MOGU Inc. (NYSE: MOGU) (“MOGU” or the “Company”), a KOL-driven

online fashion and lifestyle destination in China, today announced

its unaudited financial results for the six months ended September

30, 2023.

Mr. Fan Yiming, Chief Executive Officer of MOGU, commented,

“Throughout 2023, China's online retail industry experienced

heightened competition, with the focus shifting from customer scale

to customer value on the various platforms. Against the backdrop of

a saturated online traffic environment and escalating customer

acquisition costs, our new customer acquisition fell short of

expectations. In the first half of fiscal year 2024, our gross

merchandise value (GMV1) decreased by 22.3% year-on-year to

RMB2,196 million.

In order to cope with this new competition, we have proactively

adjusted our commodity categories and supply chain. In the past

months, we have restructured our platform from a traditional

e-commerce platform to a professional service platform in beauty

and personal care, health, baby, foods and other categories. We

also provide the merchants on our platform with a series of

differentiated services in sourcing supply chain, product

selection, brand extension and other support. These measures drove

our users' growth in some commodity categories. In the future, we

will further strengthen our e-commerce live streaming service

capabilities and channels to generate new business growth

points.”

“During the first half of fiscal year of 2024, our total

revenues decreased by 27.5% to RMB83.3 million. The loss from

operations was RMB 52.1 million, compared to RMB48.1 million for

the same period of fiscal year 2023. Over the past six months, we

have diligently optimized our cost structure and improved

operational efficiency, yielding positive outcomes. However,

despite these efforts, the increasing cost of acquiring new

customers and a decline in revenue prevented us from achieving our

targeted operational results. Looking ahead, we will continue to

focus on cost reduction and efficiency enhancements and continue

looking for new revenue growth opportunities. We are confident that

these measures will contribute to our overall financial resilience

and sustainable growth. ” added Ms. Qi Feng, Financial

Controller.

Highlights For the Six Months Ended September 30,

2023

- Total revenues for the six months ended September 30,

2023 decreased by 27.5% to RMB83.3 million (US$11.4 million) from

RMB114.8 million during the same period of the fiscal year

2023.

- Live video broadcast (“LVB”) associated GMV for

the six months ended September 30, 2023 decreased by 20.9%

period-over-period to RMB2,137 million (US$292.9 million2).

- GMV for the six months ended September 30, 2023 was

RMB2,196 million (US$301.0 million), a decrease of 22.3%

period-over-period.

Financial Results For the Six Months Ended September 30,

2023

Total revenues for the six months ended September 30,

2023 decreased by 27.5% to RMB83.3 million (US$11.4 million) from

RMB114.8 million during the same period of the fiscal year

2023.

- Commission revenues for the six months ended September

30, 2023 decreased by 22.4% to RMB55.6 million (US$7.6 million)

from RMB71.7 million in the same period of the fiscal year 2023,

primarily attributable to the lower GMV due to the heightened

competitive environment.

- Marketing services revenues for the six months ended

September 30, 2023 decreased by 75.0% to RMB0.7 million (US$0.1

million) from RMB3.0 million in the same period of the fiscal year

2023, primarily attributable to the lower GMV due to the heightened

competitive environment.

- Financing solutions revenues for the six months ended

September 30, 2023 decreased by 22.0% to RMB5.4 million (US$0.7

million) from RMB6.9 million in the same period of the fiscal year

2023. The decrease was primarily due to the decrease in the service

fee of loans to users in line with the lower GMV.

- Technology service revenues for the six months ended

September 30, 2023 decreased by 34.5% to RMB18.4 million (US$2.5

million) from RMB28.1 million in the same period of fiscal year

2023, primarily attributable to the decrease of software service

revenue as a result of weaker-than-expected operating results of

Ruisha Technology.

- Other revenues for the six months ended September 30,

2023 decreased by 39.0% to RMB3.1 million (US$0.4 million) from

RMB5.2 million in the same period of the fiscal year 2023,

primarily due to the decrease of promotion services revenue

provided to financial institutions.

