Mueller Industries, Inc. (NYSE: MLI) today reported 2022 fourth

quarter and full year results.

For the Fourth Quarter 2022 versus Fourth Quarter 2021:

- Operating income: $190.4 million vs $172.1 million, up

10.6%.

- Net sales: $877.6 million vs $956.4 million, down 8.2%.

- Net income: $138.9 million vs $125.6 million, up 10.6%.

- Diluted EPS: $2.46 vs $2.21, up 11.3%.

For the Full Year 2022 versus the Full Year 2021:

- Operating income: $877.1 million vs $655.8 million, up

33.7%.

- Net sales: $4.0 billion vs $3.8 billion, up 5.7%.

- Net income: $658.3 million vs $468.5 million, up 40.5%.

- Diluted EPS: $11.64 vs $8.25, up 41.1%.

Fourth Quarter Financial and Operating Commentary

- The average price of copper was $3.66 per pound, a 16.4 percent

decline as compared with the fourth quarter of 2021.

- Net sales declined $78.8 million, reflecting the impact of

lower copper prices as well as an 11 percent reduction in unit

volumes across our mill businesses, the largest of which emanated

from our international operations. These reductions were offset by

a 22 percent increase in net sales from our higher value added

businesses, particularly in our climate segment.

- The Company recognized a $13.1 million expense related to its

complete withdrawal from a multi-employer pension plan, thereby

eliminating a significant long term financial risk.

- The Company generated $207 million of cash from operations in

the fourth quarter, $723.9 million for the year and cash and

short-term investments totaled $678.9 million at year end. The

Company’s current ratio is 4 to 1.

Operating Highlights and Outlook:

Greg Christopher, CEO, commented, “We concluded 2022 by

delivering the best fourth quarter of operating and net income in

the Company’s history. Not only have we reinvested to be a low cost

producer, but we have also pursued acquisitions that both

strengthen our market leading positions in core products and expand

our portfolio into higher value added content. In tandem, these

strategic actions have improved our gross margins to levels we

believe are more appropriate for the industries we serve.

Economic activity as a whole began to temper during the second

half of 2022 amidst rising interest rates, inflationary pressures,

and global instability. Beyond that, the destocking of inventories

and normalization of supply chains exerted downward impacts.

Notwithstanding, we head into 2023 with an optimistic outlook.

Although we anticipate some decline in U.S. residential building

markets as compared with 2022, we also believe that household

formations will remain underserved by the housing supply. As such,

demand levels should remain at healthy levels relative to industry

capacity. At the same time, we maintain continued backlogs in other

critical markets including commercial construction, refrigeration,

HVAC and transportation. Internationally, we believe that following

a difficult 2022, market conditions may be bottoming out, thereby

positioning our businesses for a rebound.

This was another record year of financial performance for our

Company, but we still see many opportunities ahead of us.

Importantly, our strong performance has enabled us to build a war

chest to fund continued investments to improve our low cost

position and support our bold plans for growth.”

Mueller Industries, Inc. (NYSE: MLI) is an industrial

corporation whose holdings manufacture vital goods for important

markets such as air, water, oil and gas distribution; climate

comfort; food preservation; energy transmission; medical; aerospace

and automotive. It includes a network of companies and brands

throughout North America, Europe, Asia, and the Middle East.

Statements in this release that are not strictly historical may

be “forward-looking” statements, which involve risks and

uncertainties. These include economic and currency conditions,

continued availability of raw materials and energy, market demand,

pricing, competitive and technological factors, and the

availability of financing, among others, as set forth in the

Company’s SEC filings. The words “outlook,” “estimate,” “project,”

“intend,” “expect,” “believe,” “target,” “encourage,” “anticipate,”

“appear,” and similar expressions are intended to identify

forward-looking statements. The reader should not place undue

reliance on forward-looking statements, which speak only as of the

date of this report. The Company has no obligation to publicly

update or revise any forward-looking statements to reflect events

after the date of this report.

