UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): October 1, 2014

NATURAL RESOURCE PARTNERS L.P.

(Exact Name of Registrant as Specified in Charter)

|

|

|

|

|

| Delaware |

|

001-31465 |

|

35-2164875 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

601 Jefferson, Suite 3600

Houston, Texas 77002

(Address of principal executive office) (Zip Code)

(713) 751-7507

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 2.01. Completion of Acquisition or Disposition of Assets.

On October 1, 2014, Natural Resource Partners L.P. (“NRP”) closed the previously announced acquisition of VantaCore Partners LP.

Pursuant to an Agreement and Plan of Merger dated August 18, 2014 (the “Merger Agreement”) by and among NRP, NRP (Operating) LLC (“NRP Operating”), Rubble Merger Sub, LLC, a wholly owned subsidiary of NRP Operating

(“Merger Sub”), VantaCore Partners LP (“VantaCore”), VantaCore LLC (“VantaCore GP”), TCP VantaCore SPV, LLC, Kayne Anderson Energy Development Company, Corridor Private Holdings, Inc. and Hartz Alternative Investments,

LLC, VantaCore and VantaCore GP merged with and into Merger Sub, with Merger Sub surviving as a wholly owned subsidiary of NRP Operating (the “Merger”).

As consideration for the Merger, NRP paid a purchase price of $205 million, subject to customary post-closing purchase price adjustments. NRP

funded the purchase price using a combination of borrowings under NRP Operating’s revolving credit facility and the issuance of approximately $36 million in common units representing limited partner interests in NRP (“Common Units”)

to certain of the unitholders of VantaCore and certain of the members of VantaCore GP (together, the “Rollover Holders”).

The

foregoing description of the Merger does not purport to be complete and is qualified in its entirety by reference to the Merger Agreement, which was previously filed as Exhibit 2.1 to NRP’s Current Report on Form 8-K filed with the Securities

and Exchange Commission on August 19, 2014 and is incorporated by reference in this Item 2.01.

Item 3.02. Unregistered Sales of

Equity Securities.

In connection with the closing of the Merger, on October 1, 2014, NRP issued 2,426,690 Common Units to the

Rollover Holders in exchange for such Rollover Holders’ interests in VantaCore and VantaCore GP upon closing of the Merger. The aggregate offering price of the Common Units was $36 million. Such Common Units were issued and sold in reliance

upon an exemption from the registration requirements of the Securities Act of 1933, pursuant to Section 4(2) thereof.

Item 7.01 Regulation

FD Disclosure.

In accordance with General Instructions B.2. and B.6 of Form 8-K, the following information and the exhibit referenced

therein are being furnished under Item 7.01 of Form 8-K and are not deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, are not subject to the liabilities of that section and are not

deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

On October 2, 2014, the Partnership

issued a press release announcing the closing of the Merger. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Item 8.01. Other Events.

In

connection with the closing of the Merger, NRP intends to supplement the risk factors contained in its Annual Report on Form 10-K for the year ended December 31, 2013. The risk factors below should be considered together with the other risk

factors described in the 2013 Form 10-K and other filings with the SEC under the Securities Exchange Act of 1934, as amended. References in this Item 8.01 to “we,” “our,” and “us” refer to NRP and its subsidiaries

unless the context requires otherwise.

We are exposed to operating risks as a result of the VantaCore acquisition that we have not

previously experienced.

Prior to the VantaCore acquisition, we did not operate aggregates mining and production assets. VantaCore

currently operates three hard rock quarries, six sand and gravel plants, two asphalt plants and a marine terminal. As an operator of these assets, we will be exposed to risks that we have not historically been exposed to in our mineral rights and

royalties business. Such risks include, but are not limited to, prices and demand for construction aggregates, capital and operating expenses necessary to maintain VantaCore’s operations, production levels, general economic conditions,

conditions in the local markets that VantaCore serves, inclement or hazardous weather

2

conditions, permitting risk, fire, explosions or other accidents, and unanticipated geologic conditions. Any of these risks could result in damage to, or destruction of, VantaCore’s mining

properties or production facilities, personal injury, environmental damage, delays in mining or processing, reduced revenue or losses or possible legal liability. In addition, not all of these risks are reasonably insurable, and our insurance

coverage contains limits, deductibles, exclusions and endorsements. Our insurance coverage may not be sufficient to meet our needs in the event of loss. Any prolonged downtime or shutdowns at VantaCore’s mining properties or production

facilities or material loss could have an adverse effect on our results of operations and prevent us from realizing all of the anticipated benefits of the acquisition.

We may incur unanticipated costs or delays in connection with the integration of VantaCore and future aggregates operations into our

company.

