Nuveen Announces Investment Policy Changes for Several Insured Municipal Closed-End Funds

January 22 2010 - 4:45PM

Business Wire

Nuveen Investments, a leading global provider of investment

services to institutions and high-net-worth investors, today

announced that the Board of Trustees of 16 of its insured municipal

closed-end funds has approved changes to each such fund’s

investment policies. The Board of each fund took this action in

response to the continuing challenges faced by municipal bond

insurers. The changes to each fund’s investment policies are

intended to increase the fund’s investment flexibility in pursuing

its investment objective, while retaining the insured nature of its

portfolio.

The changes will allow the funds to invest:

- At least 80 percent of their net

assets in municipal bonds insured by insurance providers with a

claims-paying ability of at least investment grade at the time of

investment; and

- Up to 20 percent in uninsured

municipal bonds that are either escrowed to maturity, rated

investment grade or unrated but judged by the fund’s investment

adviser to be investment grade quality.

These changes are effective immediately. The affected funds

are:

Nuveen Insured Premium Income 2

Fund (NPX)

Nuveen Insured Municipal

Opportunity (NIO)

Nuveen Premier Insured Municipal

Fund (NIF)

Nuveen Insured Dividend Advantage

Fund (NVG)

Nuveen Insured Tax Free Advantage

Fund (NEA)

Nuveen Insured Quality Fund

(NQI)

Nuveen Insured New York Premium

Income Fund (NNF)

Nuveen New York Quality Income

Fund (NUN)

Nuveen New York Select Quality

Fund (NVN)

Nuveen New York Investment Quality

Fund (NQN)

Nuveen Insured New York Dividend

Advantage Fund (NKO)

Nuveen Insured New York Tax Free

Advantage Fund (NRK)

Nuveen Insured California Premium

Income 2 Fund (NCL)

Nuveen Insured California Dividend

Advantage Fund (NKL)

Nuveen Insured Tax Free Dividend

Advantage (NKX)

Nuveen Insured Massachusetts Tax

Free Advantage (NGX)

For more information on these policies and other Nuveen

closed-end funds, please visit www.nuveen.com/cef

Nuveen Investments provides high quality investment services

designed to help secure the long-term goals of institutions and

high net worth investors as well as the consultants and financial

advisors who serve them. Nuveen Investments markets its growing

range of specialized investment solutions under the high-quality

brands of HydePark, NWQ, Nuveen, Santa Barbara, Symphony,

Tradewinds and Winslow Capital. In total, the Company managed $141

billion of assets on September 30, 2009. For more information,

please visit the Nuveen Investments website at www.nuveen.com.

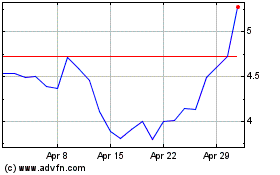

NIO (NYSE:NIO)

Historical Stock Chart

From Jun 2024 to Jul 2024

NIO (NYSE:NIO)

Historical Stock Chart

From Jul 2023 to Jul 2024