

June 30, 2022

December 31, 2021

Percentage of

Percentage of

Agency

Fair Value

Entire Portfolio

Fair Value

Entire Portfolio

Fannie Mae

$

2,591,682

65.8

%

$

4,719,349

72.5

%

Freddie Mac

1,349,178

34.2

%

1,791,746

27.5

%

Total Portfolio

$

3,940,860

100.0

%

$

6,511,095

100.0

%

June 30, 2022

December 31, 2021

Weighted Average Pass-through Purchase

Price

$

107.77

$

107.19

Weighted Average Structured Purchase

Price

$

15.35

$

15.21

Weighted Average Pass-through Current

Price

$

94.61

$

105.31

Weighted Average Structured Current

Price

$

16.21

$

14.08

Effective Duration (1)

5.900

3.390

(1)

Effective duration of 5.900 indicates that an interest rate

increase of 1.0% would be expected to cause a 5.900% decrease in

the value of the RMBS in the Company’s investment portfolio at June

30, 2022. An effective duration of 3.390 indicates that an interest

rate increase of 1.0% would be expected to cause a 3.390% decrease

in the value of the RMBS in the Company’s investment portfolio at

December 31, 2021. These figures include the structured securities

in the portfolio, but do not include the effect of the Company’s

funding cost hedges. Effective duration quotes for individual

investments are obtained from The Yield Book, Inc.

Financing, Leverage and Liquidity

As of June 30, 2022, the Company had outstanding repurchase

obligations of approximately $3,759.0 million with a net weighted

average borrowing rate of 1.36%. These agreements were

collateralized by RMBS with a fair value, including accrued

interest, of approximately $3,939.4 million and cash pledged to

counterparties of approximately $51.1 million. The Company’s

leverage ratio at June 30, 2022 was 7.8 to 1. At June 30, 2022, the

Company’s liquidity was approximately $233.7 million, consisting of

cash and cash equivalents and unpledged RMBS (not including

unsettled securities purchases). To enhance our liquidity even

further, we may pledge more of our structured RMBS as part of a

repurchase agreement funding, but retain the cash in lieu of

acquiring additional assets. In this way we can, at a modest cost,

retain higher levels of cash on hand and decrease the likelihood we

will have to sell assets in a distressed market in order to raise

cash. Below is a list of our outstanding borrowings under

repurchase obligations at June 30, 2022.

($ in thousands)

Weighted

Weighted

Total

Average

Average

Outstanding

% of

Borrowing

Amount

Maturity

Counterparty

Balances

Total

Rate

at Risk(1)

in Days

J.P. Morgan Securities LLC

$

355,463

9.4

%

1.44

%

$

23,431

40

ABN AMRO Bank N.V.

332,722

8.9

%

0.97

%

12,527

12

Mitsubishi UFJ Securities (USA), Inc.

330,133

8.8

%

1.69

%

35,065

34

Merrill Lynch, Pierce, Fenner & Smith

Inc.

320,104

8.5

%

1.15

%

15,687

16

Mirae Asset Securities (USA) Inc.

291,534

7.8

%

1.16

%

14,802

65

Cantor Fitzgerald & Co.

246,670

6.6

%

1.50

%

15,636

28

RBC Capital Markets, LLC

228,511

6.1

%

1.23

%

9,416

26

ING Financial Markets LLC

196,520

5.2

%

1.64

%

10,070

28

ASL Capital Markets Inc.

179,465

4.8

%

1.57

%

11,301

18

Santander Bank, N.A.

173,115

4.6

%

1.34

%

10,128

27

Goldman Sachs & Co. LLC

158,182

4.2

%

1.62

%

10,858

25

ED&F Man Capital Markets Inc.

150,941

4.0

%

1.02

%

7,416

20

Daiwa Capital Markets America, Inc.

144,585

3.8

%

1.58

%

7,031

18

Wells Fargo Bank, N.A.

123,434

3.3

%

1.10

%

7,373

14

Citigroup Global Markets, Inc.

115,434

3.1

%

1.37

%

7,055

21

BMO Capital Markets Corp.

115,236

3.1

%

1.20

%

8,471

18

Nomura Securities International, Inc.

86,155

2.3

%

1.61

%

5,958

22

Austin Atlantic Asset Management Co.

