0000791963false00007919632022-07-292022-07-29

As filed with the Securities and Exchange Commission on October 27, 2023

___________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 27, 2023

OPPENHEIMER HOLDINGS INC.

(Exact name of registrant as specified in its charter)

Commission File Number 1-12043

| | | | | | | | |

| Delaware | | 98-0080034 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

85 Broad Street

New York, New York 10004

(Address of principal executive offices) (Zip Code)

(212) 668-8000

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CRF 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Class A non-voting common stock | OPY | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

SECTION 2 – FINANCIAL INFORMATION

ITEM 2.02. Results of Operations and Financial Condition.

(a)On October 27, 2023, Oppenheimer Holdings Inc. (the “Company”) issued a press release announcing its third quarter 2023 earnings. A copy of the October 27, 2023 press release is furnished as Exhibit 99.1 to this Report and is incorporated herein by reference.

The information contained in this Item 2.02 and the related exhibit attached hereto shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information or such exhibit be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing. The information set forth in this Item 2.02 or any exhibit related to this Item 2.02 on this Form 8-K shall not be deemed an admission as to the materiality of any information in the referenced items.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

ITEM 9.01. Financial Statements and Exhibits.

(d)Exhibits:

The following exhibit is furnished (not filed) with this Current Report on Form 8-K:

99.1 Oppenheimer Holdings Inc.'s Press Release dated October 27, 2023

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Oppenheimer Holdings Inc.

| | |

Date: October 27, 2023

By: /s/ Brad M. Watkins

---------------------------------

Brad M. Watkins

Chief Financial Officer

(Duly Authorized Officer) |

EXHIBIT INDEX

| | | | | |

| Exhibit Number | Description |

| |

Exhibit 99.1

Oppenheimer Holdings Inc. Reports Third Quarter 2023 Earnings

New York, October 27, 2023 – Oppenheimer Holdings Inc. (NYSE: OPY) (the "Company" or "Firm") today reported net income of $13.9 million or $1.32 basic earnings per share for the third quarter of 2023, an increase of approximately 206.7%, compared with net income of $4.5 million or $0.40 basic earnings per share for the third quarter of 2022. Revenue for the third quarter of 2023 was $312.7 million, an increase of 6.3%, compared to revenue of $294.1 million for the third quarter of 2022.

Albert G. Lowenthal, Chairman and CEO commented, "The profitable results for the quarter reflect improved performance across many of our businesses, owing to higher interest rates and increased market volumes emanating from a still resilient economy. The rate of inflation continued to stabilize, while the labor market remained strong despite higher interest rates and labor unrest. The U.S. economy can perhaps yet achieve a “soft landing”. The stronger economy, however, has led to a market expectation that the Federal Reserve will maintain "higher for longer" interest rates well into 2024 which, in conjunction with continued fighting in Ukraine and the new eruption of unparalleled violence in Israel and Gaza, has resulted in a pullback in most major equity indices.

Our Wealth Management business continued to benefit from recent macroeconomic conditions, with the elevated interest rate environment driving large increases in bank deposit sweep income and margin interest revenue compared to the prior year period. Higher valuations in client portfolios and the addition of new client assets also resulted in meaningful improvements in advisory fees, though these were offset to some extent by the stock market retreat during the quarter and lower transaction-based fees due to subdued client activity. Our Capital Markets business also generated strong results, with higher fixed income sales and trading and somewhat higher equities underwriting revenues offsetting lower M&A advisory fees.

We finished the quarter with a strong balance sheet and ample capital levels that will permit us to continue seeking investment opportunities across our businesses. During the quarter, the Company completed its previously disclosed “Dutch auction” tender offer in which we repurchased 437,183 shares of our Class A non-voting common stock at a price of $40.00 per share. During the quarter, the Company also purchased 168,904 shares (2%) of our Class A non-voting common stock at an average price of $38.30 per share in the open market under our share repurchase program. This resulted in 10,289,233 shares of Class A non-voting common stock remaining outstanding, resulting in book value and tangible book value per share at record levels as of September 30, 2023."

