Filed by Vast Solar Pty Ltd

Pursuant to Rule 425 of the Securities

Act of 1933

and deemed filed pursuant to Rule 14a-12

of the Securities Exchange Act of 1934

Subject Company: Nabors Energy Transition Corp.

Commission File No.: 001-41073

Set forth below is an article published by

The Australian on or around October 8, 2023 regarding Vast Solar Pty Ltd’s (“Vast”) proposed business combination (the

“Business Combination”) with Nabors Energy Transition Corp. (“NETC”), which was incorrectly identified as “Nabors

Energy Transition Corp I” in the article.

The article below incorrectly quotes Craig Wood, Chief Executive

Officer of Vast, as stating that Vast has secured major strategic partners to invest in Vast, including major worldwide utility companies,

airlines, and shipping groups. Although Vast is in ongoing discussions and negotiations with a number of potential strategic partners

in a number of industries, it has not secured commitments from any of such unnamed counterparties. There can be no assurance that Vast

will successfully enter into definitive agreements with any potential strategic partners for investment or otherwise on favorable terms

or at all.

The article also indicates that the equity

value of Vast upon listing will be approximately USD586 million (AUD900 million). This figure was taken from the press release announcing

the business combination issued on February 14, 2023 which included a statement that the implied equity value of the combined company

would be between approximately USD 305 million and USD 586 million depending on the level of redemptions from NETC’s trust account.

Subsequent to the date of that press release, NETC stockholders holding 17,749,359 NETC public shares exercised their right to redeem

such shares for a pro rata portion of the funds in the trust account in connection with a stockholder meeting held by NETC on May 11,

2023 to obtain stockholder approval to extend the date by which NETC must complete a business combination. As a result of such redemptions,

and certain other changes since February 14, 2023, the implied equity value of the combined company is now expected to be between approximately

USD 280 million and USD 390 million depending on the level of redemptions from NETC’s trust account.

In connection with the proposed Business Combination between Vast

and NETC, Vast has filed a registration statement on Form F-4 (File No. 333-272058) (as amended, the “Registration Statement”)

with the U.S. Securities and Exchange Commission (the “SEC”), which includes (i) a preliminary prospectus of Vast relating

to the offer of securities to be issued in connection with the proposed Business Combination and (ii) a preliminary proxy statement of

NETC to be distributed to holders of NETC’s capital stock in connection with NETC’s solicitation of proxies for the vote

by NETC’s stockholders with respect to the proposed Business Combination and other matters described in the Registration Statement.

NETC and Vast also plan to file other documents with the SEC regarding the proposed Business Combination. After the Registration Statement

has been declared effective by the SEC, a definitive proxy statement/prospectus will be mailed to the stockholders of NETC. INVESTORS

AND SECURITY HOLDERS OF NETC AND VAST ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE REGISTRATION STATEMENT, THE PROXY

STATEMENT/PROSPECTUS CONTAINED THEREIN (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND ALL OTHER DOCUMENTS RELATING TO THE PROPOSED

BUSINESS COMBINATION THAT HAVE BEEN OR WILL BE FILED WITH THE SEC WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN IMPORTANT INFORMATION

ABOUT THE PROPOSED BUSINESS COMBINATION.

THE AUSTRALIAN

BUSINESS REVIEW

Vast nears $900m NYSE listing as it looks to

crack 'missing piece’ in renewable puzzle

12:06PM

October 8,2023

Australian

solar energy outfit Vast says its ability to store energy from the sun at a fraction of the price of batteries is the country’s

answer to offering cheap renewable energy two months out from a $US586m ($900m) listing on the New York Stock Exchange.

Vast’s

chief executive Craig Wood tells The Australian his company has been solving a problem that government and business are only now just

beginning to realize in that solar power and hydrogen have limitations as part of a push to net zero.

Currently

backed by Johnny Kahlbetzer’s AGCentral, Vast is scheduled to hit the boards of Wall Street by Thanksgiving if final approvals from

the US Securities and Exchange Commission go to plan.