83,356

2.2

%

1.62

%

5,124

6

South Street Securities, LLC

60,322

1.6

%

1.17

%

3,595

18

Lucid Cash Fund USG LLC

24,157

0.6

%

1.27

%

1,420

14

StoneX Financial Inc.

23,337

0.6

%

1.62

%

1,454

28

Lucid Prime Fund LLC

19,604

0.5

%

1.52

%

3,790

14

Total / Weighted Average

$

3,758,980

100.0

%

1.36

%

$

227,608

27

(1)

Equal to the sum of the fair value of securities sold, accrued

interest receivable and cash posted as collateral (if any), minus

the sum of repurchase agreement liabilities, accrued interest

payable and the fair value of securities posted by the

counterparties (if any).

Hedging

In connection with its interest rate risk management strategy,

the Company economically hedges a portion of the cost of its

repurchase agreement funding against a rise in interest rates by

entering into derivative financial instrument contracts. The

Company has not elected hedging treatment under U.S. generally

accepted accounting principles (“GAAP”) in order to align the

accounting treatment of its derivative instruments with the

treatment of its portfolio assets under the fair value option

election. As such, all gains or losses on these instruments are

reflected in earnings for all periods presented. At June 30, 2022,

such instruments were comprised of Treasury note (“T-Note”) futures

contracts, interest rate swap agreements, interest rate swaption

agreements, interest rate caps and contracts to buy and sell TBA

securities.

The table below presents information related to the Company’s

T-Note futures contracts at June 30, 2022.

($ in thousands)

Average

Weighted

Weighted

Contract

Average

Average

Notional

Entry

Effective

Open

Expiration Year

Amount

Rate

Rate

Equity(1)

Treasury Note Futures Contracts (Short

Positions)(2)

September 2022 5-year T-Note futures

(Sep 2022 - Sep 2027 Hedge Period)

$

1,200,500

3.13

%

3.32

%

4,138

September 2022 10-year Ultra futures

(Sep 2022 - Sep 2032 Hedge Period)

$

274,500

2.64

%

2.84

%

$

2,442

(1)

Open equity represents the cumulative gains (losses) recorded on

open futures positions from inception.

(2)

5-Year T-Note futures contracts were valued at a price of

$112.25 at June 30, 2022. The contract values of the short

positions were $1,347.6 million at June 30, 2022. 10-Year Ultra

futures contracts were valued at a price of $127.38 at June 30,

2022. The contract value of the short position was $349.6 million

at June 30, 2022.

The table below presents information related to the Company’s

interest rate swap positions at June 30, 2022.

($ in thousands)

Average

Net

Fixed

Average

Estimated

Average

Notional

Pay

Receive

Fair

Maturity

Expiration

Amount

Rate

Rate

Value

(Years)

> 3 to ≤ 5 years

$

500,000

0.84

%

1.95

%

43,221

4.2

> 5 years

900,000

1.70

%

1.32

%

60,917

7.1

$

1,400,000

1.39

%

1.54

%

$

104,138

6.1

The following table presents information related to our interest

rate swaption positions as of June 30, 2022.

($ in thousands)

Option

Underlying Swap

Weighted

Average

Weighted

Average

Average

Adjustable

Average

Fair

Months to

Notional

Fixed

Rate

Term

Expiration

Cost

Value

Expiration

Amount

Rate

(LIBOR)

(Years)

Payer Swaptions - long

≤ 1 year

$

31,905

$

65,684

8.3

$

1,282,400

2.44

%

3 Month

11.3

>1 year ≤ 2 years

24,050

23,168

15.8

728,400

3.00

%

3 Month

10.0

$

55,955

$

88,852

11.0

$

2,010,800

2.65

%

3 Month

10.8

Payer Swaptions - short

≤ 1 year

$

(22,250

)

$

(43,296

)

2.8

$

(1,433,000

)

2.65

%

3 Month

10.8

The following table presents information related to our interest

cap positions as of June 30, 2022.

($ in thousands)

Net

Strike

Estimated

Notional

Swap

Curve

Fair

Expiration

Amount

Cost

Rate

Spread

Value

February 8, 2024

$

200,000

$

2,350

0.09

%

10Y2Y

$

3,837

The following table summarizes our contracts to purchase and

sell TBA securities as of June 30, 2022.