| | | | | | | | |

| Summary Operating Results (Unaudited) |

| ('000s, except per share amounts or otherwise indicated) |

| Firm | 3Q-23 | 3Q-22 |

| Revenue | $ | 312,667 | | $ | 294,111 | |

| Compensation Expense | $ | 195,684 | | $ | 179,134 | |

| Non-compensation Expense | $ | 95,396 | | $ | 107,739 | |

| Pre-Tax Income | $ | 21,587 | | $ | 7,238 | |

| Income Taxes Provision | $ | 7,808 | | $ | 2,573 | |

Net Income (1) | $ | 13,861 | | $ | 4,520 | |

Earnings Per Share (Basic) (1) | $ | 1.32 | | $ | 0.40 | |

Earnings Per Share (Diluted) (1) | $ | 1.21 | | $ | 0.37 | |

| Book Value Per Share | $ | 75.01 | | $ | 70.23 | |

Tangible Book Value Per Share (2) | $ | 58.65 | | $ | 54.74 | |

| | |

| Private Client | | |

| Revenue | $ | 193,254 | | $ | 178,614 | |

| Pre-Tax Income | $ | 65,249 | | $ | 29,973 | |

| Assets Under Administration (billions) | $ | 110.7 | | $ | 100.3 | |

| | |

| Asset Management | | |

| Revenue | $ | 20,830 | | $ | 24,870 | |

| Pre-Tax Income | $ | 4,951 | | $ | 8,322 | |

| Assets Under Management (billions) | $ | 40.4 | | $ | 35.3 | |

| | |

| Capital Markets | | |

| Revenue | $ | 94,576 | | $ | 90,947 | |

| Pre-Tax Income (Loss) | $ | (15,254) | | $ | 2,401 | |

| | |

| (1) Attributable to Oppenheimer Holdings Inc. |

| (2) Represents book value less goodwill and intangible assets divided by number of shares outstanding. |

Highlights

•Increased revenue for the third quarter of 2023 was primarily driven by a rise in interest sensitive income, including margin interest and bank deposit sweep income, as well as higher fixed income sales and trading and equities underwriting revenues

•Assets under administration and under management were both at higher levels at September 30, 2023 when compared with the same period last year, benefiting from market appreciation and positive net asset flows

•Non-compensation expenses decreased from the prior year quarter largely due to lower legal costs partially offset by higher interest expense

•The Company completed its “Dutch Auction” tender offer, resulting in the repurchase of 437,183 shares of the Company's Class A non-voting common stock. The Company also repurchased 168,904 shares of Class A Stock during the third quarter of 2023 under its previously announced share repurchase program, or approximately 2% of shares outstanding at year-end 2022

•Book value and tangible book value per share reached new record highs as a result of positive earnings and share re-purchases

Private Client

Private Client reported revenue for the current quarter of $193.3 million, 8.2% higher when compared with the prior year period. Pre-tax income was $65.2 million, compared with pre-tax income of $30.0 million in the prior year period. Financial advisor headcount at the end of the current quarter was 946 compared to 985 at the end of the third quarter of 2022.

Revenue:

•Retail commissions were reduced compared with the prior year quarter due to continued subdued retail trading activity

•Advisory fees increased 6.0% from a year ago primarily due to higher AUM during the billing period for the current quarter when compared to the third quarter of last year

•Bank deposit sweep income increased $6.5 million or 18.3% from a year ago due to higher short-term interest rates partially offset by lower cash sweep balances

•Interest revenue increased 46.8% from a year ago due to higher short-term interest rates

•Other revenue decreased from a year ago primarily due to lower Company-owned life insurance death benefit proceeds

Total Expenses:

•Compensation expenses increased 5.5% from a year ago primarily due to higher production-related expenses and deferred compensation costs, partially offset by lower share-based compensation expenses