There are risks with respect to the integration of VantaCore into our company that may result in unanticipated costs or

delays to us. Such risks include:

| |

• |

|

integrating additional personnel into our company, including the approximately 230 people employed by VantaCore; |

| |

• |

|

establishing the internal controls and procedures for the acquired businesses that we are required to maintain under the Sarbanes-Oxley Act of 2002; |

| |

• |

|

consolidating other corporate and administrative functions; |

| |

• |

|

diversion of management’s attention away from our other business concerns; |

| |

• |

|

loss of key employees; and |

| |

• |

|

the assumption of any undisclosed or other potential liabilities of the acquired company. |

Similar risks may

apply to the integration of future aggregates operations that we may acquire through the VantaCore platform. Any significant costs and delays resulting from the risks described above could cause us not to realize the anticipated benefits of these

acquisitions.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

| 2.1 |

|

Agreement and Plan of Merger, dated as of August 18, 2014, by and among VantaCore Partners LP, VantaCore LLC, the Holders named therein, Natural Resource Partners L.P., NRP (Operating) LLC and Rubble Merger Sub, LLC

(incorporated by reference to Exhibit 2.1 to Current Report on Form 8-K filed on August 19, 2014). |

|

|

| 99.1 |

|

Press Release dated October 2, 2014. |

3

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

NATURAL RESOURCE PARTNERS L.P. |

|

|

|

|

|

|

|

|

By: |

|

NRP (GP) LP, Its General Partner |

|

|

|

|

|

|

|

|

By: |

|

GP NATURAL RESOURCE PARTNERS, LLC Its General

Partner |

|

|

|

|

| Dated: October 2, 2014 |

|

|

|

By: |

|

/s/ Kathryn S. Wilson |

|

|

|

|

|

|

Name: Kathryn S. Wilson Title: Vice

President and General Counsel |

4

Exhibit 99.1

|

|

|

| Natural Resource Partners L.P. 601

Jefferson St., Suite 3600, Houston, TX 77002 |

|

|

NEWS RELEASE

Natural Resource Partners L.P.

Closes Acquisition of

VantaCore Partners LP

HOUSTON,

October 2, 2014 – Natural Resource Partners L.P. (NYSE:NRP) today reported that it has closed the acquisition of VantaCore Partners LP, a privately held limited partnership specializing in the construction materials industry,

for $205 million.

The acquisition was funded in part by issuing approximately $36 million in common units to certain of the sellers, including Kayne

Anderson Energy Development Company, Hartz Alternative Investments, LLC and members of VantaCore’s management team. NRP funded the remaining $169 million through borrowings under NRP (Operating) LLC’s revolving credit facility.

Company Profile

Natural Resource Partners L.P.

(“NRP”) is a master limited partnership headquartered in Houston, TX, with its operations headquarters in Huntington, WV. NRP is a diversified natural resource company principally engaged in the business of owning and managing mineral

reserve properties. NRP owns interests in coal, aggregates and industrial minerals, and oil and gas across the United States that generate royalty and other income for the partnership. In addition, NRP owns an equity investment in OCI

Wyoming, a trona/soda ash operation, owns non-operated working interests in oil and gas properties and owns VantaCore, ranked as one of the top 25 aggregates producers in the United States.

For additional information, please contact Kathy H. Roberts at 713-751-7555 or kroberts@nrplp.com. Further information about NRP is available on the

partnership’s website at http://www.nrplp.com.

Forward-Looking Statements

This press release may include “forward-looking statements” as defined by the Securities and Exchange Commission (“SEC”). All

statements, other than statements of historical facts included in this press release that address activities, events or developments that the partnership expects, believes or anticipates will or may occur in the future are forward-looking

statements. These statements are based on certain assumptions made by the partnership based on its experience and perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the

circumstances. Such statements are subject to a number of assumptions, risks and uncertainties, many of

|

|

|

| NRP Closes Acquisition of VantaCore Partners LP |

|

Page 2 of

2

|

which are beyond the control of the partnership. These risks include, but are not limited to, decreases in demand for coal, aggregates and industrial minerals and oil and gas; changes in

operating conditions and costs; production cuts by our lessees; commodity prices; unanticipated geologic problems; changes in the legislative or regulatory environment and other factors detailed in NRP’s SEC filings. In addition, there are

significant risks and uncertainties relating to NRP’s acquisition and ownership of VantaCore and VantaCore’s performance over the short and long terms. The assumptions on which NRP’s estimates of future results of the business have

been based, which include prices and demand for VantaCore’s products, production levels, economic and market conditions, and reserves and other geologic conditions, may prove to be incorrect in a number of material ways, resulting in our not

realizing the expected benefits of the acquisition. NRP has no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise.

14-12

-end-

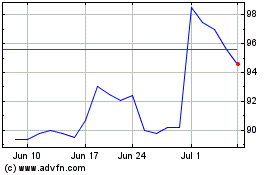

Natural Resource Partners (NYSE:NRP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Natural Resource Partners (NYSE:NRP)

Historical Stock Chart

From Jul 2023 to Jul 2024