Cost of revenues for the six months ended September 30, 2023

decreased by 16.8% to RMB49.6 million (US$6.8 million) from RMB59.6

million in the same period of the fiscal year 2023, which was

primarily due to the decrease in payroll of RMB 4.4 million,

IT-related expenses of RMB 4.0 million and payment handling costs

of RMB1.1 million, correlating with an overall reduction in

revenue.

Sales and marketing expenses for the six months ended September

30, 2023 increased by 14.2% to RMB37.3 million (US$5.1 million)

from RMB32.6 million in the same period of the fiscal year 2023,

primarily due to increased spending on user acquisition activities

of RMB8.4 million, which was partly offset by the a decrease in

payroll costs of RMB 4.7 million.

Research and development expenses for the six months ended

September 30, 2023 decreased by 33.7% to RMB13.9 million (US$1.9

million) from RMB20.9 million in the same period of the fiscal year

2023, primarily due to a decrease in payroll costs.

General and administrative expenses for the six months ended

September 30, 2023 decreased by 14.7% to RMB27.9 million (US$3.8

million) from RMB32.7 million in the same period of the fiscal year

2023, primarily due to a decrease in payroll costs and professional

service fees.

Amortization of intangible assets for the six months ended

September 30, 2023 decreased by 90.9% to RMB1.8 million (US$0.3

million) from RMB20.0 million in the same period of the fiscal year

2023, primarily because the intangible assets recorded as a result

of the business cooperation agreement MOGU entered into with

Tencent in July 2018 have been fully amortized as of December 31,

2022.

Impairment of intangible assets for the six months ended

September 30, 2023 increased to RMB9.9 million (US$1.4 million)

from nil in the same period of fiscal year 2023, primarily due to

the Company’s recognition of a full impairment charge of RMB9.9

million against its intangible assets arising from the acquisition

of Hangzhou Ruisha Technology Co., Ltd. (“Ruisha Technology”). The

recorded impairments resulted from weaker-than-expected operating

results which reflect an increasingly competitive business

environment and the related limited future economic benefits

expected to be generated from these intangible assets.

Loss from operations for the six months ended September

30, 2023 was RMB52.1 million (US$7.1 million), compared to a loss

from operations of RMB48.1 million in the same period of the fiscal

year 2023.

Net loss attributable to MOGU Inc. for the six months

ended September 30, 2023 was RMB35.4 million (US$4.9 million),

compared to a net loss attributable to MOGU Inc. of RMB57.4 million

in the same period of the fiscal year 2023.

Adjusted EBITDA3 for the six months ended September 30,

2023 was negative RMB34.0 million (US$4.7 million), compared to

negative RMB17.1 million in the same period of the fiscal year

2023.

Adjusted net loss4 for the six months ended September 30,

2023 was RMB32.8 million (US$4.5 million), compared to an adjusted

net loss of RMB31.8 million in the same period of the fiscal year

2023.

Basic and diluted loss per ADS for the six months ended

September 30, 2023 were RMB4.11 (US$0.56) and RMB4.11 (US$0.56),

respectively, compared with RMB6.79 and RMB6.79, respectively, in

the same period of the fiscal year 2023. Each ADS represents 300

Class A ordinary shares.

Cash and cash equivalents, Restricted cash and Short-term

investments were RMB470.3 million (US$64.5 million) as of

September 30, 2023, compared with RMB562.8 million as of March 31,

2023.