•Non-compensation expenses decreased 41.7% from a year ago primarily due to lower legal costs

| | | | | | | | |

| ('000s, except otherwise indicated) |

| 3Q-23 | 3Q-22 |

| | |

| Revenue | $ | 193,254 | | $ | 178,614 | |

| Commissions | $ | 44,385 | | $ | 46,893 | |

| Advisory Fees | $ | 82,774 | | $ | 78,055 | |

| Bank Deposit Sweep Income | $ | 42,304 | | $ | 35,769 | |

| Interest | $ | 21,248 | | $ | 14,471 | |

| Other | $ | 2,543 | | $ | 3,426 | |

| | |

| Total Expenses | $ | 128,005 | | $ | 148,641 | |

| Compensation | $ | 92,383 | | $ | 87,555 | |

| Non-compensation | $ | 35,622 | | $ | 61,086 | |

| | |

| Pre-Tax Income | $ | 65,249 | | $ | 29,973 | |

| | |

| Compensation Ratio | 47.8 | % | 49.0 | % |

| Non-compensation Ratio | 18.4 | % | 34.2 | % |

| Pre-Tax Margin | 33.8 | % | 16.8 | % |

| | |

| Assets Under Administration (billions) | $ | 110.7 | | $ | 100.3 | |

| Cash Sweep Balances (billions) | $ | 3.5 | | $ | 6.5 | |

Asset Management

Asset Management reported revenue for the current quarter of $20.8 million, 16.2% lower when compared with the prior year period. Pre-tax income was $5.0 million, a decrease of $3.4 million compared with the prior year period.

Revenue:

•Advisory fees increased 1.6% from a year ago due to an increase in management fees resulting from the higher net value of billable AUM during the quarter

•Other revenue decreased $4.4 million from a year ago due to a decrease in fair value of the positions held in private equity funds

Assets under Management (AUM):

▪AUM increased to $40.4 billion at September 30, 2023, which is the basis for advisory fee billings for October 2023

▪The increase in AUM was comprised of higher asset values of $4.4 billion on existing client holdings and a net contribution of $0.7 billion in new assets

Total Expenses:

•Compensation expenses were down 16.7% from a year ago which was due to decreases in incentive compensation

•Non-compensation expenses were up 4.6% when compared to the prior year period mostly due to higher external portfolio management costs which are directly related to the increase in billable AUM

| | | | | | | | |

| ('000s, except otherwise indicated) |

| 3Q-23 | 3Q-22 |

| | |

| Revenue | $ | 20,830 | | $ | 24,870 | |

| Advisory Fees | $ | 25,188 | | $ | 24,787 | |

| Other | $ | (4,358) | | $ | 83 | |

| | |

| Total Expenses | $ | 15,879 | | $ | 16,548 | |

| Compensation | $ | 5,585 | | $ | 6,702 | |

| Non-compensation | $ | 10,294 | | $ | 9,846 | |

| | |

| Pre-Tax Income | $ | 4,951 | | $ | 8,322 | |

| | |

| Compensation Ratio | 26.8 | % | 26.9 | % |

| Non-compensation Ratio | 49.4 | % | 39.6 | % |

| Pre-Tax Margin | 23.8 | % | 33.5 | % |

| | |

| AUM (billions) | $ | 40.4 | | $ | 35.3 | |

Capital Markets reported revenue for the current quarter of $94.6 million, 4.0% higher when compared with the prior year period. Pre-tax loss was $15.3 million, compared with pre-tax income of $2.4 million in the prior year period.

Revenue:

Investment Banking

•Advisory fees earned from investment banking activities decreased 38.5% compared with a year ago due to fewer M&A transactions

•Equities underwriting fees increased 201.2% when compared with a year ago due to higher new issuance volumes and deal sizes

•Fixed income underwriting fees were relatively flat with the prior year

Sales and Trading

•Equities sales and trading revenue decreased 11.2% compared with a year ago due to reduced volumes as a result of lower market volatility

•Fixed income sales and trading revenue increased by 48.9% compared with a year ago primarily due to an increase in trading income attributable to higher volatility and higher volumes

Total Expenses:

•Compensation expenses increased 20.7% compared with a year ago primarily due to costs associated with opportunistic hiring and increased incentive compensation