The listing

would follow the signing of a Business Combination Agreement with so called blank cheque company Nabors Energy Transition Corp I in February,

which is an affiliate of US-listed oil and gas drilling fleet group Nabors Industries.

Mr. Wood

said as part of the final push to becoming a listed company it would reveal names of major strategic partners that will invest in Vast

including major worldwide utility companies, airlines, and shipping groups.

“The

names that we have secured as strategic partners will be surprising to say,” he said.

Investors

announced so far include Canberra Airport, which has agreed to purchase up to $US10m in shares ordinary shares at an approximate price

of $US10.20 per share to help it achieve decarbonisation targets and to produce low-cost sustainable aviation fuel.

Mr. Wood

said the decision to shun a listing on the resources heavy ASX for the US was the result of a lack of capital available to get off the

ground domestically.

“The

US listing allows us to tap into what are much deeper capital markets for the sort of technology and size of cheques. That depth is crucial

for the next stage in our development,” he said.

“We

did explore raising capital here in Australia and there is lots of capital for early- stage endeavours and plenty for mature projects.

But we are in the middle of both and that is challenging to secure capital.”

A Wall Street

presence will also enable Vast to compete for funding as part of the US government’s Inflation Reduction Act which is designed to

mobilize private capital to achieve decarbonisation.

Vast has

developed a proprietary next-generation concentrated solar power (CSP) system that provides clean, dispatchable renewable energy for utility-scale

power, industrial heat and clean fuel production applications.

Having built

a grid-connected 1.1MW demonstration facility in Forbes, the technology is designed to gather energy from the sun, which is then stored

in molten salt for later dispatch as either power or heat.

Mr. Wood

said that Vast needed to be build a commercial scale plant to be able to demonstrate and unlock a pipeline of projects.

“From

there it is just as quickly we can scale the business in those core sunny markets that keeps costs down and delivers reliable energy,”

he said.

In addition

to chasing the lucrative US market and having a strong presence in Australia, the last cornerstone of what Mr. Wood describes as

its “sunny countries” market that offer favourable weather conditions is the Middle East, particularly Saudi Arabia.

“Saudi

Arabia is undertaking a massive greenfield project called Neom and they will need lots of overnight power and heat for industry, which

offers us lots of opportunity. It is also on the Red Sea where a huge volume of container ships pass,” Mr. Wood said.

He added

that Vast’s technology made it well placed to solve problems facing Australia’s power grid, notably the transition to greener

power sources and rising power bills.

“For

a long time, we have been solving a problem people didn’t realize they had,” he said.

“Australia

needs long duration electricity storage, and we can do it for consumers at the cheapest price, while the second problem we solve is offering

heat for industry and that is also the cheapest form of heat that is green.

Mr. Wood

said that renewable energies needed to be low cost if governments wanted to roll them out to consumers.

“We

talk about battery and hydrogen as key to going to net zero, but people are starting to see that while batteries are great, they have

limitations and are not cheap,” he said.

He was adamant

that its solar thermal technology was not the complete but if you was able to provide long-term overnight storage of solar power then

it would be part of the solution to enabling affordable power to the grid.

The listing

on Wall Street will secure funding to construct 230MW of projects, including a 30MW grid-connected facility in Port Augusta that is expected

to become operational in 2025, and the world’s first 20 ton per day solar methanol facility that will be co-located with and partially

powered by the 30MW plant

It has also

secured $110m in concessional financing from the Federal government, and up to $65m non-dilutive grant from the Australian Renewable Energy

Agency (ARENA) as part of its plans in Port Augusta. The SMI methanol plant is being funded in part by the German-Australian Hydrogen

Innovation with the plan to export solar thermal power to Germany.

About Vast

Vast is a renewable energy company that has developed

CSP systems to generate, store and dispatch carbon free, utility-scale electricity and industrial heat, and to enable the production of

green fuels. Vast’s CSP v3.0 approach to CSP utilizes a proprietary, modular sodium loop to efficiently capture and convert solar

heat into these end products.