MUELLER INDUSTRIES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF INCOME

(Unaudited)

For the Quarter Ended

For the Year Ended

(In thousands, except per share data)

December 31, 2022

December 25, 2021

December 31, 2022

December 25, 2021

Net sales

$

877,581

$

956,357

$

3,982,455

$

3,769,345

Cost of goods sold

620,800

726,594

2,864,862

2,938,989

Depreciation and amortization

10,738

11,633

43,731

45,390

Selling, general, and administrative

expense

55,630

48,729

203,086

184,052

Gain on sale of businesses

—

(3,001

)

—

(57,760

)

Gain on sale of assets, net

—

—

(6,373

)

—

Impairment charges

—

261

—

2,829

Operating income

190,413

172,141

877,149

655,845

Interest expense

(144

)

(258

)

(810

)

(7,709

)

Environmental expense

349

(982

)

(1,298

)

(5,053

)

Redemption premium

—

—

—

(5,674

)

Pension plan termination expense

(13,100

)

—

(13,100

)

—

Other income, net

8,430

947

14,090

3,730

Income before income taxes

185,948

171,848

876,031

641,139

Income tax expense

(49,798

)

(44,862

)

(223,322

)

(165,858

)

Income (loss) from unconsolidated

affiliates, net of foreign tax

4,085

(288

)

10,111

(157

)

Consolidated net income

140,235

126,698

662,820

475,124

Net income attributable to noncontrolling

interests

(1,329

)

(1,097

)

(4,504

)

(6,604

)

Net income attributable to Mueller

Industries, Inc.

$

138,906

$

125,601

$

658,316

$

468,520

Weighted average shares for basic earnings

per share

55,642

56,104

55,779

56,011

Effect of dilutive stock-based awards

717

796

776

787

Adjusted weighted average shares for

diluted earnings per share

56,359

56,900

56,555

56,798

Basic earnings per share

$

2.50

$

2.24

$

11.80

$

8.36

Diluted earnings per share

$

2.46

$

2.21

$

11.64

$

8.25

Dividends per share

$

0.25

$

0.13

$

1.00

$

0.52

For the Quarter Ended

For the Year Ended

(In thousands)

December 31, 2022

December 25, 2021

December 31, 2022

December 25, 2021

Summary Segment Data:

Net sales:

Piping Systems Segment

$

567,039

$

652,466

$

2,730,084

$

2,600,030

Industrial Metals Segment

146,322

176,226

644,689

703,363

Climate Segment

170,551

130,428

650,307

495,414

Elimination of intersegment sales

(6,331

)

(2,763

)

(42,625

)

(29,462

)

Net sales

$

877,581

$

956,357

$

3,982,455

$

3,769,345

Operating income:

Piping Systems Segment

$

131,056

$

142,482

$

671,062

$

486,287

Industrial Metals Segment

22,960

27,077

82,464

85,475

Climate Segment

53,158

21,757

188,067

85,536

Unallocated expenses

(16,761

)

(19,175

)

(64,444

)

(1,453

)

Operating income

$

190,413

$

172,141

$

877,149

$

655,845

MUELLER INDUSTRIES,

INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(In thousands)

December 31, 2022

December 25 2021

ASSETS

Cash and cash equivalents

$

461,018

$

87,924

Short-term investments

217,863

—

Accounts receivable, net

380,352

471,859

Inventories

448,919

430,244

Other current assets

26,501

28,976

Total current assets

1,534,653

1,019,003

Property, plant, and equipment, net

379,950

385,562

Operating lease right-of-use assets

22,892

23,510

Other assets

304,904

300,861

$

2,242,399

$

1,728,936

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current portion of debt

$

811

$

811

Accounts payable

128,000

180,793

Current portion of operating lease

liabilities

4,942

6,015

Other current liabilities

214,542

194,820

Total current liabilities

348,295

382,439

Long-term debt

1,218

1,064

Pension and postretirement liabilities

13,055

17,533

Environmental reserves

16,380

17,678

Deferred income taxes

16,258

14,347

Noncurrent operating lease liabilities

16,880

17,099

Other noncurrent liabilities

16,349

21,813

Total liabilities

428,435

471,973

Total Mueller Industries, Inc.