•Non-compensation expenses were 31.2% higher than a year ago primarily due to an increase in interest expense in financing trading inventories

| | | | | | | | |

| ('000s) | | |

| 3Q-23 | 3Q-22 |

| | |

| Revenue | $ | 94,576 | | $ | 90,947 | |

| | |

| Investment Banking | $ | 36,000 | | $ | 36,951 | |

| Advisory Fees | $ | 18,001 | | $ | 29,270 | |

| Equities Underwriting | $ | 15,246 | | $ | 5,061 | |

| Fixed Income Underwriting | $ | 2,049 | | $ | 2,111 | |

| Other | $ | 704 | | $ | 509 | |

| | |

| Sales and Trading | $ | 58,102 | | $ | 53,093 | |

| Equities | $ | 30,985 | | $ | 34,877 | |

| Fixed Income | $ | 27,117 | | $ | 18,216 | |

| | |

| Other | $ | 474 | | $ | 903 | |

| | |

| Total Expenses | $ | 109,830 | | $ | 88,546 | |

| Compensation | $ | 72,933 | | $ | 60,415 | |

| Non-compensation | $ | 36,897 | | $ | 28,131 | |

| | |

| Pre-Tax Income (Loss) | $ | (15,254) | | $ | 2,401 | |

| | |

| Compensation Ratio | 77.1 | % | 66.4 | % |

| Non-compensation Ratio | 39.0 | % | 30.9 | % |

| Pre-Tax Margin | (16.1) | % | 2.6 | % |

Other Matters

•The Board of Directors announced a quarterly dividend in the amount of $0.15 per share payable on November 24, 2023 to holders of Class A non-voting and Class B voting common stock of record on November 10, 2023

•Compensation expense as a percentage of revenue was higher at 62.6% during the current period versus 60.9% during the same period last year due to opportunistic hiring and the impact of inflation on salary levels during the year

•The effective tax rate for the current period was 36.2% compared with 35.5% for the prior year period and was impacted by permanent items and non-deductible losses in non-U.S. businesses

| | | | | | | | |

| (In millions, except number of shares and per share amounts) |

| 3Q-23 | 3Q-22 |

| Capital | | |

Stockholders' Equity (1) | $ | 779.3 | | $ | 770.7 | |

Regulatory Net Capital (2) | $ | 437.1 | | $ | 425.8 | |

Regulatory Excess Net Capital (2) | $ | 415.4 | | $ | 399.4 | |

| | |

| Common Stock Repurchases |

| Share Repurchase Program |

| Repurchases | $ | 6.5 | | $ | 14.0 | |

| Number of Shares | 168,904 | | 413,052 | |

| Average Price Per Share | $ | 38.30 | | $ | 33.86 | |

| | |

| "Dutch Auction" Tender Offer |

| Repurchases | $ | 17.5 | | $ | — | |

| Number of Shares | 437,183 | | — | |

| Average Price Per Share | $ | 40.00 | | $ | — | |

| | |

| Period End Shares | 10,388,898 | 10,974,655 |

| Effective Tax Rate | 36.2 | % | 35.5 | % |

| | |

(1) Attributable to Oppenheimer Holdings Inc. |

(2) Attributable to Oppenheimer & Co. Inc. broker-dealer |

Company Information

Oppenheimer Holdings Inc., through its operating subsidiaries, is a leading middle market investment bank and full service broker-dealer that is engaged in a broad range of activities in the financial services industry, including retail securities brokerage, institutional sales and trading, investment banking (corporate and public finance), equity and fixed income research, market-making, trust services, and investment advisory and asset management services. With roots tracing back to 1881, the Company is headquartered in New York and has 92 retail branch offices in the United States and institutional businesses located in London, Tel Aviv, and Hong Kong.

Forward-Looking Statements

This press release includes certain "forward-looking statements" relating to anticipated future performance. For a discussion of the factors that could cause future performance to be different than anticipated, reference is made to Factors Affecting "Forward-Looking Statements" and Part 1A – Risk Factors in the Company's Annual Report on Form 10-K for the year ended December 31, 2022 and Factors Affecting "Forward-Looking Statements" in Part I, Item 2 in the Company’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Oppenheimer Holdings Inc. |

| Condensed Consolidated Income Statements (Unaudited) |

| ('000s, except number of shares and per share amounts) | | | | | | | | | | |

| | | | | | | | |

| | For the Three Months Ended September 30, | | For the Nine Months Ended September 30, |

| | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| REVENUE | | | | | | | | | | | |

| Commissions | $ | 83,933 | | | $ | 89,608 | | | (6.3) | | $ | 259,174 | | | $ | 282,307 | | | (8.2) |

