Occidental (NYSE: OXY) today announced it has achieved $3

billion in principal debt reduction in the third quarter of 2024,

utilizing robust organic cash flow from operations and proceeds

from divestitures.

“We are pleased with the rapid and significant progress of our

deleveraging program along with enhancements made to our already

premier portfolio. By the end of the third quarter, we expect to

achieve nearly 85% of our near-term $4.5 billion debt reduction

commitment,” said President and CEO Vicki Hollub. “We believe our

recent financial actions strengthen our balance sheet and

accelerate our shareholder return pathway.”

Following closing of the Barilla Draw divestment, which is

expected by the end of the third quarter, Occidental plans to apply

the proceeds from the $818 million transaction toward debt

repayments, which will bring total year-to-date debt redemptions to

over $3.8 billion, or approximately 85% of the near-term $4.5

billion debt reduction commitment.

Last week’s sale of 19.5 million common units representing

limited partner interests in Western Midstream Partners, LP (NYSE:

WES) raised $700 million. Occidental has now achieved approximately

$1.7 billion in completed or announced divestments in 2024.

Occidental announced a commitment to achieve at least $4.5

billion in debt reduction within 12 months of closing the

acquisition of CrownRock. Proceeds from the ongoing divestiture

program will continue to go toward reducing debt. Occidental will

also continue to prudently advance deleveraging via free cash

flow.

About Occidental

Occidental is an international energy company with assets

primarily in the United States, the Middle East and North Africa.

We are one of the largest oil and gas producers in the U.S.,

including a leading producer in the Permian and DJ basins, and

offshore Gulf of Mexico. Our midstream and marketing segment

provides flow assurance and maximizes the value of our oil and gas.

Our chemical subsidiary OxyChem manufactures the building blocks

for life-enhancing products. Our Oxy Low Carbon Ventures subsidiary

is advancing leading-edge technologies and business solutions that

economically grow our business while reducing emissions. We are

committed to using our global leadership in carbon management to

advance a lower-carbon world. Visit oxy.com for more

information.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, including, but not

limited to, statements about Occidental’s expectations, beliefs,

plans or forecasts. All statements other than statements of

historical fact are “forward-looking statements” for purposes of

federal and state securities laws, including, but not limited to:

any projections of earnings, revenue or other financial items or

future financial position or sources of financing; any statements

of the plans, strategies and objectives of management for future

operations or business strategy; any statements regarding future

economic conditions or performance; any statements of belief; and

any statements of assumptions underlying any of the foregoing.

Words such as “estimate,” “project,” “will,” “should,” “could,”

“may,” “anticipate,” “plan,” “intend,” “believe,” “expect,” “goal,”

“target,” "commit," "advance," or similar expressions that convey

the prospective nature of events or outcomes are generally

indicative of forward-looking statements. You should not place

undue reliance on these forward-looking statements, which speak

only as of the date of this press release unless an earlier date is

specified. Unless legally required, Occidental does not undertake

any obligation to update, modify or withdraw any forward-looking

statements as a result of new information, future events or

otherwise.

Forward-looking statements involve estimates, expectations,

projections, goals, forecasts, assumptions, risks and

uncertainties. Actual outcomes or results may differ from

anticipated results, sometimes materially. Factors that could cause

actual results to differ include, but are not limited to: general

economic conditions, including slowdowns and recessions,

domestically or internationally; Occidental’s indebtedness and

other payment obligations, including the need to generate

sufficient cash flows to fund operations; Occidental’s ability to

successfully monetize select assets and repay or refinance debt and

the impact of changes in Occidental’s credit ratings or future

increases in interest rates; assumptions about energy markets;

global and local commodity and commodity-futures pricing

fluctuations and volatility; supply and demand considerations for,

and the prices of, Occidental’s products and services; actions by

the Organization of the Petroleum Exporting Countries (OPEC) and

non-OPEC oil producing countries; results from operations and

competitive conditions; future impairments of Occidental's proved

and unproved oil and gas properties or equity investments, or

write-downs of productive assets, causing charges to earnings;