stockholders’ equity

1,790,914

1,222,118

Noncontrolling interests

23,050

34,845

Total equity

1,813,964

1,256,963

$

2,242,399

$

1,728,936

MUELLER INDUSTRIES,

INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

For the Year Ended

(In thousands)

December 31, 2022

December 25, 2021

Cash flows from operating

activities

Consolidated net income

$

662,820

$

475,124

Reconciliation of consolidated net income

to net cash provided by operating activities:

Depreciation and amortization

44,088

45,655

Stock-based compensation expense

17,801

9,822

Provision for doubtful accounts

receivable

323

1,216

(Income) loss from unconsolidated

affiliates

(10,111

)

157

Gain on sale of businesses

—

(57,760

)

(Gain) loss on disposals of assets

(6,373

)

(769

)

Redemption premium

—

5,674

Insurance proceeds - noncapital

related

1,646

—

Impairment charges

—

2,829

Deferred income tax (benefit) expense

(3,880

)

7,413

Changes in assets and liabilities, net of

effects of businesses acquired and sold:

Receivables

82,713

(124,708

)

Inventories

(24,189

)

(119,514

)

Other assets

(8,971

)

919

Current liabilities

(26,633

)

73,755

Other liabilities

(7,564

)

(5,467

)

Other, net

2,273

(2,645

)

Net cash provided by operating

activities

723,943

311,701

Cash flows from investing

activities

Proceeds from sale of assets, net of cash

transferred

7,850

2,302

Purchase of short-term investments

(217,863

)

—

Proceeds from sale of business, net of

cash sold

—

81,884

Acquisition of businesses, net of cash

acquired

—

(30,206

)

Capital expenditures

(37,639

)

(31,833

)

Insurance proceeds - capital related

3,354

—

Dividends from unconsolidated

affiliates

2,295

—

Payment received for (issuance of) notes

receivable

—

8,539

Investments in unconsolidated

affiliates

—

(1,613

)

Net cash (used in) provided by investing

activities

(242,003

)

29,073

For the Year Ended

(In thousands)

December 31, 2022

December 25, 2021

Cash flows from financing

activities

Dividends paid to stockholders of Mueller

Industries, Inc.

(55,787

)

(29,137

)

Dividends paid to noncontrolling

interests

(7,248

)

(9,722

)

Issuance of long-term debt

—

595,000

Repayments of long-term debt

(204

)

(920,610

)

Issuance (repayment) of debt by

consolidated joint ventures, net

67

(5,113

)

Repurchase of common stock

(38,054

)

(4,864

)

Payment of contingent consideration

—

(1,250

)

Net cash (used) received to settle

stock-based awards

(1,429

)

85

Debt issuance costs

—

(1,111

)

Net cash used in financing activities

(102,655

)

(376,722

)

Effect of exchange rate changes on

cash

(4,365

)

(1,052

)

Increase (decrease) in cash, cash

equivalents, and restricted cash

374,920

(37,000

)

Cash, cash equivalents, and restricted

cash at the beginning of the year

90,376

127,376

Cash, cash equivalents, and restricted

cash at the end of the year

$

465,296

$

90,376

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230207005332/en/

Jeffrey A. Martin (901) 753-3226

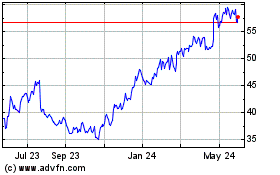

Mueller Industries (NYSE:MLI)

Historical Stock Chart

From Aug 2024 to Sep 2024

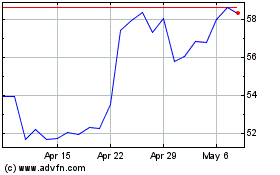

Mueller Industries (NYSE:MLI)

Historical Stock Chart

From Sep 2023 to Sep 2024