($ in thousands)

Notional

Net

Amount

Cost

Market

Carrying

Long (Short)(1)

Basis(2)

Value(3)

Value(4)

June 30, 2022

30-Year TBA securities:

2.0%

$

(175,000

)

$

(153,907

)

$

(152,250

)

$

1,657

15-Year TBA securities:

3.5%

175,000

174,434

174,139

(295

)

$

-

$

20,527

$

21,889

$

1,362

(1)

Notional amount represents the

par value (or principal balance) of the underlying Agency RMBS.

(2)

Cost basis represents the forward

price to be paid (received) for the underlying Agency RMBS.

(3)

Market value represents the

current market value of the TBA securities (or of the underlying

Agency RMBS) as of period-end.

(4)

Net carrying value represents the

difference between the market value and the cost basis of the TBA

securities as of period-end and is reported in derivative assets

(liabilities) at fair value in our balance sheets.

Dividends

In addition to other requirements that must be satisfied to

qualify as a REIT, we must pay annual dividends to our stockholders

of at least 90% of our REIT taxable income, determined without

regard to the deduction for dividends paid and excluding any net

capital gains. We intend to pay regular monthly dividends to our

stockholders and have declared the following dividends since our

February 2013 IPO.

(in thousands, except per share data)

Year

Per Share Amount

Total

2013

$

1.395

$

4,662

2014

2.160

22,643

2015

1.920

38,748

2016

1.680

41,388

2017

1.680

70,717

2018

1.070

55,814

2019

0.960

54,421

2020

0.790

53,570

2021

0.780

97,601

2022 - YTD(1)

0.335

59,383

Totals

$

12.770

$

498,947

(1)

On July 13, 2022, the Company declared a dividend of $0.045 per

share to be paid on August 29, 2022. The effect of this dividend is

included in the table above but is not reflected in the Company’s

financial statements as of June 30, 2022.

Book Value Per Share

The Company's book value per share at June 30, 2022 was $2.87.

The Company computes book value per share by dividing total

stockholders' equity by the total number of shares outstanding of

the Company's common stock. At June 30, 2022, the Company's

stockholders' equity was $506.4 million with 176,251,193 shares of

common stock outstanding.

Capital Allocation and Return on Invested Capital

The table below details the changes to the respective

sub-portfolios during the quarter.

(in thousands)

Portfolio Activity for the

Quarter

Structured Security

Portfolio

Pass-Through

Interest-Only

Inverse Interest

Portfolio

Securities

Only Securities

Sub-total

Total

Market value - March 31, 2022

$

4,372,517

$

206,617

$

1,460

$

208,077

$

4,580,594

Securities purchased

190,638

-

-

-

190,638

Securities sold

(486,927

)

(34,638

)

-

(34,638

)

(521,565

)

(Losses) Gains on sales

(17,440

)

1,997

-

1,997

(15,443

)

Return of investment

n/a

(6,304

)

(42

)

(6,346

)

(6,346

)

Pay-downs

(116,595

)

n/a

-

n/a

(116,595

)

Discount accretion due to pay-downs

726

n/a

-

n/a

726

Mark to market (losses) gains

(176,768

)

6,082

(463

)

5,619

(171,149

)

Market value - June 30, 2022

$

3,766,151

$

173,754

$

955

$

174,709

$

3,940,860

The Company allocates capital to two RMBS sub-portfolios, the

pass-through RMBS portfolio, consisting of mortgage pass-through

certificates issued by Fannie Mae, Freddie Mac or Ginnie Mae (the

“GSEs”) and collateralized mortgage obligations (“CMOs”) issued by

the GSEs (“PT RMBS”), and the structured RMBS portfolio, consisting

of interest-only (“IO”) and inverse interest-only (“IIO”)

securities. As of March 31, 2022, approximately 62% of the

Company’s investable capital (which consists of equity in pledged

PT RMBS, available cash and unencumbered assets) was deployed in

the PT RMBS portfolio. At June 30, 2022, the allocation to the PT

RMBS portfolio remained approximately 62%.

The tables below present the allocation of capital between the

respective portfolios at June 30, 2022 and March 31, 2022, and the

return on invested capital for each sub-portfolio for the three

month period ended June 30, 2022.