Use of Non-GAAP Financial Measures

In evaluating the business, the Company considers and uses

Non-GAAP measures, such as Adjusted EBITDA and Adjusted net

income/loss as supplemental measures to review and assess operating

performance. The presentation of these Non-GAAP financial measures

is not intended to be considered in isolation or as a substitute

for the financial information prepared and presented in accordance

with accounting principles generally accepted in the United States

of America (“U.S. GAAP”). The Company defines Adjusted EBITDA as

net loss before interest income, interest expense, loss/(gain) from

investments, net, income tax benefits, share of results of equity

investees, impairment of intangible assets, share-based

compensation expenses, amortization of intangible assets, and

depreciation of property and equipment. The Company defines

Adjusted net loss as net loss excluding loss/(gain) from

investments, net, impairment of intangible assets, share-based

compensation expenses, and adjustments for tax effects. The Company

excluded “amortization of intangible assets” as a non-recurring

item in the presentation of adjusted net loss in its Unaudited

Reconciliations of GAAP and Non-GAAP Results for the six months

ended March 31, 2023 and fiscal year 2023. As a result, the Company

made the corresponding change to the prior period comparative

metrics to conform with the new definition. See “Unaudited

Reconciliations of GAAP and Non-GAAP Results” at the end of this

press release.

The Company presents these Non-GAAP financial measures because

they are used by management to evaluate operating performance and

formulate business plans. The Company believes that the non-GAAP

financial measures help identify underlying trends in its business

by excluding certain expenses, gain/loss and other items that are

not expected to result in future cash payments or that are

nonrecurring in nature or may not be indicative of the Company’s

core operating results and business outlook. The Company also

believes that the Non-GAAP financial measures could provide further

information about the Company’s results of operations, enhance the

overall understanding of the Company’s past performance and future

prospects.

The Non-GAAP financial measures are not defined under U.S. GAAP

and are not presented in accordance with U.S. GAAP. The non-GAAP

financial measures have limitations as analytical tools. The

Company’s non-GAAP financial measures do not reflect all items of

income and expense that affect the Company’s operations and do not

represent the residual cash flow available for discretionary

expenditures. Further, these non-GAAP measures may differ from the

non-GAAP information used by other companies, including peer

companies, and therefore their comparability may be limited. The

Company compensates for these limitations by reconciling the

non-GAAP financial measures to the nearest U.S. GAAP performance

measure, all of which should be considered when evaluating

performance. The Company encourages you to review the Company’s

financial information in its entirety and not rely on a single

financial measure.

For more information on the non-GAAP financial measures, please

see the table captioned “Unaudited Reconciliations of GAAP and

Non-GAAP Results” set forth at the end of this press release.

Safe Harbor Statement

This announcement contains forward-looking statements. These

statements are made under the “safe harbor” provisions of the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements can be identified by terminology such as

“will,” “expects,” “anticipates,” “aims,” “future,” “intends,”

“plans,” “believes,” “estimates,” “confident,” “potential,”

“continue” or other similar expressions. Among other things, the

business outlook and quotations from management in this

announcement, as well as MOGU’s strategic and operational plans,

contain forward-looking statements. MOGU may also make written or

oral forward-looking statements in its periodic reports to the U.S.

Securities and Exchange Commission (the “SEC”), in its annual

report to shareholders, in press releases and other written

materials and in oral statements made by its officers, directors or

employees to third parties. Statements that are not historical

facts, including but not limited to statements about MOGU’s beliefs

and expectations, are forward-looking statements. Forward-looking

statements involve inherent risks and uncertainties. A number of

factors could cause actual results to differ materially from those

contained in any forward-looking statement, including but not

limited to the following: MOGU’s growth strategies; the risk that

COVID-19 or other health risks in China or globally could adversely

affect its operations or financial results; its future business

development, results of operations and financial condition; its

ability to understand buyer needs and provide products and services

to attract and retain buyers; its ability to maintain and enhance

the recognition and reputation of its brand; its ability to rely on

merchants and third-party logistics service providers to provide

delivery services to buyers; its ability to maintain and improve

quality control policies and measures; its ability to establish and

maintain relationships with merchants; trends and competition in

China’s ecommerce market; changes in its revenues and certain cost

or expense items; the expected growth of China’s ecommerce market;

PRC governmental policies and regulations relating to MOGU’s

industry, and general economic and business conditions globally and

in China and assumptions underlying or related to any of the

foregoing. Further information regarding these and other risks is

included in MOGU’s filings with the SEC. All information provided

in this press release and in the attachments is as of the date of

this press release, and MOGU undertakes no obligation to update any

forward-looking statement, except as required under applicable

law.