Visit www.vast.energy

for more information.

About Nabors Energy Transition Corp.

Nabors Energy Transition Corp. (NYSE: NETC, NETC.WS,

NETC.U) is a blank check company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase,

reorganisation or similar business combination with one or more businesses or entities. NETC was formed to identify solutions, opportunities,

companies or technologies that focus on advancing the energy transition; specifically, ones that facilitate, improve or complement the

reduction of carbon or greenhouse gas emissions while satisfying growing energy consumption across markets globally.

NETC is an affiliate of Nabors Industries Ltd.

(“Nabors”), a leading provider of advanced technology for the energy industry. By leveraging its core competencies, particularly

in drilling, engineering, automation, data science and manufacturing, Nabors, which owns the global industry’s largest fleet of

land drilling rigs and equipment, is committed to innovate the future of energy and enable the transition to a lower-carbon world.

Contacts:

Vast

For Investors:

Caldwell Bailey

ICR, Inc.

VastIR@icrinc.com

For US Media:

Matt Dallas

ICR, Inc.

VastPR@icrinc.com

For Australian media:

Nick Albrow

Wilkinson Butler

nick@wilkinsonbutler.com

Nabors Energy Transition Corp. Contacts:

For Investors:

William C. Conroy, CFA

Vice President – Corporate Development & Investor Relations

William.conroy@nabors.com

For Media:

Brian Brooks

Senior Director, Corporate Communications

Brian.brooks@nabors.com

Important Information about the Business Combination and Where to Find It

This communication does not constitute an offer

to sell or the solicitation of an offer to buy any securities or constitute a solicitation of any vote or approval.

In connection with the proposed business combination

(the “Business Combination”) between Vast Solar Pty Ltd (“Vast") and Nabors Energy Transition Corp. (“NETC”),

Vast has filed a registration statement on Form F-4 (File No. 333-272058) (as amended, the “Registration Statement”)

with the U.S. Securities and Exchange Commission (the “SEC”), which includes (i) a preliminary prospectus of Vast relating

to the offer of securities to be issued in connection with the proposed Business Combination and (ii) a preliminary proxy statement

of NETC to be distributed to holders of NETC’s capital stock in connection with NETC’s solicitation of proxies for the vote

by NETC’s stockholders with respect to the proposed Business Combination and other matters described in the Registration Statement.

NETC and Vast also plan to file other documents with the SEC regarding the proposed Business Combination. After the Registration Statement

has been declared effective by the SEC, a definitive proxy statement/prospectus will be mailed to the stockholders of NETC. INVESTORS

AND SECURITY HOLDERS OF NETC AND VAST ARE URGED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS CONTAINED THEREIN (INCLUDING

ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND ALL OTHER DOCUMENTS RELATING TO THE PROPOSED BUSINESS COMBINATION THAT HAVE BEEN OR WILL BE

FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED

BUSINESS COMBINATION.

Investors and security holders are able to obtain

free copies of the proxy statement/prospectus and other documents containing important information about NETC and Vast once such documents

are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov. In addition, the documents filed by NETC may

be obtained free of charge from NETC’s website at www.nabors-etcorp.com or by written request to NETC at 515 West Greens Road, Suite 1200,

Houston, TX 77067.

Participants in the Solicitation

NETC, Nabors, Vast and their respective directors

and executive officers may be deemed to be participants in the solicitation of proxies from the stockholders of NETC in connection with

the proposed Business Combination. Information about the directors and executive officers of NETC is set forth in the Registration Statement.

To the extent that holdings of NETC’s securities have changed since the amounts printed in the Registration Statement filed on June 29,

2023, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Other information

regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or

otherwise, will be contained in the Registration Statement and other relevant materials to be filed with the SEC when they become available.

You may obtain free copies of these documents as described in the preceding paragraph.

