Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

July 18 2022 - 6:01AM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934

For the month of July,

2022

Commission File Number 001-41129

Nu Holdings Ltd.

(Exact name of registrant as specified

in its charter)

Nu Holdings Ltd.

(Translation of Registrant's

name into English)

Campbells Corporate Services

Limited, Floor 4, Willow House, Cricket Square, KY1-9010 Grand Cayman, Cayman Islands

+1 345 949 2648

(Address of principal executive

office)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F (X) Form 40-F

Indicate by check mark whether the registrant by furnishing

the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934.

Yes No (X)

NOTICE TO THE MARKET

Grand Cayman, Cayman Islands Company, July 15, 2022 -

Nu Holdings Ltd. (“Nu” or “Company”), hereby informs its shareholders and the market as follows:

| 1. | As

a regulated financial institution, Nu Financeira - Sociedade de Credito financiamento e Investimento ("Nu Financeira"),

together with its consolidated subsidiaries, or collectively the “Nu Financeira Financial Conglomerate,” are required to

comply with the capital requirements set by CMN Resolution No. 4,958/21. The minimum capital adequacy ratio required from financial institutions

in Brazil (Total Capital Ratio, or “TCR”) is typically equivalent to up to 10.5% of their total risk weighted assets,

or “RWAs.”

|

| 2. | Notwithstanding

the minimum capital adequacy ratio provided under CMN Resolution No. 4,958/21, upon being granted its financial institution license in

2017, Nu Financeira undertook a commitment to operate with a higher Basel Committee minimum capital adequacy ratio of 14.0% during its

first five years of operations (the "2017 Commitment"). |

| 3. | On

July 15, 2022, the Brazilian Central Bank ("BCB") informed Nu Financeira that it is no longer required to comply with

the higher capital adequacy ratio of 14.0% set out under the 2017 Commitment; provided, however, that it should remain complying with

the capital adequacy requirements set out under under CMN Resolution No. 4,958/21, as typically applied to financial institutions in

Brazil. |

Contacts:

Investors Contact:

Jorg Friedemann

investors@nubank.com.br

Media Contact:

Leila Suwwan

press@nubank.com.br

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Nu Holdings Ltd. |

| |

|

| |

By: |

/s/ Guilherme Lago |

| |

|

Guilherme Lago

Chief Financial Officer |

Date: July

15, 2022

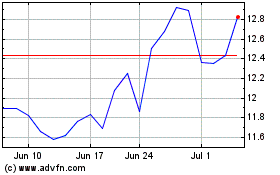

Nu (NYSE:NU)

Historical Stock Chart

From Jul 2024 to Aug 2024

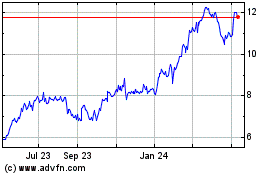

Nu (NYSE:NU)

Historical Stock Chart

From Aug 2023 to Aug 2024