About MOGU Inc.

MOGU Inc. (NYSE: MOGU) is a KOL-driven online fashion and

lifestyle destination in China. MOGU provides people with a more

accessible and enjoyable shopping experience for everyday fashion,

particularly as they increasingly live their lives online. By

connecting merchants, KOLs and users together, MOGU’s platform

serves as a valuable marketing channel for merchants, a powerful

incubator for KOLs, and a vibrant and dynamic community for people

to discover and share the latest fashion trends with others, where

users can enjoy a truly comprehensive online shopping

experience.

MOGU INC. Unaudited Condensed

Consolidated Balance Sheets (All amounts in thousands,

except for share and per share data)

As of March 31,

As of September 30,

2023

2023

RMB

RMB

US$

ASSETS

Current assets:

Cash and cash equivalents

416,201

366,151

50,185

Restricted cash

810

510

70

Short-term investments

145,836

103,679

14,210

Inventories, net

144

113

15

Loan receivables, net*

7,229

3,278

449

Prepayments, receivables and other current

assets*

69,126

99,135

13,588

Amounts due from related parties

1,260

1,311

180

Total current assets

640,606

574,177

78,697

Non-current assets:

Property and equipment, net

194,589

222,228

30,459

Intangible assets, net

12,554

1,026

141

Right-of-use assets

5,441

2,155

295

Investments

69,318

82,231

11,271

Other non-current assets*

63,640

46,430

6,364

Total non-current assets

345,542

354,070

48,530

Total assets

986,148

928,247

127,227

LIABILITIES AND SHAREHOLDERS’

EQUITY

Current liabilities:

Accounts payable

8,179

6,480

888

Salaries and welfare payable

13,550

8,293

1,137

Advances from customers

245

55

8

Taxes payable

11,126

3,809

522

Amounts due to related parties

4,196

4,692

643

Current portion of lease liabilities

2,654

1,485

204

Accruals and other current liabilities

270,717

265,218

36,351

Total current liabilities

310,667

290,032

39,753

Non-current liabilities:

Non-current lease liabilities

753

—

—

Deferred tax liabilities

3,369

1,614

221

Total non-current liabilities

4,122

1,614

221

Total liabilities

314,789

291,646

39,974

Shareholders’ equity

Ordinary shares

181

181

25

Treasury stock

(137,446

)

(137,446

)

(18,839

)

Statutory reserves

3,331

3,331

457

Additional paid-in capital

9,484,664

9,487,453

1,300,364

Accumulated other comprehensive income

82,396

89,068

12,207

Accumulated deficit*

(8,795,764

)

(8,832,878

)

(1,210,647

)

Total MOGU Inc. shareholders’ equity

637,362

609,709

83,567

Non-controlling interests

33,997

26,892

3,686

Total shareholders’ equity

671,359

636,601

87,253

Total liabilities and shareholders’

equity

986,148

928,247

127,227

*On April 1, 2023, the Company adopted ASU 2016-13, Financial

Instruments - Credit Losses (Topic 326), using the modified

retrospective method and the adoption did not have material impact

on the consolidated financial statements.

MOGU INC. Unaudited Condensed

Consolidated Statements of Operations and Comprehensive Loss

(All amounts in thousands, except for share and per share

data)

For the six months

ended

September 30,

2022

2023

RMB

RMB

US$

Net revenues

Commission revenues

71,700

55,619

7,623

Marketing services revenues

2,982

746

102

Financing service revenues

6,930

5,403

741

Technology service revenues

28,077

18,388

2,520

Other revenues

5,157

3,146

431

Total revenues

114,846

83,302

11,417

Cost of revenues (exclusive of

amortization of intangible assets shown separately below)