unexpected changes in costs; inflation, its impact on markets and

economic activity and related monetary policy actions by

governments in response to inflation; availability of capital

resources, levels of capital expenditures and contractual

obligations; the regulatory approval environment, including

Occidental's ability to timely obtain or maintain permits or other

government approvals, including those necessary for drilling and/or

development projects; Occidental's ability to successfully

complete, or any material delay of, field developments, expansion

projects, capital expenditures, efficiency projects, acquisitions

or divestitures, including the Barilla Draw divestment; risks

associated with acquisitions, mergers and joint ventures, such as

difficulties integrating businesses, uncertainty associated with

financial projections, projected synergies, restructuring,

increased costs and adverse tax consequences; uncertainties and

liabilities associated with acquired and divested properties and

businesses; uncertainties about the estimated quantities of oil,

natural gas liquids and natural gas reserves; lower-than-expected

production from development projects or acquisitions; Occidental’s

ability to realize the anticipated benefits from prior or future

streamlining actions to reduce fixed costs, simplify or improve

processes and improve Occidental’s competitiveness; exploration,

drilling and other operational risks; disruptions to, capacity

constraints in, or other limitations on the pipeline systems that

deliver Occidental’s oil and natural gas and other processing and

transportation considerations; volatility in the securities,

capital or credit markets, including capital market disruptions and

instability of financial institutions; government actions, war

(including the Russia-Ukraine war and conflicts in the Middle East)

and political conditions and events; health, safety and

environmental (HSE) risks, costs and liability under existing or

future federal, regional, state, provincial, tribal, local and

international HSE laws, regulations and litigation (including

related to climate change or remedial actions or assessments);

legislative or regulatory changes, including changes relating to

hydraulic fracturing or other oil and natural gas operations,

retroactive royalty or production tax regimes, and deep-water and

onshore drilling and permitting regulations; Occidental's ability

to recognize intended benefits from its business strategies and

initiatives, such as Occidental's low-carbon ventures businesses or

announced greenhouse gas emissions reduction targets or net-zero

goals; potential liability resulting from pending or future

litigation, government investigations and other proceedings;

disruption or interruption of production or manufacturing or

facility damage due to accidents, chemical releases, labor unrest,

weather, power outages, natural disasters, cyber-attacks, terrorist

acts or insurgent activity; the scope and duration of global or

regional health pandemics or epidemics, and actions taken by

government authorities and other third parties in connection

therewith; the creditworthiness and performance of Occidental's

counterparties, including financial institutions, operating

partners and other parties; failure of risk management;

Occidental’s ability to retain and hire key personnel; supply,

transportation, and labor constraints; reorganization or

restructuring of Occidental’s operations; changes in state, federal

or international tax rates; and actions by third parties that are

beyond Occidental’s control.

Additional information concerning these and other factors that

may cause Occidental’s results of operations and financial position

to differ from expectations can be found in Occidental’s filings

with the U.S. Securities and Exchange Commission, including

Occidental’s Annual Report on Form 10-K for the year ended December

31, 2023, Quarterly Reports on Form 10-Q and Current Reports on

Form 8-K.

Contacts

| Media |

Investors |

| Eric

Moses713-497-2017eric_moses@oxy.com |

R. Jordan

Tanner713-552-8811investors@oxy.com |

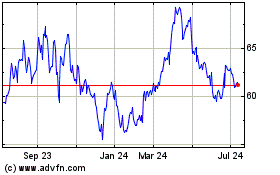

Occidental Petroleum (NYSE:OXY)

Historical Stock Chart

From Nov 2024 to Dec 2024

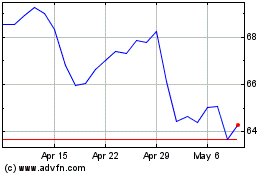

Occidental Petroleum (NYSE:OXY)

Historical Stock Chart

From Dec 2023 to Dec 2024