($ in thousands)

Capital Allocation

Structured Security

Portfolio

Pass-Through

Interest-Only

Inverse Interest

Portfolio

Securities

Only Securities

Sub-total

Total

June 30, 2022

Market value

$

3,766,151

$

173,754

$

955

$

174,709

$

3,940,860

Cash

283,371

-

-

-

283,371

Borrowings(1)

(3,758,980

)

-

-

-

(3,758,980

)

Total

$

290,542

$

173,754

$

955

$

174,709

$

465,251

% of Total

62.4

%

37.3

%

0.2

%

37.6

%

100.0

%

March 31, 2022

Market value

$

4,372,517

$

206,617

$

1,460

$

208,077

$

4,580,594

Cash

427,445

-

-

-

427,445

Borrowings(2)

(4,464,109

)

-

-

-

(4,464,109

)

Total

$

335,853

$

206,617

$

1,460

$

208,077

$

543,930

% of Total

61.7

%

38.0

%

0.3

%

38.3

%

100.0

%

(1)

At June 30, 2022, there were outstanding repurchase agreement

balances of $144.9 million secured by IO securities and $0.8

million secured by IIO securities. We entered into these

arrangements to generate additional cash available to meet margin

calls on PT RMBS; therefore, we have not considered these balances

to be allocated to the structured securities strategy.

(2)

At March 31, 2022, there were outstanding repurchase agreement

balances of $157.1 million secured by IO securities and $1.4

million secured by IIO securities. We entered into these

arrangements to generate additional cash available to meet margin

calls on PT RMBS; therefore, we have not considered these balances

to be allocated to the structured securities strategy.

The return on invested capital in the PT RMBS and structured

RMBS portfolios was approximately (19.7)% and 5.3%, respectively,

for the second quarter of 2022. The combined portfolio generated a

return on invested capital of approximately (10.1)%.

($ in thousands)

Returns for the Quarter Ended

June 30, 2022

Structured Security

Portfolio

Pass-Through

Interest-Only

Inverse Interest

Portfolio

Securities

Only Securities

Sub-total

Total

Income (net of borrowing cost)

$

23,714

$

3,107

$

267

$

3,374

$

27,088

Realized and unrealized (losses) /

gains

(193,657

)

8,079

(463

)

7,616

(186,041

)

Derivative gains

103,758

n/a

n/a

n/a

103,758

Total Return

$

(66,185

)

$

11,186

$

(196

)

$

10,990

$

(55,195

)

Beginning Capital Allocation

$

335,853

$

206,617

$

1,460

$

208,077

$

543,930

Return on Invested Capital for the

Quarter(1)

(19.7

)%

5.4

%

(13.4

)%

5.3

%

(10.1

)%

Average Capital Allocation(2)

$

313,198

$

190,186

$

1,208

$

191,394

$

504,592

Return on Average Invested Capital for the

Quarter(3)

(21.1

)%

5.9

%

(16.2

)%

5.7

%

(10.9

)%

(1)

Calculated by dividing the Total Return by the Beginning Capital

Allocation, expressed as a percentage.

(2)

Calculated using two data points, the Beginning and Ending

Capital Allocation balances.

(3)

Calculated by dividing the Total Return by the Average Capital

Allocation, expressed as a percentage.

Stock Offerings

On October 29, 2021, we entered into an equity distribution

agreement (the “October 2021 Equity Distribution Agreement”) with

four sales agents pursuant to which we may offer and sell, from

time to time, up to an aggregate amount of $250,000,000 of shares

of our common stock in transactions that are deemed to be “at the

market” offerings and privately negotiated transactions. Through

June 30, 2022, we issued a total of 15,835,700 shares under the

October 2021 Equity Distribution Agreement for aggregate gross

proceeds of approximately $78.3 million, and net proceeds of

approximately $77.0 million, after commissions and fees. We did not

issue any shares under the October 2021 Equity Distribution

Agreement during the six months ended June 30, 2022.

