Morgan Stanley China A Share Fund, Inc. Announces Tender Offer

June 10 2022 - 8:00AM

Business Wire

Morgan Stanley China A Share Fund, Inc. (NYSE: CAF) (the “Fund”)

announced today that its Board of Directors has approved a

performance-related conditional tender offer to acquire in exchange

for cash up to 25 percent of the Fund’s then issued and outstanding

shares at a price equal to 98.5 percent of the Fund’s net asset

value per share (“NAV”) (minus the costs and expenses related to

the tender offer) as of the close of regular trading on the New

York Stock Exchange (“NYSE”) on the business day the offer expires

(a “Tender Offer”). The Fund will conduct such a Tender Offer only

if both (1) the Fund’s total return investment performance measured

on a NAV basis does not equal or exceed the total return investment

performance of the Fund’s benchmark index, the MSCI China A Onshore

Index, during the three-year period commencing on July 1, 2022 and

ending on June 30, 2025 (and for the term of successive five-year

periods thereafter commencing July 1, 2025), and (2) the Fund’s

shares are trading at or below NAV at the conclusion of the

applicable measurement period, with such Tender Offer occurring on

or before September 30, 2025, and thereafter on each five-year

anniversary of September 30, 2025. If the Fund’s performance

described above equals or exceeds that of the MSCI China A Onshore

Index during any such period or if the Fund’s shares are trading at

a premium to NAV at the conclusion of the applicable measurement

period, no Tender Offer will be conducted for that period.

If a Tender Offer is triggered, the Fund will issue a press

release announcing the Tender Offer and providing additional

information about such Tender Offer. Additional terms and

conditions of a Tender Offer would also be set forth in the

relevant offering materials, which would be distributed to the

Fund’s shareholders. The size of any such Tender Offer (up to 25

percent of the Fund’s then issued and outstanding shares), the

price at which shares are to be tendered and other terms and

conditions of such Tender Offer would be determined by the Board of

Directors in its discretion based on its review and consideration

of the then-current size of the Fund, market conditions, the

ability to repatriate the necessary cash and subject to local

Chinese regulatory requirements, and other factors it deems

relevant.

In the event that a Tender Offer is triggered and more than 25

percent of the Fund’s then issued and outstanding shares are

tendered, the Fund will purchase its shares from tendering

shareholders on a pro rata basis (odd-lot tenders for stockholders

who own fewer than 100 shares are still subject to pro ration),

based on the number of tendered shares, at a price equal to 98.5

percent of the Fund’s NAV (minus the costs and expenses related to

the tender offer), as described above.

The Fund continues to maintain a share repurchase program (the

“Program”) for purposes of enhancing stockholder value by providing

the ability to repurchase shares at a discount to NAV. Since the

inception of the Program, the Fund has not repurchased any of its

shares in part because of the Fund's ability to repatriate capital

gains and income out of China. The Board of Directors regularly

monitors the Program as part of its review and consideration of the

Fund's premium/discount history. The Fund may only repurchase its

outstanding shares at such time and in such amounts as it believes

will further the accomplishment of the foregoing objectives of the

Program, subject to review by the Board of Directors and the Fund's

ability to repatriate capital gains and income out of China. Upon

commencement of a Tender Offer, the Fund expects to temporarily

suspend any purchases of shares in the open market pursuant to the

Program until at least 10 business days after the termination of

the Tender Offer, as required by the Securities Exchange Act of

1934, as amended.

The Fund is a non-diversified, closed-end management investment

company that seeks capital growth by investing, under normal

circumstances, at least 80% of its assets in A-shares of Chinese

companies listed on the Shanghai and Shenzhen Stock Exchanges. The

Fund’s shares are listed on the NYSE under the symbol “CAF.”

About Morgan Stanley Investment Management Morgan Stanley

Investment Management, together with its investment advisory

affiliates, has more than 1,200 investment professionals around the

world and $1.4 trillion in assets under management or supervision

as of March 31, 2022. Morgan Stanley Investment Management strives

to provide outstanding long-term investment performance, service

and a comprehensive suite of investment management solutions to a

diverse client base, which includes governments, institutions,

corporations and individuals worldwide. For further information

about Morgan Stanley Investment Management, please visit

www.morganstanley.com/im.

About Morgan Stanley Morgan Stanley is a leading global

financial services firm providing a wide range of investment

banking, securities, investment management and wealth management

services. The Firm’s employees serve clients worldwide including

corporations, governments, institutions and individuals from more

than 1,300 offices in 43 countries. For further information about

Morgan Stanley, please visit www.morganstanley.com.

The Fund has not commenced a Tender Offer described in this

release. A Tender Offer will be announced and commenced only if

triggered by the circumstances described above. Any Tender Offer

will only be made pursuant to a tender offer statement on Schedule

TO containing an offer to purchase, a related letter of transmittal

and other documents filed with the SEC as exhibits to a tender

offer statement on Schedule TO (collectively, the “Tender Offer

Materials”), with all such documents made available on the SEC's

website at www.sec.gov. For each Tender Offer, the Fund will also

make available to shareholders without charge the offer to

purchase, the letter of transmittal and other necessary documents.

Shareholders should read any Tender Offer Materials carefully and

in their entirety when and if they become available, as well as any

amendments or supplements thereto, as they would contain important

information about the Tender Offer.

This press release shall not constitute an offer to buy or

the solicitation of an offer to sell any shares. The Fund does not

intend to make any Tender Offer to (nor will tenders be accepted

from or on behalf of) holders of shares in any jurisdiction in

which the making of the Tender Offer or the acceptance thereof

would not be in compliance with the securities, blue sky or other

laws of such jurisdictions.

This press release shall not constitute an offer to sell or

the solicitation of an offer to buy nor shall there be any sale of

the securities in any state in which such offer, solicitation or

sale would be unlawful under the securities laws of any such

state.

Investing involves risk and it is possible to lose money on

any investment in the Fund.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220610005076/en/

For more information call: 1-800-231-2608

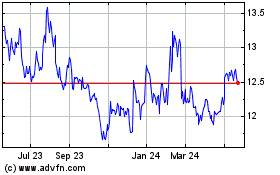

Morgan Stanley China A S... (NYSE:CAF)

Historical Stock Chart

From Dec 2024 to Jan 2025

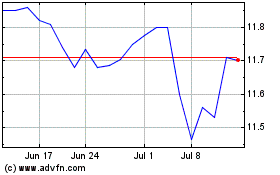

Morgan Stanley China A S... (NYSE:CAF)

Historical Stock Chart

From Jan 2024 to Jan 2025