| Advisory fees | 107,969 | | | 102,927 | | | 4.9 | | 310,214 | | | 326,098 | | | (4.9) |

| Investment banking | 37,411 | | | 38,393 | | | (2.6) | | 95,354 | | | 93,516 | | | 2.0 |

| Bank deposit sweep income | 42,304 | | | 35,769 | | | 18.3 | | 135,273 | | | 54,968 | | | 146.1 |

| Interest | 26,430 | | | 17,361 | | | 52.2 | | 78,691 | | | 38,667 | | | 103.5 |

| Principal transactions, net | 16,892 | | | 6,502 | | | 159.8 | | 46,635 | | | 10,124 | | | 360.6 |

| Other | (2,272) | | | 3,551 | | | * | | 15,195 | | | (8,319) | | | * |

| Total revenue | 312,667 | | | 294,111 | | | 6.3 | | 940,536 | | | 797,361 | | | 18.0 |

| EXPENSES | | | | | | | | | | | |

| Compensation and related expenses | 195,684 | | | 179,134 | | | 9.2 | | 589,200 | | | 543,144 | | | 8.5 |

| Communications and technology | 22,590 | | | 21,500 | | | 5.1 | | 67,813 | | | 63,981 | | | 6.0 |

| Occupancy and equipment costs | 17,281 | | | 15,457 | | | 11.8 | | 49,622 | | | 44,701 | | | 11.0 |

| Clearing and exchange fees | 6,051 | | | 6,705 | | | (9.8) | | 18,241 | | | 18,923 | | | (3.6) |

| Interest | 19,744 | | | 7,018 | | | 181.3 | | 50,353 | | | 13,158 | | | 282.7 |

| Other | 29,730 | | | 57,059 | | | (47.9) | | 136,369 | | | 98,172 | | | 38.9 |

| Total expenses | 291,080 | | | 286,873 | | | 1.5 | | 911,598 | | | 782,079 | | | 16.6 |

| | | | | | | | | | | | |

| Pre-Tax Income | 21,587 | | | 7,238 | | | 198.2 | | 28,938 | | | 15,282 | | | 89.4 |

| Income taxes provision | 7,808 | | | 2,573 | | | 203.5 | | 10,262 | | | 5,559 | | | 84.6 |

| Net Income | $ | 13,779 | | | $ | 4,665 | | | 195.4 | | $ | 18,676 | | | $ | 9,723 | | | 92.1 |

| | | | | | | | | | | | |

| Less: Net income (loss) attributable to noncontrolling interest, net of tax | (82) | | | 145 | | | * | | (403) | | | (215) | | | 87.4 |

| Net income attributable to Oppenheimer Holdings Inc. | $ | 13,861 | | | $ | 4,520 | | | 206.7 | | $ | 19,079 | | | $ | 9,938 | | | 92.0 |

| | | | | | | | | | | | |

| Earnings per share attributable to Oppenheimer Holdings Inc. | | | | | | | | |

| Basic | $ | 1.32 | | | $ | 0.40 | | | 230.0 | | $ | 1.75 | | | $ | 0.84 | | | 108.3 |

| Diluted | $ | 1.21 | | | $ | 0.37 | | | 227.0 | | $ | 1.62 | | | $ | 0.78 | | | 107.7 |

| | | | | | | | | | | | |

| Weighted average number of common shares outstanding | | | | | | | | |

| Basic | 10,519,431 | | | 11,270,589 | | | (6.7) | | 10,874,055 | | | 11,901,727 | | | (8.6) |

| Diluted | 11,440,229 | | | 12,190,425 | | | (6.2) | | 11,746,337 | | | 12,809,000 | | | (8.3) |

| | | | | | | | | | | | |

| Period end number of common shares outstanding | 10,388,898 | | | 10,974,655 | | | (5.3) | | 10,388,898 | | | 10,974,655 | | | (5.3) |

* Percentage not meaningful

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

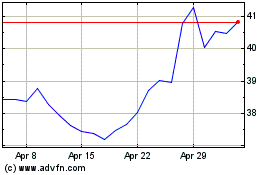

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From Apr 2024 to May 2024

Oppenheimer (NYSE:OPY)

Historical Stock Chart

From May 2023 to May 2024