Forward Looking Statements

The

information included herein and in any oral statements made in connection herewith include “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934,

as amended. All statements, other than statements of present or historical fact included herein, regarding the proposed Business Combination,

NETC’s and Vast’s ability to consummate the proposed Business Combination, the benefits of the proposed Business Combination,

the proposed financing from Capital Airport Group (“CAG”), CAG’s ability to provide the proposed financing and NETC’s

and Vast’s future financial performance following the proposed Business Combination, as well as NETC’s and Vast’s strategy,

future operations, financial position, estimated revenues and losses, projected costs, prospects, plans and objectives of management are

forward-looking statements. When used herein, including any oral statements made in connection herewith, the words “could,”

“should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,”

“expect,” “project,” the negative of such terms and other similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on

NETC and Vast management’s current expectations and assumptions about future events and are based on currently available information

as to the outcome and timing of future events. Except as otherwise required by applicable law, NETC and Vast disclaim any duty to update

any forward-looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances

after the date hereof. NETC and Vast caution you that these forward-looking statements are subject to risks and uncertainties, most of

which are difficult to predict and many of which are beyond the control of NETC and Vast. These risks include, but are not limited to,

general economic, financial, legal, political and business conditions and changes in domestic and foreign markets; the inability to complete

the Business Combination or the convertible debt and equity financings contemplated in connection with the proposed Business Combination,

including the proposed financing from CAG (the “Financing”) in a timely manner or at all (including due to the failure to

receive required stockholder or shareholder, as applicable, approvals, or the failure of other closing conditions such as the satisfaction

of the minimum trust account amount following redemptions by NETC’s public stockholders and the receipt of certain governmental

and regulatory approvals), which may adversely affect the price of NETC’s securities; the inability of the Business Combination

to be completed by NETC’s business combination deadline and the potential failure to obtain an extension of the business combination

deadline if sought by NETC; the occurrence of any event, change or other circumstance that could give rise to the termination of the Business

Combination or the Financing; the inability to recognize the anticipated benefits of the proposed Business Combination; the inability

to obtain or maintain the listing of Vast’s shares on a national exchange following the consummation of the proposed Business Combination;

costs related to the proposed Business Combination; the risk that the proposed Business Combination disrupts current plans and operations

of Vast, business relationships of Vast or Vast’s business generally as a result of the announcement and consummation of the proposed

Business Combination; Vast’s ability to manage growth; Vast’s ability to execute its business plan, including the completion

of the Port Augusta project, at all or in a timely manner and meet its projections; potential disruption in Vast’s employee retention

as a result of the proposed Business Combination; potential litigation, governmental or regulatory proceedings, investigations or inquiries

involving Vast or NETC, including in relation to the proposed Business Combination; changes in applicable laws or regulations and general

economic and market conditions impacting demand for Vast’s products and services. Additional risks are set forth in the section

titled "Risk Factors" in the Registration Statement and other documents filed, or to be filed with the SEC in connection with

the proposed Business Combination. Should one or more of the risks or uncertainties described herein and in any oral statements made in

connection therewith occur, or should underlying assumptions prove incorrect, actual results and plans could differ materially from those

expressed in any forward-looking statements. Additional information concerning these and other factors that may impact NETC’s

expectations can be found in NETC’s periodic filings with the SEC, including NETC’s Annual Report on Form 10-K filed

with the SEC on March 22, 2023 and any subsequently filed Quarterly Reports on Form 10-Q. NETC’s SEC filings are available

publicly on the SEC’s website at www.sec.gov.

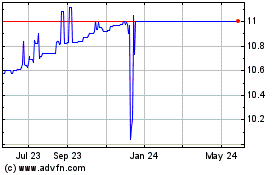

Nabors Energy Transition (NYSE:NETC)

Historical Stock Chart

From Apr 2024 to May 2024

Nabors Energy Transition (NYSE:NETC)

Historical Stock Chart

From May 2023 to May 2024