(59,641

)

(49,602

)

(6,799

)

Sales and marketing expenses

(32,646

)

(37,274

)

(5,109

)

Research and development expenses

(20,922

)

(13,879

)

(1,902

)

General and administrative expenses

(32,741

)

(27,914

)

(3,826

)

Amortization of intangible assets

(20,022

)

(1,826

)

(250

)

Impairment of intangible assets

—

(9,945

)

(1,363

)

Other income, net

3,066

5,059

693

Loss from operations

(48,060

)

(52,079

)

(7,139

)

Interest income

9,013

7,142

979

Interest expense

(328

)

—

—

(Loss)/gain from investments, net

(19,431

)

1,267

174

Loss before income tax and share of

results of equity investees

(58,806

)

(43,670

)

(5,986

)

Income tax benefits

1,086

1,662

228

Share of results of equity investee

(1,125

)

(504

)

(69

)

Net loss

(58,845

)

(42,512

)

(5,827

)

Net loss attributable to non-controlling

interests

(1,407

)

(7,105

)

(974

)

Net loss attributable to MOGU

Inc.

(57,438

)

(35,407

)

(4,853

)

Net loss

(58,845

)

(42,512

)

(5,827

)

Other comprehensive

income/(loss):

Foreign currency translation adjustments,

net of nil tax

18,495

4,970

681

Unrealized securities holding

(losses)/gains, net of tax

(1,186

)

1,702

233

Total comprehensive loss

(41,536

)

(35,840

)

(4,913

)

Total comprehensive loss attributable to

non-controlling interests

(1,407

)

(7,105

)

(974

)

Total comprehensive loss attributable

to MOGU Inc.

(40,129

)

(28,735

)

(3,939

)

Net loss per share attributable to

ordinary shareholders

Basic

(0.02

)

(0.01

)

(0.00

)

Diluted

(0.02

)

(0.01

)

(0.00

)

Net loss per ADS

Basic

(6.79

)

(4.11

)

(0.56

)

Diluted

(6.79

)

(4.11

)

(0.56

)

Weighted average number of shares used

in computing net loss per share

Basic

2,537,852,017

2,581,758,960

2,581,758,960

Diluted

2,537,852,017

2,581,758,960

2,581,758,960

Share-based compensation expenses

included in:

Cost of revenues

808

415

57

General and administrative expenses

5,069

1,763

242

Sales and marketing expenses

2,448

419

57

Research and development expenses

511

192

26

MOGU INC. Unaudited Condensed

Consolidated Statements of Cash Flows (All amounts in

thousands, except for share and per share data)

For the six months

ended

September 30,

2022

2023

RMB

RMB

US$

Net cash used in operating

activities

(16,020

)

(32,907

)

(4,510

)

Net cash used in investing

activities

(28,155

)

(20,779

)

(2,848

)

Net cash used in financing

activities

(2,972

)

—

—

Effect of foreign exchange rate changes on

cash and cash equivalents and restricted cash

1,509

3,336

457

Net decrease in cash and cash equivalents

and restricted cash

(45,638

)

(50,350

)

(6,901

)

Cash and cash equivalents and restricted

cash at beginning of period

439,417

417,011

57,156

Cash and cash equivalents and restricted

cash at end of period

393,779

366,661

50,255

MOGU INC. Unaudited Reconciliations

of GAAP and Non-GAAP Results (All amounts in thousands,

except for share and per share data)

For the six months

ended

September 30,

2022

2023

RMB

RMB

US$

Net loss

(58,845

)

(42,512

)

(5,827

)

Add:

Interest expense

328

—

—

Less:

Income tax benefits

(1,086

)

(1,662

)

(228

)

Less:

Interest income

(9,013

)

(7,142

)

(979

)

Add:

Amortization of intangible assets

20,022

1,826

250

Add:

Depreciation of property and equipment

2,067

3,529

484

EBITDA

(46,527

)

(45,961

)

(6,300

)

Add:

Impairment of intangible assets

—

9,945

1,363

Add:

Share-based compensation expenses

8,836

2,789

382

Add:

Share of result of equity investees

1,125

504

69

Less:

Loss/(gain) from investments, net

19,431

(1,267

)

(174

)

Adjusted EBITDA

(17,135

)

(33,990

)

(4,660

)

Net loss

(58,845

)

(42,512

)

(5,827

)

Add:

Loss/(gain) from investments, net

19,431

(1,267

)

(174

)

Add:

Share-based compensation expenses

8,836

2,789

382

Add:

Impairment of intangible assets

—

9,945

1,363

Less:

Adjusted for tax effects

(1,235

)

(1,755

)

(241

)

Adjusted net loss

(31,813

)

(32,800

)

(4,497

)

1 GMV are to gross merchandise volume, refers to the total value

of orders placed on the MOGU platform regardless of whether the

products are sold, delivered or returned, calculated based on the

listed prices of the ordered products without taking into

consideration any discounts on the listed prices. Buyers on the

MOGU platform are not charged for separate shipping fees over the

listed price of a product. If merchants include certain shipping

fees in the listed price of a product, such shipping fees will be

included in GMV. As a prudent matter aiming at eliminating any

influence on MOGU’s GMV of irregular transactions, the Company

excludes from its calculation of GMV transactions over a certain

amount (RMB100,000) and transactions by users over a certain amount

(RMB1,000,000) per day.

2 The U.S. dollar (US$) amounts disclosed in this press release,

except for those transaction amounts that were actually settled in

U.S. dollars, are presented solely for the convenience of the

readers. The conversion of Renminbi (RMB) into US$ in this press

release is based on the exchange rate set forth in the H.10

statistical release of the Board of Governors of the Federal

Reserve System as of September 30, 2023, which was RMB7.2960 to

US$1.00. The percentages stated in this press release are

calculated based on the RMB amounts.

3 Adjusted EBITDA represents net loss before (i) interest

income, interest expense, loss/(gain) from investments, net, income

tax benefits and share of results of equity investee, impairment of

intangible assets and (ii) certain non-cash expenses, consisting of

share-based compensation expenses, amortization of intangible

assets, and depreciation of property and equipment. See “Unaudited

Reconciliations of GAAP and Non-GAAP Results” at the end of this

press release.

4 Adjusted net loss represents net loss excluding (i)

loss/(gain) from investments, net, (ii) share-based compensation

expenses, (iii) impairment of intangible assets, (iv) adjustments

for tax effects. The Company excluded “amortization of intangible

assets” as a non-recurring item in the presentation of adjusted net

loss in its Unaudited Reconciliations of GAAP and Non-GAAP Results

for the six months ended March 31, 2023 and fiscal year 2023. As a

result, the Company made the corresponding change to the prior

period comparative metrics to conform with this new definition. See

“Unaudited Reconciliations of GAAP and Non-GAAP Results” at the end

of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231215513432/en/

For investor and media inquiries, please contact:

MOGU Inc. Ms. Qi Feng Phone: +86-571-8530-8201 E-mail:

ir@mogu.com

Christensen

In China Ms. Crystal Lai Phone: +852 2232 3907

E-mail:crystal.lai@christensencomms.com

In the United States Ms. Linda Bergkamp Phone: +1-480-614-3004

Email: linda.bergkamp@christensencomms.com

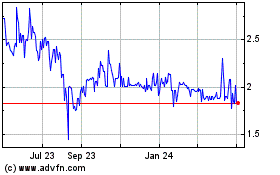

MOGU (NYSE:MOGU)

Historical Stock Chart

From Nov 2024 to Dec 2024

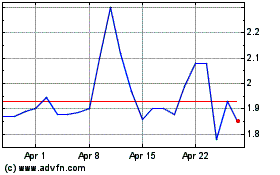

MOGU (NYSE:MOGU)

Historical Stock Chart

From Dec 2023 to Dec 2024