Stock Repurchase Program

On July 29, 2015, the Company’s Board of Directors authorized

the repurchase of up to 2,000,000 shares of our common stock. The

timing, manner, price and amount of any repurchases is determined

by the Company in its discretion and is subject to economic and

market conditions, stock price, applicable legal requirements and

other factors. The authorization does not obligate the Company to

acquire any particular amount of common stock and the program may

be suspended or discontinued at the Company’s discretion without

prior notice. On February 8, 2018, the Board of Directors approved

an increase in the stock repurchase program for up to an additional

4,522,822 shares of the Company’s common stock. Coupled with the

783,757 shares remaining from the original 2,000,000 share

authorization, the increased authorization brought the total

authorization to 5,306,579 shares, representing 10% of the

Company’s then outstanding share count. On December 9, 2021, the

Board of Directors approved an increase in the number of shares of

the Company’s common stock available in the stock repurchase

program for up to an additional 16,861,994 shares, bringing the

remaining authorization under the stock repurchase program to

17,699,305 shares, representing approximately 10% of the Company’s

then outstanding shares of common stock. This stock repurchase

program has no termination date.

From the inception of the stock repurchase program through June

30, 2022, the Company repurchased a total of 6,561,810 shares at an

aggregate cost of approximately $42.6 million, including

commissions and fees, for a weighted average price of $6.49 per

share. During the three months ended June 30, 2022, the Company

repurchased a total of 876,299 shares at an aggregate cost of

approximately $2.2 million, including commissions and fees, for a

weighted average price of $2.53 per share.

Earnings Conference Call Details

An earnings conference call and live audio webcast will be

hosted Friday, August 5, 2022, at 10:00 AM ET. The conference call

may be accessed by dialing toll free (888) 510-2356. The conference

passcode is 8493186. The supplemental materials may be downloaded

from the investor relations section of the Company’s website at

https://ir.orchidislandcapital.com. A live audio webcast of the

conference call can be accessed via the investor relations section

of the Company’s website at https://ir.orchidislandcapital.com, and

an audio archive of the webcast will be available until September

4, 2022.

About Orchid Island Capital, Inc.

Orchid Island Capital, Inc. is a specialty finance company that

invests on a leveraged basis in Agency RMBS. Our investment

strategy focuses on, and our portfolio consists of, two categories

of Agency RMBS: (i) traditional pass-through Agency RMBS, such as

mortgage pass-through certificates, and CMOs issued by the GSEs,

and (ii) structured Agency RMBS, such as IOs, IIOs and principal

only securities, among other types of structured Agency RMBS.

Orchid is managed by Bimini Advisors, LLC, a registered investment

adviser with the Securities and Exchange Commission.

Forward Looking Statements

Statements herein relating to matters that are not historical

facts, including, but not limited to statements regarding interest

rates, liquidity, pledging of our structured RMBS, funding levels

and spreads, prepayment speeds, portfolio positioning and

repositioning, hedging levels, dividends, growth, the supply and

demand for Agency RMBS, the effect of actual or expected actions of

the U.S. government, including the Federal Reserve, market

expectations, future opportunities and prospects of the Company,

the stock repurchase program and general economic conditions, are

forward-looking statements as defined in the Private Securities

Litigation Reform Act of 1995. The reader is cautioned that such

forward-looking statements are based on information available at

the time and on management's good faith belief with respect to

future events, and are subject to risks and uncertainties that

could cause actual performance or results to differ materially from

those expressed in such forward-looking statements. Important

factors that could cause such differences are described in Orchid

Island Capital, Inc.'s filings with the Securities and Exchange

Commission, including its most recent Annual Report on Form 10-K

and Quarterly Reports on Form 10-Q. Orchid Island Capital, Inc.

assumes no obligation to update forward-looking statements to

reflect subsequent results, changes in assumptions or changes in

other factors affecting forward-looking statements.

Summarized Financial Statements

The following is a summarized presentation of the unaudited

balance sheets as of June 30, 2022, and December 31, 2021, and the

unaudited quarterly statements of operations for the six and three

months ended June 30, 2022 and 2021. Amounts presented are subject

to change.

ORCHID ISLAND CAPITAL,

INC.

BALANCE SHEETS

($ in thousands, except per

share data)

(Unaudited - Amounts Subject

to Change)

June 30, 2022

December 31, 2021

ASSETS:

Mortgage-backed securities

$

3,940,860

$

6,511,095

U.S. Treasury Notes

36,302

37,175

Cash, cash equivalents and restricted

cash

283,371

450,442

Accrued interest receivable

13,932

18,859

Derivative assets, at fair value

198,484

50,786

Other assets

1,420

320

Total Assets

$

4,474,369

$

7,068,677

LIABILITIES AND STOCKHOLDERS'

EQUITY

Repurchase agreements

$

3,758,980

$

6,244,106

Dividends payable

7,960

11,530

Derivative liabilities, at fair value

43,591

7,589

Accrued interest payable

3,940

788

Due to affiliates

1,138

1,062

Other liabilities

152,398

35,505

Total Liabilities

3,968,007

6,300,580

Total Stockholders' Equity

506,362

768,097

Total Liabilities and Stockholders'

Equity

$

4,474,369

$

7,068,677

Common shares outstanding

176,251,193

176,993,049

Book value per share

$

2.87

$

4.34

ORCHID ISLAND CAPITAL,

INC.

STATEMENTS OF

OPERATIONS

($ in thousands, except per

share data)

(Unaudited - Amounts Subject

to Change)

Six

Months Ended June 30,

Three

Months Ended June 30,

2022

2021

2022

2021

Interest income

$

77,125

$

56,110

$

35,268

$

29,254

Interest expense

(10,835

)

(3,497

)

(8,180

)

(1,556

)

Net interest income

66,290

52,613

27,088

27,698

Losses on RMBS and derivative

contracts

(265,515

)

(91,635

)

(82,283

)

(40,844

)

Net portfolio loss

(199,225

)

(39,022

)

(55,195

)

(13,146

)

Expenses

9,641

7,212

4,944

3,719

Net loss

$

(208,866

)

$

(46,234

)

$

(60,139

)

$

(16,865

)

Basic net loss per share

$

(1.18

)

$

(0.50

)

$

(0.34

)

$

(0.17

)

Diluted net loss per share

$

(1.18

)

$

(0.50

)

$

(0.34

)

$

(0.17

)

Weighted Average Shares

Outstanding

177,015,963

92,456,082

177,034,159

99,489,065

Dividends Declared Per Common

Share:

$

0.290

$

0.390

$

0.135

$

0.195

Three Months Ended June

30,

Key Balance Sheet Metrics

2022

2021

Average RMBS(1)

$

4,260,727

$

4,504,887

Average repurchase agreements(1)

4,111,544

4,348,192

Average stockholders' equity(1)

549,390

509,999

Leverage ratio(2)

7.8:1

8.2:1

Key Performance Metrics

Average yield on RMBS(3)

3.31

%

2.60

%

Average cost of funds(3)

0.80

%

0.14

%

Average economic cost of funds(4)

0.60

%

0.61

%

Average interest rate spread(5)

2.51

%

2.46

%

Average economic interest rate

spread(6)

2.71

%

1.99

%

(1)

Average RMBS, borrowings and

stockholders’ equity balances are calculated using two data points,

the beginning and ending balances.

(2)

The leverage ratio is calculated

by dividing total ending liabilities by ending stockholders’

equity.

(3)

Portfolio yields and costs of

funds are calculated based on the average balances of the

underlying investment portfolio/borrowings balances and are

annualized for the quarterly periods presented.

(4)

Represents the interest cost of

our borrowings and the effect of derivative agreements attributed

to the period related to hedging activities, divided by average

borrowings.

(5)

Average interest rate spread is

calculated by subtracting average cost of funds from average yield

on RMBS.

(6)

Average economic interest rate

spread is calculated by subtracting average economic cost of funds

from average yield on RMBS.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220804005839/en/

Orchid Island Capital, Inc. Robert E. Cauley, 772-231-1400

Chairman and Chief Executive Officer

https://ir.orchidislandcapital.com

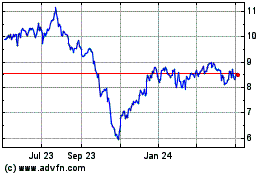

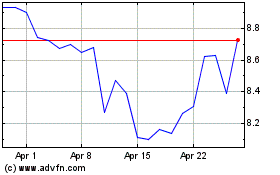

Orchid Island Capital (NYSE:ORC)

Historical Stock Chart

From Aug 2024 to Sep 2024

Orchid Island Capital (NYSE:ORC)

Historical Stock Chart

From Sep 2023 to Sep 2024